Overview

The article provides a comprehensive overview of various crowdfunding platforms, including equity, rewards, donation-based, and debt-based models, highlighting their unique features and benefits for startups and entrepreneurs. It supports this by detailing specific platforms like Seedrs, Crowdcube, Kickstarter, and Indiegogo, emphasizing their roles in democratizing access to funding and fostering community engagement, which enhances market validation and capital acquisition for innovative projects.

Introduction

In a world where traditional funding avenues often fall short for aspiring entrepreneurs, crowdfunding emerges as a revolutionary alternative, reshaping the financial landscape. This innovative model harnesses the collective power of individuals, allowing startups and creators to secure necessary capital while fostering community engagement.

With various types of crowdfunding—ranging from equity to reward-based models—entrepreneurs can connect with diverse investor profiles, paving the way for unprecedented opportunities. As the crowdfunding sector continues to flourish, it not only democratizes access to funding but also acts as a catalyst for innovation, enabling small businesses to thrive in an increasingly competitive environment.

This article delves into the multifaceted world of crowdfunding, exploring its models, platforms, benefits, challenges, and the profound impact it has on the entrepreneurial journey.

Understanding Crowdfunding: An Overview

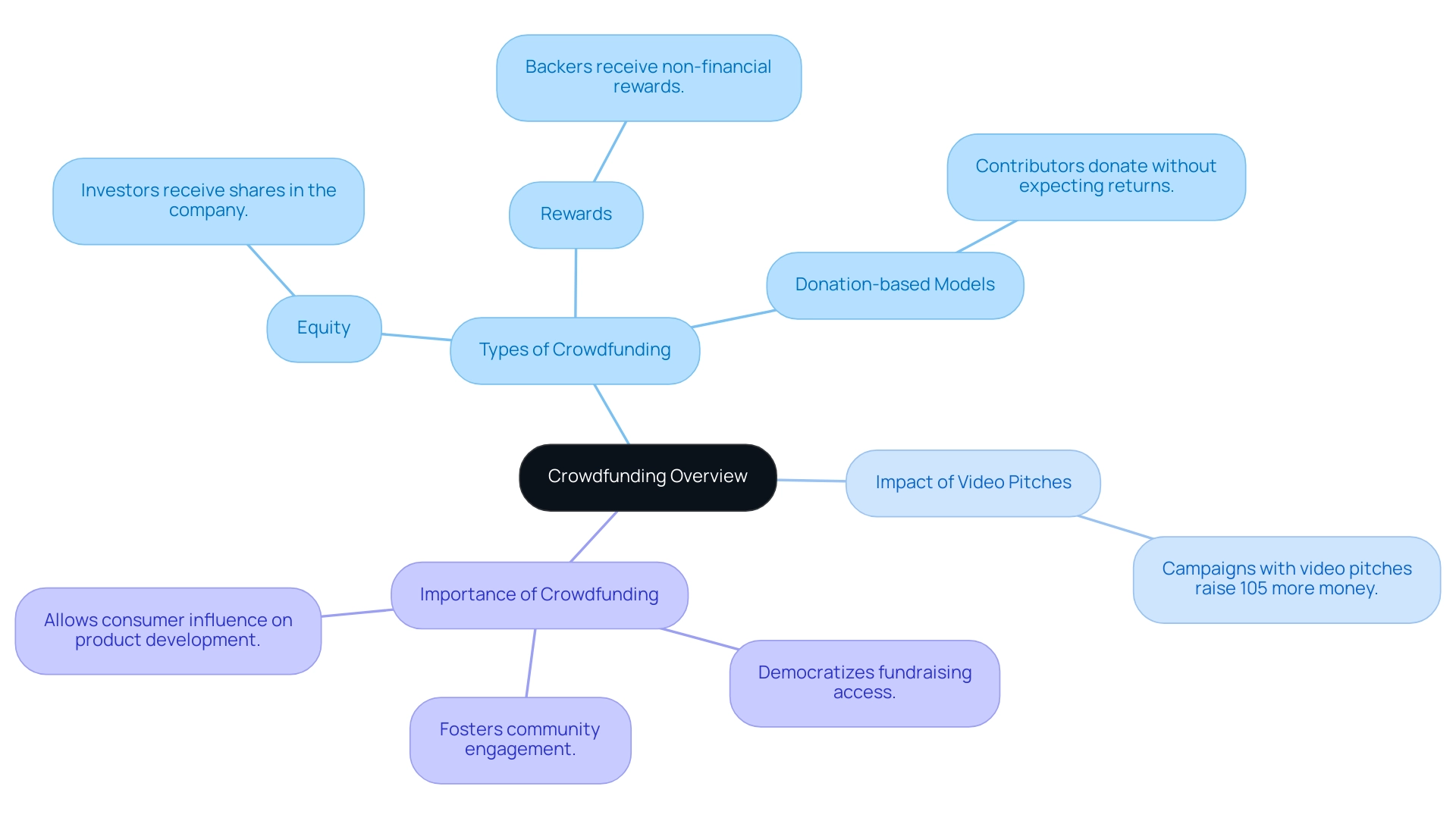

Crowdfunding represents a dynamic approach to raising capital, leveraging the collective efforts of numerous individuals through examples of crowdfunding platforms available online. This innovative financing model democratizes the fundraising process, empowering startups, entrepreneurs, and creators to access a varied pool of backers instead of depending solely on banks or venture capitalists. With the median VC valuation for Seed deals stabilizing at $13.0 million in Q3-2024, the importance of alternative financing methods like crowdfunding becomes even more prominent.

Crowdfunding can be categorized into several types, and examples of crowdfunding platforms include:

- Equity

- Rewards

- Donation-based models

Each addressing distinct needs and appealing to various investor profiles. This versatility not only enhances accessibility for entrepreneurs but also fosters community engagement, allowing businesses to cultivate a loyal customer base before their official launch. As emphasized in the case study titled 'Consumer Engagement in Crowdfunding,' this financing method provides consumers with unprecedented access to innovative products and allows them to influence product development, fostering a sense of community and participation in the entrepreneurial process.

Additionally, as noted by Wifi Talent, > Crowdfunding campaigns that include a video pitch tend to raise 105% more money than those without <, emphasizing the importance of effective communication in this space. Overall, crowdfunding serves as a powerful tool in the modern financial ecosystem, bridging the gap between innovators and supporters while contrasting traditional funding methods.

Types of Crowdfunding: Exploring Different Models

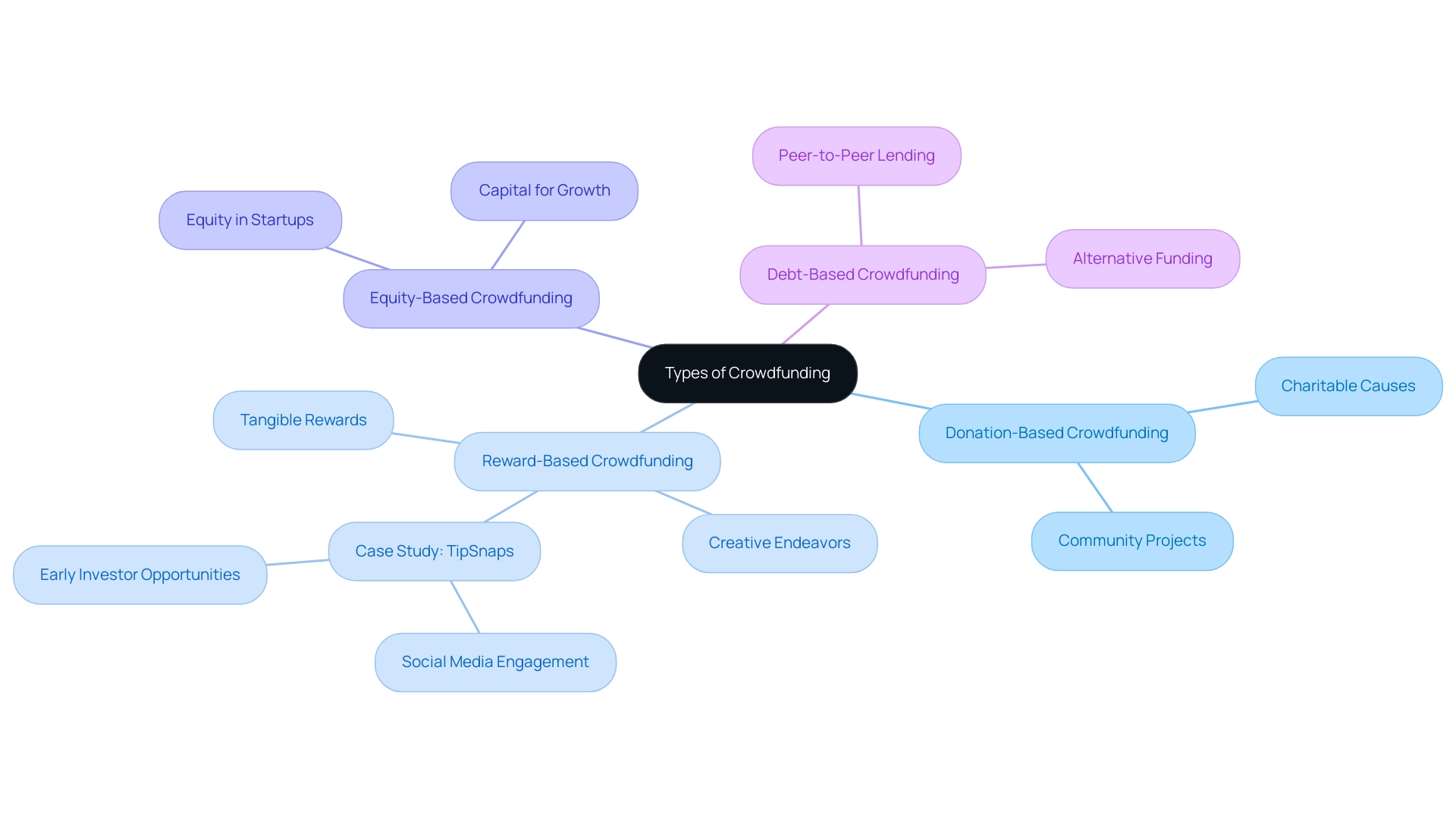

Crowdfunding includes four main models, each addressing different stakeholder interests and project needs:

- Donation-Based Crowdfunding: This model allows individuals to contribute to charitable causes without the expectation of a return on their investment. It is particularly effective for social initiatives and community projects, proving that altruism can drive substantial funding.

- Reward-Based Crowdfunding: In this model, backers receive tangible rewards or products in exchange for their contributions. This approach has gained immense popularity, especially among creative endeavors and startups. For example, TipSnaps, a black-owned social media firm with 450k users, launched a fundraising campaign on Republic in March 2022. This campaign effectively utilized the reward-based model, enabling early backers to engage with the company while leveraging its social media presence to attract a broad audience.

- Equity-Based Crowdfunding: This model enables individuals to obtain equity in the business in exchange for their financial backing. By investing in startups, backers not only provide essential capital but also position themselves to benefit from the company's growth and success, aligning their interests with the entrepreneurial vision.

- Debt-Based Crowdfunding: Also known as peer-to-peer lending, this model involves individuals providing funds to people or companies with the expectation of repayment along with interest. It functions as an alternative funding choice for borrowers who may not meet the criteria for conventional loans.

Each funding model, such as examples of crowdfunding platforms, serves distinct purposes and draws various types of investors. As stated, successful campaigns usually average about 300 supporters, indicating a strong interest across these avenues and demonstrating the effectiveness of these models. Despite challenges such as service consolidation and investment volume fluctuations, the resilience and innovation within the funding industry, as noted by experts from Kingscrowd, remain undeniable.

Top Crowdfunding Platforms in the UK for Startups

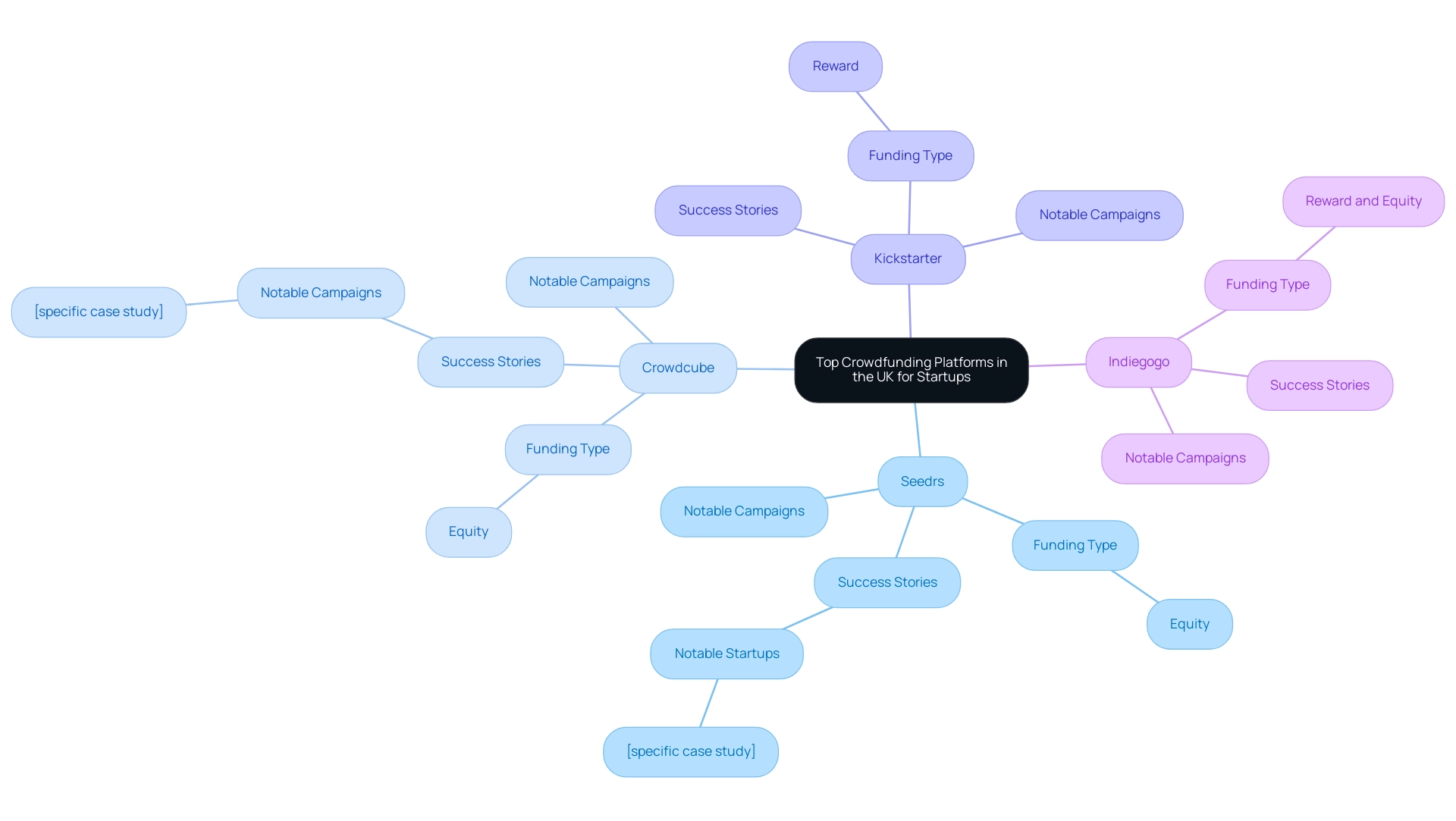

The UK features several notable fundraising services that effectively assist startups and entrepreneurs in their funding journeys:

- Seedrs: This equity crowdfunding service enables investors to purchase shares in innovative startups and growing businesses. Its organized method enables significant investment opportunities, as shown by success stories from various campaigns that have prospered in the environment. For instance, notable startups like [specific case study] have successfully raised funds, showcasing the platform's effectiveness.

- Crowdcube: This is one of the examples of crowdfunding platforms that, similar to Seedrs, specializes in equity crowdfunding, creating a robust marketplace for investors to discover and back pioneering companies. Notable campaigns, such as [specific case study], have demonstrated significant financial success, with entrepreneurs sharing their experiences about how Crowdcube facilitated their growth.

- Kickstarter: While mainly a reward-based service, Kickstarter has gained popularity for creative projects, enabling startups to obtain early-stage funding by providing backers tangible rewards. This model has proven effective for a range of innovative ideas seeking initial capital.

- Indiegogo: This is among the examples of crowdfunding platforms that offer both reward and equity funding options, standing out for its versatility in catering to various project types. This flexibility has turned it into a preferred choice for entrepreneurs seeking to engage various kinds of investors.

These systems not only link entrepreneurs with prospective investors but also provide them with vital resources to navigate the fundraising environment. As the crowd-sourced finance sector experiences growth, with figures like Sunswap raising £17.3m in March 2024, the significance of these platforms as viable financial sources continues to increase. However, it is crucial to note that crowdfunded companies show slower progression post-investment, with only 6% exiting the private market compared to 11% for venture rounds.

This statistic highlights the need for strategic planning in the funding process. Entrepreneurs such as Grant Ejimone, who remarked that contributions of $106 million were collected for natural disaster relief in 2023, illustrate the changing environment where collective financing is becoming a vital component in supporting innovative ideas and tackling societal challenges.

Pros and Cons of Using Crowdfunding Platforms

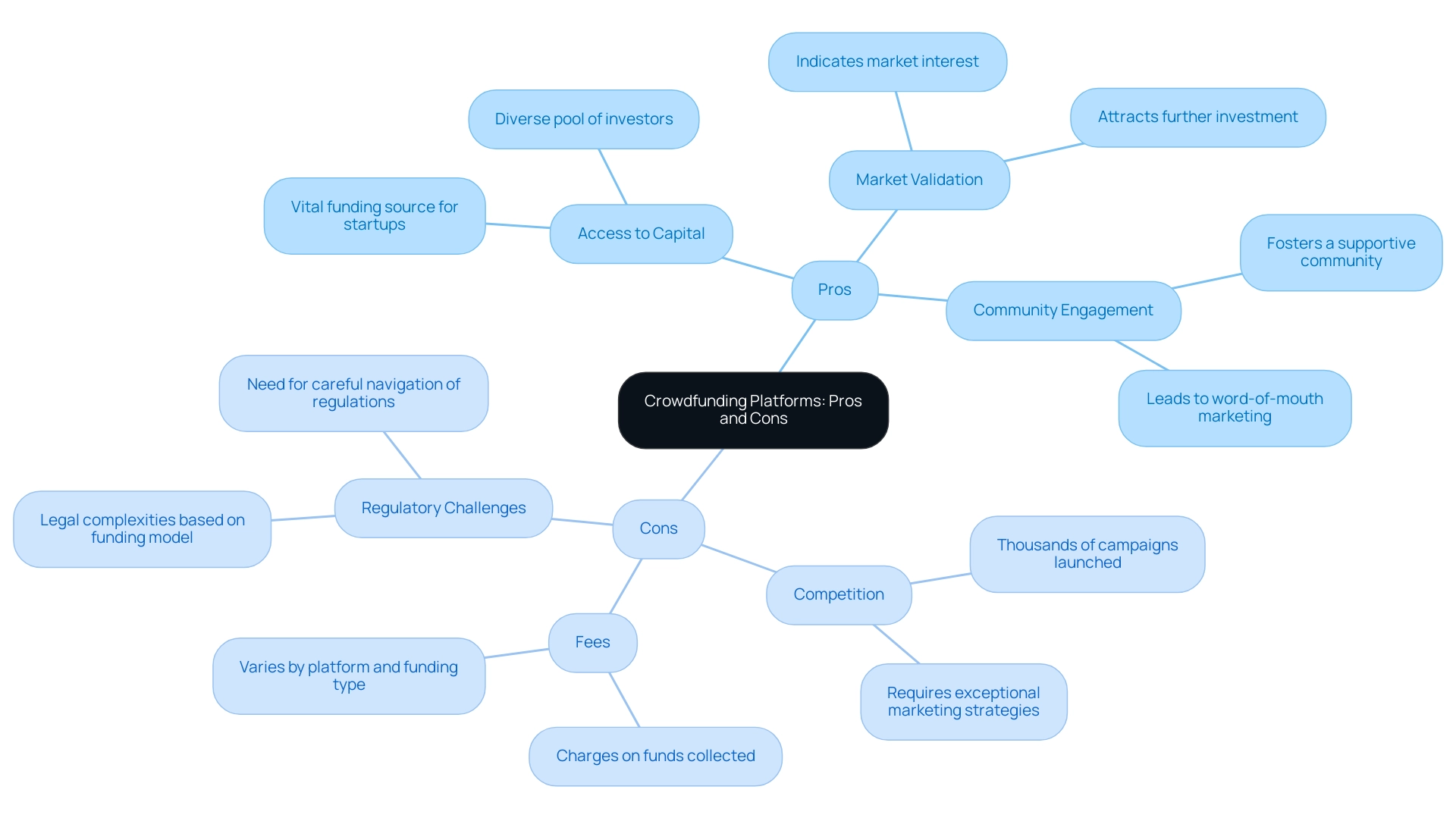

Navigating crowdfunding platforms entails understanding a range of benefits and challenges that can significantly impact a startup's journey:

Pros:

-

Access to Capital: Crowdfunding serves as a vital source of funding for startups that may have difficulty obtaining traditional financing. This avenue provides examples of crowdfunding platforms that allow entrepreneurs to tap into a diverse pool of investors, facilitating growth in innovative projects.

-

Market Validation: A successful crowdfunding campaign can serve as a strong indicator of market interest, validating a business idea and potentially attracting further investment.

This validation can be a game changer, encouraging venture capitalists to consider funding the project.

-

Community Engagement: These venues foster a robust community of supporters who share a vested interest in the project's success, often leading to invaluable word-of-mouth marketing and customer loyalty.

Cons:

-

Competition: With thousands of campaigns launched simultaneously, standing out and capturing attention can be a daunting task.

This crowded marketplace necessitates exceptional marketing strategies to gain visibility.

-

Fees: Most fundraising websites impose charges on the funds collected, which can reduce the total amount received by the startup. Understanding these fee structures is crucial for effective financial planning.

The specific fees can vary based on examples of crowdfunding platforms and the type of funding, whether it be equity financing or reward-based donations, making it vital for startups to evaluate these costs carefully.

-

Regulatory Challenges: Depending on the funding model—such as equity or donation-based—there may be legal complexities that complicate the process. Startups must navigate these regulations carefully to avoid potential pitfalls.

Statistics indicate that the average success rate for fundraising campaigns hovers between 22.4% and 23.7%, underscoring the competitive nature of this funding model. This low success rate highlights the significant challenges startups face in gaining traction within a crowded marketplace. Furthermore, campaigns that utilize video pitches tend to raise an impressive 105% more funds than those that do not, emphasizing the power of storytelling and visual engagement in capturing investor interest.

As Grant Ejimone highlights, examples of crowdfunding platforms, such as Kickstarter, have more than 30 million supporters and 8 million returning supporters, demonstrating the potential reach and community that can be utilized through effective funding strategies.

The Impact of Crowdfunding on Small Businesses

Crowdfunding has emerged as a game-changer for small businesses, offering alternative financial sources that circumvent traditional financing barriers. By allowing entrepreneurs to gather funds without giving up considerable equity or taking on major debt, this method democratizes access to finance. This model not only offers essential financial support but also serves as a powerful marketing instrument, creating enthusiasm and drawing in early adopters.

Many small enterprises have effectively utilized collective funding, using the resources for production, market testing, and brand development. Amidst challenges such as selective financial access and talent retention, crowdfunding serves as a vital lifeline for UK startups. As Stephanie Lennox aptly noted,

The full picture of Brexit’s impact on UK small businesses is still unfolding,

emphasizing the ongoing challenges that entrepreneurs encounter in obtaining financial support.

Additionally, with 24% of UK enterprises citing economic instability as their primary concern, the urgency for effective financial solutions is heightened. Crowdfunding nurtures innovation and supports a diverse range of business ideas, fostering growth in this increasingly complex landscape. With the collective funding sector projected to grow at a compound annual growth rate (CAGR) of 13.8% from 2024 to 2032, its impact on small business financing is set to expand, paving the way for even greater opportunities in the near future.

Building Trust: Security Considerations in Crowdfunding

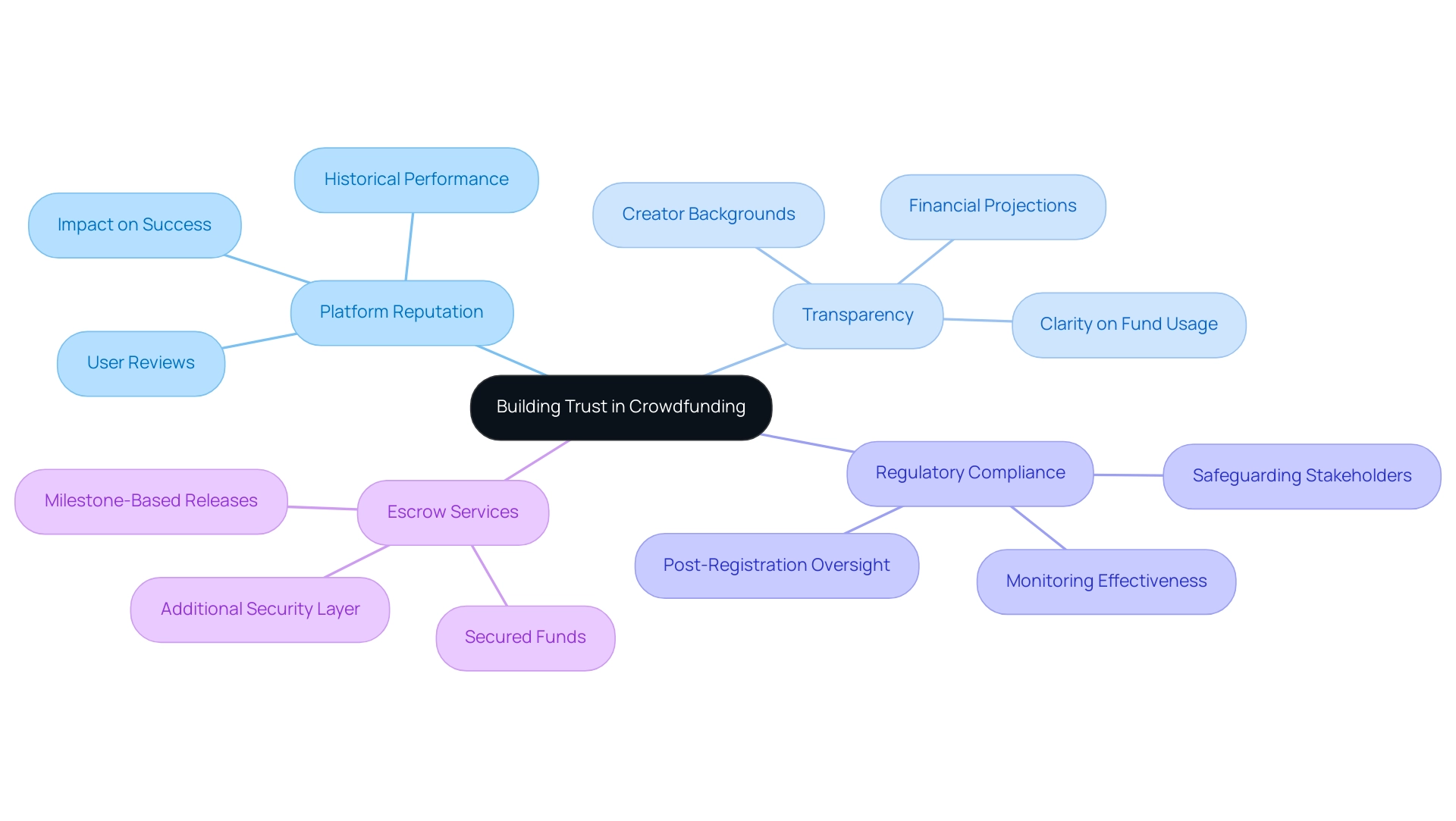

Trust and security remain paramount within the funding landscape, as both investors and project creators require assurance in their financial interactions. Critical considerations for establishing confidence include:

- Platform Reputation: Analyzing a platform’s history, user reviews, and performance can reveal its reliability and impact on crowdfunding success. Given that the number of active equity crowdfunding raises reached an all-time high of 569 by December 2024, understanding the reputation of these venues is more crucial than ever. Notably, statistics show that 19% of the Disengaged Donors segment are aware of the Charity Commission, highlighting varying levels of trust among different donor segments.

- Transparency: Platforms that excel in transparency typically offer comprehensive details about their projects, encompassing financial projections and backgrounds of the creators. For instance, individuals in the Trusting Receivers Segment engage with charities expecting clarity on fund usage and the effectiveness of their contributions. This expectation for transparency fosters trust and encourages ongoing participation.

- Regulatory Compliance: Following applicable regulatory frameworks not only safeguards stakeholders but also strengthens the reliability of the system. As one respondent noted regarding the Charity Commission, "I trust that they only register charities that meet the criteria, but it is the after bit that has the question marks... I’m not sure the confidence is there that the Charity Commission can be on top of monitoring them all." This viewpoint highlights the significance of strong regulatory supervision and the examination entities are undergoing to improve their monitoring abilities, tackling issues regarding post-registration oversight.

- Escrow Services: The utilization of escrow accounts by select platforms ensures that funds are secured until specific project milestones are accomplished, thus providing an additional layer of security for stakeholders.

By emphasizing these critical considerations, both investors and creators can navigate the funding landscape with enhanced confidence, ultimately contributing to a more secure and trustworthy ecosystem across various geographical regions.

Success Stories: Notable Crowdfunding Campaigns

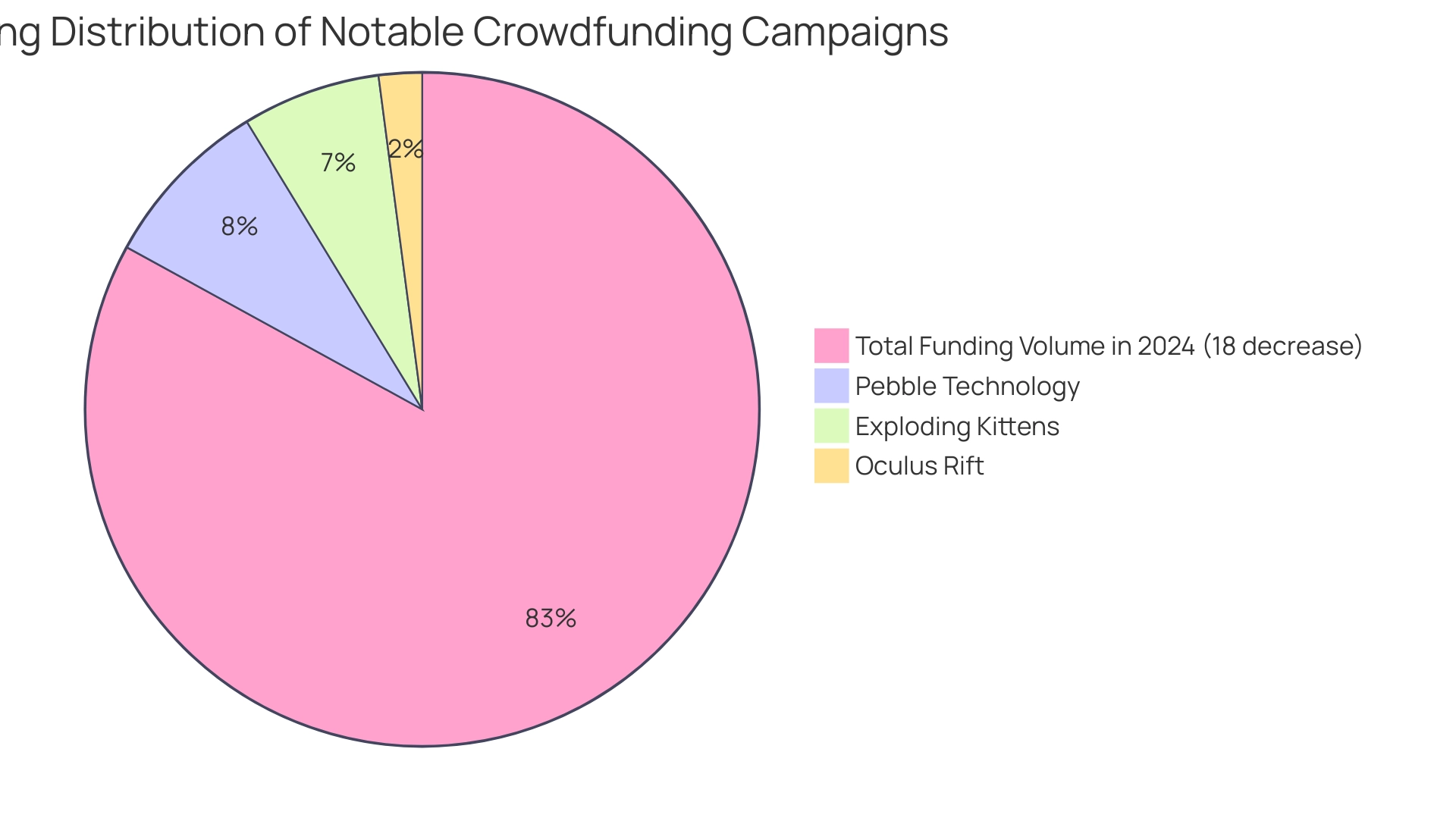

The fundraising landscape is rich with examples of campaigns that have not only succeeded but also transformed industries. Noteworthy successes include:

-

Pebble Technology: Their groundbreaking smartwatch campaign on Kickstarter amassed over $10 million, underscoring the potential of community backing in tech innovation.

The campaign not only attracted funding but also established Pebble as a pioneer in the wearable technology market.

-

Oculus Rift: This virtual reality headset garnered nearly $2.5 million on Kickstarter, a campaign that ultimately led to its acquisition by Facebook, highlighting how collective funding can serve as a launchpad for groundbreaking tech products.

-

Exploding Kittens: This card game achieved astounding popularity, raising over $8 million on Kickstarter, making it one of the most funded projects in the platform's history. Its success reflects the power of engaging storytelling and community involvement in funding initiatives.

Despite these successes, it's important to note that the total investment volume in 2024 was 18% lower than in 2023, indicating a shift in the fundraising landscape that could impact future campaigns. Statistics suggest that roughly 37.86% of financial campaigns obtain at least some capital, demonstrating the feasibility of collective financing as a financial option. Additionally, advertising trends in the United States play a significant role in shaping campaign visibility and success.

As articulated by Kingscrowd,

At Kingscrowd, we remain committed to building the tools and services that democratize access to capital and empower both investors and entrepreneurs to thrive in this dynamic ecosystem.

These success stories not only illustrate the potential of crowdfunding but also serve as inspiration for aspiring entrepreneurs to leverage this innovative funding model, while understanding the various types of crowdfunding available, including examples of crowdfunding platforms like equity crowdfunding and reward-based donations.

Conclusion

Crowdfunding has emerged as a transformative force in the entrepreneurial landscape, providing innovative funding solutions that bypass traditional financial barriers. By harnessing the collective power of individuals through various models—such as donation-based, reward-based, equity, and debt-based crowdfunding—entrepreneurs can access a diverse pool of investors while simultaneously engaging their communities. This democratization of finance not only fosters creativity and innovation but also validates market demand, enabling startups to thrive.

While the benefits of crowdfunding are substantial, including increased capital access and enhanced community engagement, challenges such as intense competition and regulatory complexities remain. The statistics underscore the competitive nature of this funding avenue, with an average success rate of around 22.4% to 23.7% for campaigns. However, successful examples, such as Pebble Technology and Oculus Rift, illustrate the immense potential of crowdfunding to launch groundbreaking products and reshape industries.

As the crowdfunding sector continues to grow, projected to expand at a compound annual growth rate of 13.8% from 2024 to 2032, it is crucial for entrepreneurs to approach this funding model strategically. Emphasizing transparency, platform reputation, and effective communication will enhance trust and security for both investors and creators, ultimately contributing to a more robust crowdfunding ecosystem. With the right approach and a compelling narrative, crowdfunding can serve as a vital lifeline for startups, paving the way for a new generation of innovative ideas that can significantly impact society.