Overview

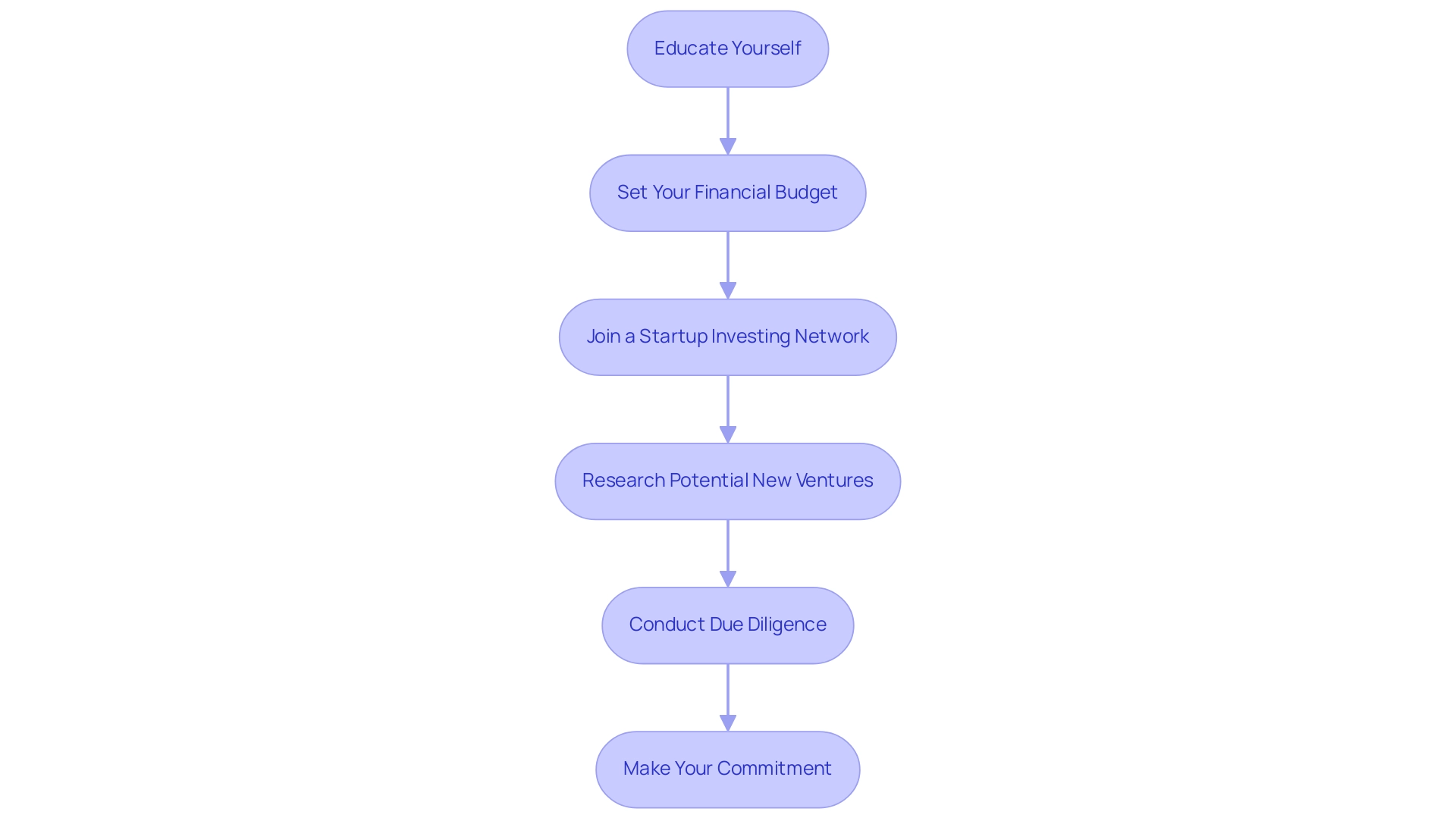

To get started with startup angel investing, individuals should educate themselves about the investment landscape, set a financial budget, and engage with networks that provide mentorship and resources. The article outlines a step-by-step guide emphasizing the importance of thorough due diligence and strategic networking, which are crucial for navigating the risks and rewards of investing in early-stage startups.

Introduction

Angel investing has emerged as a vital component of the startup ecosystem, offering affluent individuals the opportunity to support early-stage ventures in exchange for equity ownership.

As this investment avenue grows, particularly in regions like Montenegro, where the market for business angel investments is estimated at around 0.5 million euros, understanding the intricacies of angel investing becomes essential for new investors.

This article delves into the fundamentals of angel investing, guiding prospective investors through the necessary steps to embark on their journey, from education and networking to evaluating startups and navigating the associated risks and rewards.

By equipping investors with the knowledge to make informed decisions, it aims to illuminate the path toward successful engagement in this dynamic sector.

Understanding Angel Investing: A Primer for New Investors

Startup angel investing refers to the practice of affluent individuals providing capital to early-stage startups in return for equity ownership, a model integral to the startup ecosystem, as it enables entrepreneurs to secure essential funds for growth. Recent statistics emphasize the growing potential in areas such as Montenegro, with the market for business backers estimated at around 0.5 million euros. Furthermore, an increasing trend of co-financing between US and UK participants, especially in the flourishing AI sector, has been crucial in strengthening the UK funding ecosystem.

Generally, private equity backers, particularly in the realm of startup angel investing, are high-net-worth individuals driven by a passion for nurturing innovation and entrepreneurship, yet it is essential to approach this funding avenue with a clear understanding of the associated risks and rewards. While substantial financial returns are possible, the high failure rates of new ventures across various industries present the inherent risk of complete capital loss. For example, startups such as Elnora AI and Coursera illustrate the potential for expansion and creativity in the Baltic area, demonstrating how early-stage funding can result in successful outcomes.

Industry reports emphasize the necessity for thorough due diligence before committing funds, especially as the venture capital activity in Europe indicates a robust environment for funding opportunities. As Nikolaus Hutter, founder and expert in the field, aptly states, "These sessions will clarify all of your questions on the funding process and access to financing," emphasizing the importance of being well-informed as one navigates the complexities of startup angel investing. Moreover, recent case studies and funding highlights from Baltic enterprises, alongside insights from financial leaders like Sten Tamkivi and Kristjan Vilosius, illustrate the essential role of community and strategic insight in promoting successful allocations within the region.

Step-by-Step Guide to Starting Your Angel Investing Journey

-

Educate Yourself: Begin by immersing yourself in the entrepreneurial ecosystem and familiarizing yourself with various investment strategies across sectors such as venture capital, private credit, and real estate. Understanding the challenges that startups face is essential for successful startup angel investing. Consider attending workshops or utilizing comprehensive education resources that focus on startup angel investing opportunities, which are increasingly available for newcomers. Significantly, the value of business angel contributions in Montenegro is 0.5 million euros, illustrating the potential landscape for new investors.

-

Set Your Financial Budget: Establish a clear financial budget. It is crucial to determine how much capital you are comfortable allocating, keeping in mind that startup funding can be highly volatile. As a rule of thumb, consider investing only what you can afford to lose, given the inherent risks associated with this asset class.

-

Join a Startup Investing Network: Engaging with established startup investing groups or networks, such as those connected to fff.club, can be highly beneficial. These networks offer access to valuable resources, mentorship, and a broader range of funding opportunities. They also facilitate co-investing, as noted by Jenny Tooth, Executive Chair of the UK Business Angels Association, who remarked,

Yes, I think you’re absolutely right. There’s a lot more co-investing going on into the earlier-stage businesses between the US and UK.

Additionally, be aware of the 'invisible market' of startup angel investing, which includes unreported or informal contributions that can significantly impact the overall landscape. -

Research Potential New Ventures: Utilize various online platforms and networks to identify emerging companies that are actively seeking funding. Conduct a careful evaluation of their business models, market potential, and the capabilities of their management teams. This initial research lays the groundwork for informed investment decisions related to startup angel investing.

-

Conduct Due Diligence: Prior to making any capital commitments, it is imperative to perform thorough due diligence on the chosen venture. This process involves assessing the company’s viability, understanding its market position, and analyzing potential risks. Specific methodologies for due diligence may include financial analysis, market research, and management assessments. The transformative potential of generative AI in private markets, particularly in areas such as thesis generation and deal sourcing, should be considered during this phase, as it can provide insights into the startup's strategic direction and operational efficiency. Furthermore, opportunities for co-investing in venture capital, private credit, and real estate can be explored through platforms like fff.club, enhancing due diligence efforts.

-

Make Your Commitment: When you are confident in your analysis and ready to proceed, finalize your commitment. Ensure that all legalities are meticulously addressed and documented, safeguarding your interests as an investor. As the private markets evolve, particularly with trends such as the transformative applications of generative AI, keeping abreast of these developments will further enhance your investment strategy.

Evaluating Startups: Key Criteria and Assessment Models

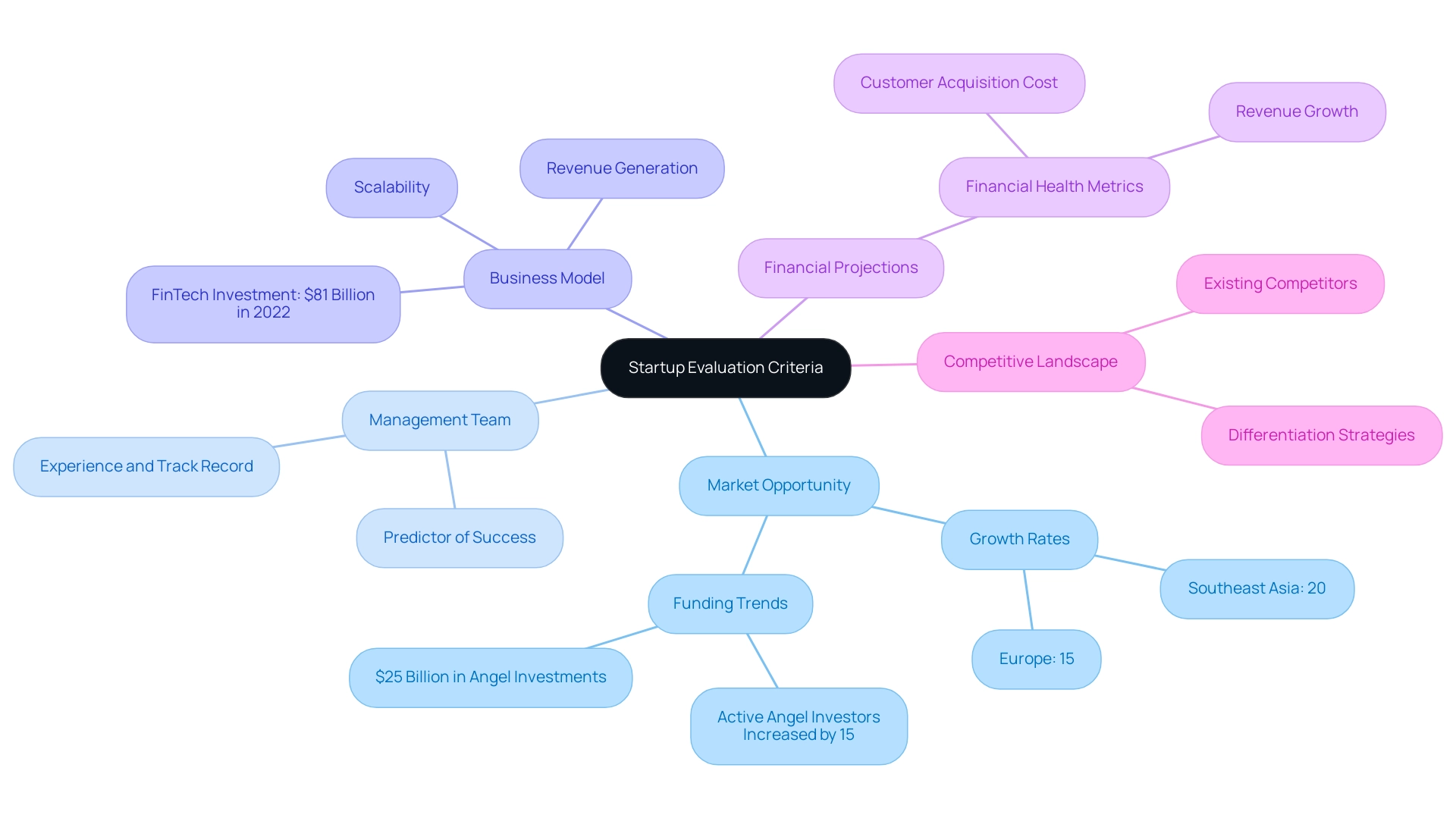

When assessing new ventures, a comprehensive analysis based on the following criteria is essential:

-

Market Opportunity: Examine the target market's size and growth potential. With Southeast Asia and Europe experiencing growth rates of 20% and 15% in financing for new ventures respectively, understanding the market dynamics is crucial for identifying a company's unique value proposition in a competitive landscape. A report by the Angel Capital Association indicated that the number of active angel investors increased by 15% compared to the previous year, resulting in an influx of around $25 billion in startup angel investing for the year, underscoring the importance of staying informed about funding trends.

-

Management Team: Investigate the experience and track record of the founders and key team members. A well-rounded and seasoned team is frequently a strong predictor of success and sustainability in the entrepreneurial ecosystem.

-

Business Model: Scrutinize how the venture intends to generate revenue and maintain growth. It's vital to evaluate the scalability of their model, particularly in light of current trends where venture investment into FinTech companies reached $81 billion in 2022, indicating robust interest in innovative business approaches.

-

Financial Projections: Analyze financial statements and projections to assess the company's financial health and its potential for future growth. A detailed understanding of financial metrics, such as customer acquisition cost and revenue growth, can offer insights into the viability of the business.

-

Competitive Landscape: Identify existing competitors and evaluate how the new venture differentiates itself in the market. This comprehension aids in assessing the company's positioning and potential for success.

To demonstrate the practical application of these evaluation criteria, new ventures should concentrate on key metrics that indicate growth and financial wellness when reporting to stakeholders. Customizing reports to stakeholder interests helps build confidence and illustrates the venture's potential for success.

To organize your evaluation process effectively, consider utilizing assessment models such as SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis and the Business Model Canvas. These frameworks provide a systematic approach to identifying key criteria for startup assessment, allowing investors to make informed decisions in startup angel investing within a rapidly evolving landscape.

Building Connections: Networking Strategies for Angel Investors

To navigate the competitive landscape of startup angel investing, adopting effective networking strategies is crucial. Venture capital funding typically ranges from £1 million to £10 million or more, underscoring the significance of strategic connections. Here are several approaches that can enhance your connections and funding opportunities:

- Engage with the Community at fff.club: For tech investors, participating in the vibrant community at fff.club provides access to over 400 fellow investors, enabling collaborative wealth management and financial insights. This network enables you to exchange knowledge and experiences, offering a strong basis for financial decisions. Members frequently share testimonials regarding their successful partnerships, like Salv Bolt from Inbank, who mentioned, 'The connections I made at fff.club have been essential to my financial strategy.' Attending industry events such as startup conferences, pitch competitions, and networking gatherings enables you to directly connect with entrepreneurs and other financiers involved in startup angel investing. These gatherings offer priceless opportunities for networking and acquiring insights into emerging trends.

- Join Online Communities: Actively engaging in forums and social media groups focused on venture funding and entrepreneurship nurtures connections with like-minded individuals and broadens your knowledge base.

- Leverage Professional Platforms: Using professional networks such as LinkedIn can assist you in connecting with industry leaders and showcasing your funding interests, thereby increasing your visibility within the community.

- Seek Mentorship: Building relationships with seasoned venture funders can provide you with essential guidance and insights drawn from their experiences, enhancing your own funding decisions. As Daniel Priestley, CEO and founder of Dent Global, states, 'This book will help you translate your entrepreneurial vision into something investors can get behind.'

- Collaborate with Other Investors: Co-investing with fellow angels not only mitigates risks but also allows for shared insights, leading to more informed and strategic funding choices. At fff.club, the collaborative evaluation of high-grade deals ensures that you are making well-informed decisions backed by collective expertise. This includes a structured due diligence process that enhances the quality of investment opportunities in startup angel investing, and these strategies are particularly relevant as the landscape evolves. A structured approach to networking is beneficial, as evidenced by successful collaborations that have emerged through these channels. According to recent developments, startups are encouraged to customize their pitch decks for various types of backers, which underscores the importance of these networking strategies in improving funding outcomes. Additionally, businesses must follow a detailed process to secure investor funding, which includes developing a solid business plan and demonstrating market traction, as highlighted in the case study titled 'Securing Investor Funding.' This organized method enhances the chances of attracting private backers and successfully obtaining funding. Furthermore, members receive weekly tech and economic updates, keeping them informed about market trends and opportunities.

Navigating Risks and Rewards in Angel Investing

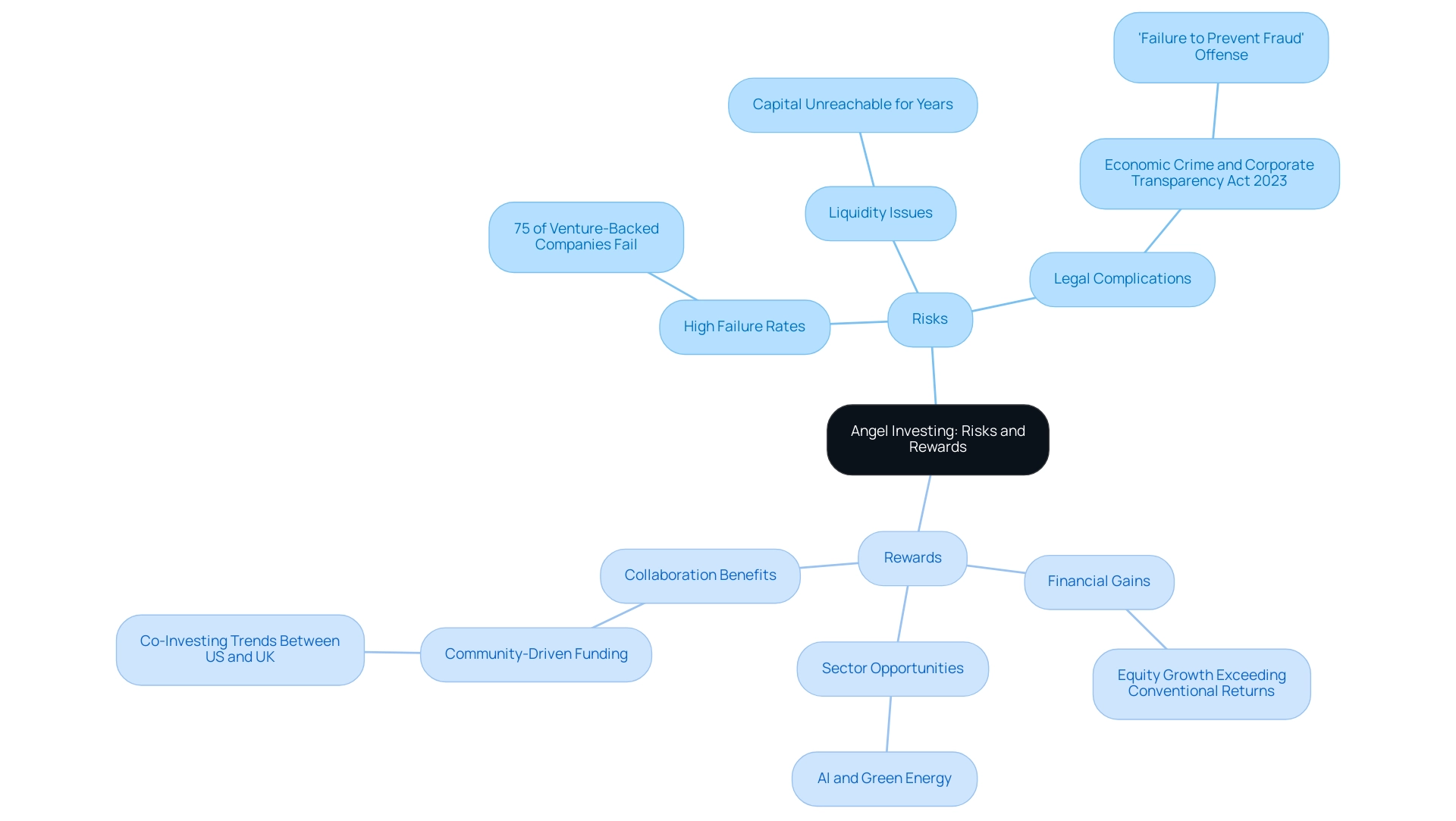

Startup angel investing presents a landscape characterized by both considerable risks and substantial potential rewards, necessitating a well-informed approach for investors.

-

Risks: The inherent risk of angel investing is underscored by the high failure rates among new ventures, with statistics indicating that approximately 75% of venture-backed companies fail to deliver returns. This situation implies that those engaged in startup angel investing may encounter the total loss of their complete financial contribution if a new business does not thrive. Furthermore, liquidity is a common issue; it may require several years for a venture in a new business to produce returns, making the capital unreachable during that period. The Economic Crime and Corporate Transparency Act 2023 has further complicated the landscape, introducing a 'failure to prevent fraud' offense that stakeholders need to navigate carefully. This new legislation emphasizes the need for diligence in evaluating emerging companies to mitigate potential legal risks associated with fraud and money laundering.

-

Rewards: Conversely, successful startup angel investing can lead to remarkable financial gains. Historically, initial backers in prosperous startups through startup angel investing have encountered equity growth that significantly surpasses conventional returns. The potential for significant rewards is particularly evident in sectors like artificial intelligence and green energy, which are projected to drive innovation and growth in the coming years. Insights from leaders like Sten Tamkivi and Kristjan Vilosius emphasize the significance of startup angel investing through community-driven funding opportunities, illustrating how joint efforts among over 400 tech backers can enhance wealth management and success rates. Notably, Sten Tamkivi and Taavet Hinrikus recently founded Plural, a funding platform aimed at supporting unemployables, showcasing their commitment to innovative funding strategies. Jenny Tooth, Executive Chair of the UK Business Angels Association, emphasizes this collaborative spirit, stating,

Yes, I think you’re absolutely right. There’s a lot more co-investing going on into the earlier-stage businesses between the US and UK.

This collaboration not only promotes a nurturing environment but also increases the chances of success for individuals engaged in startup angel investing by combining their resources and knowledge.

To successfully maneuver through the intricate dynamics of early-stage funding, particularly in startup angel investing, it is crucial to embrace a strategy of diversification, perform comprehensive due diligence on prospective opportunities, and stay alert to emerging market trends. Recent reports indicate that subjective time discounting among individuals with entrepreneurial experience positively correlates with angel funding actions, suggesting that a long-term perspective can be beneficial. Furthermore, insights from the case study titled 'Global Economic Landscape for 2025' recommend that individuals concentrate on strategic diversification, particularly in sectors like AI, green energy, and startup angel investing, to effectively navigate the complex economic environment.

By aligning investment strategies with current risks and opportunities, investors can make informed decisions that balance potential rewards against the inherent uncertainties of the startup ecosystem.

Conclusion

Angel investing represents a significant opportunity for affluent individuals to engage in the startup ecosystem, particularly in emerging markets such as Montenegro. The journey begins with:

- Education

- Setting a clear investment budget

- Joining networks that facilitate access to valuable resources and mentorship

By understanding key criteria for evaluating startups—such as market opportunity, management team, and business model—investors can make informed decisions that enhance their chances of success.

Moreover, effective networking strategies play a crucial role in building connections that can lead to fruitful investments. Engaging with communities like fff.club, attending industry events, and seeking mentorship are all essential steps in establishing a robust investment approach. While the risks associated with angel investing—such as high startup failure rates and liquidity concerns—are significant, the potential rewards can be substantial, especially in innovative sectors like artificial intelligence and green energy.

Ultimately, a well-informed investor who navigates the complexities of angel investing with diligence and strategic insight can capitalize on the unique opportunities presented in this dynamic market. By embracing a long-term perspective and focusing on diversification, investors can balance the inherent risks with the potential for remarkable financial gains, marking a successful foray into the world of angel investing.