Overview

Crowdfunding platforms primarily make money by charging a percentage of the total funds raised, typically between 5% to 10%, along with transaction fees from payment processors. The article supports this by detailing various revenue models, including subscription services and marketing assistance, which illustrate how these platforms sustain their operations while providing essential resources for project creators.

Introduction

In the dynamic world of finance, crowdfunding platforms have emerged as pivotal players, revolutionizing how projects secure funding. These online services harness the collective power of individuals to support innovative ideas, ranging from creative ventures to social causes.

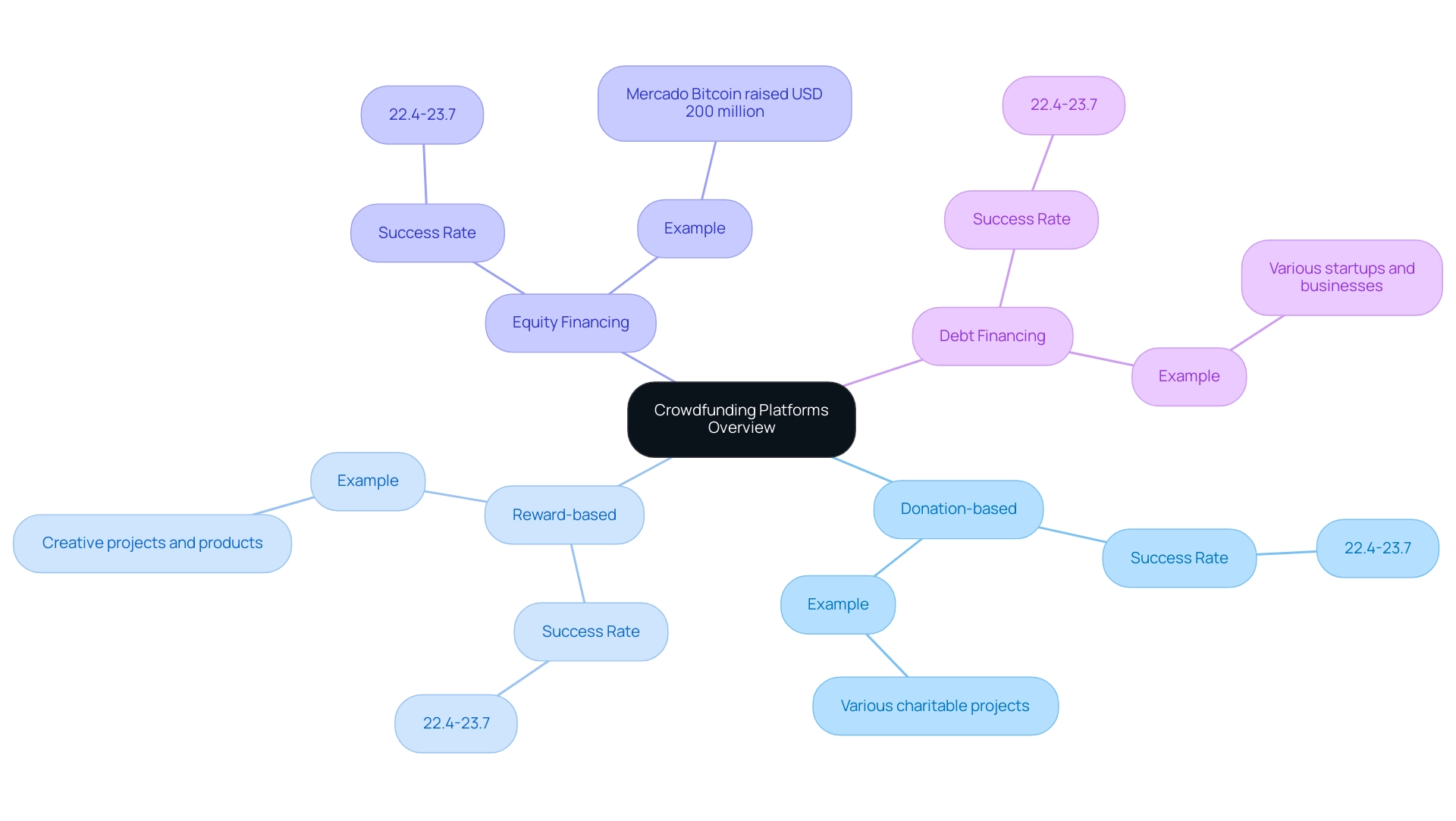

With various models like:

- Donation-based

- Reward-based

- Equity

- Debt crowdfunding

each platform caters to distinct needs and investor interests. Despite the average success rate hovering around 22.4% to 23.7%, many projects thrive with the right strategies in place.

As the crowdfunding landscape continues to evolve, understanding the intricacies of these platforms—including their revenue models, fee structures, and the challenges they face—becomes essential for both creators and investors aiming to navigate this burgeoning ecosystem effectively.

Understanding Crowdfunding Platforms: An Overview

Crowdfunding websites serve as essential online services that enable the financing of various projects by collecting small contributions from a large group of individuals, mainly through the internet. These systems function under various models:

- Donation-based

- Reward-based

- Equity financing

- Debt financing

Each model caters to specific types of projects and aligns with different investor interests.

Notably, the average success rate for fundraising campaigns hovers around 22.4% to 23.7%, with those reaching at least 30% of their funding goal within the first week enjoying a higher likelihood of success. As stated by Zippia, 22.4% of all fundraising campaigns succeed, highlighting the websites' efficiency in rallying financial backing for innovative concepts that may otherwise find it difficult to obtain conventional funding from banks or venture capitalists. A prime example of successful collective funding is Mercado Bitcoin, which raised USD 200 million from the SoftBank Latin America Fund, significantly increasing its market share and positioning it for future growth.

As intermediaries, these services enable artists to connect with possible supporters, establishing the foundation for a thorough investigation into how do crowdfunding platforms make money and sustain their activities. Moreover, analyzing prominent fundraising sites based on the total funds collected in the UK in 2016 will offer important context concerning the competitive environment of fundraising.

Revenue Models of Crowdfunding Platforms: How They Make Money

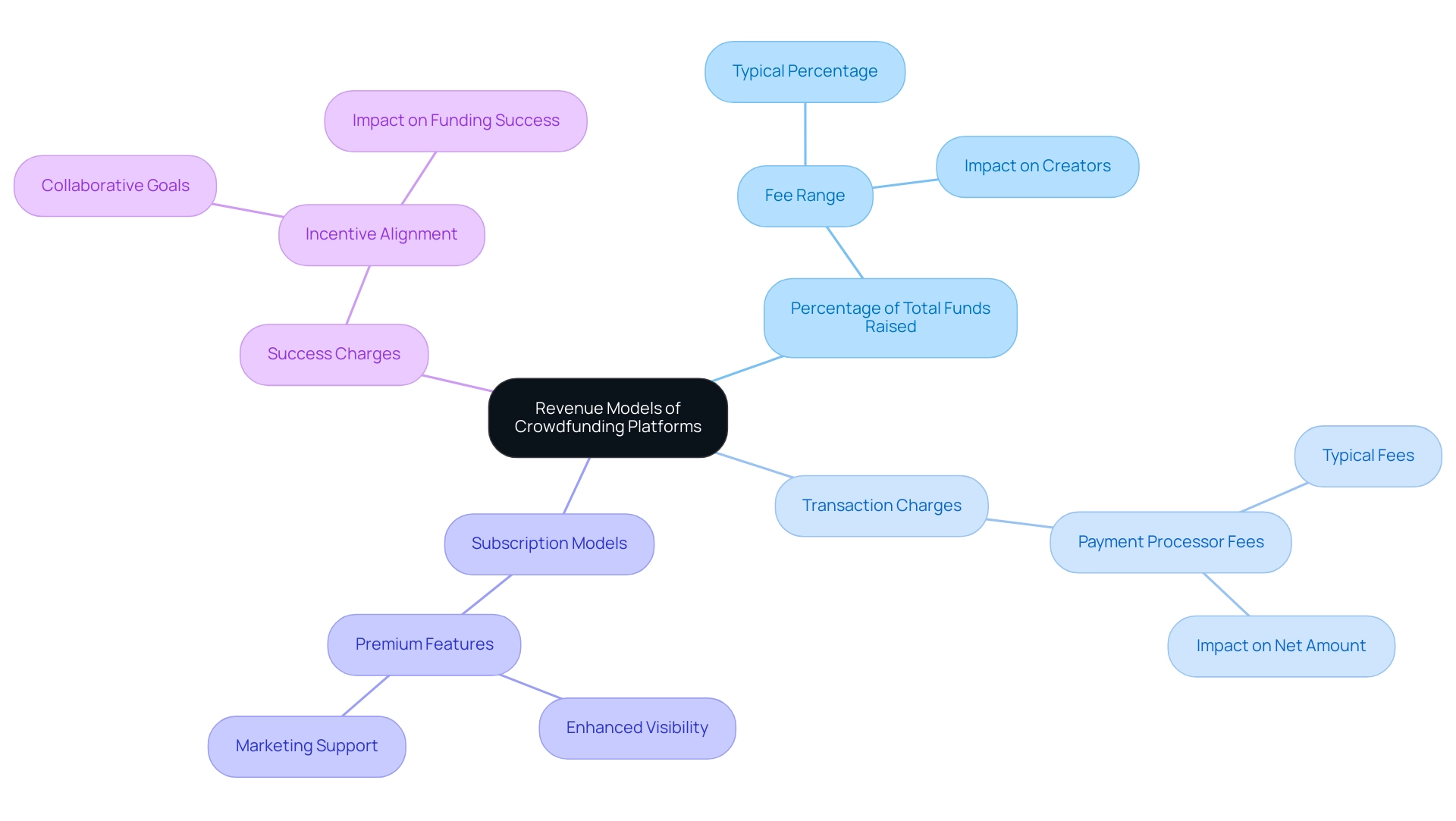

Crowdfunding services generate revenue through several distinct models, each impacting the overall funding experience for creators and backers alike:

- One common question is how do crowdfunding platforms make money, as most of them charge a percentage of the total funds raised, typically ranging from 5% to 10%. This fee is deducted at the conclusion of a successful campaign, ensuring that only successful projects incur this cost. Considering that 20% of crowdfunded firms failed compared to 12% of venture-backed companies, understanding how do crowdfunding platforms make money is essential for reducing risks.

- Transaction Charges: Beyond platform costs, understanding how do crowdfunding platforms make money reveals an additional layer of expenses. Payment processors like PayPal and Stripe impose transaction charges, which raises the question of how do crowdfunding platforms make money, as these charges decrease the net amount creators ultimately receive. These fees can vary but are often around 2.9% plus a fixed fee per transaction, which raises the question of how do crowdfunding platforms make money, as they can add up significantly depending on the campaign's size.

- Subscription Models: Some services provide premium features for an added monthly fee. These services may include enhanced visibility options or specialized marketing support, aimed at increasing a campaign's chances of success. The importance of outreach and marketing strategies is underscored by the average success rate for crowdfunding campaigns, which hovers around 22.4% to 23.7%. Campaigns that achieve at least 30% of their funding goal within the first week are more likely to succeed.

- Success Charges: Certain systems apply success charges, which relate to how do crowdfunding platforms make money, depending on a project's successful funding. This model aligns the interests of both the system and the creator, providing an incentive to work collaboratively towards achieving funding goals, leading to inquiries about how do crowdfunding platforms make money.

Crowdfunding has become a central part of the UK’s high-growth ecosystem, with investments involving the crowd accounting for around 21% of deals in recent years. However, with the current macroeconomic climate and the rising cost of living, individual investors may feel the impact more significantly than institutional funds. In 2024, the average platform charges have been observed to remain consistent, continuing to hover around the 5% to 10% mark.

With the total investment volume anticipated to be 18% lower than in 2023, it’s more crucial than ever for campaigners to be aware of the costs involved. By strategically planning around these costs, users can better navigate the crowdfunding landscape and optimize their chances of success.

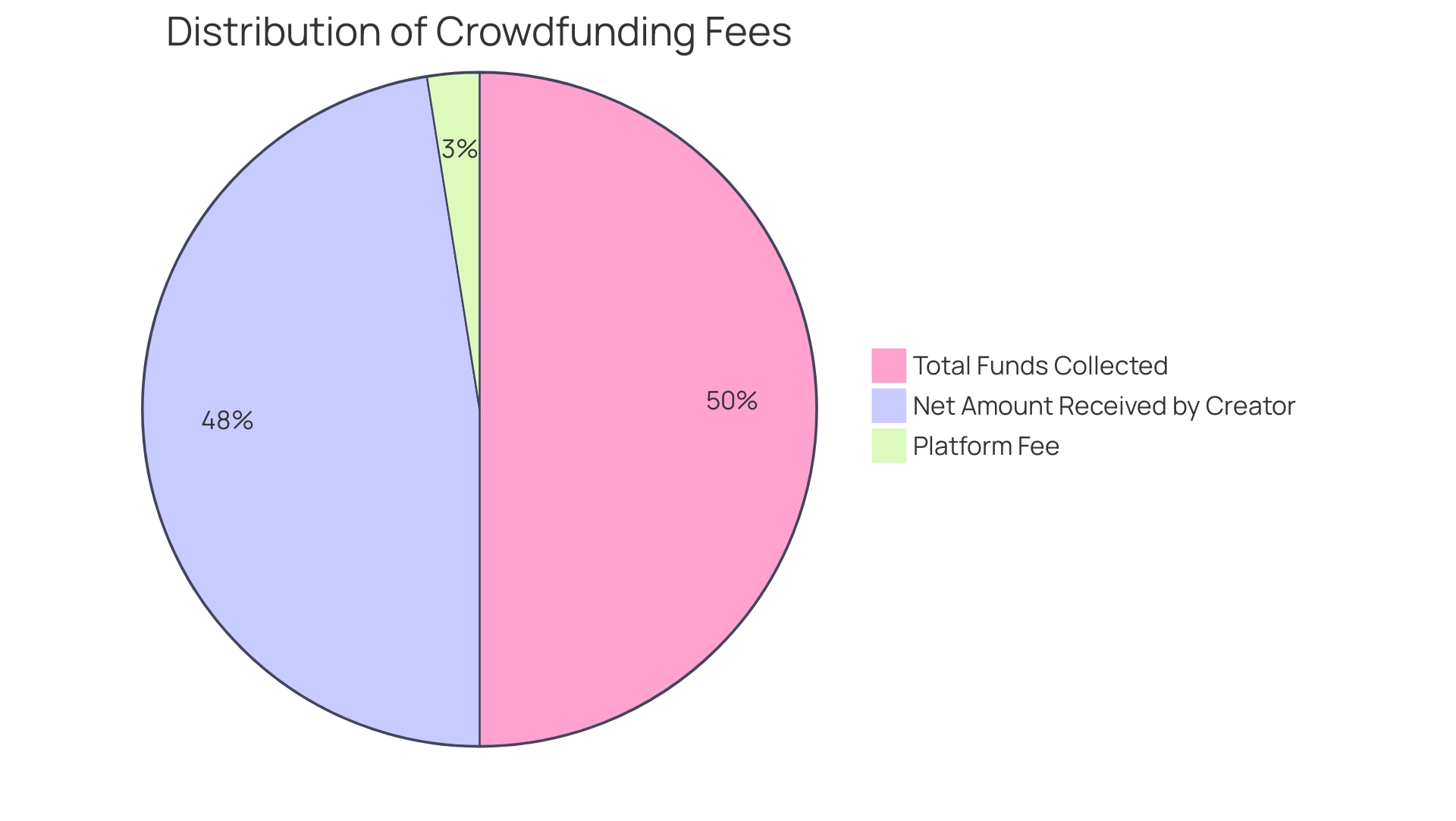

Exploring Platform Fees: The Cost of Crowdfunding

Crowdfunding sites usually charge expenses based on a portion of the total funds collected, making it crucial for innovators and backers to understand how do crowdfunding platforms make money. For example, if a project effectively collects $10,000 and the service takes a 5% fee, the individual ultimately receives $9,500 after the deduction. Furthermore, it's crucial to consider additional transaction fees, which can vary between 2% to 5% depending on the chosen payment processor.

Creators must account for these expenses in their funding goals to ensure they cover their project requirements effectively. Notably, many platforms implement tiered fee structures that reward larger fundraising efforts, encouraging creators to aim higher. Grasping these fee dynamics is crucial, particularly considering that the average success rate for funding campaigns ranges from 22.4% to 23.7%.

Campaigns that secure at least 30% of their funding goal within the first week significantly enhance their chances of success. Moreover, as of December 2024, the number of active equity fundraising efforts reached an all-time high of 569, highlighting the growing popularity of this funding method. The advantages of collective funding, including enhanced access to capital for small enterprises and possible substantial returns, further highlight the necessity for creators to be aware of service charges.

Furthermore, collective funding acts as a tool for market validation and community engagement, enhancing credibility and customer loyalty, which is reflected in the recent case studies. Consequently, understanding how do crowdfunding platforms make money through service charges can significantly affect the choice of a funding site and the overall financial approach behind a project. As reported in the Q3-2024 PitchBook Venture Monitor, this understanding is critical as the landscape evolves, and the median VC valuation for Seed deals reached $13.0 million, reflecting the growing significance of informed financial planning in crowdfunding.

Types of Crowdfunding: Impact on Platform Revenue

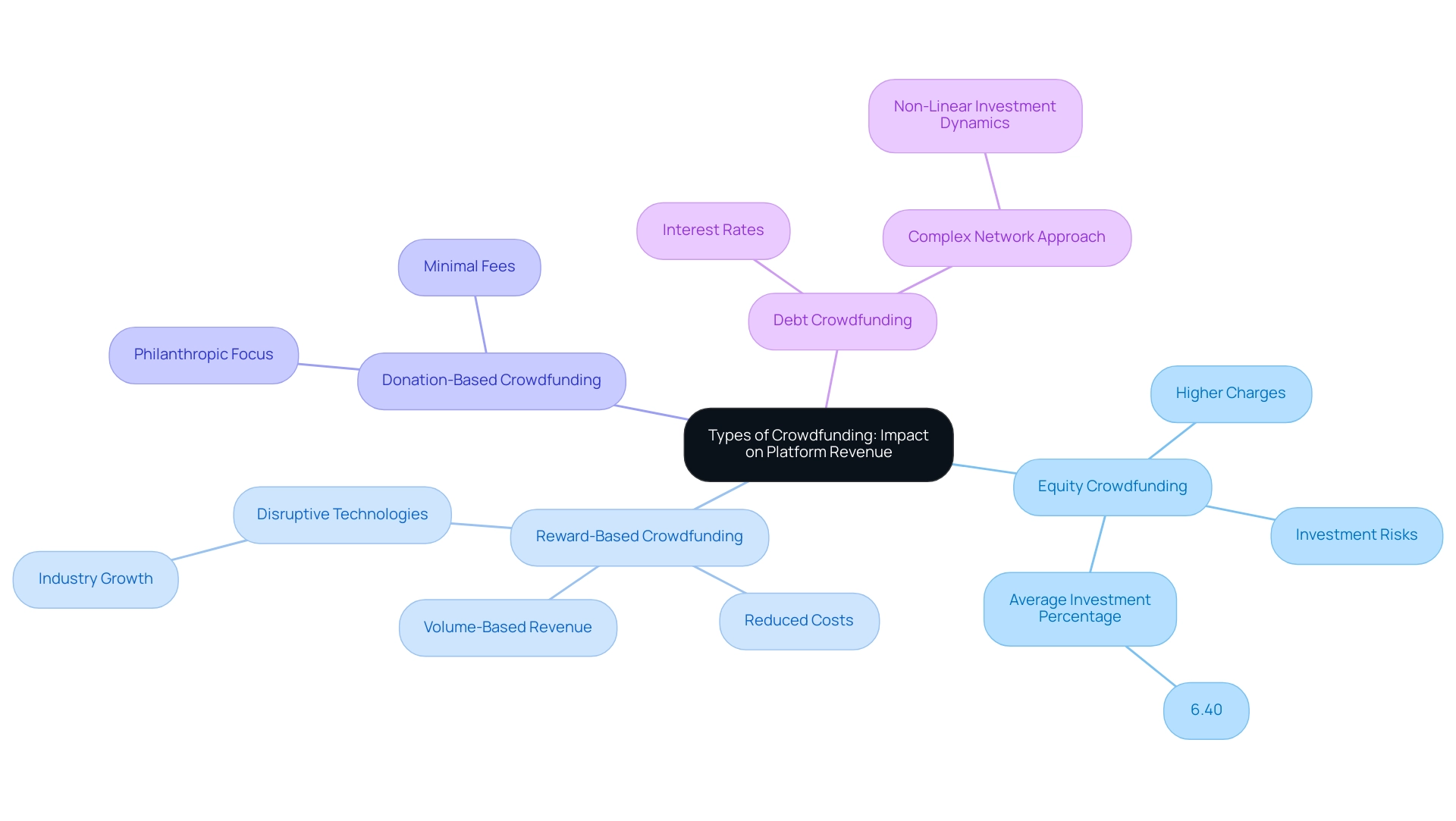

Crowdfunding includes various models, each with unique revenue implications for services:

-

Equity Crowdfunding: This model allows investors to acquire shares in a startup or business. Due to the complex legal adherence and investor oversight involved, systems typically impose higher charges, leading many to wonder how do crowdfunding platforms make money.

The substantial revenue generated often raises the question of how do crowdfunding platforms make money, reflecting the value of investments and the associated risks. Recent insights indicate that to understand the revenue implications of equity fundraising systems in 2024, we must explore how do crowdfunding platforms make money, necessitating a closer examination of their fee structures. Notably, the average percentage of money invested by lone start-ups is 6.40%, highlighting the potential for significant financial engagement in this model.

-

Reward-Based Crowdfunding: In this approach, backers receive non-monetary rewards, such as products or experiences, in exchange for their contributions. Platforms concentrating on this model typically impose reduced costs, leading to the inquiry of how do crowdfunding platforms make money by relying on volume to generate revenue.

The typical charges for reward-based crowdfunding services are competitive, prompting an inquiry into how do crowdfunding platforms make money, which makes them appealing for creators. As noted by industry expert Jenny Chang, 'The explosive growth in this sector is driven by businesses quickly adopting disruptive technologies,' which enhances the overall funding landscape.

-

Donation-Based Crowdfunding: Platforms operating on a donation basis do not provide financial returns. Instead, they depend on philanthropic contributions, often maintaining minimal fees. The focus here is on supporting causes rather than generating profit, making it appealing for social initiatives.

-

Debt Crowdfunding: Also known as peer-to-peer lending, this type involves services that facilitate loans between individuals. These platforms often impose interest rates, leading to an understanding of how do crowdfunding platforms make money.

As investment dynamics shift toward more complex systems, understanding how do crowdfunding platforms make money in relation to debt financing is essential. The emerging research highlights a complex network approach to collective funding, shifting from linear to non-linear perspectives on investment matching dynamics. This shift could transform how services strategize their revenue generation.

By examining these funding methods and their financial frameworks, users can better appreciate how do crowdfunding platforms make money and the various strategies used by providers to sustain and grow their enterprises.

Marketing and Consulting: Additional Revenue Streams for Platforms

In addition to standard fees, understanding how do crowdfunding platforms make money involves examining how they are increasingly tapping into marketing and consulting, which have become significant revenue streams. These offerings can include:

-

Marketing Assistance: Numerous services offer promotional tools, advertising campaigns, and social media strategies designed to assist individuals in expanding their reach.

This marketing assistance can either be provided as a paid service or incorporated in premium subscription plans, enabling project developers to select the level of support that best suits their needs.

-

Consulting Services: Several platforms offer individual consulting sessions for project developers.

These consultations focus on refining pitches, developing effective marketing strategies, and navigating the complexities of compliance issues. While these personalized services usually incur extra expenses, they provide considerable value to individuals aiming for successful campaigns.

-

Data Analytics: Platforms often offer access to advanced data analytics services that deliver insights into funding trends, investor behaviors, and emerging market opportunities. This data can be invaluable for both developers and investors, aiding decision-making and strategy formulation.

The worldwide collective funding sector was estimated at $1.41 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 14.5%.

As the industry continues to flourish, these services not only enhance profitability but also provide creators with essential tools to succeed in various leading categories, including social causes and business. Imed Bouchrika, Co-Founder and Chief Data Scientist, captures this feeling, stating,

The realm of collective financing is flourishing, providing a variety of avenues to assist individuals and businesses in gathering resources for their initiatives and causes.

By diversifying their revenue sources through innovative marketing and consulting services, funding initiatives can create additional value for users while illustrating how do crowdfunding platforms make money from the industry’s growth potential.

Challenges and Risks: Navigating the Crowdfunding Landscape

Crowdfunding sites face a variety of challenges and risks that significantly affect their operations and profitability:

- Regulatory Compliance: Navigating the intricate legal landscape is a formidable challenge, as entities must adhere to diverse regulations based on the type of fundraising they provide. Non-compliance can result in substantial penalties, making adherence not just advisable but essential. As compliance professionals prepare for 2024, they must also navigate emerging risks, which further complicate the regulatory landscape.

- Market Competition: The crowdfunding sector is characterized by intense rivalry, with a growing number of services vying for creators and investors. This heightened rivalry can compress fees, subsequently affecting how crowdfunding platforms make money. In a landscape where services must differentiate themselves, standing out becomes critical.

- Project Viability: The success of funding initiatives relies on the feasibility of the projects they support. Platforms thrive when projects meet their funding targets and deliver on promises. Conversely, failures can tarnish reputations, discouraging potential creators from seeking support in the future. Notably, campaigns featuring video pitches tend to raise 105% more funds, underscoring the importance of effective project presentation.

- Fraud Risks: The potential for fraudulent projects presents a significant risk to investors, leading to increased regulatory scrutiny. While implementing thorough vetting processes is vital to mitigate these risks, it often demands considerable resources. As Gareth Cleverly, Director of Sales at Dacxi Chain, highlights, the push for compliance and transparency is crucial in democratizing investments and shaping the future of global finance.

- Challenges in Third-Party Compliance Audits: A pertinent case study reveals that only 22% of organizations perform regular compliance audits on third parties, with many auditing based on triggering events. This statistic underscores the importance of ongoing monitoring, as 11% of risk and compliance professionals rated their ongoing monitoring of third parties as poor, highlighting a critical area for improvement in the crowdfunding sector.

Understanding these challenges equips users with the knowledge to navigate the crowdfunding landscape effectively and make informed decisions as they engage with various platforms.

Conclusion

The evolution of crowdfunding platforms has transformed the financing landscape, providing creators with innovative avenues to secure funding while offering investors diverse opportunities to support projects of interest. By comprehensively understanding the different crowdfunding models—donation-based, reward-based, equity, and debt—both creators and investors can tailor their approaches to maximize success. With average success rates hovering around 22.4% to 23.7%, it is evident that strategic planning and effective marketing can significantly enhance the chances of achieving funding goals.

Moreover, the revenue models employed by these platforms play a crucial role in shaping the overall crowdfunding experience. From platform and transaction fees to subscription and success fees, creators must navigate these costs to ensure their projects remain viable. Understanding the implications of these fees, alongside the potential for additional revenue streams through marketing and consulting services, can empower creators to optimize their funding strategies and enhance their project's visibility.

Despite the promising growth of the crowdfunding industry, challenges such as regulatory compliance, market competition, and the risk of project failures cannot be overlooked. It is essential for both platforms and project creators to address these challenges proactively to maintain credibility and foster a trustworthy environment for investors. By equipping themselves with knowledge about the intricacies of crowdfunding, users can confidently engage in this dynamic ecosystem, harnessing its potential to bring groundbreaking ideas to fruition and support meaningful social causes. As the crowdfunding landscape continues to evolve, staying informed and adaptable will be key to thriving in this competitive arena.