Overview

The article highlights the vital importance of understanding equity within a startup, a concern that resonates deeply with both founders and investors. It emphasizes how crucial equity is not just for funding, but also for motivating employees and ensuring long-term success. As many of our members have experienced, navigating the complexities of equity can be daunting. This piece supports its insights by detailing various types of equity, the implications of equity distribution and dilution, and the significance of vesting schedules.

We understand that legal and tax considerations can feel overwhelming; however, addressing these aspects is essential for fostering a sustainable and fair equity structure within the startup ecosystem. By sharing these insights, we hope to foster a sense of community and support among those embarking on this journey.

Introduction

In the dynamic world of startups, we understand that equity can be a pivotal element determining the trajectory of a company's growth and success. As founders navigate the treacherous waters of funding and investment, grasping the nuances of equity becomes essential. This is especially true in a landscape where a staggering 70% of e-commerce startups fail within five years—a reality that weighs heavily on many aspiring entrepreneurs.

From the foundational concepts of ownership to the intricate details of equity distribution and dilution, this article delves into the critical aspects that every entrepreneur and investor must grasp. By exploring the various types of equity, the importance of vesting schedules, and the legal and tax implications involved, we aim to provide valuable insights into how to leverage equity effectively.

Our goal is to ensure not only survival but also the potential for remarkable growth in the competitive startup ecosystem, fostering a sense of community and shared knowledge along the way.

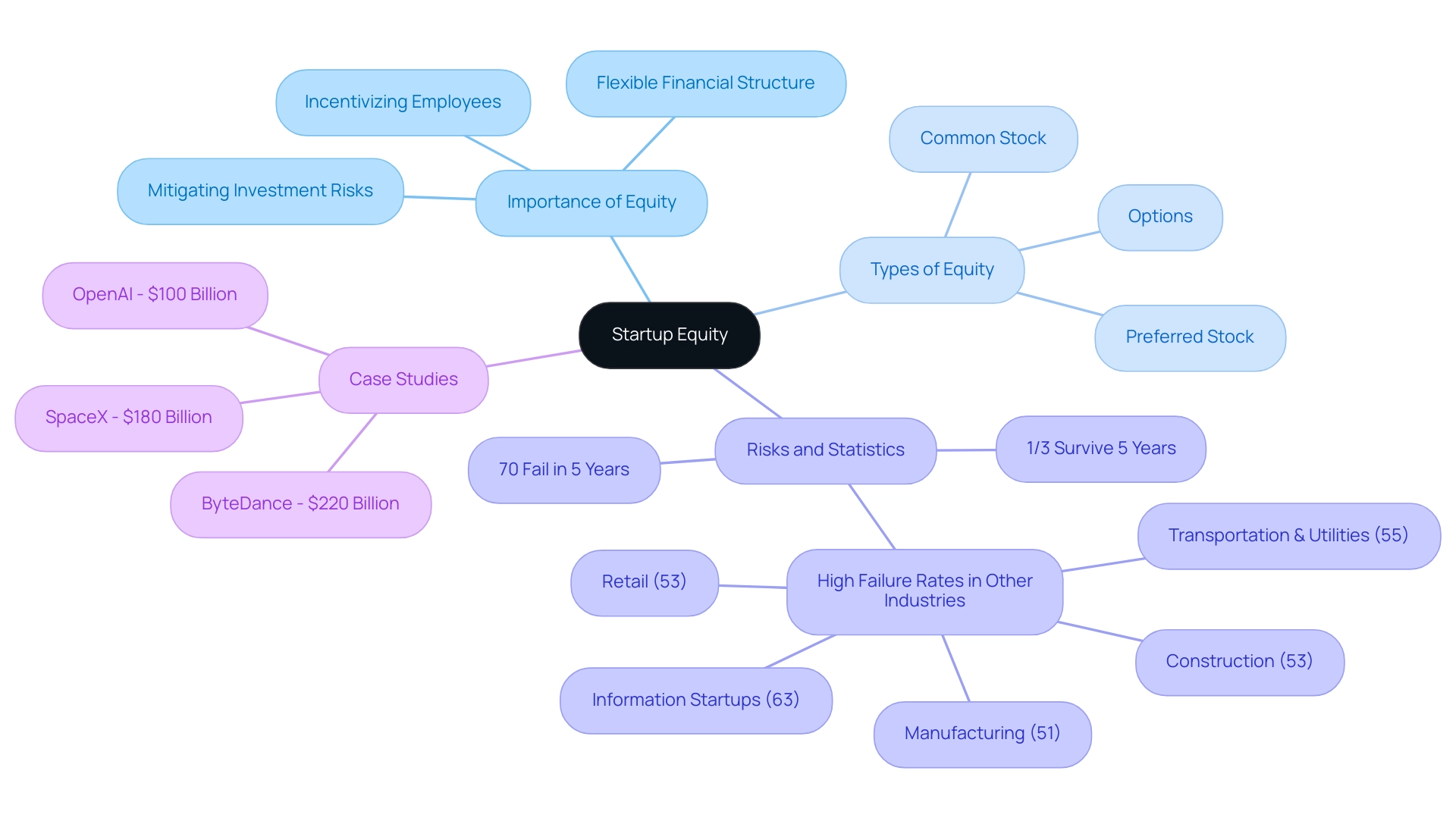

What is Startup Equity and Why It Matters

Equity at a startup represents a stake in a company and plays an essential role in the funding environment for new businesses. With 70% of e-commerce startups failing within five years, we understand that grasping equity at a startup is crucial for mitigating the risks associated with these investments. It empowers entrepreneurs to secure capital without the burden of debt, fostering a flexible financial structure that can adapt to the evolving needs of the business.

Moreover, fairness serves as a powerful tool for incentivizing employees, aligning their interests with the long-term success of the company. A comprehensive understanding of equity at a startup allows both founders and investors to effectively navigate their respective roles and expectations within this challenging ecosystem. Typically, ownership is issued in various forms, including common stock, preferred stock, and options, each possessing unique rights and privileges that can influence governance and financial outcomes.

As many of our members have experienced, the case studies of leading unicorn valuations illuminate the immense potential attainable through effective capital management. Companies like ByteDance, valued at $220 billion, SpaceX at $180 billion, and OpenAI at $100 billion, serve as inspiring examples. Understanding these distinctions is essential for making informed financing decisions and maximizing the potential for both growth and investment return. Chris Demetriou, Head of Business Advisory at Archimedia Accounts, poignantly remarks, 'It’s always a shame to see businesses fail early. But we take heart from the fact that over a third survive five years, which is no mean feat at all.' This highlights the critical role of fairness in ensuring survival and development in the competitive entrepreneurial landscape.

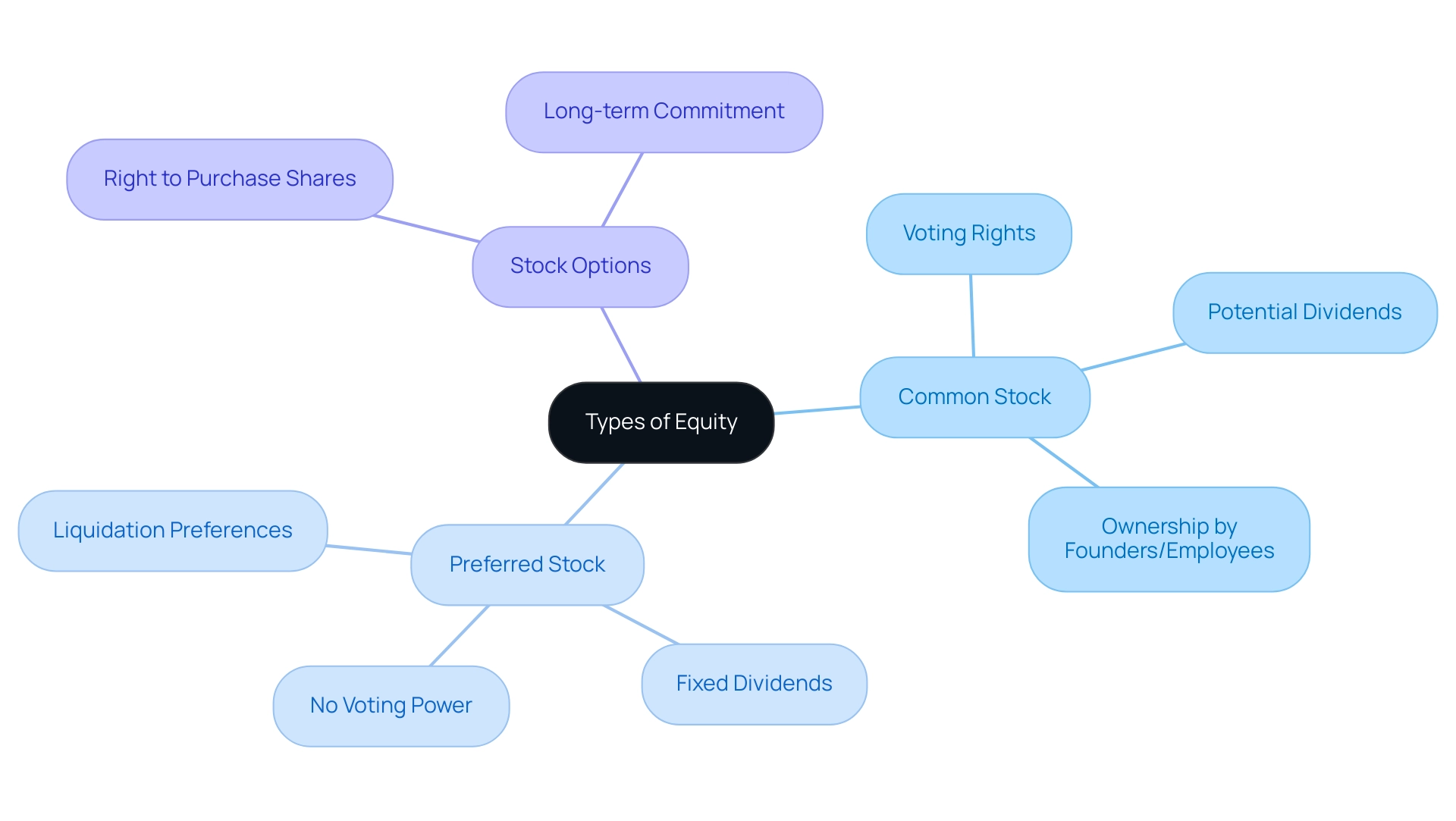

Types of Equity: Understanding Your Options

In the realm of startups, equity is primarily divided into two categories: common stock and preferred stock. Common stock, typically owned by founders and employees, not only provides voting rights but also presents potential dividends, aligning the interests of these stakeholders with the organization's success. We understand that for many, this connection to the company’s growth is crucial. On the other hand, preferred stock, often more appealing to investors, offers distinct advantages, such as liquidation preferences and fixed dividends, providing a layer of stability and predictability in returns that many seek during uncertain times.

As Tyler Corvin, a Senior Trader, insightfully notes,

In general, those with preferred stocks don’t have voting power.

This highlights a significant trade-off for investors who prioritize financial security over control, an important consideration that can weigh heavily on decision-making.

Alongside these types, stock options emerge as another crucial element, granting employees the right to purchase shares at a predetermined price. This not only fosters a long-term commitment to the company but also nurtures a sense of belonging and investment in the future. As the landscape evolves, particularly in 2025, understanding the nuances of these equity types becomes essential. At the Series B stage, the median founding team ownership sees a decline to just 23%. This statistic is a stark reminder of the dilution of control for entrepreneurs as they seek additional funding, a challenge many can relate to.

Moreover, the consequences of high liquidation preferences can be severe, particularly for entrepreneurs desperate for funding. Many may find themselves accepting unfavorable terms that limit their financial upside in acquisition scenarios. For instance, entrepreneurs who accept high liquidation preferences might discover they have no financial benefit despite a modest acquisition proposal. This situation can lead to frustration, reinforcing the importance of informed decision-making in ownership negotiations. Engaging with mentors and colleagues for guidance on fairness issues can be invaluable, as their perspectives can assist entrepreneurs in making strategic choices that safeguard their interests.

By understanding the differences between common and preferred stock, along with the strategic benefits of each, new ventures can navigate their funding rounds effectively. This knowledge ensures that their ownership structures align with their long-term goals, fostering a supportive community where every member feels empowered and informed.

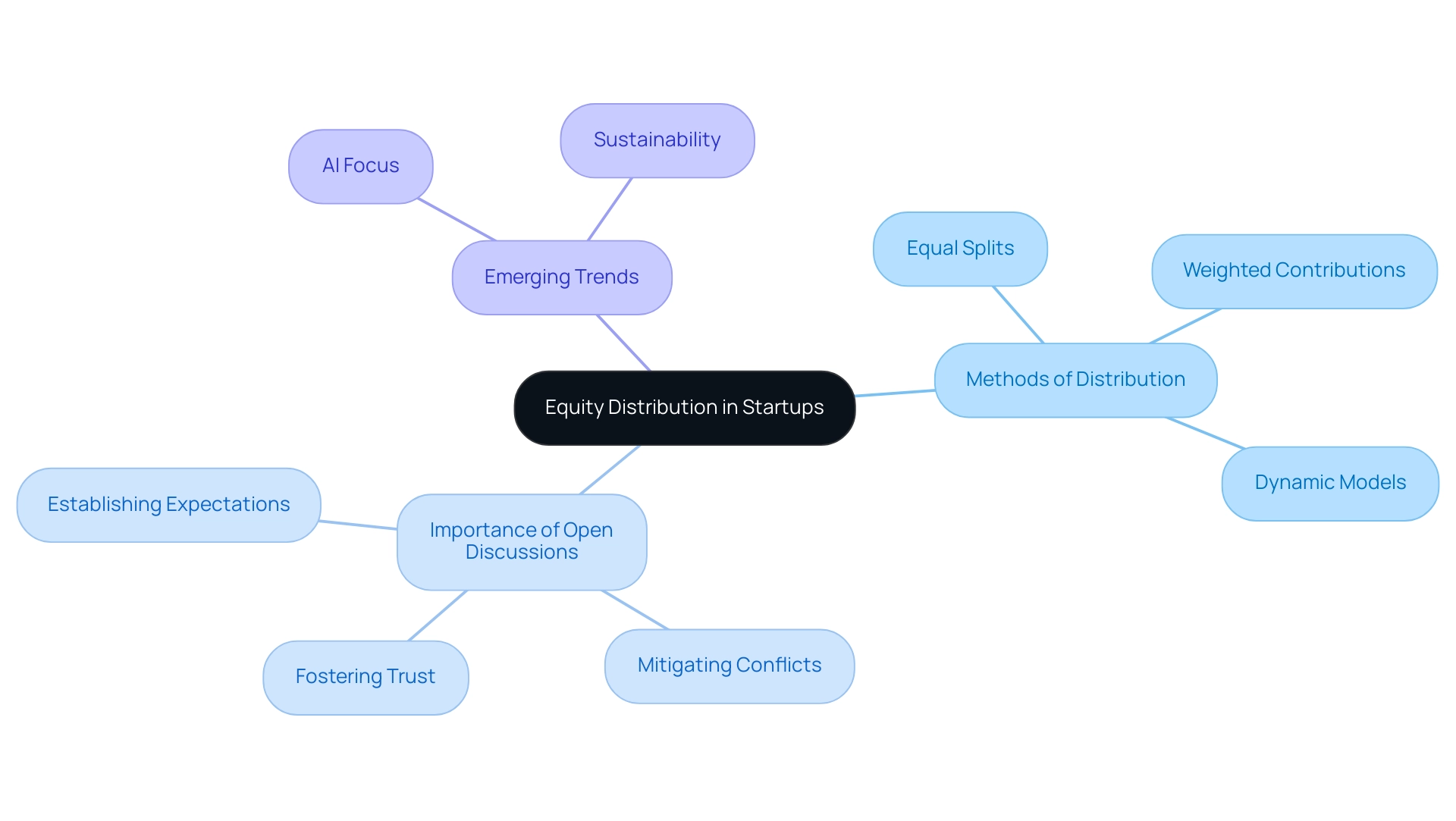

Equity Distribution: Splitting Shares Among Founders and Team

Distributing equity at a startup among founders and team members is a vital process that deserves thoughtful consideration of each individual's contributions, skills, and roles. We understand that navigating this landscape can be challenging. Common practices for equity distribution include:

- Equal splits

- Weighted contributions based on the value each member brings

- Dynamic models that adjust ownership stakes as contributions evolve

Engaging in open discussions is essential to establish clear expectations and mitigate potential conflicts, fostering an environment of trust and collaboration.

A transparent approach to resource distribution not only strengthens partnerships but also cultivates commitment and loyalty among team members. As many of our members have experienced, recent trends indicate that startups in 2025 are increasingly adopting innovative ownership distribution strategies to enhance team cohesion and drive performance. For instance, with the rise of artificial intelligence and sustainability as focal points for growth, resource distribution strategies must adapt to align with these emerging trends, ensuring everyone feels included in the journey.

As industry leader Mihkel Torim emphasizes, the commitment to equipping members with essential insights fosters informed decision-making, which is pivotal in navigating the complexities of financial arrangements. Insights from fff. Club members, including notable figures like Martin Villig and Taavi Roivas, can provide valuable perspectives on how effective equity distribution can lead to higher engagement and better alignment of interests within the team. This ultimately positions the organization for long-term success, reinforcing the idea that we are all in this together.

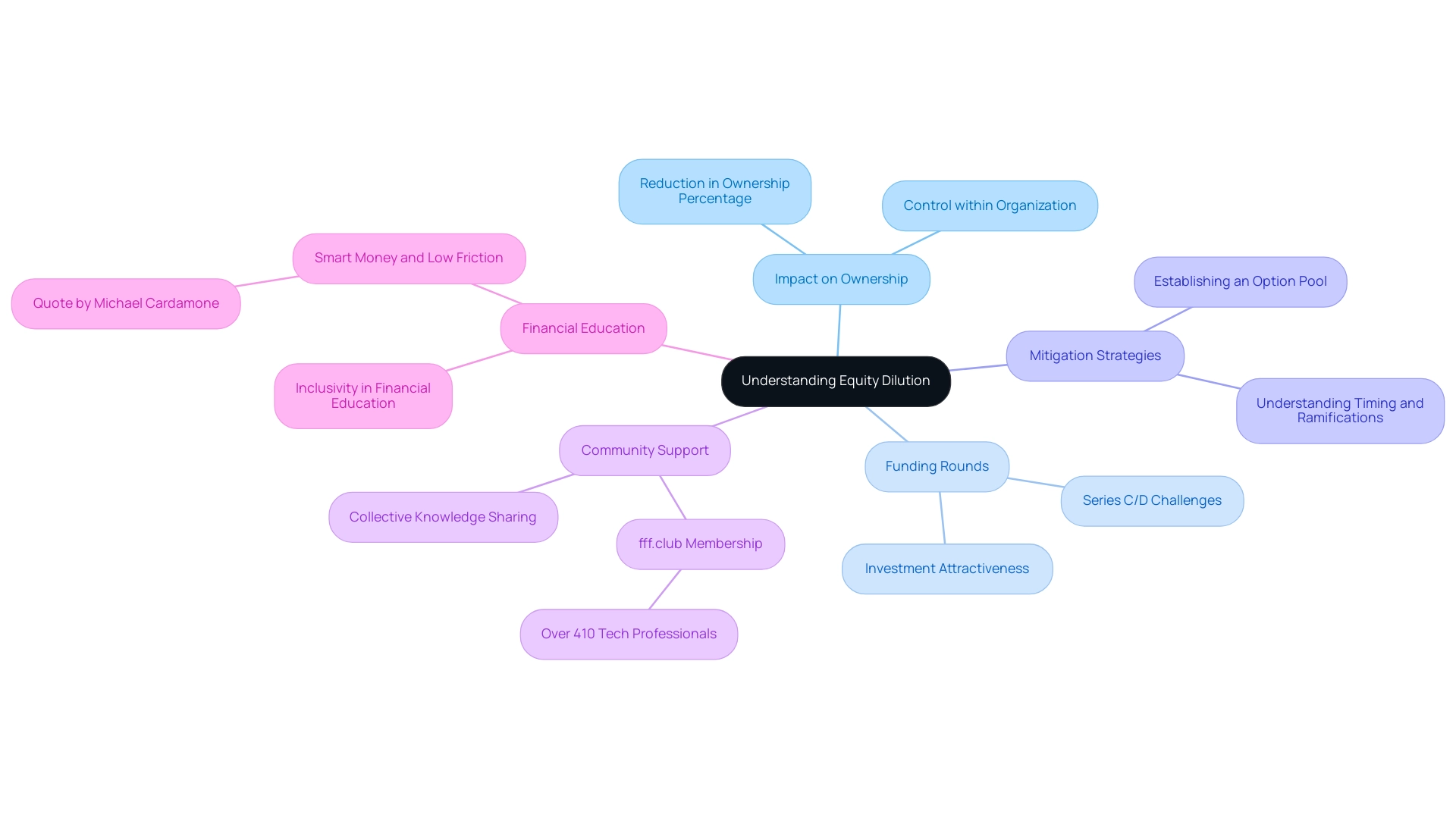

Understanding Equity Dilution: Protecting Your Ownership

Equity at a startup can be a source of anxiety for many entrepreneurs, as it involves the reduction in ownership percentage that existing shareholders experience when new shares are issued. This often happens during funding rounds, and it’s crucial for creators to grasp how dilution affects their equity and overall control within the organization. For instance, during Series C or D funding rounds, established companies frequently navigate these complexities to diversify or scale their operations. We understand that comprehending the timing and strategic ramifications of these rounds is vital for entrepreneurs striving to manage dilution effectively while attracting necessary investments.

To mitigate the effects of dilution, there are several proactive strategies that entrepreneurs can embrace. One effective approach is establishing an option pool before seeking external funding. This preparation not only sets the stage for future hires but also helps maintain the owners' ownership stakes during investment rounds. Grasping the subtleties of ownership dilution is essential, as it enables entrepreneurs to strike a balance between attracting necessary investments and retaining significant control over their ventures.

Furthermore, with over 410 tech professionals as members, fff. Club exemplifies the importance of community in addressing these challenges. Founders can tap into the collective knowledge and experiences of fellow members to better understand ownership dilution and its implications. As many of our members have experienced, a community-driven approach fosters collaboration and empowers tech investors by providing exclusive insights and educational resources. Notably, Akim Arhipov, an entrepreneur with multiple successful exits, emphasizes that financial superpowers should be accessible to everyone.

As Michael Cardamone, managing director at Acceleprise, articulates, 'It’s more important in the beginning stages to get the right people around the table and get smart money in relatively quickly and with relatively low friction.' This sentiment reflects a broader understanding within the investment community that maintaining a healthy ownership structure is crucial for long-term success.

Join fff.club today to access exclusive insights and community support in navigating ownership dilution. By understanding the implications of ownership dilution and applying strategic approaches, entrepreneurs can successfully manage funding rounds, ensuring that their equity at a startup and vision remain intact. This aligns with Akim Arhipov's commitment to inclusivity in financial education, reinforcing the belief that financial superpowers should be accessible to everyone, thereby fostering a deeper understanding of ownership dilution among all members.

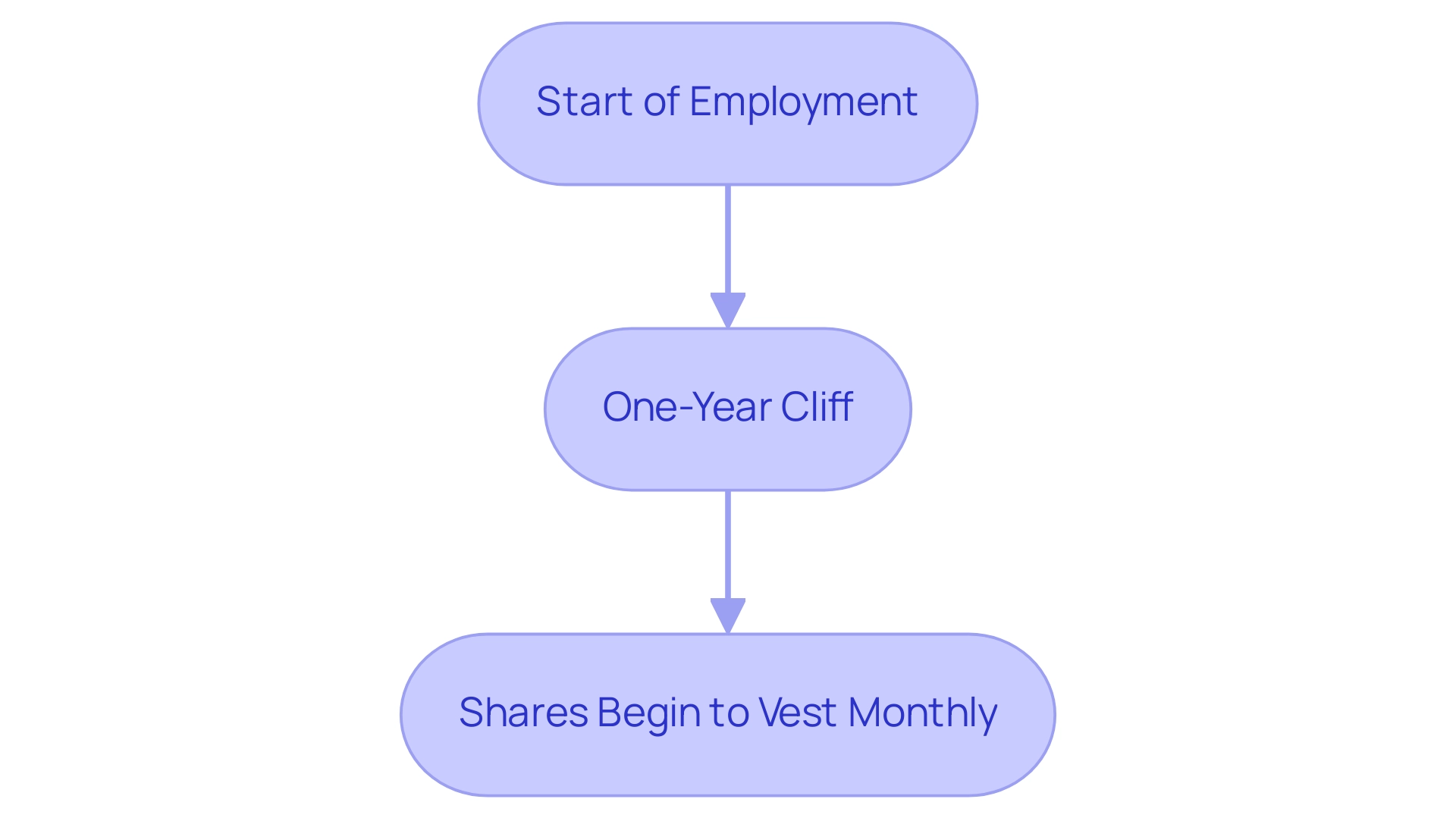

The Importance of Vesting Schedules in Equity Grants

A vesting schedule serves as a vital framework, guiding the timeline over which equity at a startup becomes fully owned by employees or founders. Many startups implement a four-year vesting period with a one-year cliff, meaning that no shares will vest until an employee has completed one year with the organization. After this point, shares begin to vest monthly.

This model is particularly effective in nurturing long-term commitment among team members, encouraging them to stay engaged with the company. By tying ownership stakes to tenure, startups can significantly reduce the risk of early departures, which could lead to substantial equity loss for both the startup and its remaining stakeholders. We understand that the complexities surrounding ownership distribution can be daunting, which is why founders must prioritize clear communication about stakes early in their journey to prevent potential conflicts down the line.

As highlighted in the case analysis 'Managing Ownership as Your Startup Expands,' regular assessments and revisions to the ownership framework are essential for adapting to the evolving needs of the organization. Establishing a well-defined vesting schedule not only aligns the interests of the team with the company's long-term vision but also enhances employee retention—crucial for maintaining equity at a startup and fostering a more stable, committed workforce. In a community like fff.club, which includes over 410 tech professionals, the practices surrounding fairness management resonate deeply.

As Taavi Roivas wisely noted, clear communication in resource management is essential for building trust and collaboration among team members. We recognize that these principles are foundational to a thriving startup culture, and we are here to support you in navigating these challenges.

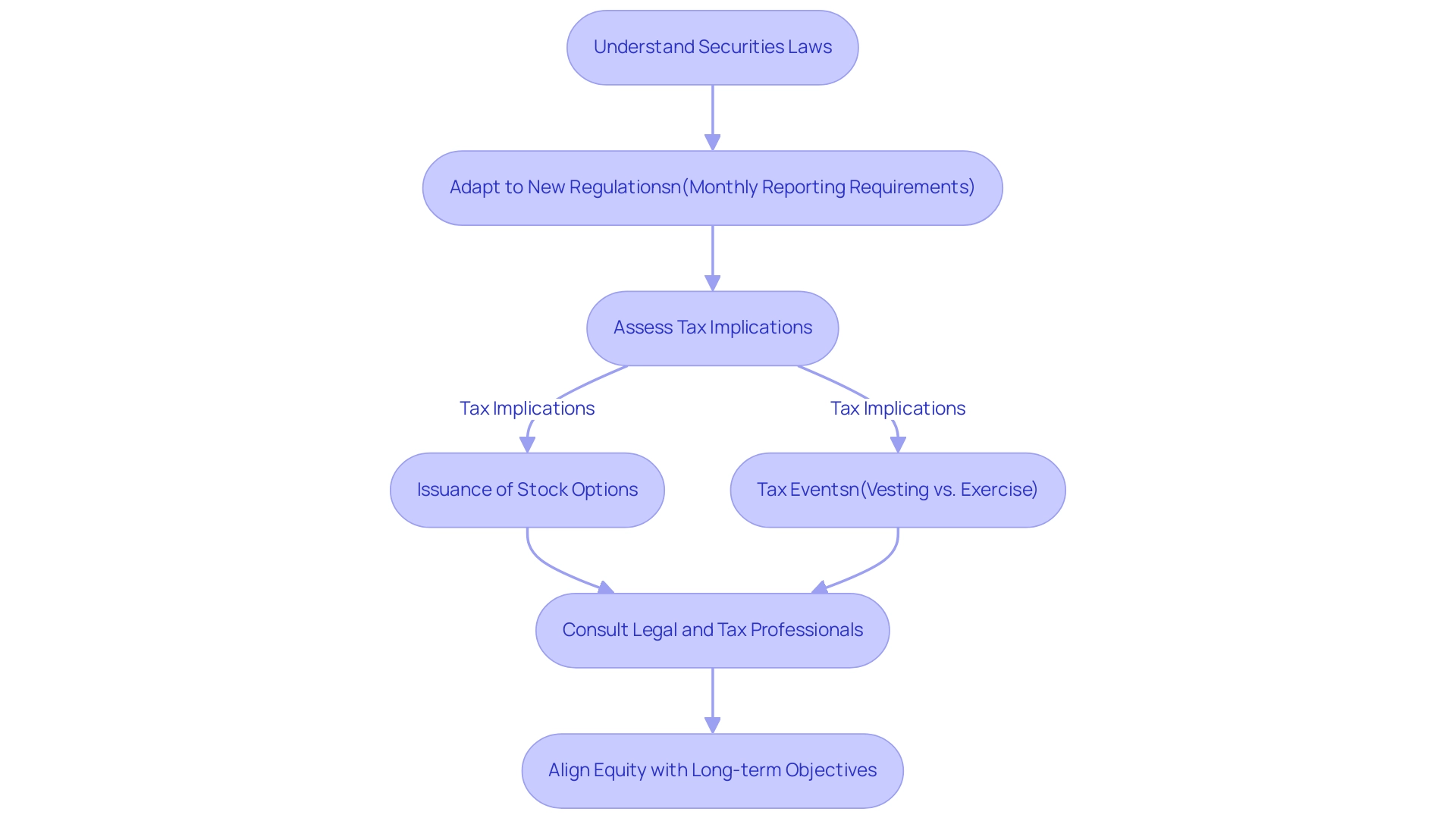

Legal and Tax Considerations for Startup Equity

Issuing shares can present a myriad of legal and tax implications that founders and investors must navigate with care. We understand that adherence to securities laws is crucial during this process; failure to comply can lead to significant penalties, which can be daunting. For example, Vietnam's recent changes to its ownership plan administration have streamlined processes for multinational enterprises, yet they have also introduced new monthly reporting requirements, shifting from a quarterly to a monthly reporting period. This shift can feel overwhelming.

This change highlights the importance of adapting to new regulations, as businesses must establish processes to meet these obligations. It's essential to grasp the tax implications for both the issuing company and the shareholders to avoid unexpected liabilities. For instance, the issuance of stock options can trigger tax events either upon vesting or at exercise, potentially leading to unforeseen tax burdens for recipients. We recognize that these complexities can be stressful.

As one client expressed gratitude to Sue, saying, 'I just want to say a big thank you Sue for all your help and support,' it underscores the value of having knowledgeable support when navigating these challenges. To effectively manage these issues and ensure that equity at a startup aligns with the company's long-term objectives, it is vital for founders and investors to consult with legal and tax professionals. This proactive approach not only aids in compliance with current regulations but also enhances the overall financial strategy and sustainability of the startup. We are here to support you through this journey.

Conclusion

Navigating the complexities of startup equity can feel overwhelming for founders and investors, especially when striving for sustainable growth in a challenging landscape. We understand that grasping the fundamental concepts of equity—its types and distribution—is essential for entrepreneurs to make informed decisions. By recognizing the roles of common stock, preferred stock, and stock options, startups can align their financial structures with long-term goals, helping to mitigate the risks of dilution.

Equity distribution among founders and team members is a delicate matter that requires thoughtful consideration and transparent communication. Establishing fair and motivating equity splits not only fosters commitment and loyalty but also drives the startup towards success. As many of our members have experienced, implementing vesting schedules can reinforce this commitment by linking equity ownership to tenure, ensuring that the team remains engaged over the long haul.

However, legal and tax considerations can further complicate the equity landscape. It’s essential for founders to seek professional guidance to navigate these waters. By understanding compliance with regulations and potential tax implications, founders can prevent unforeseen liabilities and promote a robust financial strategy. Leveraging community resources and expert advice can empower founders to tackle these challenges effectively, ensuring their vision for the startup remains intact.

In conclusion, a comprehensive understanding of equity mechanics not only enhances the survival rate of startups but also positions them for remarkable growth. By fostering a culture of shared knowledge and collaboration, entrepreneurs can harness the power of equity to build resilient businesses that thrive in the competitive startup ecosystem. Together, we can create a supportive environment where every founder feels valued and equipped to succeed.