Overview

Financial management for startups encompasses essential practices such as budgeting, forecasting, and cash flow management, which are critical for establishing and maintaining a successful business. The article underscores the importance of these practices by highlighting that effective financial management enables startups to make informed decisions, secure funding, and navigate challenges, ultimately positioning them for sustainable growth and investment opportunities.

Introduction

Navigating the financial landscape is a daunting yet essential task for startups aiming for success. As the backbone of business operations, effective financial management encompasses a range of practices, from budgeting and forecasting to cash flow oversight. Understanding and implementing these fundamentals can mean the difference between thriving and merely surviving in a competitive market.

With a plethora of funding options available, startups must evaluate the advantages and potential pitfalls of each, while also mastering the art of financial forecasting to anticipate future challenges. This article delves into the crucial aspects of financial management for startups, offering insights into:

- Funding strategies

- The importance of a skilled finance team

- Practical approaches to overcoming common financial hurdles

By equipping themselves with this knowledge, entrepreneurs can better position their ventures for sustainable growth and long-term success.

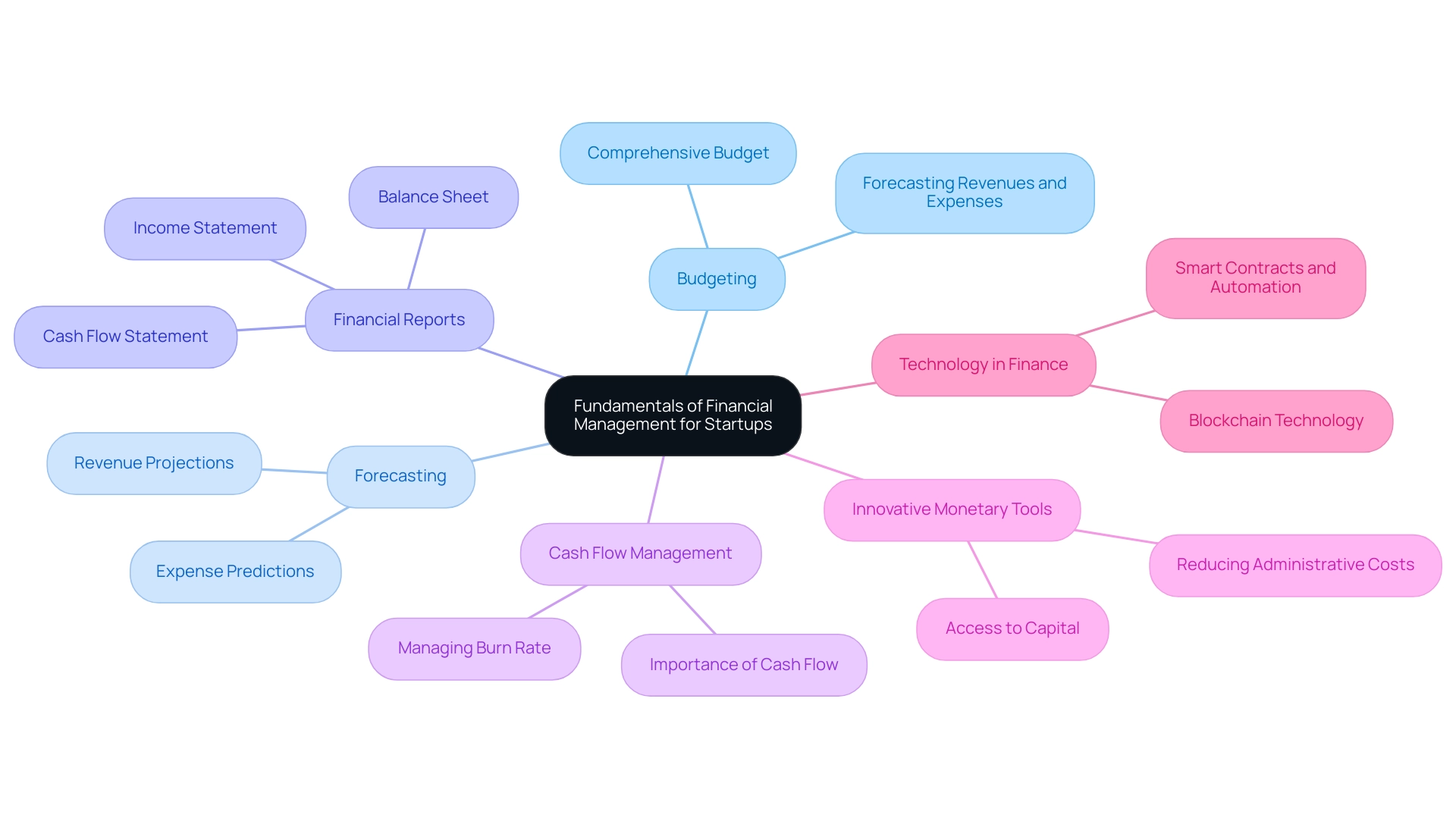

Fundamentals of Financial Management for Startups

Financial management for startups is a vital aspect of operations, encompassing essential practices necessary for both establishing and maintaining a successful business. This discipline combines budgeting, forecasting, and careful flow management. Startups must develop a comprehensive budget that forecasts revenues and expenses, which is essential for efficient financial management.

Essential fiscal reports—including the income statement, balance sheet, and flow statement—serve as vital tools for assessing the new business's economic condition. These documents empower founders to make data-driven decisions and strategically navigate the complexities of the business landscape. As Cassidy Horton aptly states,

Managing cash flow is critical for any startup, as running out of cash is one of the most common reasons startups fail.

In addition, innovative monetary tools can expedite access to capital and significantly reduce administrative costs, providing modern solutions that enhance management. Startups should also be aware of their burn rate, as a high burn rate can lead to monetary problems before obtaining essential support. Moreover, the implementation of blockchain technology in the monetary sector demonstrates how new ventures can utilize technology for enhanced efficiency and cost savings, highlighting a practical instance of effective monetary management practices.

By understanding these financial fundamentals for startups, they can better position themselves to secure future investment and enhance their sustainability.

Exploring Funding Options: From Loans to Venture Capital

Today, startups have a diverse array of financial options for startups, each presenting distinct advantages and challenges that can significantly impact their success. Traditional bank loans, while straightforward, often require substantial collateral and a solid credit history, which can be barriers for many emerging businesses. In contrast, venture capital not only provides essential financial support but also strategic guidance and access to valuable networks, as highlighted by insights from Baltic investment leaders like Donatas Keras, whose fund Practica Capital has invested in successful companies such as Montonio and TransferGo, and Kristjan Tamla.

However, this route typically involves giving up a portion of equity and control, which can be a difficult trade-off for founders. Additionally, angel investors serve as a crucial source of capital, usually offering smaller investments in exchange for equity. They can be especially advantageous for new businesses seeking mentorship and industry insights.

Comprehending these financial pathways is essential for startups to make informed choices that align with their growth goals and monetary plans, particularly in the context of financial for startups. Furthermore, the power of community in investment, as exemplified by organizations like fff.club, enhances deal flow and due diligence through collaborative support, providing vetted investment opportunities across various sectors, including ClimateTech. fff.club’s services facilitate connections among investors, enhancing the overall financial landscape.

Recent data emphasizes the competitive environment; in 2021, all-female founded ventures secured 25% less than their male counterparts, highlighting the disparities in financial access. Moreover, the FinTech sector continues to grow—with over 12,000 enterprises worldwide—illustrating the industry's dynamism; Mint noted that in 2021, the country added 44 new companies to its unicorn list, showcasing potential for growth. To navigate these financial for startups effectively and secure the necessary resources to thrive, new businesses must also consider case studies on risk management, emphasizing the importance of assessing readiness to handle industry-specific risks and learning from competitors.

Furthermore, FinTech companies encounter considerable obstacles with customer acquisition expenses, further complicating their financial strategies.

The Role of Financial Forecasting in Startup Success

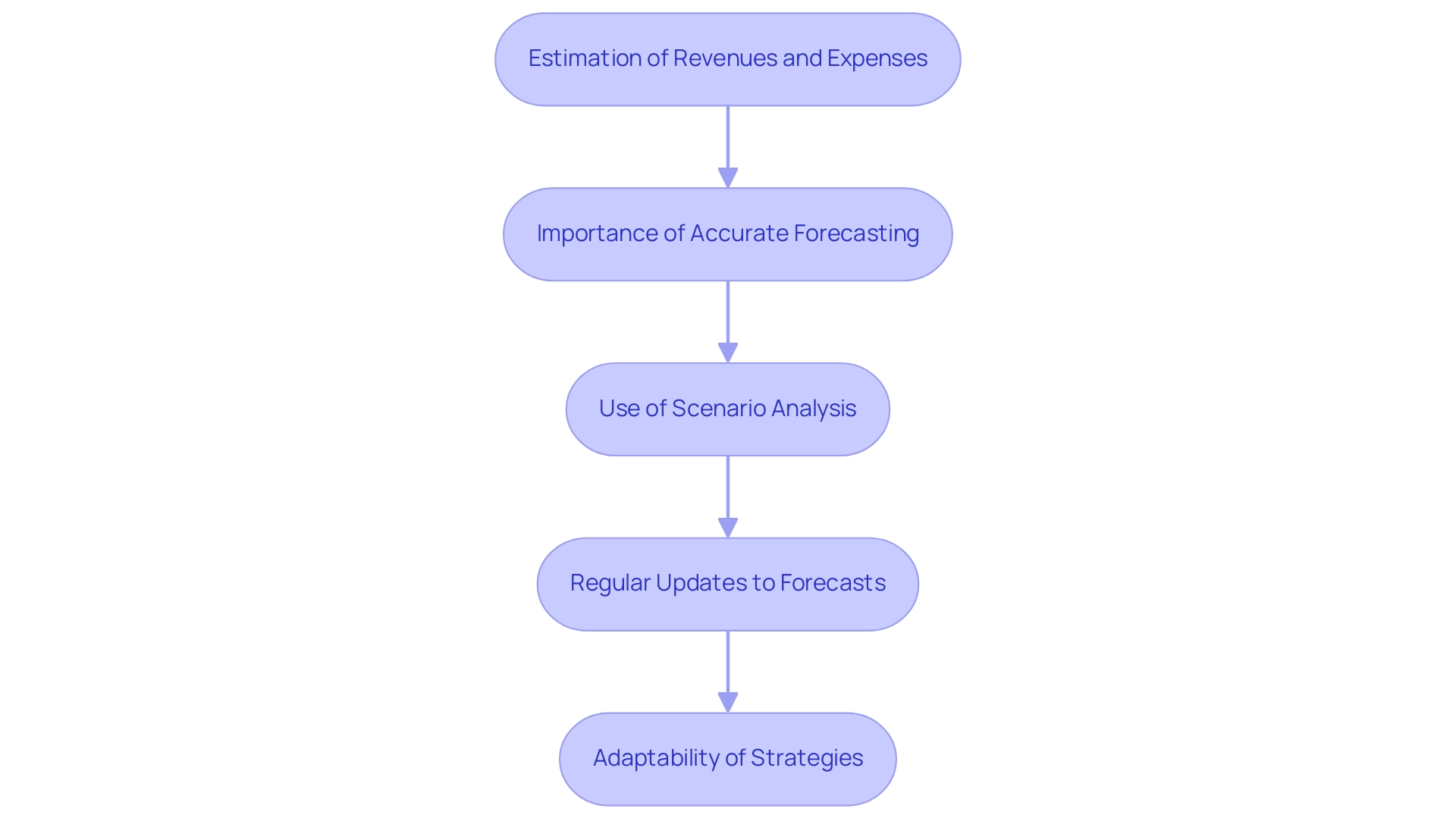

Financial forecasting is an essential procedure for startups, involving the estimation of future revenues, expenses, and liquidity based on historical data and current market trends, highlighting the importance of financial for startups. The importance of accurate forecasting for financial for startups cannot be overstated, as it plays a vital role in budgeting, securing funding, and enabling proactive cash flow management. By creating realistic monetary projections, startups can identify potential shortfalls early, which is essential for their financial for startups strategies, allowing them to adjust effectively.

Recent findings indicate that 72% of business leaders acknowledged the growing significance of fiscal planning and analysis, underscoring the value placed on these practices since Summer 2020. Furthermore, utilizing advanced tools such as scenario analysis can significantly enhance the accuracy of monetary forecasts. This technique enables new businesses to prepare for a variety of market conditions, facilitating informed decision-making that is essential for sustaining operational stability and navigating uncertainties in their financial strategies for startups.

Regular updates and revisions to economic forecasts are essential to ensure they remain aligned with actual business performance and evolving market dynamics. As emphasized in the case study "Revising and Updating Financial Forecasts," regularly updating projections is crucial for maintaining their accuracy and relevance, ultimately enhancing a startup's agility in navigating uncertainties and seizing financial for startups opportunities. Additionally, the use of procurement software can improve budget efficiency, allowing more resources for revenue-generating activities.

As mentioned by Michael Burdick, Founder and Chief Strategy Officer of Paro,

To be truly useful to you, a forecast should be a living document,

emphasizing the need for adaptability in monetary strategies.

Navigating Financial Challenges: Strategies for Startups

Startups frequently encounter significant financial challenges, including cash flow shortages, unforeseen expenses, and the struggle to secure financial support for startups. Significantly, recent statistics indicate that 60% of new businesses in the United Kingdom fail, underscoring the specific challenges within the local business environment compared to other regions such as the USA and Canada. Furthermore, demographic factors play a crucial role in entrepreneurial dynamics; for instance, individuals aged 55 and over have a notably higher likelihood of starting a business, with 9.01% having taken the leap compared to just 1.16% of those aged 16 to 24.

To effectively navigate these hurdles, startups should prioritize comprehensive financial management. This involves:

- Closely monitoring expenses

- Maintaining an adequate cash reserve for emergencies

- Building strong connections with lending institutions to facilitate access to credit during difficult periods

Additionally, implementing robust monetary controls and regularly reviewing statements are essential practices for identifying and addressing potential issues proactively. The economic environment for new enterprises is also encouraging, as demonstrated by Germany's remarkable $6.6 billion in venture capital funding, placing second in Europe. As entrepreneurs with previous business experience have a 30% greater likelihood of success in future endeavors, utilizing past insights can further bolster resilience in handling economic challenges.

By adopting these strategic approaches, new ventures can significantly enhance their economic stability and increase their chances of long-term sustainability in a competitive landscape.

Building Your Finance Team: Key Roles and Responsibilities

Creating a skilled finance group is crucial for new businesses aiming for financial success, particularly in the context of financial for startups. The Chief Financial Officer (CFO) plays a crucial role by creating monetary strategies and supervising comprehensive reporting. In 2024, the average salary for CFOs in new businesses is projected to reflect the high demand for this expertise, indicating the critical nature of this role.

Supporting the CFO is the Controller, who oversees accounting operations and ensures precise reporting. Financial analysts also contribute significantly by extracting actionable insights from data analysis, which aids in making informed strategic decisions. Each team member is integral to aligning financial practices with the company's overarching goals.

Importantly, as highlighted in the case study titled 'Team Dynamics in New Ventures,' successful enterprises require a balance of experience and passion within their teams, emphasizing the significance of soft skills in building an effective finance team. Moreover, as the Unmanned Aerial Vehicle (UAV) Manufacturing industry is expected to grow by 44.7% between 2023 and 2024, new companies in this sector should consider engaging external advisors or consultants to navigate specialized areas such as tax planning and compliance effectively.

As Rosalie Macmillan aptly states, 'HR superheroes, assemble – 2024 awaits!

Are you ready to level up and lead the change?' This sentiment aligns with the need for new businesses to prepare strategically for the upcoming year. A well-rounded finance team not only enhances a startup's financial management capabilities but also positions it favorably to capitalize on emerging industry trends, thereby facilitating financial for startups and supporting strategic advancement.

Readers are invited to join flair’s newsletter for the latest HR tips and trends, ensuring they remain informed and equipped for the challenges ahead.

Conclusion

Navigating the financial landscape is essential for startups aiming for long-term success. Effective financial management encompasses:

- Budgeting

- Forecasting

- Cash flow oversight

These are critical for establishing a solid operational foundation. By understanding these financial fundamentals, startups can make data-driven decisions that enhance their sustainability and prepare them for future growth opportunities.

Exploring diverse funding options is equally vital. Each avenue—from traditional loans to venture capital and angel investments—comes with its unique advantages and challenges. Entrepreneurs must evaluate these options carefully, aligning their funding strategies with their business goals while also being mindful of the implications of equity dilution and control. The collaborative efforts of community investment organizations further enrich the funding landscape, providing valuable support for emerging businesses.

Financial forecasting emerges as a crucial tool for anticipating future challenges, allowing startups to adjust strategies proactively. By developing realistic financial projections and employing advanced forecasting methods, startups can enhance their agility and decision-making capabilities. This adaptability is essential for navigating uncertainties and seizing opportunities in a competitive market.

Finally, building a competent finance team is integral to overcoming common financial hurdles. Each member, from the CFO to financial analysts, plays a significant role in aligning financial practices with the startup's strategic objectives. By fostering a well-rounded team and establishing robust financial controls, startups can significantly improve their financial stability and resilience.

In summary, mastering these elements of financial management empowers startups to not only survive but thrive in a challenging landscape. By prioritizing effective financial practices and leveraging available resources, entrepreneurs can position themselves for sustainable growth and long-term success.