Overview

Best practices for finance in startups involve creating a robust financial model, exploring diverse funding options, and building a proficient finance team to ensure sustainable growth and informed decision-making. The article emphasizes that effective financial modeling and planning, alongside understanding investor expectations and forming a capable finance team, are crucial for navigating the competitive landscape and enhancing the likelihood of startup success.

Introduction

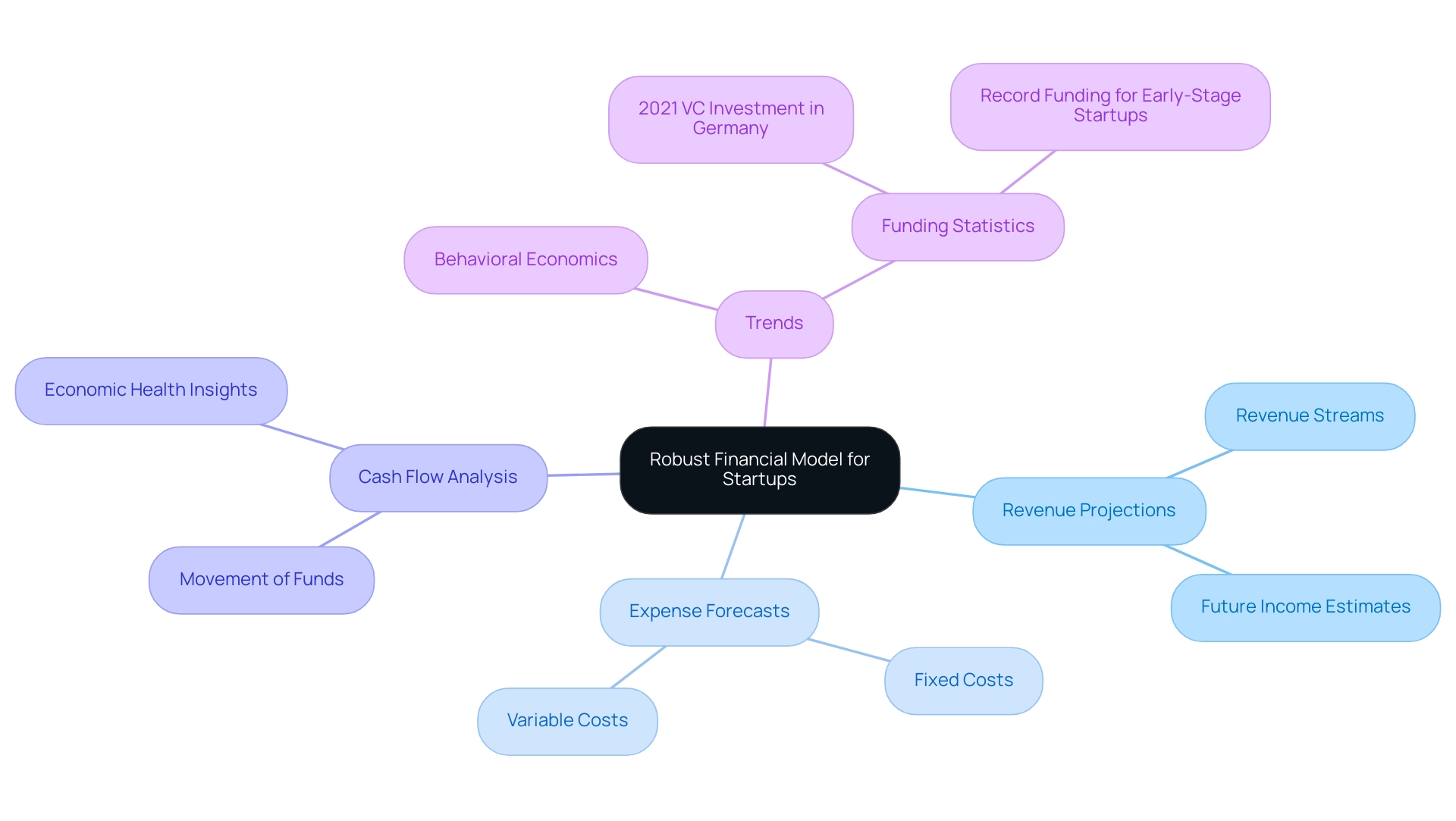

Navigating the complex landscape of startup finance is crucial for success in today's competitive environment. A well-structured financial model serves as the backbone of any startup, encompassing essential components such as:

- Revenue projections

- Expense forecasts

- Cash flow analysis

As startups seek funding from various sources—ranging from bootstrapping to venture capital—understanding the implications of each funding strategy is vital for maintaining control and fostering growth. Moreover, engaging professional financial guidance can significantly enhance a startup's ability to set realistic goals and adapt to market fluctuations.

This article delves into the key elements of financial modeling, explores diverse funding options, emphasizes the importance of strategic planning, and highlights what investors look for in promising startups. By equipping founders with the knowledge and tools necessary for effective financial management, the path to startup success becomes clearer and more attainable.

Creating a Robust Financial Model: The Backbone of Startup Success

A comprehensive economic model is anchored in several critical elements, including revenue projections, expense forecasts, and cash flow analysis. Initially, outline your startup's revenue streams and estimate future income, which is crucial for finance in startup, informed by market research and historical performance. It is imperative that your expense forecasts are meticulously detailed, encompassing both fixed and variable costs.

Cash flow analysis plays a vital role in elucidating the movement of funds within your business, offering profound insights into economic health. Recent trends indicate that approximately 60% of economic models now employ principles of behavioral economics, enhancing their predictive accuracy regarding consumer behavior. Utilizing tools such as Excel or specialized modeling software can significantly streamline the creation of these intricate models.

Regularly updating your economic model is crucial to reflect real-time business performance and account for external market fluctuations, thus maintaining agility in your planning. Given that 2021 marked a record year for technology new ventures funding, with early-stage companies raising an unprecedented $201 billion, a remarkable 92% growth year over year from 2012 to 2021, the necessity for effective finance in startup models becomes increasingly clear. Furthermore, Germany's position as second in Europe and fifth overall, with $6.6 billion in VC investment, highlights the competitive environment for new ventures.

This foundation not only supports informed decision-making but also strengthens finance in startup ventures for greater success in a competitive landscape. As Mint noted, in 2021, the country added 44 new companies to its unicorn list, highlighting the potential success for new businesses that effectively utilize financial modeling.

Exploring Diverse Funding Options: From Bootstrapping to Venture Capital

Startups today have a variety of finance in startup options available, including:

- Bootstrapping

- Crowdfunding

- Angel investments

- Venture capital

Bootstrapping is a strategy that allows founders to maintain complete control over their business, thereby preserving the vision and direction of their startup. However, this approach can often restrict the growth potential, as founders may find it challenging to scale operations without outside financial support.

Crowdfunding platforms, such as Kickstarter and Indiegogo, have gained traction as innovative avenues for raising capital. These platforms not only assist in financing but also allow entrepreneurs to assess market interest and confirm their ideas with potential customers. In recent years, successful crowdfunding campaigns have become prominent success stories, demonstrating the viability of this approach for new businesses.

Angel investors offer another valuable source of capital. They typically invest their own capital in exchange for equity while providing mentorship and industry connections, enhancing the venture's chances of success. On the other hand, venture capitalists usually invest larger sums of money but demand significant equity stakes, which can dilute the founders' control.

In 2024, it is important to note that venture capitalists demonstrate a preference for male co-founding teams, with all-female enterprises raising 25% less than their male counterparts, emphasizing a persistent disparity in the investment landscape. Moreover, it takes roughly 22 months for new ventures to achieve Series A from seed capital, highlighting the timeline difficulties that founders may encounter in their financial journey.

Significantly, FinTech enterprises have drawn considerable investor interest, obtaining a total of $31.1 billion in capital between 2022 and 2024, accentuating the strong allure of this sector. However, it is also important to acknowledge the risks associated with financing strategies; for instance, the failure rate for construction startups stands at 53%, as reported by Failory. Overall, each method of finance in startup carries its own set of implications for control, growth, and financial obligations.

It is crucial for founders to evaluate these options carefully and align their finance in startup strategies with their overarching business objectives. As the funding landscape continues to evolve, understanding the current dynamics—including statistics that indicate the time it takes to reach Series A—will be essential for informed decision-making.

The Importance of Financial Planning and Professional Guidance

A budgeting strategy is a crucial element of finance in startup, as it involves the development of both short- and long-term monetary objectives, planning, and predicting future economic performance. Considering the dynamic and agile nature of planning and analysis (FP&A) in new ventures, which is significantly different from established firms, it is wise for these enterprises to involve an advisor or accountant with expertise in early-stage businesses. These professionals are instrumental in crafting a comprehensive monetary plan that not only identifies potential risks but also optimizes cash flow and ensures compliance with tax regulations.

A notable challenge in this domain is emphasized by a survey where 61% of CFOs indicated that integration with their existing systems is the primary obstacle of automation in finance, highlighting the intricacies of planning in new ventures. Furthermore, the venture-backed U.S. real estate firms, which experienced an average drop of 85% from their offering price yet succeeded in raising $19.8 billion worldwide in 2022, demonstrate the potential for investor interest in well-planned ventures, particularly in sectors like proptech. According to Protiviti, 73% of CFOs ranked security and privacy as their top concern, closely followed by profitability reporting and analysis, highlighting the critical areas where expert guidance is invaluable.

Regularly revisiting and adjusting your budget plan is essential for managing finance in startup as your business evolves and market conditions fluctuate. Furthermore, leveraging resources such as workshops and educational materials can significantly enhance money management skills, empowering you to make informed decisions. The ability to navigate unforeseen challenges with a robust financial plan is crucial for finance in startup, providing a buffer that enhances resilience, especially in an unpredictable market landscape.

Understanding Investor Expectations: What Do Investors Look For?

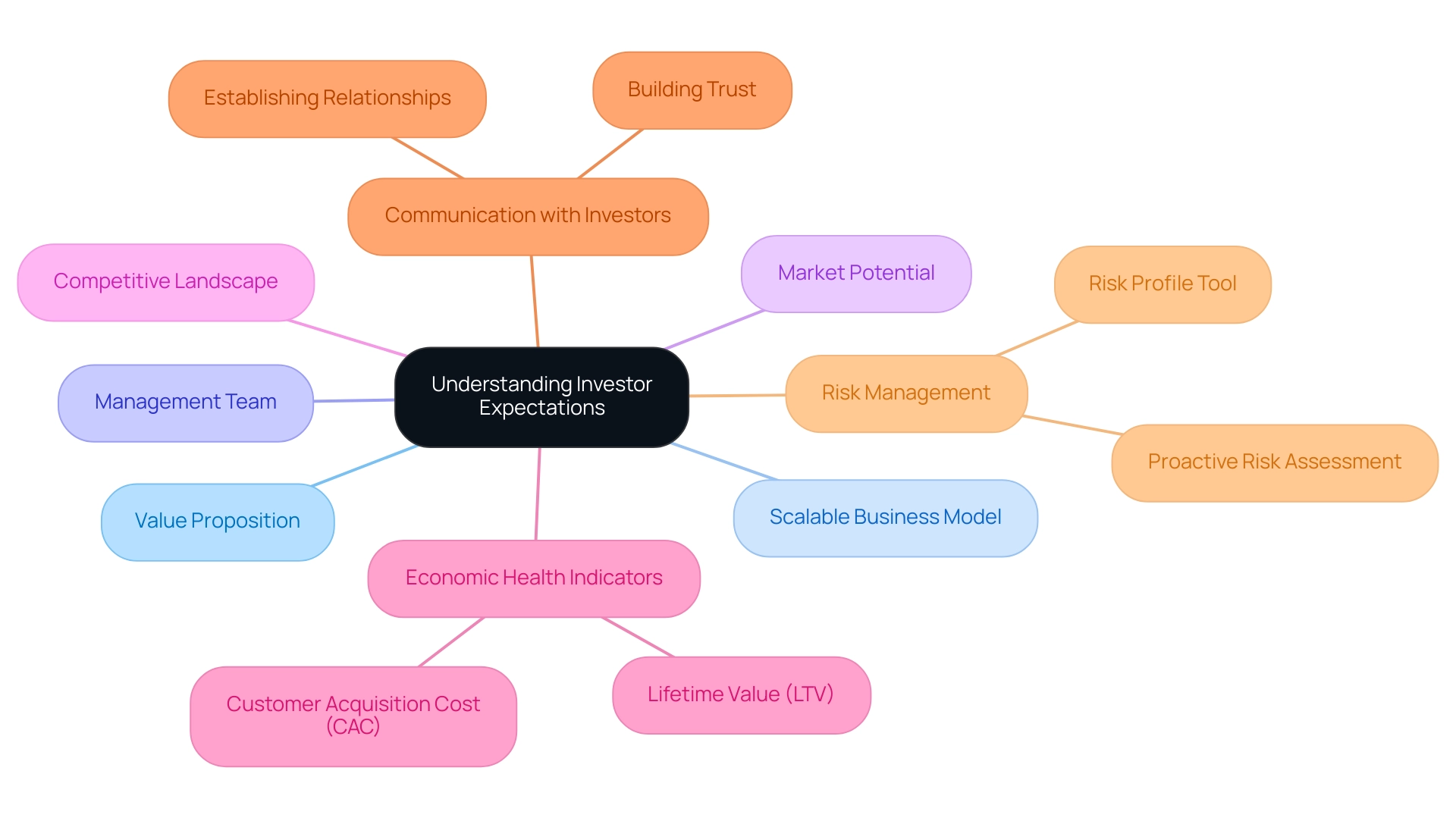

Investors prioritize new ventures that exhibit a compelling value proposition, a scalable business model, and a proficient management team. They conduct thorough evaluations of a new venture's market potential and competitive landscape, which are pivotal in determining investment viability. Essential economic health indicators encompass customer acquisition cost (CAC) and lifetime value (LTV), two metrics that capture the efficiency and profitability of a new business's customer interactions.

In 2023, cash flow issues were a significant cause of company failures, highlighting the necessity for new ventures to focus on finance in startup to maintain strong economic stability. Founders must be prepared to articulate their business strategies, conduct comprehensive market analysis, and present robust financial projections that encompass finance in startup. For instance, new businesses are advised to assess their readiness to handle industry-specific risks using tools like the Risk Profile tool, as proactive risk management is essential for investor confidence and long-term success.

Moreover, creating transparent communication channels with potential investors is crucial; this practice not only builds trust but also establishes the foundation for lasting relationships, which are necessary for managing the intricacies of the business ecosystem. As observed, 'In 2023, of companies that failed did so due to cash flow issues,' emphasizing the essential nature of these economic metrics in evaluations of new ventures.

Building Your Finance Team: Key Roles and Hiring Strategies

As startups navigate their growth trajectories, the establishment of a proficient team for finance in startup becomes paramount. Essential roles within this team include the Chief Financial Officer (CFO), analysts, and accountants. The CFO is pivotal in steering monetary operations, ensuring their alignment with broader business objectives.

Financial analysts play a crucial role by leveraging data analysis to provide actionable insights that inform strategic decision-making. Meanwhile, accountants are responsible for maintaining compliance with monetary regulations and managing day-to-day bookkeeping activities. When hiring for these roles, prioritizing candidates with experience in emerging companies or related sectors is crucial, as they bring the agility and innovative mindset necessary to thrive in a rapidly changing environment.

Furthermore, cultivating a collaborative team culture is essential for enhancing performance and driving overall success. According to a report by Protiviti, 73% of CFOs identified security and privacy as their foremost concern, closely followed by profitability reporting and analysis, underscoring the importance of strategic management. Moreover, the second largest reason why startups fail, representing 29% of instances, is due to running out of resources and personal money, which underscores the critical need for effective finance in startup management.

The recent success of Embat, which raised a $16m Series A led by Creandum, further illustrates the economic landscape and the significance of strong finance in startup teams for securing necessary funding. As demonstrated by the case of DataSnipper's acquisition of UpLink, effective fiscal leadership can significantly enhance operational efficiency, particularly in managing extensive document workloads. This acquisition not only enhanced DataSnipper's capabilities in document analysis but also streamlined financial operations, demonstrating the tangible benefits of robust financial management.

Thus, implementing effective hiring strategies for professionals in finance in startup is critical for startups aiming for sustainable growth.

Conclusion

A robust financial model is essential for startups seeking to thrive in a competitive landscape. By focusing on critical components such as:

- Revenue projections

- Expense forecasts

- Cash flow analysis

founders can create a solid foundation that informs decision-making and enhances financial health. The integration of behavioral economics principles into financial modeling reflects the evolving nature of consumer behavior, allowing startups to adapt more effectively to market demands.

Exploring diverse funding options is equally crucial. Each method, whether:

- Bootstrapping

- Crowdfunding

- Angel investments

- Venture capital

presents unique implications for control and growth. Understanding these dynamics enables founders to align their funding strategies with their business objectives, ultimately enhancing their chances of success. The importance of professional financial guidance cannot be overstated, as expert advisors help navigate the complexities of financial planning and ensure compliance with regulations, thereby bolstering investor confidence.

Investors are particularly drawn to startups that demonstrate a compelling value proposition and a scalable business model. By maintaining transparency and effectively communicating their strategies, founders can build trust and foster long-term relationships with potential investors. Furthermore, establishing a proficient finance team is vital for managing financial operations and ensuring strategic alignment with business goals.

In conclusion, the path to startup success is paved with careful financial planning, strategic funding decisions, and a commitment to maintaining robust financial health. By prioritizing these elements, founders can navigate the challenges of the startup ecosystem with confidence, positioning their businesses for sustainable growth and success.