Overview

Advisory shares refer to equity compensation granted to consultants in recognition of their expertise and contributions to a startup, distinguishing them from regular employee equity. The article explains that this arrangement not only aligns the interests of advisors and companies but also provides startups with valuable guidance and mentorship without immediate cash outlay, thereby fostering growth and strategic development during critical phases.

Introduction

In the competitive landscape of startups, the strategic use of advisory shares has emerged as a pivotal tool for fostering growth and innovation. These unique equity compensations are designed to attract experienced advisors who bring invaluable expertise and networks to the table, ultimately aligning their interests with the company’s success.

Unlike traditional equity shares reserved for employees, advisory shares cater specifically to external advisors, creating a framework that encourages collaboration without immediate financial strain on the startup. As the market shifts and companies face increasing challenges, understanding the nuances of advisory shares becomes essential for navigating the complexities of growth and ensuring long-term sustainability.

This article delves into the definition, benefits, and structural considerations of advisory shares, highlighting their critical role in the startup ecosystem.

Understanding Advisory Shares: Definition and Purpose

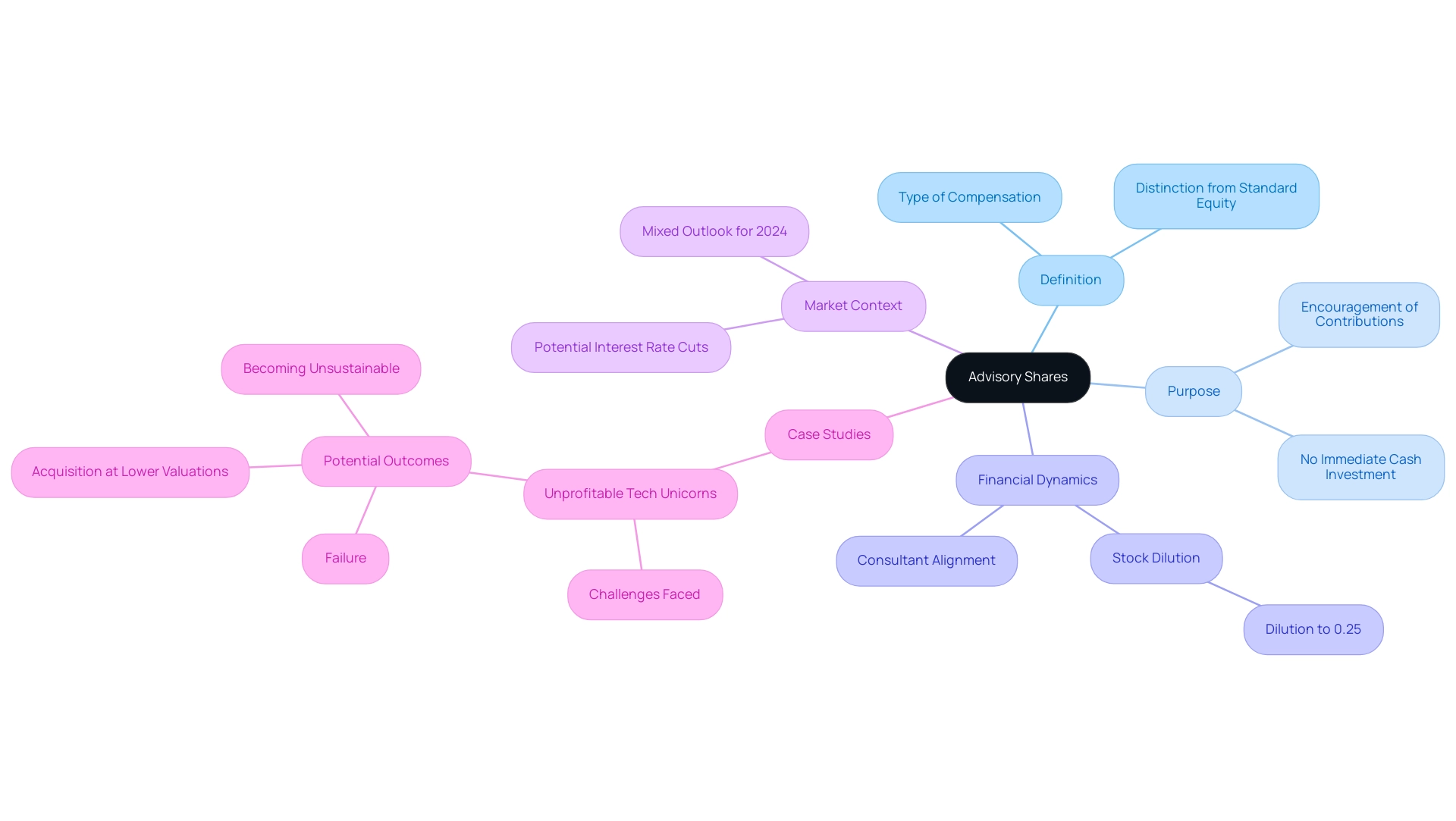

In the entrepreneurial environment, advisory equity, which can be understood through advisory shares meaning, serves as a type of compensation distributed to consultants within an organization. These stocks are awarded in acknowledgment of the consultant's expertise, guidance, and network connections, distinguishing them from standard equity holdings usually provided as part of employee compensation packages. The main aim of advisory shares meaning is to encourage participants to actively contribute to the growth and strategic direction of the startup without requiring an immediate cash investment.

This arrangement effectively aligns the interests of both the consultants and the company, fostering a collaborative environment conducive to long-term success. Notably, after another round of financing, an advisor's stock can be further diluted to just 0.25%, underscoring the financial dynamics at play. As new businesses navigate the complexities of growth, knowing the advisory shares meaning serves as a vital tool in leveraging expert insights to enhance overall performance.

In the current market, as highlighted by Atomico, 'We haven’t fully washed through the overhang from the peak years but the green shoots are all around us.' This sentiment reflects the mixed outlook for the end of 2024, where advisory interests may provide essential support to startups, particularly those facing challenges like unprofitability, as illustrated in the case study of unprofitable tech unicorns. By utilizing advisory equity, these businesses can attract seasoned advisors to help guide them through turbulent times, potentially transforming weaknesses into pathways for growth.

Advisory Shares vs. Regular Equity Shares: Key Differences

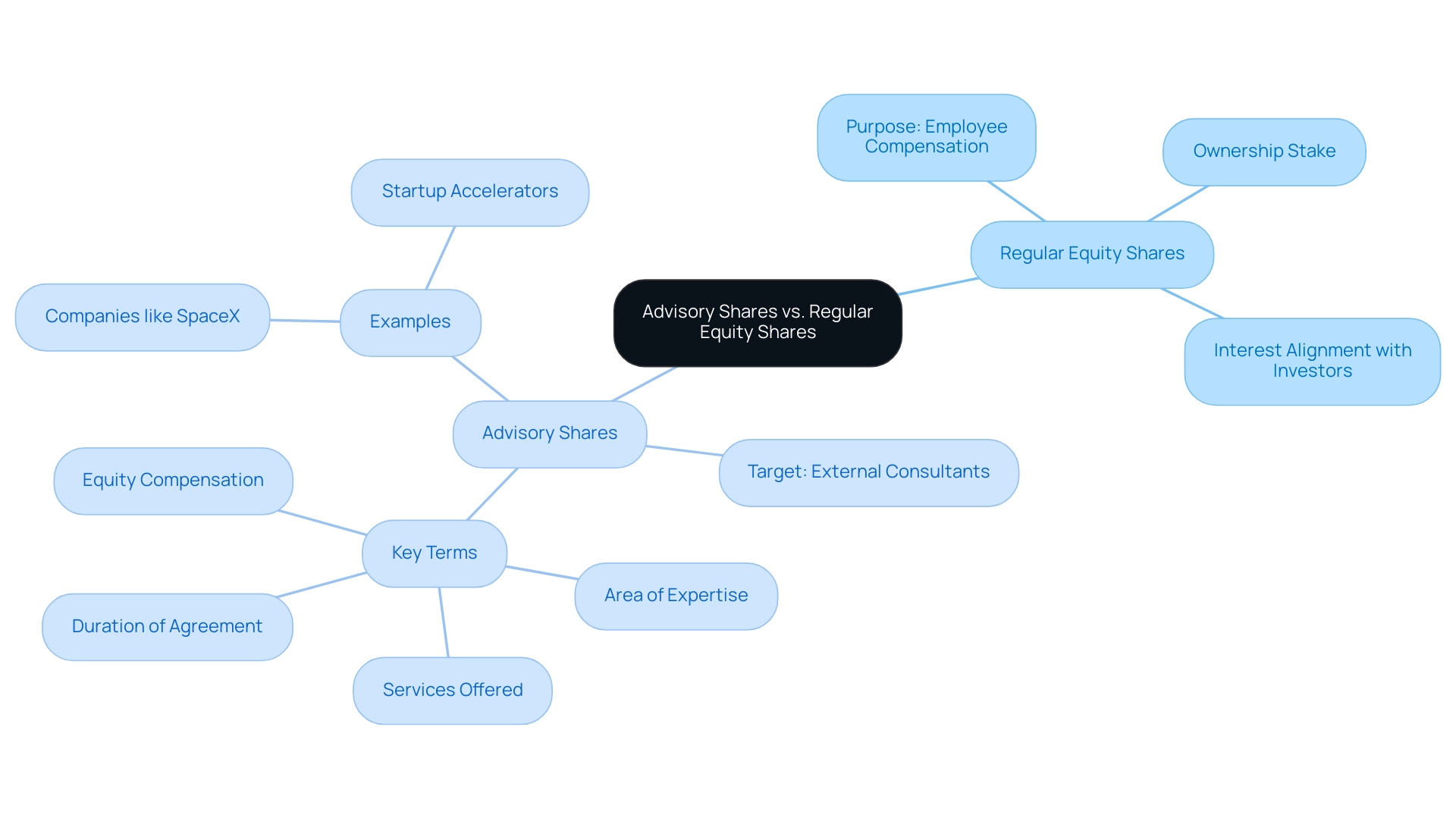

Advisory units and regular equity units serve fundamentally different purposes and are allocated to distinct recipients. Regular equity units are mainly provided to employees as part of their compensation packages, granting them ownership stakes in the organization and aligning their interests with those of investors. In contrast, the advisory shares meaning refers to the units assigned to external consultants who do not have a conventional employment connection with the company.

The advisory shares meaning typically incorporates specific terms and conditions, such as:

- The advisor's area of expertise

- Services offered

- Duration of the agreement

- Equity compensation details

These elements reflect the distinctive contributions expected from advisors. This differentiation is crucial for new ventures, particularly as they seek to leverage external expertise to foster growth. For example, startup accelerator programs frequently offer advisory interests to mentors, thus nurturing a cooperative environment that aids participating businesses.

Notably, renowned companies like SpaceX have effectively utilized advisory equity to engage leading experts in space exploration and engineering, exemplifying how strategic partnerships can enhance innovation and development. Additionally, it's important to note that an advisor's stock can be diluted to as low as 0.25% after another round of financing, highlighting the financial implications of these arrangements.

Benefits of Advisory Shares for Startups

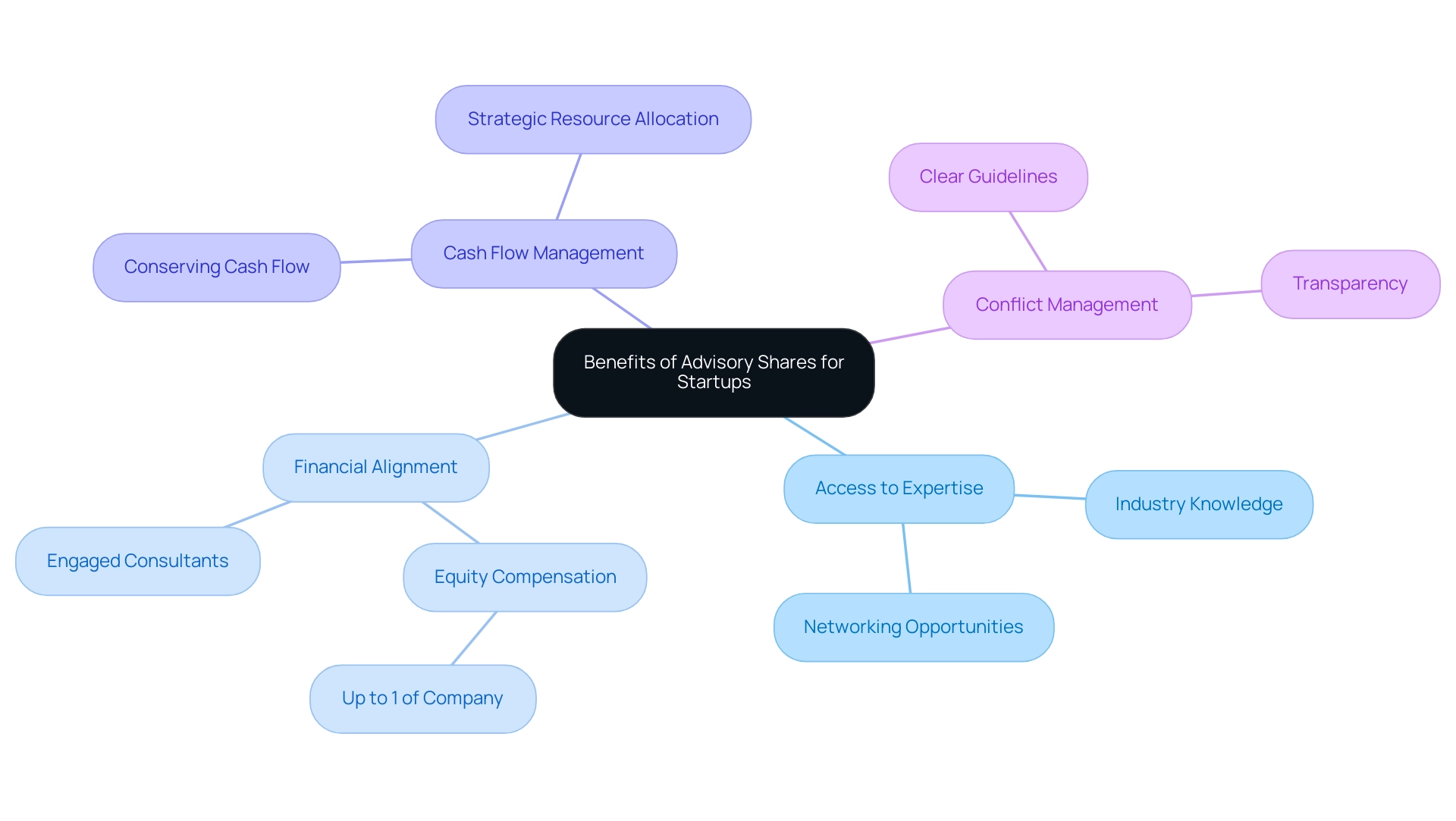

Advisory shares meaning includes providing numerous benefits for new businesses, allowing them to access valuable expertise without the immediate financial obligation of high salaries. By providing equity compensation, which can amount to 1% of the organization, emerging firms can attract experienced professionals who bring not only their industry expertise but also vast networks and mentorship possibilities, illustrating the advisory shares meaning in this context. This strategy not only assists in attracting top-tier consultants but also fosters a deeper commitment from them, as their financial success, which relates to advisory shares meaning, becomes directly linked to the company’s performance.

Amit Bhatti, a Principal at 500 Global, notes,

It only makes sense to give equity if the founder feels like they’re going to be demanding on somebody’s time.

This alignment of interests often translates into more engaged and committed consultants, thus playing a crucial role in the venture's ultimate success. Additionally, understanding advisory shares meaning is crucial as they serve as a vital tool for conserving cash flow during critical growth phases, enabling startups to allocate resources more strategically while still benefiting from expert guidance.

However, to mitigate potential conflicts of interest that may arise when consultants are involved with competing entities, it is essential to establish clear guidelines and transparency regarding the consultant's role and expectations. As highlighted in the case study titled 'Managing Conflicts of Interest,' conflicts may arise when consultants are involved with competing companies or when their interests diverge from those of the founders or investors. Establishing clear guidelines is essential to ensure transparency and defined expectations, significantly reducing risks associated with advisory roles.

This proactive strategy ensures that both the startup and its consultants can thrive.

Structuring Advisory Shares: Agreements and Vesting

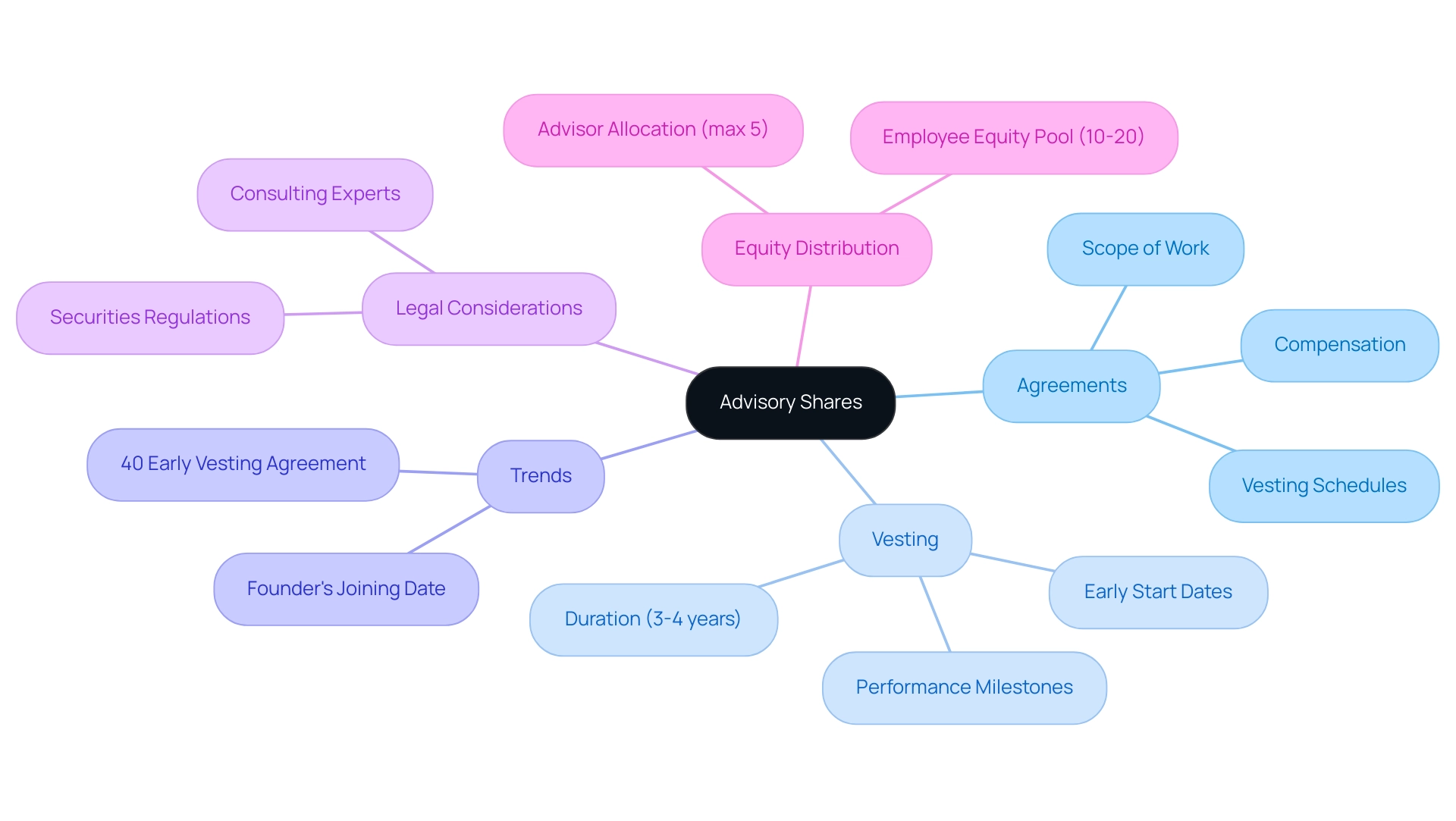

The advisory shares meaning involves structuring advisory interests through the careful drafting of agreements that delineate the terms of the advisory relationship, encompassing the scope of work, compensation, and vesting schedules. Vesting represents a pivotal facet of these agreements, as it stipulates when consultants acquire full ownership of their shares, typically contingent upon time or performance milestones. Typically, vesting schedules are structured to span a duration of three to four years, which encourages continuous involvement and dedication from consultants towards the organization's success.

Significantly, recent trends suggest that around 40% of the time, founders and investors consent to commence the vesting period before the funding round, frequently choosing the date the founder became part of the organization or the incorporation date. This practice can align interests more closely from the outset. Given the complexities involved, it is imperative for startups to engage legal and financial consultants when formulating these agreements.

This step guarantees adherence to securities regulations and protects the interests of both the organization and its consultants. Furthermore, it is advisable that no more than 5% of a company's total equity is allocated to advisors, with compensation tailored to their contributions and the company's development stage. Such strategic structuring not only aligns interests but also cultivates trust, ultimately benefiting the new venture.

Furthermore, it is crucial to recognize that at a typical venture-backed new enterprise, the employee equity pool usually ranges from 10-20% of the total outstanding units, emphasizing the importance of meticulous distribution.

Challenges and Considerations in Issuing Advisory Shares

The advisory shares meaning highlights various challenges for new ventures, particularly regarding ownership dilution and its impact on current stakeholders. For example, if a consultant receives a total of 10,000 equities upon full vesting, this translates to 416 equities vesting each month, illustrating the gradual nature of distribution. However, startups must also be aware of the high tax implications linked to unapproved equity schemes, which can significantly impact both the startup and the consultant.

This aspect must be communicated clearly to consultants to avoid unexpected financial burdens. Moreover, the case study on Non-Qualified Stock Options (NSOs) exemplifies how consultants can purchase shares at a fixed price, potentially leading to profits if the share value increases, but also highlights the tax implications when exercising options and selling shares. It is essential for new ventures to outline the consultant's role and expectations clearly to avoid misunderstandings and promote a productive collaboration.

Furthermore, the potential for conflicts of interest arises, especially when advisors possess equity in competing firms. As highlighted by Ben Chong, Co-director of the Founder Institute, navigating these complexities requires strategic foresight. To address these issues effectively, startups should prioritize establishing clear communication channels and conducting regular reviews of the advisory relationship.

This proactive approach not only aligns expectations but also mitigates potential risks associated with advisory shares meaning, ensuring that both parties remain aligned and engaged.

Conclusion

Advisory shares play a crucial role in the startup ecosystem, offering a strategic avenue for companies to leverage external expertise while conserving financial resources. By differentiating advisory shares from regular equity, startups can attract seasoned professionals whose insights and networks can drive growth and innovation. This unique compensation model aligns the interests of advisors with the company's success, ensuring that both parties are motivated to achieve shared goals.

The benefits of advisory shares extend beyond merely attracting talent; they also foster deeper commitment among advisors, as their financial success is directly tied to the company’s performance. However, navigating the complexities of issuing advisory shares requires careful structuring, clear agreements, and an awareness of potential challenges such as ownership dilution and tax implications. Establishing transparent guidelines and maintaining open communication can significantly mitigate risks and enhance the effectiveness of the advisory relationship.

In summary, startups that effectively utilize advisory shares can transform challenges into opportunities for growth. As the market continues to evolve, understanding the nuances of this compensation model will be essential for harnessing the full potential of advisory relationships, ultimately paving the way for sustainable success and innovation in an increasingly competitive landscape.