Overview

This article highlights the importance of understanding equity for startup founders, acknowledging the challenges they face in navigating ownership structures and types of equity. Many founders may feel overwhelmed by the complexities involved, and it's vital to address these concerns. The article emphasizes strategies for fair distribution among team members, fostering a sense of community and collaboration.

By detailing various forms of equity, such as common and preferred stock, it sheds light on the significance of vesting schedules and advisory shares. These elements are crucial in creating a fair and motivating startup environment, one that not only enhances growth but also attracts talented individuals who resonate with the company’s vision.

As many of our members have experienced, a thoughtful approach to equity can truly make a difference in building a supportive and thriving team.

Introduction

Navigating the intricate world of startup equity is essential for founders who are striving to build a solid foundation for their ventures. We understand that equity is more than just a financial metric; it shapes ownership dynamics, influences decision-making, and fosters a culture of commitment among team members.

As the startup landscape evolves, grasping the various types of equity—ranging from common and preferred stock to stock options and restricted stock units—becomes crucial. This article delves into the fundamentals of equity distribution, the importance of structured vesting schedules, and strategies to protect founder ownership amidst the challenges of dilution.

By equipping themselves with knowledge about equity management, founders can not only attract top talent but also position their startups for sustainable growth and success. We recognize the journey can be daunting, but with the right insights and support, you can navigate these waters with confidence.

The Fundamentals of Startup Equity

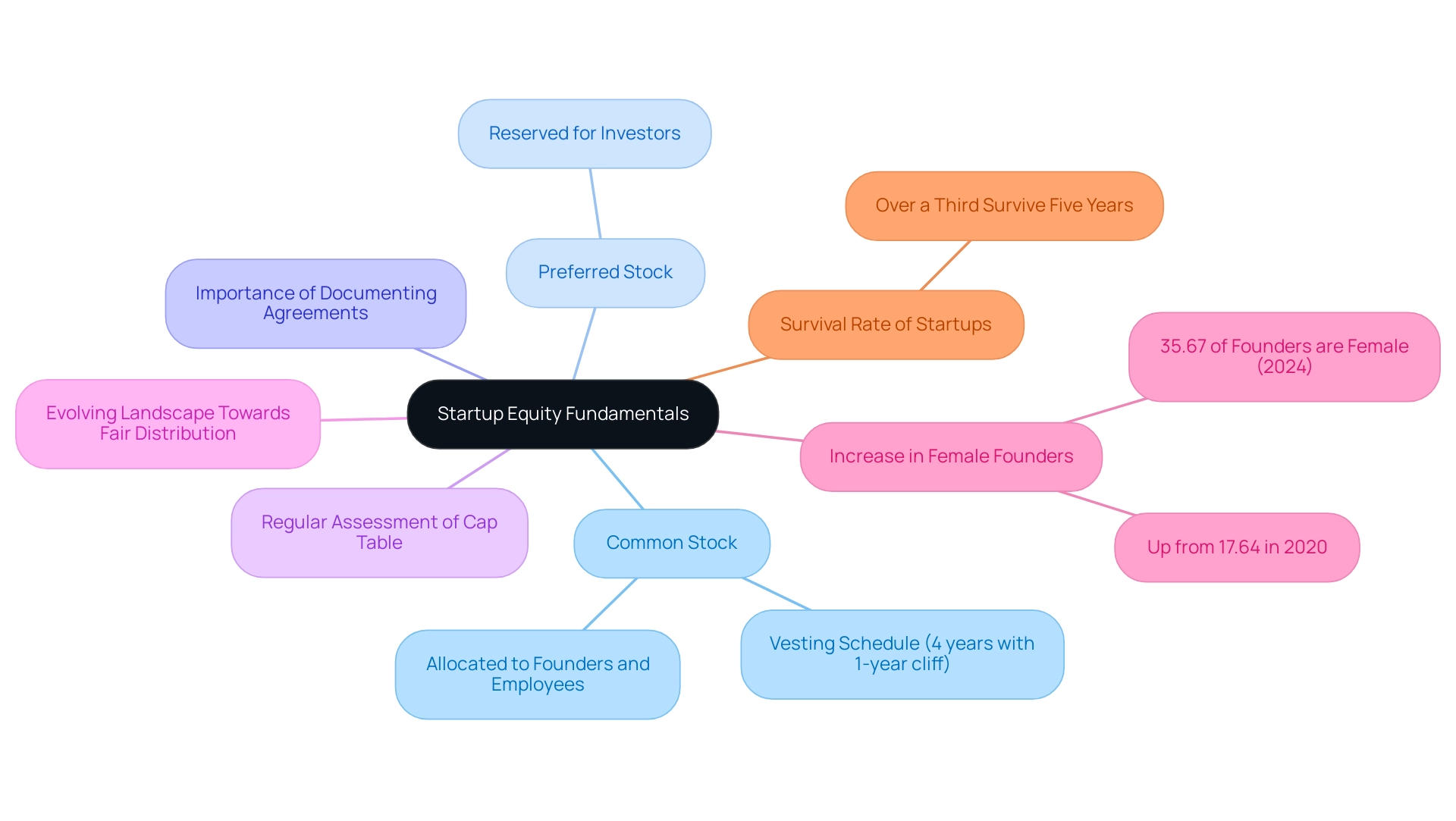

Startup shares are a vital part of what it means to possess a stake in a company, typically measured in shares. Founders need to understand that ownership goes beyond just financial figures; it is essential to the ownership structure, decision-making processes, and the overall culture of the organization. Equity for startups can be divided into two main types:

- Common stock, generally allocated to creators and employees

- Preferred stock, which is often reserved for investors

A common vesting schedule for Restricted Stock Units (RSUs) is four years with a one-year cliff, underscoring the importance of structured ownership management practices. As we look ahead to 2025, the landscape of shareholding frameworks is evolving, with an increasing emphasis on fair distribution and inclusivity among creators and their teams. We understand that disagreements over ownership distributions can arise, making it crucial for creators to document agreements and regularly assess the cap table to minimize potential conflicts.

In this shifting entrepreneurial ecosystem, it becomes essential for creators to strategically leverage equity for startup ownership—not just to drive growth but also to attract top talent motivated by a stake in the company's success and long-term value. As Chris Demetriou, Head of Business Advisory at Archimedia Accounts, wisely observes, "It’s always a shame to see businesses fail early. But we take heart from the fact that over a third survive five years, which is no mean feat at all."

By fostering an environment that values fairness, new businesses can enhance their operational efficiency and cultivate a more engaged workforce. This approach not only helps in navigating the complexities of ownership but also builds a supportive community that thrives on shared success.

Types of Equity: Understanding Your Options

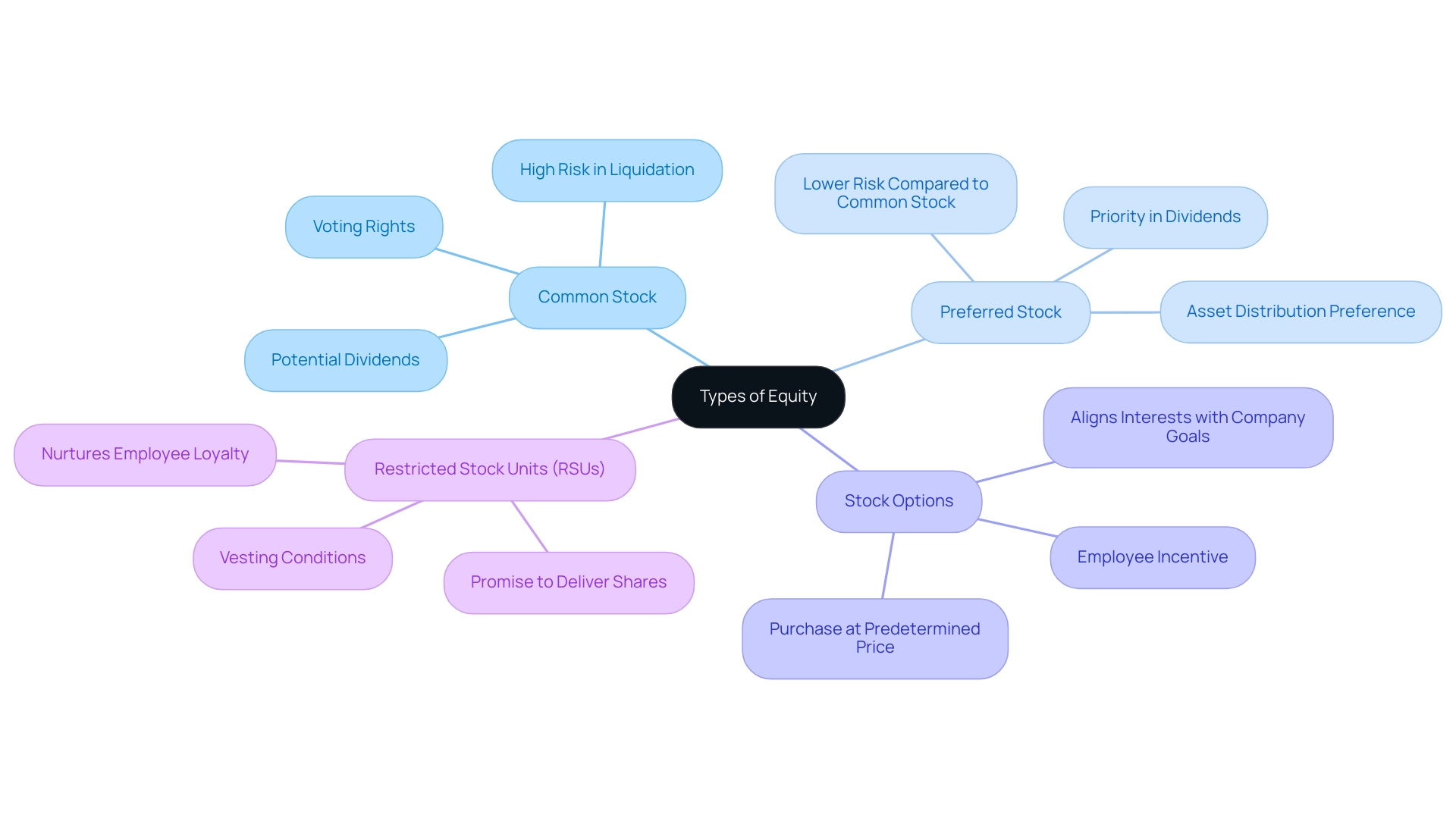

Understanding the various forms of ownership is crucial for entrepreneurs as they navigate the complexities of business growth. Many face challenges in managing ownership effectively, and recognizing these can make a significant difference in their journey. The primary categories include:

- Common Stock - This type of ownership is often granted to founders and employees, offering voting rights and potential dividends. However, it holds the last position in the hierarchy during liquidation, meaning common shareholders carry the highest risk. Many significant IPOs consist solely of new shares that the company offers to raise funds, underscoring the importance of thoughtful ownership management throughout the business lifecycle.

- Preferred Stock - Typically offered to investors, preferred stock provides benefits such as priority over common stockholders when it comes to receiving dividends and asset distribution in liquidation events. This can be a comforting choice for those seeking more security in their investments.

- Stock Options - These options empower employees to purchase shares at a predetermined price, serving as a motivating incentive for them to contribute to the company's growth and success. By aligning employee interests with the company's goals, stock options can foster a more engaged and dedicated workforce.

- Restricted Stock Units (RSUs) - RSUs signify a promise to deliver shares at a future date, often depending on certain vesting conditions. This approach not only nurtures loyalty among employees but also aligns their financial interests with the company's overall performance.

As Tessa Campbell insightfully remarked, "A small investment is better than nothing, and the mistakes you make along the way are a necessary part of the learning process." Navigating these ownership types effectively is vital for entrepreneurs to maintain control and ensure equity for sustainable growth. Regular evaluations of the ownership framework, as highlighted in the case study on managing shares during initial growth, can help prevent common pitfalls and encourage informed decision-making. We understand that each step in this process can be daunting, but with the right support and resources, entrepreneurs can thrive.

Equity Distribution: Splitting Shares Among Founders and Employees

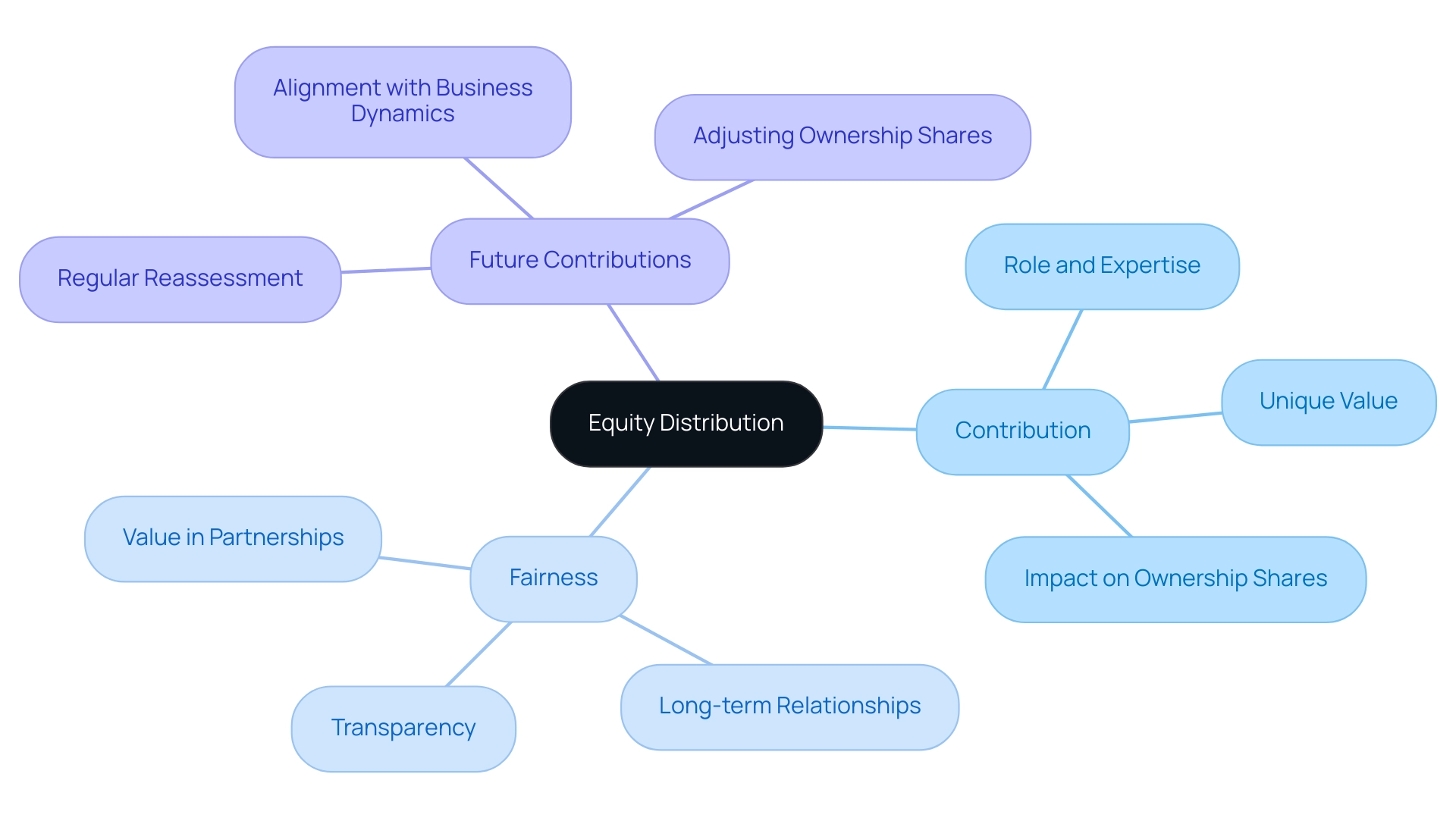

Navigating the complexities of ownership distribution can be challenging for creators, and it’s important to consider several critical factors that can significantly impact your journey:

- Contribution: It’s essential to assess each creator's role, expertise, and the unique value they bring to the startup. This assessment is crucial as it directly affects future ownership shares. For instance, by 2024, the main co-founder held 44% of the shares, while the third co-founder had 22%. This illustrates how contributions can shape ownership stakes over time.

- Fairness: Striving for transparency and fairness among founders is vital to prevent resentment and foster a collaborative environment. Taavi Rõivas, the former Prime Minister of Estonia, emphasizes that fairness in ownership divisions is key to sustaining long-term relationships within the team. We understand that feeling valued is essential in any partnership.

- Future Contributions: It’s also important to consider the potential for future contributions, as these can significantly influence ownership shares over time. Regularly reassessing these contributions, as highlighted by Startups.com, can help ensure that ownership divisions remain aligned with the evolving dynamics of the business.

Common strategies for ownership distribution include equal splits, which may simplify initial agreements, weighted distributions based on contributions, or dynamic agreements that adjust as the company progresses. Engaging in open discussions about these options is crucial; many of our members have found that using resources like ownership calculators can further simplify this process, assisting entrepreneurs in determining fair ownership distribution practices.

By prioritizing these considerations and recognizing the importance of annual reevaluation, startup founders can lay a solid foundation for equity in ownership agreements. This approach ultimately contributes to a healthier and more productive startup environment, fostering a sense of community and shared purpose among all members.

Leveraging Advisory Shares for Strategic Guidance

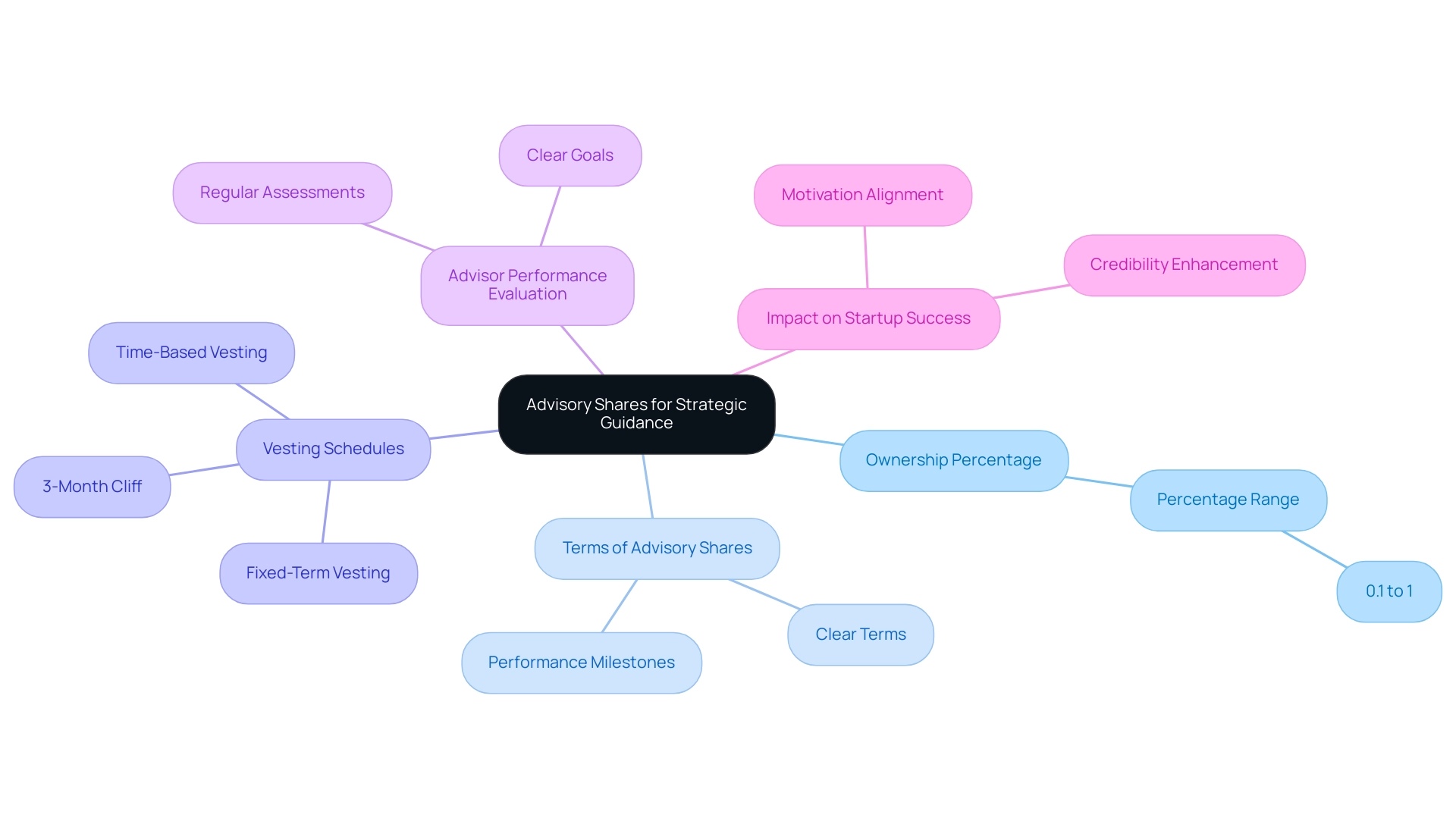

Advisory shares represent a thoughtful ownership grant offered to advisors in exchange for their invaluable expertise and guidance. In 2025, these shares typically represent a percentage of the company's ownership, ranging from 0.1% to 1%, depending on the advisor's influence and the depth of their contribution. It's encouraging to note that 1.16% of respondents aged 16 to 24 have already embarked on their entrepreneurial journeys, highlighting a vibrant landscape where effective advisory relationships can profoundly influence success.

To truly maximize the effectiveness of these agreements, founders should consider establishing clear terms regarding advisory shares to ensure fairness for their startups. This includes a well-defined vesting schedule and specific performance milestones. For example, advisory shares can incorporate fixed-term or time-based vesting schedules, which allow companies to manage equity distribution over time; a 3-month cliff can be an excellent way to assess the mutual benefits of the advisor relationship. This structured approach not only enhances the company's credibility but also keeps advisors motivated and aligned with its long-term success, particularly in securing equity for startups.

As Mihkel Torim, an industry leader, insightfully points out, 'The club's commitment to equipping members with the necessary insights and resources to make informed decisions' is crucial in nurturing these relationships. By regularly evaluating each advisor's performance against the objectives outlined in the advisory agreement, businesses can cultivate mutually beneficial relationships that drive growth and innovation. We understand that building these connections can be challenging, but with the right framework, they can lead to remarkable outcomes.

Navigating Equity Dilution: Protecting Founder Ownership

Equity dilution can be a concern for many entrepreneurs, as it occurs when a startup issues new shares, resulting in a decrease in the ownership percentage of existing shareholders. This issue is particularly significant in today's entrepreneurial landscape, where 9.01% of individuals aged 55 and over have already embarked on their business journeys. This statistic highlights the growing relevance of equity dilution strategies, as many are seeking to protect their hard-earned ownership. For entrepreneurs, being strategic in fundraising is essential to minimize dilution and safeguard their equity.

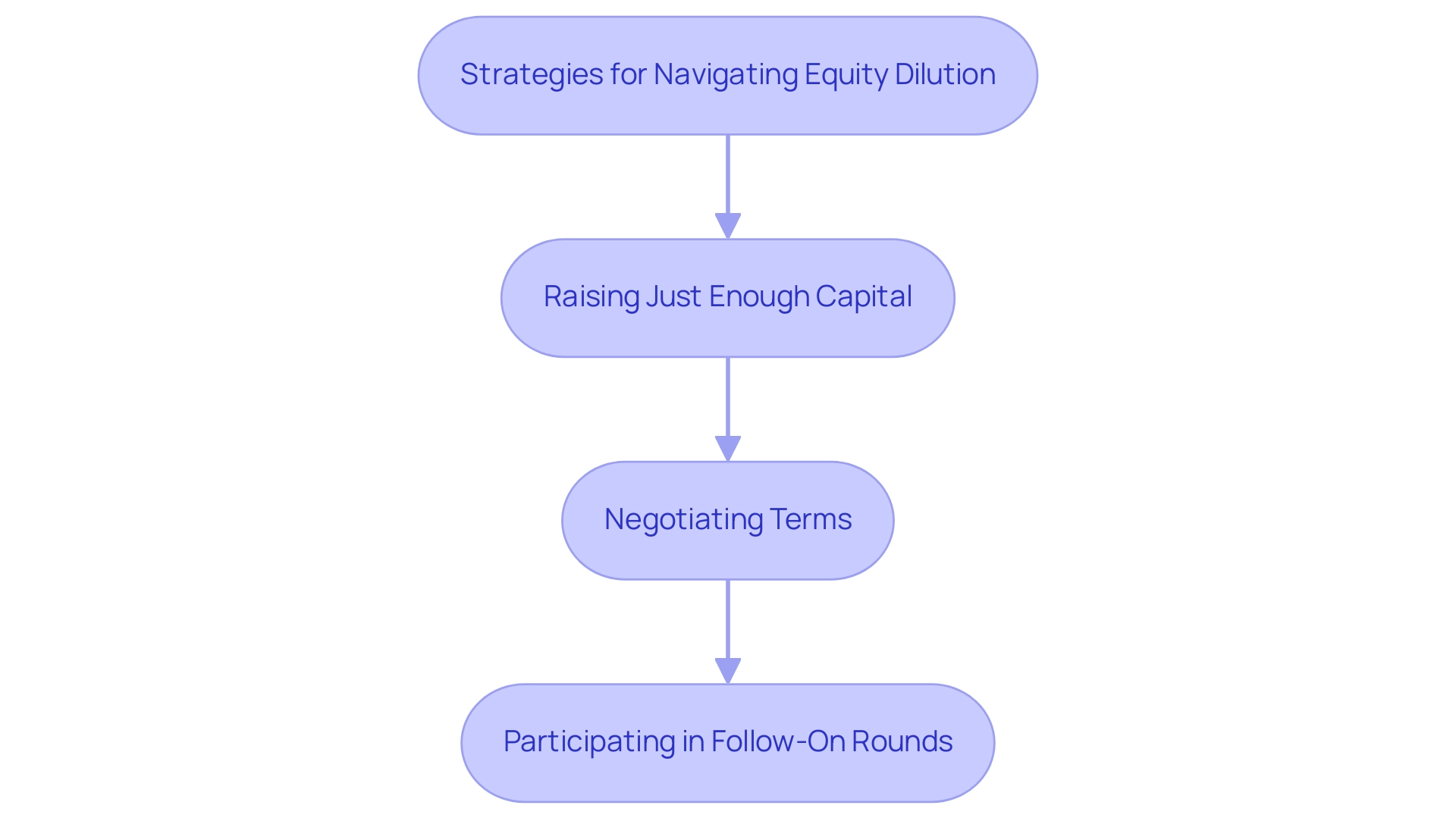

We understand that navigating this terrain can be challenging, so here are some empathetic techniques to protect ownership:

- Raising Just Enough Capital: It’s crucial to avoid overfunding, as this can lead to unnecessary dilution of ownership. By thoughtfully evaluating funding requirements, entrepreneurs can ensure they secure only what is essential to foster growth without compromising their ownership.

- Negotiating Terms: Founders should strive to secure favorable funding terms, such as anti-dilution clauses, which can protect existing shareholders' percentages during future funding rounds. This proactive approach can help maintain the integrity of ownership. As Josh Howarth notes, '91% of working-age Saudis believe they possess the necessary knowledge, skills, and experience to initiate a new business.' This reflects the confidence of prospective entrepreneurs in managing their enterprises, including the complexities of equity dilution.

- Participating in Follow-On Rounds: Whenever possible, founders should engage in subsequent funding rounds. This participation not only helps preserve ownership percentages but also demonstrates a commitment to the company’s growth.

Moreover, it’s vital to consider the impact of diversity in early-stage funding. For instance, Black entrepreneurs represent only 5% of Y Combinator-supported ventures. Understanding ownership dilution tactics can be especially beneficial for underrepresented entrepreneurs. By grasping and applying these strategies, entrepreneurs can effectively manage ownership dilution, maintain control over their startups, and maximize their potential for success while securing their equity.

Vesting Schedules: Structuring Equity Over Time

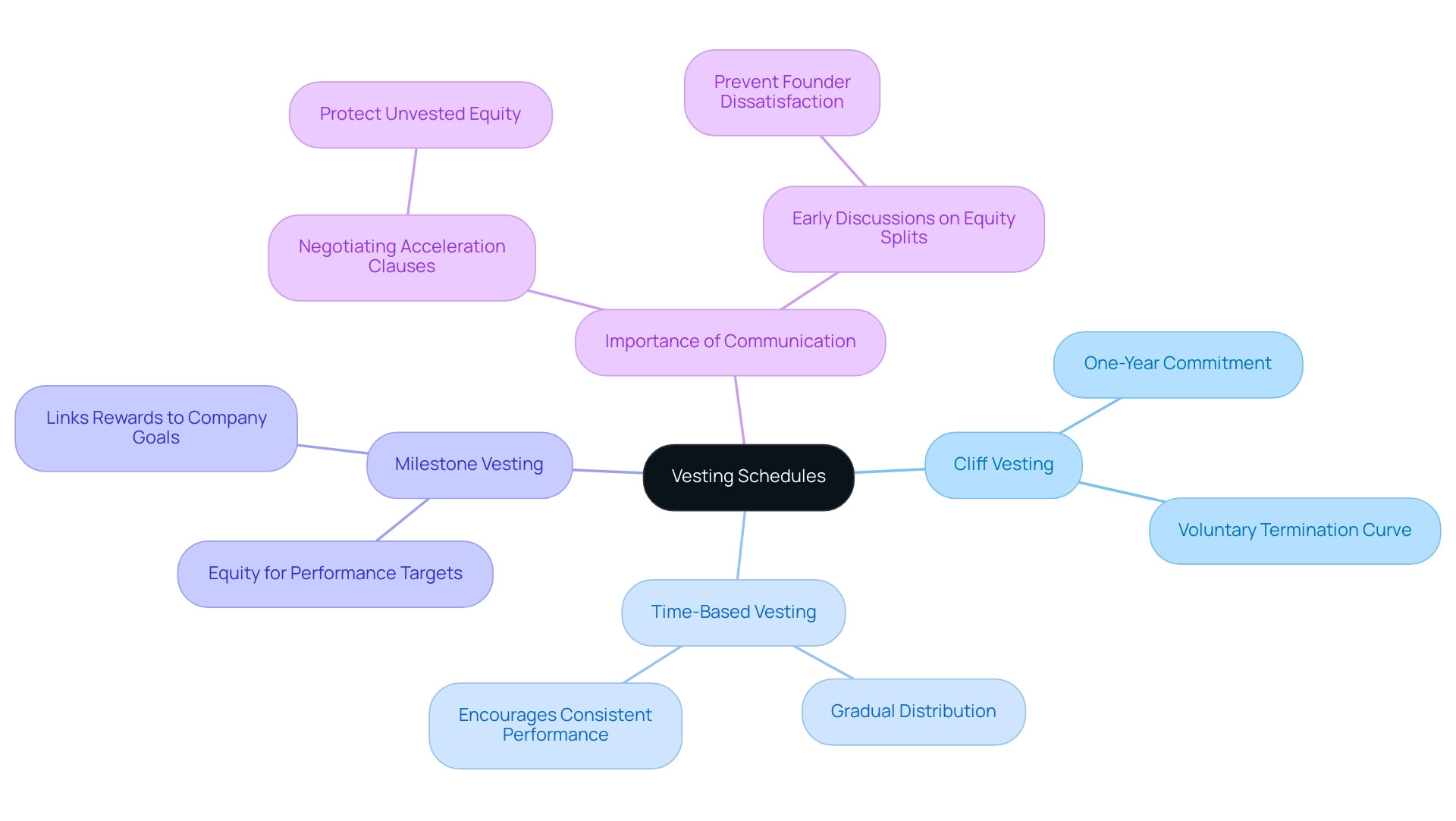

A vesting schedule is not just a technical necessity; it’s a vital part of nurturing relationships within a startup, establishing the timeline over which ownership becomes accessible to founders and employees. This framework plays a crucial role in aligning incentives with the company’s long-term objectives, which we understand can be a source of concern for many.

The main categories of vesting schedules include:

- Cliff Vesting: This arrangement typically involves a one-year period during which no ownership is granted. It ensures that team members are committed before any stake is awarded, reflecting the dedication we all value. The voluntary termination curve flattens towards the end of this first year, underscoring the significance of this initial commitment phase.

- Time-Based Vesting: In this model, ownership is gradually distributed over a set timeframe—often four years—through monthly or quarterly distributions. This method encourages consistent performance, fostering a sense of stability and trust.

- Milestone Vesting: Here, equity is awarded upon the achievement of specific performance targets, linking rewards directly to key company goals.

Implementing a thoughtfully structured vesting schedule not only protects ownership for startups against loss due to departing employees but also fosters equity by aligning individual contributions with the company's overall growth trajectory. This strategic alignment is becoming increasingly important in today's tech landscape, where effective resource distribution can significantly influence retention and motivation.

As Jason Flaks wisely notes, when negotiating acceleration clauses, it’s essential to express concerns regarding the safeguarding of unvested interests amid unforeseen changes. Furthermore, engaging in early discussions about equity splits, as highlighted in Noam Wasserman's study, can alleviate potential dissatisfaction among founders, contributing to a more harmonious and successful startup environment. We understand that navigating these complexities can be challenging, but by fostering open communication and shared understanding, we can create a supportive community that thrives together.

Conclusion

Understanding and effectively managing startup equity is not just a financial necessity; it is a vital aspect for founders striving to create a successful venture. We recognize that equity represents more than mere numbers on a balance sheet; it embodies the essence of ownership dynamics and the culture within an organization. As many founders have experienced, navigating through various types of equity—such as common and preferred stock, stock options, and restricted stock units—can be daunting. Each type serves a unique purpose in aligning interests and fostering commitment among team members.

The distribution of equity significantly influences relationships within the founding team and among employees. By considering factors like contribution, fairness, and future potential, founders can establish arrangements that not only feel equitable but also promote collaboration and motivation. We understand that leveraging advisory shares and implementing structured vesting schedules can enhance a startup's credibility while aligning incentives with long-term goals.

However, equity dilution is a concern that weighs heavily on many founders as they seek funding. By employing strategic approaches—such as raising only the capital that is truly necessary, negotiating favorable terms, and participating in follow-on rounds—founders can safeguard their ownership stakes while still attracting the essential investment for growth.

Ultimately, a profound understanding of equity management empowers founders to cultivate an environment that draws in top talent and supports sustainable growth. By prioritizing clear communication and regularly assessing equity structures, startups can build a strong foundation that not only benefits the organization but also nurtures its members, helping them to thrive in a competitive landscape. We are here to support you on this journey, ensuring that you feel informed, valued, and connected in your endeavors.