Overview

Special Purpose Vehicles (SPVs) are distinct legal entities created to achieve specific financial objectives, primarily to isolate risks and manage assets effectively. The article explains that SPVs are increasingly favored by investors due to their ability to limit liability, enhance fundraising capabilities, and provide structural flexibility, while also highlighting the complexities and risks associated with their establishment and operation.

Introduction

The landscape of investment vehicles has evolved significantly, with Special Purpose Vehicles (SPVs) emerging as a pivotal tool for investors seeking to manage risk and enhance returns. Designed to isolate financial liabilities and streamline asset management, SPVs are increasingly utilized across sectors such as private equity and real estate.

This article delves into the intricacies of SPVs, exploring their:

- Definition

- Operational mechanics

- Strategic advantages they offer investors

Furthermore, it addresses the inherent risks associated with these vehicles and provides a step-by-step guide for setting up an SPV, ensuring that both novice and seasoned investors are equipped with the knowledge necessary to navigate this complex yet rewarding investment avenue.

Understanding Special Purpose Vehicles (SPVs): Definition and Purpose

What is spv? A Special Purpose Vehicle (SPV) is a distinct legal entity established for a specific objective, typically designed to isolate financial risk or manage assets effectively. Special purpose vehicles find frequent application in sectors such as private equity, real estate, and venture capital. What is SPV encompasses the core objectives of pooling resources from multiple participants, enabling targeted investment in specific projects, and limiting liability for all parties involved.

By establishing a segregated framework for assets and liabilities, special purpose vehicles enhance the management of financial risk, leading to the question of what is SPV and why they are an attractive option for both individual and institutional investors. As of 2023, the median General Partner (GP) commitment for special purpose vehicles with assets under management (AUM) greater than $50 million stands at 0.39%, whereas for those under $1 million, it is notably higher at 1.2%. Furthermore, the rise in management fees among SPVs—escalating from 41% in 2021 to 67% in 2023 for those surpassing $10 million in AUM—reflects the increasing dependence on SPVs within the financial landscape.

This trend highlights what is spv in the context of the changing dynamics of its usage in private equity and real estate ventures. However, the financial landscape is not without its challenges. For instance, recent data indicates a 53% decline in infrastructure and natural resources fundraising, the lowest level since 2013.

This decline highlights the necessity for special purpose vehicles to adapt in a shifting market. Kevin Dowd, a senior writer focusing on private markets, observes that among special purpose vehicles with between $10 million and $20 million in AUM, the median limited partner (LP) count is 18, emphasizing the collaborative nature of these ventures. Additionally, investors considering special purpose vehicles in jurisdictions like Singapore should be aware of the legal requirements, tax considerations, and compliance obligations necessary for incorporating a private limited company.

How Special Purpose Vehicles Operate: Mechanics and Setup

What is SPV? Special Purpose Vehicles function by creating a separate legal entity, often organized as a limited liability company or corporation, which is accountable for managing the assets and obligations associated with the funding. The initial step in the setup process involves clearly defining the specific purpose of the SPV, which is crucial for understanding what is SPV and informs the subsequent choice of an appropriate legal structure. Once established, the SPV must be duly registered and adhere to all relevant regulatory requirements.

Investors are then invited to contribute capital to the SPV, which leads to a better understanding of what is SPV, as it aggregates these funds to pursue targeted projects or acquire specific assets. The administration of the SPV is usually assigned to designated directors or managers, whose duties involve supervising operations and ensuring that the SPV stays aligned with its objectives and regulatory frameworks. Notably, in 2023, the median general partner (GP) commitment for special purpose vehicles (SPVs) in the range of $1 million to $9.9 million reached an unprecedented 1.8%, highlighting a significant trend in understanding what is SPV and the commitment levels associated with these investment vehicles.

As Ashley Neville, who leads strategy for the Insights team at Carta, points out, this rise reflects a growing confidence in what is SPV among investors. Furthermore, the case study of Consolidated Worldwide Claims illustrates what is SPV by demonstrating the practical application of special purpose vehicles in managing financial operations, offering valuable insights into their mechanics and effectiveness.

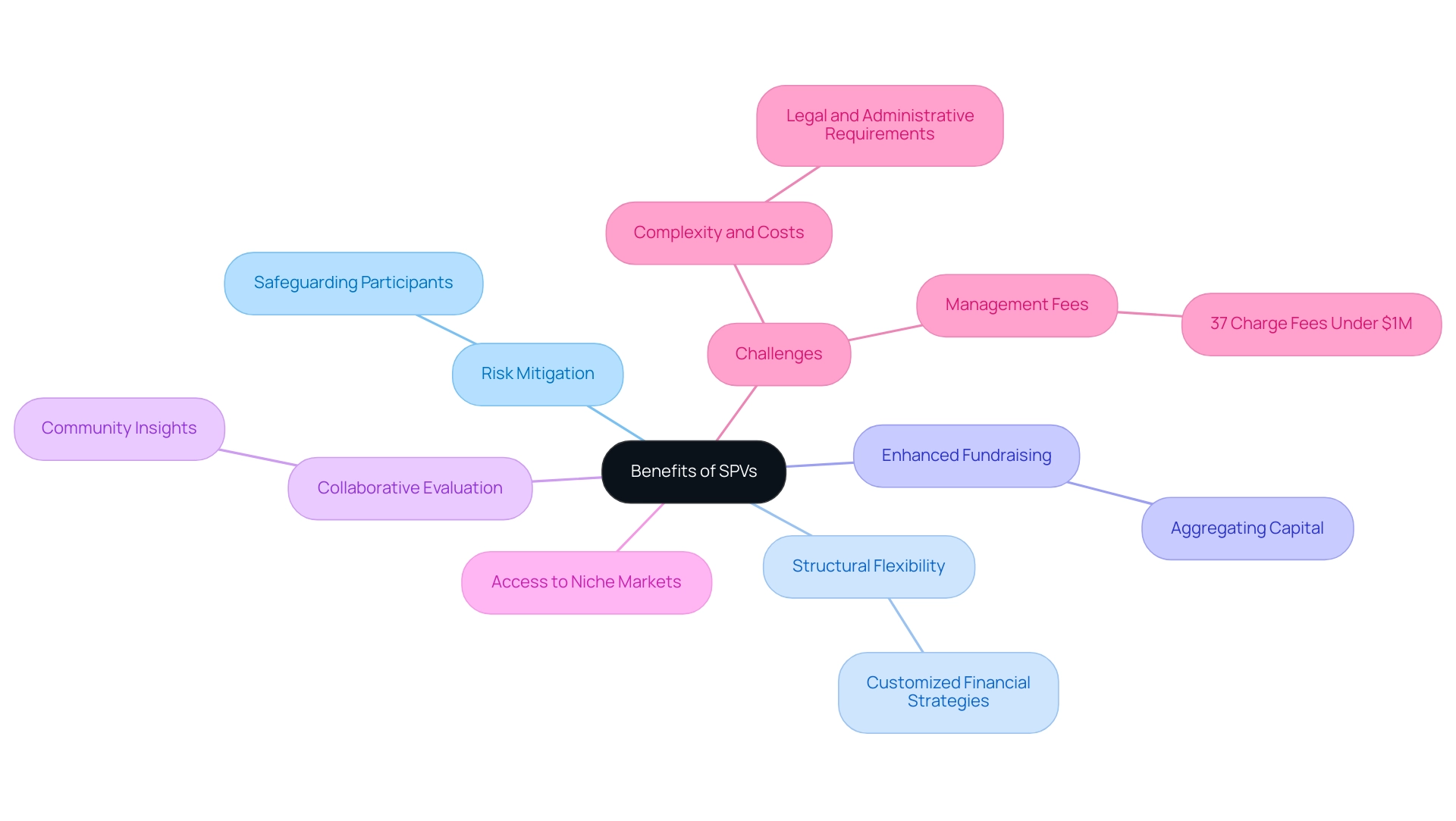

Why Investors Prefer SPVs: Benefits and Strategic Uses

Investors are increasingly favoring Special Purpose Entities, leading many to ask what is SPV, due to a variety of strategic benefits. One of the main benefits of special purpose vehicles, or what is SPV, lies in their capacity to restrict liability, effectively safeguarding participants from losses that surpass their initial contribution. This inherent risk mitigation is a significant draw for those looking to engage in high-stakes ventures.

Moreover, special purpose vehicles offer significant flexibility in structuring agreements, facilitating customized financial strategies that align with particular fiscal objectives. This adaptability is especially attractive in today's ever-changing investment environment.

Alongside risk management and structural flexibility, SPVs improve fundraising abilities by aggregating capital from various contributors. At fff.club, we utilize the knowledge of over 300 members to evaluate high-quality opportunities and conduct comprehensive due diligence, enabling participants to make informed choices and pursue ambitious initiatives. This collaborative method not only enhances the potential for larger funding amounts but also cultivates a community of knowledgeable participants who can share insights and strategies.

As one of our members noted, 'The collaborative evaluation process at fff.club has made my financial decisions much more confident and informed.' Importantly, special purpose vehicles also allow participants to diversify their portfolios by providing access to niche markets and projects that may not typically be available through traditional investment channels.

However, it is essential to note what is SPV, as the complexity and associated costs of establishing and maintaining such entities can pose significant challenges. Establishing an SPV often entails substantial legal, accounting, and administrative obligations, which may discourage some prospective backers. As highlighted in the case study on Total Value to Paid-In (TVPI) performance, special purpose vehicles historically saw their median TVPI rise above 1x after the first year from 2016 to 2019, but recent vintages (2021-2023) have shown prolonged negative performance.

This demonstrates the possible dangers present despite the advantages, highlighting the necessity for comprehensive due diligence prior to committing resources.

In spite of these obstacles, the benefits of improved transparency and governance—where financial activities and responsibilities are distinctly outlined—make special purpose vehicles an appealing option for numerous stakeholders, leading to the question of what is SPV. As Ashley Neville, who directs strategy for the Insights team at Carta, pointed out, 'The strategic applications of special purpose vehicles are becoming increasingly acknowledged among experienced financiers, particularly in maneuvering through intricate financial landscapes.' As observed in recent statistics, all 2,442 special purpose vehicles analyzed in this report are US-domiciled, direct-investment, and institutional in nature, underscoring their growing acceptance among sophisticated investors.

Notably, management fees are less common among special purpose vehicles with less than $1 million under management, with only 37% charging any fees, which further enhances their allure as a cost-effective financial option. Our collaborative evaluation process not only streamlines the funding journey but also ensures that all members are well-informed and supported throughout.

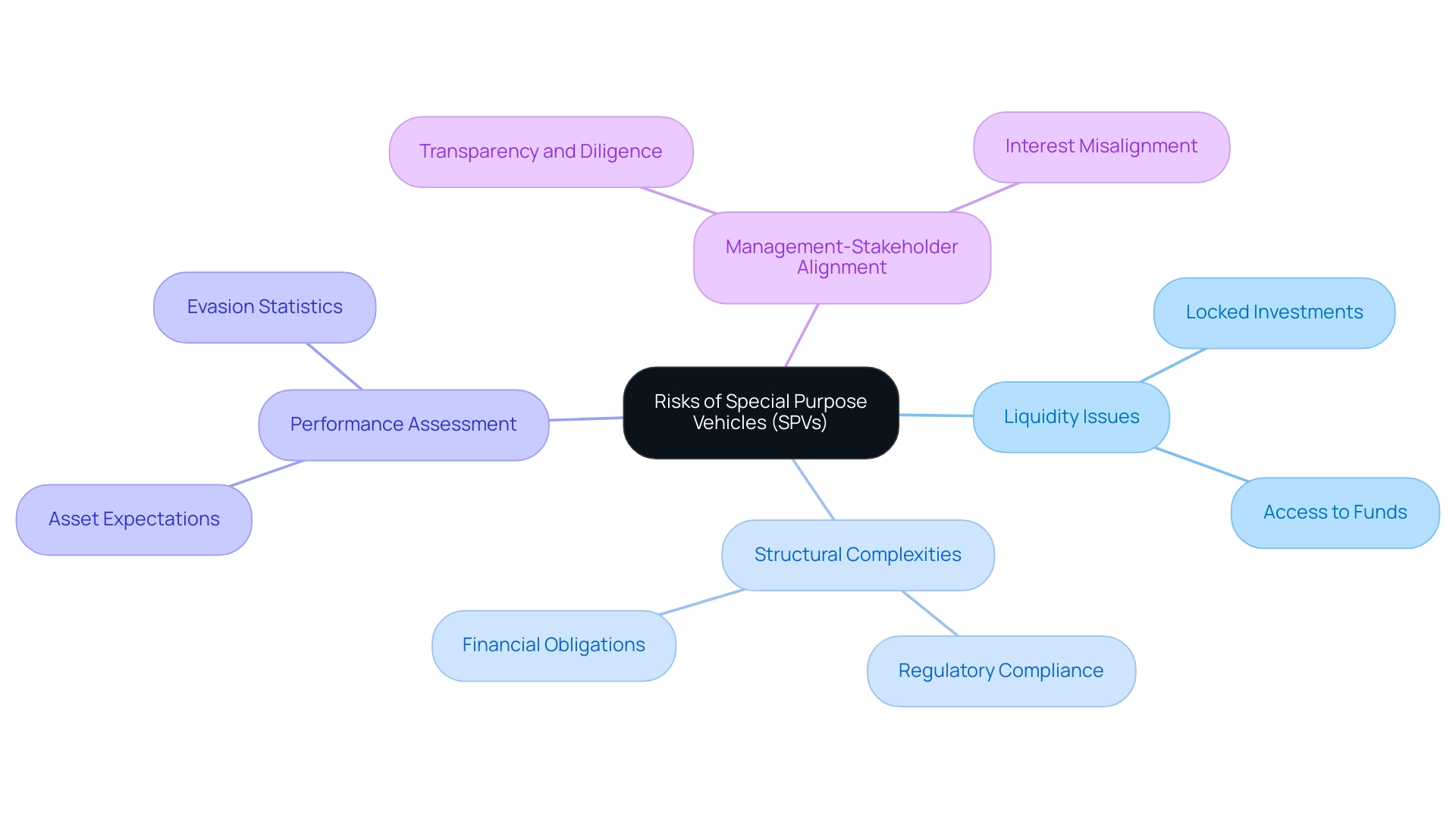

Navigating the Risks of Special Purpose Vehicles

Although Special Purpose Entities offer various advantages, understanding what is spv involves navigating a set of inherent risks that potential stakeholders must manage. One significant concern is liquidity; investments in SPVs can often be locked in for extended periods, limiting the ability to access funds when needed. This challenge is underscored by recent data indicating that liquidity issues are a growing concern within the SPV market, raising the question of what is spv as of 2024.

The complexities of what is spv structures can further complicate matters, potentially leading to misunderstandings regarding financial obligations and regulatory compliance. For instance, statistics on vehicle excise duty evasion reveal a complex landscape of financial implications, with ongoing efforts to develop robust methodologies for estimating evasion rates. Investors also face hurdles in accurately assessing an SPV's performance, particularly when the underlying assets do not meet expectations.

Additionally, the possibility of misalignment between management interests and stakeholder objectives can adversely impact decision-making processes. As Laura Holtham, a partner in the field, aptly notes,

We regularly win awards for the quality of our client service, our work, and our people

highlighting the importance of transparency and diligence in SPV management. To further assist stakeholders, additional resources such as the SPE FAQ Document and SPV Reporting Template are available, providing practical tools for navigating these challenges.

Therefore, it is vital for stakeholders to engage in comprehensive due diligence and remain cognizant of these risks before allocating capital to understand what is spv.

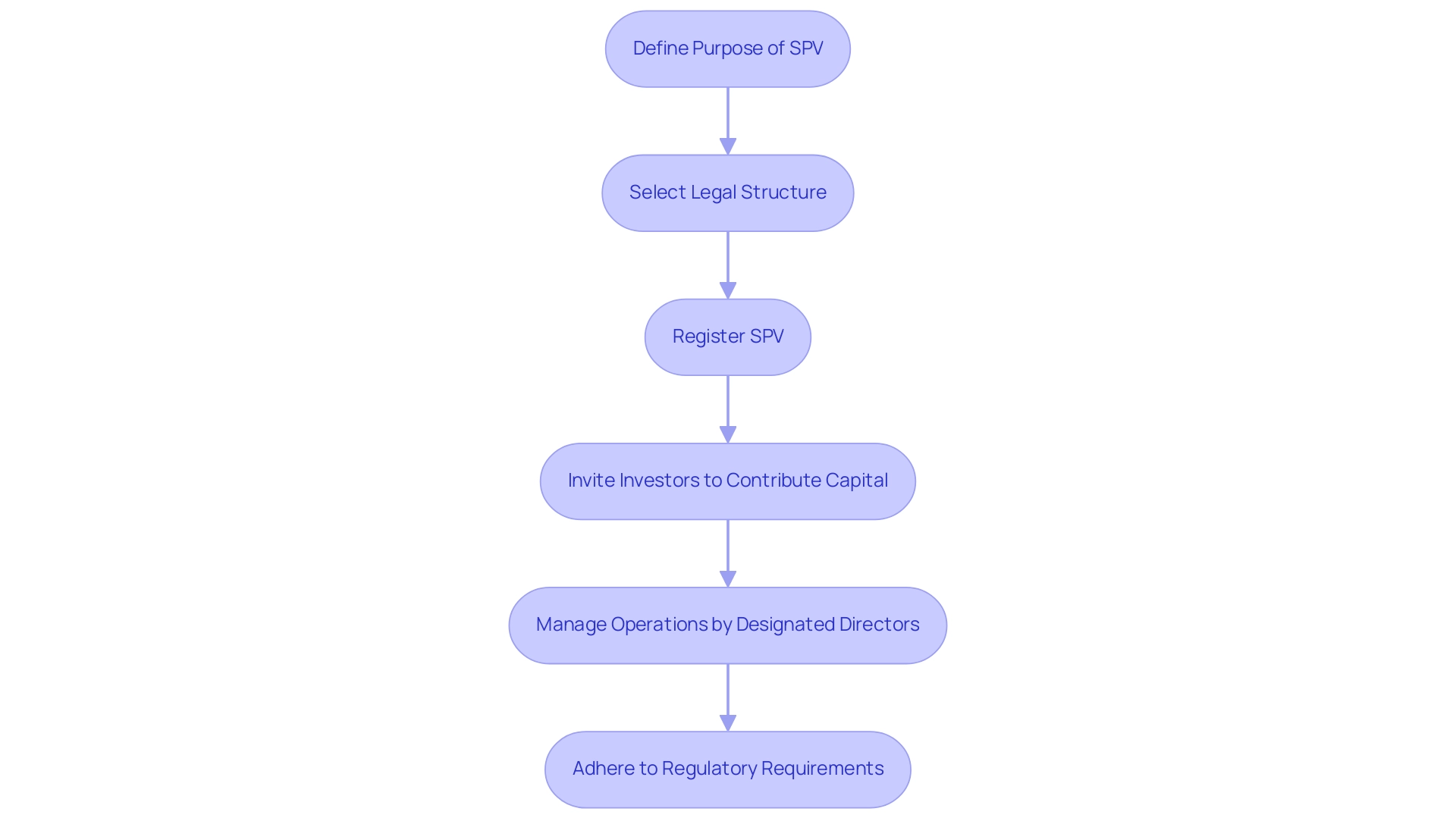

Setting Up Your SPV: A Step-by-Step Guide

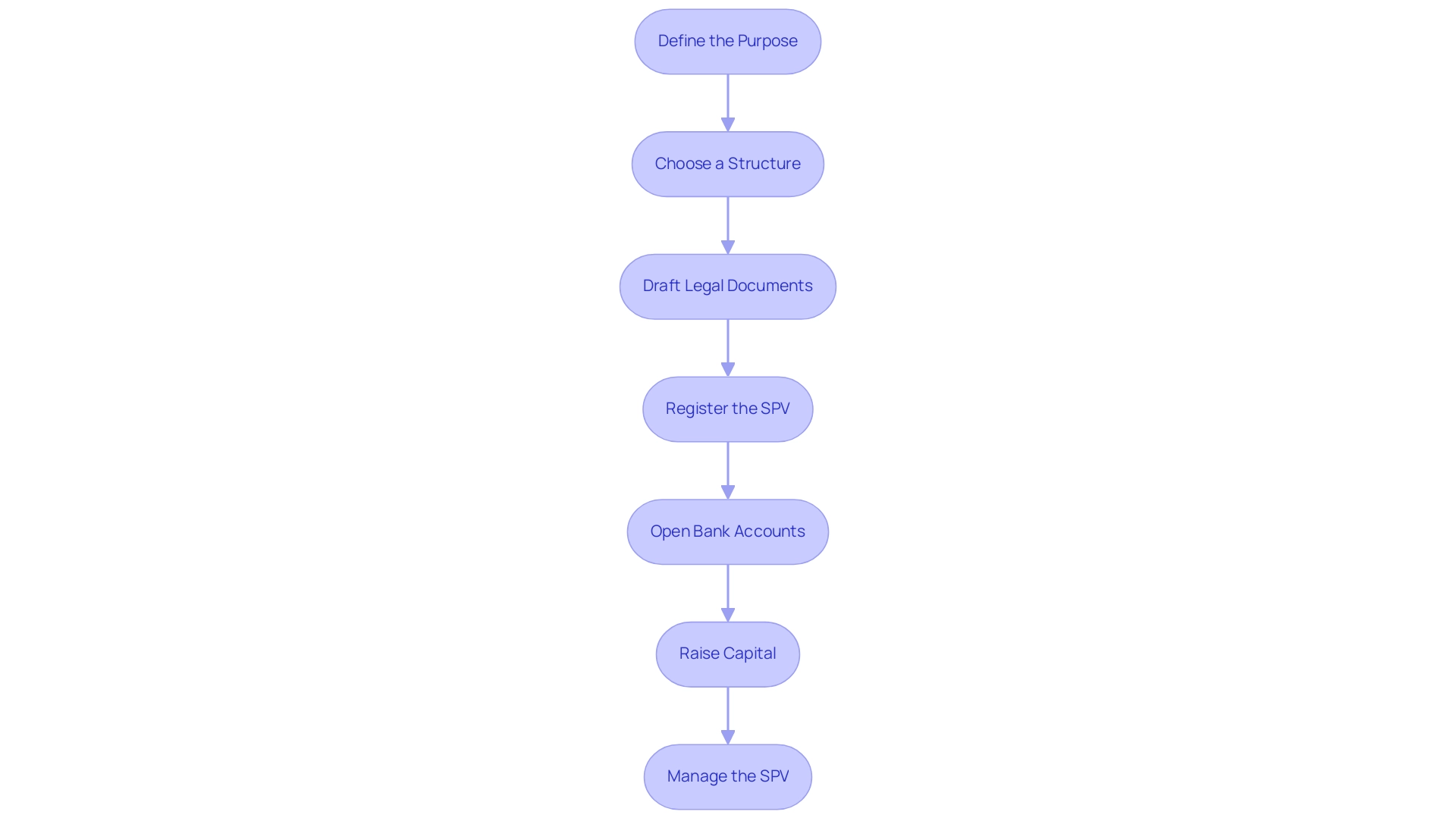

Creating a Special Purpose Vehicle (SPV) involves understanding what is SPV and several crucial steps designed to ensure a streamlined process tailored to your financial objectives. With around 2.8 million companies listed on the Inter-Departmental Business Register (IDBR), stakeholders often ask what is SPV when considering the formation of these entities to organize their financial activities efficiently. Follow this structured approach:

- Define the Purpose: Begin by articulating a clear financial objective and identifying the types of assets the SPV will manage. This foundational step sets the direction for all subsequent actions.

- Choose a Structure: Decide between forming an LLC or a corporation, considering your specific needs, regulatory requirements, and tax implications. The right structure can enhance operational efficiency and compliance.

- Draft Legal Documents: Engage with legal experts to prepare essential documentation, including an operating agreement and subscription agreements. These documents are critical for outlining governance and operational frameworks.

- Register the SPV: Complete the necessary paperwork and file it with the appropriate state or regulatory authority to legally establish the SPV. Ensure you comply with all local regulations to avoid future complications.

- Open Bank Accounts: Set up bank accounts in the name of the SPV. This separation of finances is vital for managing funds and transactions, thereby safeguarding personal assets.

- Raise Capital: Actively pursue backers to contribute to the SPV, ensuring you clearly communicate the funding strategy, potential returns, and associated risks. Transparency is key to building trust among stakeholders.

- Manage the SPV: Implement robust governance structures and oversight mechanisms to ensure compliance with regulations and effective management of the SPV’s assets. This ongoing oversight is essential for maintaining stakeholder confidence and achieving financial goals. The significance of confidentiality in handling an SPV cannot be overstated, as demonstrated by the case study on Disclosure Control in Statistical Reporting, which highlights techniques to safeguard sensitive data.

By following these steps, investors can effectively set up an SPV, understanding what is SPV in relation to their financial objectives. As highlighted by GM Professional Accountants,

By following the steps outlined in this guide and consulting expert accountants, you can efficiently set up your SPV in 2024 and manage your investments with confidence.

Conclusion

Special Purpose Vehicles (SPVs) have emerged as a significant tool for investors aiming to navigate the complexities of modern investment landscapes. By isolating financial risks and streamlining asset management, SPVs offer distinct advantages such as:

- Limited liability

- Enhanced fundraising capabilities

- Structural flexibility

All of which appeal to both individual and institutional investors. The mechanics of establishing an SPV involve careful planning, from defining its purpose to ensuring compliance with regulatory requirements, making it essential for investors to approach this process with diligence and clarity.

However, despite their many benefits, SPVs are not without risks. Issues such as:

- Liquidity constraints

- Potential misalignment of interests between management and investors

Can complicate investment outcomes. As the market evolves, it becomes increasingly critical for investors to conduct thorough due diligence, understand the inherent risks, and remain informed about the operational intricacies associated with SPVs.

In conclusion, the strategic use of SPVs can enhance investment portfolios, offering access to unique opportunities while mitigating risks. By following a structured approach to setup and management, investors can leverage the full potential of SPVs, making informed decisions that align with their financial goals. As the investment landscape continues to change, the adaptability and innovative structure of SPVs will likely play an integral role in shaping the future of investment strategies.