Overview

In this article, we explore the Total Value to Paid-In (TVPI) metric, a vital tool for assessing the performance of private equity investments. We understand that navigating the complexities of private equity can be daunting for many investors. The TVPI metric serves as a beacon, comparing the total value generated to the capital you’ve contributed. By grasping this concept, you can better understand not just the historical performance of your investments but also how to make informed decisions about your future strategies in a rapidly evolving market. We believe that having a clear understanding of TVPI empowers you to face these challenges with confidence, fostering a community of informed investors who can support one another in this journey.

Introduction

In the intricate world of private equity, we understand that navigating investment performance can be daunting. The Total Value to Paid-In (TVPI) metric emerges as a vital indicator, shedding light on both realized and unrealized returns. As we look ahead to the evolving landscape of 2025, grasping the nuances of TVPI becomes essential for making informed decisions that can profoundly affect your financial journey.

With the backdrop of a thriving market for large buyout transactions and the experiences shared by notable Estonian tech investors, this article aims to explore the intricacies of TVPI. We will provide a comprehensive overview of its calculation, significance, and practical applications.

By examining the interplay between TVPI and other performance metrics, we hope to empower you to position yourself to seize emerging opportunities while being mindful of common pitfalls in your investment strategies. Together, we can navigate this landscape with confidence and support.

What is TVPI? A Comprehensive Overview

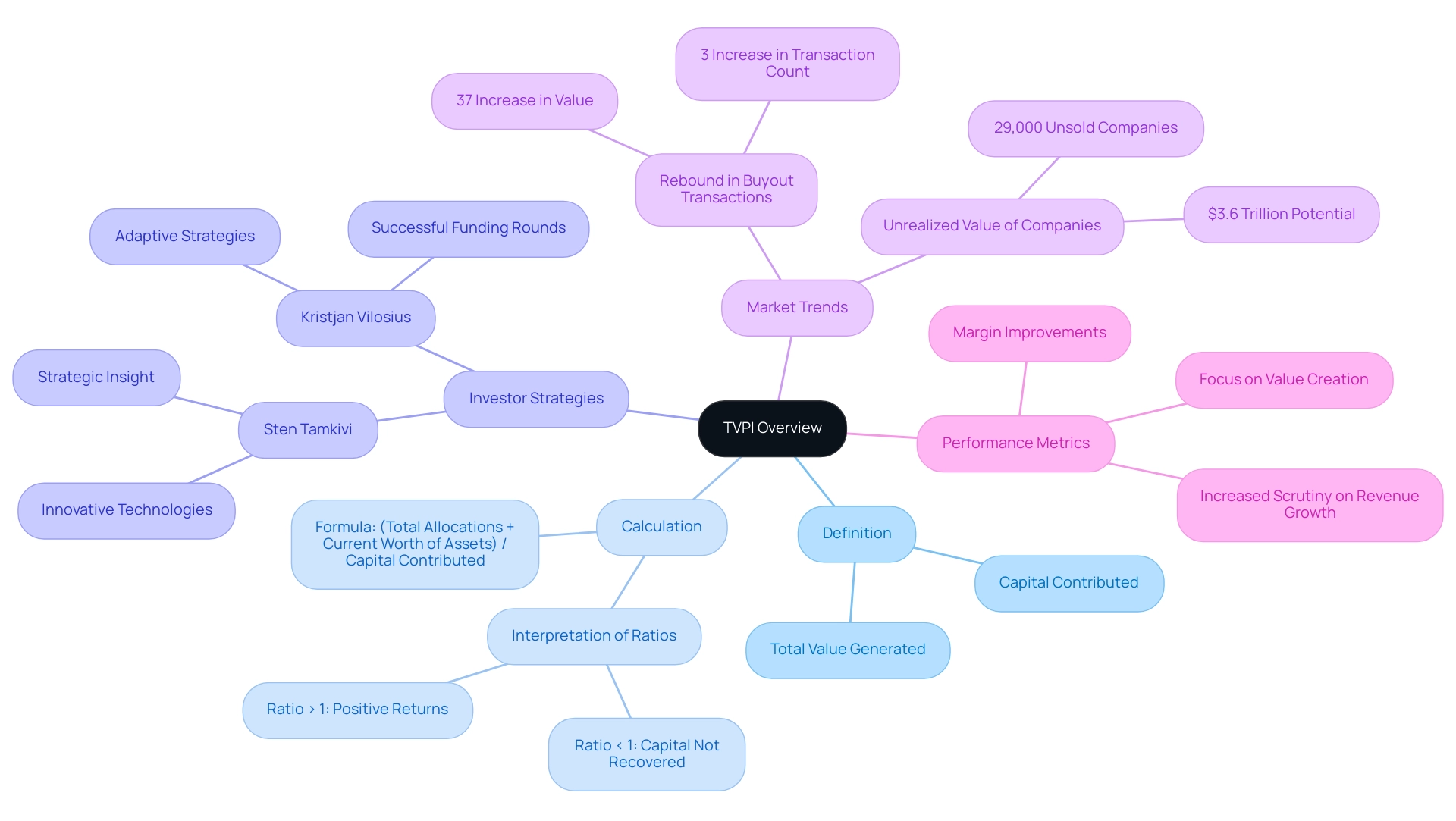

The TVPI definition serves as a vital performance indicator in private equity, quantifying the total value generated by a financial commitment in relation to the capital contributed. It involves adding the total allocations made to stakeholders along with the current worth of remaining assets, then dividing this sum by the overall capital contributed by stakeholders. A TVPI ratio exceeding 1 indicates that the fund has produced positive returns, while a ratio below 1 suggests that the capital has yet to recover its initial amount.

As we look ahead to 2025, the landscape of private equity funding reveals significant insights into TVPI performance metrics, particularly through the lens of leading Estonian tech investors like Sten Tamkivi and Kristjan Vilosius. Tamkivi, known for his strategic insight at Skype and his role in establishing Plural, highlights the importance of leveraging innovative technologies to achieve financial success. Meanwhile, Vilosius, who recently secured a 35m€ funding round for Katana MRP, exemplifies how adaptive strategies can yield substantial returns.

Their experiences remind us of the critical role innovation and resilience play in navigating the investment landscape. We understand that private equity operators are increasingly focused on value creation, with heightened scrutiny on revenue growth and margin improvements. This shift is underscored by a notable rebound in large buyout transactions across North America and Europe, which saw a 37 percent increase in value and a 3 percent rise in transaction count. These trends highlight the growing significance of TVPI as a gauge of success, indicating a more favorable environment for technology backers seeking lucrative opportunities.

For tech investors, grasping the TVPI definition is essential as it provides a comprehensive overview of a fund's performance and potential profitability. The typical ratios for private equity funds in 2025 indicate a rising trend towards stronger financial strategies, with many funds achieving ratios that surpass historical averages. This trend is especially meaningful given the current market dynamics, where approximately 29,000 unsold companies represent an unrealized value of $3.6 trillion, emphasizing the potential for profitable opportunities.

Furthermore, case studies from sectors like European eye and hearing care illustrate effective retail strategies that have led to remarkable outcomes. These examples show how efficient management and strategic funding can generate significant returns, underscoring the importance of total value to assess fund results. As Mihkel Torim, an industry leader at LHV, emphasizes, "The club's commitment to equipping members with the necessary insights and resources to make informed decisions" is crucial in this complex landscape.

Thus, the metric not only serves as an evaluation tool but also as a guiding principle for individuals navigating the complexities of private equity endeavors in 2025.

How to Calculate TVPI: Step-by-Step Guide

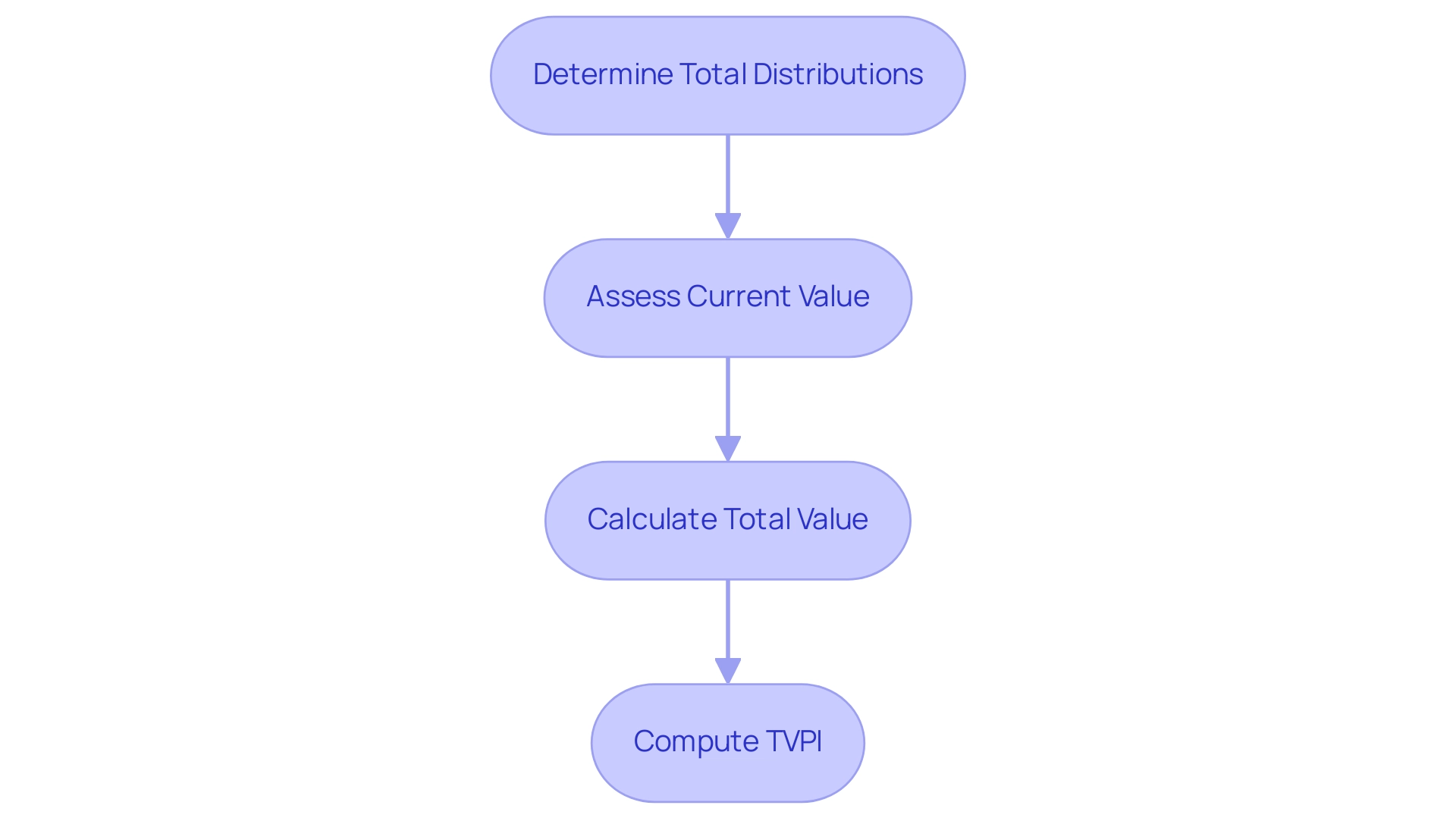

Calculating the Total Value to Paid-In (TVPI) ratio, often referred to as the tvpi definition, is essential for technology stakeholders who seek to evaluate the performance of their assets in private equity funds. We understand that navigating these financial waters can be challenging, so here’s a step-by-step guide to accurately determine TVPI. Moreover, insights on how fff. Club can enhance this process through community collaboration in deal flow, due diligence, and co-investing opportunities are included:

-

Determine Total Distributions: Begin by calculating the total distributions made to investors, which represent the realized gains from the asset. This step can feel daunting, but it is crucial for understanding your investment.

-

Assess Current Value: Next, evaluate the current worth of any remaining assets, reflecting unrealized gains. Many of our members have experienced the importance of this assessment in their decision-making.

-

Calculate Total Value: Combine these two figures to arrive at the total value of the investment:

Total Value = Total Distributions + Current Value of Remaining Investments -

Compute TVPI: Finally, divide the total value by the total capital paid in by investors:

TVPI = (Total Distributions + Current Value of Remaining Investments) / Total Paid-In Capital

This calculation provides a cumulative performance measure throughout the fund's life, allowing investors to gauge overall investment success. A total value to paid-in ratio of 1.51 or above generally indicates strong performance, showcasing the general partner's effectiveness in identifying lucrative opportunities.

Understanding this concept is particularly significant for members of fff.club, where teamwork and knowledge exchange among more than 410 tech professionals enhance strategies in deal flow, due diligence, and co-investing. As Ethan Mitchell, a Business Intelligence Analyst, wisely observes, 'The total value indicator provides a snapshot of overall worth, while IRR concentrates on the speed of returns.' By engaging in due diligence and co-investing opportunities, members can leverage insights into performance calculations, avoiding common pitfalls and ensuring a more informed approach to their investments in the dynamic tech landscape.

Additionally, this metric is straightforward to acquire and comprehend, making it accessible for technology stakeholders. We recognize that fostering a community-oriented atmosphere nurtures important relationships while deepening the understanding of wealth management. This enables individuals to make strategic choices based on thorough metrics. Furthermore, the creators of fff.club, Akim Arhipov and Tim Vaino, possess extensive knowledge in wealth management and legal frameworks, further enhancing the credibility of the community and its collaborative financial opportunities.

The Importance of TVPI in Private Equity Investing

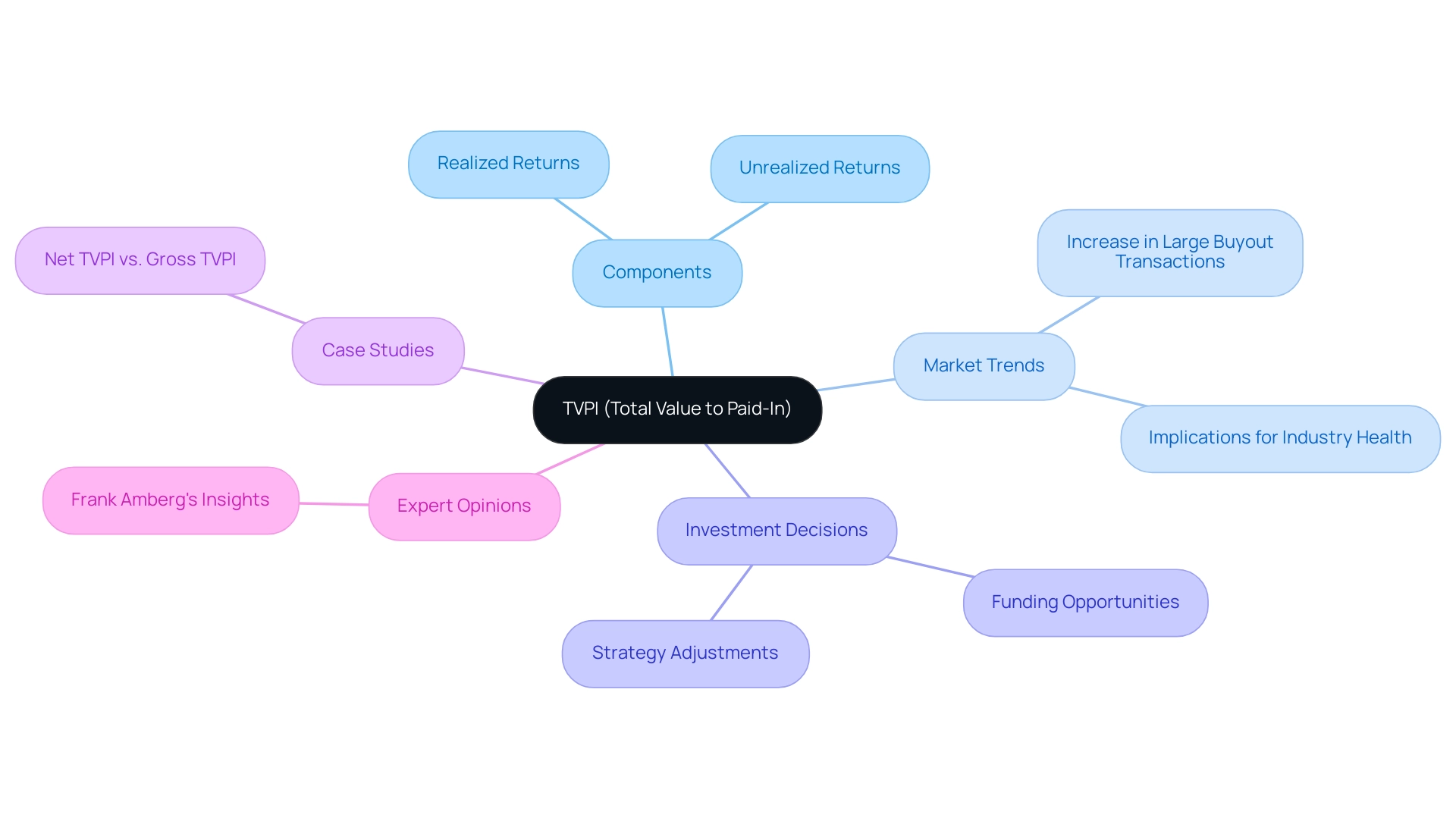

The TVPI definition, or Total Value to Paid-In, is an important metric for private equity stakeholders, offering a comprehensive view of a fund's performance. It includes both realized returns—those that have been distributed to investors—and unrealized returns, which reflect the current value of the fund's holdings. This duality allows stakeholders to assess the overall worth produced by their assets, making the TVPI definition particularly essential in the private equity environment, where contributions often take years to develop.

As we look to 2025, the significance of this metric becomes even more pronounced with the substantial rise in large buyout transactions across North America and Europe, suggesting a healthy industry landscape. Recent data shows that large buyout transactions have increased in both value and count, reflecting a thriving market environment. We understand that as stakeholders navigate these complex markets, grasping the TVPI definition serves as a vital resource for evaluating whether to uphold commitments to a fund, explore new funding opportunities, or adjust strategies based on the fund's performance relative to their expectations.

Real-world examples illustrate how Total Value to Paid-In impacts investment decisions. For instance, when comparing net performance metrics to gross performance metrics, stakeholders typically focus on net figures, which account for management fees and carried interest. This focus provides a clearer picture of a fund's performance after costs, empowering individuals to make more informed decisions.

A case study emphasizing this distinction reveals that a solid understanding of the TVPI definition can significantly influence an investor's confidence in a fund's future prospects. As Frank Amberg, an Invest Europe LP council member, notes, "As infrastructure evolves, funding prospects expand beyond traditional assets to include areas such as energy transition and digitalisation."

Expert opinions further underscore the importance of the TVPI definition in grasping the total value to paid-in capital in private equity investing. As the financial landscape shifts, metrics like total value to paid-in, encapsulated by the TVPI definition, become increasingly critical for strategic asset distribution. The total worth in total value paid in kind, which includes both realized assets and the residual worth of unrealized assets, reflects the current state of a fund's holdings and any distributions made to shareholders.

This comprehensive view is essential for individuals aiming to optimize their portfolios in a dynamic market.

In summary, the TVPI definition emphasizes that this metric is not just a number; it is a crucial indicator that provides insights into fund performance and guides financial choices. As the private equity industry continues to expand and evolve, understanding and utilizing the TVPI definition will remain a vital approach for individuals seeking to enhance their returns.

TVPI vs. Other Metrics: Understanding DPI and IRR

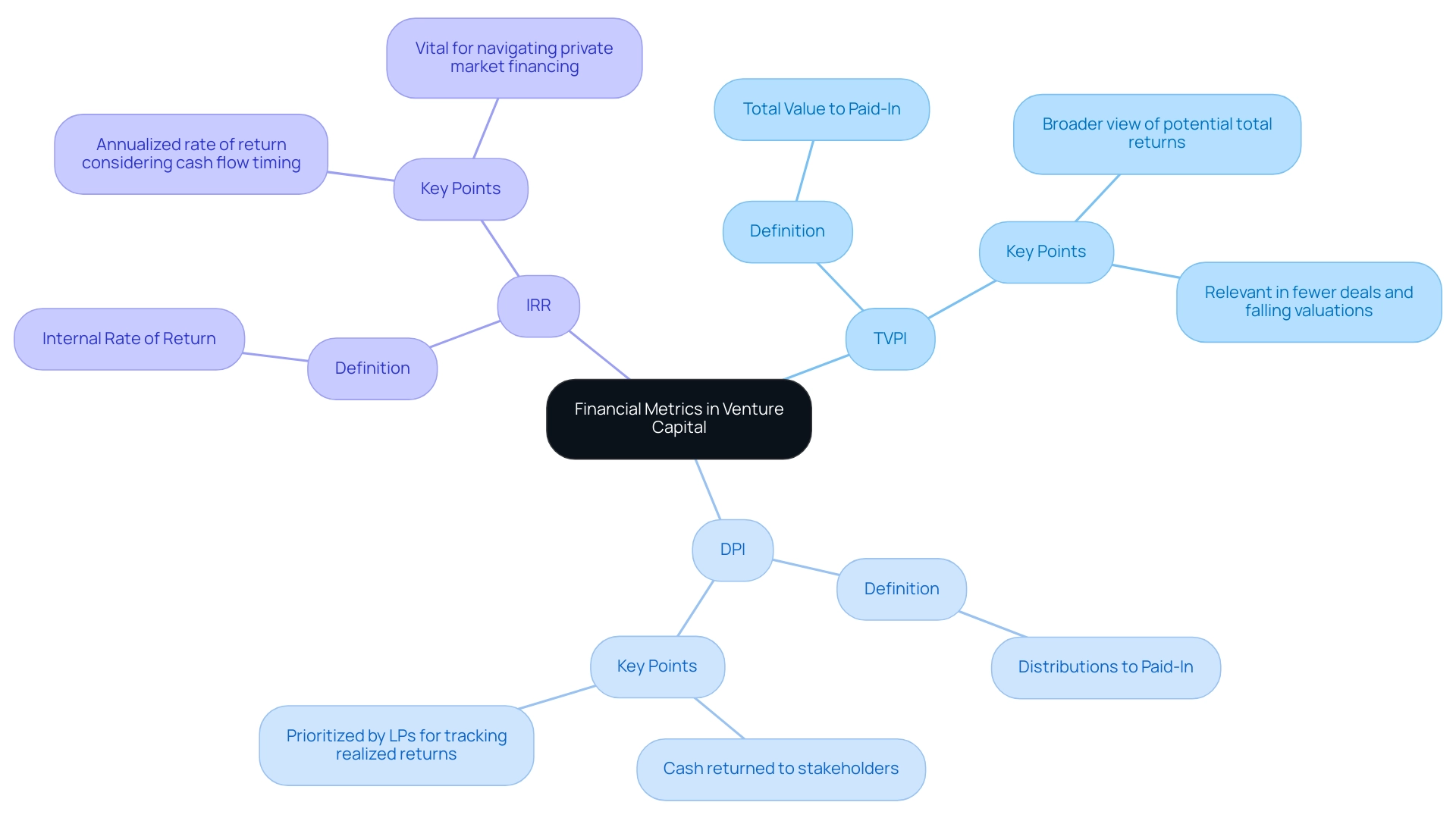

The metric known as TVPI, or Total Value to Paid-In, plays a vital role in evaluating a venture's overall worth in relation to the capital invested, illustrating its definition. On the other hand, DPI, or Distributions to Paid-In, centers on the cash returned to stakeholders, calculated by dividing total distributions by the total capital paid in. This provides a clear picture of actual cash returns. Meanwhile, IRR, or Internal Rate of Return, assesses the annualized rate of return on a financial venture, taking into account the timing of cash flows.

Understanding these differences is essential for technology financiers navigating private market opportunities, such as deal flow, due diligence, and co-investing in venture capital, private credit, and real estate. Many of our members have shared that while LPs (Limited Partners) often prioritize DPI to track realized returns, the TVPI definition offers a broader view of potential total returns. This perspective is particularly relevant in today's financial landscape, characterized by fewer deals, fewer exits, and falling valuations, as seen in the 2021 and 2022 vintages.

As we approach 2025, the significance of these metrics becomes even more pronounced amid the challenges faced in private equity. DPI, RVPI (Residual Value to Paid-In), and the TVPI definition serve as essential tools for assessing fund performance. They empower investors to evaluate liquidity risks and develop effective exit strategies. As Taavi Roivas, former Prime Minister of Estonia, emphasizes, grasping these metrics is crucial for making informed financial decisions in the tech sector.

Real-world examples resonate deeply with these concepts. For instance, BIP Ventures' collaboration with Atlanta's Year of the Youth initiative not only inspired entrepreneurial aspirations among students but also underscored the importance of mentorship in nurturing future innovators. This initiative serves as a poignant reminder of the broader impact of funding strategies beyond mere financial returns, showcasing how support and guidance can enhance financial outcomes.

The founders of Finance, Freedom, Fellows, Akim Arhipov and Tim Vaino, bring invaluable expertise to this discussion, with backgrounds in wealth management and law, respectively. Their insights into private market possibilities further empower technology financiers at fff.club.

As the funding landscape evolves, understanding the relationship between DPI and IRR becomes increasingly vital for tech financiers, particularly those striving to navigate the complexities of private market financing successfully. We understand that engaging with educational resources and community initiatives can truly empower investors to optimize their strategies and seize exclusive financial opportunities.

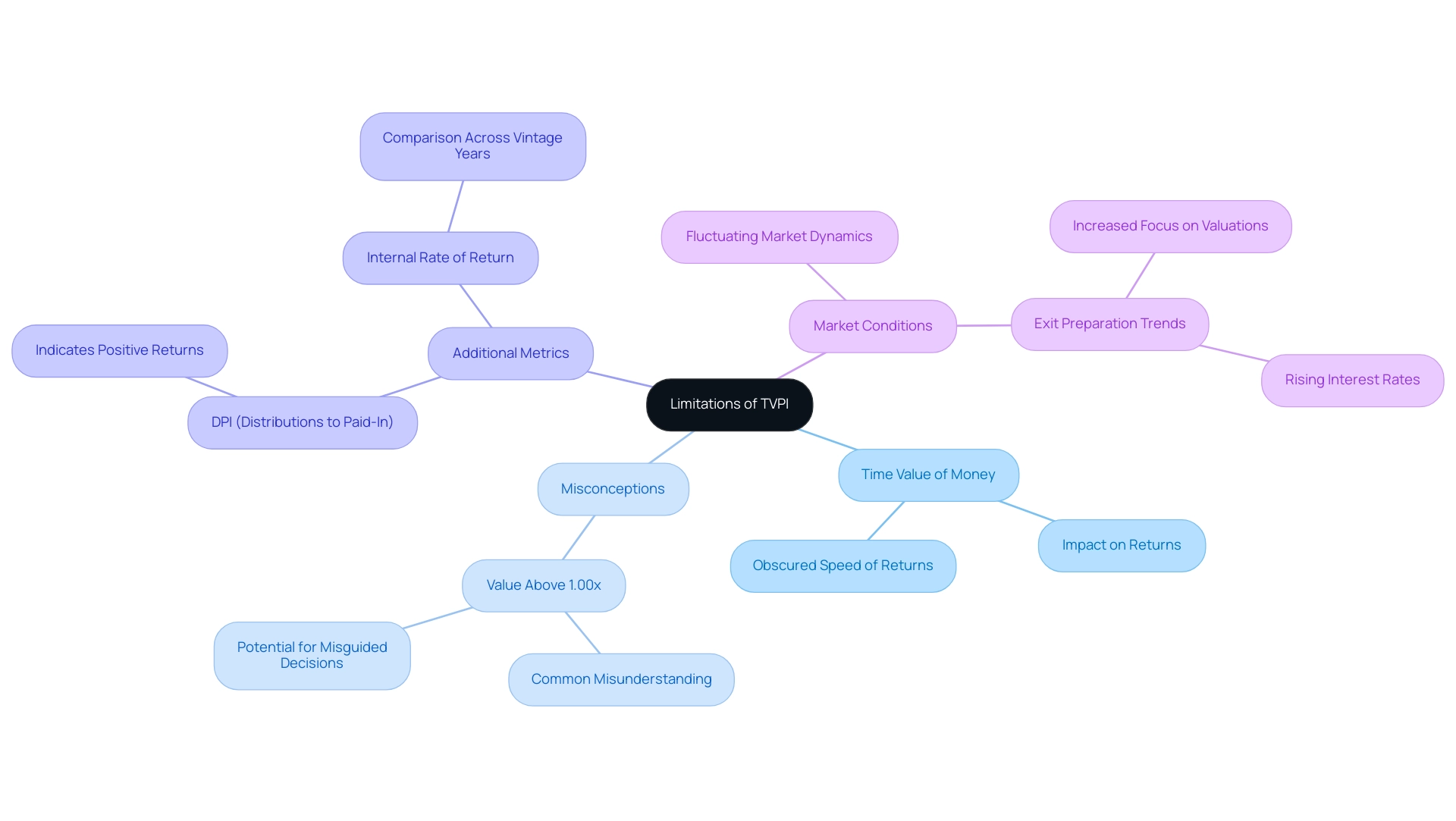

Limitations and Misconceptions of TVPI: What Investors Should Know

While the TVPI definition serves as a useful measure in evaluating investment results, we must acknowledge its constraints. One significant drawback is that this metric does not consider the time value of money, which can obscure the actual speed at which returns are generated. As a result, a high total value to paid-in capital may not necessarily signify strong future results; it can be significantly affected by current market conditions and the tactics employed by fund managers.

We understand that investors should proceed with care and refrain from placing too much dependence on total value to paid-in capital alone. It is crucial to consider additional metrics and qualitative factors that can significantly impact fund performance. For instance, many of our members have expressed a common misunderstanding: that a value above 1.00x always indicates a successful financial endeavor.

However, this assumption can lead to misguided decisions, especially in the context of fluctuating market dynamics. As noted, a DPI (Distributions to Paid-In) above 1.00x indicates that a fund has generated positive returns, which further complicates the interpretation of the TVPI definition. Recent trends show that portfolio companies are increasingly focusing on exit preparation to secure attractive returns, particularly amid heightened scrutiny on valuations and rising interest rates. This change highlights the importance of a thorough approach to financial assessment, where measurements are enhanced by an understanding of market conditions and strategic planning.

Akim Arhipov, the creator of fff.club, emphasizes that financial advantages should be accessible to all, underscoring the necessity for inclusive funding strategies that consider diverse success metrics.

Additionally, case studies reveal that in 2024, distributions from private equity funds surpassed capital requests for the first time since 2015, emphasizing enhanced liquidity for limited partners (LPs). This positive cash flow reflects effective liquidity management by general partners (GPs), even as overall returns in private equity face challenges. Such real-world instances remind us of the importance of looking beyond total value to comprehend the wider financial landscape.

In summary, while the total value remains a helpful tool, it is essential for stakeholders to recognize the TVPI definition and its limitations, as well as the prevalent misunderstandings associated with it. By embracing a more comprehensive perspective that includes diverse evaluation metrics and contextual elements, we can make better-informed choices in the intricate realm of private equity, fostering a supportive community for all investors.

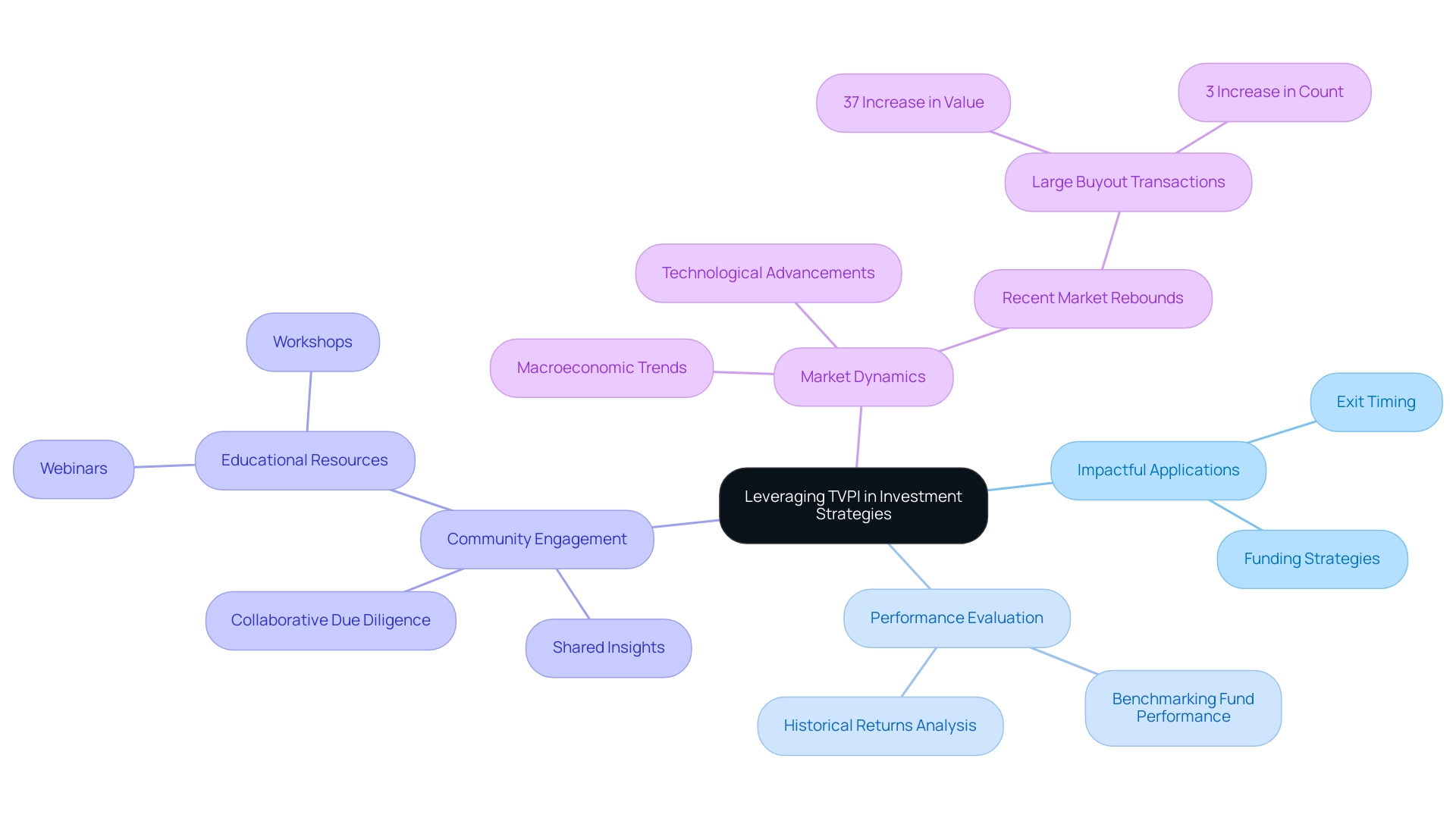

Leveraging TVPI in Investment Strategies: Practical Applications

Investors can utilize Total Value to Paid-In in various impactful ways, particularly within the vibrant community at fff.club, to enhance their funding strategies. We understand that navigating the complexities of investment can be daunting. This metric serves as an essential standard for evaluating the performance of various funds, allowing stakeholders to contrast potential opportunities based on their historical returns. This comparative analysis is crucial in a competitive landscape, especially considering the challenges faced in fundraising for private equity in 2024, where only the largest and most experienced funds attracted significant capital.

Remarkably, minority stakes amounted to $71 billion in 2024, accounting for 15% of the exit total. This figure highlights the importance of total value to paid-in in today’s financial landscape, a reality many investors are grappling with.

By interacting with other technology stakeholders in the fff.club community, members can enhance their decision-making processes through shared insights and collaborative due diligence. As many of our members have experienced, the metric can assist in determining the timing of exits from holdings; a decreasing value may indicate the necessity to reevaluate an asset's viability, encouraging stakeholders to explore different strategies or exit alternatives.

This proactive approach is essential, particularly in light of macroeconomic trends and technological advancements that are shaping opportunities in 2025. As mentioned by NYC BAM, 'Infra possesses the best inflation passthrough in private markets,' emphasizing the significance of comprehending market dynamics when making financial choices.

Integrating total value to paid-in into routine evaluations enables stakeholders to recognize emerging trends and make informed modifications to their portfolios. This practice ensures that strategies remain aligned with financial goals, especially in a dynamic market where large buyout transactions in North America and Europe have recently rebounded, reflecting a 37 percent increase in value.

Moreover, the practical applications of total value to paid-in extend to benchmarking fund performance, providing a clear framework for evaluating the effectiveness of various approaches. By employing a guiding metric alongside the community support and educational resources provided by fff.club, such as webinars and workshops, investors can enhance their decision-making processes. Ultimately, this leads to better results in their tech funding efforts. The challenges in fundraising for private equity, illustrated by the decline in the number of funds closed and total capital raised, further emphasize the necessity of utilizing the TVPI definition as a benchmark in this competitive environment.

Conclusion

Understanding the Total Value to Paid-In (TVPI) metric is essential for navigating the complex realm of private equity investments. We recognize that many investors face challenges in grasping this multifaceted concept. This article has explored the nature of TVPI, highlighting its calculation and significance in assessing both realized and unrealized returns. As many of our members have experienced, a robust grasp of TVPI empowers investors to make informed decisions that could significantly enhance their financial outcomes.

The interplay between TVPI and other metrics, such as DPI and IRR, further underscores the importance of a comprehensive approach to evaluating investment performance. While TVPI provides a holistic view of total value generated, we understand that it also has limitations and potential misconceptions. A sound investment strategy must account for various performance indicators, market dynamics, and qualitative factors that influence overall investment success.

As the private equity landscape continues to evolve in 2025, leveraging TVPI effectively will remain a cornerstone of strategic investment planning. By embracing this metric alongside community-driven insights and collaborative opportunities, investors can navigate the challenges ahead with confidence. We believe that positioning yourself to capitalize on emerging opportunities while avoiding common pitfalls is crucial. Mastery of TVPI not only enriches individual investment strategies but also fosters a more informed and resilient investment community, where we all support each other in our journeys.