Overview

This article offers a caring overview of cash advance credit cards, exploring how they function, the costs involved, and their potential effects on credit scores. We understand that while these cards can provide immediate access to funds, they often come with high fees and interest rates that can lead to overwhelming debt. This not only affects your financial stability but can also negatively impact your credit utilization ratio. It's essential to approach these options with careful financial management and awareness of the possible consequences, ensuring that you make informed decisions that support your financial well-being.

Introduction

In a world where financial emergencies can arise unexpectedly, we understand the appeal of cash advances from credit cards. This service offers cardholders the ability to access immediate funds, which can be a lifeline in challenging times. However, it’s important to recognize that this convenience often comes with hidden costs and risks that can lead to significant debt if not approached with caution.

As many of our members have navigated the complexities of cash advances—grappling with everything from the mechanics of withdrawals to the potential impact on credit scores—they have shared their experiences weighing the pros and cons against traditional loan options.

With the financial landscape continuously changing, it becomes essential for individuals to equip themselves with knowledge about:

- Fees

- Interest rates

- Strategic withdrawal practices

We encourage you to consider these factors carefully, especially when contemplating cash advances for urgent financial needs, and remind you that you are not alone on this journey.

What is a Cash Advance and How Does it Work?

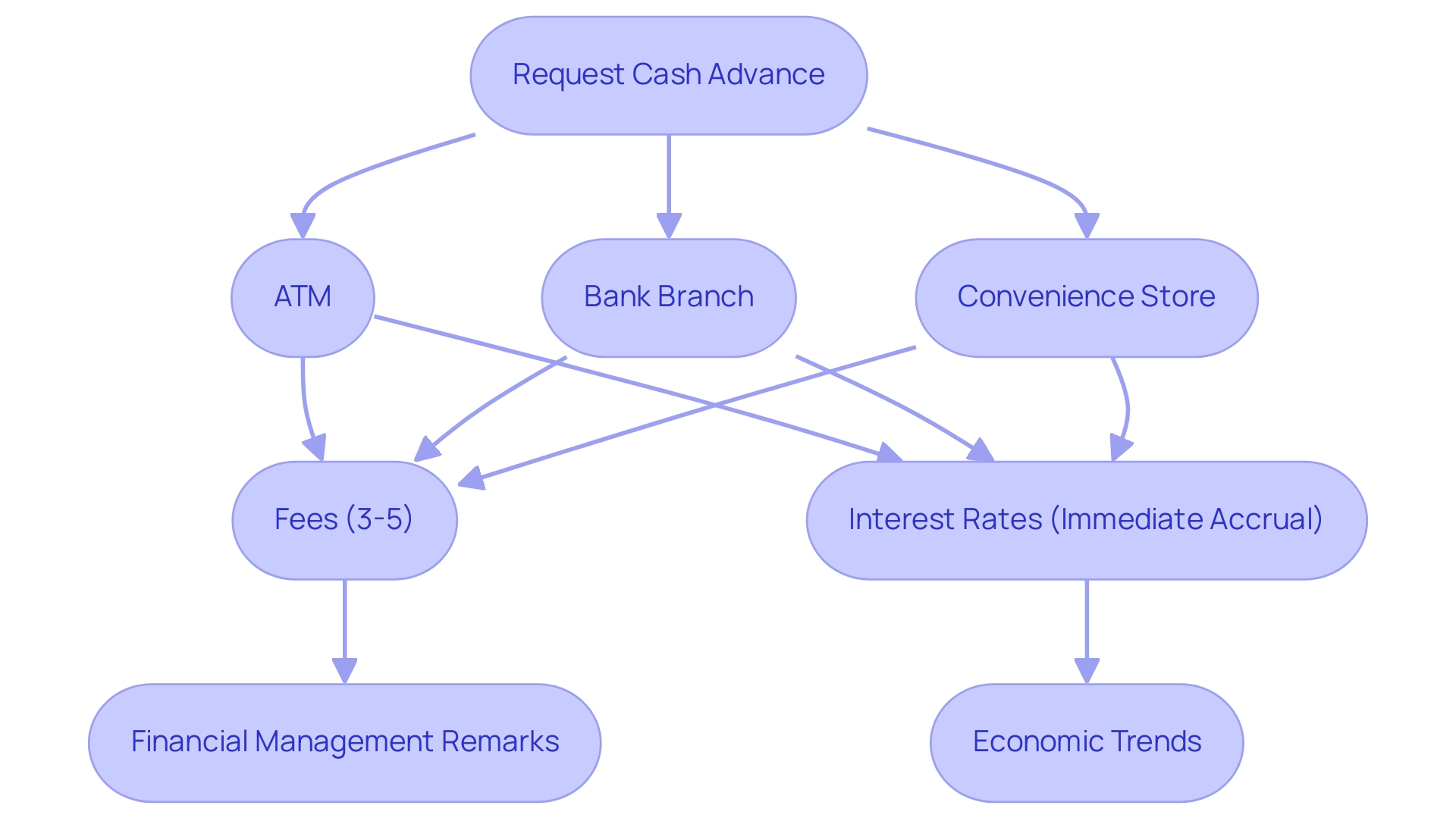

A monetary loan represents a financial service provided by card issuers that enables cardholders to withdraw funds up to their limit using a 0 cash advance credit card. This process can be carried out through various channels, including ATMs, bank branches, or convenience stores. It’s essential to recognize that monetary withdrawals made with a 0 cash advance credit card are quite different from standard purchases, as they often come with higher fees and interest rates. In fact, interest accrual begins immediately, without any grace period, which can be a source of concern for many cardholders.

For instance, a cardholder withdrawing $500 as a monetary withdrawal might encounter fees ranging from 3% to 5%, alongside interest rates that are usually higher than those associated with standard credit card transactions. While monetary loans can provide quick access to liquidity, they also carry the risk of accumulating significant debt if not managed with care. As many of our members have experienced, recent trends indicate that the effective interest rate for new time deposits rose to 4.40% in April, reflecting broader economic changes that should be considered when evaluating funding options.

Moreover, as highlighted in the case study titled 'The Future of Payments,' the payment landscape is evolving towards digital methods, with physical currency declining in favor of credit cards and mobile wallets. This shift underscores the importance of understanding monetary progress within the context of changing financial services. We understand that concerns about regulatory proposals are prevalent, as noted in a recent quote regarding the FCA's consultation. These worries emphasize the potential reputational risks in the monetary lending sector that technology investors should be mindful of.

In navigating these complexities, it’s vital to stay informed and connected with our community, sharing experiences and insights that can help each other make better financial decisions.

The Mechanics of Cash Advances on Credit Cards

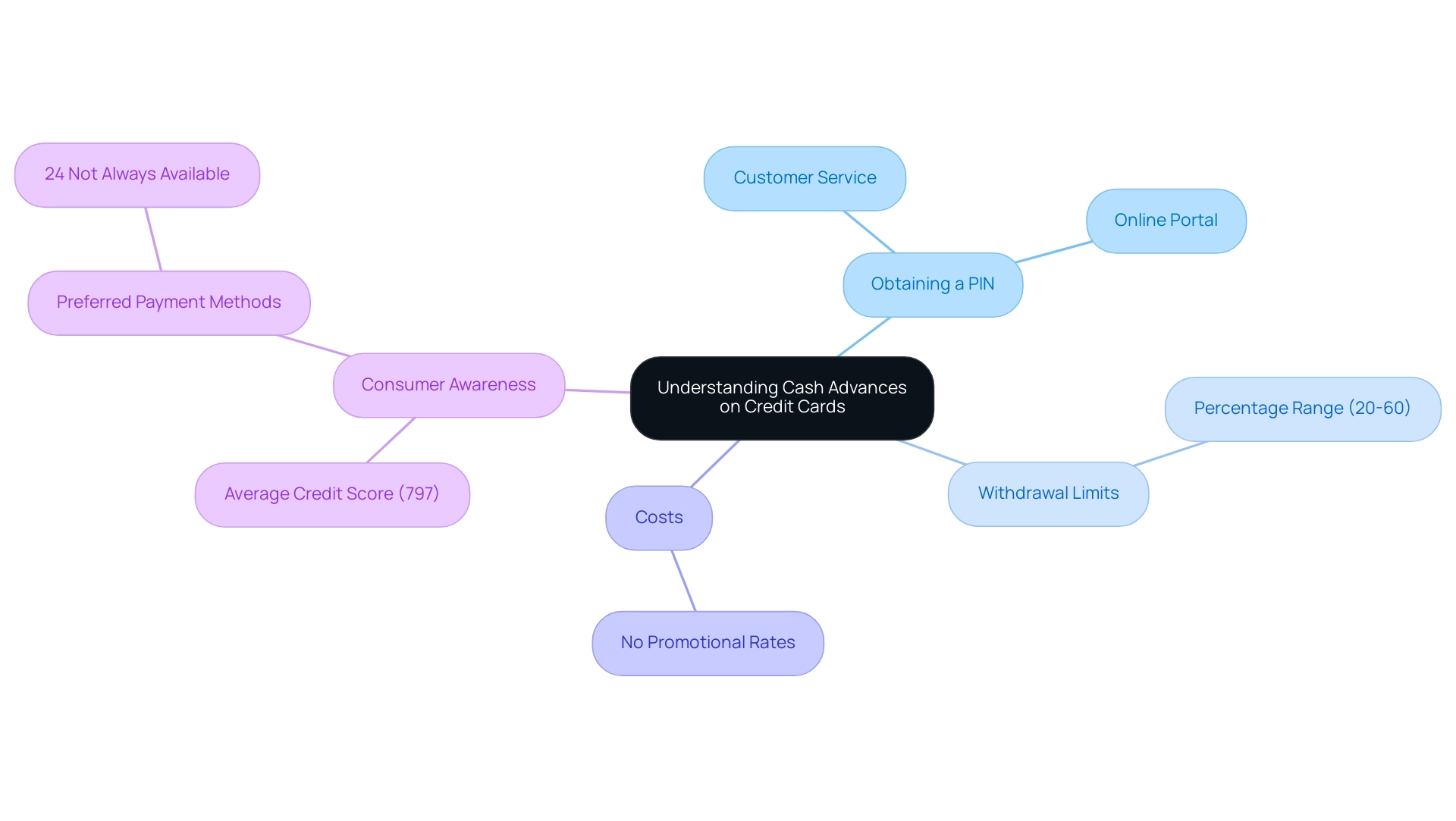

To embark on a monetary extension, cardholders first need to obtain a Personal Identification Number (PIN) from their card issuer. This process typically involves reaching out to customer service or accessing the issuer's online portal. This PIN is crucial for accessing funds at ATMs or through bank tellers, and we understand that navigating these steps can sometimes feel overwhelming. When a monetary withdrawal occurs, the amount taken is deducted from the available limit, which is often lower than the total limit due to the risk management strategies employed by issuers.

Monetary loan limits usually range from 20% to 60% of the total borrowing limit. For instance, if a cardholder's credit limit is $5,000, they may only have a withdrawal limit of $1,500. It's important to recognize that monetary loans do not benefit from promotional interest rates like standard purchases, making them a costlier option for accessing funds. We empathize with those who may find this aspect concerning, especially when seeking financial relief.

As stakeholders prepare for economic shifts in 2025, understanding the nuances of a 0 cash advance credit card and its associated costs becomes essential. The Consumer Borrowing Outlook for 2025 indicates a cautious approach among lenders and consumers alike, driven by worries about rising delinquency rates and potential tax policy changes. This context is vital as consumers strive for relief from borrowing costs amidst uncertainty, particularly with options like a 0 cash advance credit card. We understand that these decisions weigh heavily on many individuals.

Moreover, with the average score in the UK resting at 797, categorized as 'fair,' consumers are increasingly aware of the financial implications of their borrowing choices. This heightened awareness is underscored by the 24% of euro area consumers who reported that their preferred payment method was not always available. As Salman Haqqi, Senior Editor, notes, 'We’ve gathered the latest card statistics for 2023 including data on users, usage, transactions, providers, scores, crime, and more.' This insight truly emphasizes the importance of understanding financial mechanics in today's lending landscape.

We recognize that navigating these complexities can be daunting, and we're here to support you in making informed decisions.

Impact of Cash Advances on Your Credit Score

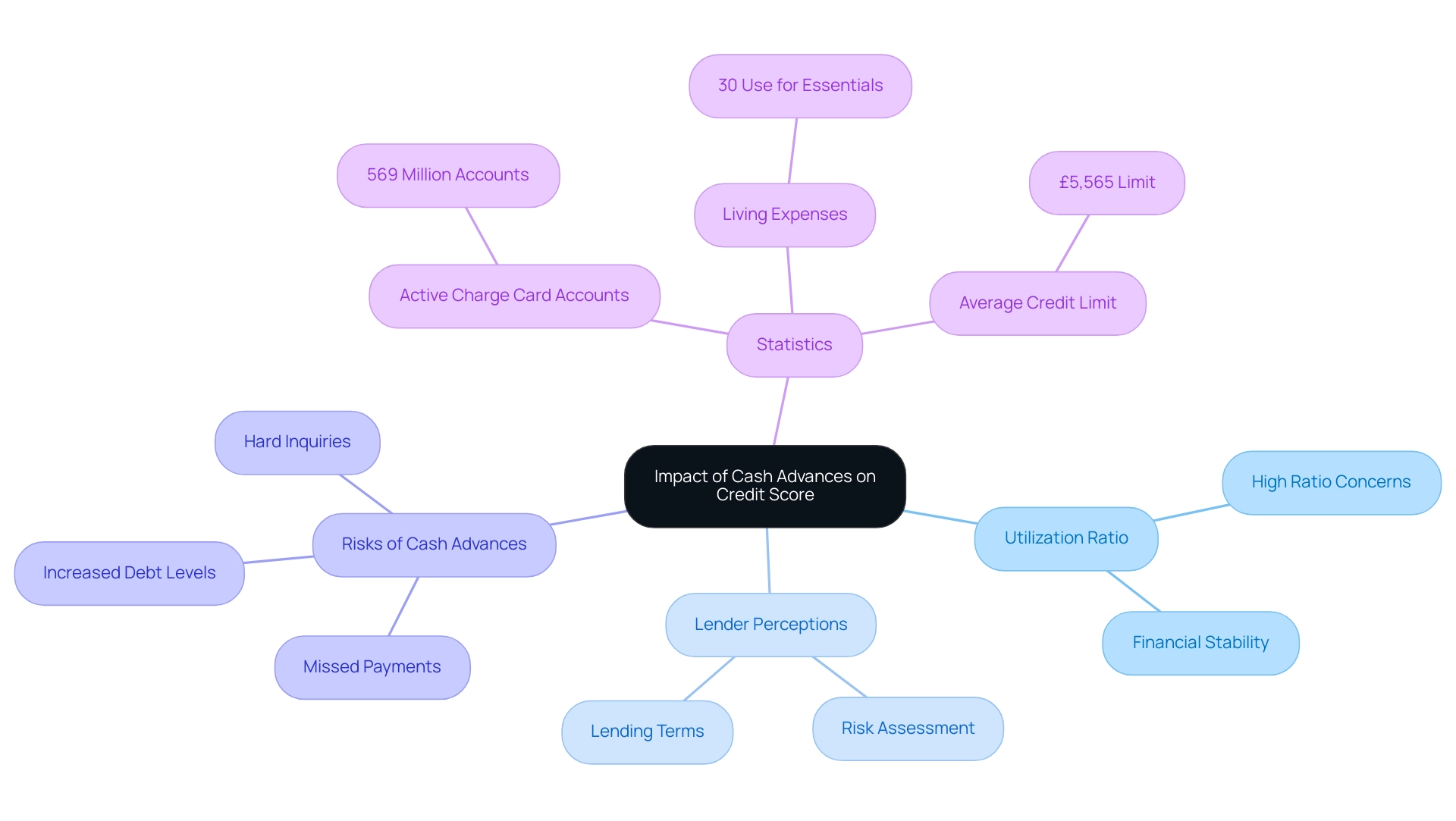

Cash advances from a 0 cash advance credit card can significantly affect a cardholder's score, primarily by increasing their utilization ratio. This ratio—a measure of borrowing used relative to total available funds—serves as a critical indicator for lenders. We understand that a high utilization ratio can indicate excessive dependence on borrowing, which might raise concerns about one’s financial stability.

For instance, many individuals using loan withdrawals may find their borrowing utilization ratio climbing to 80%. This situation can lead lenders to view them as higher risk, potentially resulting in less favorable lending terms or higher interest rates. Additionally, if frequent cash advances from a 0 cash advance credit card lead to missed payments or increased debt levels, the consequences can be even more detrimental to their scores.

Recent data shows that close to 569 million charge card accounts were active as of the third quarter of 2023, with 30% of respondents primarily relying on charge cards for essential living expenses amid the ongoing cost of living crisis. As Chris Horymski observes, this reliance heightens the importance of managing utilization carefully to prevent negative impacts on credit scores. Furthermore, the typical limit on a UK charge card was £5,565 as of May 2023, underscoring the potential dangers associated with using a 0 cash advance credit card.

The case study on the risks of increasing credit limits illustrates that while such increases can improve credit utilization ratios, they also come with risks, including potential hard inquiries on credit reports and the temptation to overspend. Therefore, we encourage cardholders to be cautious and ensure they do not exceed their repayment capabilities. Remember, you are not alone in this journey, and there are resources available to help you navigate these challenges.

Cash Advances vs. Traditional Loans: Key Differences

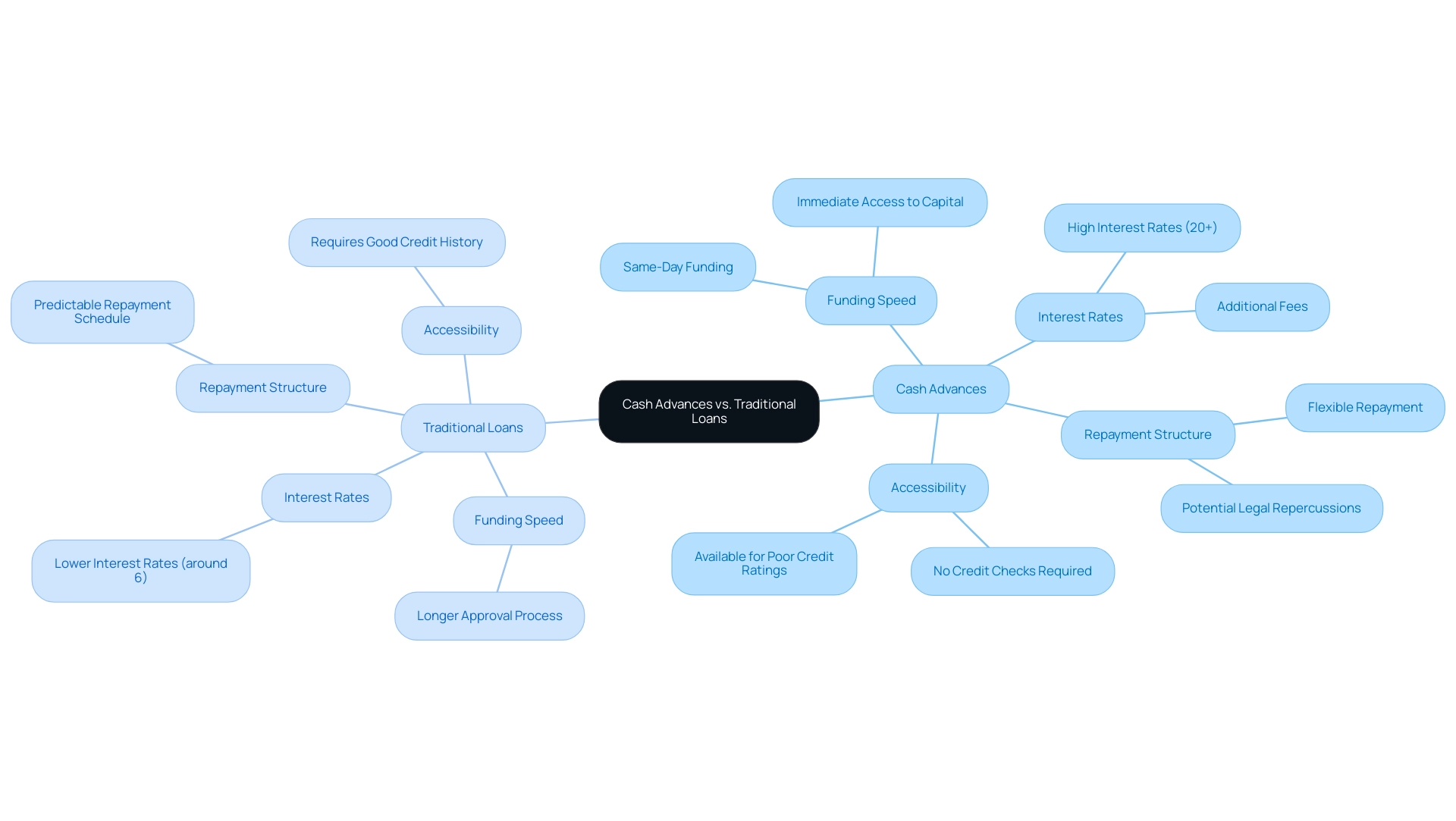

Cash provisions and traditional loans cater to distinct financial needs, each with terms that can significantly influence decision-making. We understand that for many businesses, immediate access to capital is crucial. Cash options, particularly merchant cash advances, provide rapid funding—often on the same day—making them an appealing choice for those in urgent need of cash flow. For example, Love Finance offers advances ranging from £5,000 to £250,000, requiring just three months of trading history and a minimum of £2,000 in monthly card sales.

However, this convenience often comes at a steep price. Interest rates can exceed 20%, and additional fees may accumulate quickly. As many of our members have experienced, this can create a burden that’s hard to manage. In contrast, traditional loans present a more structured option, featuring lower interest rates—around 6% for a three-year term—and predictable repayment schedules, making them suitable for larger, long-term commitments.

Understanding these differences is paramount for making informed economic decisions, especially in a challenging landscape where European banks are under pressure to manage operating costs and optimize efficiency. Deutsche Bank's recent earnings release highlights their commitment to advancing on a US$2.8 billion Operational Efficiency plan, having realized US$1.3 billion in savings by the second quarter of 2024. This context underscores the importance of thoughtful financial decision-making amid operational pressures.

Additionally, the case study on Merchant Cash Advances illustrates their accessibility for businesses with poor credit ratings. While they can be a viable alternative, we recognize that failure to repay can lead to legal repercussions and negatively impact credit scores. Consequently, companies must carefully evaluate the advantages and disadvantages of monetary boosts versus personal loans, considering not only the immediate benefits but also the long-term implications of repayment. Together, we can navigate these financial waters with awareness and support.

Understanding Fees and Interest Rates for Cash Advances

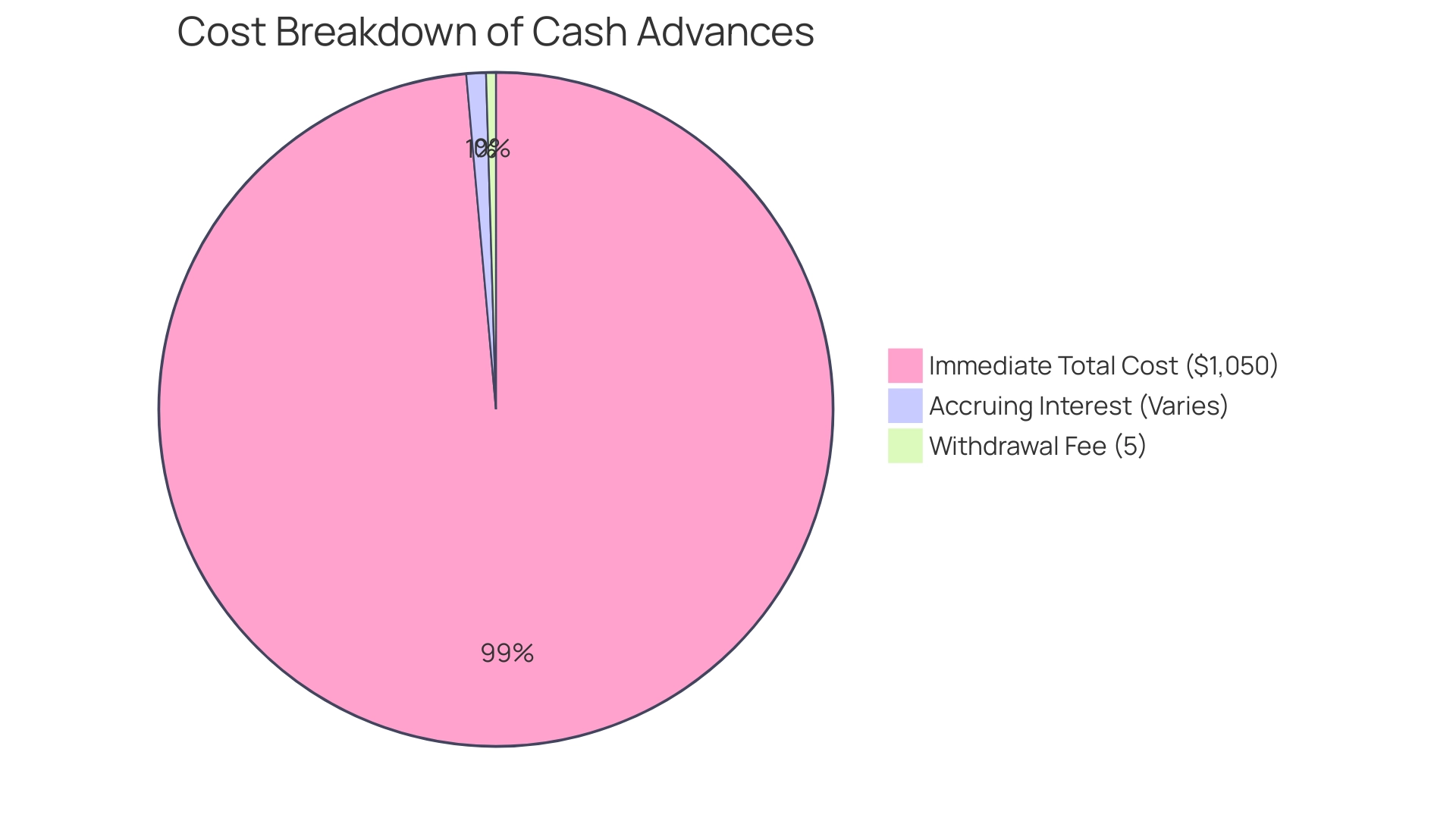

Cardholders who utilize monetary withdrawals should be mindful of the associated fees and increased interest rates that can significantly elevate the overall cost of borrowing. Typically, withdrawal fees fall between 3% and 5% of the amount withdrawn. Additionally, the interest rates for monetary withdrawals are generally several percentage points higher than those applied to standard purchases.

For context, interest rates on a UK business bank loan vary from 2% to 13%, underscoring the potential financial strain of monetary loans. It's important to note that interest on these loans begins to accumulate immediately—there is no grace period. This means that if a cardholder opts for a $1,000 monetary withdrawal with a 5% fee, they are instantly responsible for $1,050, not accounting for the accruing interest.

As Philippe Rispal insightfully points out, 'Comprehending the expenses linked to monetary withdrawals is essential for borrowers to prevent unforeseen economic pressure.' As we approach 2024, understanding the typical charges and interest rates for monetary withdrawals becomes increasingly vital, especially as these figures may fluctuate based on economic conditions. Financial advisors gently remind us that borrowers should thoughtfully assess these costs before moving forward, as immediate interest accrual can lead to unexpected financial burdens.

Moreover, broader economic trends, such as those illustrated by the welfare spending forecast, which anticipates a reduction in welfare expenditure due to lower inflation and earnings projections, may also influence loan fees and interest rates. We understand that navigating these financial waters can be challenging, and we are here to support you in making informed decisions.

Withdrawing Cash Overseas: Tips and Considerations

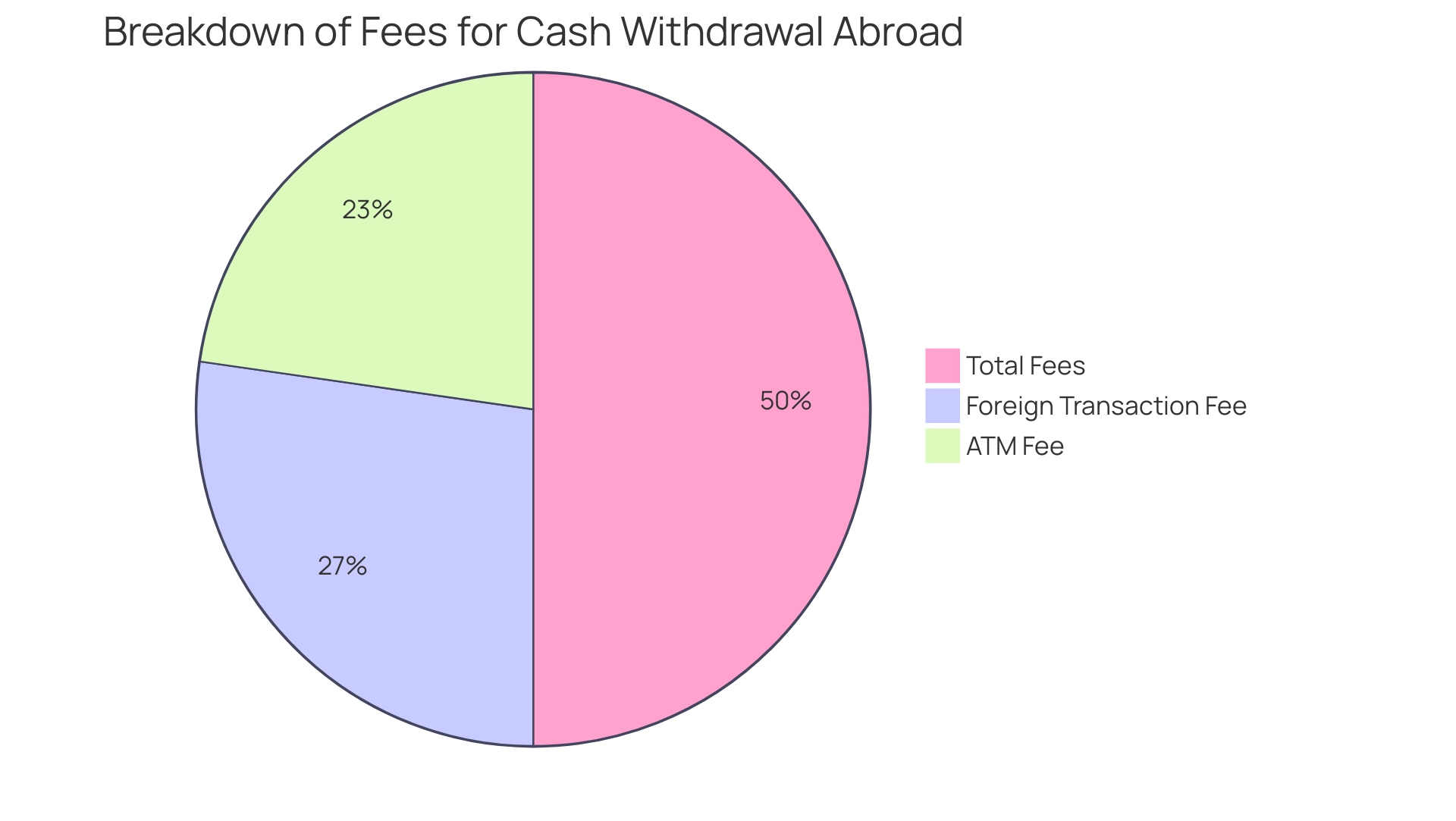

When withdrawing funds abroad with a charge card, we understand that managing related fees and potential challenges can feel overwhelming. Many card issuers impose foreign transaction fees on cash advances, which typically range from 1% to 3%. For instance, if a traveler withdraws $200 from an ATM in Europe, they might encounter a $5 fee from the ATM operator, along with a 3% foreign transaction fee from their credit card issuer, leading to a total of $11 in fees alone.

Additionally, ATMs often have their own withdrawal fees that can vary significantly. It's reassuring to note that an average of 74% of respondents across the euro area reported no technical issues with payments in the past month, highlighting the reliability of card payments while traveling. To help mitigate costs, we encourage travelers to seek out ATMs affiliated with their bank or financial institution, as these typically offer lower fees.

Another thoughtful approach is to opt for charges in the local currency rather than U.S. dollars, as this can help avoid unfavorable exchange rates. The 2024 survey also revealed that monetary payments remain common in various locations, with cash being most frequently used in restaurants (57%) and vending machines (55%). By understanding these fees and employing smart withdrawal strategies, travelers can minimize expenses while enjoying their time abroad.

Weighing the Pros and Cons of Cash Advances

A 0 cash advance credit card can serve as an immediate solution for those facing urgent financial needs, providing support when cash is required quickly. However, this convenience is often accompanied by significant costs, including high fees and interest rates that can increase swiftly. Many financial experts express concern that relying on loans, such as a 0 cash advance credit card, can lead to detrimental financial consequences, including rising debt levels and potential damage to credit scores due to elevated utilization ratios.

As many of our members have experienced, around 30% of those who use monetary loans report feeling overwhelmed by their debt levels due to the repeated use of a 0 cash advance credit card. Regular users may find themselves caught in a cycle of debt, making it increasingly challenging to regain financial stability. Financial analyst Sheryl Nance-Nash emphasizes the importance of understanding both the potential risks and benefits of a 0 cash advance credit card for effective financial management.

It is crucial to weigh the necessity of a financial boost against its potential long-term impacts, especially in light of ongoing discussions about the use of a 0 cash advance credit card and the average debt levels among users. Additionally, a case study on payment trends in Asia reveals that while cash usage is declining in places like China, it remains significant in certain Southeast Asian countries, illustrating the diversity in financial dependency. As we move into 2024, it is more important than ever to approach monetary loans with caution and to prioritize repayment strategies, particularly when utilizing a 0 cash advance credit card, to avoid falling into further financial difficulties.

We understand that evaluating your financial situation and exploring alternatives before opting for a 0 cash advance credit card is advisable. This approach not only empowers you but also fosters a sense of community support as we navigate these challenges together.

Conclusion

Cash advances can indeed provide a quick solution for accessing funds during financial emergencies, but it's important to recognize the significant costs and risks that accompany them. We understand that navigating these financial waters can be daunting, so grasping the mechanics of cash advances—such as fees, interest rates, and their potential impact on credit scores—is essential for making informed choices. Unlike traditional loans, cash advances often come with higher fees and immediate interest accrual, which can create a challenging cycle of debt if not managed with care.

As many of our members have experienced, it's crucial to be especially cautious about how cash advances affect credit utilization ratios, as high utilization can influence creditworthiness. The stark differences between cash advances and traditional loans highlight the need to evaluate long-term financial implications alongside immediate needs. While cash advances may offer immediate relief, the risk of escalating costs and debt should encourage individuals to explore all available options before proceeding.

Ultimately, the key takeaway is to approach cash advances with a strategic mindset. By weighing the pros and cons and considering alternative solutions, individuals can better navigate the complexities of their financial situations and make choices that align with their long-term financial health. Taking proactive steps to understand the financial landscape can help prevent unnecessary hardships and foster more sustainable financial practices, ensuring that you feel supported and empowered in your journey.