Overview

The article focuses on the top seven business credit card options for balance transfers, highlighting their features and benefits, such as introductory 0% APR offers and cash back rewards. It supports this by providing detailed descriptions of each card, emphasizing their promotional periods and potential fees, which help businesses make informed decisions about managing existing debt effectively.

Introduction

Navigating the world of credit can be a complex endeavor, particularly for those grappling with existing debt. Balance transfer credit cards emerge as a potential solution, designed to help individuals and businesses manage their financial obligations more effectively. By allowing users to shift high-interest balances to cards with lower rates or promotional offers, these financial tools can provide significant relief.

However, the journey does not come without its challenges; understanding the associated fees, interest rates, and potential pitfalls is crucial for making informed decisions. This article delves into the intricacies of balance transfer credit cards, offering insights into:

- Top options available

- Strategic approaches for successful transfers

- A careful evaluation of the risks involved

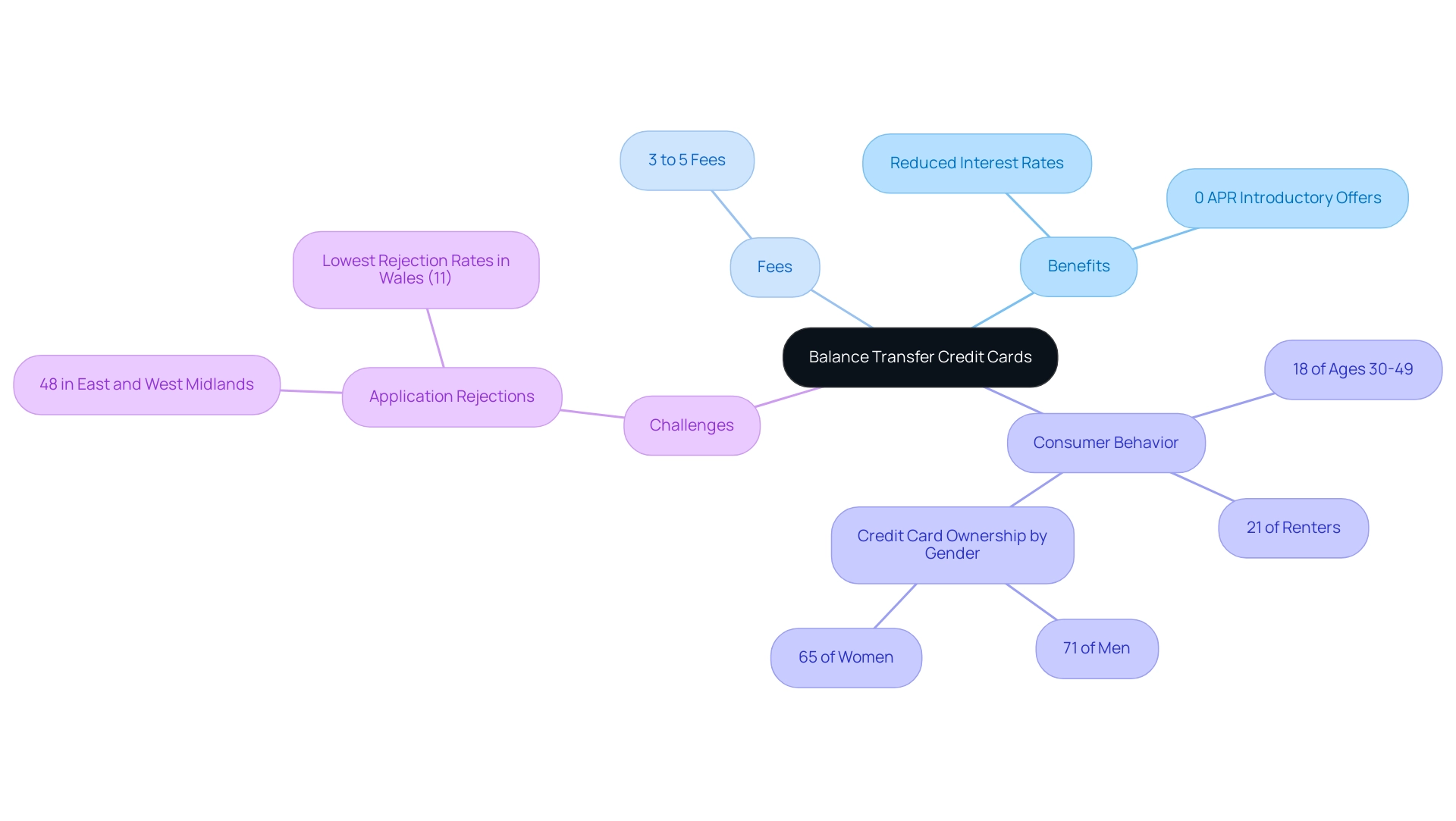

Understanding Balance Transfer Credit Cards

Balance shifting payment options function as tactical financial tools intended to help individuals and enterprises in handling existing debt more efficiently. These pieces enable the movement of funds from high-interest credit accounts to a new account, usually presenting a reduced interest rate or an appealing promotional deal. Most credit options offer an introductory 0% APR phase, which can be utilized through a 0 business credit card balance transfer, enabling users to lower their debt without facing extra interest fees.

However, it is essential to acknowledge that these instruments often involve fee charges, which typically vary from 3% to 5% of the amount moved. As consumer preferences change, with NFC-enabled transactions increasing by 20% each year, grasping the dynamics of credit options becomes essential for managing debt strategies effectively. Furthermore, according to Mintel, ownership of payment methods is significantly higher among individuals aged 30-49, with 18% of this group actively utilizing such methods, and 21% of renters, emphasizing the importance of these financial tools in modern debt management.

Moreover, it is essential to examine the difficulties encountered by consumers, as demonstrated by a case study showing that 48% of individuals in the East and West Midlands have faced application rejections, highlighting the possible obstacles to obtaining financing and the significance of option shifts in addressing such issues.

Top Business Credit Card Options for Balance Transfers

- Chase Ink Business Cash® Credit Option: This credit option includes an attractive 0 business credit card balance transfer with a 0% introductory APR on debt shifts for the first 12 months, making it an appealing selection for businesses looking to consolidate obligations. Furthermore, it offers cash back rewards on eligible purchases, which adds significant value for routine business expenses.

- American Express® Business Gold Card: Designed for companies requiring flexibility, this option offers a 0 business credit card balance transfer and a 0% introductory APR on funds moved for the initial 12 months. It also rewards spending across various categories, catering to diverse business expenditures and enhancing cash flow management.

- Capital One Spark Cash for Business: With a promotional 0% APR on fund movements for the first 9 months, this option is excellent for enterprises that focus on both managing their accounts and earning rewards, particularly through the benefits of a 0 business credit card balance transfer, as it also provides unlimited 2% cash back on all purchases.

- Bank of America® Business Advantage Cash Rewards MasterCard®: This financial product enables businesses to receive cash back on routine expenditures and features a 0 business credit card balance transfer with a 0% introductory APR on fund shifts for the initial 9 billing cycles. This dual benefit of effective debt management coupled with rewards makes it a versatile financial tool.

- Wells Fargo Business Platinum Credit Account: This option offers a promotional 0 business credit card balance transfer at 0% APR on fund shifts for the initial 18 months, distinguishing itself with one of the longest introductory periods accessible. It is especially appropriate for companies looking to move larger amounts without facing significant interest fees.

- U.S. Bank Business Platinum Credit Option: Recognized for its impressive 0% introductory APR for a 0 business credit card balance transfer on account shifts for the initial 20 billing cycles, this option is perfect for businesses needing longer timeframes to settle moved amounts. The payment method imposes a fee for shifting funds of 3% or $5, whichever is higher, making it a favorable choice for fund reallocations. Its lack of an annual fee further enhances its attractiveness.

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard®: This option features a 0 business credit card balance transfer along with a 0% introductory APR on shifts for the first 12 months and valuable travel rewards, making it a superb choice for enterprises that often travel and aim to handle their financial obligations efficiently.

Additionally, the M&T Business Rewards Credit Card offers unlimited 2% cash back on all new purchases during the first year, providing substantial rewards for businesses looking to maximize their cash flow. According to iwoca, "Whether you want to manage cash flow, invest in growth, or seize new opportunities, iwoca can help you achieve your goals with simple, fair and transparent business loans designed around your needs." This viewpoint highlights the significance of choosing the appropriate financial product to foster business expansion.

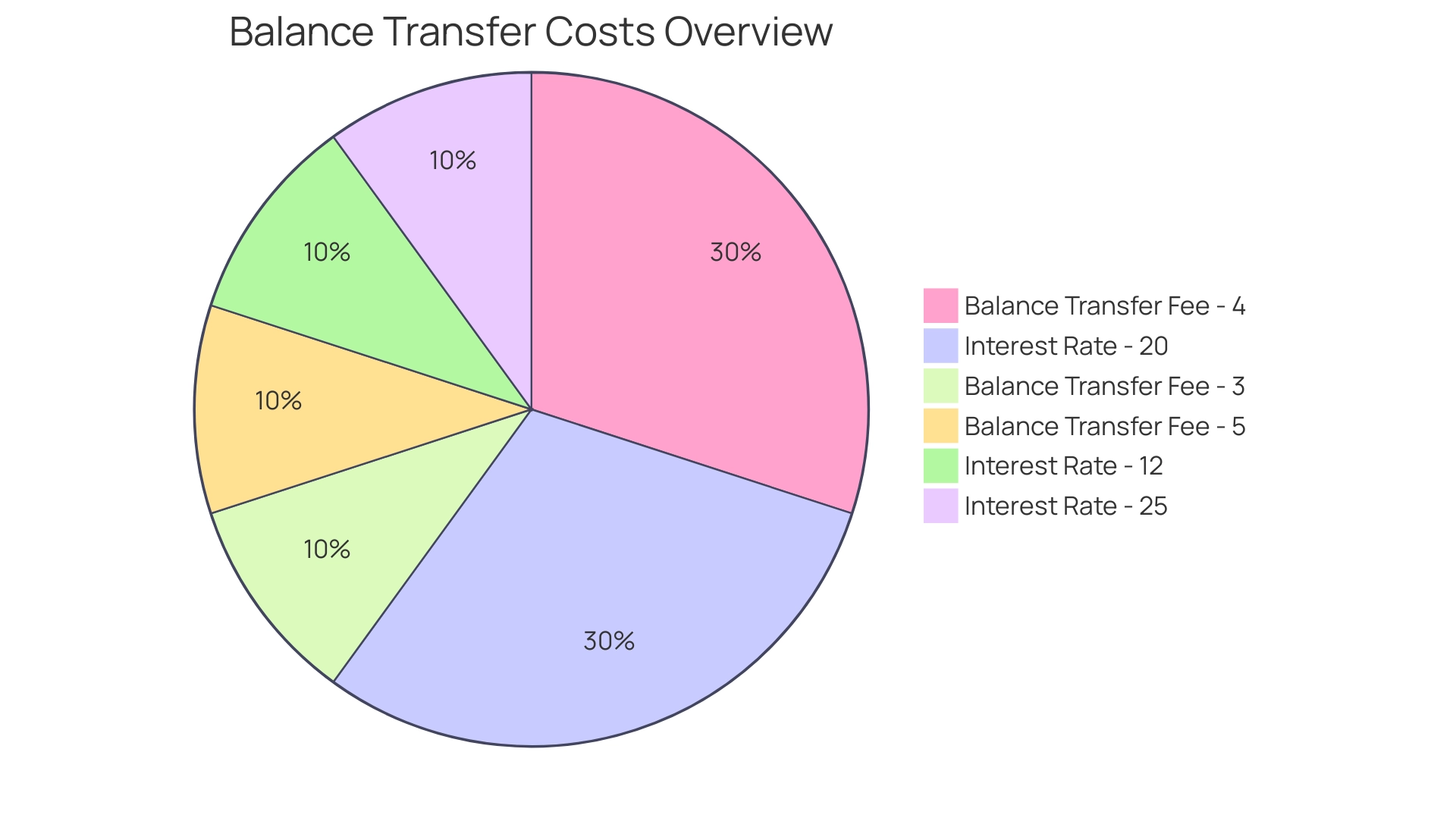

Evaluating Balance Transfer Fees and Interest Rates

When evaluating a credit card for a 0 business credit card balance transfer, it is essential to consider both the fees for moving and the interest rates that will apply once the promotional period ends. Generally, fee charges for moving funds vary from 3% to 5% of the amount moved, with typical costs expected to stay near 4% in 2024. For instance, transferring an amount of £5,000 could incur an upfront cost of £200 if a 4% fee is applied.

Furthermore, interest rates following the promotional period can vary widely, often falling between 12% and 25%, with projections suggesting that the average rate may reach 20% in 2024. This variability necessitates a thorough cost analysis to determine whether a balance shift will yield long-term savings. According to Kara Gammell, a personal finance expert, using a 0 business credit card balance transfer can be a great tool for managing and paying down debt without interest charges eroding your best efforts.

However, businesses must remain vigilant; missing repayments can jeopardize the low introductory rate and lead to extra fees. Recent statistics show that while 71% of customers succeed in clearing their debt within the first six months of using a promotional offer, around 29% persist in holding a debt after the introductory offer ends. This suggests that a significant portion of users may face increased costs post-promotion, emphasizing the importance of strategic planning in debt management.

Moreover, with approximately 472 payment companies functioning in the UK, including leading firms such as Visa and MasterCard, comprehending the competitive environment is crucial for tech investors evaluating the feasibility of debt shifting options.

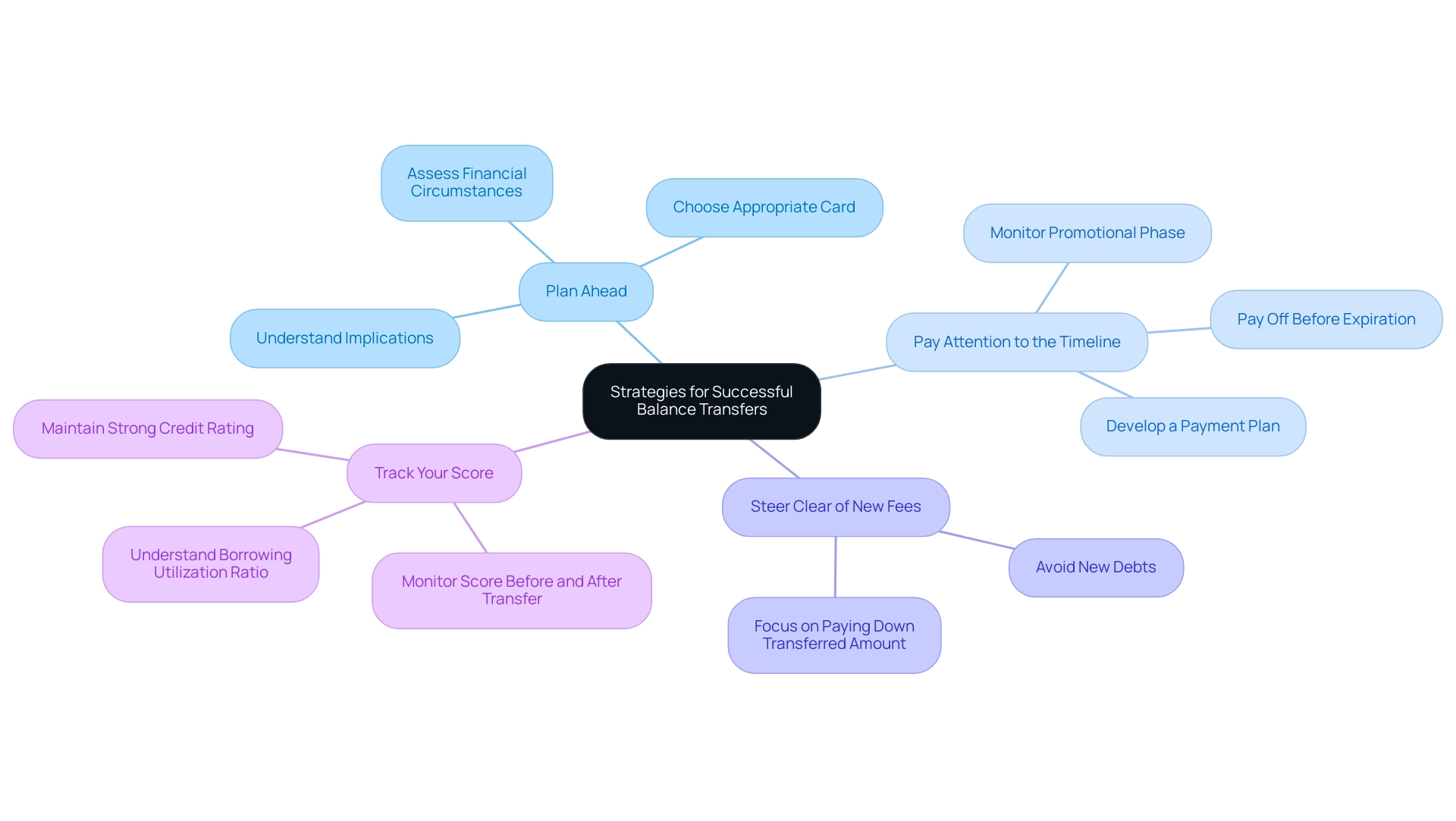

Strategies for Successful Balance Transfers

- Plan Ahead: Before starting a balance shift, it is crucial to assess your financial circumstances thoroughly. Identify the overall sum of obligations you plan to move for a 0 business credit card balance transfer, as this will assist you in choosing the most appropriate card. Recognizing the potential implications of this exchange on your overall financial health is essential for making informed decisions. With over 400 million consumers worldwide tracked by the Equifax bureau, it's clear that effective credit management is a widespread concern.

- Pay Attention to the Timeline: It's crucial to be aware of the promotional phase related to your offer. Develop a strategic plan to ensure that you can pay off the transferred amount before the introductory rate expires. Creating a monthly payment plan will aid in staying organized, promoting timely repayment and maximizing the advantages of the transaction. Research shows that consumers tend to pay off debts before the end of the promotional period, which supports the effectiveness of this strategy.

- Steer Clear of New Fees: To fully take advantage of the benefits of a fund shift, it is wise to avoid accumulating more debts on your current cards. Focusing your efforts on paying down the transferred amount will effectively reduce your overall debt, enhancing your financial stability.

Track Your Score: It is essential to continuously observe your score both prior to and following a balance shift. Such movements can influence your borrowing utilization ratio, an essential element of your score. Maintaining a strong rating is paramount, as it can open doors to better financial opportunities in the future. According to Colin Drake, a certified financial planner at Marin Financial Advisors,

They’ve done all the research they need to realize that this seeming loss-leader investment will very likely lead to very profitable customer relationships for them.

This emphasizes the long-term advantages of strategic financial planning in the context of fund reallocations. Moreover, essential advantages of shifting debts through a [[0 business credit card balance transfer include reduced interest rates](https://118118money.com/blog/balance-transfers-in-the-uk-a-smart-debt-strategy-or-a-credit-score-trap)](https://118118money.com/blog/balance-transfers-in-the-uk-a-smart-debt-strategy-or-a-credit-score-trap), debt consolidation, possible enhancement of financial rating, flexibility in payments, and strategic financial planning.

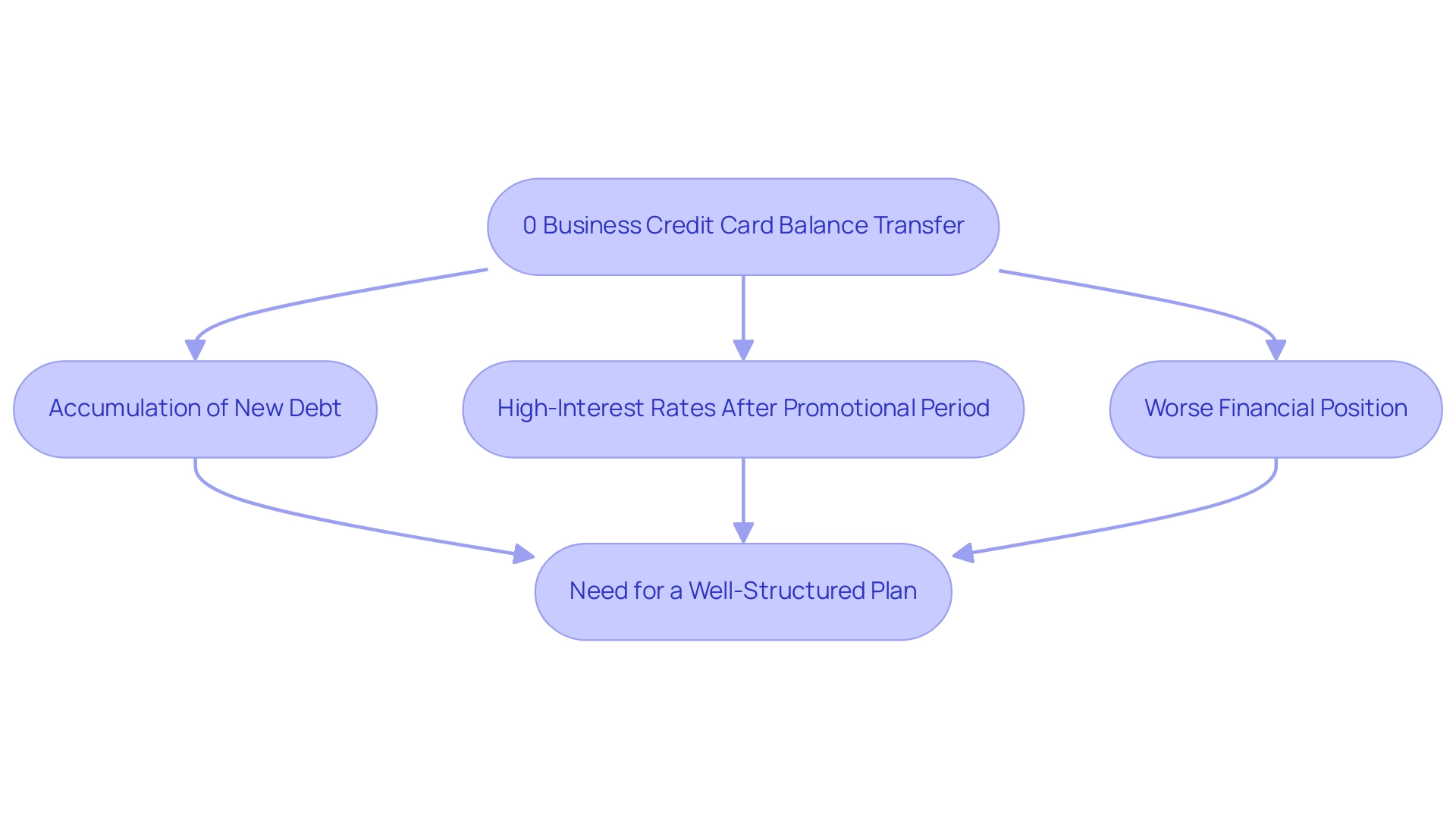

Potential Risks of Balance Transfers

While a 0 business credit card balance transfer can provide a strategic method for managing existing debt, it comes with significant risks that warrant careful consideration. A primary concern is the potential for accumulating new debt on the original credit cards, which can create a detrimental cycle of debt if not managed effectively. Financial experts have observed that if the amount from a 0 business credit card balance transfer is not fully paid off before the promotional period ends, the remaining sum may incur high-interest rates, exacerbating financial strain.

Recent statistics reveal that a significant number of individuals experience new debt accumulation after a 0 business credit card balance transfer, with studies indicating that nearly 30% of users find themselves in a worse financial position within six months. This highlights the necessity for a well-structured plan. Moreover, the average yearly expense of cyber crime for companies, estimated at £1,120 per victim, acts as a stark reminder of the financial consequences of inadequate debt management, drawing a parallel to the risks linked with fund reallocations.

The case study on retail payment systems, which handled roughly 52.1 billion transactions worth €25.1 trillion in the first half of 2024, demonstrates the magnitude of financial transactions and the possible effects of fund shifts on enterprises. By understanding these risks, businesses can approach 0 business credit card balance transfers with a more cautious and informed perspective.

Conclusion

Balance transfer credit cards can serve as a valuable tool for individuals and businesses looking to manage and reduce existing debt. By transferring high-interest balances to cards with lower rates or promotional offers, users can benefit from significant interest savings, particularly during the introductory periods that often feature 0% APR. However, it is essential to carefully evaluate the associated fees, interest rates, and potential pitfalls that can arise from these financial instruments.

The article highlighted several top balance transfer options available for businesses, each offering unique benefits that cater to various needs. From competitive introductory rates to cash back rewards, selecting the right card can enhance both debt management and overall financial strategy. Nevertheless, understanding the implications of balance transfer fees and the variability of interest rates post-promotion remains crucial for making informed decisions.

Strategic planning is paramount when utilizing balance transfer credit cards. By assessing financial circumstances, adhering to timelines, and avoiding new charges, users can maximize the benefits of their transfers while minimizing risks. It is equally important to monitor credit scores throughout the process to ensure continued financial health. Ultimately, while balance transfers can provide a pathway to debt relief, a cautious and informed approach is essential to avoid the potential pitfalls that may arise. By prioritizing strategic financial planning, individuals and businesses can navigate their debt management journey more effectively and achieve long-term financial stability.