Overview

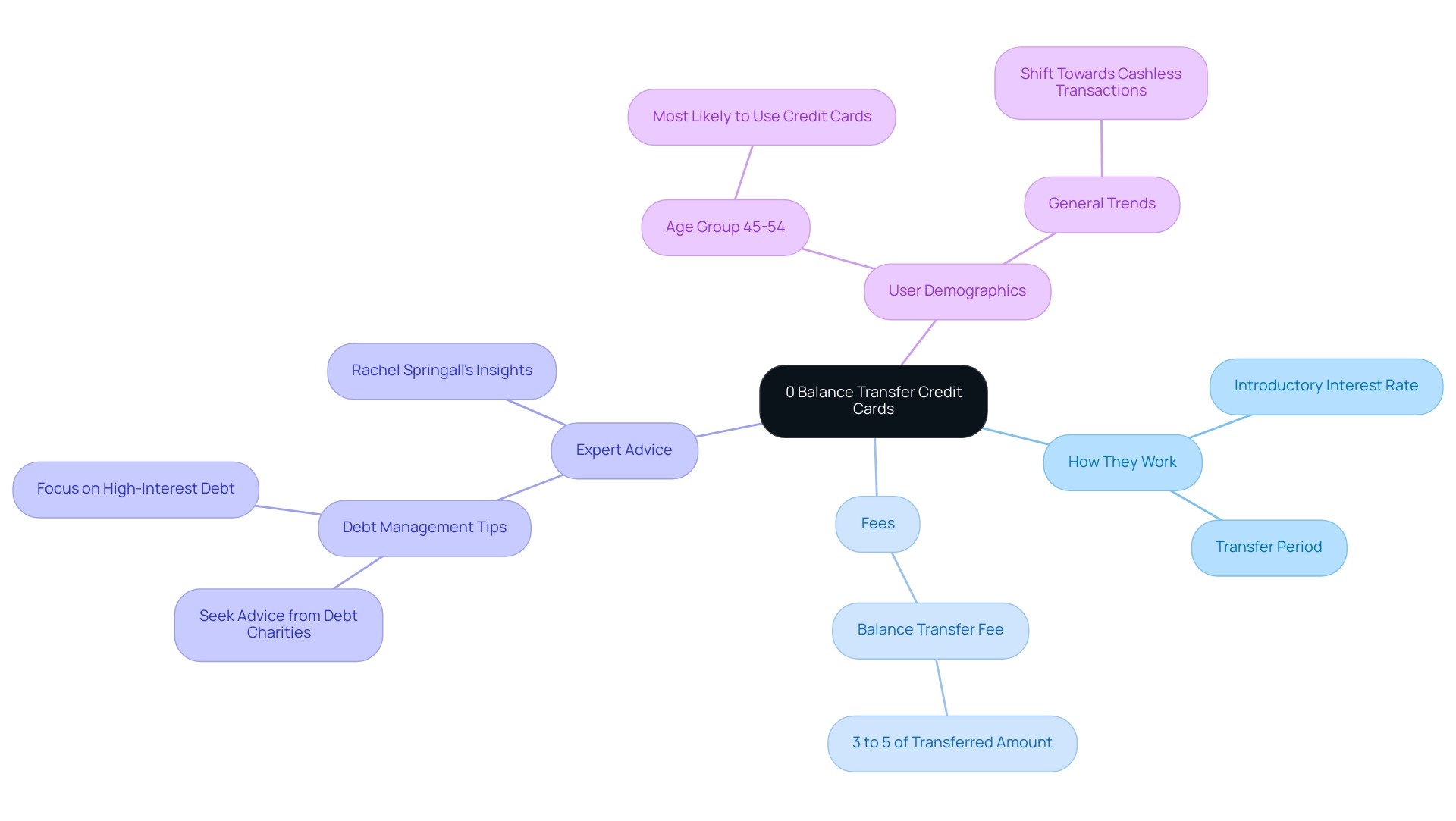

0% balance transfer business credit cards allow users to transfer existing credit debt to a new card with an introductory interest rate of 0% for a limited time, typically between 6 to 18 months, enabling significant interest savings. The article emphasizes the importance of understanding the associated fees, eligibility requirements, and effective strategies for maximizing savings to navigate debt management efficiently, highlighting that these cards can be a valuable tool for those with good credit seeking to consolidate and reduce their financial burdens.

Introduction

In the realm of personal finance, 0% balance transfer credit cards have emerged as a powerful strategy for managing debt effectively. These cards allow individuals to transfer existing credit card balances to a new account with a temporary interest rate of 0%, providing a significant opportunity to save on interest payments and streamline financial obligations.

However, navigating the intricacies of these financial products requires a clear understanding of their benefits and potential pitfalls. From eligibility criteria to effective repayment strategies, this article delves into the essential aspects of 0% balance transfer credit cards, equipping readers with the knowledge needed to make informed decisions in their financial journey.

What Are 0% Balance Transfer Credit Cards and How Do They Work?

0 balance transfer business credit cards serve as a strategic financial instrument that allows holders to shift current credit debt to a new account with an introductory interest rate of 0% for a specified period, usually ranging from 6 to 18 months. This promotional phase enables users to pay no interest on the transferred amount, leading to substantial savings over time. It is important to note that these pieces usually impose a balance transfer fee, generally ranging from 3% to 5% of the total amount transferred.

As Rachel Springall, a finance expert at Moneyfacts, advises,

Seeking advice from a debt charity or asking for support from an existing lender is always wise to better manage repayments and find ways to avoid high interest charges.

With the average score in the UK reaching 797 in September 2021, potential users of these products are often in a favorable position to leverage such offerings. Furthermore, it is recommended to focus on settling the most costly debt first, particularly if one account has a 0% offer with little time remaining in contrast to another account with a higher APR.

As of 2024, the increasing use of financial products, such as the 0 balance transfer business credit card, reflects a broader trend in debt management, with many consumers leveraging the 0% interest period to effectively navigate their financial obligations. Significantly, the use of payment cards is most common among individuals aged 45-54, suggesting that this group may especially gain from debt swapping options. Understanding the operational mechanics of these tools is crucial for those looking to utilize them as an effective means of managing debt.

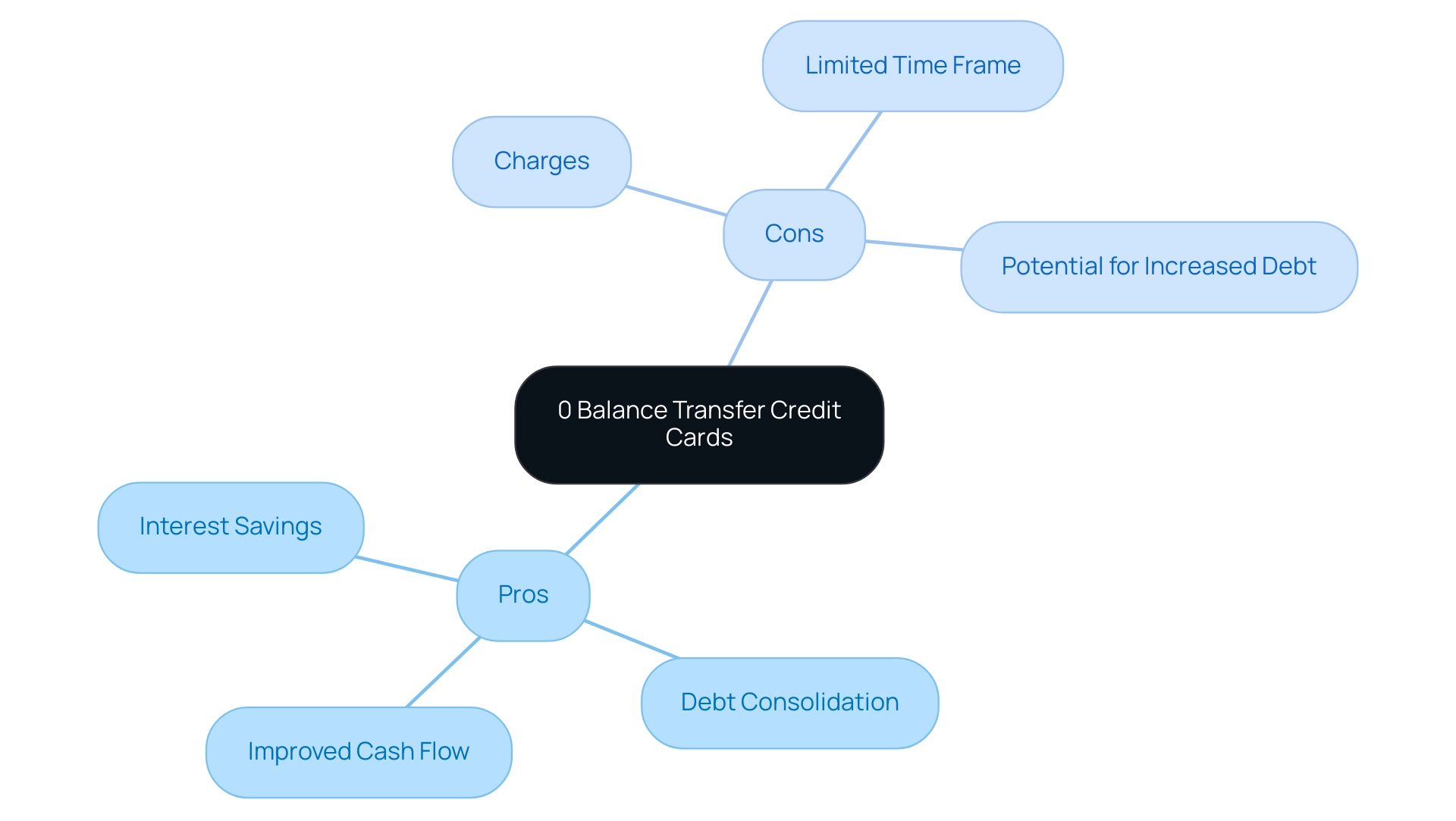

Pros and Cons of Using 0% Balance Transfer Credit Cards

Pros:

- Interest Savings: One of the most significant advantages of using a 0 balance transfer business credit card is the chance to save considerably on interest costs during the promotional phase, which can enable faster debt repayment.

- Debt Consolidation: The 0 balance transfer business credit card provides a streamlined approach to managing finances by consolidating multiple debts into a single payment, thereby simplifying the repayment process.

- Improved Cash Flow: With interest charges paused, cardholders often find themselves with enhanced cash flow, allowing for allocation of funds to other necessary expenses or investments.

Cons:

- Charges: Although the possibility for savings is attractive, transfer fees can build up, possibly offsetting the interest savings realized during the promotional period. It is essential to calculate whether the fees outweigh the benefits.

- Limited Time Frame: The promotional interest rate is temporary; once it expires, cardholders may encounter significantly higher interest rates, which can lead to increased repayment amounts if amounts remain.

- Potential for Increased Debt: Without careful financial management, there is a risk of increasing overall debt on the new account while still carrying balances from previous accounts, which could exacerbate financial strain.

Given the increasing occurrence of plastic debt—apparent from the findings of the StepChange Debt Charity, which reported that 'almost two-thirds (64%) of its 12,500 new clients receiving debt advice in April 2022 had plastic debt'—grasping these advantages and disadvantages is essential for informed financial choices. Moreover, the average UK score reaching 797 in September 2021 signifies a fair lending environment, but with the yearly growth rate for borrowing on accounts at 11.8% as of August 2023, consumers must proceed cautiously to avoid overextending their limits. Significantly, nearly half (48%) of inhabitants in the East and West Midlands have faced application rejections, emphasizing the difficulties within the financial landscape.

Furthermore, demographic patterns indicate that younger buyers are progressively adopting cashless payment options, which may affect their interaction with credit products.

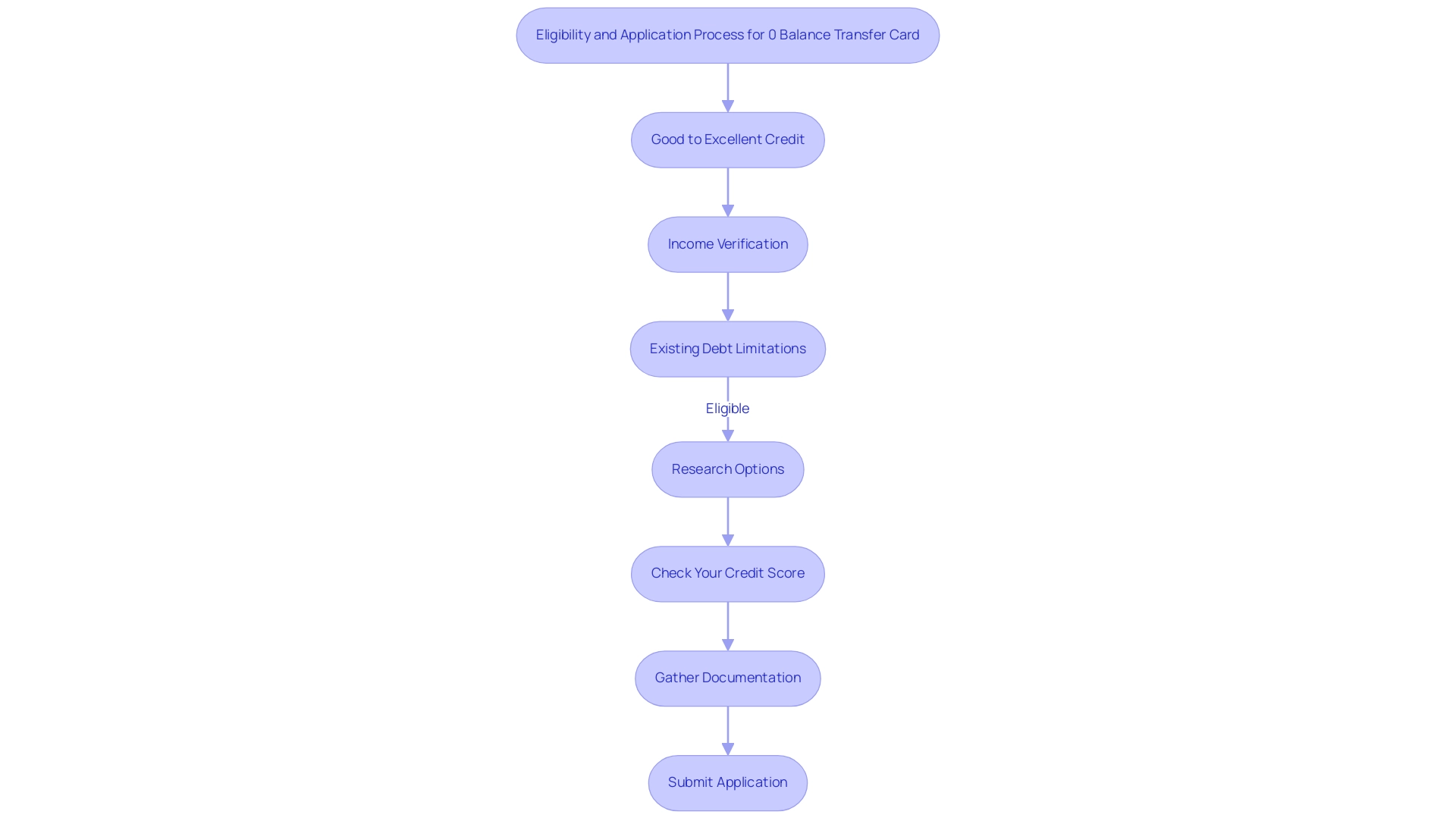

Eligibility Requirements and How to Apply for a 0% Balance Transfer Card

Eligibility for 0% balance transfer credit cards typically involves meeting specific criteria:

- Good to Excellent Credit: Most issuers mandate a credit score of at least 680, reflecting an expectation for responsible credit behavior.

- Income Verification: Applicants must demonstrate adequate income to manage repayments effectively, ensuring they can meet their financial commitments.

- Existing Debt Limitations: Certain issuers impose restrictions on the amount that can be transferred based on the applicant’s existing debt levels, which may affect eligibility.

Furthermore, it's essential to highlight that you cannot move funds between two accounts provided by the same bank, which could affect your choices.

To successfully apply for a 0% balance transfer credit card, adhere to the following steps:

- Research Options: Conduct a thorough comparison of various options, focusing on their terms and conditions, including promotional periods and fees. For instance, Virgin Money offers 20 months at 0% interest with a 2% fee, which is a beneficial option to consider.

- Check Your Credit Score: Assess your credit standing to understand your likelihood of approval.

- Gather Documentation: Prepare the necessary financial documents, such as proof of income and existing debt statements.

- Submit Application: Complete the application either online or in-person, and await the issuer's decision regarding your approval.

As Julia aptly noted, "@MartinSLewis, finally took your advice and told my family I can’t afford Christmas presents. What a weight off my mind. Thank you."

This highlights the emotional aspect of making financial decisions, emphasizing the importance of being aware of your financial situation before applying.

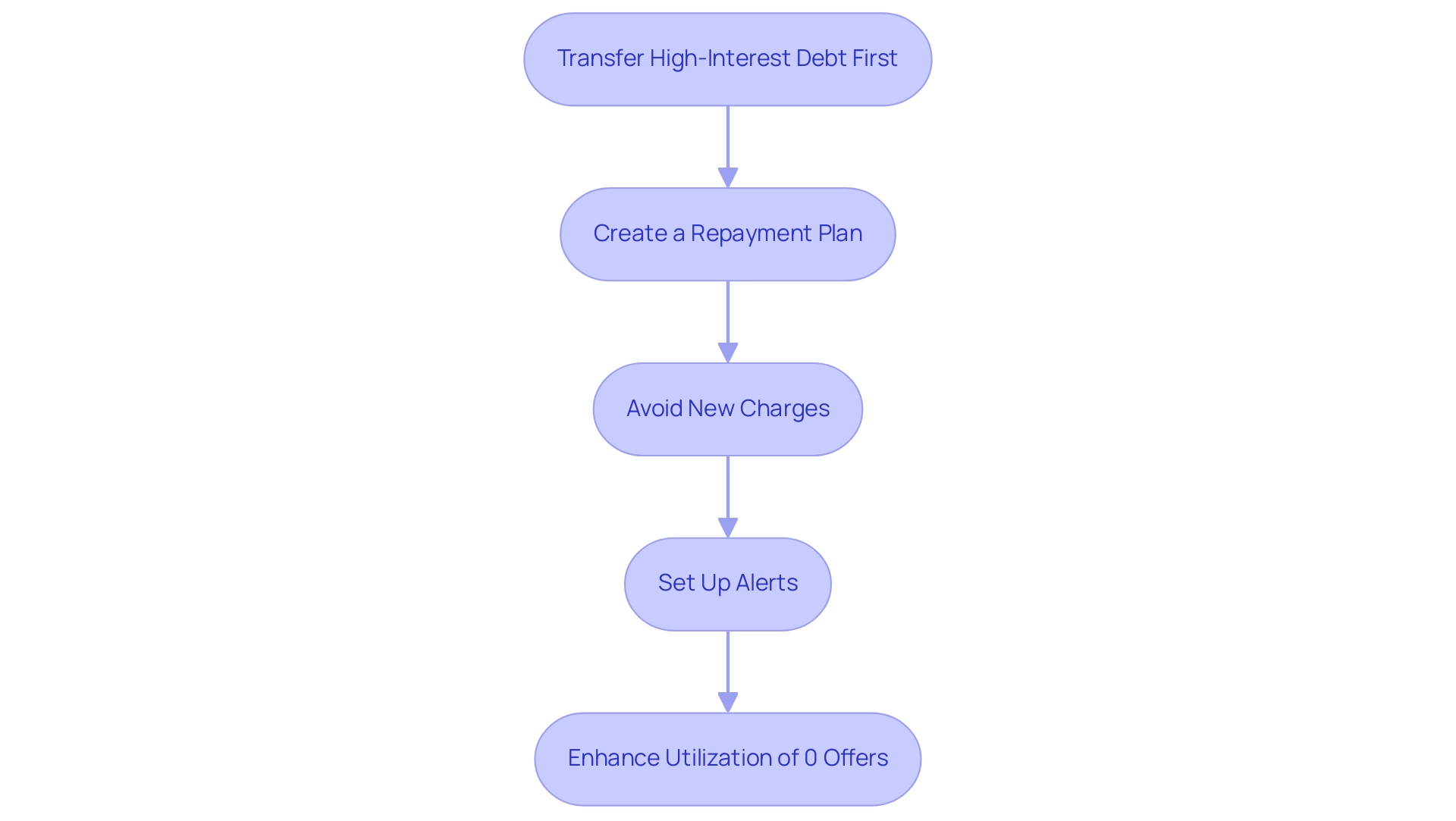

Maximizing Your Savings: Tips for Effective Balance Transfers

To effectively enhance your savings with a 0% transfer option, consider the following strategies:

-

Transfer High-Interest Debt First:

Prioritize moving amounts from high-interest accounts. By doing so, you can significantly reduce overall interest payments, potentially lowering the average interest rate to around 14.1%. This strategic shuffle can lead to substantial savings, evidenced by an average reduction of £1,156 in total interest.

-

Create a Repayment Plan:

Establish a clear repayment plan by calculating a feasible monthly payment amount. Aim to pay off the entire amount before the promotional period concludes. This ensures that you avoid reverting to higher interest rates, which can lead to increased debt. Given that the average UK household credit debt was £2,376 in July 2023, having a solid repayment strategy is crucial for managing financial pressures.

-

Avoid New Charges:

It is crucial to refrain from making new purchases on the transferred balance. Utilizing the payment method for additional spending during the promotional period can lead to accruing new debt, undermining the benefits of the 0% rate.

-

Set Up Alerts:

Implement reminders for payment due dates. This proactive approach helps in avoiding late payment fees that could negate your savings. Financial specialist Martin Lewis highlights the significance of ensuring at least the minimum monthly payment, stating,

Just because you secured a 0% offer DOESN'T mean you can avoid paying anything – you must pay at least the minimum monthly payments, preferably more.

With 30% of respondents mainly utilizing revolving accounts for living expenses and groceries, it's clear that many are depending on such financing to manage their day-to-day costs amid the ongoing cost of living crisis. By adhering to these practices, you can enhance your utilization of 0% interest offers, ensuring efficient management of your finances in this challenging environment.

Understanding the Impact of Balance Transfers on Your Credit Score

Balance transfers can greatly influence your score through various mechanisms:

- Utilization Ratio: When you transfer a balance to a new account, particularly one with a high limit, it can reduce your overall utilization ratio. A lower ratio is advantageous for your score, as it shows responsible management of finances. For instance, the average score in the UK was 797 in September 2021, categorized as 'fair,' indicating that maintaining a low utilization is essential for keeping a healthy score.

- Hard Inquiry: The application process for a new card typically involves a hard inquiry on your report. While this may lead to a temporary decline in your score, the impact is generally minimal and brief.

- Length of Account History: Opening a new account can change the average age of your accounts. Although this change has a minor impact, keeping older accounts is generally beneficial for your score.

Despite potential short-term effects, if handled wisely, a 0 balance transfer business credit card can improve your financial profile by reducing high-interest liabilities. For instance, a debt of £5,000 can be paid back at £280 each month over an 18-month interest-free duration, demonstrating the financial relief that shifting debts can provide. Furthermore, based on an Experian survey, 82% of users of revolving accounts fall into one of nine unique categories, emphasizing diverse financial behaviors across demographics.

Significantly, Mintel indicates that 18% of people aged 30-49 and 21% of tenants participate in fund shifts, suggesting an increasing trend among these demographics. Moreover, it's essential to examine the case study titled 'Closing Credit Cards After Balance Transfer,' which demonstrates that closing several cards, particularly those maintained for an extended period, can adversely affect your score in the short term. In light of these factors, using a 0 balance transfer business credit card, if approached wisely, can serve as a strategic tool for improving financial health without severely impacting your credit score.

Conclusion

Utilizing 0% balance transfer credit cards can be a strategic approach for managing debt effectively. By transferring existing high-interest balances to a new card with a temporary 0% interest rate, individuals can significantly reduce their interest payments, streamline their finances, and improve their cash flow. However, it is essential to be aware of the associated fees and the limited duration of the promotional rate, which can lead to higher costs if not managed properly.

Understanding the eligibility requirements and application process is crucial for potential cardholders. A good credit score and stable income are typically needed to qualify, along with a thoughtful consideration of the various card options available. Once a balance transfer is initiated, implementing effective repayment strategies can maximize savings and prevent the accumulation of additional debt:

- Prioritizing high-interest debts

- Creating a structured payment plan

Furthermore, balance transfers can impact credit scores in both positive and negative ways. While they may lower the credit utilization ratio and relieve high-interest burdens, they can also involve hard inquiries that temporarily affect scores. Therefore, managing these transfers judiciously is key to enhancing financial health in the long run.

In conclusion, 0% balance transfer credit cards offer a valuable opportunity to take control of debt, but they require careful navigation to avoid potential pitfalls. By equipping oneself with the right knowledge and strategies, individuals can leverage these financial tools to achieve greater stability and ultimately pave the way toward a healthier financial future.