Overview

Start-up equity holds immense significance for tech investors, as it shapes ownership stakes, profit-sharing, and potential financial returns. We understand that navigating these dynamics can be daunting, which is why it's essential for investors to grasp the various types of equity and distribution strategies available. By fostering informed decision-making, you can enhance your investment outcomes, even as market conditions evolve and challenges arise in the tech landscape. Many of our members have shared their experiences, underscoring the importance of understanding these complexities. Together, we can cultivate a supportive community that empowers you to make confident choices in your investment journey.

Introduction

In the rapidly evolving world of startups, equity has emerged as a cornerstone of ownership and investment strategy, influencing everything from control dynamics to financial returns. We understand that as more individuals express a desire to launch their own ventures, the intricacies of startup equity can feel overwhelming. It becomes essential for both founders and investors to navigate this landscape with confidence.

This article delves into the multifaceted nature of startup equity, exploring its significance and the various types of equity compensation available. We will share best practices for distribution, negotiation strategies, and the critical legal and tax considerations that accompany these investments. By examining expert insights and real-world case studies, we aim to empower you with a comprehensive understanding of how to navigate the complexities of equity in the startup ecosystem.

Ultimately, we hope to support you in making informed decisions in this competitive landscape, fostering a sense of community and shared experience among all our readers.

What is Startup Equity and Why Does It Matter?

Start-up equity represents possession in a company, generally expressed through shares, and plays a crucial role for both founders and backers. It not only dictates control and profit-sharing but also shapes the potential for future financial gains. We understand that for technology financiers, a detailed comprehension of start-up equity is essential, as it directly influences the valuation of a new venture and the expected return on capital.

In 2025, current statistics reveal that a significant portion of working-age individuals, approximately 91%, feel equipped with the necessary knowledge and skills to launch startups. This trend suggests an increasing fascination with ownership, which tech investors must take into account when assessing potential opportunities.

Equity, such as start-up equity, can be categorized into common stock, preferred stock, and options, each carrying distinct rights and privileges. We recognize that investors must familiarize themselves with these differences to effectively evaluate the associated risks and rewards of their investments. The significance of new business ownership is further emphasized by recent case studies, such as the drop in infrastructure fundraising, which decreased by 53% to its lowest level since 2013.

This shift in investor preferences illustrates the critical need for tech investors to adapt their strategies in response to changing market dynamics, particularly as they navigate the complexities of equity in new ventures.

Insights from Baltic investment leaders like Sten Tamkivi and Kristjan Vilosius emphasize the role of community in supporting early-stage investments. For instance, Tamkivi's experience as a General Manager at Skype and his advisory role to the Estonian president showcases how strategic guidance can influence business success. Likewise, Vilosius, with his recent funding round for Katana MRP, illustrates the balance between managing a new business and investing in others.

Successful tech ventures often allocate a portion of their start-up equity to advisors, which enhances their strategic guidance and increases the likelihood of achieving favorable outcomes. As Georgios Farchat noted, "Barbara has been of excellent help to me in the early days of my start-up!" This highlights the importance of mentorship and advisory roles in the startup ecosystem, reinforcing the commitment to inclusive financial education.

Moreover, we must acknowledge the challenges faced by women and minorities in the financial landscape, as they remain underrepresented in senior positions and investing roles. These challenges, including lower promotion rates and higher attrition, underscore the need for a more inclusive approach within the financial community, as advocated by initiatives such as fff.club. Both Tamkivi and Vilosius have actively backed initiatives aimed at promoting diversity in technology funding.

Specialist views highlight that understanding start-up equity in new ventures is not just advantageous but crucial for individuals looking to navigate the intricacies of the technology environment in 2025. Additionally, with over 5% of new ventures failing in their first year, understanding the risks associated with these investments is vital. As the market develops, the importance of new venture ownership continues to increase, making it essential for technology backers to remain knowledgeable and involved with these trends.

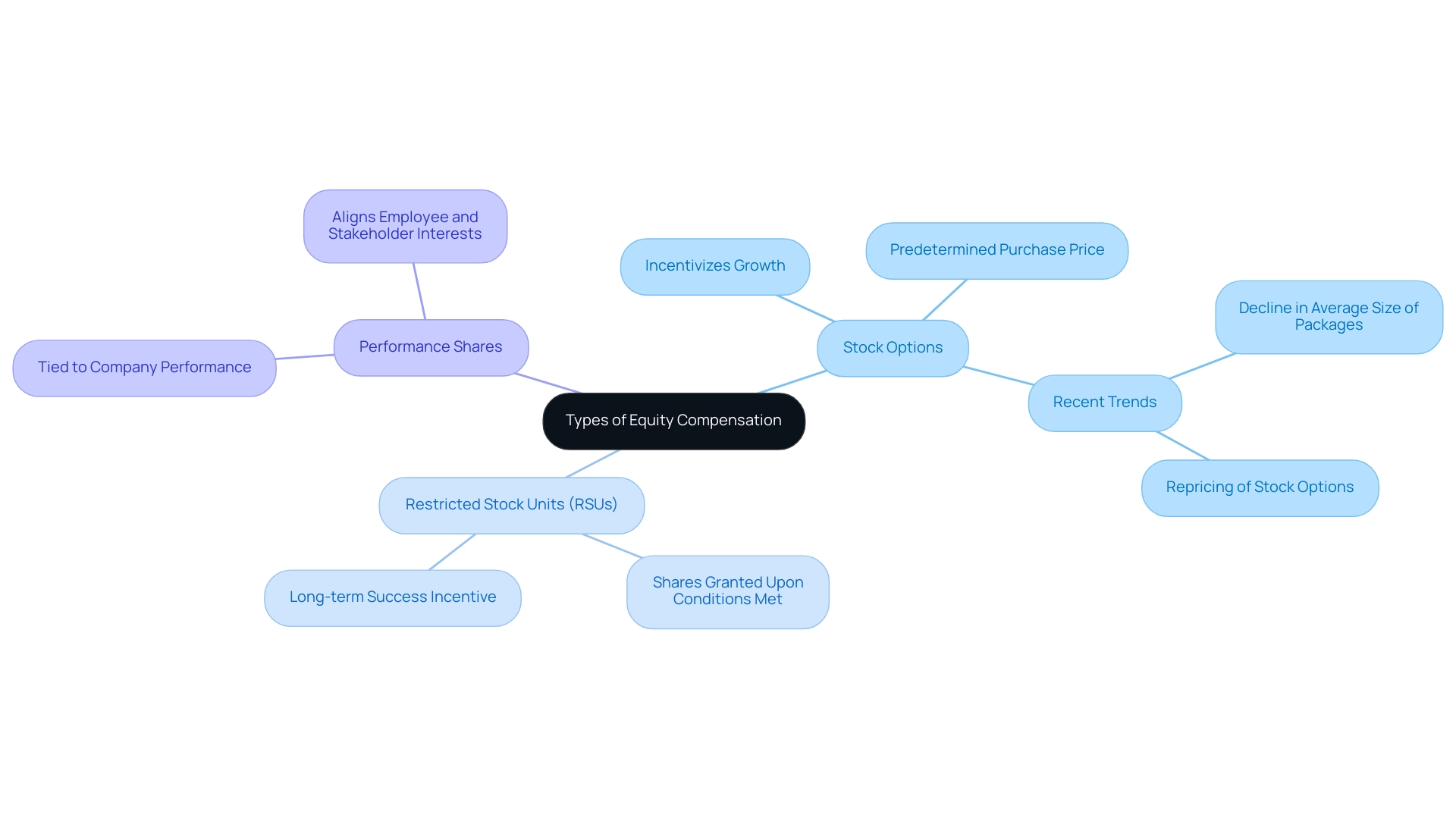

Types of Equity Compensation: Understanding Employee Stock Options and More

Start-up equity represents a vital non-cash benefit that grants employees an ownership stake in the company, playing a crucial role in attracting and retaining talent. We understand that navigating compensation can be challenging, but recognizing the most common forms of ownership compensation—such as stock options, restricted stock units (RSUs), and performance shares—can help illuminate the path forward. Stock options empower employees by granting them the right to purchase shares at a predetermined price, which incentivizes them to contribute to the company's growth.

In contrast, RSUs provide employees with shares outright once specific conditions are met, ensuring they have a vested interest in the company's long-term success. As many of our members have experienced, understanding these compensation types is essential for investors, as they can significantly influence a company's cash flow and employee motivation. For instance, recent trends indicate that the average size of equity packages for new hires has seen a notable decline since November 2022, stabilizing only recently. This shift reflects broader market dynamics, including lower venture-backed valuations, which can directly impact a new company's ability to attract top talent and drive growth through start-up equity.

Moreover, insights from financial experts underscore the importance of employee stock options in fostering business growth. These options not only encourage employees to excel but also align their interests with those of stakeholders, creating a shared vision for success. As new ventures navigate the complexities of ownership compensation, we recognize that understanding how start-up equity options influence investor decisions becomes essential.

Looking ahead to 2025, the landscape of ownership compensation continues to evolve, with 184 companies on Carta repricing nearly 19,000 individual stock option grants. This highlights the ongoing adjustments in response to market conditions, reinforcing the importance of staying informed. Real-life examples further illustrate the impact of stock compensation on start-up equity performance. The case study titled 'Compensation Trends in Startups' reveals that the decline in start-up equity ownership packages and the increase in extended post-termination exercise periods for stock options are adapting to changing market expectations. These adjustments can enhance employee satisfaction and retention, which is crucial for long-term success.

As Akim Arhipov, founder of fff.club, poignantly states, "Financial superpowers should be accessible to everyone," emphasizing the importance of compensation in democratizing financial opportunities for employees and stakeholders alike. Additionally, identifying and managing people risk is crucial, as it can significantly impact business success. We understand that as the technology sector progresses, grasping the subtleties of compensation will empower stakeholders to make educated choices, ultimately fostering significant results in the competitive entrepreneurial environment.

Equity Distribution: Best Practices for Founders and Investors

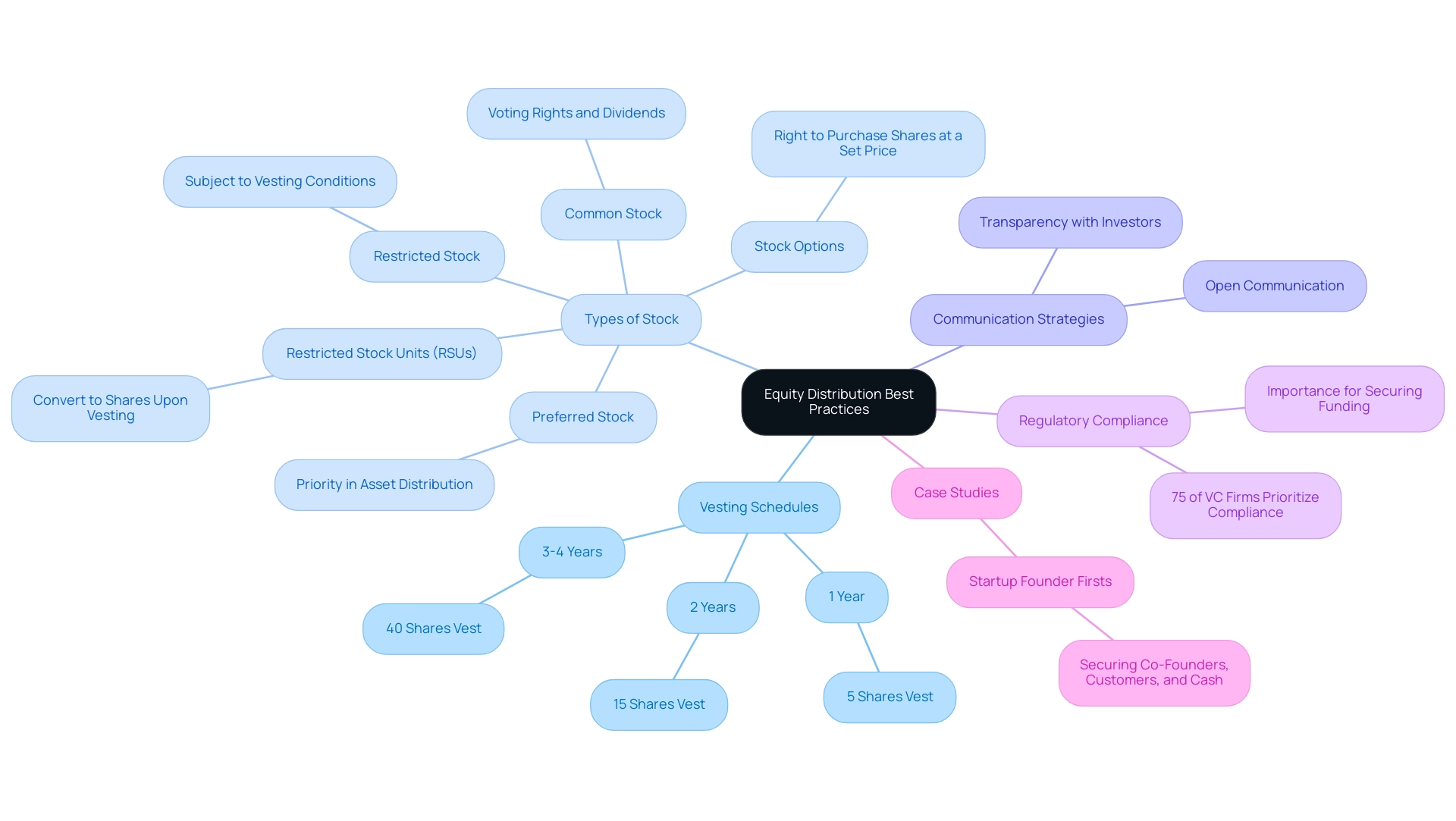

The allocation of start-up equity among founders, employees, and backers is a critical aspect that can significantly impact a startup's journey to success. We understand that navigating this delicate balance can be challenging, which is why best practices emphasize the importance of establishing clear agreements that outline ownership percentages, vesting schedules, and dilution policies. For instance, at Amazon, employees benefit from a structured vesting schedule where:

- 5% of shares vest after one year

- 15% after two years

- 40% in the third and fourth years

This approach not only incentivizes employees but also aligns their interests with the company's long-term aspirations.

Mihkel Torim, a respected leader in the field, reminds us that "the club's dedication to providing members with the essential insights and resources to make informed choices" is vital for effectively managing distribution. Founders should prioritize open communication with investors about their ownership distribution strategy. This transparency fosters trust and alignment, both of which are essential for nurturing strong partnerships.

Investors, in turn, must carefully evaluate how ownership is distributed to ensure that key contributors are adequately incentivized. Many of our members have experienced that new ventures with clearly articulated start-up equity distribution plans often achieve remarkable results and maintain talent more effectively.

Looking ahead to 2025, ownership distribution best practices highlight the significance of tailoring agreements to the unique needs of each new venture, particularly regarding start-up equity. Successful tech ventures often employ a blend of:

- Common Stock

- Preferred Stock

- Restricted Stock

- Restricted Stock Units (RSUs)

- Stock options

Each type serves distinct purposes: Common Stock typically provides voting rights and dividends, Preferred Stock offers priority in asset distribution, Restricted Stock is subject to vesting conditions, RSUs convert to shares upon vesting, and stock options grant the right to purchase shares at a predetermined price.

Industry experts advocate for a balanced approach that considers both immediate and long-term incentives. Case studies demonstrate that founders who implement effective resource distribution strategies can significantly enhance their ventures' chances of success. For example, the case study titled 'Founder Firsts' illustrates how founders can address challenges in securing co-founders, customers, and funding—critical elements for the success of their ventures. By establishing clear ownership agreements and vesting schedules related to start-up equity, founders can bolster performance and investor confidence.

Furthermore, a recent survey revealed that 75% of venture capital firms view regulatory compliance as a top concern when assessing new businesses. This underscores the importance for new ventures to prioritize compliance alongside resource allocation to secure funding and foster sustainable growth.

In conclusion, ownership distribution strategies for founders and investors in 2025 should emphasize clarity, communication, and compliance. By adhering to these best practices, new companies can lay a solid foundation for growth and success in the competitive tech landscape, ensuring that every member feels valued and supported in their journey.

Negotiating Equity Stakes: Strategies for Tech Investors

Negotiating start-up equity stakes in new ventures can feel daunting, and it requires a strategic mindset along with a comprehensive understanding of the investment landscape. We understand that investors often grapple with the intricacies of assessing a startup's valuation, market position, and growth potential. Prioritizing thorough due diligence is essential, as this foundational knowledge empowers individuals to make informed decisions and negotiate effectively.

Being part of fff. Club can be a game-changer for tech stakeholders. It provides access to a vibrant community where members can learn, network, and share insights, all of which enhance their negotiation strategies. As many of our members have experienced, this collaborative environment fosters growth and confidence.

Key strategies for negotiating equity stakes include:

- Assessing Equity Needs: It's vital to determine the appropriate amount of equity to request, taking into account the startup's current needs and the value you bring to the table. Finding this balance is crucial for establishing a fair agreement.

- Preparedness to Walk Away: We recognize that investors must be ready to walk away if the terms do not align with their expectations or investment strategy. This assertiveness often leads to better offers, signaling confidence in your valuation.

- Building Rapport with Founders: Establishing a strong relationship with the startup's founders can facilitate smoother negotiations. Open communication fosters trust and can lead to more favorable terms for both parties.

In 2025, the landscape for technology financiers is evolving. Current trends indicate that the top 10 funds captured 36% of the total capital raised, highlighting the competitive nature of the market. This reality underscores the necessity for stakeholders to be well-prepared, a principle echoed by Sten Tamkivi and Kristjan Vilosius in their discussions about resilience and collaborative funding strategies. Sten Tamkivi emphasizes the significance of grasping the startup's vision and aligning it with funding objectives, while Kristjan Vilosius advocates for a systematic approach to negotiations that considers both short-term and long-term value.

Real-life examples illustrate how proactive strategies can lead to successful ownership negotiations. Stakeholders who negotiated higher initial start-up equity grants and secured regular ownership refresh grants were able to mitigate dilution and safeguard their stakes. The case study titled "Strategies to Mitigate Dilution" outlines how these proactive strategies can effectively protect ownership percentages in start-up equity, enhancing the practical application of the negotiation strategies discussed.

As Taavi Rõivas, former Prime Minister of Estonia, emphasizes, strategic negotiation is crucial in today’s investment climate to secure start-up equity. Expert opinions further highlight the importance of adapting due diligence practices to the current market dynamics. As the tech landscape continues to evolve, stakeholders must remain agile, leveraging insights from industry leaders to refine their negotiation tactics and ensure successful outcomes in their financial negotiations.

Additionally, fff.club's emphasis on co-investing and learning from fellow investors enhances the negotiation process for tech investors. By encouraging teamwork, members can exchange insights and strategies, ultimately driving meaningful outcomes in their negotiations. We invite you to join fff. Club today to empower your investment journey and connect with over 400 tech fellows. Gain access to valuable resources and networks that can elevate your strategic wealth management.

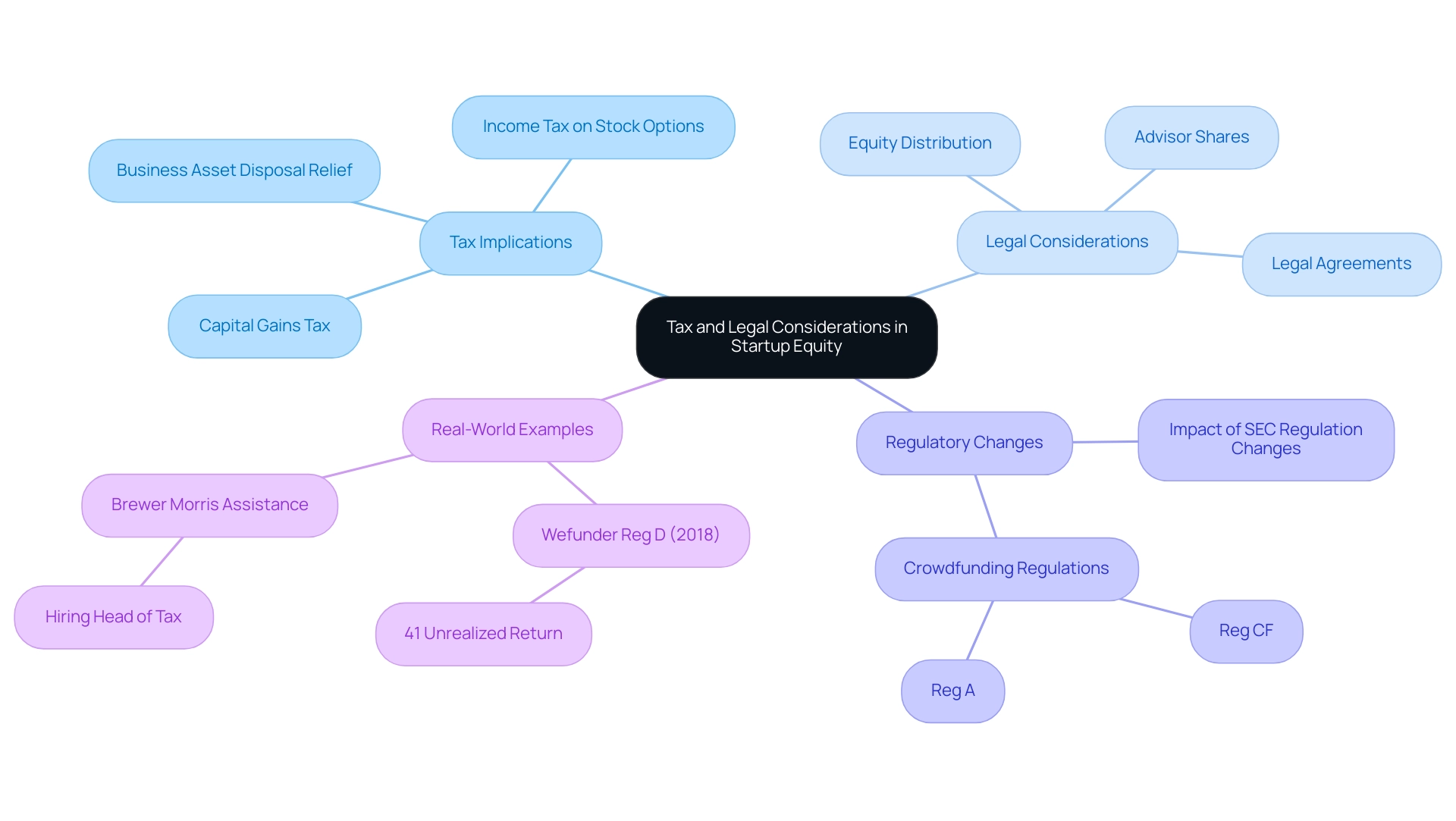

Tax and Legal Considerations in Startup Equity

Navigating the landscape of start-up equity can be daunting, especially when considering the associated tax implications like capital gains tax and income tax on stock options. As we look ahead to 2025, it’s crucial for investors to remain vigilant about how regulatory changes may affect their financial outcomes. For example, anticipated adjustments in capital gains tax could have a profound impact on capital allocation strategies, particularly if they are not matched by improvements in Business Asset Disposal Relief, as noted by industry experts.

Seb Wallace, Investment Director at Triple Point Ventures, highlights a vital point: "We must separate the conversation about capital gains from unearned income, such as property investments, from gains earned by hard-working entrepreneurs who are actively driving economic growth." This distinction is important as it acknowledges the efforts of those in the start-up ecosystem, and it emphasizes the need for clarity in these discussions.

Legal considerations also play a critical role in this landscape. Agreements must be carefully crafted to protect the interests of all parties involved. Understanding the intricacies of start-up equity distribution and advisor shares is essential, as these can vary significantly across different ventures. Engaging with legal and tax professionals is not just advisable; it’s essential for ensuring compliance with current regulations and optimizing investment structures effectively.

Real-world examples remind us of the importance of these considerations. Take, for instance, the impact of SEC regulation changes on early-stage investing. As new regulations emerge—like those affecting crowdfunding platforms such as Wefunder and Republic—investors must be ready to adapt their strategies. Many of our members have experienced firsthand the challenges and opportunities these changes present.

The Wefunder Reg D (2018) reported a remarkable 41% unrealized return, underscoring the potential benefits of understanding tax implications in new venture ownership. These developments highlight the necessity of a robust tax strategy. Brewer Morris emphasizes this by assisting in recruiting a Head of Tax for new businesses, guiding them through these complexities.

By gaining a deeper understanding of the tax consequences and legal structures surrounding start-up equity, individuals can avoid costly mistakes and enhance their overall investment journey. This proactive approach not only encourages informed decision-making but also positions individuals to seize the dynamic opportunities within the tech landscape. We understand that navigating these complexities can be overwhelming, but together, we can foster a supportive community that empowers each other to thrive.

The Power of Community: Leveraging Networks for Investment Success

In the competitive landscape of start-up equity funding, we understand that building a robust network is paramount for tech professionals striving for success. Engaging with communities like fff. Club empowers participants to share invaluable knowledge, gain access to exclusive deal flows, and collaborate on thorough due diligence processes across venture capital, private credit, and real estate.

This cooperative atmosphere not only encourages co-financing opportunities but also offers essential insights into market trends and optimal practices. As many of our members have experienced, the support of a community can make a significant difference in navigating these challenges.

With over 400 tech financiers involved, fff.club fosters a community-driven approach to funding opportunities, where collective knowledge significantly enhances deal assessment. Testimonials from members highlight the tangible benefits of this collaboration; for instance, one member noted, 'My partnership through fff. Club led to a successful co-investing venture that I wouldn't have accessed alone.' This sentiment resonates with many, showcasing the power of shared experiences.

Statistics reveal that over 60% of companies are struggling to secure reliable and skilled IT talent, underscoring the necessity for stakeholders to leverage their networks effectively. By utilizing the collective knowledge of fellow members, individuals can enhance their decision-making processes, ultimately improving their chances of attaining positive financial results.

The importance of community in achieving success cannot be overstated. Tech funding specialists emphasize that a robust network enables access to varied viewpoints and resources, which are crucial for maneuvering through the intricacies of the entrepreneurial landscape. Real-life examples abound, showcasing how community engagement has led to successful co-investing ventures, reinforcing the notion that collaboration is a key driver of success in this dynamic field.

For instance, members of fff. Club have collaborated on diverse funding opportunities, showcasing the concrete advantages of their joint endeavors.

As the startup environment continues to change in 2025, the significance of networking for technology financiers in relation to start-up equity remains essential. The commitment to inclusivity articulated by fff.club's founder, Akim Arhipov, reflects a broader belief that financial superpowers should be accessible to all. Akim, along with co-founder Tim Vaino, who has co-built Latitude59, brings extensive experience that enhances the community's capabilities.

By fostering an environment where members can learn from one another and co-invest, fff. Club enhances the overall financial experience, paving the way for meaningful outcomes in the ever-changing tech market. Furthermore, as organizations increasingly prioritize cybersecurity solutions, understanding these trends will be vital for investors looking to secure their investments in a landscape marked by rapid technological advancements.

Conclusion

Understanding startup equity is vital for both founders and investors as they navigate the complex landscape of startup ownership and investment strategies. We recognize that equity serves as a crucial determinant of control and profit-sharing, highlighting the importance of a nuanced comprehension of its various forms, such as common stock, preferred stock, and options. In an ever-evolving startup ecosystem, adapting to market dynamics and nurturing community support are essential components for achieving success.

Equity compensation significantly impacts the ability to attract and retain talent, ultimately shaping the startup's cash flow and employee motivation. By implementing thoughtful equity distribution strategies, founders can enhance their startups' chances of success while ensuring alignment with investor interests. It is important to remember that thorough negotiation strategies and a solid understanding of tax and legal implications are key to securing favorable outcomes in equity stakes.

The power of community in the investment landscape is truly invaluable. Engaging with networks like fff.club fosters knowledge sharing and collaboration, enriching decision-making processes and boosting investment success. As the tech landscape continues to shift, leveraging these community resources will be crucial for investors striving to navigate the complexities of startup equity effectively.

In summary, a comprehensive understanding of startup equity, paired with strategic negotiation, informed decision-making, and community engagement, positions both investors and founders to flourish in a competitive environment. Embracing these principles empowers stakeholders to make informed choices, ultimately driving meaningful outcomes in the dynamic world of startups. Together, we can navigate this journey with confidence and support.