Overview

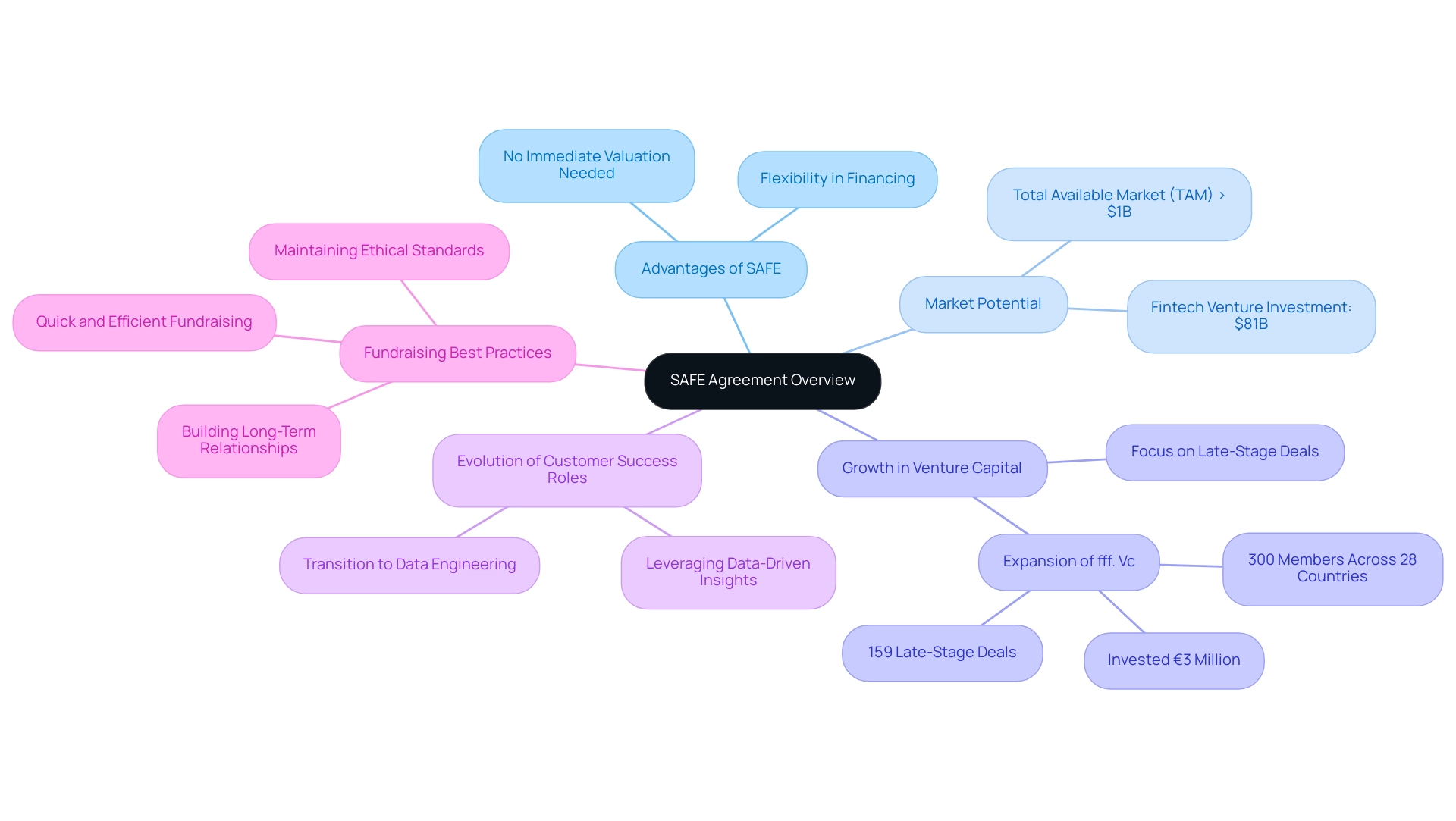

SAFE agreements, or Simple Agreements for Future Equity, serve as a flexible financing tool for startups, allowing investors to convert their contributions into equity at a later date without requiring an immediate company valuation. The article highlights their growing popularity in the tech sector due to advantages such as speed and investor appeal, while also addressing potential risks like lack of control and uncertainty in equity conversion, emphasizing the need for careful consideration by both startups and investors.

Introduction

In the dynamic world of startup financing, the Simple Agreement for Future Equity (SAFE) has emerged as a game-changing tool that redefines how early-stage companies secure funding. Unlike traditional equity financing, SAFEs allow investors to convert their contributions into equity without the burden of immediate company valuation, making them particularly appealing in a rapidly changing market.

As innovative sectors like fintech witness unprecedented investment growth, understanding the mechanics and implications of SAFE agreements becomes vital for both startups and investors alike. This article delves into the intricacies of SAFEs, exploring their advantages and disadvantages, key terms like valuation caps and discounts, and how they compare to other financing instruments.

With a focus on the evolving landscape of startup funding, it sheds light on the challenges and best practices that can enhance fundraising efforts in an era marked by uncertainty and opportunity.

What is a SAFE Agreement? An Overview

A Simple Agreement for Future Equity (SAFE) functions as a crucial financing tool for emerging companies, enabling backers to transform their contributions into equity at a later date, usually during later funding rounds. This instrument diverges from traditional equity financing by eliminating the need for immediate company valuation, particularly advantageous for early-stage businesses navigating a volatile market. As noted by Paul Graham, founder of Y Combinator,

If the soda is empty, stop making that awful sucking sound with the straw

<— a reminder for investors to seek practical solutions in uncertain environments.

With the Total Available Market (TAM) for innovative businesses exceeding $1 billion, the potential for growth is significant, especially in sectors like FinTech, where venture investment alone soared to $81 billion last year. This growth indicates a rising acceptance and reliance on innovative funding structures like safe agreements, particularly as fff. Vc shifts focus towards late-stage and secondary tech deals amidst market uncertainty.

As customer success roles evolve into data engineering, new companies can leverage data-driven insights to enhance fundraising strategies. By offering a defined right to equity under specific conditions, such contracts are becoming more appealing in the tech sector, where valuations are susceptible to rapid fluctuations. This flexibility positions safe agreements as a preferable choice in the current environment of financing new ventures, particularly as trends toward these arrangements keep gaining momentum into 2024, showcasing the strategic development of funding groups like fff.

Vc in nurturing varied investment portfolios and adjusting to evolving market dynamics. In its second year, fff. Vc grew to 300 members across 28 countries, worked through 159 late-stage deals, and invested approximately €3 million in notable companies like Inbank, Bolt, and Salv.

The organization also hosted workshops with industry leaders such as Blackstone and UBS, enhancing community engagement and knowledge sharing. Furthermore, following best practices in fundraising can improve the chances of successful fundraising and lasting connections with backers, demonstrating how such contracts align with ethical standards and effective fundraising initiatives.

How SAFE Agreements Work: Key Mechanics

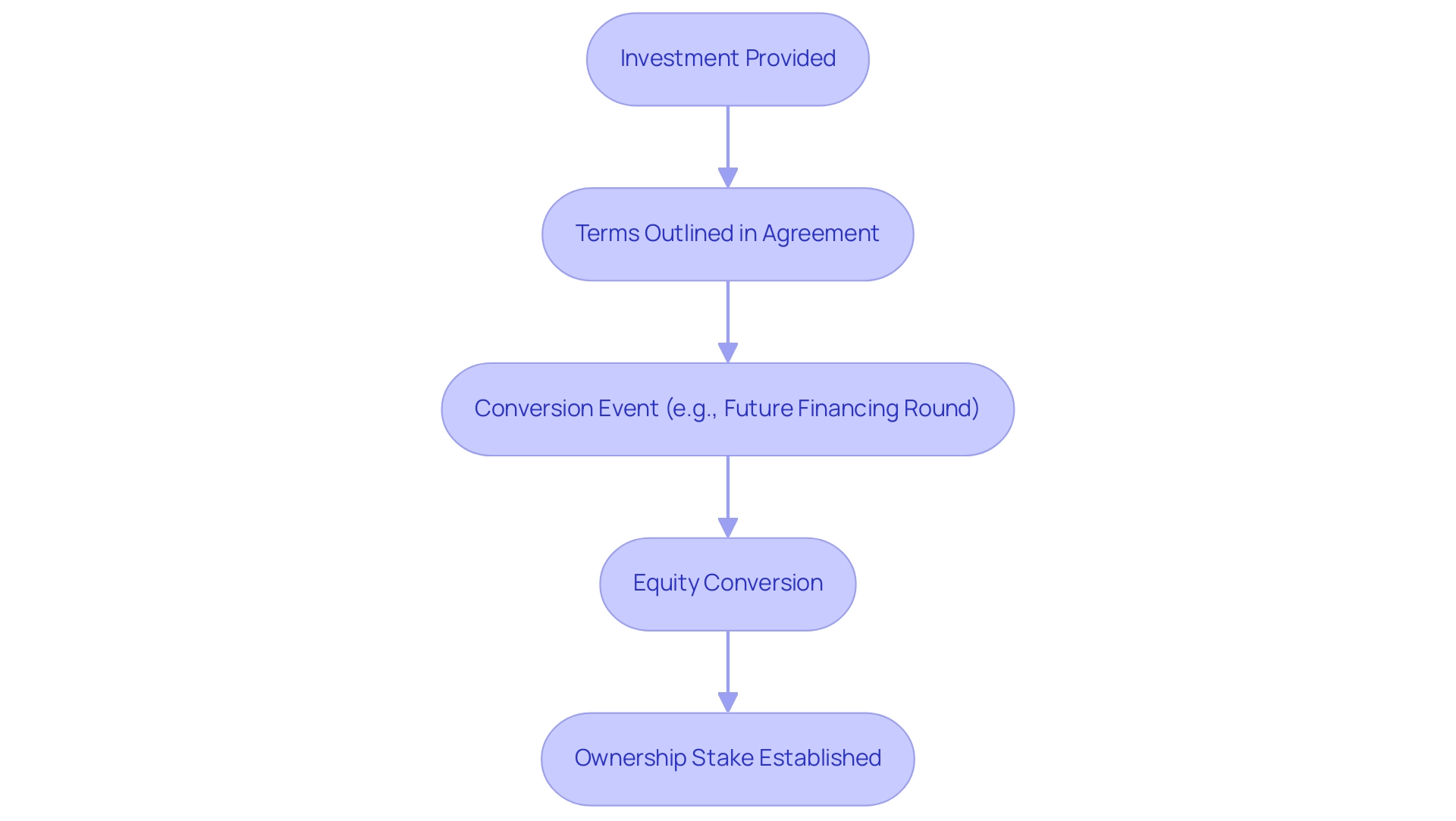

Simple Agreements for Future Equity allow individuals to provide funds to a new business in return for the option to transform that funding into equity at a future time, usually during a later financing round. This conversion process is structured around predetermined terms outlined in the agreement, which often include valuation caps and discounts that directly affect the conversion ratio. Such features enable stakeholders to gain from favorable terms without the necessity to negotiate a valuation beforehand—a particularly valuable aspect in the volatile tech sector where valuations can fluctuate significantly.

Recent statistics indicate that only one in ten new ventures in the United States manage to thrive and achieve sustained growth. Considering this situation, grasping the principles of convertible notes is essential for individuals aiming to manage the intricacies of early-stage funding. Notably, approximately 31% of U.S. commercial investors are considering investments in proptech companies, highlighting the relevance of safe agreements in attracting capital within specific sectors. Furthermore, according to CrunchBase data, generative AI and AI-related firms raised around US$50 billion in 2023, underscoring the current investment landscape and the significance of safe agreements in facilitating such funding.

For instance, companies that scale prematurely often encounter challenges due to inconsistent growth and over-investment, as highlighted by the Genome Project. This project identifies key metrics for consistent versus inconsistent businesses, emphasizing that consistent companies report lower valuations and more sustainable growth. By efficiently employing safe agreements for future equity, new ventures can reduce some of these risks, guaranteeing that initial investments convert seamlessly into ownership, thus promoting a more stable growth path.

As the market develops, it is crucial for investors to understand these dynamics, especially with the prominence of funding arrangements in 2024, where numerous new ventures are increasingly embracing this financing model to support their growth strategies.

Pros and Cons of SAFE Agreements for Startups

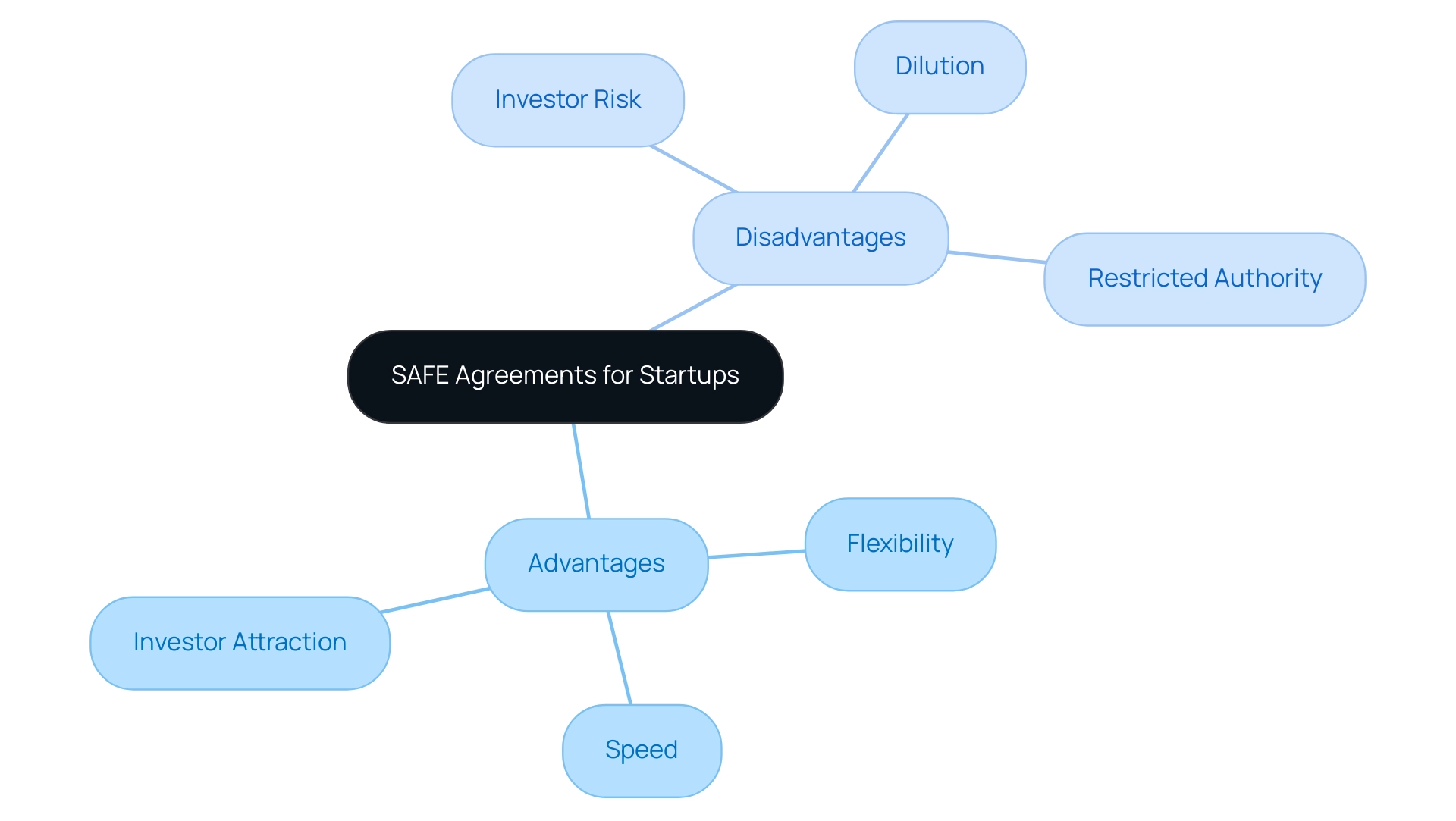

Advantages of SAFE Agreements

- Flexibility: One of the standout features of SAFE agreements is their inherent flexibility. Unlike traditional funding methods that require a new venture to establish a valuation upfront, a SAFE agreement allows companies to defer this decision, streamlining the fundraising process. This is particularly beneficial in a competitive investment landscape where venture capital funding is becoming increasingly concentrated.

- Speed: The legal framework surrounding SAFEs is typically less complex than that of traditional equity financing. This simplification allows new businesses to prepare documentation rapidly, enabling them to secure funding without extensive delays, which is crucial during periods of heightened market uncertainty.

- Investor Attraction: Startups utilizing a SAFE agreement typically discover it simpler to attract backers. The favorable terms associated with these instruments, such as valuation caps and conversion discounts, can create a compelling proposition for potential backers, thereby enhancing the startup's appeal as a SAFE agreement.

Disadvantages of SAFE Agreements

- Investor Risk: While SAFEs offer advantages, they also introduce significant risks for investors. The uncertainty surrounding future equity stakes can be daunting, as the eventual ownership depends on subsequent financing rounds. This unpredictability can deter careful individuals.

- Dilution: If a SAFE agreement is not structured with care, it can contribute to excessive dilution for existing shareholders upon conversion to equity. This potential for dilution necessitates a thorough understanding of the implications for ownership percentages, particularly as startups navigate their growth stages.

- Restricted Authority: Another disadvantage of these contracts is that early backers often find themselves with restricted rights and authority compared to conventional equity holders in a SAFE agreement. Since SAFEs typically do not confer voting rights until conversion, stakeholders may have little influence over company decisions during critical early phases of development.

The dynamics surrounding funding arrangements continue to evolve, particularly as the startup environment encounters difficulties such as heightened closures, which hit a new high in the first quarter of 2024. As Y Combinator aptly observed, the idea of a financial contract was introduced in 2013, yet its implications for stakeholder experience and risk remain a relevant subject of discussion today. Furthermore, prior to raising funds with a SAFE agreement, companies ought to contemplate their objectives and equity distribution strategies, as emphasized in the case study titled 'Factors to Consider Before Issuing a SAFE.'

Careful consideration of these factors is essential for deciding on the use of SAFEs in fundraising.

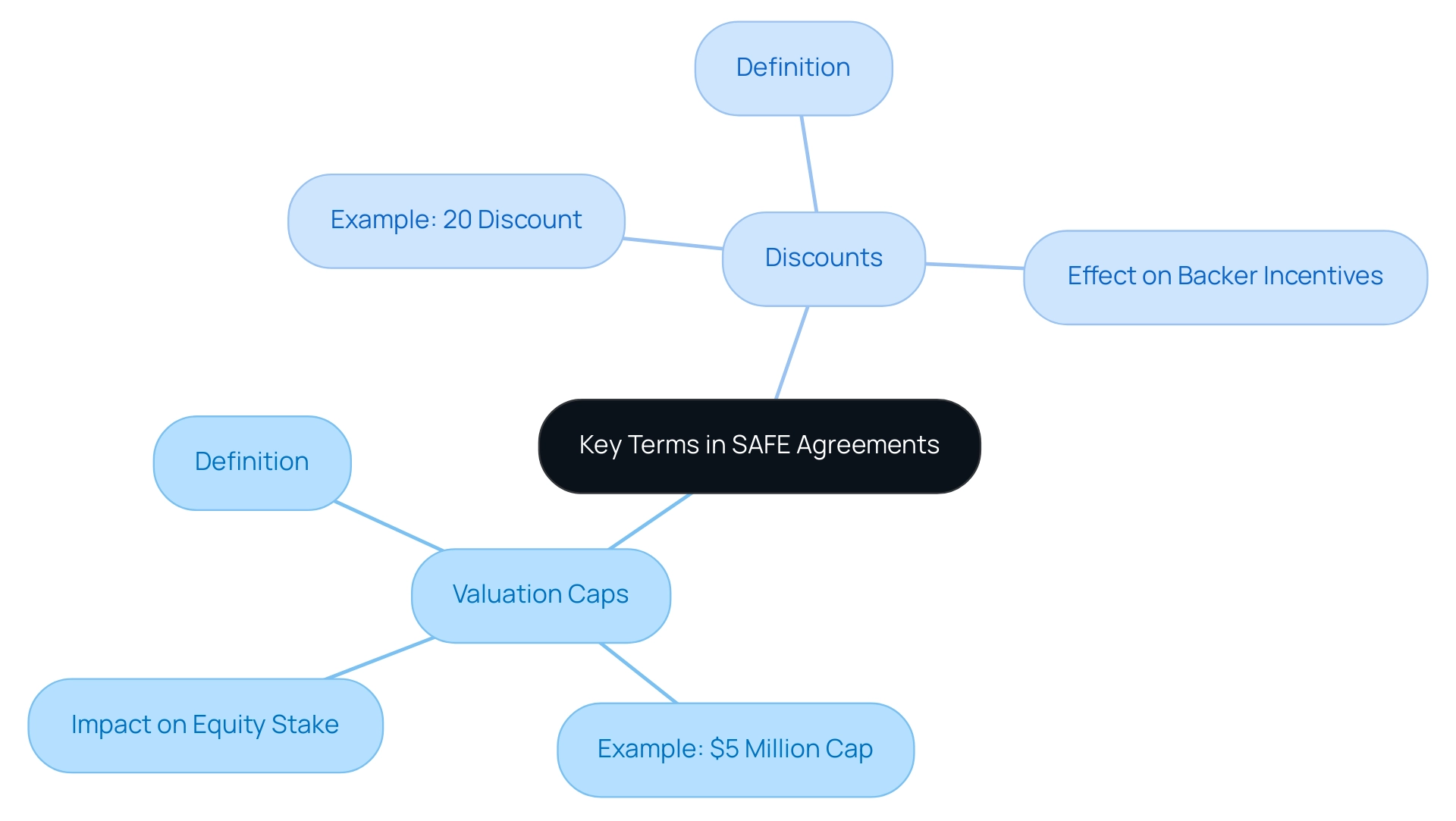

Key Terms in SAFE Agreements: Valuation Caps and Discounts

Valuation caps and discounts are essential elements of funding agreements that greatly affect returns for backers. A valuation cap sets a limit on the company's worth for conversion to equity, effectively protecting stakeholders from excessive dilution when a new venture's valuation rises. For example, if a backer consents to a valuation cap of $5 million, but the company subsequently secures funding at a $10 million valuation, the agreement will convert as though the valuation remained at $5 million, thus increasing the backer's equity stake.

This aspect is vital, particularly given the growing intricacy of new business valuations in 2024, where average valuation caps have increased considerably.

Conversely, a discount encourages early funding by permitting backers to convert their agreement at a lower price per share. For example, a 20% discount means that if the shares are priced at $1 during the next funding round, the agreement will convert at a price of $0.80, effectively rewarding early backers for their risk. This mechanism is not only advantageous for stakeholders but also plays a crucial role in influencing stakeholder sentiment towards new ventures, as demonstrated by recent trends observed in safe agreements for future equity.

Notably, TechStars has the right to convert outstanding principal and unpaid accrued interest into Tokens at a 20% discount, illustrating a real-world application of discounts in a safe agreement. Additionally, understanding the dynamics of safe agreements is essential for tech investors, especially in light of the complexities highlighted in the case study comparing safes, convertible notes, and equity rounds. While safes and convertible notes simplify funding, they may lead to complications in cap tables, emphasizing the importance of valuation caps and discounts in navigating the financing landscape effectively.

SAFEs vs. Other Financing Instruments: A Comparative Analysis

When evaluating a safe agreement against other financing instruments like convertible notes, it's crucial to understand their distinct structural characteristics. Convertible notes serve as debt instruments, creating an obligation for repayment if the company fails to obtain subsequent financing or fulfill specific conditions. Statistics indicate that convertible notes are especially appropriate for pre-revenue or early-stage companies, offering a safety net for investors.

In contrast, safe agreements are designed to be straightforward and do not accrue interest, significantly easing the financial burden on new businesses. This simplicity can make Safes, as a form of safe agreement, an attractive option for early-stage companies, especially in supportive environments like New Zealand, where government initiatives foster entrepreneurship and early-stage investment. Successful examples such as Airbnb and Uber demonstrate how these ventures validated their business models through traction metrics, reinforcing the importance of selecting the right financing instrument.

However, the debt nature of convertible notes may offer stakeholders a sense of security, as they have a claim on the company's assets if it underperforms. Ultimately, the choice between Safes and convertible notes as a safe agreement depends on several factors, including the company's developmental stage, the individual's risk tolerance, and the anticipated timeline for future funding. As noted by Eric Hanson, a partner at WilmerHale, “The most important thing for a lot of these companies is to raise capital and survive through to the next stage.

They may have to make some compromises.” This perspective highlights the critical nature of financing decisions and their implications for a startup's journey.

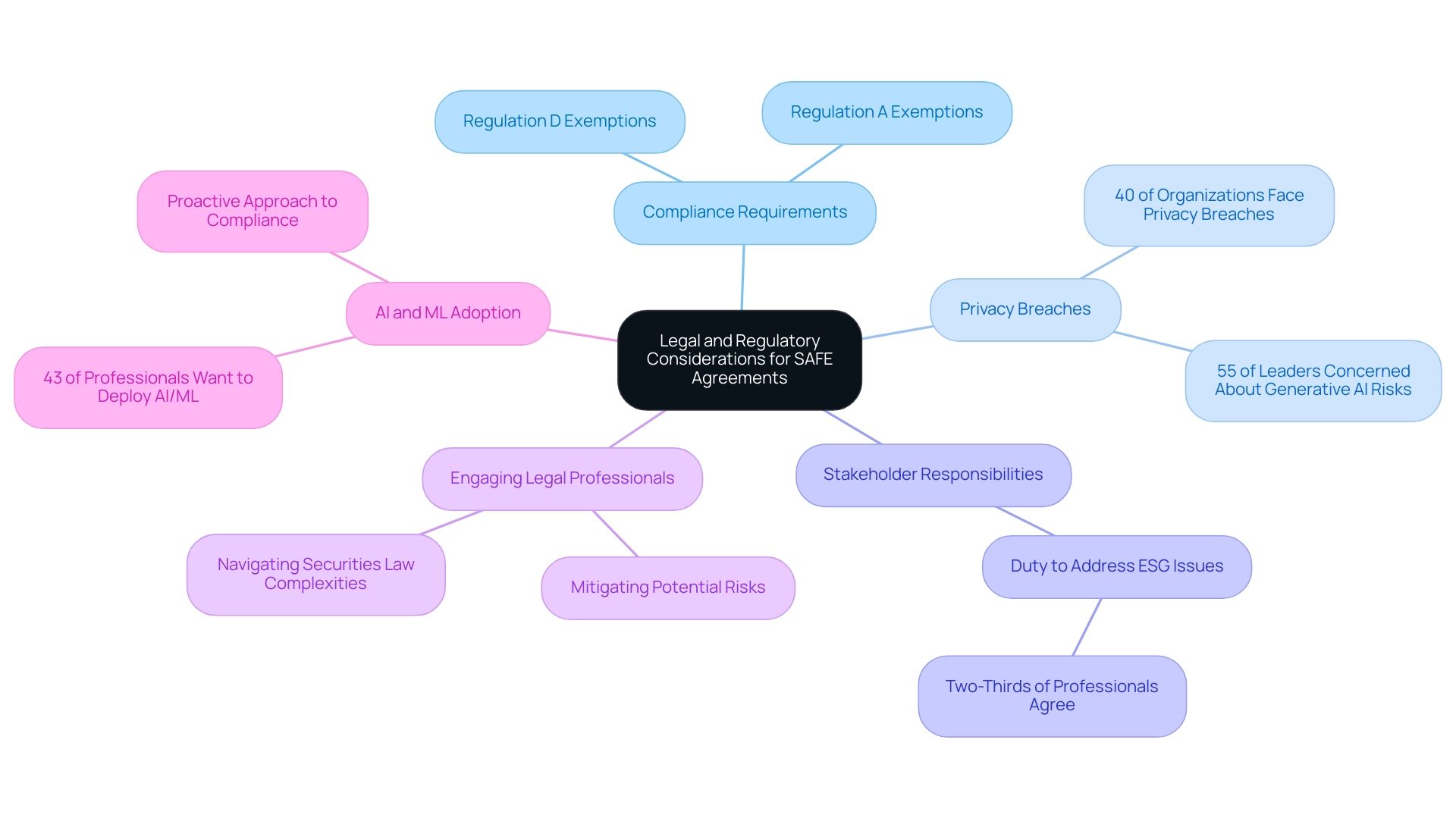

Legal and Regulatory Considerations for SAFE Agreements

For individuals exploring the terrain of safe agreements, a comprehensive grasp of the legal and regulatory factors is essential. These contracts, while generally classified as securities, often escape the stringent regulations that govern traditional equity offerings. It is crucial for stakeholders to verify that the startup adheres to relevant securities laws, including potential exemptions under Regulation D or Regulation A, which can vary based on the size of the offering.

Significantly, 40% of organizations have faced privacy breaches associated with AI, highlighting the urgent necessity for compliance in this developing area, especially as these breaches can have considerable consequences for agreements. Furthermore, legal experts emphasize that organizations hold a responsibility to their stakeholders regarding ESG-related issues, with two-thirds agreeing on this duty, as noted by Saravanan. Consequently, it is crucial for stakeholders to thoroughly examine the conditions of each safe agreement, as they can vary significantly and may involve different compliance stipulations.

Engaging with legal professionals experienced in securities law is highly advisable to navigate these complexities and mitigate potential risks. This is especially relevant given the case study highlighting how 43% of professionals under pressure to increase revenue express a desire to deploy AI and ML to combat financial crime, reflecting a proactive approach to leveraging technology for compliance and risk management. Additionally, the increasing scrutiny on compliance is evidenced by the 114 disclosed security incidents in October 2023 affecting over 867 million records.

By proactively addressing these legal considerations, individuals can better position themselves to manage regulatory risks effectively.

Common Challenges and Pitfalls in SAFE Agreements

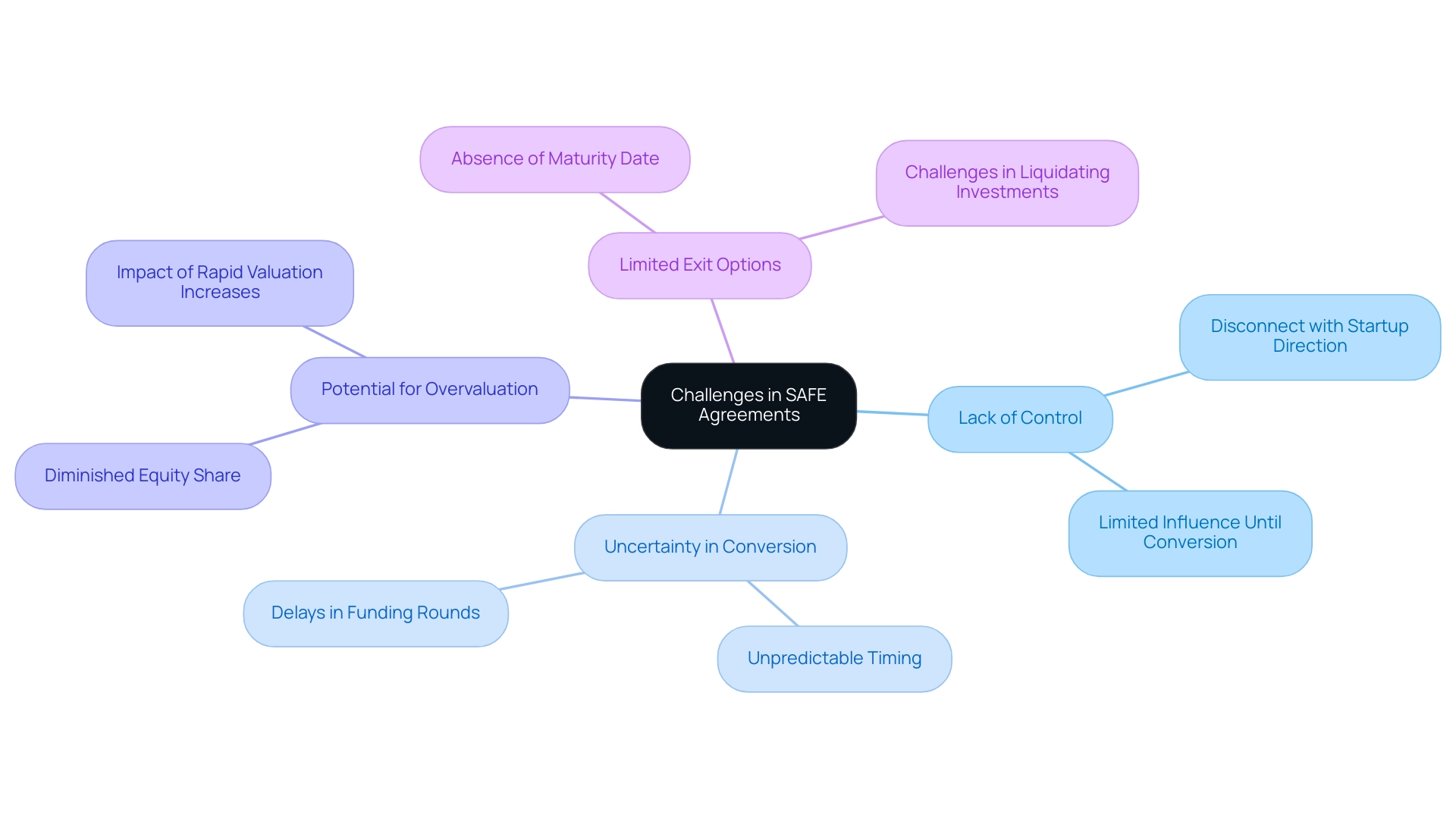

Investors need to be aware of several prevalent challenges when dealing with SAFE agreements:

- Lack of Control: Early-stage investors often find themselves without a voice in company decisions until their SAFE converts, which may result in a disconnect with the startup's evolving direction.

- Uncertainty in Conversion: The conversion timing and terms can be highly unpredictable, particularly if a new venture experiences delays in subsequent funding rounds.

- Potential for Overvaluation: In situations where a new venture's valuation rises quickly, early backers could observe their equity share considerably diminished, even with a valuation cap established.

- Limited Exit Options: The absence of a maturity date within SAFEs means that stakeholders may struggle to liquidate their investments if the startup does not actively pursue further funding or an exit strategy. Awareness of these pitfalls is crucial for individuals, enabling them to make informed decisions and structure their investments with greater precision.

As Val Srinivas, a Senior Research Leader in Banking & Capital Markets, notes, "Integrating risk controls early in transformation initiatives can help ensure sustainable cost reductions." This is particularly relevant in the current landscape, where in 2024, 15 out of 26 large European banks are projected to experience cost growth outpacing revenue growth. Numerous financial organizations are dedicating themselves to improved cost discipline as they near 2025, which could significantly influence investor behavior and decision-making regarding SAFE agreements.

Moreover, the case study titled 'High Resolution Fundraising' illustrates how SAFE agreements are embraced by the startup community for their efficiency. These contracts, typically around six pages long, eliminate the need for interest payments and maturity dates, allowing founders to focus on growth. However, this simplicity can also lead to potential pitfalls, as individuals may overlook critical aspects of their investment structure.

Therefore, navigating the complexities of a SAFE agreement requires careful consideration, ensuring investors are equipped to handle these common challenges.

Conclusion

The emergence of Simple Agreements for Future Equity (SAFEs) has transformed startup financing by providing a flexible alternative to traditional equity methods. SAFEs allow investors to convert their contributions into equity without requiring immediate company valuations, making them particularly suited for early-stage funding. Key benefits include:

- Speed

- Enhanced investor attraction

While drawbacks like dilution and limited control for early investors are important to consider.

Understanding essential elements such as valuation caps and discounts is crucial for both startups and investors, as these features influence returns and funding dynamics. A comparison with other financing instruments, like convertible notes, further highlights the advantages SAFEs offer in meeting the unique needs of startups.

Legal and regulatory considerations surrounding SAFEs are also vital, necessitating that investors ensure compliance with relevant securities laws and manage associated risks. Awareness of common challenges, such as lack of control and uncertainty in conversion, is essential for informed decision-making.

In conclusion, SAFEs represent a strategic shift in startup financing, aligning the interests of startups and investors in a fast-evolving market. By utilizing these agreements, startups can improve their fundraising efforts while offering favorable terms to investors, ultimately fostering a more resilient entrepreneurial environment. The insights provided in this article serve as a practical guide for navigating the complexities of SAFE agreements, empowering stakeholders to effectively leverage this innovative financing tool.