Overview

This article delves into Restricted Stock Awards (RSAs), a vital form of equity compensation that many in the tech industry encounter. We understand that navigating the complexities of RSAs can be overwhelming, especially when considering their benefits and tax implications.

RSAs offer immediate ownership, aligning your interests with the company's performance, which can be an exciting prospect. However, it’s essential to be aware of potential tax burdens and vesting challenges that may arise. By addressing these concerns, we aim to guide you toward making informed investment decisions that support your financial well-being.

Remember, you’re not alone in this journey—many of our members have shared similar experiences, and together we can foster a community of understanding and support.

Introduction

In the ever-evolving tech industry, we understand that attracting and retaining top talent is a significant challenge. As many of our members have experienced, the landscape is competitive, and finding effective ways to support employees is crucial. Restricted Stock Awards (RSAs) are emerging as a compassionate solution in employee compensation strategies.

Unlike traditional stock options, RSAs provide employees with immediate ownership of company shares, though certain restrictions apply until the shares vest. This unique structure not only nurtures a sense of loyalty among employees but also aligns their financial success with the company’s performance.

With a growing number of tech firms incorporating RSAs into their compensation packages, it is vital for both employees and investors to understand the nuances of these awards—from taxation implications to vesting processes. By navigating this complex landscape together, we can foster a community where the strategic use of RSAs enhances our collective ability to thrive in a rapidly changing market.

What Are Restricted Stock Awards (RSA)?

Restricted Stock Awards represent a significant form of equity remuneration, offering employees actual units of company stock, albeit with certain limitations. Unlike stock options, which provide the right to purchase units at a set price, restricted stock awards grant immediate ownership of units. However, these units cannot be sold or transferred until they vest. This approach proves particularly beneficial in the competitive tech industry, where attracting and retaining top talent is essential.

Typically, these agreements feature a vesting timeline, allowing employees to gradually gain full rights to the stocks, often tied to continued employment or the achievement of performance goals. This alignment of interests ensures that employees directly benefit from the company's success, as the value of their shares rises alongside the company's performance.

In 2025, a noteworthy trend emerged, with around 70% of tech firms incorporating restricted stock awards into their compensation packages. This reflects a growing recognition of their value in retention strategies. For example, companies like Google and Microsoft have successfully implemented recruitment strategies that enhance their ability to attract talented professionals while nurturing loyalty among existing employees. Venkat Kodavati, SVP of Wireless Products Group at Synaptics, expressed enthusiasm about welcoming new team members, underscoring the positive sentiment surrounding risk-sharing agreements and their role in building a successful future for companies.

The tax implications of restricted stock awards also significantly contribute to their appeal. In the UK, for instance, RSUs are taxed as income upon vesting, based on the market value of the stocks at that time. This can result in higher tax rates during the vesting period. However, any profit from selling shares after vesting may incur Capital Gains Tax, typically at a lower rate than income tax. This makes Restricted Stock Awards a financially wise choice for employees, especially as they navigate the complexities of equity compensation.

Understanding these considerations is vital as individuals face the intricacies of equity compensation.

Specialist perspectives highlight the benefits of retention strategies for employees. HR professionals note that reward systems not only motivate performance but also foster a sense of ownership among employees, potentially leading to greater productivity and commitment. As the tech landscape continues to evolve, the thoughtful application of reward systems is likely to remain a cornerstone of effective compensation practices, helping companies navigate the complexities of talent management in a competitive market.

Moreover, the SEC's announcement of new pay versus performance rules on August 25, 2022, further underscores the regulatory environment surrounding equity compensation reporting, which is essential to the discussion of restricted stock awards.

RSA vs. RSU: Key Differences Explained

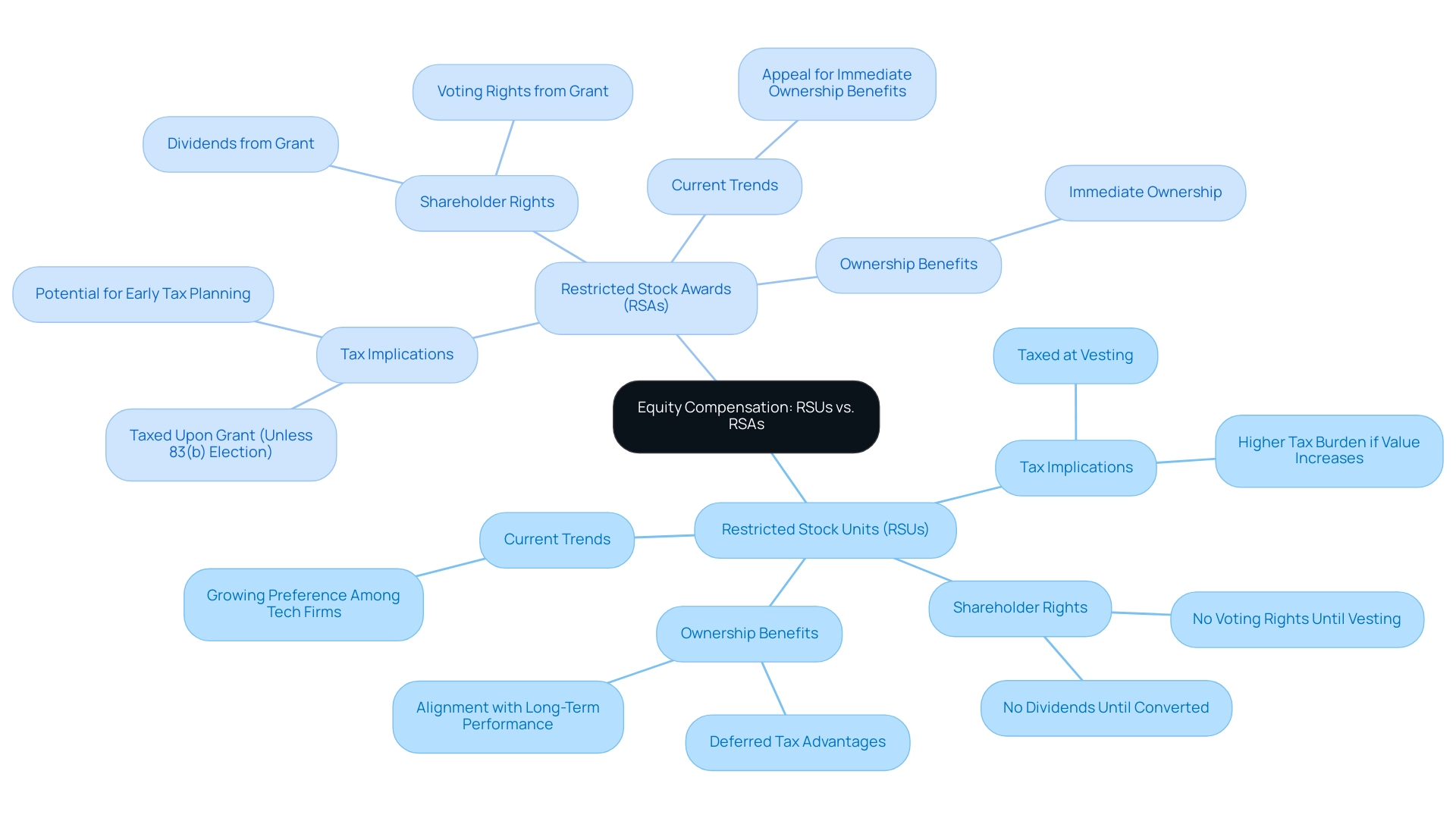

Restricted Stock Units (RSUs) and Restricted Stock Awards are both common forms of equity compensation in the tech industry, yet they come with distinct characteristics that can impact your financial journey. We understand that navigating these options can feel overwhelming. Restricted stock awards provide individuals with actual stocks at the moment of the grant, offering immediate ownership advantages. In contrast, restricted stock units represent a promise to deliver stocks later, contingent on meeting vesting conditions. This distinction is crucial for making informed decisions.

A key difference lies in how these are taxed, which can significantly affect your financial planning. Restricted stock awards are subject to ordinary income tax upon grant unless an 83(b) election is filed. This election allows you to potentially reduce your tax liability by paying taxes based on the fair market value (FMV) at the time of the grant. On the other hand, RSUs are taxed as ordinary income at the time of vesting, which can lead to a higher tax burden if the stock value increases before you vest. For instance, if the FMV at grant is $2 and you sell at $15, your capital gains tax obligation would be evaluated at $13 per unit. This highlights the importance of strategic tax planning, something many of our members have navigated successfully.

In terms of shareholder rights, RSAs typically grant voting rights and dividends from the outset, making them more appealing to employees. Conversely, RSUs do not confer these rights until they are converted into actual shares post-vesting. This difference can influence your decisions regarding your compensation package and overall financial strategy, as many have shared in our community discussions.

Current trends in equity compensation among tech firms in 2025 indicate a growing preference for RSUs, largely due to their deferred tax advantages and alignment with long-term company performance. However, RSAs still hold appeal for their immediate ownership benefits and potential for early tax planning, as many have expressed in our forums.

Real-world examples illustrate the varying tax implications of RSAs and RSUs. A case study on the tax treatment of these awards reveals that understanding the nuances of each can significantly impact your financial planning. Proper tax planning is essential for maximizing equity compensation benefits and minimizing tax burdens, as emphasized by financial advisors in the industry. We know that many of you are seeking clarity in this area, and that’s why we’re here to support you.

As Taavi Roivas, former Prime Minister of Estonia, wisely stated, "Equity compensation is a vital tool for empowering staff and aligning their interests with those of the company."

Additionally, Global Shares offers expertise in equity compensation matters, helping individuals like you navigate the complexities of restricted stock awards and RSUs, ensuring informed decisions. Their commitment to inclusivity aims to make financial superpowers accessible to everyone, enhancing the investment experience for tech investors.

Ultimately, the decision between RSUs and other options should be guided by your financial objectives, tax circumstances, and the specific conditions of your compensation package. By understanding these key differences, you can make more informed decisions that align with your long-term financial strategies. Remember, you are not alone in this journey; our community is here to support you every step of the way.

Pros and Cons of Restricted Stock Awards

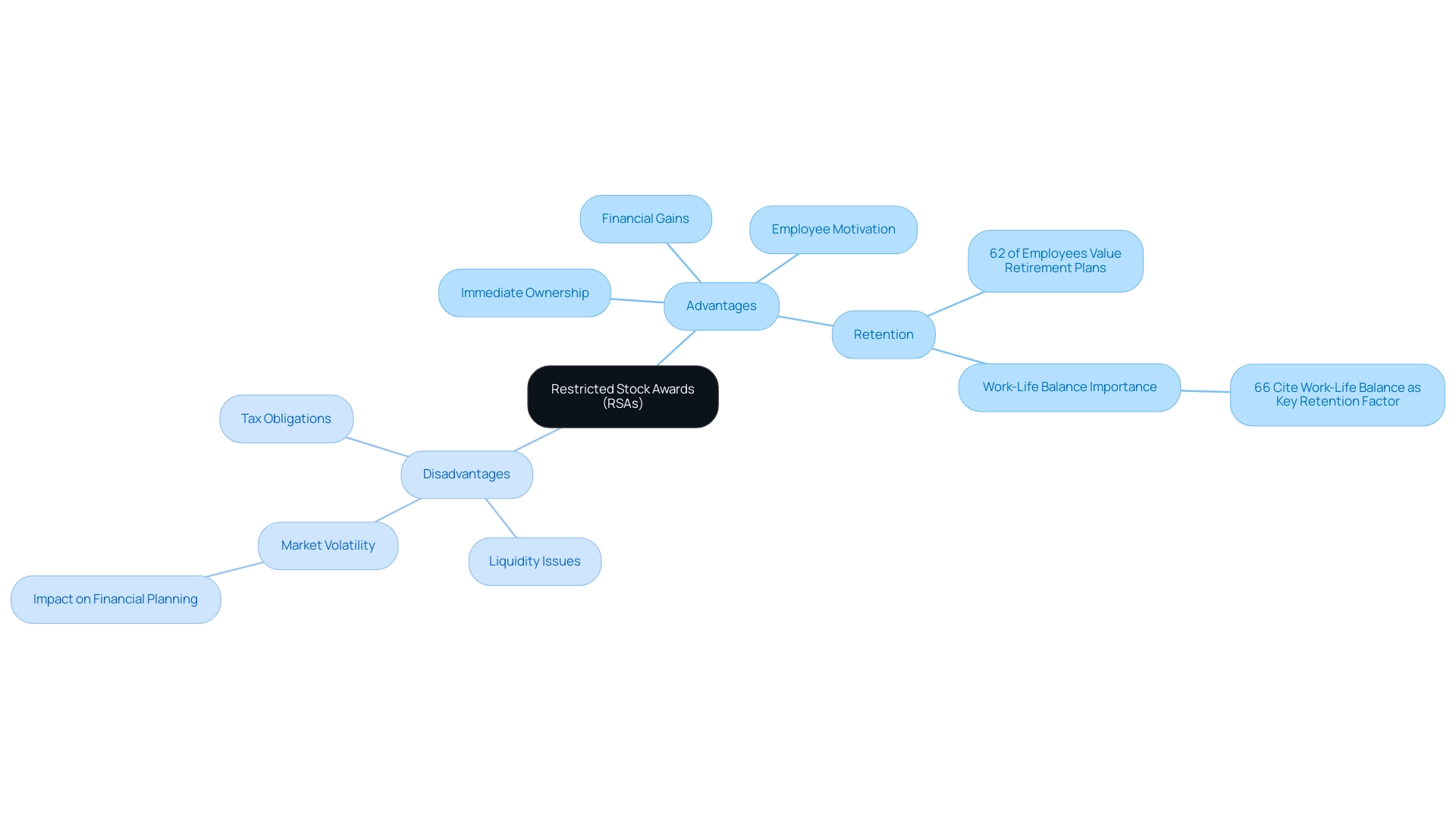

Restricted Stock Awards (RSAs) present a unique opportunity for tech professionals, offering several advantages that can profoundly impact their financial well-being. One of the most significant benefits is the immediate ownership of shares, which can lead to substantial financial gains if the company's stock performs well. This direct stake in the company's success not only incentivizes staff but also nurtures a sense of loyalty and motivation, as their financial outcomes are closely tied to the organization's performance.

Yet, we understand that potential downsides must also be considered. Upon receiving restricted stock awards, individuals face immediate tax obligations, which can pose a financial challenge. Additionally, the limitations on selling stocks until they vest can restrict liquidity, making it difficult for workers to access their funds when they need them most.

In a volatile market, if the company's stock value decreases, staff may find themselves holding shares that are worth less than they anticipated, complicating their financial planning. This situation can be disheartening, and it's crucial to acknowledge these feelings.

Recent studies reveal that restricted stock awards can enhance worker satisfaction and retention in the tech sector. For instance, a notable 62% of staff indicated that retirement schemes, including retirement savings accounts, significantly bolster their financial security, reflecting a growing recognition of the importance of such benefits. Furthermore, expert opinions suggest that these arrangements serve as a powerful tool for attracting and retaining top talent in competitive tech environments.

Key to this discussion is the belief promoted by fff. Club that financial superpowers should be accessible to everyone. This inclusivity resonates deeply with the benefits of retirement savings accounts, empowering individuals to take control of their financial futures.

Case studies from leading technology companies illustrate the positive influence of reward systems on staff loyalty. Organizations that have embraced these strategies often report heightened engagement and dedication from their employees, who feel more invested in the company's future. For instance, companies that expanded mental health coverage have observed a direct link between staff satisfaction and productivity, underscoring the importance of comprehensive benefits.

However, it's essential to remain vigilant. Financial analysts caution that the risks associated with retirement savings accounts, particularly in volatile markets, should not be overlooked. Balancing these advantages and disadvantages is vital for both investors and staff to ensure that restricted stock awards align with their broader financial objectives and strategies. As emphasized in Bank of America’s '2024 Workplace Benefits Report', maintaining a healthy work-life balance is crucial for staff retention, highlighting the necessity for careful evaluation of all benefits, including restricted stock awards.

Understanding the Taxation of Restricted Stock Awards

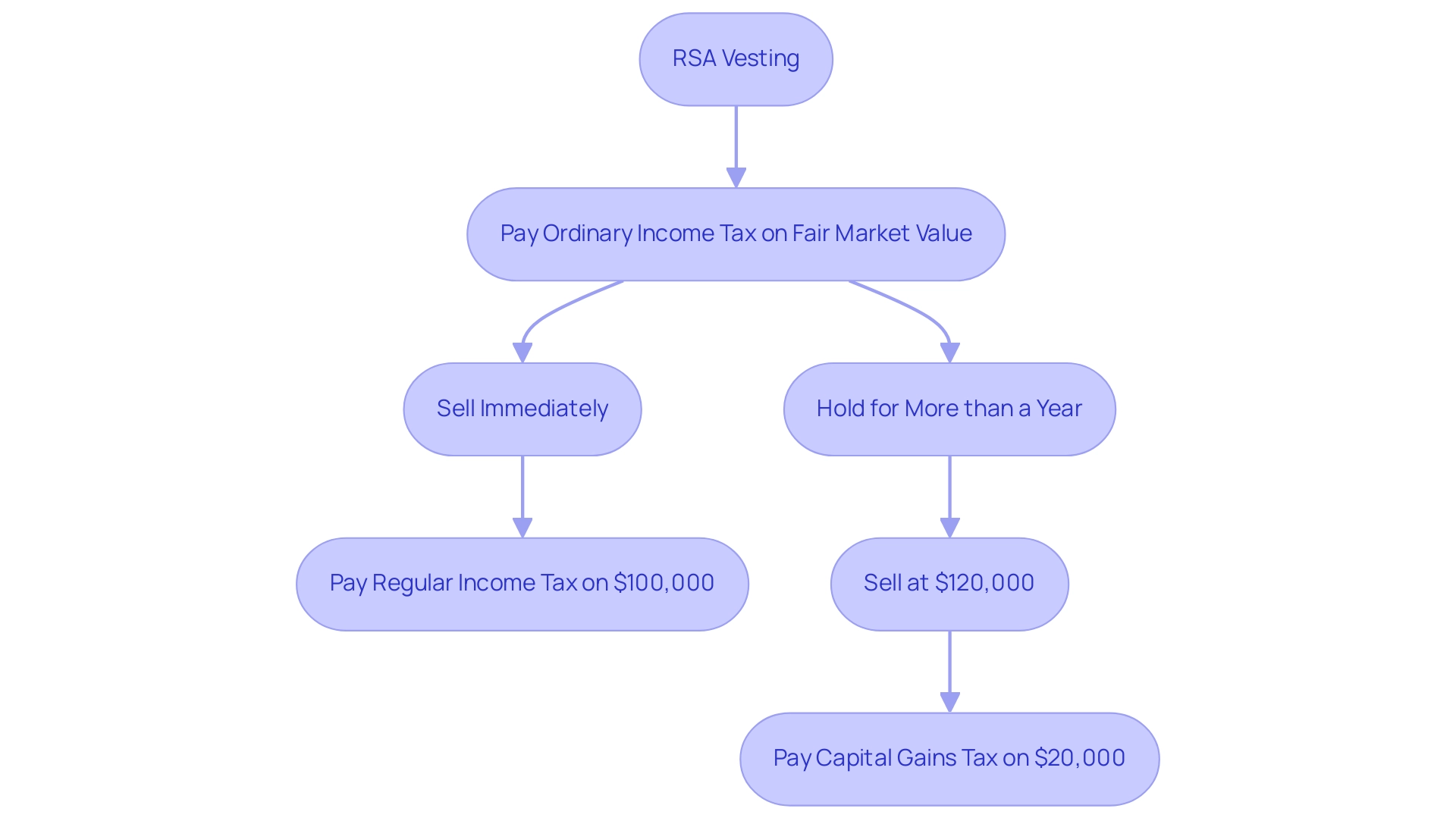

In 2025, understanding the taxation of RSA stock related to Restricted Stock Awards is critical for tech investors. We recognize that when RSAs vest, the fair market value of the RSA stock is classified as ordinary income, meaning employees must pay income tax on this amount at their applicable tax rate. This initial tax obligation can be substantial, particularly in a volatile market where values may fluctuate dramatically.

After vesting, any gains from the sale of these assets are subject to capital gains tax, which varies based on the holding period post-vesting. For instance, selling stocks within a year may incur short-term capital gains tax, which is typically higher than the long-term capital gains tax applied to assets held for over a year. In 2025, current tax rates for capital gains can vary significantly, underscoring the need for effective financial planning.

Moreover, as many of our members have experienced, expert insights from leading members of the fff.club community highlight how timing tax strategies can greatly affect RSA holders' financial outcomes. Tax experts stress that workers should evaluate their financial circumstances and market conditions when determining the right time to sell their RSA stock. This strategic approach can help mitigate tax liabilities and maximize after-tax returns.

Mihkel Torim, a leader in the field and community participant, emphasizes the club's dedication to equipping its members with vital resources and knowledge essential for managing restricted stock awards.

To illustrate, consider a case study where an individual received restricted stock awards that vested at a fair market value of $100,000. If the worker sold the stocks right away, they would face regular income tax on the entire sum. However, if they held the shares for a year and sold them at $120,000, they would only pay capital gains tax on the $20,000 gain, potentially benefiting from a lower tax rate.

Notable members of fff.club, such as Martin Villig, co-founder of Bolt, and Taavi Roivas, former Prime Minister of Estonia, exemplify the caliber of professionals engaged in discussions about restricted stock agreements and their implications. In addition, fff.club hosts regular webinars and workshops focusing on tax strategies and investment insights, providing members with direct access to experts in the field.

By utilizing the community-driven strategy of fff.club, holders of RSA stock can deepen their comprehension of these complexities and make more informed investment choices.

In summary, grasping the tax implications of RSA stock is essential for workers. We understand that by considering the timing of taxation and employing effective financial planning strategies, and by engaging with the knowledgeable community at fff.club, RSA holders can navigate their tax liabilities and enhance their overall investment experience. Join us at our next webinar to learn more about maximizing your investments and hear firsthand experiences from fellow members!

The Vesting Process: How RSAs Work

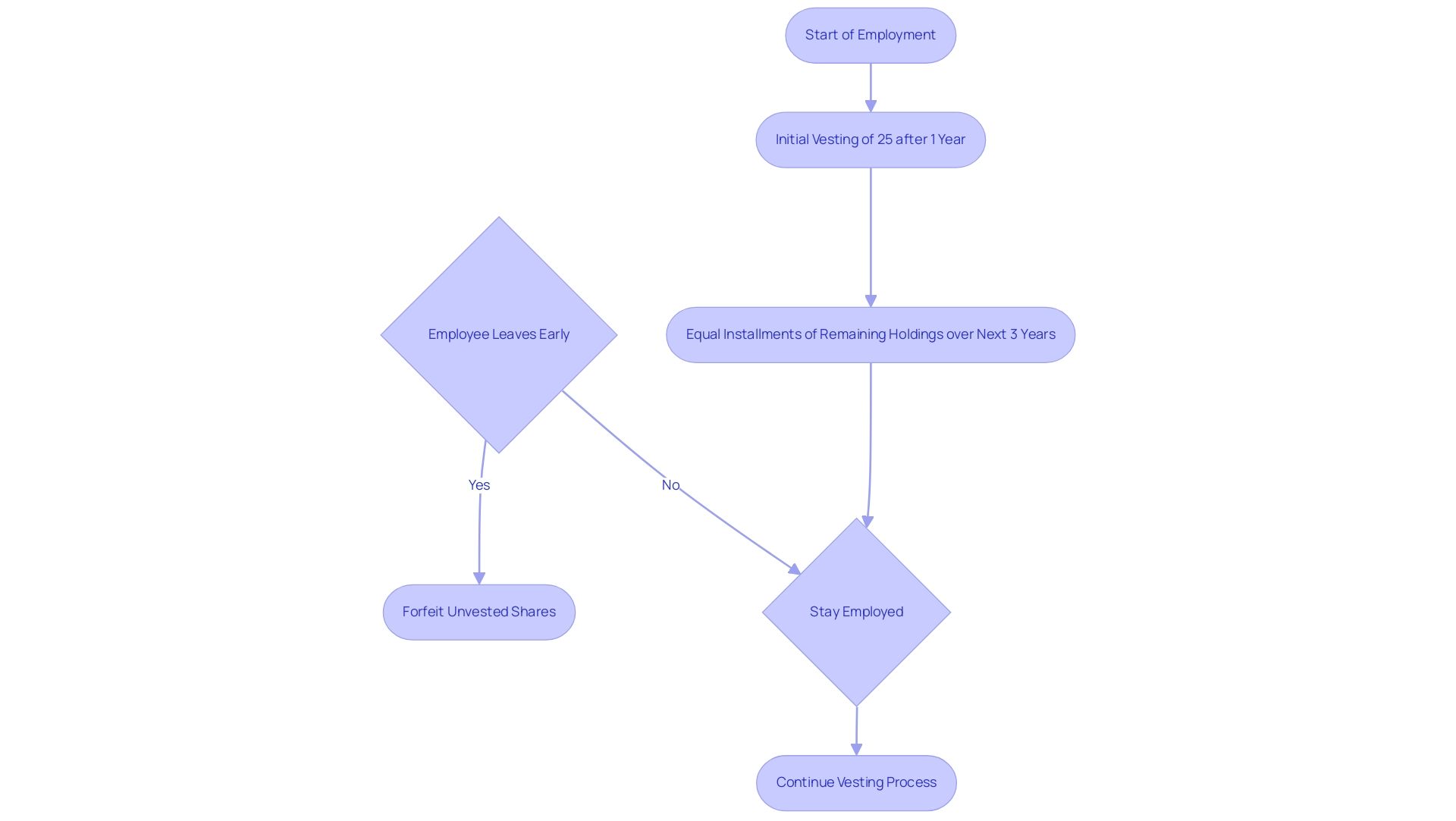

The vesting process for Restricted Stock Awards (RSAs) is a vital aspect of compensation, often following a predetermined schedule that can be either time-based or performance-based. Many employees face the challenge of navigating these complexities; a common structure involves an initial vesting of 25% of the assets after one year of employment, followed by equal installments of the remaining holdings over the next three years. This gradual vesting not only encourages staff to remain with the company but also aligns their interests with long-term organizational success.

Understanding the specifics of one's vesting schedule is crucial, as it directly impacts financial planning and tax liabilities. We understand that if a worker leaves before their stocks are fully vested, they risk losing any unvested stocks, which can significantly affect their overall compensation package. In 2025, statistics indicate that approximately 30% of individuals in tech companies forfeit unvested shares, highlighting the importance of being aware of vesting terms.

Recent trends in the tech industry reveal a shift towards more flexible vesting schedules, with companies increasingly adopting performance-based criteria alongside traditional time-based vesting. This evolution reflects a growing recognition of the need to align staff performance with company goals. As many of our members have experienced, regular evaluation of RSU performance is essential for ensuring these awards align with financial objectives, allowing employees to feel adequately rewarded for their contributions.

As Mihkel Torim, an industry leader, notes, "The club's commitment to equipping members with the necessary insights and resources to make informed decisions" is vital in navigating these complexities.

Case studies reveal effective strategies for tax planning and diversification related to retirement savings accounts, particularly emphasized in the case study titled 'Strategies for Tax Planning and Diversification.' These strategies illustrate the importance of portfolio diversification and tax-loss harvesting to maximize returns. Implementing these strategies can significantly reduce overall tax liability and mitigate investment risk, paving the way for a more stable financial future.

Notable members of the fff.club, such as Martin Villig, co-founder of Bolt, and Taavi Rõivas, former Prime Minister of Estonia, enrich the diverse knowledge pool within our community, reinforcing the importance of understanding risk-sharing agreements in the tech sector.

In summary, the vesting process of RSA stock awards is not merely a procedural formality; it plays a pivotal role in shaping worker compensation and financial outcomes in the tech sector. As the landscape continues to evolve, staying informed about vesting schedules and their implications is vital for tech investors and employees alike. We are here to support you on this journey.

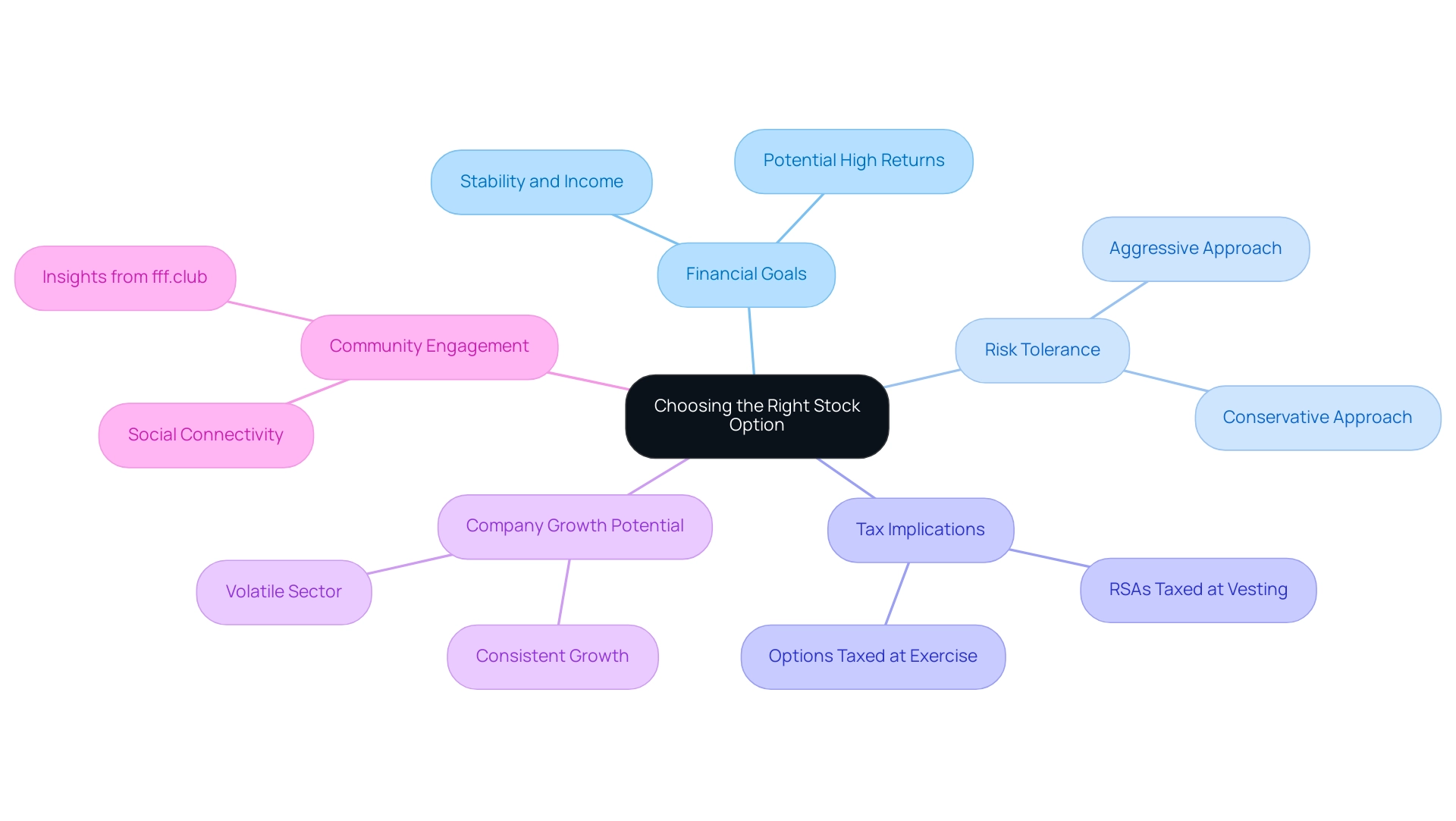

Choosing the Right Stock Option: Strategic Considerations for Investors

When navigating the choice between Restricted Stock Awards and other stock options, we understand that tech investors face a complex decision-making process. It’s essential to evaluate several strategic factors, especially in the context of community engagement and shared insights available at fff.club regarding rsa stock. Aligning these options with your financial goals and risk tolerance is not just important; it’s crucial for your peace of mind. These investments often attract individuals who value prompt ownership and the possibility of dividends, making them a reliable option for those seeking stability and income.

Conversely, stock options may appeal to those looking for higher leverage and the potential for substantial rewards, particularly in our rapidly growing tech environment. We recognize that the allure of greater returns can be enticing, but it’s vital to weigh this against your personal financial situation.

Tax implications also play a significant role in this decision-making process. Restricted stock awards are taxed upon vesting, which can lead to immediate tax liabilities, while stock options are taxed at the time of exercise. This distinction allows for more strategic tax planning, and understanding these nuances can significantly impact your overall financial strategy.

Moreover, assessing the company's growth potential and the historical performance of rsa stock is essential. These factors directly influence the value of your equity compensation. For instance, if a company has demonstrated consistent growth and a strong market position, such assets may provide a more secure investment. In contrast, if the company is in a volatile sector with high growth potential, stock options might offer greater upside. As many of our members have experienced, this careful assessment can lead to more informed decisions.

As Gordon Brown noted in his review for the Labour Party in 2022, improving governance is crucial for informed decision-making. This resonates deeply with our community, emphasizing the need for tech investors to make strategic choices regarding their equity compensation. Additionally, referencing Putnam's work highlights the importance of social capital for economic mobility and community well-being. Engaging with a community of over 410 tech professionals at fff.club can enhance your investment strategies and foster valuable connections.

The case study titled "The Role of Social Connectivity" illustrates how social connectivity contributes to well-being and can influence investment strategies. It reinforces the idea that collaboration among investors can lead to better outcomes. Ultimately, the choice between restricted stock awards and stock options should reflect your individual financial situation and long-term investment strategy. As trends in equity compensation evolve, staying informed about current preferences among tech investors can further guide your choice.

In 2025, many investors are leaning towards RSA stock due to its perceived stability and immediate benefits, while others remain drawn to the potential high returns of stock options. Engaging with fellow investors and leveraging community insights—echoing founder Akim Arhipov's commitment to inclusivity—can significantly enhance your understanding and help you make a more informed decision. Additionally, fff.club offers unique opportunities for deal flow, due diligence, and co-investing across venture capital, private credit, and real estate, along with weekly tech and economic updates to ensure you are always informed and empowered in your investment journey.

Conclusion

The discussion surrounding Restricted Stock Awards (RSAs) underscores their growing significance in the tech industry as a valuable resource for employee compensation. By granting immediate ownership of shares, RSAs nurture a sense of loyalty and align employees’ financial success with the company’s performance. We understand that this approach is increasingly being adopted by tech firms, reflecting their effectiveness in attracting and retaining top talent.

However, understanding the nuances of RSAs, including their tax implications and vesting processes, is crucial for both employees and investors. The immediate tax liabilities associated with RSAs can pose challenges, and as many of our members have experienced, strategic planning and awareness of market conditions can help mitigate these risks. Furthermore, the vesting schedule plays a pivotal role in shaping employees' financial outcomes, emphasizing the need for careful consideration of individual circumstances and company goals.

Ultimately, as the landscape of equity compensation continues to evolve, RSAs stand out for their potential to enhance employee satisfaction and commitment. By embracing these awards, companies can cultivate a workforce that feels invested in their collective success, paving the way for a more engaged and productive environment. Engaging with communities like fff.club can further empower employees and investors alike, providing valuable insights and resources to navigate the complexities of equity compensation effectively. As the tech industry progresses, we believe the strategic use of RSAs will likely remain a cornerstone of effective talent management and financial planning.