Overview

Understanding ABIO stock involves analyzing its potential as an investment, particularly in the context of its focus on cardiovascular therapies and recent strategic developments. The article highlights that while ABIO is currently operating at a loss, its promising drug pipeline, strategic partnerships, and recent merger news position it favorably for future growth, making it a compelling option for investors willing to navigate the inherent risks of the biotech sector.

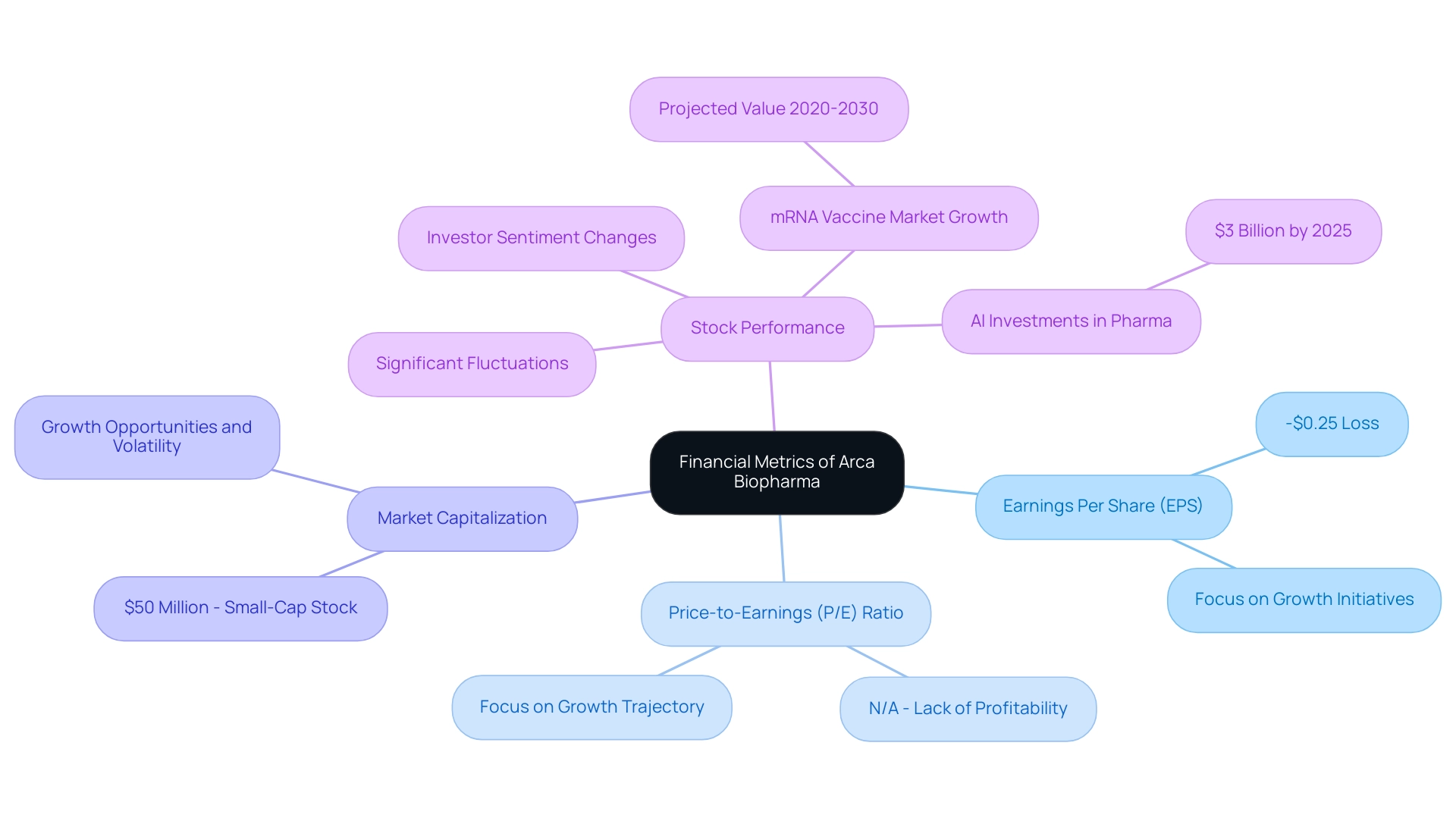

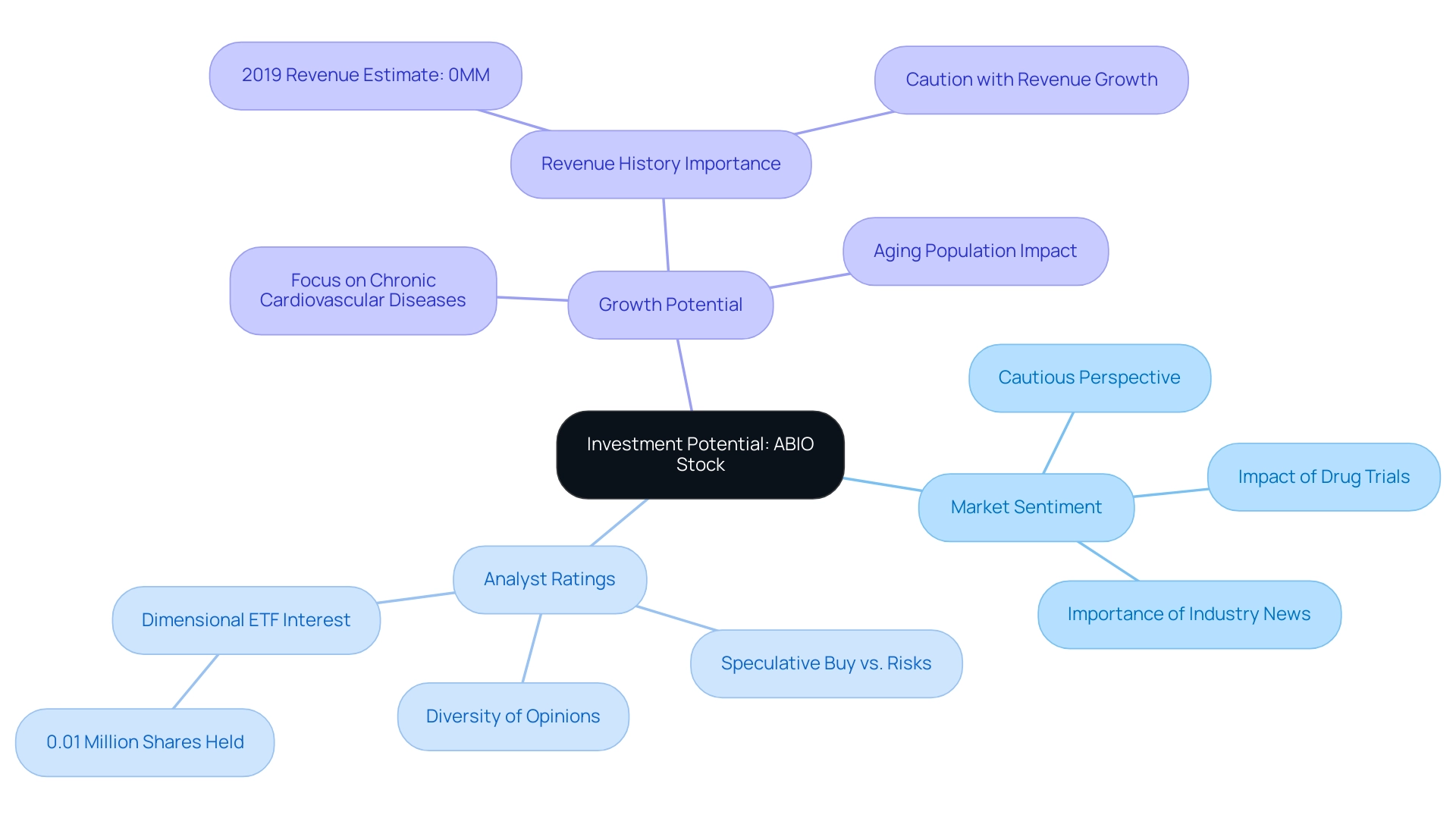

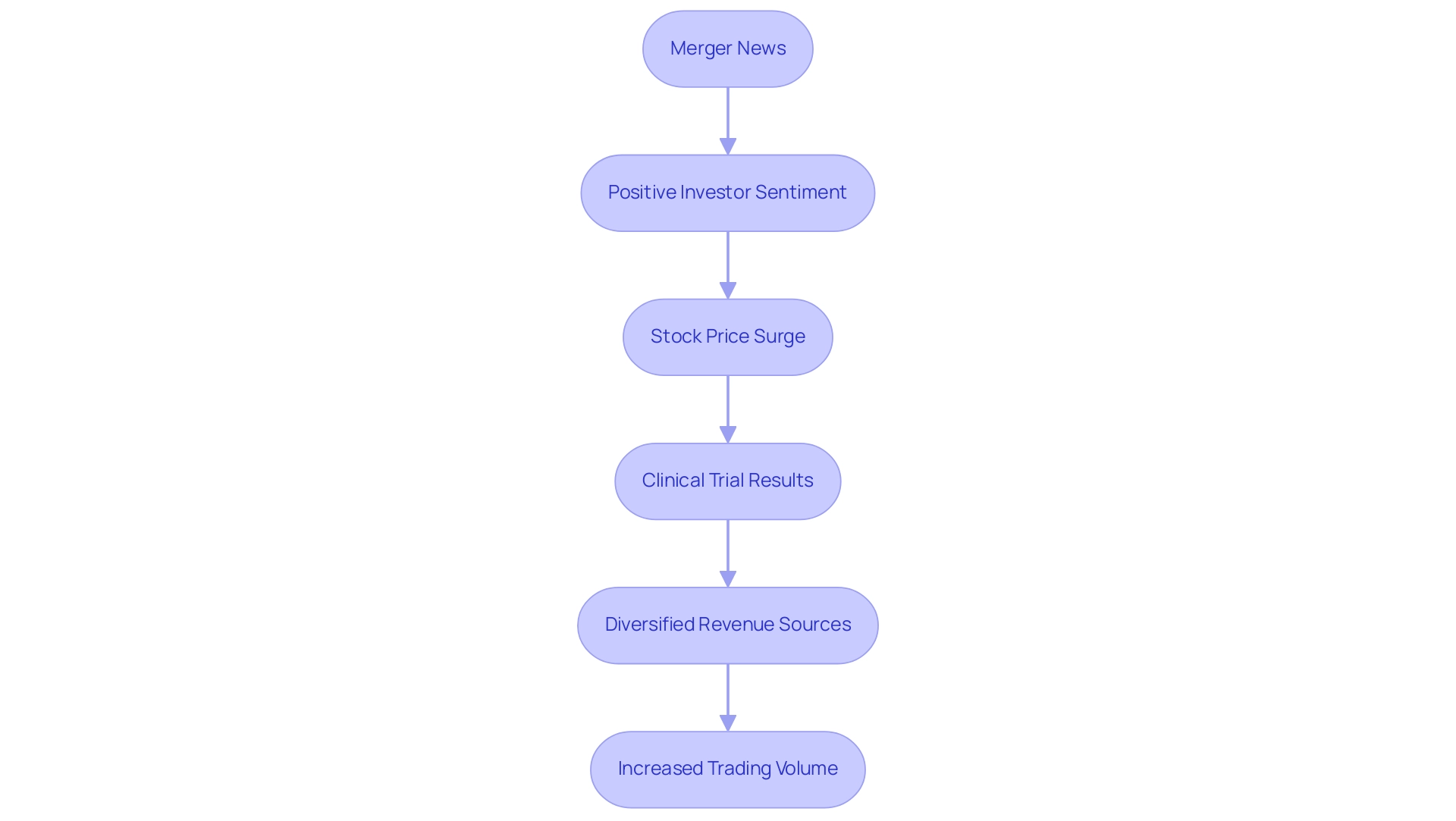

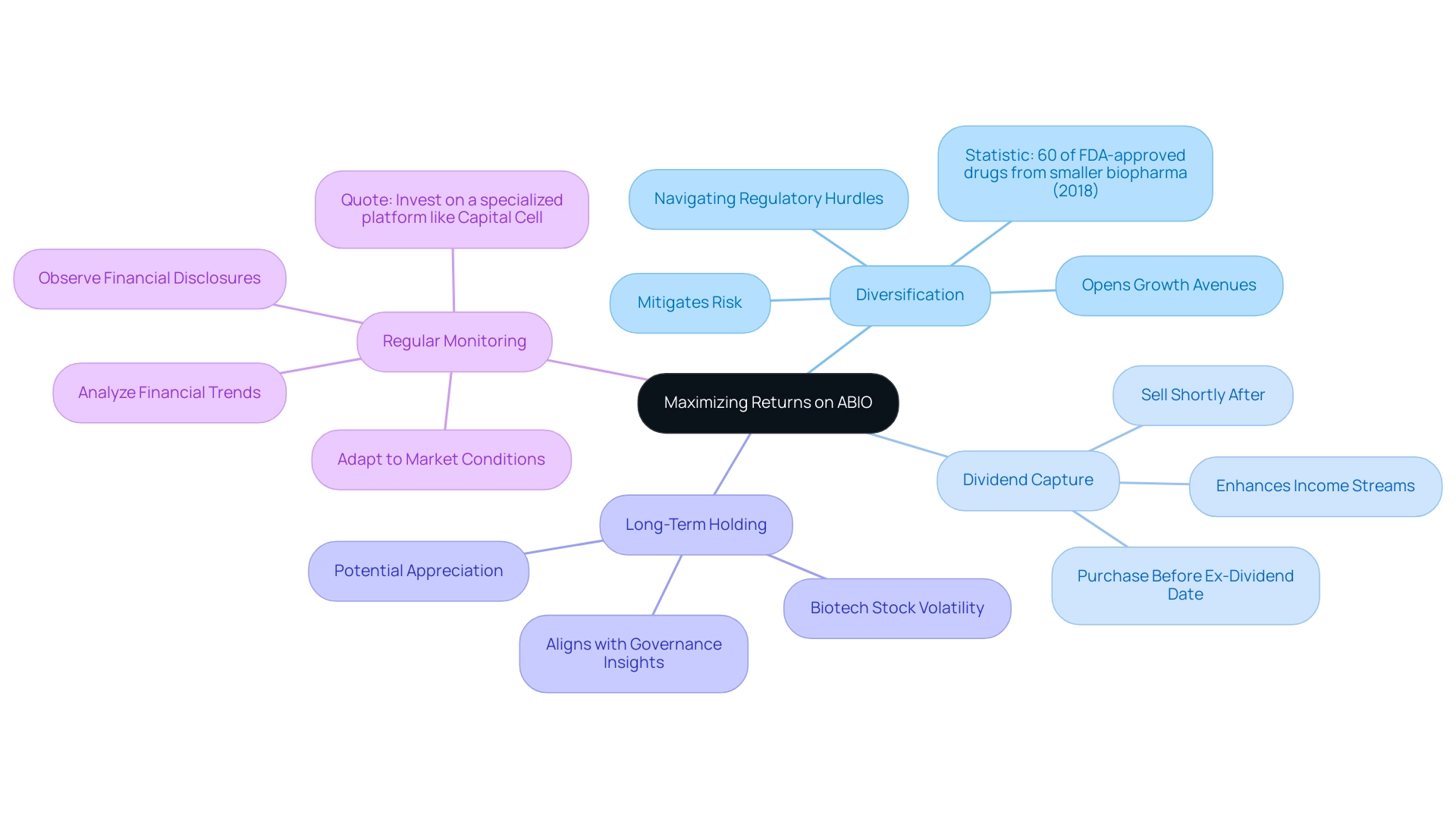

Introduction

Arca Biopharma Inc. (ABIO) stands at a crucial intersection of innovation and opportunity within the biopharmaceutical landscape, particularly in the realm of cardiovascular therapies. Established in 2004, this Colorado-based company is dedicated to addressing significant unmet medical needs through targeted research and strategic partnerships.

As the biotech sector continues to evolve, ABIO is making notable strides in its clinical programs, driven by collaborations with leading research institutions that deepen its understanding of cardiovascular diseases.

With a focus on the development of novel therapies, investors are increasingly drawn to ABIO's potential as they evaluate the dynamics of the market.

This article delves into ABIO’s financial metrics, stock performance, recent developments, and strategic investment approaches, providing a comprehensive overview for those considering the implications of investing in this promising biopharmaceutical firm.

Overview of Arca Biopharma Inc. (ABIO)

Arca Biopharma Inc. (NASDAQ: ABIO), a distinguished biopharmaceutical firm, is dedicated to developing targeted therapies specifically for cardiovascular diseases, which positively impacts the abio stock. Established in 2004 and headquartered in Westminster, Colorado, Arca Biopharma is at the forefront of addressing significant unmet medical needs through its innovative research and development efforts. In recent years, the company has made substantial strides in forming strategic partnerships that bolster its clinical programs, enabling it to expedite the development of novel therapies.

For instance, the collaboration with leading research institutions has provided critical insights into cardiovascular pathophysiology, which is pivotal for the advancement of its drug pipeline. Notably, a recent article titled 'Statistical Consideration for Fit-for-Use Real-World Data to Support Regulatory Decision Making in Drug Development' received 703 views, underscoring the growing interest in the methodologies that support drug development. Additionally, studies such as those by Yu et al. (2021), which associate clonal hematopoiesis with incident heart failure, highlight the importance of understanding underlying conditions in cardiovascular disease research.

Investors should closely monitor Arca Biopharma's ongoing clinical trials and partnerships, as these initiatives reflect its commitment to innovation and could significantly influence abio stock in the biotech landscape. Furthermore, as Musunuru noted regarding Verve Therapeutics' bold step in applying genomic editing technology to permanently delete the PCSK9 gene in vivo, such advancements are shaping the future of cardiovascular therapies.

With a keen focus on cardiovascular therapies, Arca Biopharma offers a compelling opportunity for those evaluating the dynamics of the biotech market in 2024, especially considering the growing emphasis on drug therapies that address this critical health sector.