Overview

The article delves into the vital strategies for comprehending and distributing equity in startups, recognizing its importance for founders, employees, investors, and advisors. We understand that effective equity allocation can be a challenge, yet it plays a crucial role in fostering motivation, collaboration, and transparency. These elements are essential for attracting talent and ensuring the long-term success of new ventures.

As many of our members have experienced, the right approach to equity can make all the difference, as evidenced by statistical insights and expert opinions shared throughout our discussion. By nurturing these practices, we can create a supportive community that thrives together.

Introduction

In the vibrant world of startups, equity distribution stands as a cornerstone of success, influencing everything from decision-making to attracting investors. We understand that as founders and investors navigate this intricate landscape, grasping the nuances of equity is essential.

With various forms of equity, such as common stock and options, each carrying distinct implications, the stakes are high for all stakeholders involved. Many of our members have experienced the challenges that arise in this area.

Current trends reveal a shifting paradigm where effective equity strategies not only foster collaboration but also enhance the longevity of startups in an increasingly competitive market. As the startup ecosystem evolves, we cannot overstate the importance of transparency and equitable practices.

It is imperative for both new and seasoned players to recognize the critical role equity plays in driving innovation and growth, and we are here to support you in this journey.

What is Startup Equity and Why It Matters

Ownership shares represent the vital stake held by individuals or organizations in a new venture, which is essential for establishing equity in startups and nurturing the entrepreneurial ecosystem. This aspect dictates how profits, losses, and control are shared among stakeholders, underscoring the importance of equity in startups for both founders and investors to fully understand its implications. Equity can take various forms, such as common stock, preferred stock, and options, each carrying unique characteristics and consequences for ownership and control.

Understanding equity in startup ownership distribution is crucial, as it directly impacts decision-making, investment strategies, and the overall success of the startup. For instance, ownership serves not only as a powerful motivator for employees, aligning their interests with the company's growth but also plays a significant role in attracting investors. Investors are keen to evaluate the ownership structure established by founders to gauge their potential returns.

As many of our members have experienced, platforms like fff.club provide tech investors with exclusive opportunities for deal flow, due diligence, and co-investing in sectors such as venture capital, private credit, and real estate, empowering them to make informed decisions. Specific opportunities include curated investment rounds and collaborative projects with industry leaders, offering members a competitive edge.

Current data indicates that by 2025, the landscape of new business ownership allocation is evolving. Notably, 39.60% of businesses established in 2017-18 have thrived for five years, highlighting the significance of effective financial strategies in fostering longevity. Moreover, sector-specific insights reveal that information enterprises face a staggering 63% failure rate, emphasizing the dangers associated with inadequate ownership distribution strategies.

This case study on failure rates by industry serves as a crucial reminder of the need for effective resource management.

The importance of fairness in new business success cannot be overstated. It is a key factor that influences not only the operational dynamics within the company but also the external perception by potential investors. As industry leaders emphasize, a well-organized ownership distribution can enhance equity in startups, thereby increasing a new venture's appeal and making it more attractive to investors seeking viable opportunities.

Chris Demetriou, Head of Business Advisory, notes, "The entrepreneurial spirit and ambition of people in the UK, coupled with the relative ease with which it’s possible to start a business here, make this one of the best places to start up anywhere."

Furthermore, the ongoing focus on equity in startup environments, along with diversity, fairness, and inclusion within private markets, has shown modest progress, with women representing 35% and ethnic and racial minorities 30% of the workforce as of year-end 2022. This shift reflects a growing acknowledgment of the significance of equity in startup practices in fostering innovation and success within the entrepreneurial ecosystem. The inclusivity approach of fff.club aims to make financial superpowers accessible to everyone, enhancing the investment experience for all members through community engagement and educational resources. Founders Akim Arhipov and Tim Vaino emphasize this commitment, stating, "We believe that financial superpowers should belong to everyone. Just take it!"

In conclusion, understanding ownership shares and their allocation is essential for investors navigating the complexities of the entrepreneurial environment. By grasping the nuances of fairness, investors can make informed decisions that align with their investment strategies, ultimately driving meaningful outcomes in the dynamic tech market.

Key Stakeholders in Startup Equity Distribution

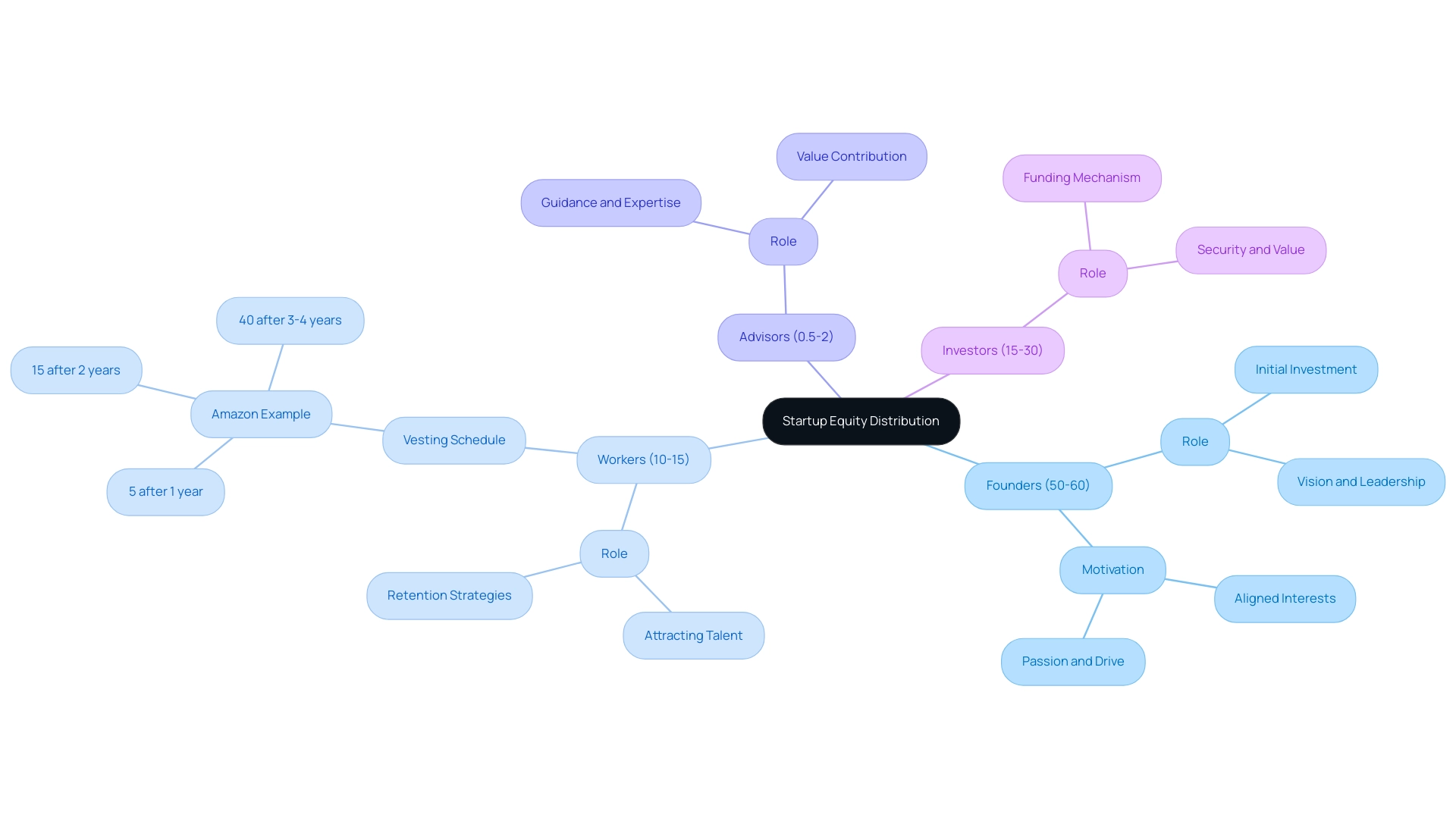

In the realm of new ventures, the distribution of equity in startup ownership is a crucial element that significantly influences the interactions among various stakeholders. We understand that navigating these dynamics can be challenging, particularly for tech investors who are deeply invested in the success of their ventures. The primary groups involved typically include:

- Founders: Generally, founders hold the largest equity stakes, reflecting their substantial initial investment of time, resources, and vision. This notable ownership not only motivates them to advance the business but also aligns their interests with the long-term success of the venture. Many of our members have shared how this commitment fuels their passion and drive.

- Workers: To attract and retain skilled individuals, new companies frequently include shares in their compensation packages. This strategy aligns employee interests with the organization's performance, fostering a sense of ownership and commitment. In 2025, the typical ownership share for employees in new ventures is projected to be approximately 10-15%, varying based on their position and the phase of the company. For instance, at Amazon, 5% of employees’ shares vest after one year, 15% after two years, and 40% after the third and fourth years, demonstrating how ownership can be structured over time. We recognize that this approach can create a more engaged workforce, which is essential for any startup’s growth.

- Advisors: Advisors play a pivotal role in guiding new ventures through early-stage challenges. In return for their expertise, they may receive shares, which can range from 0.5% to 2% of the company, depending on their level of involvement and the value they contribute. Their insights can be invaluable, and we appreciate the dedication they bring to the table.

- Investors: Equity in startups serves as a primary mechanism for attracting investment. Venture capitalists and angel investors typically receive shares in exchange for their funding, with average stakes varying widely based on the investment round and the company's valuation. In 2025, it is typical for early-stage investors to possess between 15% to 30% of a new venture's ownership. We understand how important it is for investors to feel secure and valued in their contributions.

The allocation of equity in startup shares among these stakeholders greatly affects their motivation and dedication to the startup's success. A well-organized ownership plan can enhance founder motivation, as they are directly rewarded for the company's growth. Conversely, disparities in equity allocation can lead to tensions among stakeholders, particularly if employees feel undervalued compared to founders or investors. We empathize with those feelings, as they can create a challenging environment.

Current views from venture capitalists highlight the significance of equity allocation strategies. Many advocate for a balanced approach that ensures equity by adequately incentivizing all key stakeholders, thereby fostering a collaborative environment conducive to innovation and growth. As Taavi Roivas, former Prime Minister of Estonia, wisely stated, 'Equity allocation is not just about numbers; it’s about creating a culture of shared success.' This sentiment resonates deeply within our community.

Statistics reveal that in 2025, the average ownership stakes for founders hover around 50-60%, while employees and advisors typically receive smaller portions. Significantly, the failure rate for Australian startups surpasses 75%, highlighting the essential requirement for effective ownership allocation strategies that can improve survival rates across sectors. We recognize that these figures can be daunting, but they also underscore the importance of thoughtful planning.

A recent case study on private debt resilience demonstrates the significance of strategic asset allocation. In a challenging year for private markets, firms that maintained fair stakeholder relationships saw better fundraising outcomes and investment returns, highlighting the role of fairness in fostering commitment and resilience. We believe that nurturing these relationships is key to long-term success.

Grasping these dynamics is crucial for technology investors aiming to navigate the intricacies of company ownership distribution effectively. Additionally, with female representation in entry-level positions approaching gender parity at 48%, it is vital for investors to consider diversity in their investment strategies, as it can lead to more innovative and resilient new ventures. We support efforts to promote inclusivity, knowing it enriches our community and fosters innovation.

Strategies for Splitting Equity Among Co-Founders

When it comes to splitting equity among co-founders, it’s important to recognize the various strategies that can promote fairness and align with individual contributions, addressing the concerns many face in this critical area:

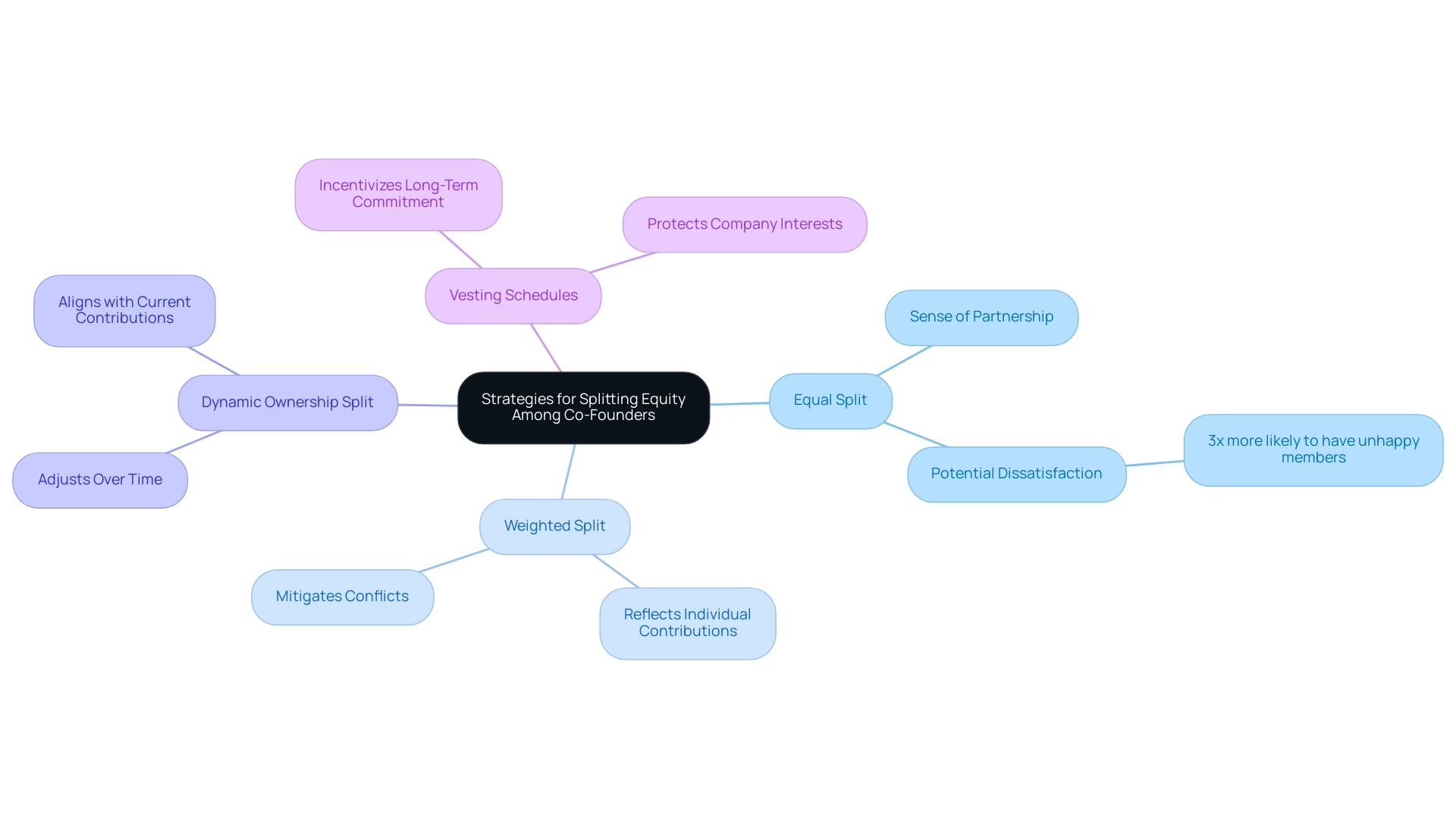

- Equal Split: This straightforward approach divides equity equally among co-founders, fostering a sense of partnership and unity. However, it may not accurately reflect the varying levels of contribution and commitment from each member, potentially leading to dissatisfaction. In fact, startups that default to an even-split model are three times more likely to have dissatisfied founding team members, emphasizing the importance of considering individual contributions when determining ownership shares.

- Weighted Split: In this model, ownership is allocated based on the specific contributions of each co-founder. Factors such as time commitment, expertise, and initial investment are considered, allowing for a more equitable allocation that reflects the true value each member brings to the table. This method can help mitigate conflicts and ensure that all co-founders feel valued, especially when discussing equity in startup.

- Dynamic Ownership Split: This innovative approach allows for adjustments in ownership distribution over time, based on ongoing contributions. By continuously evaluating each co-founder’s involvement and the value they add, this method ensures that equity in startup remains aligned with current contributions, fostering a collaborative environment. This adaptability can be crucial in the fast-paced entrepreneurial landscape, where roles and contributions may evolve.

- Vesting Schedules: Implementing vesting schedules is a strategic way to protect the company’s interests. By ensuring that co-founders receive their ownership over a specified period, vesting reduces the risk associated with early departures. This method not only incentivizes long-term commitment but also aligns the interests of all co-founders with the startup’s success.

It is essential to remember that the amount of ownership in a company is finite, so careful calculation is necessary when determining how much to give away. In 2019, for example, the primary co-founder of three-member teams held 50% of the ownership, but by 2024, this portion had decreased to 44%, while the third co-founder’s stake increased from 13% to 22%. This change demonstrates the dynamic character of ownership allocation and the significance of frequently reevaluating equity in startup divisions to accurately represent contributions.

Expert opinions emphasize the significance of these strategies. Noam Wasserman, founding director of USC’s Founder Central Initiative, notes that ownership disputes can overshadow even the most successful liquidity events, stating, "I’ve been at big liquidity events where everyone should be celebrating, but two of the three founders say, ‘The third is getting more than he deserves.’" This underscores the need for clear and fair ownership distribution methods to prevent conflicts and promote a harmonious working relationship among co-founders.

Ultimately, the selection of ownership distribution strategy can significantly influence equity in startup success. By carefully considering the implications of each method and employing effective strategies for dividing resources, co-founders can foster a collaborative environment that drives innovation and growth. Insights from the case study titled "Best Co-Founder Ownership Distribution Strategies in 2025" further highlight the importance of fairness and future collaboration, presenting techniques such as proportional to contributions and role-based allocation to help founders navigate the complexities of ownership splits.

Equity Compensation: Attracting and Retaining Talent

Equity in startup compensation is a vital strategy for startups aiming to attract and retain top talent. We understand that navigating the complexities of compensation can be challenging, and it’s important to acknowledge these hurdles. Here are several key considerations:

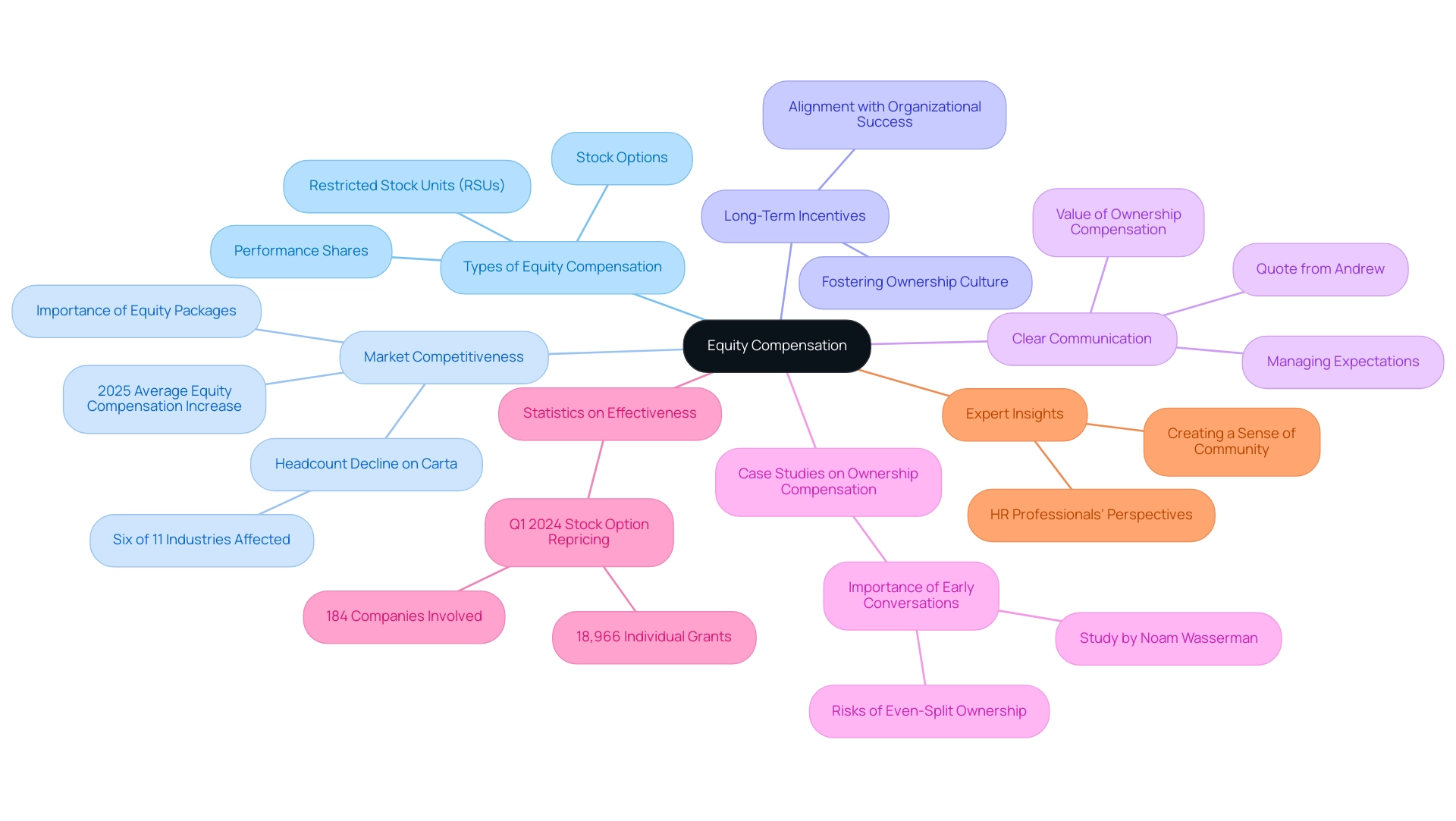

- Types of Equity Compensation: Startups can offer a variety of equity compensation forms, including stock options, restricted stock units (RSUs), and performance shares. Each type has its unique advantages and can be customized to satisfy the requirements of both the organization and its employees. As many of our members have experienced, having options can make a significant difference in feeling valued and engaged.

- Market Competitiveness: Structuring ownership compensation packages that provide equity in startups is crucial for attracting top talent, particularly when cash salaries may not match those offered by established companies. In 2025, the average equity compensation packages in tech companies have shown a significant increase, reflecting the growing importance of these incentives in recruitment strategies. We recognize that in the first four months of 2024, total net headcount on Carta declined for six of the 11 primary industries tracked, indicating a challenging market environment that startups must navigate.

- Long-Term Incentives: Equity in startup compensation aligns employees' interests with the organization's long-term success, motivating them to contribute to growth and profitability. This alignment is particularly effective in fostering a sense of ownership among employees, which can lead to enhanced performance and commitment. It’s heartening to see how shared goals can create a thriving workplace culture.

- Clear Communication: Effectively conveying the value of ownership compensation is essential. Workers must comprehend how their ownership share can increase as the business expands. This clarity not only helps in managing expectations but also reinforces the potential financial benefits tied to their contributions. As Andrew noted from his experience with executive candidates, "I much appreciated Andrew’s availability, openness and care," highlighting the importance of communication in fostering trust and understanding.

- Case Studies on Ownership Compensation: Research indicates that startups that engage in early discussions about ownership arrangements are more likely to maintain satisfied founding teams. A study by Noam Wasserman highlights that those who default to even-split ownership without discussing individual contributions often encounter dissatisfaction and conflicts during crucial organizational milestones. This underscores the necessity of having open and thorough discussions about profit divisions early on, ensuring that everyone feels heard and valued.

- Statistics on Effectiveness: In the first quarter of 2024, 184 companies on Carta repriced nearly 19,000 individual stock option grants, reflecting the importance of equity in startup strategies as a response to market conditions. This trend highlights the significance of adjusting compensation strategies to stay effective in attracting and retaining talent, a critical aspect of fostering a supportive work environment.

- Expert Insights: HR professionals emphasize that well-structured compensation packages can significantly enhance equity in startup efforts to attract top talent. By providing attractive ownership shares, new businesses can establish themselves as appealing employers in a tough market, creating a sense of community and shared purpose.

By utilizing these strategies, new ventures can develop effective compensation packages that not only attract talent but also promote a culture of collaboration and shared success. Moreover, platforms such as fff. Club improve the investment experience by facilitating co-investing and education, which can further impact ownership compensation strategies in new ventures. We believe that by coming together and sharing experiences, we can create a more supportive environment for everyone involved.

Equity for Advisors and Investors: Best Practices

When it comes to distributing ownership to advisors and investors, we understand that navigating this process can be challenging. It’s vital to follow several best practices that can significantly influence the success of your new venture:

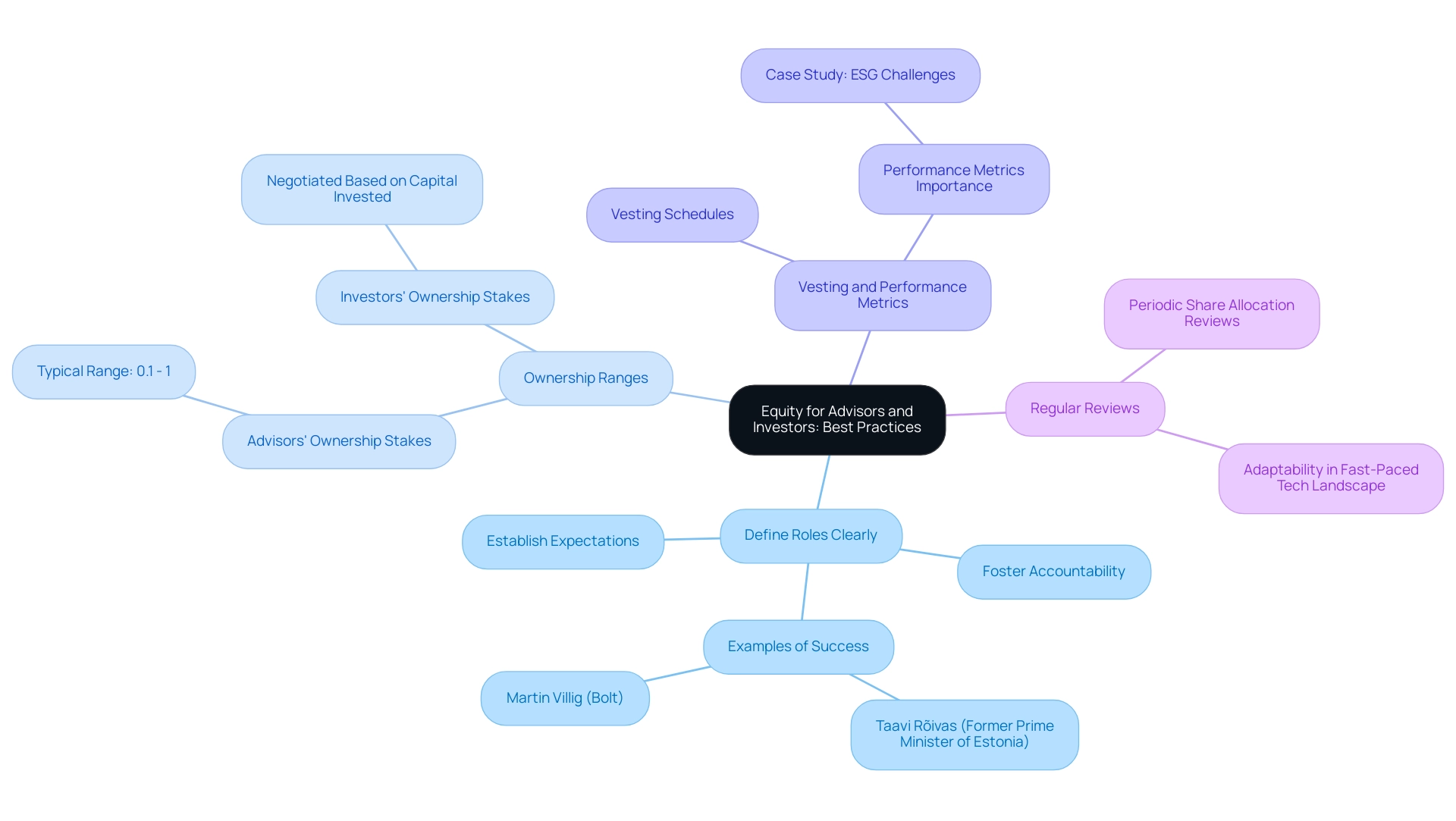

- Define Roles Clearly: Establishing clear expectations regarding the contributions and responsibilities of advisors and investors is essential. This clarity not only justifies their ownership stakes but also fosters accountability and alignment with the startup's goals. As many of our members have experienced, notable figures like Martin Villig, co-founder of Bolt, and Taavi Roivas, former Prime Minister of Estonia, exemplify how clear role definitions can lead to successful ownership allocation practices.

- Ownership Ranges: We understand that determining ownership stakes can be daunting. In 2025, ownership stakes for advisors typically range from 0.1% to 1%, influenced by their level of involvement and expertise. For investors, these stakes are often negotiated based on the capital invested, reflecting the risk and potential return associated with their contributions. Insights shared by the diverse community at fff.club, where over 400 tech investors collaborate, highlight the importance of careful consideration in ownership negotiations.

- Vesting and Performance Metrics: Implementing vesting schedules and performance metrics is vital to ensure that ownership is earned based on actual contributions and results. This practice encourages advisors and investors to stay engaged and dedicated to the venture's success. The complexities of share allocation are further illustrated by the case study on ESG challenges, where investment managers face difficulties in ensuring data reliability and regulatory compliance. This underscores the importance of performance metrics in share distribution, a concern that resonates with many in our community.

- Regular Reviews: Periodically reviewing share allocations is necessary to ensure they remain aligned with the evolving contributions of advisors and investors. We recognize that adaptability is particularly important in the fast-paced tech landscape, where roles and market conditions can change rapidly. The fff.club's dedication to inclusivity seeks to make financial superpowers available to all, emphasizing that a collaborative environment is crucial for effective resource distribution strategies.

By adhering to these best practices, startups can develop a fair and motivating resource distribution strategy that not only attracts top talent but also cultivates a collaborative atmosphere favorable to growth and innovation. This nurturing approach is essential for maintaining equity in startups through the collective resources of the fff.club community.

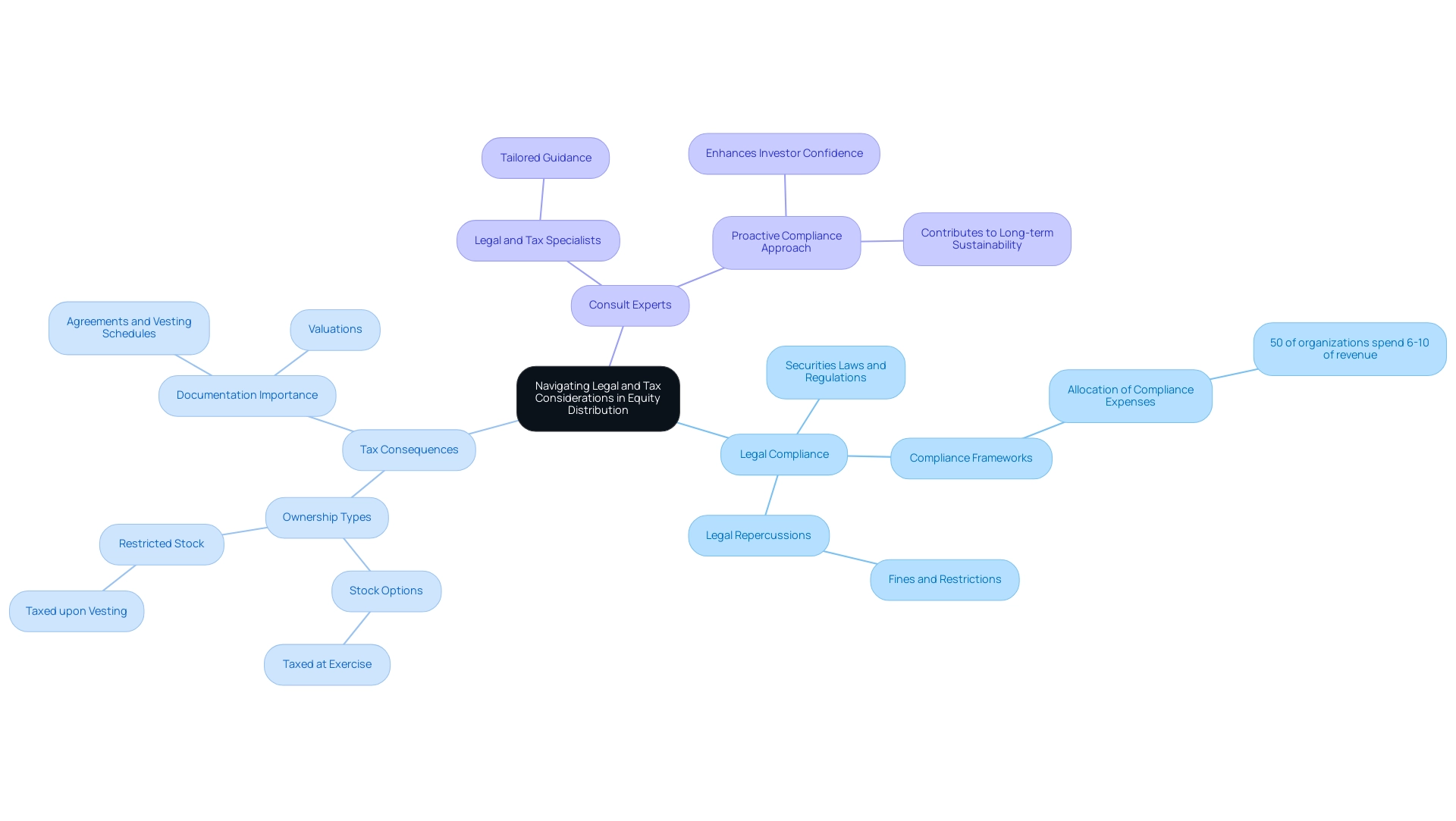

Navigating Legal and Tax Considerations in Equity Distribution

Navigating the intricate landscape of legal and tax considerations when distributing equity in startup ownership shares can feel overwhelming for many startups. It’s crucial to ensure compliance and optimize financial outcomes, but the path is often fraught with challenges.

- Legal Compliance: We understand that adhering to securities laws and regulations is paramount when issuing ownership stakes. The stakes are high; non-compliance can lead to significant legal repercussions, including fines and restrictions on future fundraising efforts. To mitigate these risks, startups should implement robust compliance frameworks. For instance, data shows that 50% of organizations allocate 6-10% of their income to compliance expenses, underscoring the financial consequences of overlooking these critical factors.

- Tax Consequences: Grasping the tax implications for both the business and its stakeholders is essential. Different ownership types, such as stock options and restricted stock, carry distinct tax treatments. Many of our members have shared their experiences with stock options being taxed at the time of exercise, while restricted stock is typically taxed upon vesting. By being aware of these nuances, startups can avoid unexpected tax liabilities. Maintaining thorough documentation of all equity-related decisions—including agreements, vesting schedules, and valuations—is critical. This not only safeguards the organization and its stakeholders but also serves as a valuable reference for compliance assessments and future financing phases.

- Consult Experts: We encourage involving legal and tax specialists to ensure that ownership allocation strategies are both compliant and optimized for tax efficiency. These experts can provide tailored guidance based on the unique circumstances of each company, helping navigate the complex legal environment.

As we look towards 2025, new ventures are increasingly recognizing the importance of legal and tax adherence in the allocation of equity in startup shares. A recent case study revealed that 91% of business leaders feel their organizations have a responsibility to address environmental, social, and governance (ESG) issues, reflecting a broader trend toward responsible business practices. This growing awareness underscores the necessity for new ventures to integrate adherence into their resource allocation strategies.

Moreover, data indicates that 76 firms with at least $50 million in funding obtained an average of $180.7 million before concluding operations, demonstrating the financial dangers associated with non-adherence in resource allocation. Farhan Advani highlights that only about 10% of firms that have secured series D funding are considered successful, emphasizing the hurdles new ventures face in achieving long-term success, particularly regarding ownership allocation. As new businesses continue to navigate these challenges, expert insights suggest that a proactive approach to compliance not only protects against legal pitfalls but also enhances investor confidence and contributes to long-term sustainability.

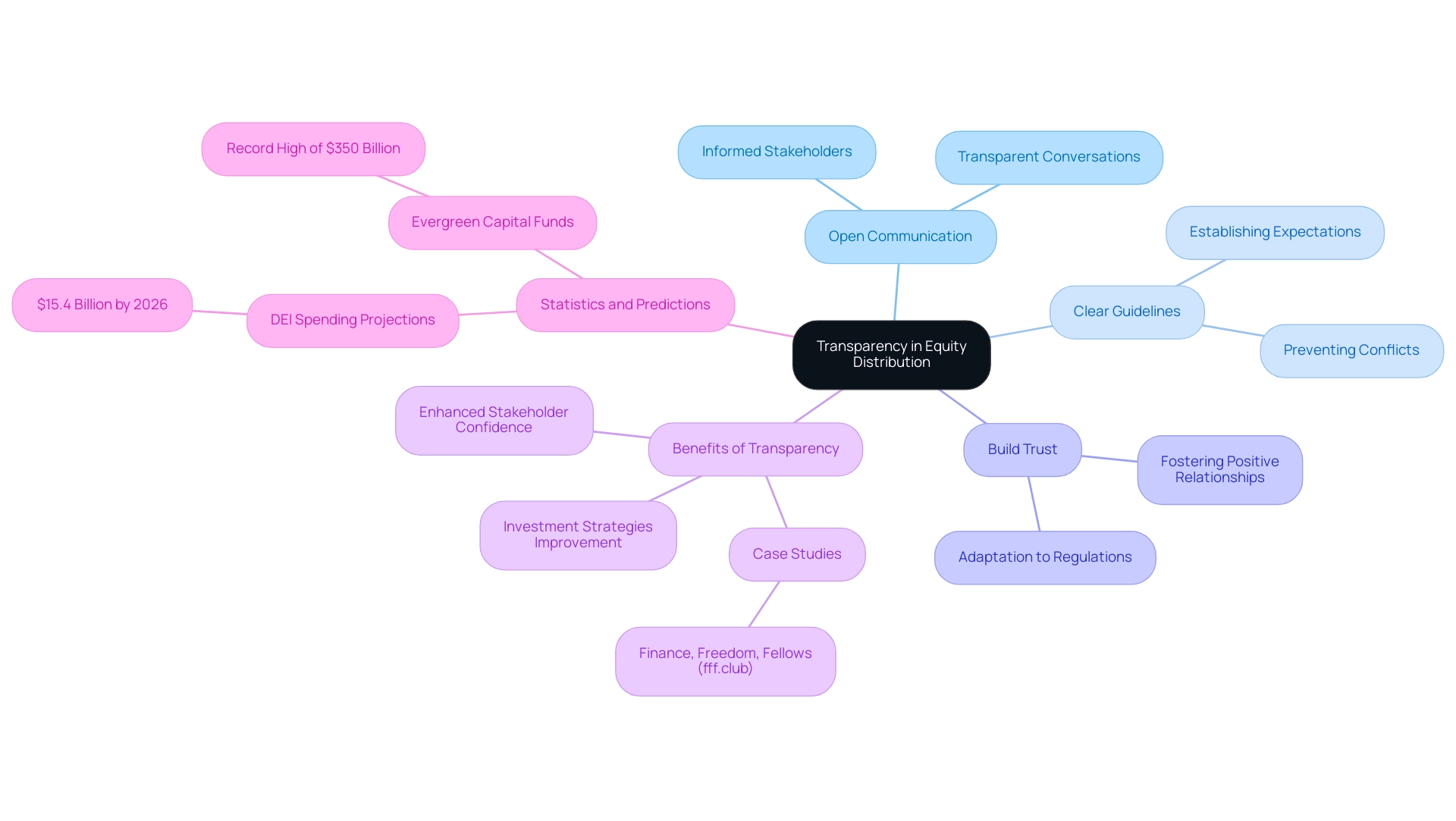

The Role of Transparency in Equity Distribution

Clarity in ownership allocation is essential for nurturing trust and cooperation among all parties involved in equity within startups. In 2025, the significance of clear communication regarding resource allocation has never been more pronounced, as it deeply influences the dynamics between co-founders, employees, and investors.

-

Open Communication: We understand that initiating transparent conversations about fair allocation is vital. By ensuring that co-founders, employees, and investors are well-informed about their roles and stakes, startups can cultivate a culture of inclusivity and shared purpose.

-

Clear Guidelines: Establishing clear guidelines and expectations around resource distribution helps prevent misunderstandings and conflicts. This clarity not only streamlines decision-making but also reinforces a sense of fairness among stakeholders.

Providing regular updates on equity allocations and any changes is crucial. Keeping all stakeholders informed fosters engagement and demonstrates a commitment to transparency, a value increasingly cherished in today’s investment landscape.

- Build Trust: Openness fosters trust, which is fundamental for maintaining positive relationships and ensuring the long-term success of new ventures. As the demand for transparency grows—especially with forecasts suggesting that more states will implement pay transparency regulations—new companies must adapt to these expectations to remain competitive.

The benefits of open dialogue surrounding fair allocation are numerous. It not only enhances stakeholder confidence but also encourages a collaborative environment where everyone feels valued. For instance, case studies from successful startups, like Finance, Freedom, Fellows (fff.club), illustrate how effective communication strategies regarding ownership allocation have led to higher employee satisfaction and retention, ultimately improving investment strategies through collaboration and informed decision-making.

Statistics reveal that openness in share allocation can significantly influence trust levels among stakeholders. A recent surge in private wealth demand has propelled evergreen capital funds to a record high of $350 billion, underscoring the importance of trust in investment decisions and how transparency can directly affect these outcomes.

As Neelie Verlinden wisely noted, "The dollars spent by companies on DEI-related efforts are projected to more than double, reaching $15.4 billion by 2026," highlighting the growing acknowledgment of inclusivity and transparency in fostering trust among stakeholders.

In conclusion, nurturing trust through openness in resource allocation is not merely a best practice; it is a strategic necessity for new businesses striving to thrive in a competitive market. As articulated by industry leaders, the commitment to open communication about equity within startups can transform the landscape, driving meaningful outcomes for all involved.

Conclusion

Equity distribution is a critical component of startup success, influencing everything from internal dynamics to external perceptions among investors. We understand that navigating this complex landscape can be challenging for founders and investors alike. By grasping the various forms of equity and their implications, you can make informed decisions that align with your long-term goals. This article highlights the evolving landscape of equity distribution, emphasizing the importance of transparency and equitable practices in fostering collaboration and sustainability within the startup ecosystem.

Key stakeholders, including founders, employees, advisors, and investors, each play a vital role in shaping the equity structure. A well-structured equity distribution not only motivates founders and employees but also attracts investors who seek viable opportunities for returns. As many of our members have experienced, the strategies for splitting equity among co-founders, implementing effective compensation packages, and adhering to best practices for advisors and investors underscore the need for careful consideration and fair practices in equity allocation.

Moreover, navigating the legal and tax implications of equity distribution is essential for compliance and optimizing financial outcomes. We recognize that prioritizing transparency and open communication can build trust among stakeholders, fostering an environment conducive to innovation and growth. As the startup landscape continues to evolve, embracing effective equity distribution strategies will be paramount for achieving long-term success and resilience in the face of competition.

Ultimately, understanding and implementing sound equity practices not only empowers individual stakeholders but also enhances the collective strength of the startup, positioning it for sustained growth and success in an increasingly competitive market. We are here to support you on this journey, ensuring that you feel valued and informed every step of the way.