Overview

Convertible senior notes are hybrid financial instruments that combine features of debt and equity, allowing investors to convert their holdings into shares of the issuing company while offering a senior claim in the event of liquidation. The article explains that these notes are particularly attractive due to their potential for capital appreciation, regular interest payments, and lower risk compared to other debt instruments, making them a strategic choice for investors, especially in a dynamic market environment.

Introduction

Convertible senior notes represent a sophisticated blend of debt and equity, appealing to investors seeking both security and growth potential. As companies increasingly utilize these instruments to raise capital, understanding their unique characteristics becomes essential for making informed investment choices. These notes not only offer the promise of regular interest payments but also the flexibility to convert into equity, aligning investor interests with the performance of the issuing company.

However, the landscape is not without its complexities, as market fluctuations and inherent risks can impact returns. With 2024 projected to be a pivotal year for convertible financing, a thorough evaluation of the features, benefits, and risks associated with convertible senior notes is crucial for investors aiming to navigate this evolving market effectively.

What Are Convertible Senior Notes? An Overview

Convertible senior notes represent a unique category of debt instruments that blend characteristics of both traditional bonds and equity. These financial instruments, which are convertible senior notes, are issued by companies mainly to aid in capital raising, offering participants the flexible choice to convert their debt holdings into shares of the issuing company's stock at predetermined times and specific prices. The classification of 'senior' signifies that these documents hold a higher priority over subordinated debt during liquidation, thereby offering a relatively secure investment profile.

This security is particularly appealing to individuals within the tech sector, where firms often prioritize growth alongside capital preservation. As Daniel J. Close, Head of Municipals, remarks, 'We expect the technical environment for municipal bonds to remain strong this year,' which underscores the favorable conditions for such instruments.

Furthermore, the recent statistics reveal that 5% coupon bonds due in 2035 came at a yield of 3.11%, highlighting the competitive landscape for investors seeking stable returns. As the environment for alternative financing changes, especially in 2024, grasping the framework and strategic objective of bonds becomes essential for making informed investment choices. The '2024 Convertible Market Outlook' indicates an active year for convertible senior notes financing, as both traditional and non-traditional issuers manage maturities and evaluate the market.

This anticipated activity underscores the importance of these instruments in navigating the complexities of a crowded market.

Key Features and Benefits of Convertible Senior Notes

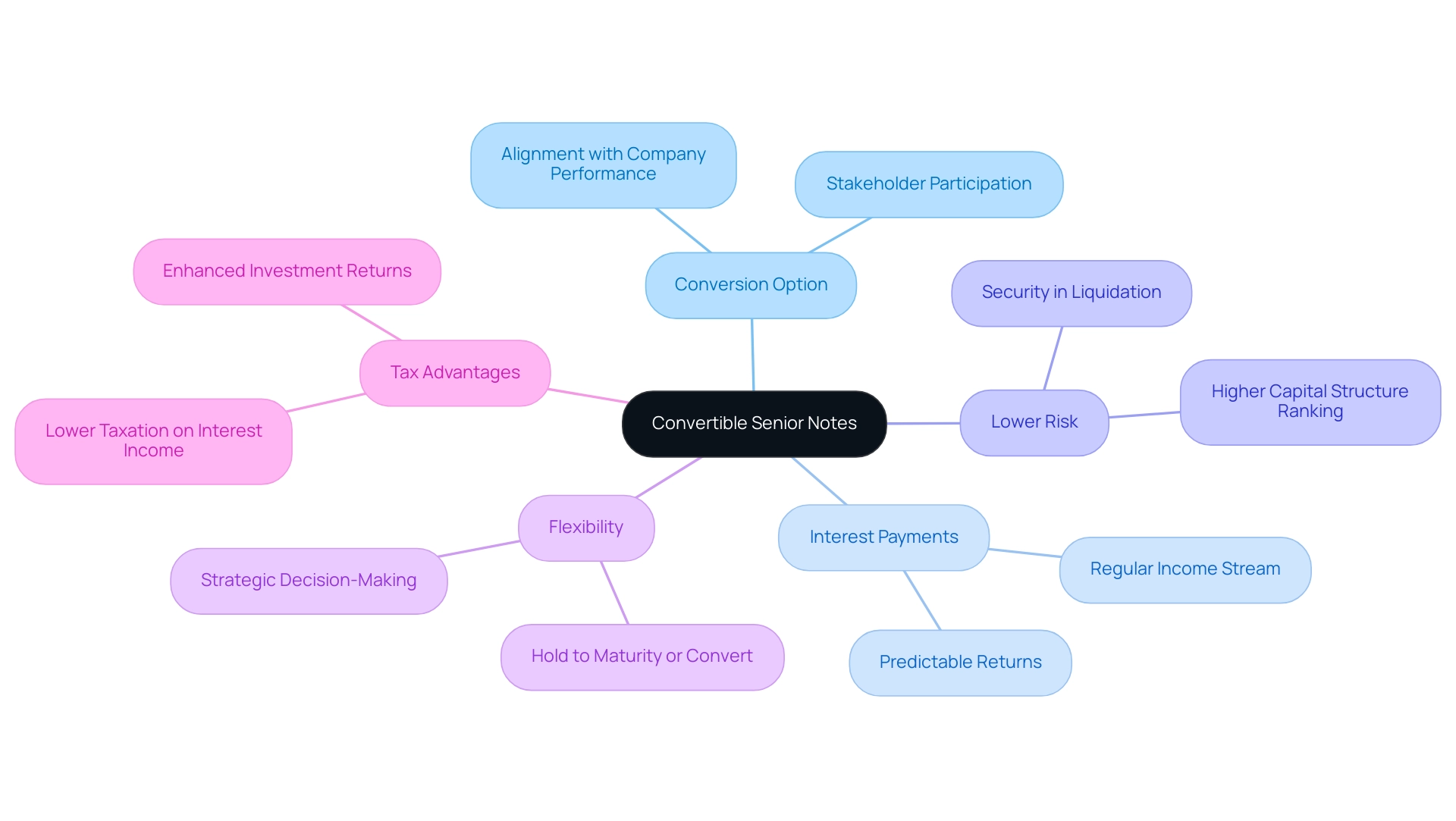

Convertible senior notes present a range of distinctive features and advantages that make them an attractive option for investors:

- Conversion Option: One of the most compelling aspects is the right for stakeholders to transform their instruments into a predetermined number of shares. This feature enables potential upside participation in the company’s growth, aligning stakeholder interests with the company’s performance.

- Interest Payments: Typically, convertible subordinated instruments provide investors with regular interest payments. This income stream can be particularly advantageous compared to common stock, offering a more predictable return on investment.

- Lower Risk: These instruments rank higher in the capital structure, making them senior securities. In the event of liquidation, they offer more security than junior debt or equity, thereby reducing the overall investment risk.

- Flexibility: Investors appreciate the flexibility of holding the instruments to maturity or converting them based on prevailing market conditions. This adaptability allows for strategic decision-making that can optimize returns.

- Tax Advantages: Another benefit is the potential for lower taxation on interest income compared to dividends, which can enhance overall investment returns for savvy investors.

Comprehending these characteristics is essential for assessing how convertible senior notes can be effectively integrated into an investment strategy. As the tech sector continues to evolve, with approximately 30% of 2023 issuance occurring within this industry, the supportive dynamics projected for 2024 further emphasize the relevance of these financial tools. Significantly, the U.S. bond market has performed similarly to the U.S. stock market, with a five-year annualized return of 18.4% for the Bloomberg U.S. Cash Pay Bond Index compared to 18.5% for the S&P 500 Index.

This performance highlights the possible advantages of investing in exchangeable bonds. For example, a case analysis on the risks related to elevated securities shows that while these instruments offer a primary claim on a borrower's assets in the case of default, stakeholders must remain vigilant, as recouping the original investment is not assured. As Lombard Odier Asset Management emphasizes, "No part of this material may be copied, photocopied or duplicated in any form, by any means, or distributed to any person that is not an employee, officer, director, or authorized agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent."

This nuanced comprehension will assist stakeholders in making informed choices as they navigate the complexities of hybrid securities.

Risks Associated with Convertible Senior Notes

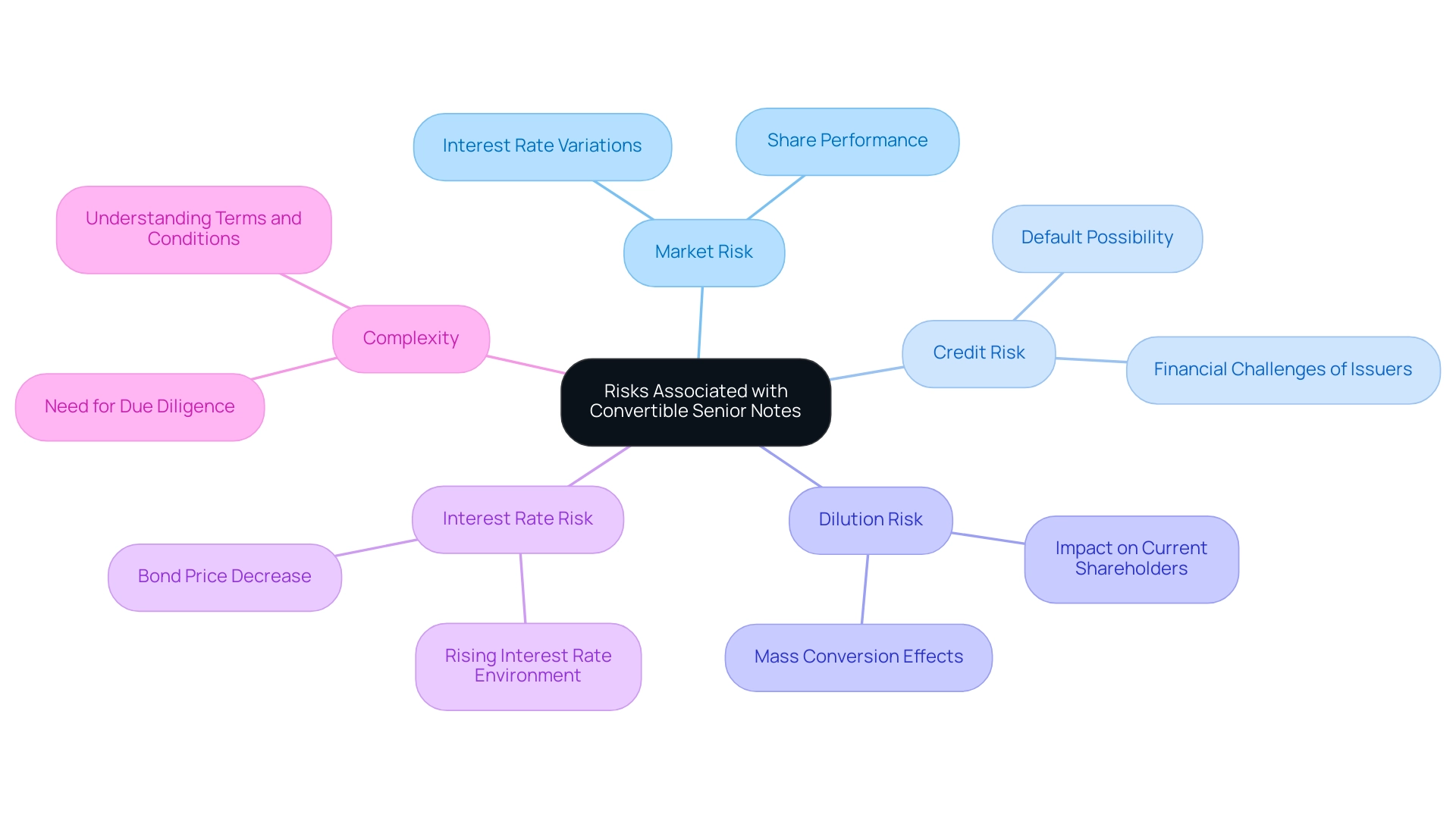

Convertible subordinated securities, while providing appealing advantages such as flexibility and investor safeguards, involve several inherent risks that investors must manage:

- Market Risk: The worth of exchangeable bonds can be significantly affected by variations in interest rates and the performance of the issuing company's shares. For instance, a notable trend in 2023 saw four of the five largest deals surpassing US$1.5 billion, reflecting a dynamic market environment.

- Credit Risk: Investors face the possibility of default if the issuing company encounters financial challenges, potentially jeopardizing interest payments and conversion obligations. Recent conversations have emphasized this risk, especially for firms with adjustable bonds amid tightening market conditions.

- Dilution Risk: When many backers transform their instruments into equity, it can cause dilution of current shares. This dilution can adversely affect the returns of current shareholders, particularly if the conversion occurs en masse.

- Interest Rate Risk: In a rising interest rate environment, bond prices generally decrease, which can adversely affect the value of subordinate securities. This risk is increasingly pertinent as market conditions shift.

- Complexity: The intricate nature of the terms and conditions associated with preferred securities necessitates that participants conduct thorough due diligence. Grasping the subtleties of these financial tools is essential for making educated investment choices.

In spite of these dangers, convertible senior notes can offer adaptability for issuers and security for stakeholders, rendering them an attractive alternative in specific situations. As the market for flexible vehicles is set for ongoing engagement in 2024, fueled by refinancing demands and interest from unconventional issuers, it is essential for stakeholders to consider these risks against the possible advantages. The 2024 Convertible Senior Notes Market Outlook suggests that while refinancing transactions will provide a baseline volume, the potential for opportunistic financing related to convertible senior notes could further increase activity, contingent on stock market conditions.

Daniel Josephs, Managing Director at Ernst & Young Capital Advisors LLC, observes that activity over the next twelve months is anticipated to increase as current issues handle a surge of forthcoming maturities and potential new issues view alternative financing options as a substitute for traditional debt. Considering present market conditions, stakeholders should stay alert to the dangers linked with adjustable bonds while aiming to strategically improve their portfolios.

How to Evaluate Convertible Senior Notes for Investment

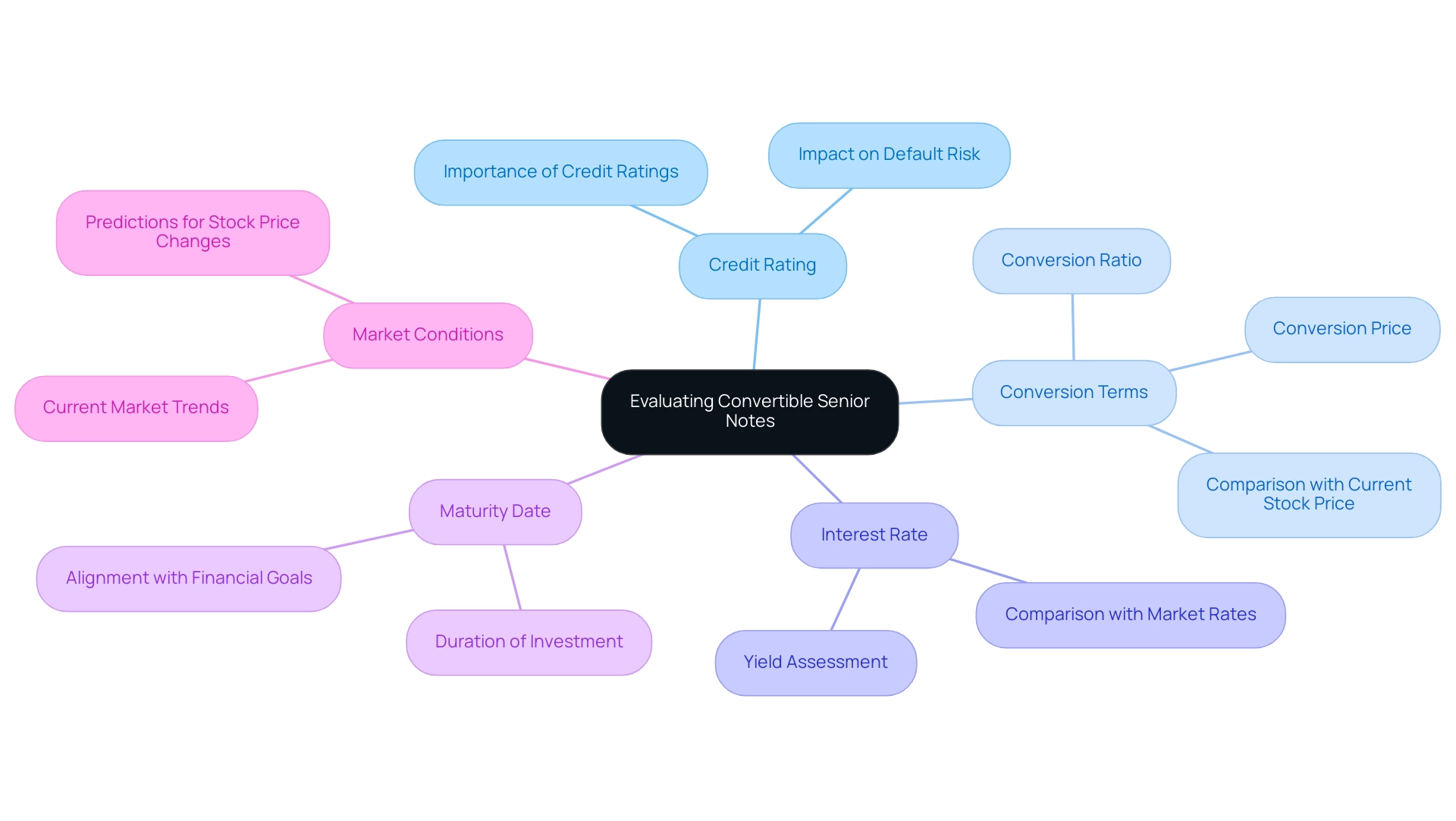

To effectively assess convertible senior securities, individuals must consider several critical factors that can influence the potential returns and risks associated with these instruments:

- Credit Rating: The credit rating of the issuing company is paramount. A strong credit rating indicates financial stability and the issuer's ability to meet its obligations, which is crucial for assessing the risk of default.

- Conversion Terms: Analyzing the conversion price and ratio is essential, as these elements directly affect the attractiveness of the investment. Investors should understand how these terms compare with the current stock price to determine the potential for conversion benefits.

- Interest Rate: The interest rate provided by the securities should be compared against prevailing market rates. This assessment helps stakeholders gauge the competitiveness of the investment and its yield relative to other fixed-income options, such as convertible senior notes, available in the market.

- Maturity Date: The maturity date of the securities affects both the duration of the investment and the associated risks. Investors should consider their investment horizon and how the maturity aligns with their financial goals.

- Market Conditions: Understanding current market conditions and industry trends is vital. This analysis assists stakeholders in predicting stock price changes, which can greatly affect the performance of exchangeable bonds.

As 2024 is anticipated to be a dynamic year for financing alternatives, with issuers like Snap Inc planning to release $700 million of unsecured bonds maturing in 2033, the significance of these assessment criteria becomes even more evident. This offering is expected to enhance Snap's financial position and support its debt management strategy, demonstrating the practical implications of these evaluation factors. According to Daniel Josephs, Managing Director at Ernst & Young Capital Markets Advisory, activity over the next twelve months is expected to ramp as existing issuers manage a wave of upcoming maturities and prospective new issuers consider hybrid instruments as an alternative to straight debt.

The expertise of the EY Capital Markets Advisory group further underscores the importance of these insights. By utilizing these assessment standards, investors can make informed choices about including adjustable debt instruments into their investment approach, particularly in a changing financing landscape.

Tax Implications of Investing in Convertible Senior Notes

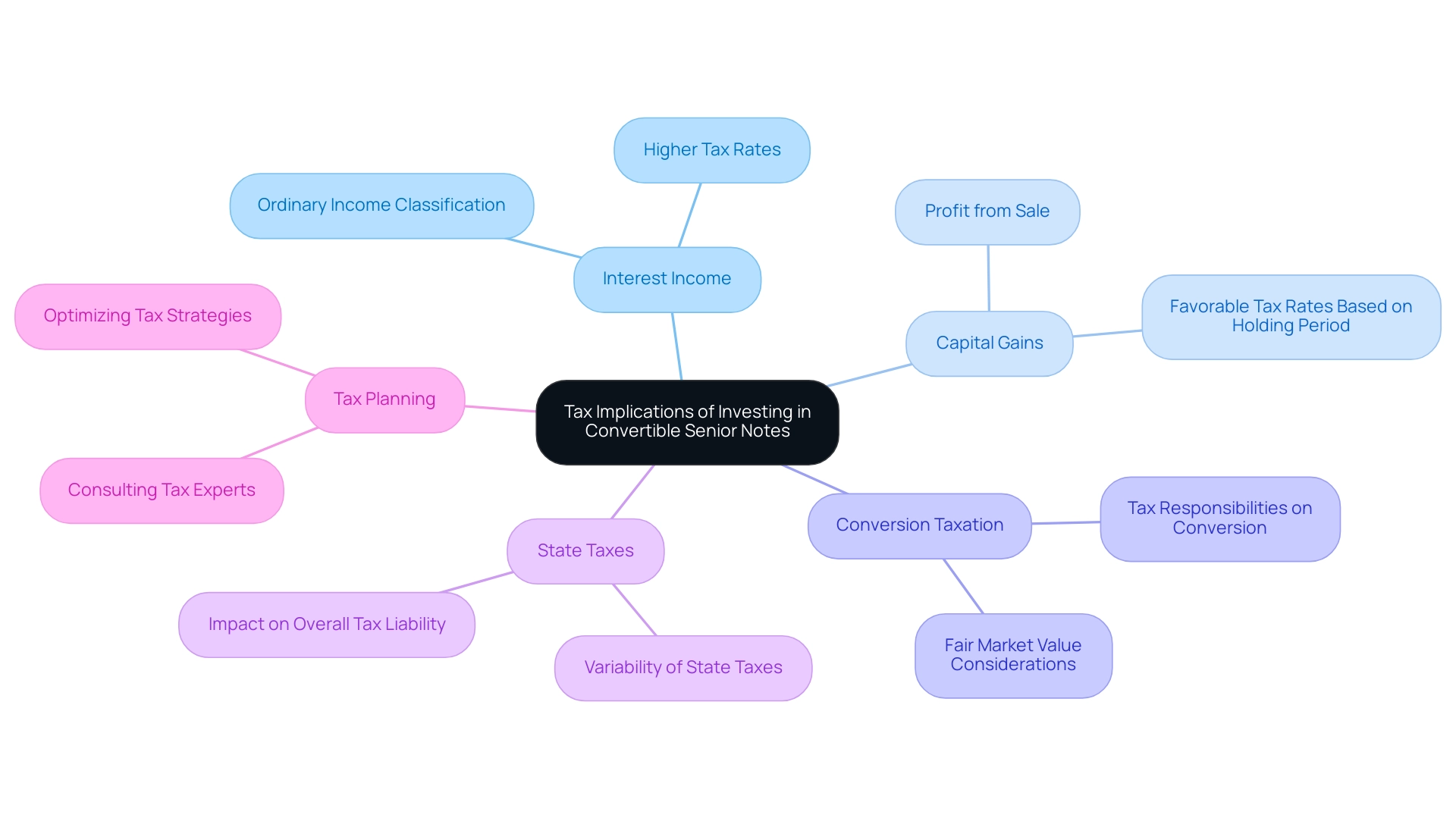

Investing in changeable high-ranking bonds carries specific tax consequences that require careful thought.

-

Interest Income: Interest earned from convertible senior notes is typically classified as ordinary income.

This classification can lead to higher tax rates depending on the individual's income bracket.

-

Capital Gains: Should the securities be sold for a price exceeding their purchase price, the profit is considered a capital gain, which may be subject to favorable tax rates depending on the duration of the holding period.

-

Conversion Taxation: Upon transforming securities into shares, participants may incur tax responsibilities based on the fair market value of the shares obtained relative to their original investment.

-

State Taxes: It is essential for investors to account for state taxes, which can vary significantly and impact overall tax liability.

-

Tax Planning: Consulting a qualified tax expert can be advantageous in optimizing tax strategies related to investments in convertible senior notes.

Research indicates that the market for mandatory convertible notes (MCNs) has expanded, with a dataset analysis revealing that between 2010 and 2018, 81 MCNs were issued, amounting to a total of USD78 billion. These MCNs not only offer high coupons but also help mitigate adverse selection problems and are perceived positively by bondholders, thereby reducing overall financial risk. The features of MCNs, as noted by expert Susan Wang, further underscore their complexity and potential tax impacts.

Furthermore, US stakeholders should be aware that acquiring equity after a company is formed can complicate tax implications. Filing a check-the-box election retroactively may trigger a taxable capital gain, highlighting the need for careful tax planning in light of recent changes set for 2024.

Understanding these tax implications is crucial for investors aiming to make informed decisions that enhance their overall investment returns while navigating the evolving landscape of tax laws.

Conclusion

Convertible senior notes present a compelling investment option, combining the security of debt with the potential for equity participation. Their unique structure allows investors to benefit from regular interest payments while maintaining the flexibility to convert their holdings into shares of the issuing company. As highlighted, the advantages of these instruments include:

- Lower risk profiles

- Tax benefits

- Strategic adaptability, especially in sectors like technology where growth is a priority

However, potential investors must remain vigilant about the risks associated with convertible senior notes. These include:

- Market fluctuations

- Credit risk

- Dilution

- Interest rate changes

Thorough due diligence is essential, including an assessment of credit ratings, conversion terms, and current market conditions. The landscape for convertible financing is poised for significant activity in 2024, making it imperative for investors to weigh both the potential rewards and the inherent risks.

In conclusion, convertible senior notes can play a vital role in a well-rounded investment strategy. By understanding their features, benefits, and risks, investors can make informed decisions that align with their financial goals. As the market evolves, staying abreast of developments in convertible financing will be crucial for capitalizing on opportunities while mitigating risks.