Overview

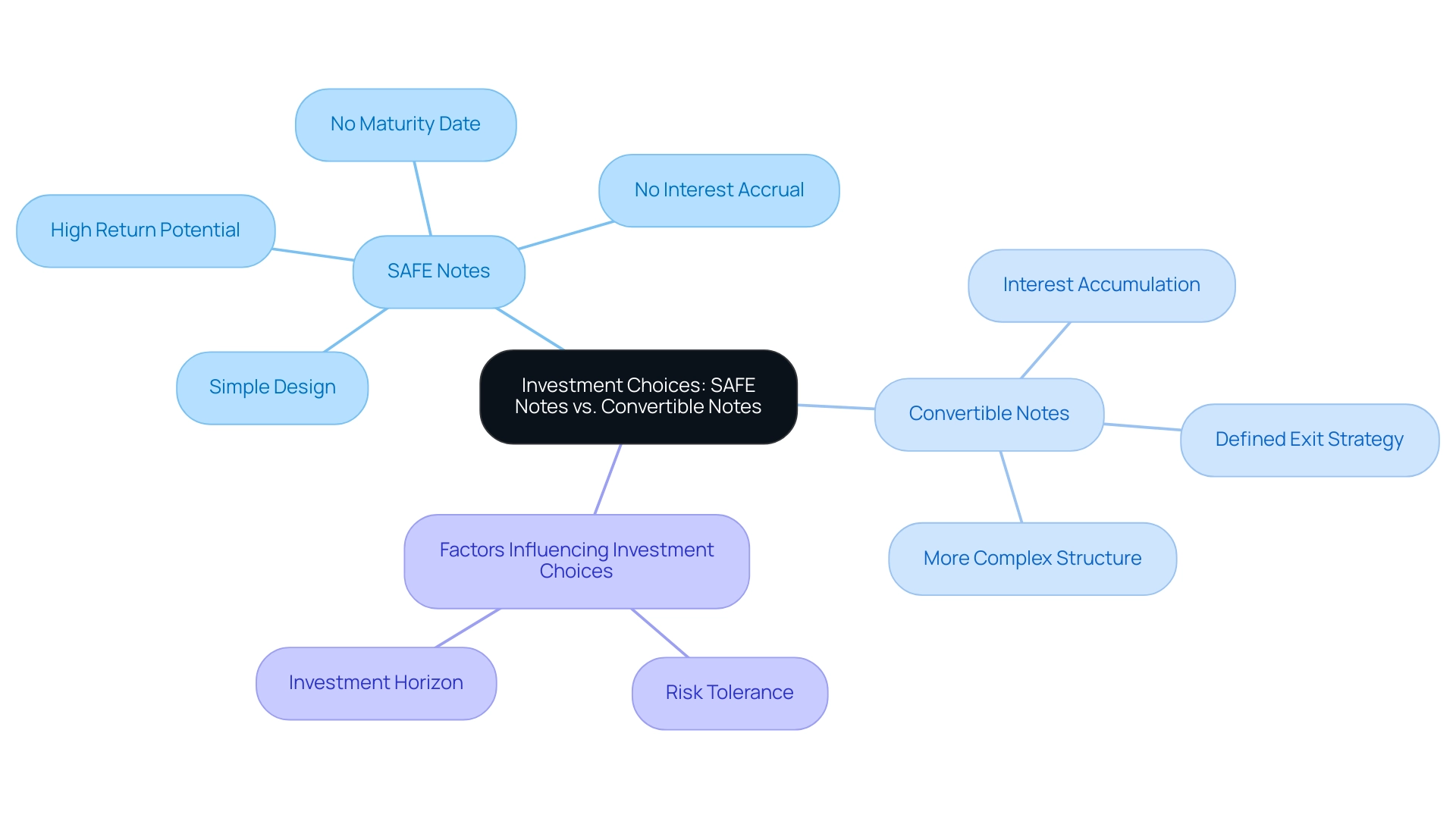

The article compares SAFE (Simple Agreement for Future Equity) and convertible notes, emphasizing their distinct characteristics and implications for tech investors. It highlights that SAFE agreements are equity instruments without interest or maturity dates, making them appealing for startups seeking quick funding, while convertible notes are debt instruments that provide structured repayment options, appealing to risk-averse investors, thus showcasing the strategic considerations each option entails for different investment scenarios.

Introduction

In the dynamic landscape of startup financing, the choice between SAFE notes and convertible notes can significantly influence a company's growth trajectory and investor relationships. As startups seek to secure funding in an increasingly competitive market, understanding these funding instruments becomes crucial.

- SAFE notes offer a streamlined approach that allows investors to convert their contributions into equity without immediate valuation.

- Convertible notes present a structured debt option with potential interest and repayment obligations.

With evolving investor preferences and the unique advantages and drawbacks of each instrument, navigating this landscape requires a keen awareness of the implications for both startups and investors.

This article delves into the distinctions, benefits, and strategic considerations surrounding SAFE and convertible notes, providing valuable insights for those looking to optimize their funding strategies in the tech sector.

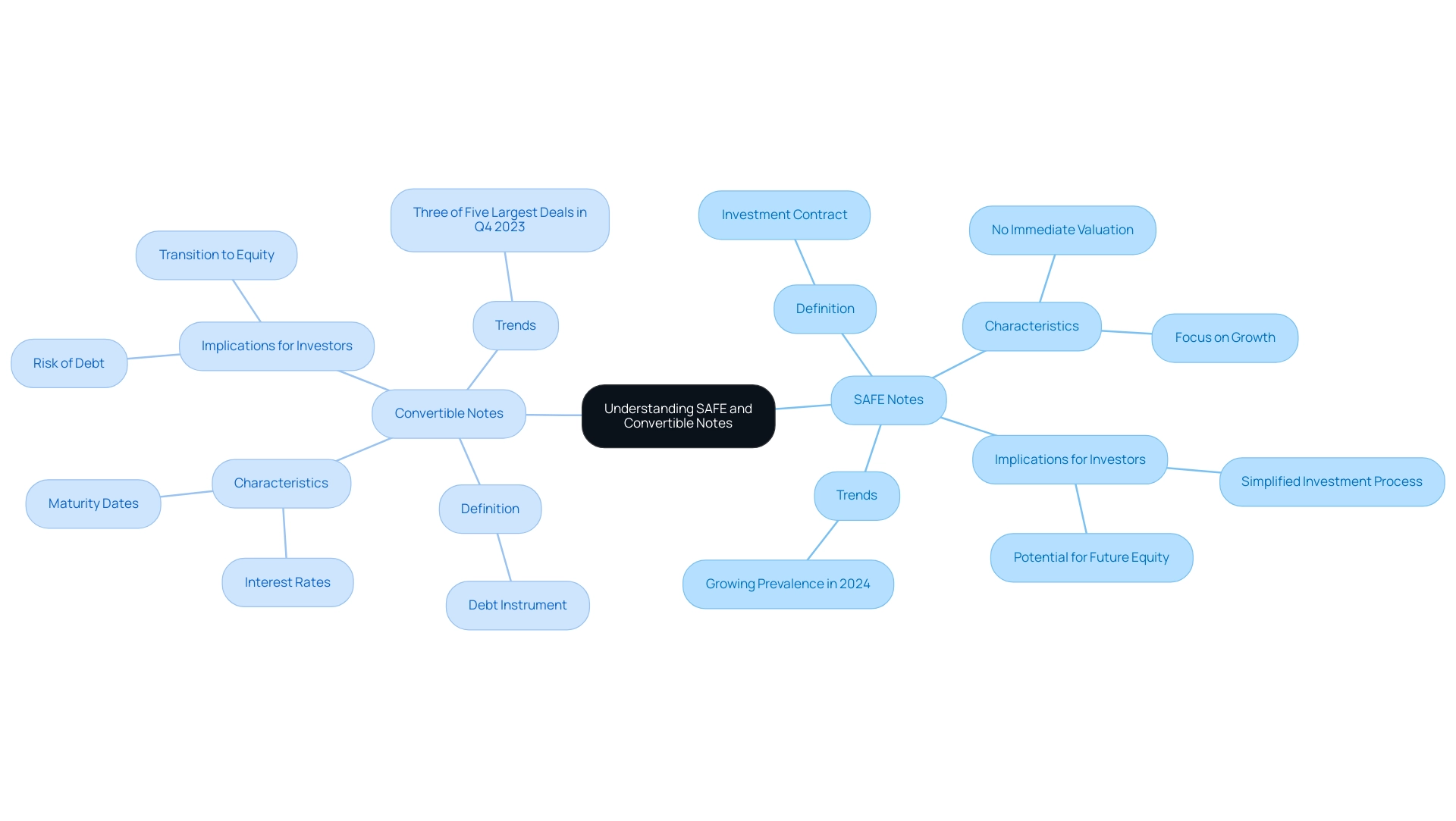

Understanding SAFE Notes and Convertible Notes

SAFE (Simple Agreement for Future Equity) agreements function as investment contracts that allow investors to convert their contributions into equity during future funding rounds, usually without necessitating an immediate valuation of the company. This streamlined approach simplifies the investment process, allowing startups to focus on growth rather than complex financial negotiations. Conversely, convertible notes represent a form of debt that transitions into equity under specified conditions, often including interest rates and maturity dates.

In 2024, trends indicate a growing prevalence of these instruments, with three of the five largest convertible deals in 2023 priced in Q4 alone. Grasping these differences between safe vs convertible note is essential for technology backers as they explore various financial choices and evaluate possible returns. As Krieger aptly put it, 'I just want to understand how you think about the drivers to your business.'

This highlights the significance of clarity in investment agreements, which can greatly impact financial strategies and stakeholder confidence. Moreover, clear financial requests, as illustrated in the case study titled 'Financial Requirements and Allocation,' reassure backers that their capital will be strategically utilized to achieve defined growth objectives. Furthermore, the knowledge of the EY Capital Markets Advisory group in navigating financing and capital structure alternatives offers valuable context for technology stakeholders seeking to optimize their funding strategies.

Key Differences Between SAFE Notes and Convertible Notes

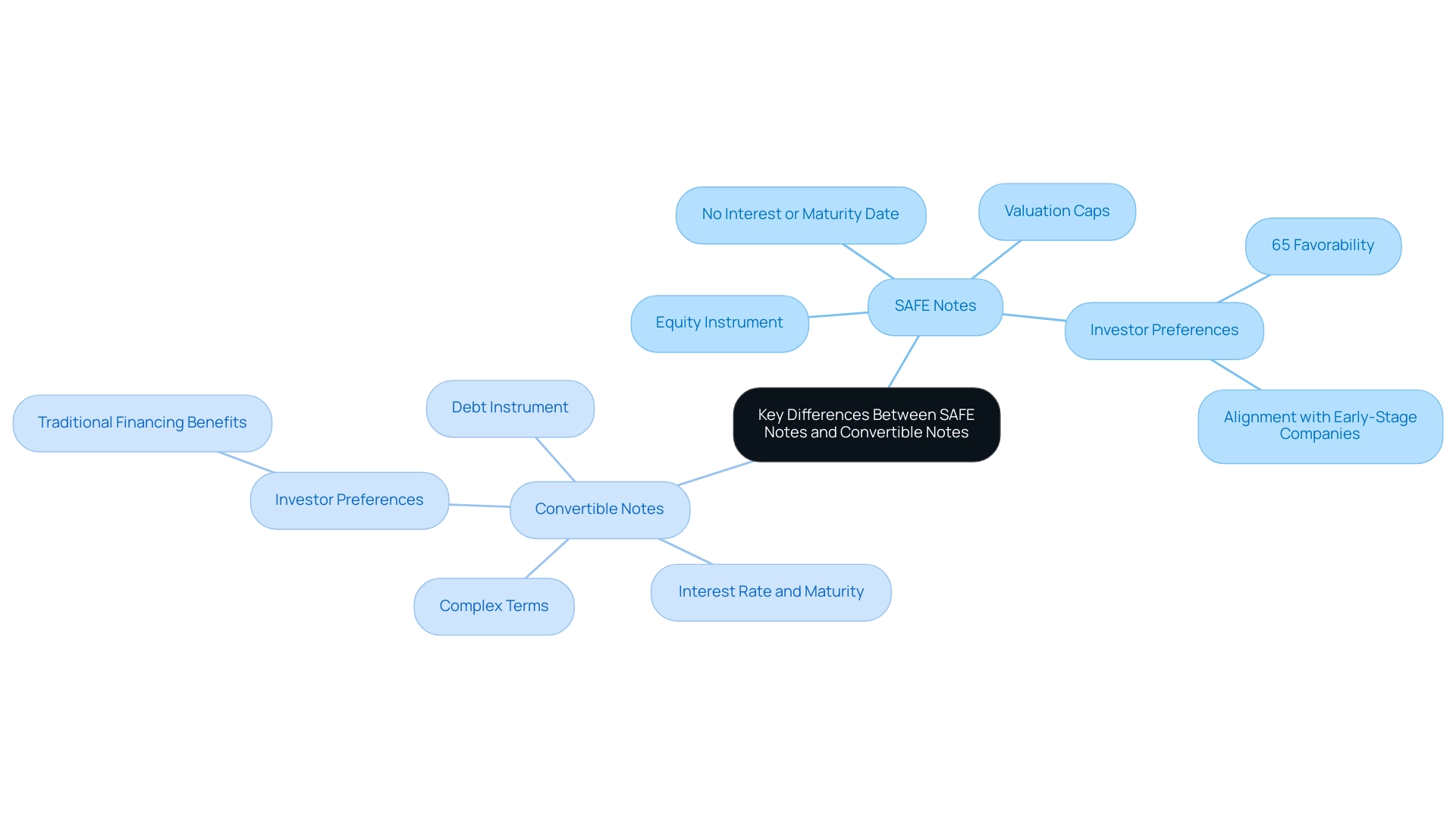

One of the key distinctions in the safe vs convertible note debate is their fundamental nature; SAFE agreements are classified as equity instruments, whereas convertible instruments are considered debt. This distinction results in several important implications for new ventures and investors alike. For example, SAFE agreements do not accumulate interest and lack a maturity date, providing emerging companies enhanced flexibility in managing their capital structure.

In contrast, convertible instruments typically involve an interest rate and a repayment obligation if they do not convert before their maturity date, which can create pressure on startups. Furthermore, SAFE agreements often incorporate valuation caps that protect early investors, ensuring that they have a favorable conversion rate when the company raises subsequent funding rounds. Conversely, convertible instruments may entail more intricate terms surrounding their conversion and repayment, which can complicate the investment landscape.

Investor opinions on these instruments are evolving, especially as the entrepreneurial ecosystem matures. Statistics from recent surveys suggest that around 65% of investors currently favor SAFE instruments over convertible instruments, mainly because of their simple nature and alignment with the interests of early-stage companies. Recent developments in New Zealand’s flourishing business scene, bolstered by increased investment opportunities and government support for entrepreneurship, further highlight the relevance of these instruments.

For instance, companies such as Xero and Pushpay have effectively employed SAFE agreements to obtain financing, demonstrating their efficiency in a competitive market. A case in point is the 'traction evidence' that successful companies like Airbnb and Uber showcased, demonstrating their growth through metrics such as a 150% increase in user acquisition and significant revenue milestones. This not only enhances investor trust in the business framework but also demonstrates how the selection of funding—whether it be safe vs convertible note—can significantly influence a company's path.

As WNT Ventures aptly states,

WNT Ventures is a venture capital firm that invests in ambitious deep tech founders,

highlighting the essential role that well-structured financing plays in attracting investment and promoting entrepreneurial success.

Pros and Cons of SAFE Notes for Startups

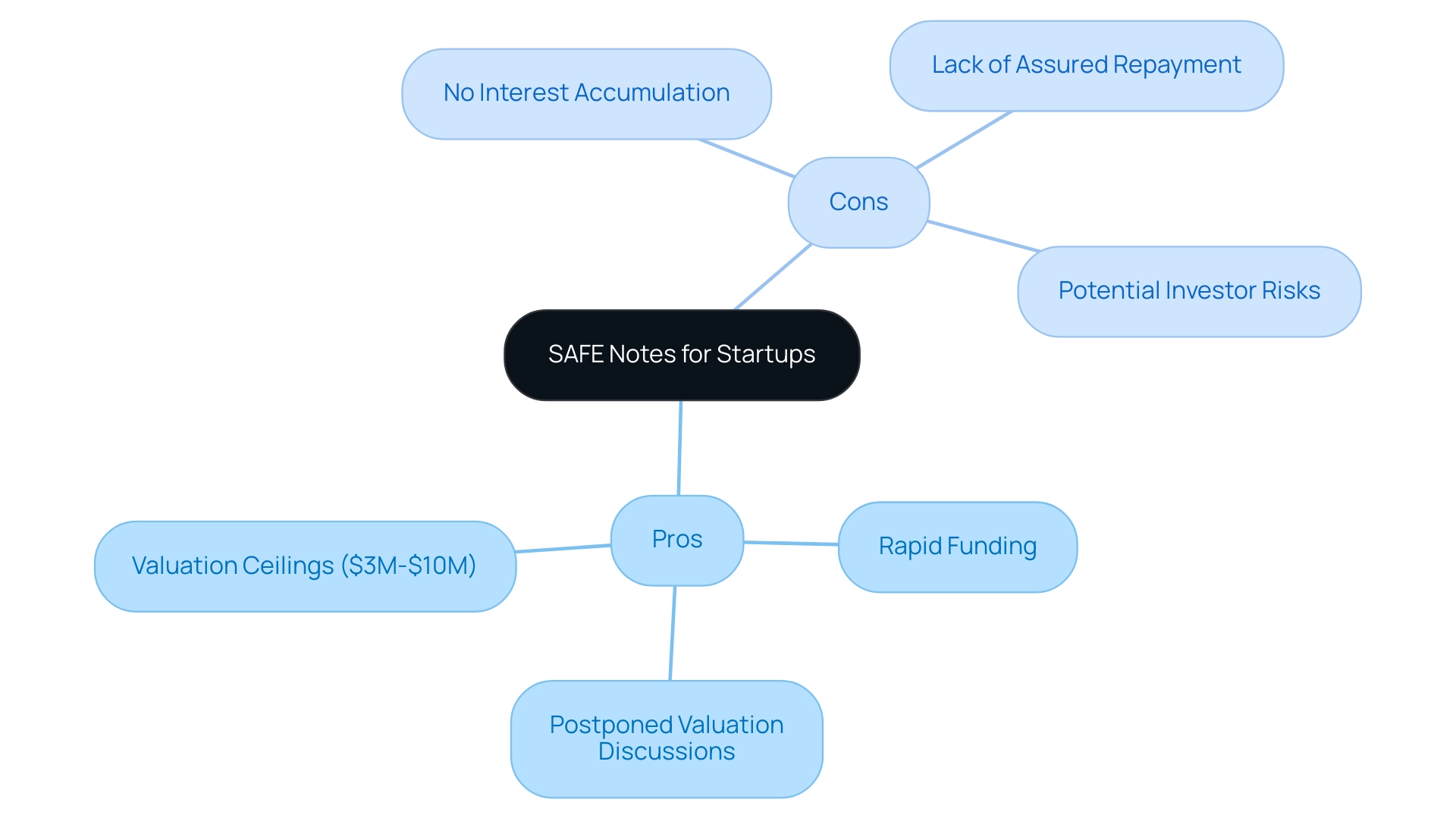

SAFE agreements offer an attractive choice for new businesses aiming to obtain funding rapidly and effectively, circumventing the intricacies linked to conventional equity financing. They allow new businesses to postpone discussions around valuation, which can be particularly advantageous in today’s unpredictable market landscape. For example, valuation ceilings for SAFE agreements usually vary from $3 million to $10 million for seed-stage companies, providing a feasible entry for initial backers.

However, potential disadvantages exist; these documents do not accumulate interest and lack assured repayment, which may deter individuals who prefer the security offered by a safe vs convertible note. In situations where a startup has difficulty securing additional capital, SAFE investors might find themselves without equity or means of recovering their initial investment. Insight from Joshua Ismin, Co-founder & CEO of Psylo, emphasizes this sentiment, as he highlights the significance of understanding the implications of financial choices.

Moreover, locating partners who have a common vision for success in raising capital is vital, as this alignment can greatly affect the effectiveness of financial strategies. WNT Ventures illustrates how investment in deep tech entrepreneurs, combined with hands-on assistance through financial grants and incubation programs, can foster an atmosphere where new ventures effectively navigate these challenges. Therefore, understanding the advantages and disadvantages of SAFE agreements in comparison to a safe vs convertible note is crucial for new ventures considering this option, especially as recent reports show a varied sentiment among investors concerning the risks linked to these financial instruments and how valuation caps influence investor choices.

When to Use SAFE Notes vs. Convertible Notes

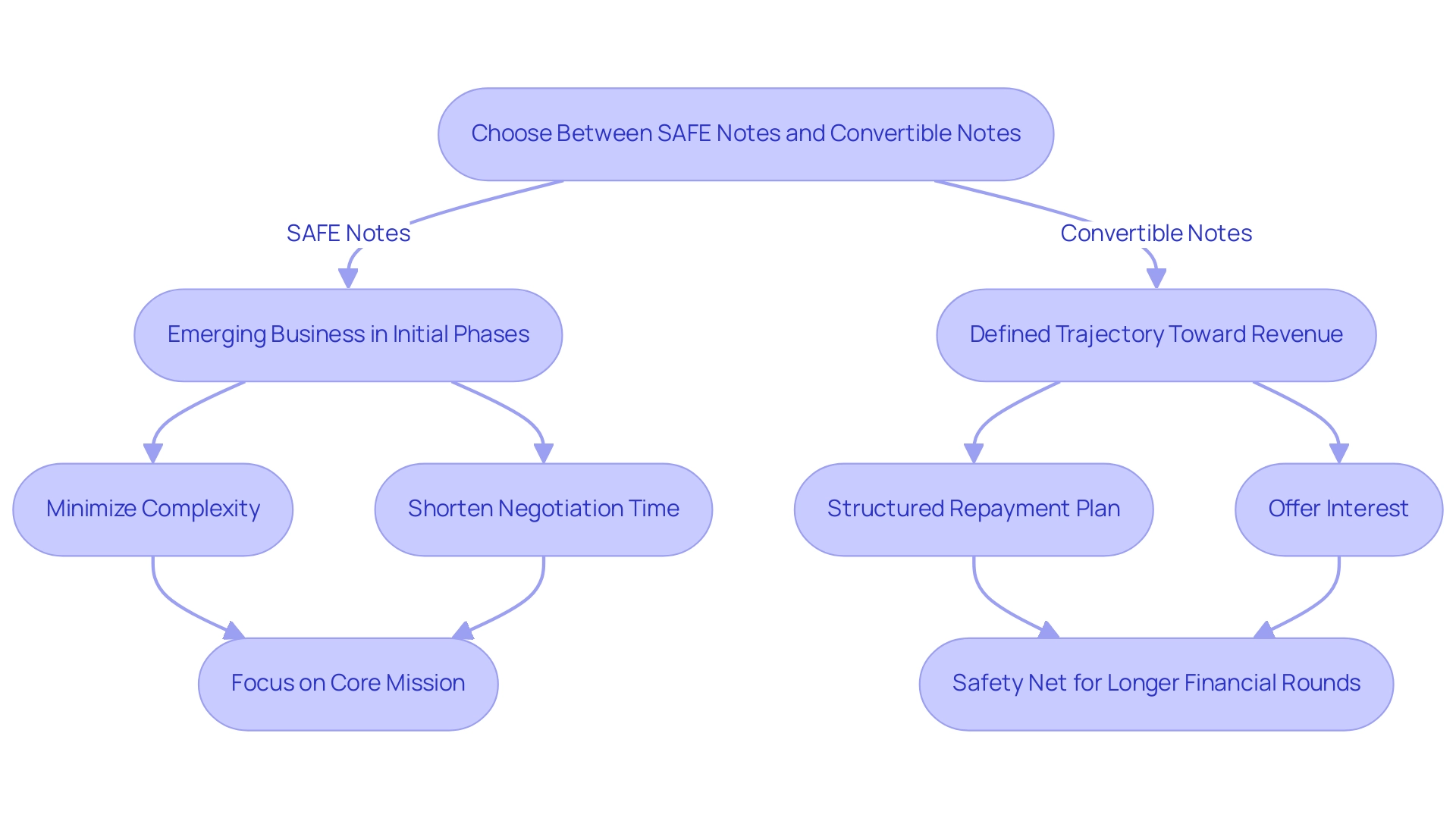

For emerging businesses in their initial phases of development, employing SAFE agreements, particularly in the context of safe vs convertible note, can be a favorable approach as it minimizes complexity and shortens negotiation time, making it especially advantageous during pre-seed and seed investment rounds. This streamlined approach allows these new ventures to focus on their core mission without getting bogged down by intricate funding structures. In fact, Hillfarrance allocates 20% of their returns to portfolio company founders, illustrating the potential financial implications of selecting SAFE agreements.

In contrast, a safe vs convertible note may be better suited for emerging companies that possess a more defined trajectory toward revenue generation and are prepared to offer interest along with a structured repayment plan. This choice can offer individuals with a safety net, particularly if the new venture expects a longer period before obtaining future financial rounds. As noted by an industry expert, 'From an accounting point of view, care must be taken to not mistakenly record any of the deposits as revenue – Surprisingly, this is more common than you think.'

Identifying these contexts is essential for new businesses to make informed choices regarding their financial strategies, aligning their growth aspirations with effective financial planning. As emphasized by industry trends, technology enterprises are increasingly motivated to collaborate with backers who align with their vision and can provide the essential assistance for success, underscoring the significance of strategic investment in nurturing innovation and resilience. Additionally, the case study titled 'Safe vs Convertible Note' emphasizes that while convertible instruments allow capital raising without upfront company valuation, they may lead to dilution if raised at a lower valuation, showcasing the benefits and risks associated with this funding option.

Investor Perspectives: Choosing Between SAFE Notes and Convertible Notes

From a financier's perspective, SAFE agreements offer an appealing chance, mainly because of their simple design and possibility for significant returns upon a startup's success. However, the lack of interest accrual and a maturity date may discourage more risk-averse individuals, who prefer investments with defined timelines and returns. In contrast, convertible instruments, albeit more intricate, provide the benefit of interest accumulation and a clear exit strategy.

This makes them a favorable option for those seeking a more structured approach to their investments. Ultimately, the choice between a SAFE vs convertible note depends on the individual's risk tolerance, investment horizon, and the specific circumstances surrounding the new venture. As demonstrated by the flourishing entrepreneurial environment in New Zealand, where the government actively backs various financial opportunities, investors are increasingly assessing these factors to align their strategies with potential high-growth ventures.

According to WNT Ventures, 'WNT Ventures is a venture capital firm that invests in ambitious deep tech founders,' highlighting the focus on innovative startups. Their case study exemplifies this trend, as they provide hands-on support through financial grants and incubation programs tailored for pre-revenue tech companies, illustrating the practical implications of the SAFE vs convertible note in the context of deep tech investments.

Legal and Financial Implications of SAFE and Convertible Notes

The distinctions between SAFE agreements and convertible notes involve distinct legal and financial consequences that require thorough evaluation from stakeholders. Specifically, SAFE agreements often include valuation caps intended to protect early backers from excessive dilution during subsequent funding rounds. This feature can be attractive, but it's important to recognize that SAFE notes do not provide the legal protections linked to traditional debt instruments, which can raise concerns for some investors.

Conversely, convertible notes, despite their complexity, provide a more structured legal framework, incorporating essential provisions for interest accrual and repayment. This clarity can be advantageous, as it offers a clearer path for recouping investments. Investors must thoughtfully weigh the differences between SAFE vs convertible note, as these can profoundly impact returns and the overall financial well-being of the new venture.

For instance, angel backers typically allocate between $25,000 to $100,000 or more in individual companies, highlighting the scale of funding relevant to these discussions. Moreover, a clear financial request that details how resources will be distributed, as shown in the case study titled 'Financial Needs and Distribution,' assures backers that their capital will be managed strategically, thereby boosting confidence in the startup’s growth trajectory. As Paul Graham wisely noted, 'If the soda is empty, stop making that awful sucking sound with the straw,' reminding investors to be vigilant about the potential risks associated with their funding choices.

Understanding these nuances is essential for making informed investment choices in the ever-evolving tech sector.

Conclusion

Navigating the funding landscape for startups requires a nuanced understanding of the instruments available, particularly SAFE notes and convertible notes. Each option presents distinct characteristics that can significantly influence a startup's capital structure and investor relationships. SAFE notes offer simplicity and flexibility, allowing startups to focus on growth without the burden of immediate valuation discussions. In contrast, convertible notes provide a structured debt option with defined terms, appealing to investors seeking security through interest accrual and clear repayment plans.

The choice between these funding instruments ultimately hinges on the unique needs of the startup and the preferences of investors. For early-stage companies, SAFE notes can streamline the fundraising process, making them an attractive option. However, as startups mature and revenue generation becomes more apparent, convertible notes may offer a more structured approach that aligns with investor expectations. Understanding these dynamics is crucial for both startups and investors, as the implications of funding decisions extend far beyond initial capital raises.

In conclusion, the decision between SAFE notes and convertible notes should be made with careful consideration of each instrument's advantages and drawbacks. By aligning funding strategies with growth objectives and investor expectations, startups can optimize their financing efforts and pave the way for sustainable success in a competitive market. As the startup ecosystem continues to evolve, staying informed on these funding options will empower both entrepreneurs and investors to make strategic choices that drive innovation and growth.