Overview

A SAFE equity agreement, or Simple Agreement for Future Equity, is a financial instrument designed to help startups raise capital by allowing investors to provide funding in exchange for the right to future equity, thereby simplifying the investment process without immediate ownership dilution. The article highlights that these agreements are increasingly popular due to their efficiency in securing funds quickly, the absence of interest payments or maturity dates, and their adaptability across different legal frameworks, making them a valuable tool for early-stage ventures.

Introduction

In the dynamic landscape of startup financing, Simple Agreements for Future Equity (SAFEs) have emerged as a crucial tool for entrepreneurs seeking to secure funding without the complexities of traditional equity arrangements. These agreements allow investors to contribute capital in exchange for the promise of future equity, simplifying the fundraising process and enabling startups to focus on growth rather than extensive negotiations.

While the benefits of SAFEs are evident, including rapid funding and reduced financial pressures, it is essential to understand the potential risks and legal considerations involved. This article delves into the definition, advantages, and challenges of SAFEs, offering insights that can help founders navigate the evolving startup funding environment effectively.

Understanding SAFE Agreements: Definition and Purpose

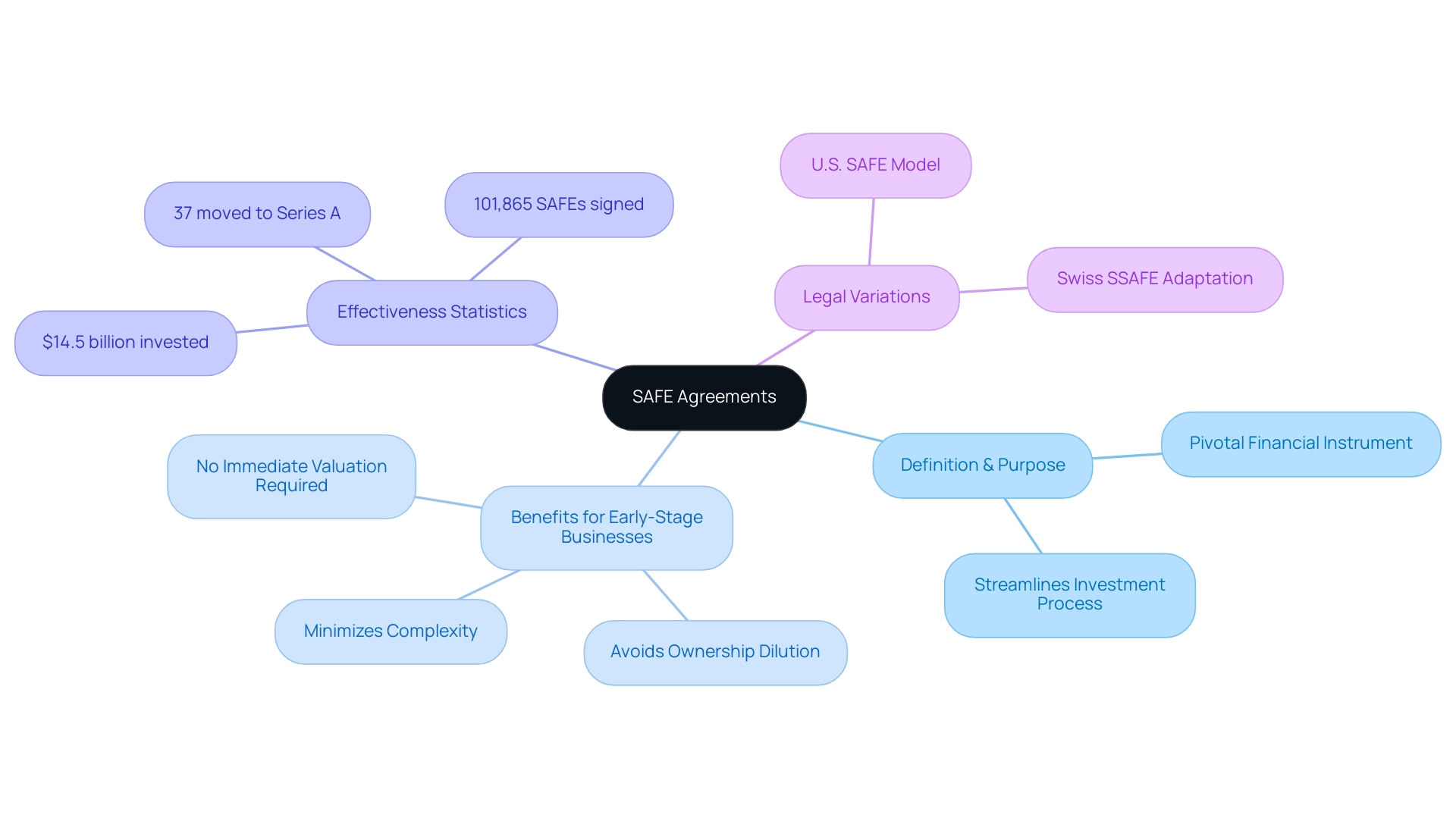

A safe equity agreement, also known as a Simple Agreement for Future Equity, serves as a pivotal financial instrument for new ventures seeking to raise capital. By allowing investors to offer financing in return for the future right to equity through a safe equity agreement, which typically takes place during later funding rounds, these agreements streamline the investment process. Their primary purpose is to minimize complex negotiations and legal documentation, facilitating a more straightforward path to securing investment.

This is especially beneficial for early-stage businesses, as safe equity agreements enable them to secure essential funding effectively without the urgent requirement to dilute ownership or set a formal company valuation. Significantly, information indicates that of the new companies that secured their seed funding in Q1 2018, 37% successfully moved to Series A within 12 quarters, emphasizing the effectiveness of convertible securities in fostering growth. Furthermore, since 2020, companies on the Carta cap table platform have signed 101,865 individual Safes and convertible notes, amounting to $14.5 billion invested in early-stage ventures, underscoring the growing trend and relevance of safe equity agreements in the current funding landscape.

Additionally, as Peter Zwyssig notes, 'The U.S. SAFE model is not directly applicable in Switzerland due to different legal frameworks; thus, a Swiss version called SSAFE has been developed to align with local regulations, ensuring compliance while maintaining the benefits of the original SAFE structure.' This demonstrates the flexibility of safe equity agreements in various legal contexts, contributing to their growing appeal among new businesses.

Benefits of SAFE Agreements for Startups

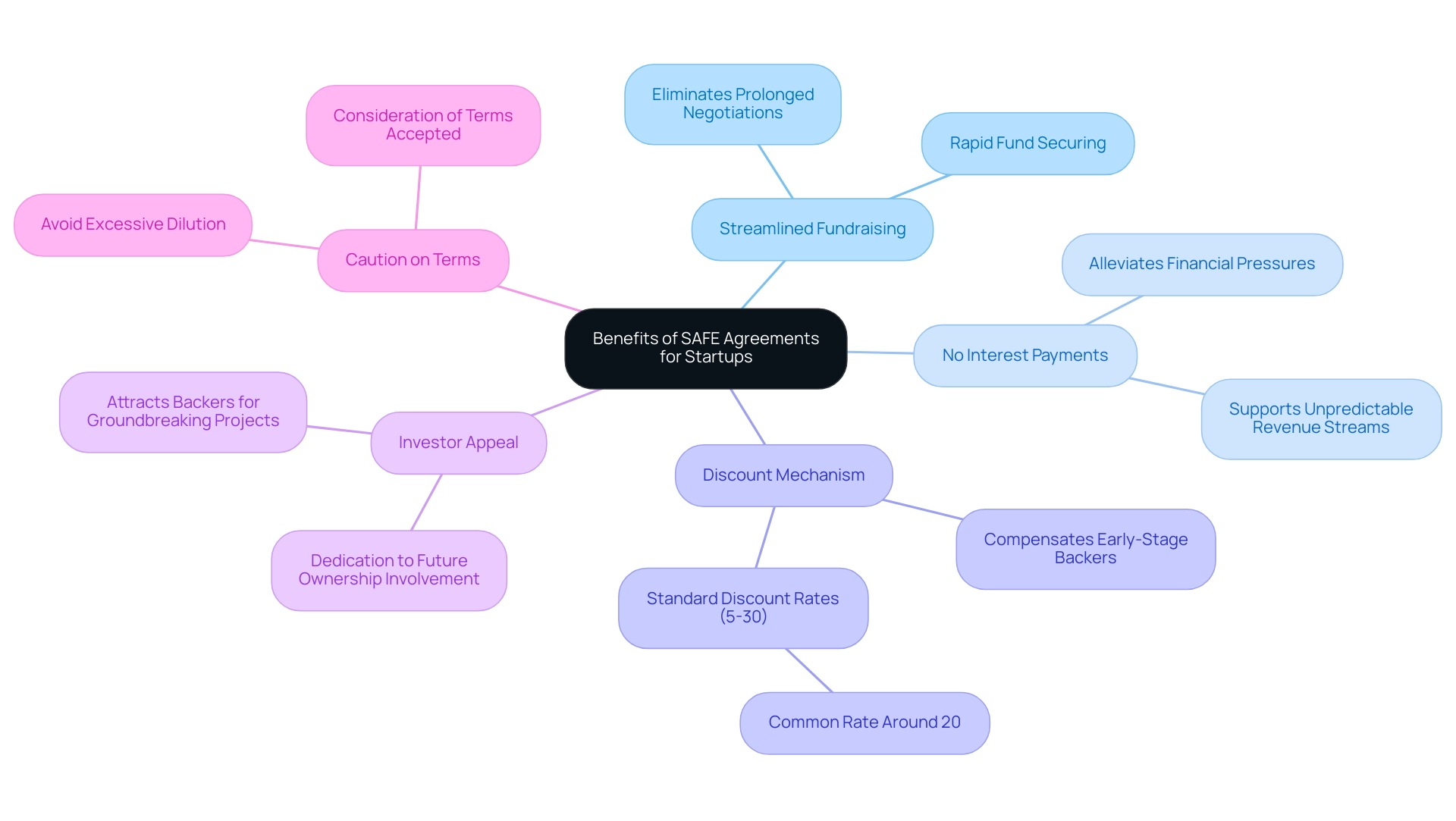

Safe equity agreements, also known as Simple Agreements for Future Equity, provide numerous benefits for new ventures, particularly in 2024. Their inherent simplicity streamlines the fundraising process, eliminating the necessity for prolonged negotiations regarding company valuations. This efficiency allows startups to secure funds rapidly, a crucial factor in today’s fast-paced market.

Moreover, these agreements do not impose interest payments or maturity dates, alleviating financial pressures on early-stage companies that often struggle with unpredictable revenue streams. As Kevin Dowd observes, 'This report depends on information from over 100,000 separate funding events monitored on Carta since the beginning of 2020,' highlighting the attractiveness of these instruments in boosting funding confidence. By showcasing a dedication to future ownership involvement without prompt financial responsibilities, convertible securities appeal to backers keen to assist groundbreaking projects.

However, founders should exercise caution regarding the terms accepted during SAFE rounds to avoid excessive dilution before reaching Series A. Additionally, the discount mechanism inherent in such agreements compensates early-stage backers for the risks they undertake, with standard discount rates ranging from 5% to 30%, often settling around 20%. This feature not only enhances the value received by stakeholders involved in a safe equity agreement but also strengthens their interests in the companies they back. As evidenced by the trends from Q1 2022 to Q2 2024, where 4,165 Seed rounds were recorded against 3,184 Series A rounds, the significance of Seed funding is often underrepresented, highlighting the critical role that safe equity agreements play in enhancing early-stage fundraising efforts.

A practical example of this is seen in the SAFE discount mechanism, which serves to protect investor interests and enhance their ownership stake.

Risks and Considerations of SAFE Agreements

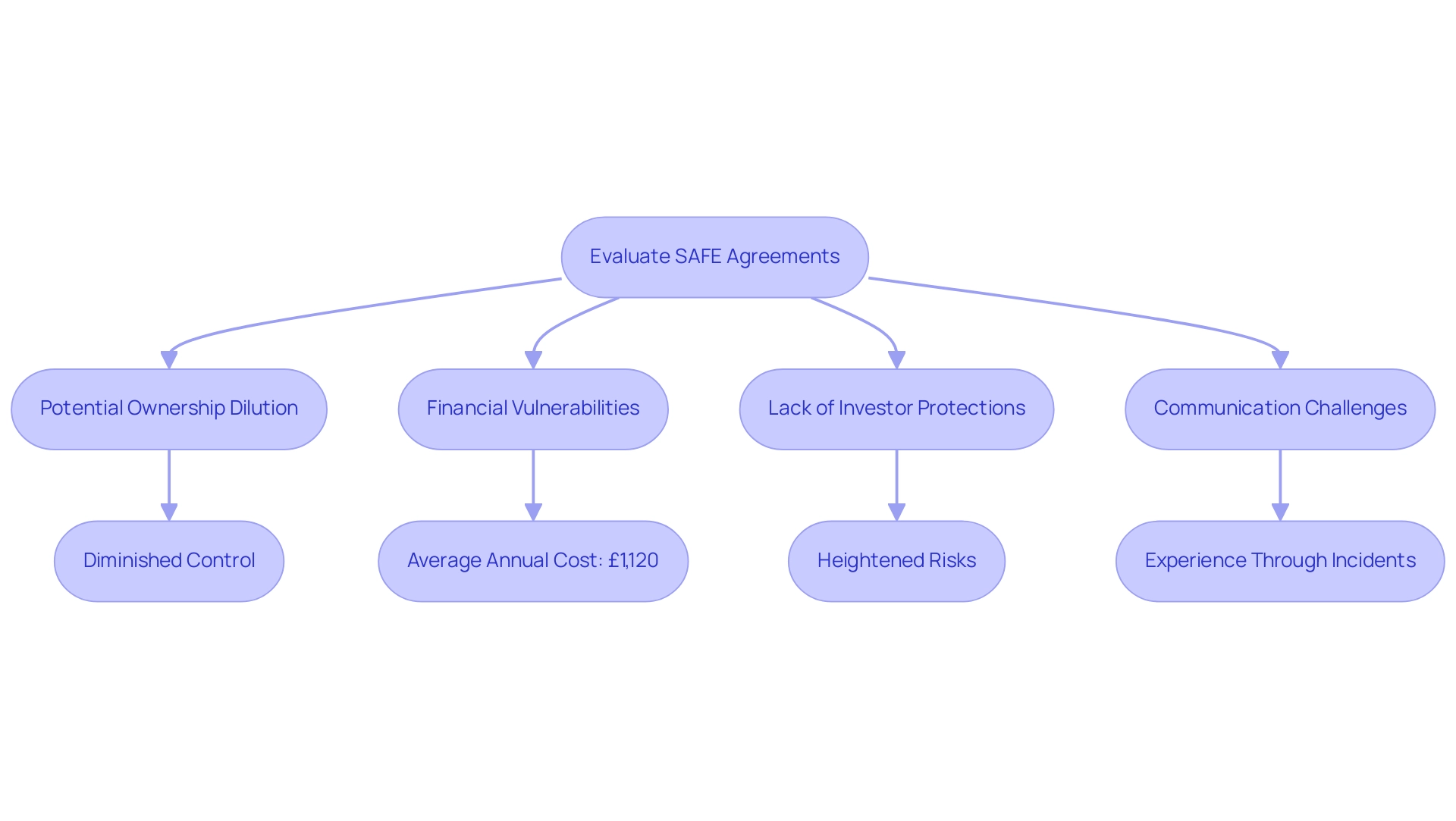

While safe equity agreements offer certain advantages for startups, they are also accompanied by notable risks that require careful consideration. A primary concern is the potential dilution of ownership that occurs when safe equity agreements convert into equity during subsequent funding rounds. This dilution can significantly affect founders and early backers, diminishing their control and financial returns.

In fact, the average annual cost of cyber crime for businesses is estimated at £1,120 per victim, highlighting the financial vulnerabilities that startups may face, including those arising from poorly managed SAFE agreements. Moreover, the characteristics of these agreements indicate they do not offer prompt ownership or control to stakeholders, which may make them less appealing in comparison to conventional funding. This sentiment is echoed by industry experts who caution that,

Communication is always the thing to work on and improve how we communicate outside the business.

Unfortunately, we will only get the experience through actual incidents. Startups must also acknowledge the absence of strong protections for backers within SAFE agreements. Unlike convertible notes or traditional stock investments, these agreements typically lack the provisions intended to protect investors' interests, which can expose them to heightened risks.

As the environment of new business financing changes, comprehending these dilution impacts and the inherent risks linked to safe equity agreements is essential for making informed investment choices.

SAFEs vs. Other Financing Instruments

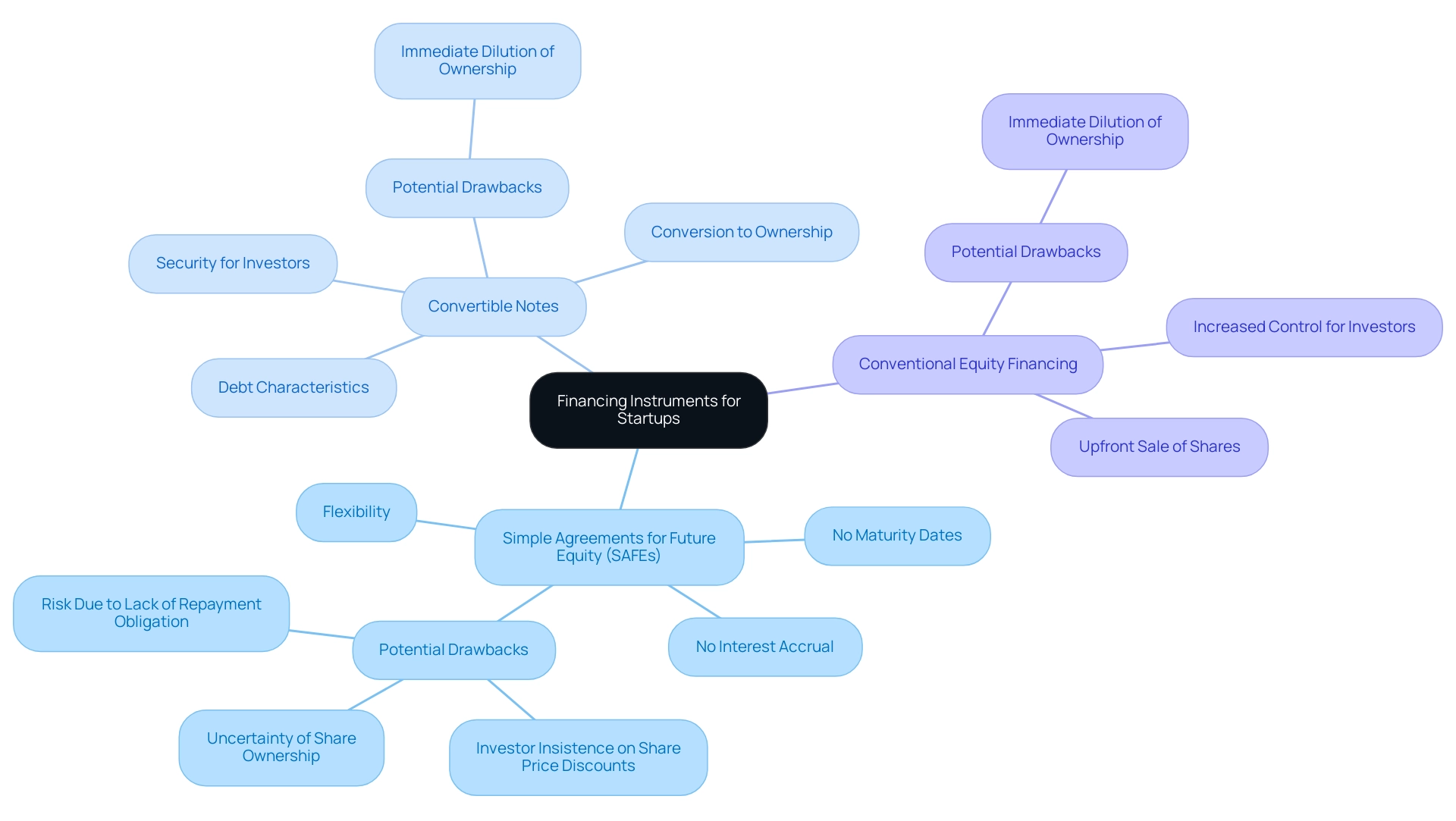

When evaluating funding options, new ventures often compare Simple Agreements for Future Equity with other instruments such as safe equity agreements, convertible notes, and conventional equity financing. Safe equity agreements distinguish themselves by omitting interest accrual and maturity dates, which streamlines the financing process and alleviates some burdens associated with debt instruments. As noted by experts, 'For very early-stage startups, a safe equity agreement can be advantageous due to its simplicity and focus on future valuation.'

In contrast, convertible notes provide stakeholders enhanced safeguards, enabling them to convert into ownership at a predetermined valuation, thus protecting their investment from future valuation changes. Traditional equity financing, on the other hand, necessitates the upfront sale of shares, which can lead to immediate dilution of ownership. However, this method may afford investors increased control and influence over the company’s direction.

Recognizing these differences is vital for startups as they navigate their financing strategies, especially in light of the evolving landscape of safe equity agreements and other startup funding instruments. Recent trends indicate that while these agreements are preferred for their simplicity, they do come with potential drawbacks. Participants may insist on share price discounts, and there is a risk due to the lack of repayment obligation, which can create discomfort among those accustomed to more traditional funding methods.

Additionally, the uncertainty of share ownership until future funding rounds are realized can be a significant concern. A comparison of simple agreements for future equity and convertible notes shows that while simple agreements for future equity provide greater flexibility and are less risky for founders, convertible notes offer more security for backers due to their debt characteristics.

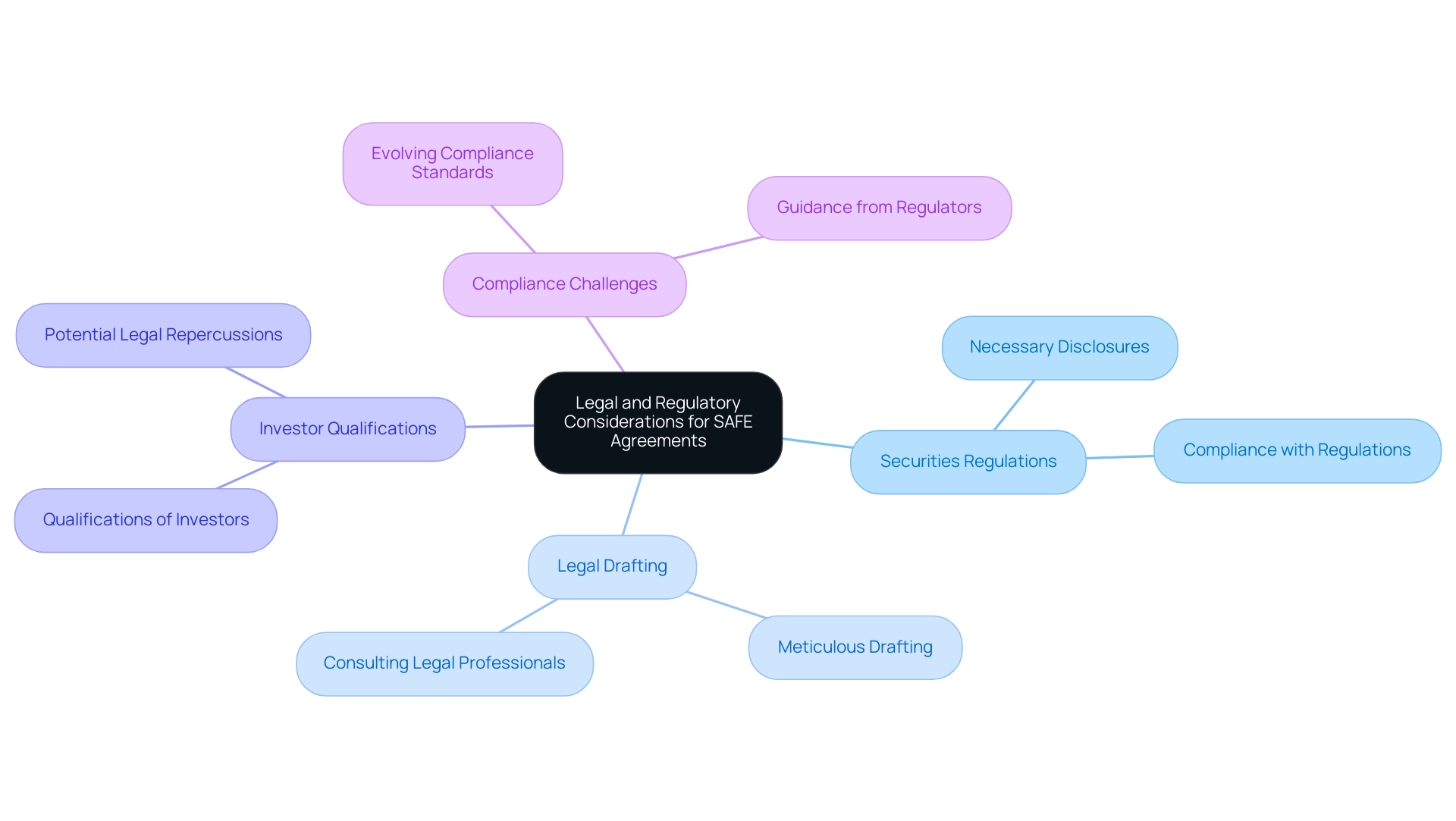

Legal and Regulatory Considerations for SAFE Agreements

Startups that engage in safe equity agreements must navigate a landscape characterized by intricate legal and regulatory considerations to ensure compliance. Although these instruments are typically perceived as simpler alternatives to traditional equity financing, they necessitate meticulous drafting to eliminate ambiguities that could result in disputes. Critical to this process is the adherence to securities regulations governing the issuance of Safes, particularly concerning necessary disclosures and the qualifications of investors involved.

As Oliver Wade, a paralegal in our award-winning Landlord & Tenant Team, emphasizes, "Landlords must accommodate tenants with recognized disabilities who rely on assistance dogs," highlighting the importance of legal compliance in various contexts. Additionally, a recent survey revealed that 77% of corporate risk and compliance professionals value staying updated on the latest ESG-related developments, underscoring the necessity for new ventures to remain vigilant about evolving compliance standards. Consulting with legal professionals who specialize in financing for new ventures is strongly advised; their expertise ensures that all legal requirements are satisfied and helps safeguard against potential liabilities.

As new ventures continue to implement safe equity agreements, it becomes increasingly paramount to be aware of regulatory challenges, including compliance issues that may arise in 2024. For instance, case studies have shown that startups often face hurdles related to investor qualifications and disclosure requirements, which can lead to significant legal repercussions if not properly addressed.

Conclusion

The exploration of Simple Agreements for Future Equity (SAFEs) reveals their growing significance in the startup financing landscape. By offering a streamlined approach to fundraising, SAFEs allow startups to secure essential capital without the complexities associated with traditional equity arrangements. Their inherent advantages, such as the elimination of interest payments and maturity dates, make them particularly appealing to early-stage companies navigating the challenges of unpredictable revenue streams.

However, it is crucial for founders to remain aware of the potential risks involved, including ownership dilution and the absence of immediate investor protections. While SAFEs provide a flexible and efficient means of securing funding, they may also lead to significant implications for founders and early investors during subsequent funding rounds. The comparison with other financing instruments, such as convertible notes and traditional equity financing, underscores the importance of understanding the unique characteristics of SAFEs to make informed decisions.

Legal and regulatory considerations also play a critical role in the successful implementation of SAFEs. Startups must ensure compliance with securities regulations and maintain transparency with investors to mitigate potential liabilities. As the startup funding environment continues to evolve, navigating these complexities will be essential for founders looking to leverage SAFEs effectively. Overall, while SAFEs present a valuable tool for raising capital, a thoughtful approach to their use is necessary to balance benefits with the accompanying risks.