Overview

This article shines a light on the top seven Indian crowdfunding platforms that play a vital role in diverse fundraising efforts, showcasing their unique features and contributions to the entrepreneurial landscape. We understand that accessing capital can be a daunting challenge for many aspiring entrepreneurs. Platforms like Ketto and Milaap are here to democratize that access, fostering community engagement and support. They not only empower individuals to pursue their innovative ideas but also significantly contribute to social causes across India. By highlighting these platforms, we celebrate the spirit of collaboration and the collective effort to uplift those in need, illustrating how community-driven initiatives can lead to meaningful change.

Introduction

In recent years, crowdfunding has emerged as a transformative force in India's financial landscape, offering innovative solutions for entrepreneurs and social initiatives alike. We understand that as traditional funding avenues become increasingly difficult to navigate, platforms dedicated to collective fundraising are stepping in to democratize access to capital.

With projections indicating significant growth in the sector, the Indian crowdfunding market is poised for rapid expansion, driven by technological advancements and a rising awareness of its potential. From supporting social causes to fueling creative ventures, crowdfunding is not merely a financial tool; it embodies a collaborative spirit that empowers communities and fosters engagement.

As many of our members have experienced, the landscape is evolving, and understanding the key players, trends, and challenges will be essential for anyone looking to harness the power of crowdfunding in India.

Understanding Crowdfunding in India

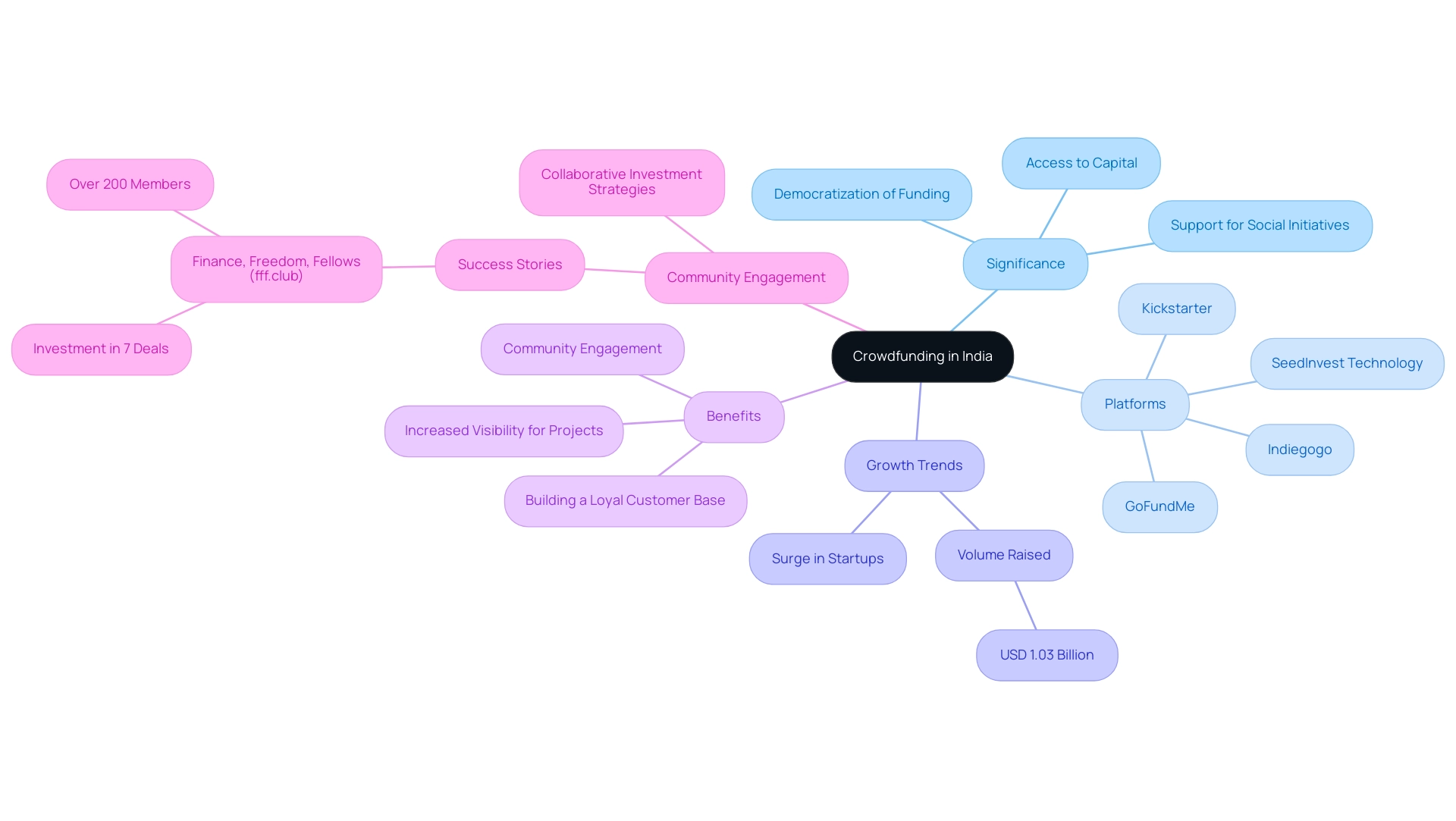

Crowdfunding in India has rapidly evolved into a vital mechanism for raising capital through collective efforts on Indian crowdfunding platforms, enabling individuals and organizations to gather resources from a broad audience via online platforms. This approach is particularly crucial in India, where many entrepreneurs and social initiatives face challenges in accessing traditional funding sources, highlighting the importance of Indian crowdfunding platforms. In 2025, the landscape of collective financing is characterized by a remarkable growth trajectory, with the volume raised through reward-based funding worldwide reaching approximately USD 1.03 billion, reflecting a growing acceptance of this funding model.

The growth of digital technology has greatly aided the accessibility and involvement of potential supporters and creators. As more individuals become acquainted with collective funding, platforms such as SeedInvest Technology, Kickstarter, GoFundMe, and Indiegogo are increasingly catering to diverse projects, ranging from innovative startups to impactful social causes. This versatility makes collective funding an appealing choice for many, especially in a dynamic market like India.

Recent trends indicate a surge in interest among Indian startups utilizing Indian crowdfunding platforms to fuel their growth. Industry leaders have noted that this funding method not only democratizes access to capital but also fosters community engagement and support for new ideas. The collaborative aspect of collective funding enables supporters to feel invested in the success of projects, fostering a sense of ownership and shared purpose.

Expert opinions emphasize the transformative influence of Indian crowdfunding platforms on the startup ecosystem in India. By offering an alternative funding route, collective financing enables entrepreneurs to validate their ideas and gain traction without depending solely on conventional investors. This shift is particularly beneficial for early-stage startups that may struggle to secure funding through conventional means.

Essential aspects regarding financial backing in India encompass its capacity to aid various sectors, the rising quantity of sites accessible, and the increasing awareness among the public about the advantages of engaging in fundraising initiatives. The success stories emerging from this space further illustrate its potential, with numerous startups achieving significant milestones through community support. For instance, the Finance, Freedom, Fellows (fff.club) community exemplifies how collaboration can enhance investment strategies and foster a deeper understanding of wealth management among its members.

In its first year, fff.VC grew to over 200 members from 23 countries, worked through 659 early-stage deals, and invested approximately 4 million euros in 7 deals, providing access to exclusive opportunities like Votemo, Insly, DriveX, Scramble, RecruitLab, Bolt, and KatanaMRP. With over 400 tech investors engaging in this community, fff.Club not only provides access to exclusive investment opportunities but also serves as a platform for educational resources and networking, empowering tech investors to maximize their investment potential.

In summary, Indian crowdfunding platforms offer numerous benefits, including enhanced access to capital, increased visibility for projects, and the ability to build a loyal customer base from the outset. As Akim Arhipov, founder of fff.club, aptly stated, "Financial superpowers should be accessible to everyone." As the collective funding market, particularly Indian crowdfunding platforms, continues to expand, it is poised to play an increasingly important role in shaping the future of entrepreneurship and innovation in the country.

To learn more about how you can engage with this vibrant community, book a call or become a member today.

Overview of the Top 7 Crowdfunding Platforms

-

Ketto: As a leader in India's fundraising landscape, Ketto is dedicated to social causes, empowering individuals to raise funds for critical needs like medical emergencies and education. Its heartfelt commitment to social impact has made it a beloved choice for many, nurturing a community-driven approach that enhances the fundraising experience.

-

Milaap: Known for its user-friendly interface, Milaap enables individuals to launch fundraising campaigns for personal and social initiatives without the burden of platform fees. This accessibility fosters its growing popularity among users eager to make a difference, resonating with the belief that financial superpowers should be available to everyone, as Akim Arhipov, founder of fff.club, articulates.

-

Wishberry: Primarily catering to creative endeavors, Wishberry utilizes a reward-based crowdfunding model that encourages backers to support innovative projects. This distinctive approach has attracted a vibrant community of creators and supporters, showcasing the potential for investment in creative ventures.

-

FuelADream: With a focus on social impact initiatives, FuelADream connects creators with passionate backers eager to make a difference. The platform's emphasis on meaningful initiatives resonates deeply with individuals looking to contribute to societal change, reflecting a community-driven ethos that enhances fundraising outcomes.

-

Catapooolt: This platform is devoted to startups and innovative initiatives, providing entrepreneurs with a stage to showcase their ideas. Catapooolt's dedication to promoting innovation has established it as a key player in the funding arena, attracting tech investors enthusiastic about supporting new ventures.

-

ImpactGuru: Concentrating on healthcare and social causes, ImpactGuru assists users in raising funds for medical treatments and community initiatives. Its focused approach has made it an essential resource for those in need of financial support for health-related issues, highlighting the importance of community engagement in fundraising.

-

Fundable: A versatile system, Fundable supports various funding models, including equity and rewards-based options. Its adaptability allows it to cater to a wide array of fundraising needs, making it a valuable tool for diverse projects. Notably, Fundable offers a monthly subscription of $59 for its services, providing a financial context that tech investors might find relevant.

In 2025, Indian crowdfunding platforms like Ketto and Milaap continue to evolve, leading the charge in the market. Success stories from these platforms highlight their effectiveness in mobilizing community support for various causes, while expert reviews emphasize their user-friendly features and impact-driven missions. As the market expands, these systems are poised to capture significant market share, reflecting the growing trend of community-driven fundraising in India.

Moreover, the case study of GoFundMe exemplifies a successful crowdfunding model that aligns with the themes of community support and personal fundraising, enhancing the credibility of the services discussed.

Key Features of Each Platform

- Ketto: This service truly shines with its zero-fee structure, allowing fundraisers to maximize their contributions without the burden of additional costs. With 24/7 support, Ketto ensures users receive assistance whenever they need it, significantly enhancing the overall user experience and providing peace of mind.

- Milaap: Renowned for its user-friendly mobile app, Milaap simplifies the management of fundraising efforts, enabling users to track their campaigns seamlessly on the go. The platform facilitates direct bank transfers, making it easier for donors to contribute and for fundraisers to access their funds promptly, fostering a sense of trust and reliability.

- Wishberry: By utilizing an innovative 'all-or-nothing' funding model, Wishberry ensures that projects receive funds only if they meet their specified goals. This feature encourages individuals to engage their supporters effectively and instills confidence in donors, who can rest assured that their contributions will only be utilized for successful campaigns.

- FuelADream: This platform emphasizes community engagement by allowing backers to interact directly with creators, fostering a sense of connection and transparency that enhances the crowdfunding experience and encourages robust support for projects.

- Catapooolt: Catapooolt distinguishes itself by offering specialized marketing assistance and a dedicated team focused on promotion. This support is crucial for creators looking to increase visibility and attract potential backers in a competitive landscape.

- ImpactGuru: Providing a comprehensive toolkit for campaign management, ImpactGuru integrates social media features that empower users to promote their campaigns effectively. In today's digital age, where social media presence can significantly influence fundraising success, this integration is vital.

- Fundable: Catering to a diverse range of projects, Fundable enables both equity and rewards-based funding. This flexibility draws a wider array of business owners and financiers, making it an adaptable option for various funding requirements.

As the fundraising environment in India evolves, crowdfunding platforms are increasingly leveraging technology to enhance user experience and interaction. For instance, the integration of AI is transforming how campaigns are optimized and assessed, leading to improved success rates and user satisfaction. Recent data shows that the volume raised through reward-based crowdfunding worldwide, particularly on Indian platforms, is approximately 1.03 billion USD, highlighting the substantial growth potential in this sector.

The commitment to inclusivity, as emphasized by Akim Arhipov, reinforces the notion that financial opportunities should be accessible to everyone, enriching the investment experience for users across these channels. As Taavi Roivas noted, the importance of these resources in democratizing funding cannot be overstated, making them essential tools for tech investors navigating the evolving market.

Types of Projects Funded by Indian Crowdfunding Platforms

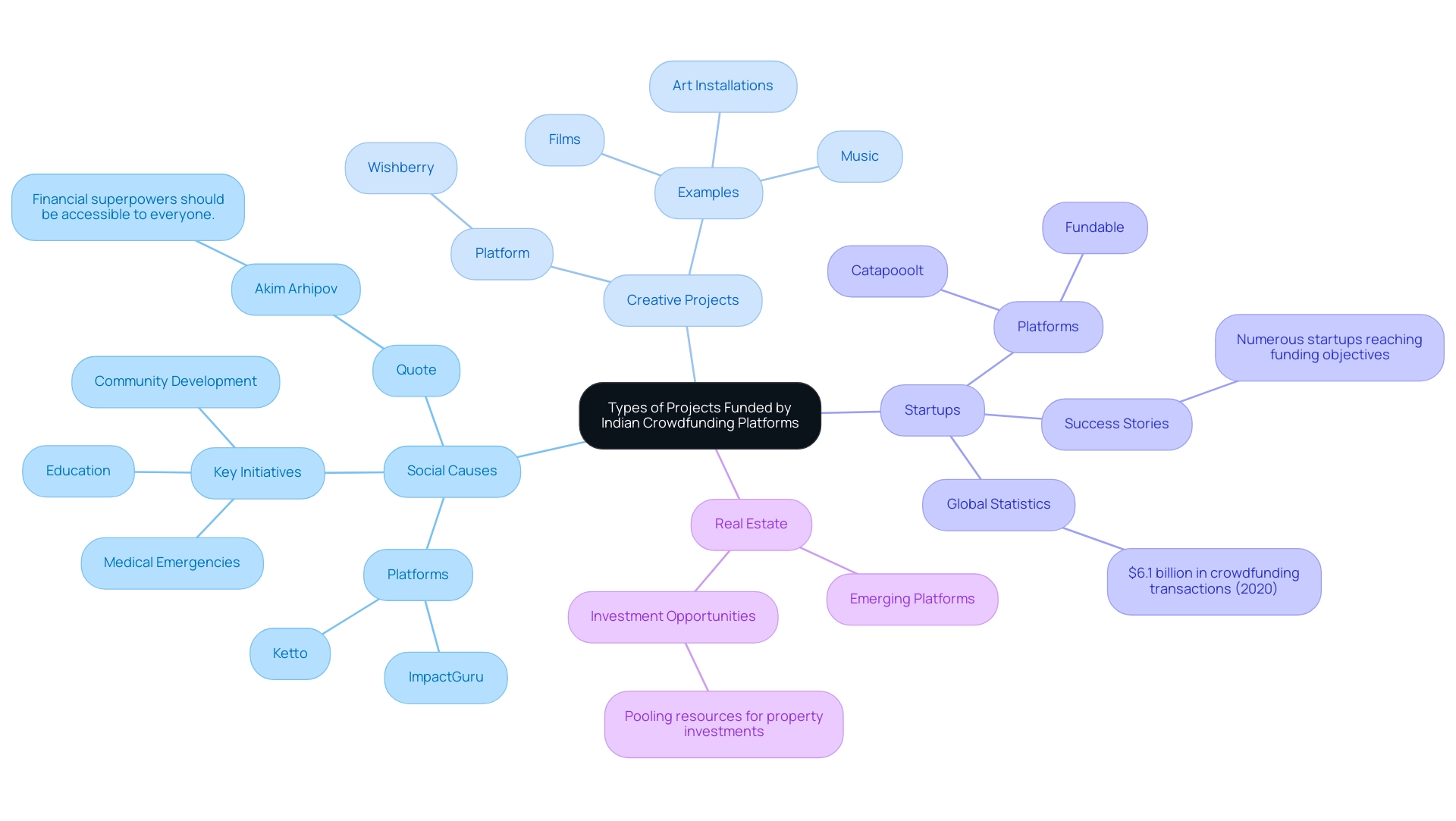

Indian crowdfunding platforms support a diverse array of projects, reflecting the dynamic entrepreneurial spirit and social consciousness of the country. Acknowledging the pressing challenges many face, these platforms offer a nurturing space for various initiatives. Key categories include:

- Social Causes: Platforms such as Ketto and ImpactGuru are at the forefront, addressing critical issues like medical emergencies, education, and community development. These Indian crowdfunding platforms have successfully raised millions for various initiatives, showcasing how collective action can drive social change. This aligns with the philosophy of inclusivity in financial empowerment, as articulated by Akim Arhipov, founder of fff.club, emphasizing that financial superpowers should be accessible to everyone. As many of our members have experienced, the impact of community support can be transformative.

- Creative Projects: Wishberry distinguishes itself as a dedicated service for artists and creators, enabling them to fund films, music, and art installations. This category has seen a surge in popularity, with many successful campaigns highlighting the importance of creative expression in society. We understand that the arts play a crucial role in our lives, and these platforms foster a sense of belonging among creators and supporters alike.

- Startups: Catapooolt and Fundable are pivotal for entrepreneurs seeking capital for innovative business ideas. These platforms have facilitated significant funding rounds, with notable success stories emerging from their ecosystems. For example, numerous startups have reached their funding objectives through Indian crowdfunding platforms, showcasing the efficiency of collective financing in initiating new enterprises. Worldwide, collective funding transactions reached $6.1 billion in 2020, indicating the scale of this funding method and its relevance to Indian crowdfunding platforms. We celebrate these successes, as they inspire others to pursue their dreams.

- Real Estate: While still in its nascent stages, real estate funding through the crowd is gaining traction in India. Some Indian crowdfunding platforms are beginning to explore this avenue, enabling investors to pool resources for property investments, thereby democratizing access to real estate opportunities. As we move forward, this innovation could open doors for many seeking to invest in their communities.

In 2025, the fundraising landscape in India is expected to evolve further, with Indian crowdfunding platforms placing a growing emphasis on social causes and innovative startups. Statistics indicate that categories such as health and education will continue to dominate, reflecting the pressing needs of the community. Specialist views suggest that as knowledge of collective funding increases, more innovators and businesspeople will utilize Indian crowdfunding platforms to bring their ideas to life.

Successful project developers have shared their experiences, emphasizing the importance of community support and engagement in achieving funding goals. Mihkel Torim, a leader in the field, remarked, "The club's dedication to providing members with the essential insights and resources to make informed choices" aligns with the collaborative ethos of collective funding. This collaborative spirit not only improves the funding process but also nurtures a sense of belonging among supporters and innovators alike. Together, we can create a brighter future through shared efforts.

Challenges and Considerations in Crowdfunding

While collective funding offers a wealth of opportunities, we understand it is not without its challenges, particularly in the Indian market:

- High Competition: The Indian collective funding landscape is becoming increasingly saturated, with numerous initiatives competing for the attention of potential backers. This heightened competition makes it essential for individuals to develop compelling narratives and marketing strategies to differentiate their projects. As many of our members have experienced, standing out in this crowded space can feel daunting.

- Trust Issues: Trust remains a significant barrier in the crowdfunding space. Many potential backers express hesitance to invest due to concerns regarding the legitimacy and transparency of projects. This skepticism can be intensified by the prevalence of scams in the industry, making it essential for services to implement robust verification processes. We understand that building credibility through transparent communication is crucial. As pointed out by Taavi Roivas, former Prime Minister of Estonia, addressing these trust issues is essential for fostering a more robust ecosystem for Indian crowdfunding platforms.

- Regulatory Hurdles: The legal framework surrounding Indian crowdfunding platforms can be intricate, especially for equity-based initiatives. Navigating these regulations requires a thorough understanding of compliance requirements, which can be daunting for new entrepreneurs. As the market evolves, staying informed about regulatory changes is essential for both platforms and creators. Many have shared their struggles with this complexity, underscoring the need for clear guidance and support.

- Funding Objectives: A common challenge faced by fundraising initiatives is the risk of not achieving their funding objectives. In India, initiatives that fail to reach their targets often receive no funds at all, which can be disheartening for creators who invest significant time and resources into their campaigns. This 'all-or-nothing' model can deter some potential backers who may prefer to see partial funding options. The Indian crowdfunding platforms are anticipated to contribute to the expansion of the India fundraising market from USD 48.2 million in 2024 to USD 133.2 million by 2030, suggesting a substantial opportunity for those who can manage these challenges efficiently.

- Statistics on Initiative Failures: Recent data shows that a considerable percentage of fundraising initiatives in India fail to meet their financial targets, emphasizing the necessity for effective planning and promotional strategies. Comprehending the reasons behind these failures can offer valuable insights for future campaigns. We encourage our members to learn from these experiences to enhance their chances of success.

- Expert Opinions: Industry leaders emphasize the importance of building trust and transparency in funding initiatives. As highlighted by notable individuals in the field, tackling these trust concerns is crucial for cultivating a more resilient funding ecosystem in India.

- Considerations for Success: To navigate these challenges effectively, project developers should concentrate on crafting clear, captivating presentations, utilizing social validation, and actively interacting with their audience throughout the campaign. Furthermore, comprehending the competitive environment and recognizing distinctive selling points can greatly improve the likelihood of success. Many of our members have found that sharing their stories and engaging with their audience has made a significant difference.

As the Indian crowdfunding platforms are expected to expand considerably, with projections indicating they will attain USD 133.2 million by 2030, tackling these challenges will be essential for both systems and creators seeking to excel in this dynamic landscape. With a community like fff.club, which boasts over 410 tech professionals, the importance of networking and shared insights cannot be overstated. Akim Arhipov's commitment to inclusivity reinforces the belief that financial superpowers should be accessible to everyone, further enhancing the investment experience for members.

Success Stories from Indian Crowdfunding Platforms

-

Ketto: In 2025, Ketto has emerged as a beacon of hope, raising over ₹1 crore for Kerala flood relief efforts. This outstanding accomplishment underscores the system's essential role in mobilizing resources during emergencies, illustrating how collective funding can effectively address pressing social needs. Ketto's success reflects a broader trend of crowdfunding initiatives making a significant impact on community support, aligning with the belief that financial superpowers should belong to everyone, as expressed by Akim Arhipov, founder of Finance, Freedom, Fellows.

-

Milaap: Renowned for its focus on medical fundraising, Milaap has facilitated numerous campaigns that have not only met but often exceeded their financial goals. Many individuals have successfully raised funds for critical medical treatments, showcasing its profound impact on personal health crises and the power of community support. One grateful campaigner shared, "Thanks to Milaap, I could afford my treatment and am now on the road to recovery."

-

Wishberry: This platform has been instrumental in supporting creative endeavors, including films and music albums, many of which have achieved remarkable commercial success. By offering a space for artists to engage with their audience, Wishberry illustrates how collective funding can turn creative visions into reality.

-

FuelADream: FuelADream empowers social entrepreneurs to fund impactful community projects, illustrating the strength of collective action. The platform has facilitated numerous initiatives that address local issues, reinforcing the belief that collective funding can stimulate significant transformation in communities and generate cooperative investment opportunities for technology investors.

-

Flangar: Flangar is a funding service that rewards artists with exclusive benefits for their supporters, emphasizing innovation and creativity. This model not only enhances the experience for supporters but also motivates individuals to launch campaigns, showcasing the diverse possibilities within the crowdfunding landscape.

-

Ketto Success Stories: In 2025, Ketto has witnessed numerous success narratives, with campaign initiators expressing heartfelt gratitude for the service's support. One creator remarked, "Ketto made it possible for us to reach our goal and help those in need during the floods."

-

Impact on Social Causes: The influence of collective fundraising on social initiatives in India has been profound, particularly through Indian crowdfunding platforms like Ketto and Milaap leading the charge. They have not only provided financial support but have also raised awareness about critical issues, fostering a culture of giving and community involvement. As Akim Arhipov stated, "Financial superpowers should be accessible to everyone," highlighting the importance of inclusivity in financial opportunities. This accessibility can also present potential investment opportunities for tech investors looking to engage with socially responsible initiatives via Indian crowdfunding platforms.

Future Trends in Indian Crowdfunding

The future of collective funding in India is poised for substantial growth, driven by several key trends that we believe will resonate with many of you:

-

Increased Regulation: As the collective funding market matures, we understand that improved regulatory clarity, particularly in equity-based funding, is essential. This shift not only safeguards investors but also fosters a more resilient investment environment, which is a concern many of us share.

-

Technological Advancements: Innovations like blockchain technology and artificial intelligence are set to transform the funding landscape. We recognize that these technologies enhance transparency, streamline processes, and improve overall efficiency, making it easier for both investors and creators to engage. For example, the Non-Fungible Token (NFT) market illustrates how technology can create new funding models and opportunities, indicating a diverse and growing landscape for digital assets that many are eager to explore.

-

Focus on Social Impact: A notable trend is the increasing emphasis on social impact within funding campaigns. As responsible investing gains traction, we see more initiatives aligning with social causes, appealing to a growing demographic of investors who prioritize ethical considerations alongside financial returns. This shift reflects the values many of us hold dear.

-

Diversification of Funding Models: To accommodate a wider array of projects, collective funding platforms are likely to introduce innovative financing models, such as revenue-based financing. This diversification will provide more options for entrepreneurs and investors alike, catering to various needs and preferences, which we know is important to our community.

-

Expert Predictions: Industry analysts predict that the collective funding market in India will continue to expand, fueled by rising digital literacy and increasing smartphone penetration. This growth is expected to create a more inclusive investment landscape, allowing a broader segment of the population to participate in funding opportunities. As Natalie Portman pointed out, customers of La Vie will have the opportunity to engage at the same share price as a professional investor, illustrating the democratization of investment opportunities within collective funding—a change that many have long awaited.

-

Case Studies: Recent reports highlight the evolving nature of collective funding, showcasing successful campaigns that leverage technology and social impact. These examples demonstrate the potential for collective funding to not only generate financial returns but also contribute positively to society, something we can all feel proud of.

-

Regulatory Changes: As the Indian government acknowledges the significance of Indian crowdfunding platforms in fostering innovation and entrepreneurship, we can anticipate ongoing regulatory adjustments aimed at supporting this sector while ensuring investor protection. We understand that this proactive approach will likely enhance confidence among investors and encourage more participation in crowdfunding initiatives, fostering a sense of community and shared purpose.

Conclusion

The evolution of crowdfunding in India signifies a transformative shift in how entrepreneurs and social initiatives access capital. We understand that for many, finding the right support can be daunting. With a diverse array of platforms catering to social causes, creative projects, and startups, the landscape is rich with opportunity. Key players such as Ketto, Milaap, and Wishberry exemplify the potential of crowdfunding to mobilize community support and drive meaningful change. These platforms not only provide financial resources but also foster a sense of belonging and shared purpose among backers and creators, creating a community that uplifts one another.

However, as the market grows, we recognize the challenges that arise, such as high competition, trust issues, and regulatory hurdles. These are significant concerns that must be addressed to ensure sustainability and success. The commitment to inclusivity and transparency will be crucial in building confidence among potential backers and enhancing the overall crowdfunding experience. As many of our members have experienced, feeling secure in your investment is essential.

Looking ahead, the future of crowdfunding in India is promising. Trends indicate increased regulation, technological advancements, and a greater focus on social impact—elements that are crucial for fostering a nurturing environment. As the sector matures, it is poised to play an integral role in shaping the entrepreneurial landscape, making financial opportunities accessible to a broader audience. Embracing these changes will not only empower innovators but also enrich communities, reinforcing the belief that financial superpowers should indeed be accessible to everyone. Together, we can nurture this growth and ensure that every voice is heard and valued.