Overview

The title "Top 10 Real Estate Crowdfunding Platforms USA for 2025" focuses on identifying the leading platforms for real estate crowdfunding that are expected to thrive in the upcoming year. The article outlines ten notable platforms, such as Fundrise and RealtyMogul, highlighting their unique features and advantages, while also discussing the broader trends and benefits of real estate crowdfunding, such as increased accessibility and diversification for investors, thus providing a comprehensive overview of the landscape for 2025.

Introduction

The emergence of real estate crowdfunding has revolutionized the investment landscape, providing a pathway for a diverse range of investors to engage in property markets that were once considered exclusive to the affluent. By pooling resources through online platforms, individuals can now participate in a variety of real estate projects, from residential developments to commercial ventures, without the need for substantial capital.

This article delves into the fundamental aspects of real estate crowdfunding, exploring its benefits and drawbacks, evaluating leading platforms for 2025, and examining the key factors that investors should consider when selecting a crowdfunding platform.

Furthermore, it highlights future trends poised to shape the industry, underscoring the significant shifts in investor behavior and market dynamics as this innovative investment model continues to gain traction.

Understanding Real Estate Crowdfunding: An Overview

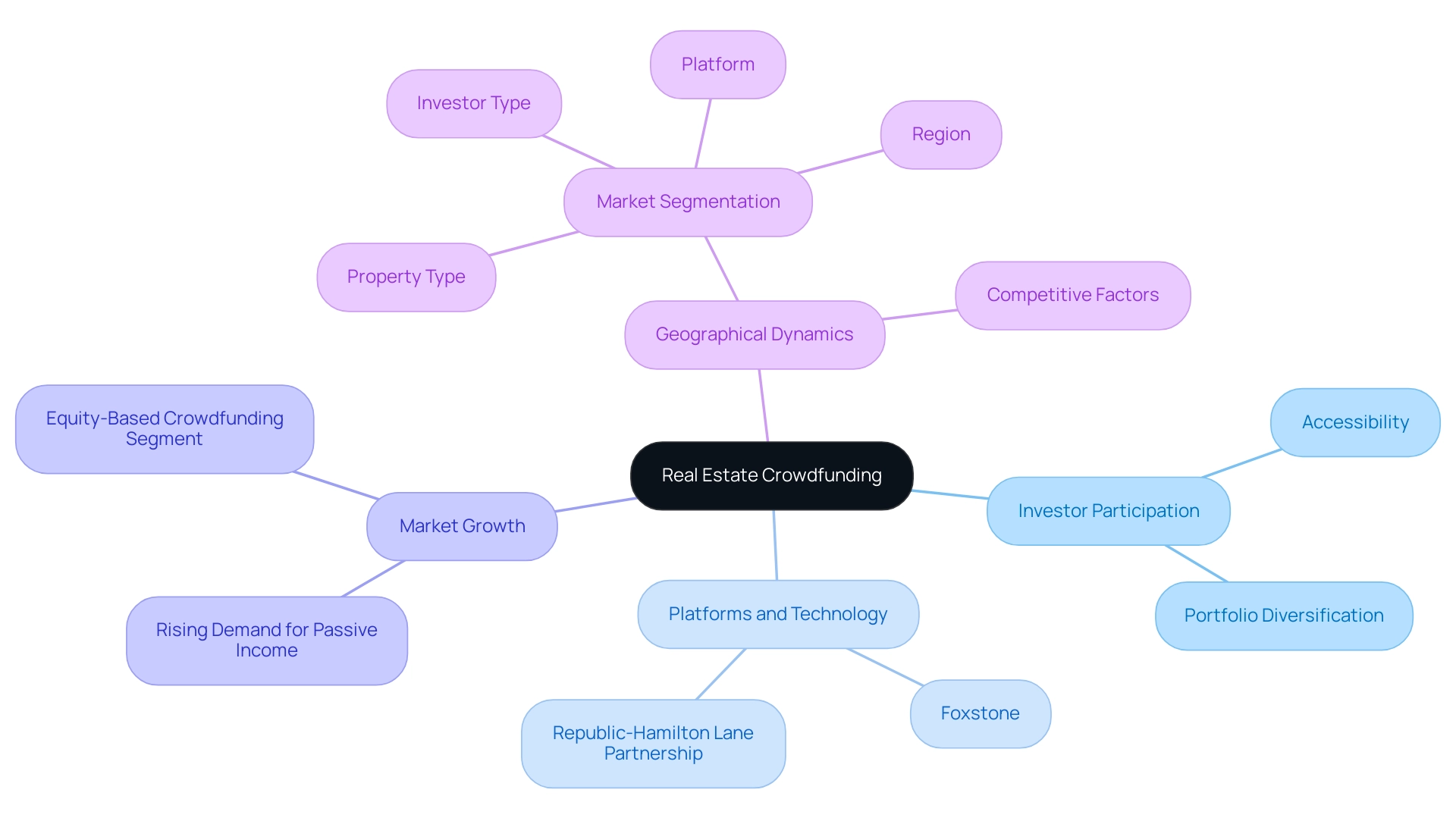

Real estate crowdfunding platforms USA represent a revolutionary method to finance, allowing a group of investors to combine their resources for funding various property initiatives. This approach greatly promotes equal access to real property opportunities, making it attainable for a wider audience, including individuals who may lack the funds to acquire properties outright. For instance, Foxstone recently closed its CHF 10 million Series A financing round, marking a significant milestone in the industry and underscoring the growing interest in crowdfunding as a viable financial option.

Investors can participate in a diverse range of real estate ventures, including both residential developments and commercial properties, often utilizing real estate crowdfunding platforms USA that are designed for these transactions. As the equity-based crowdfunding segment captures a notable market share, driven by a growing demand for passive income and increasing trust in crowdfunding models, technology plays a pivotal role in this evolution. A significant instance of this evolution is the partnership between Republic, the largest securities crowdfunding service, and Hamilton Lane, which seeks to democratize access to blockchain investments for retail participants.

These real estate crowdfunding platforms USA not only enable individuals to diversify their portfolios but also offer developers a novel route for capital acquisition. Moreover, as per Facts & Factors, the dynamics of the global marketplace indicate significant geographical and competitive factors, which are essential for comprehending market segmentation and stakeholder engagement. With 2024 expected to experience considerable growth in crowdfunding for properties, the dynamics of participant involvement indicate a notable shift towards a more inclusive financial landscape.

Top 10 Real Estate Crowdfunding Platforms for 2025

- Fundrise: Known for its user-friendly interface, Fundrise allows participants to enter the market with a low minimum contribution and offers access to a diverse range of real estate projects, making it an appealing choice for both beginners and experienced individuals.

- RealtyMogul: This platform caters to a broad spectrum of investment strategies and risk tolerances by offering both equity and debt investments. RealtyMogul's flexible approach allows individuals to tailor their portfolios according to their personal preferences.

- CrowdStreet: Focusing on commercial real property, CrowdStreet links accredited individuals with institutional-quality projects. The system is characterized by its dedication to transparency, offering comprehensive information that assists stakeholders in making informed choices.

- PeerStreet: This service concentrates on real property debt, enabling individuals to earn income through short-term loans backed by real property assets. PeerStreet's model appeals to those seeking predictable cash flow with relatively lower risk exposure.

- YieldStreet: YieldStreet diversifies opportunities across various asset classes, including real estate, providing individuals access to alternative options that feature competitive returns. The system is notable for its wide range of financial opportunities.

- Roofstock: Centered on single-family rental properties, Roofstock provides a marketplace for buying and selling tenant-occupied homes. This platform simplifies the process for individuals looking to enter the rental market without managing properties directly.

- EquityMultiple: With a strong focus on commercial property, EquityMultiple provides a range of funding opportunities, supplemented by access to comprehensive project details, which boosts confidence and decision-making for participants.

- Ground floor: Ground floor enables individuals to participate in real property projects at the grassroots level by offering funding for short-term loans with appealing returns. This model appeals to those interested in supporting new developments directly.

- ArborCrowd: Concentrating on institutional-quality real property projects, ArborCrowd provides individuals the opportunity to engage in professionally managed opportunities, guaranteeing a greater degree of oversight and expertise in their financial selections.

- Investable: As a newer entrant in the market, Investable aims to streamline the investment process by offering a curated selection of real estate crowdfunding platforms USA that simplify decision-making for investors.

In the context of the growing crowdfunding industry, it is notable that US equity crowdfunding raised $214.9 million in 2020, reflecting a 105% growth from the previous year. As Imed Bouchrika, Co-Founder and Chief Data Scientist, states, "The world of crowdfunding is thriving, providing a wide variety of options to assist individuals and businesses in raising funds for their projects and causes." Additionally, platforms like 1031 Crowdfunding, which specializes in tax deferral through 1031 exchanges, have successfully sold over $2.1 billion in securities across more than 1,500 transactions, demonstrating the potential for significant returns in this evolving market.

Evaluating the Pros and Cons of Real Estate Crowdfunding

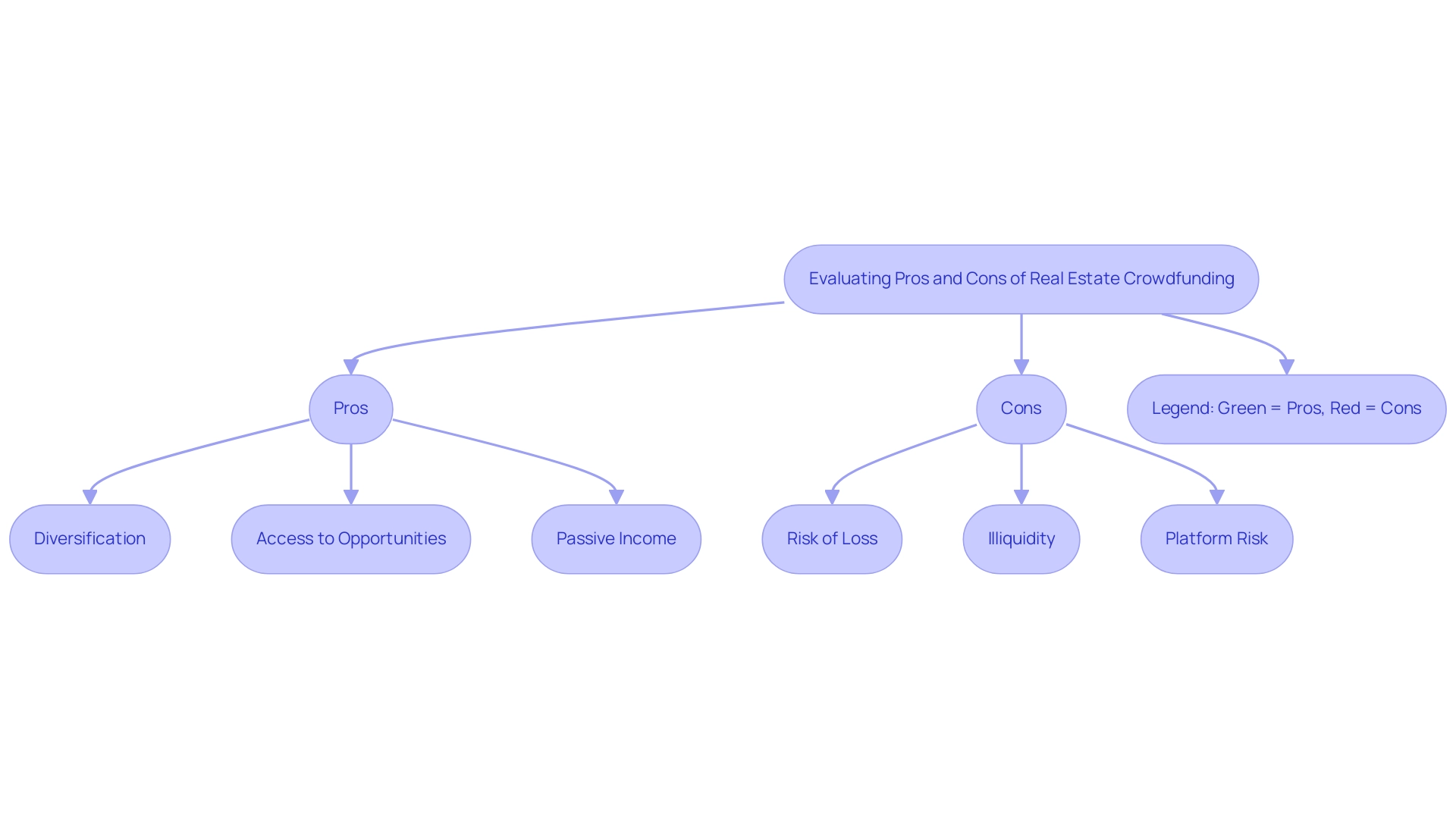

Pros:

- Diversification: Real estate crowdfunding presents a unique opportunity for investors to diversify their portfolios by allocating funds across various properties in different markets. This strategy can mitigate risks associated with single-property holdings and echoes insights from Baltic leaders like Kristjan Tamla, who emphasizes the importance of strategic asset allocation in managing multi-asset portfolios. For example, during his time at efTEN, Tamla has successfully overseen various property portfolios that demonstrate the effectiveness of this approach.

- Access to Opportunities: Crowdfunding services provide access to property projects that may have been previously unattainable for individual backers due to significant capital demands. This democratization of investment opportunities enables broader participation in the real estate market, much like the approach of real estate crowdfunding platforms USA in providing access to early-stage investments.

- Passive Income: Numerous crowdfunding platforms provide the opportunity for consistent income streams through rental yields or interest payments, enabling participants to benefit from passive income generation.

Furthermore, in the UK, investors can capitalize on tax advantages by investing up to £20,000 in an Innovative Finance ISA (IFISA), receiving interest or dividends tax-free.

Cons:

- Risk of Loss: As in any form of investment, there exists a risk of losing principal, particularly if the underlying real estate projects fail to perform as anticipated. Investors must conduct thorough due diligence to assess potential risks associated with specific projects. The limited track records of newer systems can significantly increase this risk, underscoring the caution advised by experts like Tamla, who has noted the importance of evaluating project fundamentals.

- Illiquidity: Investments in real estate are generally less liquid than stocks or bonds, implying that investors may face extended waiting periods to access their funds. This characteristic can pose challenges, especially for those needing immediate liquidity.

- Platform Risk: The success of a financial endeavor is heavily influenced by the crowdfunding site's management and operational practices. Investors should be especially careful with newer systems that lack established track records, as this can increase financial risk.

In light of these considerations, Paolo Manetta, CEO of RE-Lender, highlights the importance of careful selection in the crowdfunding landscape:

Please meet RE-Lender, a Milan-based impact crowdfunding marketplace funding industrial, urban, real property, ecological, and digital reconversion projects. Moreover, stakeholders can gain from resources such as CrowdSpace, which helps in locating appropriate real estate crowdfunding platforms USA by offering filters based on funding type, country, and other pertinent information. The evolving nature of property crowdfunding necessitates that participants remain informed about regulatory developments, particularly concerning stakeholder protection and cross-border transactions, as regulatory bodies work to establish frameworks that ensure transparency and safeguard participant interests.

Moreover, the Special Opportunity Fund from efTEN illustrates how strategic asset allocation can be effectively utilized in property crowdfunding, highlighting the potential for focused allocations that align with market opportunities.

Key Factors to Consider When Choosing a Crowdfunding Platform

When selecting a real estate crowdfunding platform, investors should carefully evaluate several critical factors:

- Minimum Contribution Requirements: It is essential to understand the minimum contribution amount required by various platforms, as this can differ widely. In 2024, average minimum contributions are expected to fluctuate, affecting accessibility for various financial profiles.

- Fees and Costs: A thorough analysis of the fee structures is crucial. This includes management fees, transaction fees, and any potential hidden costs that could impact overall returns. Clarity concerning fees is essential, as highlighted by industry specialists who stress that transparency in fees is crucial for establishing trust with stakeholders. As highlighted by Sloboda Studio, "To simplify the development process, we also offer a pre-built, customizable crowdfunding solution, allowing you to launch faster and more efficiently."

- Types of Assets Available: Ensure that the service offers asset types that align with your risk appetite and overall financial strategy. Options like equity or debt opportunities should be accessible to accommodate different investor preferences.

- Track Record and Reputation: Conduct research on the system’s history, focusing on past performance, user reviews, and the credibility of its management team. A strong track record can indicate reliability and potential for future success.

- Transparency and Reporting: Prioritize platforms that provide clear and regular updates on performance and project status. This level of accountability is essential for maintaining investor confidence and engagement.

Additionally, in 2020, real estate crowdfunding platforms USA raised over $500 million in North America, showcasing the substantial growth and potential of this investment avenue. As emphasized in a case study on key attributes for crowdfunding systems, it’s essential to identify a set of core features during the project discovery phase, such as a welcome page and user account management, which are critical for user engagement and functionality.

As emphasized in recent advancements under the JOBS Act, venues now have the chance to involve a wider pool of backers, which highlights the significance of these factors in today’s changing environment of crowdfunding in real property.

Future Trends in Real Estate Crowdfunding: What to Expect in 2025

As we approach 2025, several pivotal trends are poised to shape the future landscape of real estate crowdfunding, with insights from Baltic investment leaders like Kristjan Tamla providing valuable context:

- Increased Regulation: The industry is expected to experience heightened regulatory scrutiny as it matures. While this may enhance protection for backers, it could also impose operational challenges for crowdfunding services, necessitating adaptability and adherence. Cameron Academy notes, "Global CRE transaction volumes have reached near-decade lows, but emerging trends suggest a potential resurgence," highlighting the importance of regulatory changes in this context.

- Technological Advancements: Innovations such as blockchain technology stand to significantly enhance transparency and security in transactions. Such advancements will likely make the real estate crowdfunding platforms USA more appealing to investors looking for dependability in their funding processes. In tandem, Kristjan Tamla emphasizes that emerging technologies can transform financial strategies, as seen with IoT technology revolutionizing homes into interconnected systems to enhance convenience and energy efficiency, appealing to environmentally conscious buyers.

- Growth of Niche Markets: An expansion of services catering to niche markets is anticipated, with increased focus on sectors such as green buildings and affordable housing. This shift addresses the interests of socially conscious individuals who prioritize sustainability and social impact in their financial decisions. The competitive market is underscored by the fact that over 30% of homes were sold above the listing price, indicating a demand that could further drive interest in these niche areas.

- Enhanced Data Analytics: The anticipated use of advanced data analytics tools by real estate crowdfunding platforms USA will provide participants with deeper insights into market trends and project performance. As emphasized by figures in the Baltic funding scene, this ability will enable more informed financial choices, empowering stakeholders to navigate the changing property landscape with assurance. Additionally, Kristjan Tamla discussed the latest fund from efTEN, the Special Opportunity Fund, which exemplifies how real estate funds can adapt to these trends, offering targeted investment opportunities in a dynamic market.

Conclusion

Real estate crowdfunding has emerged as a transformative investment strategy, democratizing access to property markets that were once exclusive to wealthy individuals. By pooling resources through online platforms, a broader demographic can now invest in diverse real estate projects, ranging from residential developments to commercial ventures. The article has explored the fundamental aspects of this investment model, including its benefits such as:

- Diversification

- Access to new opportunities

- Potential for passive income

alongside the inherent risks like:

- Illiquidity

- Platform reliability

As the industry evolves, several leading crowdfunding platforms for 2025 have been evaluated, showcasing innovative options that cater to various investor needs and preferences. With platforms like Fundrise, RealtyMogul, and CrowdStreet gaining traction, investors are equipped with tools to make informed decisions and tailor their portfolios according to their risk tolerance. The importance of thorough due diligence and understanding the intricacies of each platform cannot be overstated, as these factors significantly influence investment success.

Looking ahead, the future of real estate crowdfunding is shaped by trends such as:

- Increased regulation

- Technological advancements

- Growth of niche markets

These developments are set to enhance transparency, security, and investor confidence, paving the way for a more inclusive and dynamic investment landscape. As the market continues to mature, staying informed and proactive will be essential for investors aiming to leverage the opportunities presented by real estate crowdfunding. The potential for significant returns in this evolving sector is substantial, making it a compelling option for those seeking to diversify their investment portfolios.