Overview

The article focuses on comparing real estate crowdfunding platforms to help investors determine which one suits their needs best. It emphasizes the importance of evaluating factors such as fee structures, minimum capital requirements, the platform's track record, and the types of investments offered (debt vs. equity), which collectively inform the decision-making process and align with individual financial goals and risk appetites.

Introduction

The real estate crowdfunding sector has experienced significant upheaval, prompting a critical examination of its current landscape and future potential. As fundraising activity dwindles to its lowest levels in over a decade, platforms must adapt to shifting market dynamics and investor expectations.

This article delves into the challenges and opportunities that define the industry, highlighting key considerations for investors selecting crowdfunding platforms, the advantages and disadvantages of various investment models, and the emerging trends that promise to reshape the market.

With insights from industry experts and a focus on innovative strategies, this exploration aims to equip investors with the knowledge needed to navigate the complexities of real estate crowdfunding in an evolving economic environment.

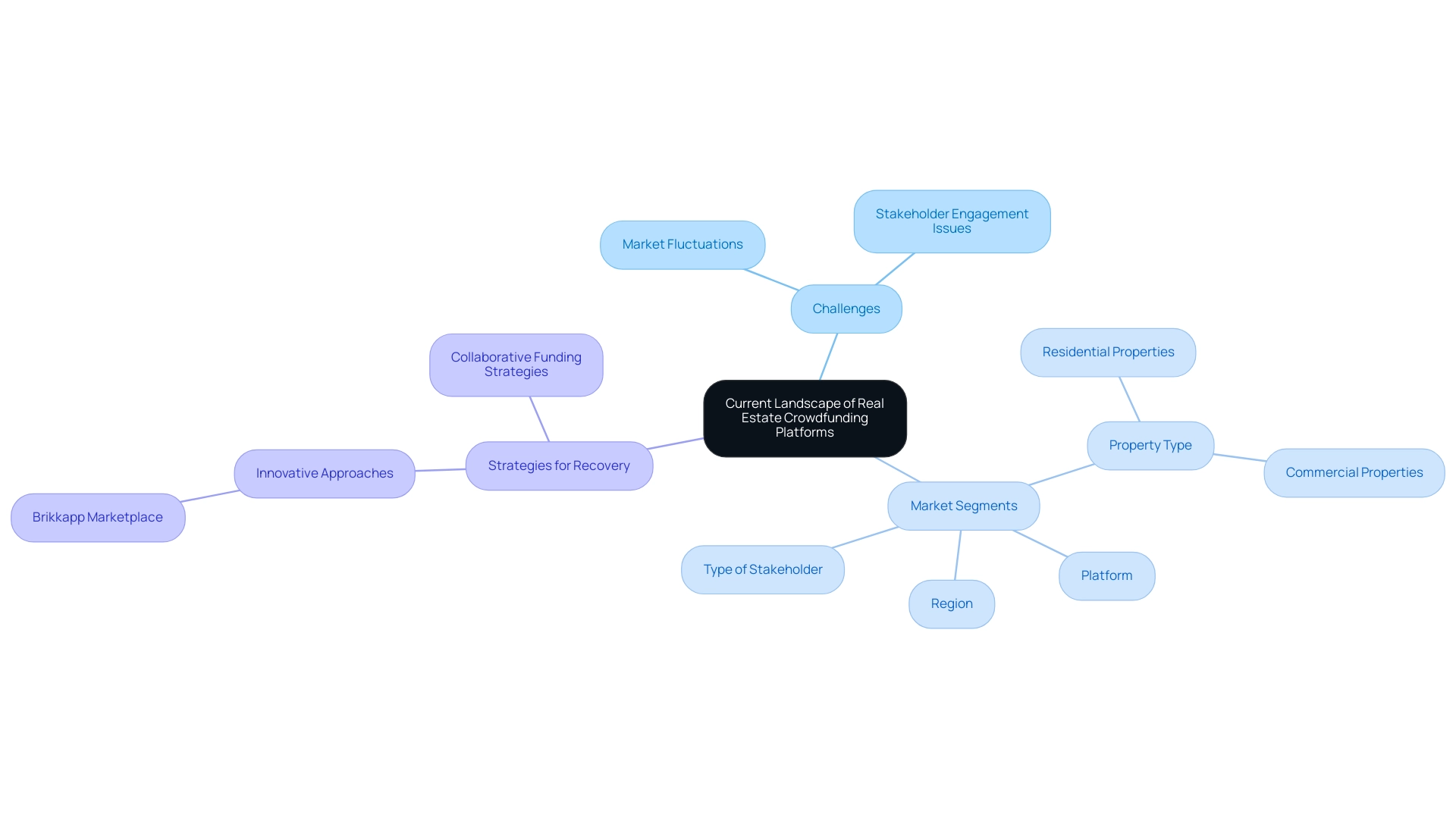

The Current Landscape of Real Estate Crowdfunding Platforms

The environment surrounding real estate crowdfunding platforms has experienced significant changes in recent years. Once celebrated as a growing sector, it now struggles with significant challenges arising from market fluctuations and changing expectations of backers. In 2023, real estate fundraising activity plummeted to US$138.83 billion, a significant decrease from US$224.63 billion in 2022, marking the lowest levels since 2012.

This downturn has prompted many platforms to reevaluate their business models, as emphasized by industry reports showing several formerly prominent platforms are struggling to sustain stakeholder engagement. Insights from prominent Estonian technology backers such as Sten Tamkivi and Kristjan Vilosius highlight the significance of innovation and resilience in navigating these turbulent waters. Tamkivi, with his extensive experience in tech and investment, emphasizes the need for adaptive strategies as the market segments by:

- Property type

- Type of stakeholder

- Platform

- Region

with residential properties being the dominant segment.

He reflects on his own experiences surviving two recessions and the lessons learned about maintaining investor trust and engagement during challenging times. Investors must remain acutely aware of these dynamics, recognizing that the performance and reliability of real estate crowdfunding platforms can vary markedly in response to economic conditions and regulatory changes. Furthermore, despite these challenges, there is a moderated sense of optimism in the sector, driven by the stabilization of interest rates and a resurgence in M&A activity, suggesting potential recovery and renewed involvement in crowdfunding for properties.

For instance, the cautious optimism among property professionals indicates a shift as they navigate out of a period of stasis. Furthermore, innovations such as Brikkapp's introduction of a marketplace that consolidates over 200 property platforms worldwide transform access to property opportunities. Kristjan Vilosius indicates that collaborative funding strategies, such as pooling resources with other stakeholders to reduce risks, can improve the likelihood of success in this evolving market.

Notably, the real estate crowdfunding platforms market size was valued at USD 17.8 billion in 2024, underscoring the sector's potential despite current challenges.

Key Considerations for Selecting the Right Crowdfunding Platform

When assessing real estate crowdfunding platforms, participants must thoughtfully contemplate several essential factors that can affect their overall financial success. Central to this decision is the platform's fee structure, which can vary significantly and potentially impact net returns. For instance, platforms like EstateGuru charge a withdrawal fee of €1 and an inactivity fee of €2.5 monthly, which could accumulate over time and affect profitability.

Additionally, the minimum capital requirement is another essential consideration, as it varies widely across different platforms, influencing accessibility and portfolio diversification.

In today's market, it is now easier than ever to build a diversified real estate portfolio, which makes the selection of the right real estate crowdfunding platforms even more crucial. Investors should also evaluate the platform's track record in successfully funded projects and financial returns to gain insight into its reliability and performance. Transparency regarding project details and associated risks is vital.

The case study titled 'Risks of Real Estate Crowdfunding' illustrates that this funding model involves various risks, including the nature of the deals, which can range from mature properties generating immediate income to new constructions that may take time to yield returns. Investors must navigate different risk parameters for each deal, including property type, location, and revenue generation potential.

Financial expert Angela Davenport emphasizes the importance of having a clear pricing strategy, stating,

Having a clear outline of your pricing strategy will not only outline your budget, goals, and timelines but also ensure your campaign’s success.

By systematically assessing these factors, including the differing fee structures and minimum capital requirements across real estate crowdfunding platforms, individuals can strategically align their selections with their financial goals and risk appetite, thereby improving their potential for successful contributions in the evolving real estate crowdfunding environment.

Understanding the Pros and Cons of Real Estate Crowdfunding

Real estate crowdfunding platforms offer a range of benefits, particularly their ability to provide participants with varied opportunities combined with the potential for appealing returns. Platforms like fff.club exemplify this by facilitating collaborative evaluation of opportunities, where over 300 experts screen high-grade deals and perform thorough due diligence, thus empowering members to make informed decisions.

This collaborative approach allows participants to engage in projects that may otherwise be financially unattainable, often with significantly lower capital outlay. For example, Density, an Austrian online real estate funding platform, allows contributions beginning at just 500 euros, highlighting protection for contributors as a key feature. Content stakeholders have observed how fff.club's process is not only seamless but also user-friendly, enabling them to explore financial opportunities effortlessly.

However, this funding model is not without its drawbacks. A primary concern is the lack of liquidity; funds are typically committed for extended periods, with platforms like EquityMultiple offering durations ranging from half a year to a decade or even longer, which can hinder a person's ability to access their capital promptly. Furthermore, the inherent risks of project failure or underperformance pose substantial threats to returns.

The limited track record of many new platforms increases the risk associated with these investments, making it crucial for individuals to be aware of the potential pitfalls. As emphasized by Paolo Manetta, CEO of RE-Lender, the challenges are numerous:

Please meet RE-Lender, a Milan-based impact crowdfunding marketplace funding industrial, urban, ecological, and digital reconversion projects.

Thus, a comprehensive grasp of these advantages and disadvantages is essential for investors looking to navigate the intricacies of real estate crowdfunding platforms effectively.

The worldwide property crowdfunding market is anticipated to expand considerably, with a projected market size of $161.8 billion by 2030, indicating a compound annual growth rate of approximately 46%, up from $11.5 billion in 2022. This indicates a rapidly evolving landscape, where awareness of both opportunities and risks, as well as the benefits of collaborative platforms like fff.club, is essential.

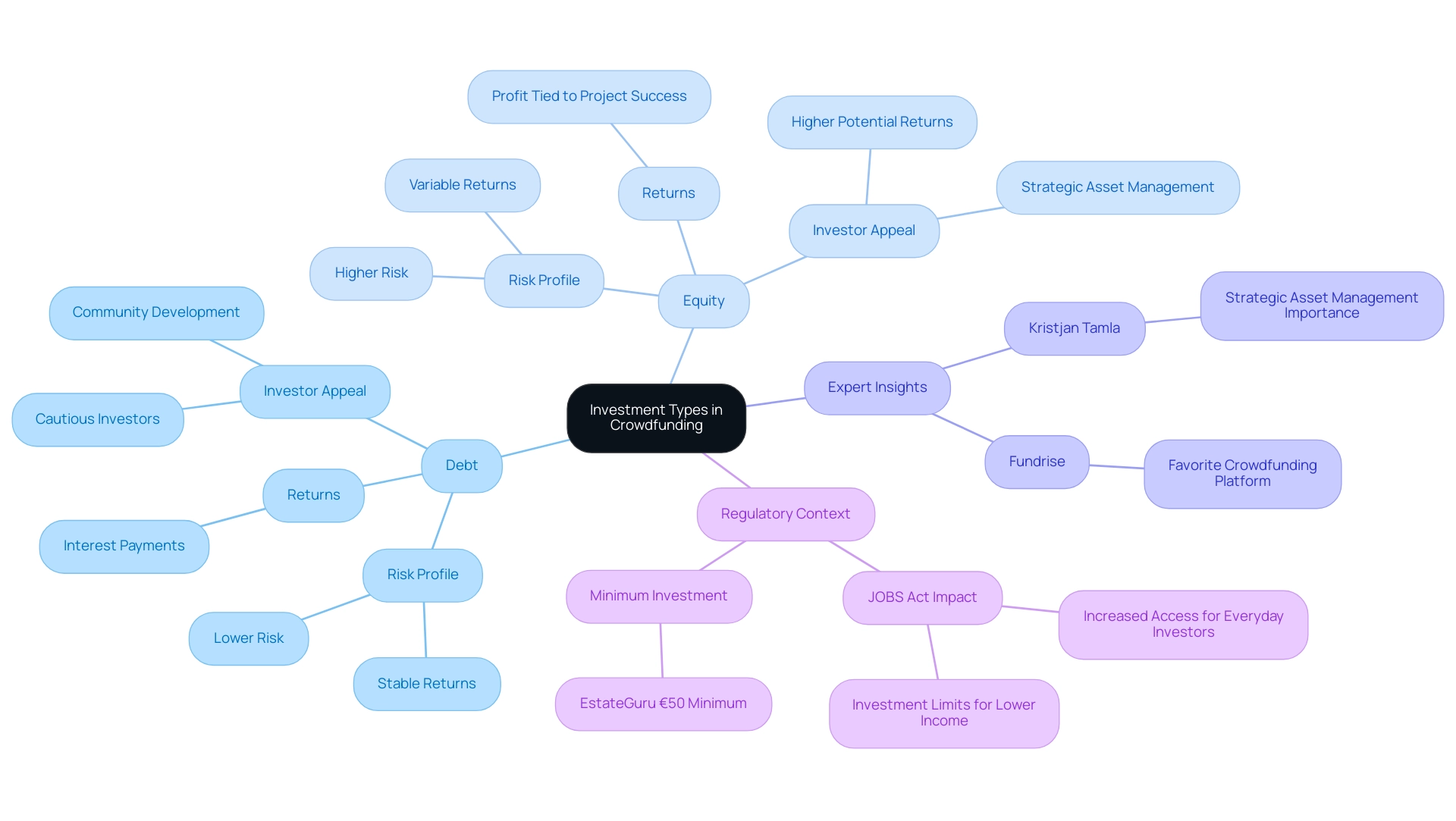

Exploring Investment Types: Debt vs. Equity in Crowdfunding

In the realm of real estate crowdfunding platforms, funding is primarily classified into two categories: debt and equity. Debt contributions typically involve providing capital to a project with the expectation of receiving interest payments in return. This model generally offers lower risk and more stable returns, making it an appealing choice for cautious individuals.

In contrast, equity contributions require purchasing shares in a project, which may yield higher returns but carry greater risk, as the potential for profit is directly tied to the project's overall success. As highlighted in a recent analysis titled 'Risks and Rewards of Crowdfunding Models,' the senior debt structure presents a lower risk profile compared to common equity, which can fluctuate significantly based on market conditions and project performance. This comprehension of the differing risk and return profiles allows individuals to tailor their financial strategies effectively, aligning them with personal financial objectives and risk tolerance.

Furthermore, with the recent changes brought about by the JOBS Act, everyday individuals now have greater access to these opportunities, albeit with certain limitations based on their financial status. For example, individuals with a net worth or yearly earnings below $124,000 encounter limitations on funding amounts. Significantly, real estate crowdfunding platforms like EstateGuru permit contributions starting from only €50, showcasing the availability of crowdfunding in property.

Furthermore, backers can bolster local economies through both equity and debt financing, aiding in community development. As mentioned by industry specialists, including Kristjan Tamla, Managing Director of efTEN, who highlights the significance of strategic asset management in property,

- 'The Special Opportunity Fund is crafted to leverage distinctive market conditions, offering investors a diversified portfolio.'

Leaders from FIRSTPICK also highlight the power of community in investment strategies, stating,

- 'Building a strong network is essential for identifying and accessing lucrative deals.'

The potential for real estate crowdfunding platforms is substantial, with innovative strategies arising from the Baltic region. Platforms like Fundrise illustrate the potential of real estate crowdfunding platforms, with one expert stating,

- 'They are my favorite crowdfunding platform for properties.'

This successful approach showcases a balance between risk and return within these investment frameworks, further emphasizing the insights provided by top Baltic asset managers.

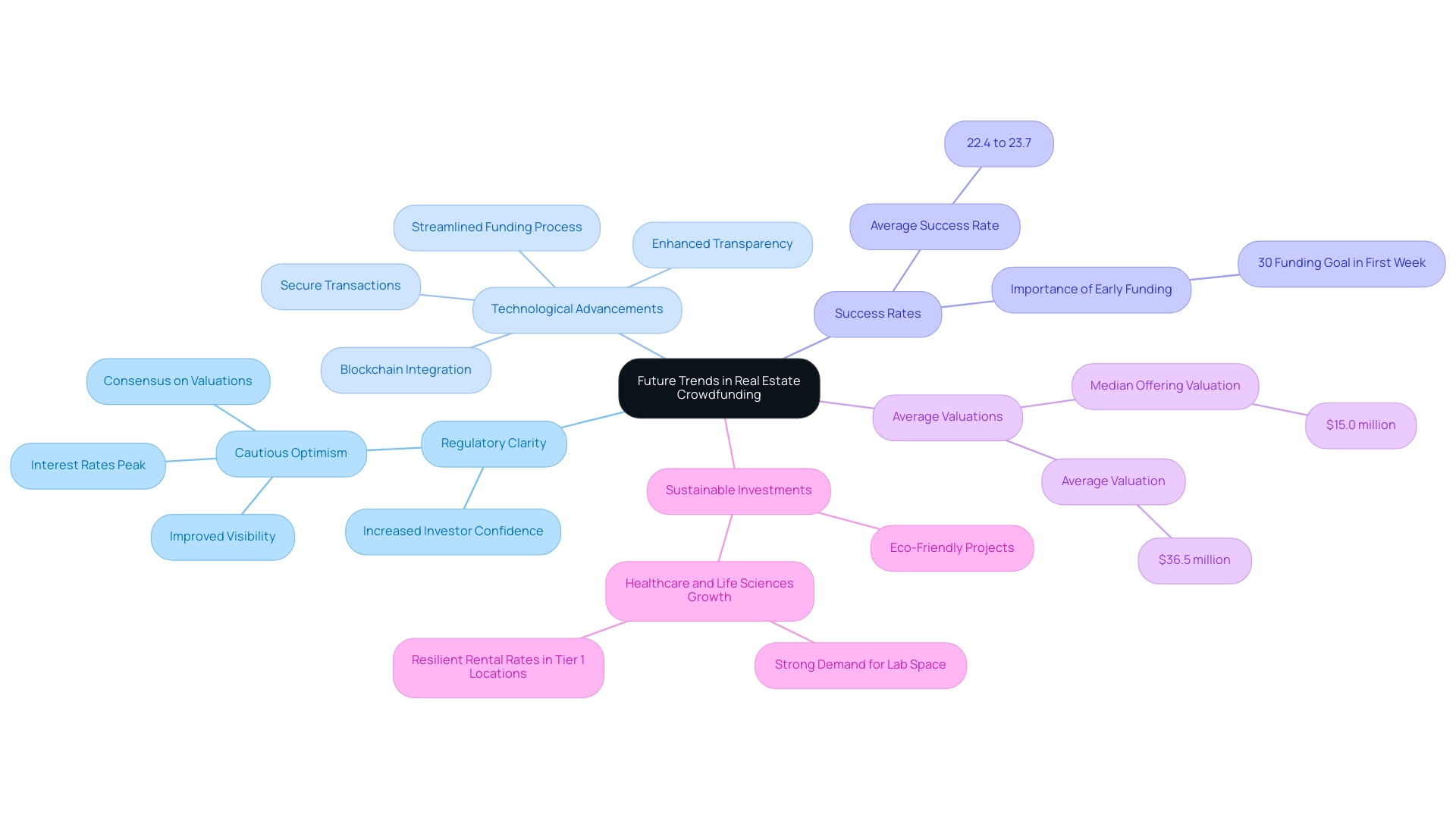

Future Trends and Opportunities in Real Estate Crowdfunding

The outlook for real estate crowdfunding platforms is becoming more positive, driven by several key trends set to transform the industry landscape. One significant development is the growing regulatory clarity, which is expected to bolster investor confidence. As James Pullen, a partner at White & Case, articulates,

For all these ongoing challenges, however, there is a sense of cautious optimism building across real estate as interest rates peak, consensus forms on valuations and visibility on future performance improves.

Furthermore, technological advancements, particularly in blockchain, are set to streamline the funding process, enhance transparency, and facilitate secure transactions. The average success rate for crowdfunding campaigns currently ranges from 22.4% to 23.7%, with campaigns that achieve at least 30% of their funding goals within the first week significantly more likely to succeed, underscoring the importance of efficient technology in these platforms. Additionally, the median offering valuation stands at $15.0 million, with an average valuation of $36.5 million, providing a clearer financial context for investors.

The growing interest in sustainable and socially responsible financial opportunities is prompting platforms to increasingly showcase eco-friendly project options. A notable example is the anticipated growth of the healthcare and life sciences sector, where strong demand for lab space and resilient rental rates in Tier 1 locations are creating attractive investment opportunities. This sector's expansion reflects the ongoing advancements in biotech and the increasing availability of lab space, which are drawing investor interest.

Investors who remain informed about these trends will be strategically positioned to capitalize on the evolving real estate crowdfunding platforms as they advance into 2024.

Conclusion

The real estate crowdfunding sector is navigating a transformative period marked by both challenges and opportunities. As fundraising levels have dropped significantly, platforms are compelled to innovate and adapt to the changing landscape. Key considerations for investors include:

- Understanding the fee structures

- Minimum investment requirements

- The inherent risks associated with different crowdfunding platforms

By carefully evaluating these factors, investors can align their choices with their financial goals and risk tolerance.

Understanding the advantages and disadvantages of investment types—debt versus equity—further empowers investors to make informed decisions. While debt investments offer stability, equity investments present higher potential returns but come with increased risks. The recent regulatory changes and technological advancements, particularly in blockchain, are set to enhance transparency and investor confidence, paving the way for a more robust market.

Looking ahead, the real estate crowdfunding industry shows promising growth potential, bolstered by emerging trends such as:

- Increased regulatory clarity

- A focus on sustainable investments

As the market evolves, investors who stay informed about these developments will be better positioned to leverage opportunities in this dynamic sector. The future of real estate crowdfunding may hold significant rewards for those willing to navigate its complexities.