Overview

The article compares various equity crowdfunding platforms to help potential investors determine which one best suits their needs. It highlights the distinct features, advantages, and risks associated with platforms like SeedInvest, Crowdcube, and Wefunder, while emphasizing the importance of thorough due diligence and understanding regulatory frameworks to make informed investment decisions.

Introduction

Equity crowdfunding has emerged as a revolutionary method for individuals to invest in startups and small businesses, offering a unique opportunity to acquire equity stakes through online platforms. This innovative investment model not only democratizes access to funding but also empowers a broader range of investors to participate in the growth of emerging enterprises.

Despite a slight decline in total investment volume in 2024, the number of active equity crowdfunding offerings has surged, indicating a robust interest in this avenue. As the landscape evolves, understanding the intricacies of equity crowdfunding—including its benefits, risks, and regulatory frameworks—becomes essential for investors looking to navigate this dynamic market effectively.

This article explores the various facets of equity crowdfunding, providing insights into its mechanics, potential returns, and the critical role of due diligence in making informed investment decisions.

Understanding Equity Crowdfunding: A Primer

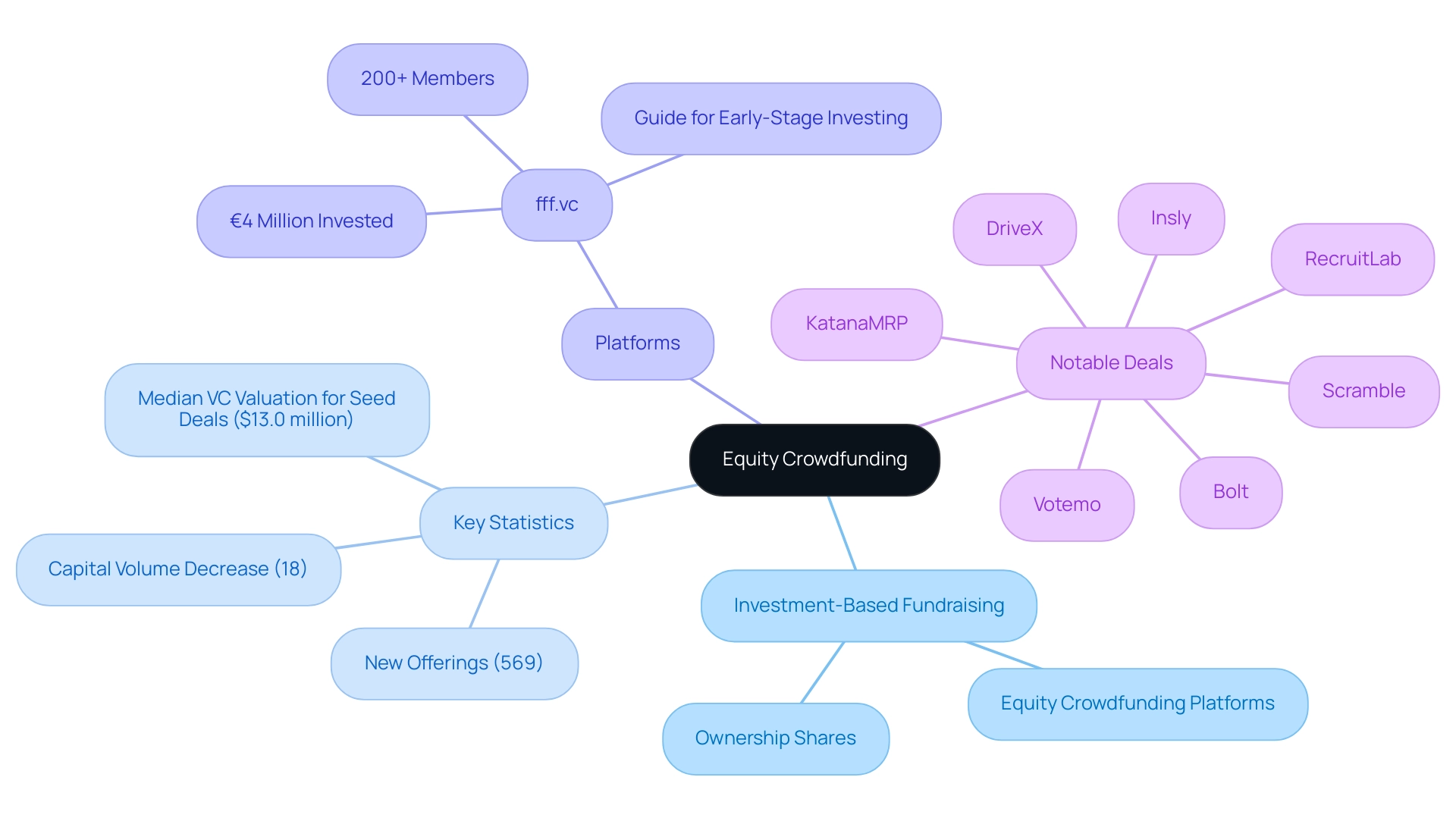

Investment-based fundraising represents a transformative method that allows individuals to invest in startups and small enterprises in exchange for ownership shares, primarily through equity crowdfunding platforms. In contrast to conventional fundraising, which usually provides incentives like goods or benefits to supporters, ownership financing gives participants a stake in the business. This model greatly opens access to funding opportunities, particularly through equity crowdfunding platforms, enabling a broader range of participants to take part in the expansion of innovative businesses.

In 2024, total capital volume was 18% lower than in 2023; however, the number of new equity-based offerings increased, reaching an all-time high of 569 active raises in December. This statistic highlights the increasing interest in collective funding despite a decrease in overall investor demand. Furthermore, the recent achievements of platforms like fff.vc, launched in 2022, which grew to over 200 members and facilitated the investment of approximately €4 million across various early-stage tech deals, demonstrate the potential of community engagement in catalyzing tech investment.

Notable deals that members accessed include:

- Votemo

- Insly

- DriveX

- Scramble

- RecruitLab

- Bolt

- KatanaMRP

Furthermore, fff.vc created a guide for investing in early-stage opportunities, imparting important insights to its community. According to the Q3-2024 PitchBook Venture Monitor, the median VC valuation for Seed deals was $13.0 million, emphasizing the importance of shared funding compared to conventional financing methods.

The recent acquisition of RedCrow by Alira Health in May 2023 highlights the evolving landscape of equity crowdfunding platforms, particularly within the healthcare sector. Grasping the implications and mechanics of this financial model becomes essential for evaluating the diverse offerings available and recognizing its potential to reshape the financial landscape.

Benefits and Risks of Equity Crowdfunding

Equity crowdfunding platforms provide numerous benefits for individuals looking to enter the early-stage financing arena, especially in the Baltic area where figures such as Donatas Keras and Kristjan Tamla are achieving notable progress. This model enables individuals to access opportunities that were previously reserved for institutional investors, significantly broadening their financial horizons via equity crowdfunding platforms. Significantly, collective funding has the potential to generate high returns, as demonstrated by the increasing trend of successful projects, with 569 active collective funding raises recorded in 2024, reflecting the growing interest in this financial avenue.

Investors can attain portfolio diversification by financing various startups, including significant contributions by Practica Capital in companies like Montonio, Ovoko, PvCase, and TransferGo, which may lead to considerable financial gains should these companies flourish. However, participating in collective funding is not without its risks. Investors must remain aware of the potential for total loss of their capital, the inherent lack of liquidity, and the complexities involved in evaluating the viability of nascent businesses.

A recent statistic shows that 57% of funding agreements were aimed at stagnant companies—a troubling comparison to 49% for private investment and venture capital firms—emphasizing the need for thorough examination. The insights offered by Keras and Tamla highlight the significance of utilizing community knowledge in financial strategies, as both have navigated the realm of venture and real estate endeavors with considerable success. Their experiences illustrate that informed decision-making is crucial, especially in light of the statistic regarding stagnant businesses, which emphasizes the necessity of thorough due diligence.

The case study on share-based funding illustrates this point well; it emphasizes that such funding through equity crowdfunding platforms focuses on investments aimed at long-term gains, where individuals seek financial returns by purchasing stock in a company, making it particularly relevant in startup financing and real estate projects. Investing in share-based fundraising can generate substantial financial benefits, as numerous projects have effectively secured capital. Additionally, as Epi Ludvik succinctly states,

Crowdsourcing Week is your global activation partner for the Crowd Economy, a collaborative platform that empowers bold changemakers to drive innovation through crowdsourcing, open innovation, and the sharing economy.

This insight emphasizes the importance of due diligence in navigating equity crowdfunding platforms, helping investors to balance the allure of high returns with the accompanying risks. To provide a broader context, it's worth noting that platforms like GoFundMe have raised more than $9 billion from over 120 million donations worldwide, showcasing the significant impact and scale of collective fundraising as a whole.

Navigating the Regulatory Landscape of Equity Crowdfunding

Equity fundraising operates under a complex framework of regulations that differ by jurisdiction. In the United States, the implementation of the JOBS Act in 2012 signified a crucial change in this area, allowing non-accredited investors to participate in fundraising through shares. This legislation has broadened access to investment opportunities, allowing a wider demographic to participate in funding entrepreneurial ventures.

As of December 2024, the number of active equity fundraising raises reached an all-time high of 569, surpassing the previous record of 561 in March 2022, indicating significant growth in the industry. Nonetheless, equity crowdfunding platforms are required to adhere to specific regulations concerning disclosures, participant limits, and reporting obligations, which are essential for maintaining transparency and protecting stakeholder interests. As noted by industry experts, 'Campaigns that achieve at least 30% of their funding goal within the first week are more likely to succeed overall,' underscoring the significance of early engagement in these campaigns.

Furthermore, a case study titled 'Risks and Benefits of Equity Crowdfunding' highlights that investing in early-stage businesses carries inherent risks, including illiquidity and potential fraud, while also offering benefits such as improved access to finance for small businesses and the potential for high returns. For stakeholders, understanding these regulations is essential, as they determine not only the rights and safeguards granted to them but also the overall credibility of the equity crowdfunding platforms they evaluate. Before allocating funds, it is crucial for stakeholders to confirm that a platform adheres to the pertinent legal standards, ensuring a secure and informed investment experience.

Furthermore, the funding sector is undergoing expansion and diversification, propelled by technological innovations and evolving consumer behaviors, further influencing the landscape of investment-based fundraising.

Comparing Popular Equity Crowdfunding Platforms

The landscape of equity crowdfunding platforms presents several prominent options, notably SeedInvest, Crowdcube, and Wefunder, each offering unique advantages tailored to different investor preferences. At fff.club, we enhance this landscape by emphasizing collaborative capital assessment, where our members leverage collective expertise to screen high-grade deals. This collaborative approach ensures rigorous due diligence, with over 300 individuals working together to evaluate opportunities effectively.

Our members have conveyed their contentment, with one saying, 'The collaborative nature of fff. Club has changed my approach to finances, allowing me to access high-quality deals I wouldn't have discovered alone.' SeedInvest distinguishes itself through its thorough vetting procedure, concentrating solely on high-quality startups, which corresponds with the interests of serious individuals seeking lower-risk opportunities.

In contrast, Crowdcube, based in the UK, allows backers to support local businesses, offering a varied selection of funding opportunities that attract those interested in community involvement. Wefunder differentiates itself by fostering a sense of community, allowing backers to fund projects that resonate with their passions. Importantly, the Financial Conduct Authority (FCA) enforces Prospectus Rules on any deal above €5 million, which adds a regulatory perspective that participants must consider when selecting a platform.

The equity crowdfunding platforms differ greatly in their fee structures, investment minimums, and the kinds of businesses they support, making it essential for individuals to assess their specific requirements and objectives when selecting among these platforms. Moreover, the influence of collective funding goes beyond shares; for example, Grant Ejimone observed that contributions of $106 million were gathered for natural disaster assistance in 2023, emphasizing the capacity of collective funding to foster substantial social transformation. Furthermore, the Congress party's 'Donate for Desh' initiative demonstrates the use of collective funding in political settings, highlighting its adaptability and attraction to technology backers interested in varied applications.

As the alternative financing market develops, comprehending these differences along with the wider effects of collective funding will assist investors in making knowledgeable choices. At fff.club, we strive to make the funding process smooth and convenient for everyone involved, ensuring that our members feel supported every step of the way.

![]()

Due Diligence: Choosing the Right Equity Crowdfunding Platform

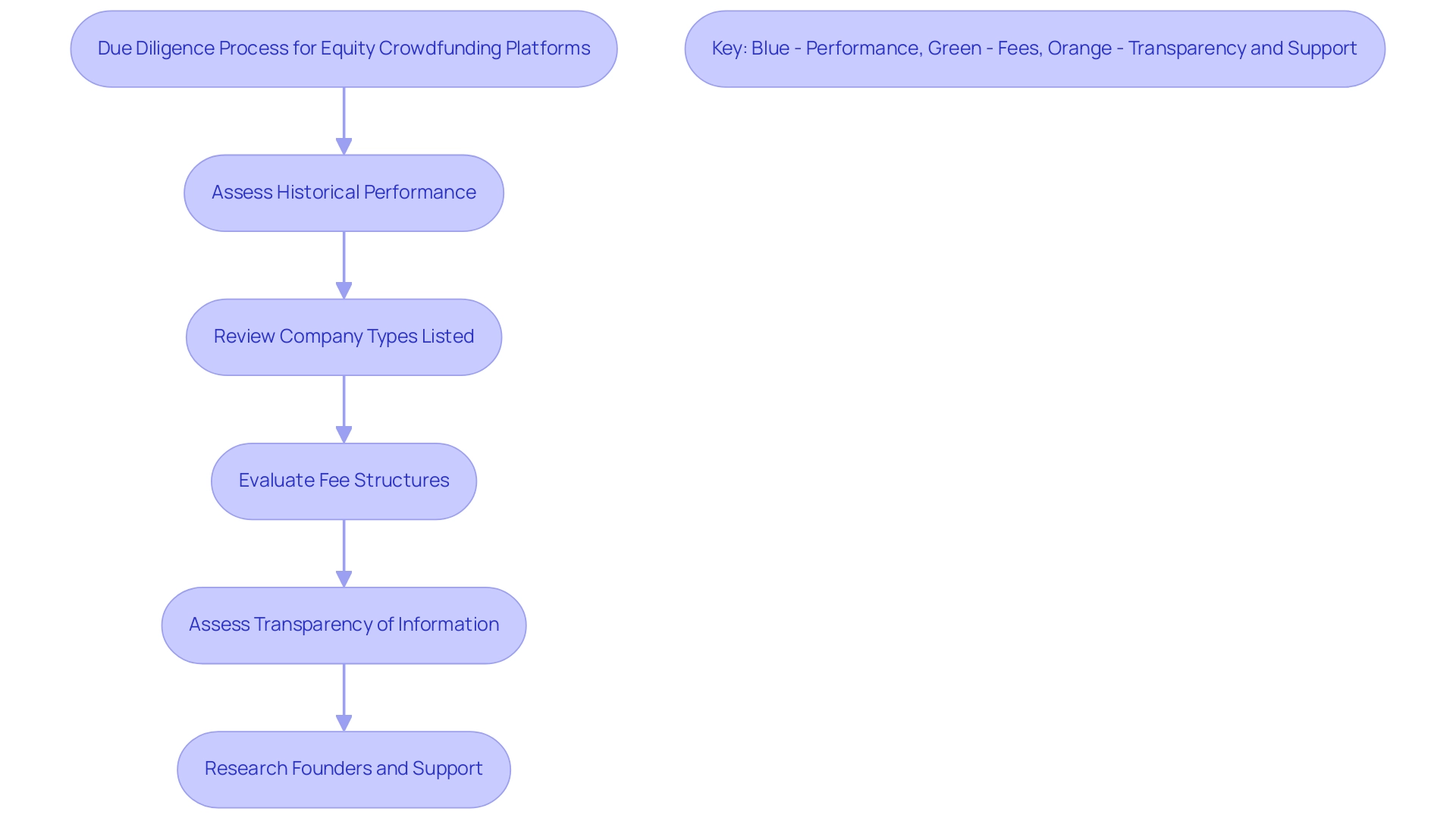

Investors venturing into equity crowdfunding platforms must undertake thorough due diligence to effectively navigate this complex landscape. Key steps in the due diligence process include:

- Assessing the historical performance and track record of equity crowdfunding platforms, which provides insight into their reliability and success rate.

- Reviewing the types of companies listed on equity crowdfunding platforms, as this reflects the investment opportunities available and the overall focus of these platforms.

Platforms such as fff.Vc enable access to deal flow in venture capital, private credit, and real estate, empowering tech financiers to explore various funding opportunities. The expansion of the crowdfunding environment is clear, especially on equity crowdfunding platforms, with private debt assets under management increasing 27 percent to $1.7 trillion, suggesting substantial opportunity for stakeholders.

According to Robert S. Reardon, 'Investors must be vigilant in their research to identify equity crowdfunding platforms that align with their investment goals and risk tolerance.' Comprehending fee structures is essential, as hidden costs can greatly affect net returns; for example, fff.Vc imposes a management fee of 2% and a performance fee of 20% on profits, which participants should take into account.

Furthermore, evaluating the transparency of information provided by equity crowdfunding platforms can help gauge the level of risk involved. Notably, crowdfunded companies have shown slower progression post-investment, with only 6% exiting the private market compared to 11% for venture rounds, underscoring the need for thorough due diligence. Additionally, fff.vc's founders, Akim Arhipov and Tim Vaino, bring valuable experience in wealth management and legal expertise, respectively, enhancing the credibility of the platform.

Their commitment to providing educational resources and robust customer support further enhances the experience for stakeholders, aiding informed decision-making. By diligently researching and analyzing these factors, investors can align their choices with their financial objectives and risk tolerance, ultimately enhancing their chances of success in equity crowdfunding platforms.

Conclusion

Equity crowdfunding represents a significant shift in how individuals can invest in startups and small businesses, offering the chance to acquire equity stakes through accessible online platforms. Despite a decline in total investment volume in 2024, the uptick in active offerings signals a growing interest in this investment model. This article has examined the transformative nature of equity crowdfunding, emphasizing its capacity to democratize access to investment opportunities and empower a diverse range of investors.

While the potential for high returns is enticing, investors must remain aware of the inherent risks, including the possibility of total loss and the lack of liquidity associated with early-stage investments. The importance of thorough due diligence cannot be overstated, as it plays a crucial role in navigating the complexities of this market. By understanding the regulatory landscape and comparing different crowdfunding platforms, investors can make informed decisions that align with their financial goals.

Ultimately, equity crowdfunding is reshaping the investment landscape, providing unique opportunities for those willing to engage with it thoughtfully. As the industry continues to evolve, the combination of informed decision-making and community-driven investment strategies will be key to unlocking the full potential of this innovative funding model. Investors who approach equity crowdfunding with diligence and awareness stand to benefit from its dynamic growth and the exciting prospects it offers.