Overview

The article focuses on identifying the top equity crowdfunding platforms in the UK that are particularly beneficial for tech investors. It highlights platforms like Seedrs, Crowdcube, and Invested, emphasizing their unique features, success stories, and the importance of community-driven support for technology financiers seeking innovative investment opportunities.

Introduction

In the ever-evolving landscape of technology investment, equity crowdfunding has emerged as a game-changer, democratizing access to capital for innovative startups while inviting a diverse array of investors to participate. This method not only allows tech enthusiasts to support groundbreaking ideas but also offers them a stake in the next big success story.

Insights from prominent figures in the field underline the importance of community and collaboration in fostering these early-stage investments, while real-world success stories showcase the potential for substantial returns. However, with opportunity comes risk, as many crowdfunded ventures face challenges that traditional funding avenues might mitigate.

As tech investors navigate this dynamic environment, understanding the intricacies of equity crowdfunding becomes crucial in making informed decisions that align with their investment strategies.

Understanding Equity Crowdfunding: A Primer for Tech Investors

Equity crowdfunding platforms UK signify a transformative method for capital raising, allowing a diverse group of contributors to provide relatively small amounts towards financing a startup or business in return for equity ownership. This model greatly broadens access to funding possibilities via equity crowdfunding platforms UK, enabling technology supporters to back creative startups that may find it difficult to obtain financing through traditional channels. Insights from prominent Estonian technology financiers such as Sten Tamkivi and Kristjan Vilosius emphasize the significance of community-driven strategies in promoting early-stage funding.

Tamkivi notes, "Creating a strong community around your startup not only draws funding sources but also cultivates loyal customers who share your vision." Vilosius adds, "Resilience and collaboration are essential for navigating the challenges of the investment landscape; we must support each other to succeed." Unlike conventional funding methods, where supporters often receive physical rewards or products, equity financing provides participants a share in the company, enabling them to possibly gain from its growth path and achievements.

For instance, the Flow Hive project exemplifies this potential, having raised over $2.1 million in just one day on Indiegogo, far surpassing its initial goal. Such successes highlight the capacity of equity raising to generate substantial funds while validating market interest for pioneering products. However, it is important to note that companies that utilize equity crowdfunding platforms UK are less likely to progress to later stages of evolution and more likely to fail compared to venture-backed companies, which adds a layer of risk for investors.

Furthermore, the Urban Jungle case study exemplifies the variety of successful fundraising campaigns; founded in 2016, Urban Jungle raised £11.2m in April 2024, demonstrating how equity crowdfunding platforms UK can assist innovative business models and reflecting Tamkivi and Vilosius's focus on community support. As Léa Bouhelier-Gautreau, an industry analyst, notes, "How do funding amounts vary across top equity raising platforms?" Discover insights on median raises, platform performance, and why Dealmaker is an outlier in today's startup funding landscape.

Comprehending the subtleties of equity fundraising, including the average of approximately 300 supporters for successful campaigns, is crucial for technology financiers seeking to diversify their portfolios and interact effectively with emerging technologies. Furthermore, for those interested in private market opportunities, deal flow, due diligence, and co-investing in venture capital, private credit, and real estate are crucial elements to consider, as they reinforce the collaborative spirit essential for modern investment strategies.

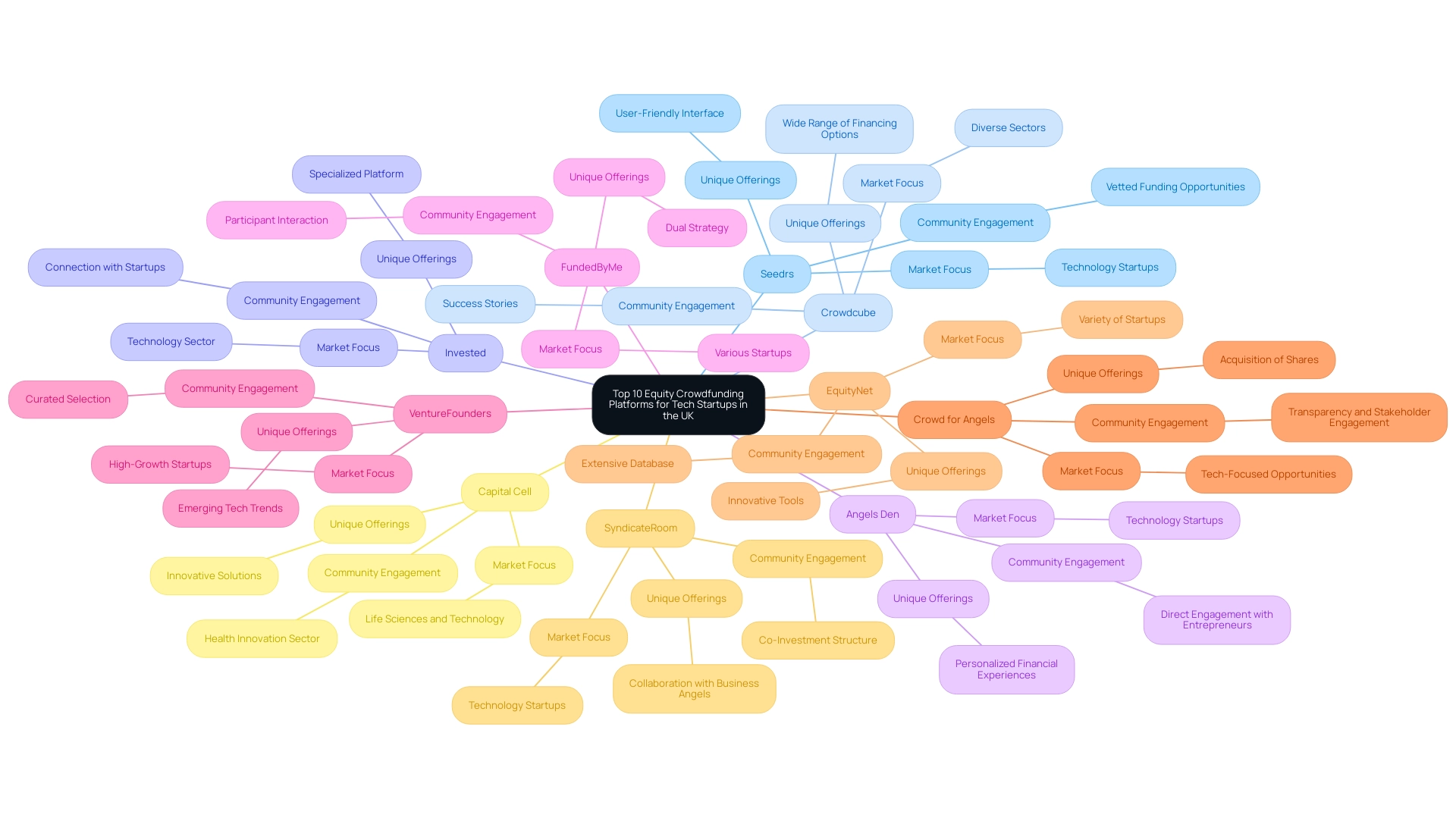

Top 10 Equity Crowdfunding Platforms for Tech Startups in the UK

- Seedrs: As a premier equity crowdfunding platform in the UK, Seedrs empowers individuals to purchase equity in startups and growth-oriented companies. The platform features an easy-to-use interface and a varied range of technology startups, making it a preferred option among technology financiers. Notably, Seedrs has seen significant engagement, with a notable number of campaigns successfully funded since its inception. For technology financiers seeking to forge valuable connections and acquire insights, platforms like fff.club, which has been active for 2.5 years, provide exclusive access to vetted funding opportunities in venture capital, private equity, real estate, and private credit, enhancing the overall financial experience. The difficulties encountered by SMEs in obtaining funding after Brexit, as emphasized by Brown, Liñares-Zegarra, and Wilson, highlight the significance of platforms such as Seedrs in offering crucial funding opportunities.

- Crowdcube: Famous for its wide range of financing options, Crowdcube focuses on equity crowdfunding platforms UK, especially in the technology field. Recent data suggests that campaigns in crucial sectors such as technology have prospered during the pandemic, with Crowdcube's funding in these areas illustrating this trend. In fact, campaigns in sectors such as food, beverages, healthcare, and financial services constituted approximately 37% of Crowdcube campaigns in 2020, demonstrating its effectiveness for technology investments amid challenging market conditions. The platform is home to numerous success stories, further establishing its credibility in the crowdfunding space, and aligns with the community-driven ethos of platforms like fff.club.

- Invested: Concentrated solely on the technology sector, Invested offers a specialized platform for individuals looking to connect with innovative startups. This specialized method enables technology financiers to uncover and back innovative firms ready for expansion, reflecting the community involvement values promoted by fff.club.

- Angels Den: An exceptional service in the equity crowdfunding platforms UK, Angels Den connects startups with backers, facilitating a variety of technological funding opportunities. The platform emphasizes personal connections and customized financial experiences, allowing participants to engage directly with entrepreneurs, similar to the networking opportunities available within the fff.club community.

- FundedByMe: This versatile platform combines equity crowdfunding with rewards-based options, enabling tech backers to interact with startups in various ways. FundedByMe's dual strategy boosts participant engagement and supports a wider variety of funding models, complementing the unique funding opportunities offered by fff.club.

- VentureFounders: Targeting high-growth startups, VentureFounders curates a selection of technology companies seeking funding. The platform is perfect for individuals seeking to capitalize on emerging tech trends and innovative solutions, reflecting the curated financial philosophy of fff.club.

- Crowd for Angels: As one of the equity crowdfunding platforms UK, Crowd for Angels enables individuals to acquire shares in startups, focusing on a variety of tech-focused opportunities. The platform's dedication to transparency and stakeholder engagement has made it a notable player in the crowdfunding space, resonating with the values of community involvement at fff.club.

- EquityNet: Functioning as an all-encompassing platform, EquityNet links financiers with a variety of startups, comprising many technology firms. Its extensive database and innovative tools make it an appealing choice for tech-savvy individuals, supporting the educational resources provided by fff.club.

- SyndicateRoom: This platform provides a distinctive co-investment structure, enabling participants to collaborate with seasoned business angels in financing technology startups. SyndicateRoom's method not only improves funding prospects but also offers valuable perspectives from experienced individuals, akin to the peer learning experiences within the fff.club community.

- Capital Cell: Focusing on life sciences and technology, Capital Cell offers distinctive funding opportunities within the health innovation sector. This platform is particularly attractive to individuals interested in innovative solutions that connect technology and healthcare, emphasizing the intersection of these dynamic fields and reinforcing the significance of community-driven financial insights as provided by fff.club.

Why Equity Crowdfunding is Ideal for Tech Investors

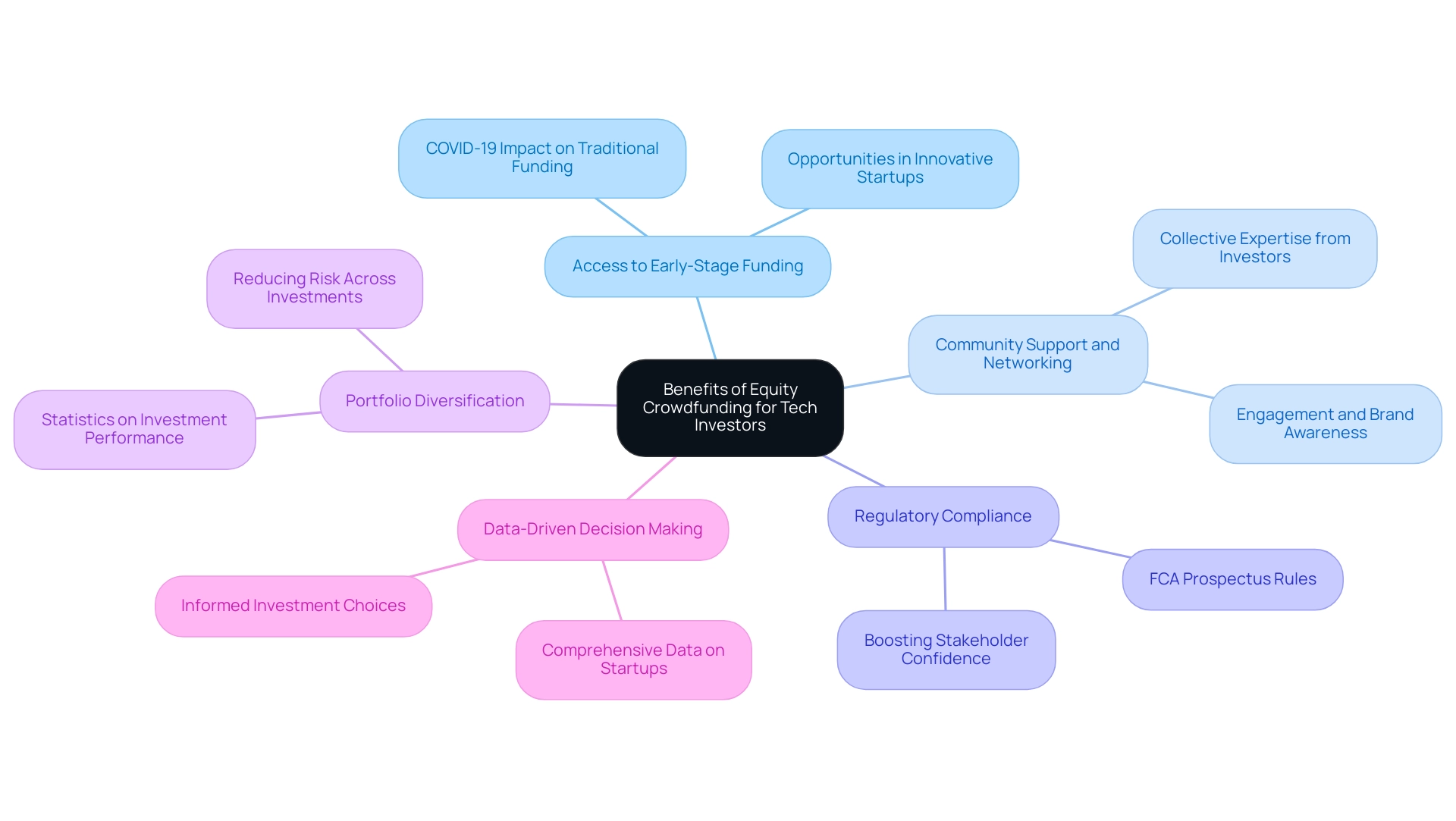

Equity crowdfunding platforms UK provide various benefits specifically designed for technology backers. It opens the door to early-stage funding opportunities in innovative startups, many of which are accessible through equity crowdfunding platforms UK, unlike conventional funding routes. This access is crucial, especially in a landscape where traditional financing has been hindered, particularly in the aftermath of the COVID-19 pandemic.

Additionally, platforms like fff. Club enhance this process by leveraging collective expertise, screening high-grade deals, and ensuring comprehensive due diligence through the collaboration of over 400 technology financiers. As one stakeholder observed, 'fff. Club has altered my financial approach by offering access to exclusive opportunities and a supportive community.' The Financial Conduct Authority (FCA) enforces Prospectus Rules on any deal above €5 million, ensuring regulatory compliance that can boost confidence among stakeholders. Moreover, equity crowdfunding platforms UK allow individuals to diversify their portfolios by distributing funds to several startups across different technology sectors, thus reducing risk linked to any one allocation.

Statistics reveal that investments in diversified portfolios can significantly enhance financial performance, which is vital in the volatile tech market. The platforms themselves often supply comprehensive data about each startup, allowing investors to make well-informed decisions. Professor Jerry Coakley observes, 'The goals of the study titled 'Seasoned equity crowdfunded offerings' were initially to explore the factors that motivate companies to make a first financing proposal on equity crowdfunding platforms UK, along with the factors behind their success.'

This insight highlights the potential for robust returns in successful campaigns while fostering community engagement and brand awareness. Furthermore, case studies such as the 'Benefits of Equity Crowdfunding Platforms UK for Startups' illustrate how startups have utilized equity crowdfunding platforms UK to raise significant capital. It is important to note that crowdfunded companies often show slower progression post-investment, with only 6% exiting the private market compared to 11% of venture rounds.

This perspective offers a balanced view of potential risks linked to equity funding. Furthermore, the cooperative nature of equity raising nurtures a lively community of individuals with similar interests, promoting networking possibilities and collective learning experiences that can enhance financial strategies. The process with fff. Club is seamless and user-friendly, making it easy to navigate investments,' shares another satisfied participant. Success narratives are plentiful, illustrating how technology financiers have profited from varied portfolios within the funding arena, boosting their market visibility while backing pioneering innovations.

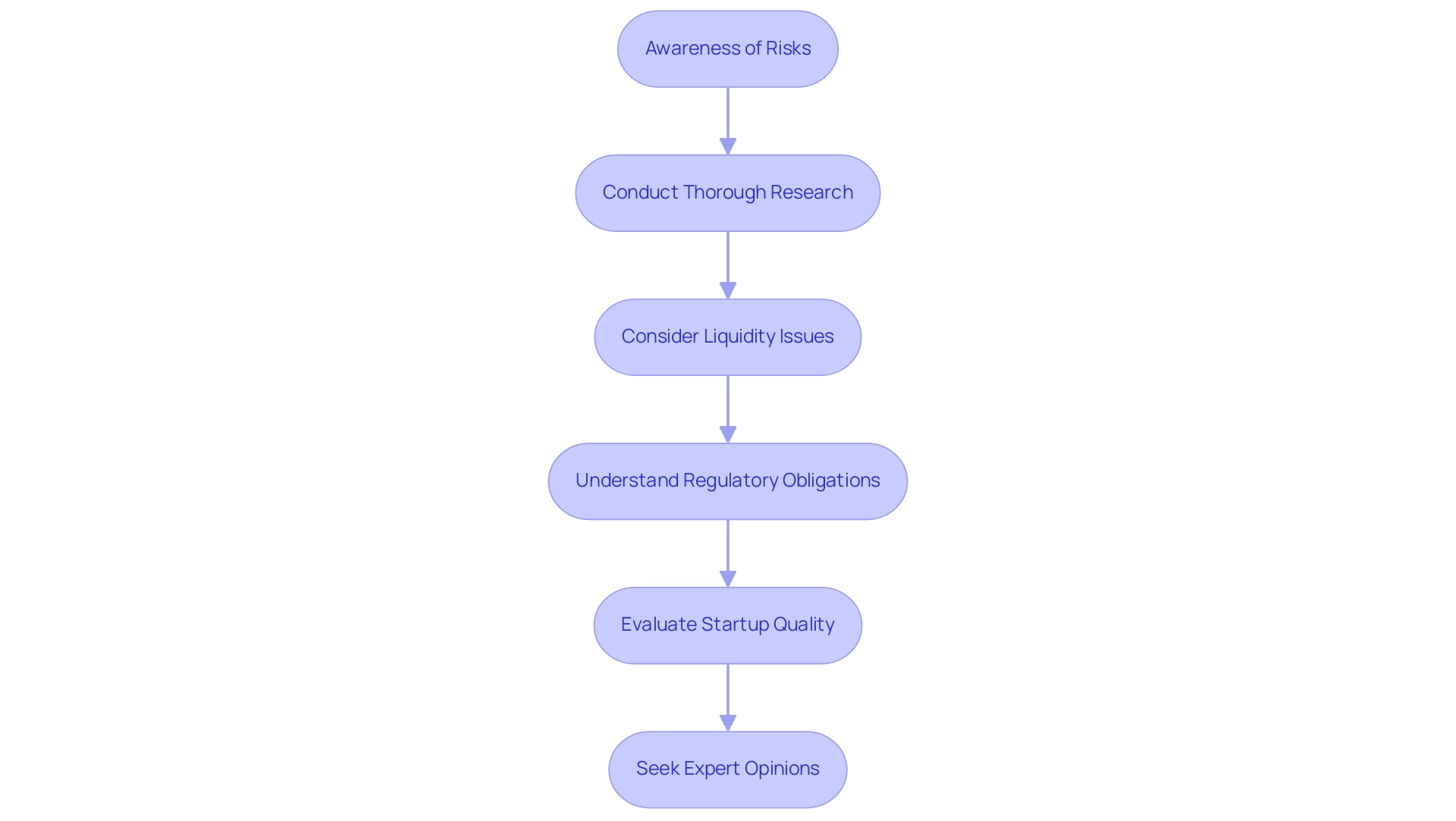

Navigating the Risks of Equity Crowdfunding in Tech Investments

Equity funding offers a multitude of opportunities for backers, yet it is essential to stay mindful of the inherent risks involved. One of the most significant concerns is the high failure rate of startups; reports indicate that approximately 75% of early-stage companies do not meet their growth projections, highlighting the potential for significant losses. This highlights the necessity for individuals to conduct thorough research before committing funds.

Furthermore, equity holdings generally lack liquidity, making it difficult for individuals to sell their shares when necessary.

The regulatory environment related to equity raising can also be overwhelming, with numerous legal obligations that participants must navigate to ensure adherence. Furthermore, the quality of startups can vary widely, underscoring the importance of due diligence as a critical strategy for risk mitigation. For example, a case study on the 'Risks and Benefits of Equity Financing' demonstrates that while individuals can access various funding sources, they also encounter hazards such as potential fraud and dilution of equity.

By comprehending these dangers and being proactive in their financial strategies, individuals can better position themselves for success in the dynamic realm of equity financing. As the financial landscape continues to change, it's essential for individuals to stay informed about the latest reports on startup failure rates and to seek expert opinions on navigating these complexities.

How to Choose the Right Equity Crowdfunding Platform for Your Tech Investments

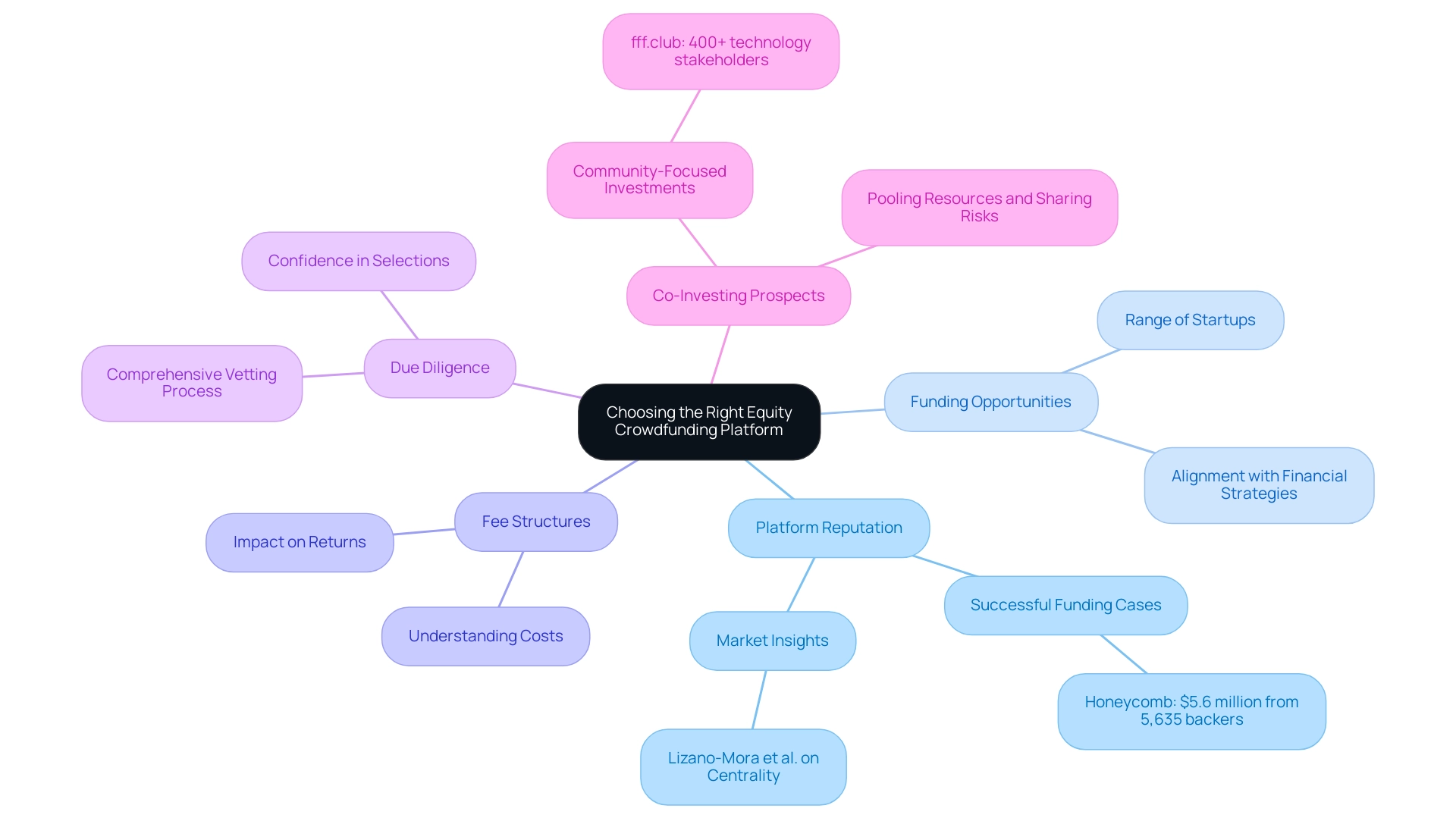

When choosing equity crowdfunding platforms UK, technology backers must thoroughly assess several important factors to enhance their financial potential, especially regarding private market opportunities. A primary consideration is the track record and reputation of equity crowdfunding platforms UK within the technology industry; platforms that have successfully facilitated funding for startups similar to those you are interested in can provide valuable insights into their effectiveness. As Lizano-Mora et al. state, 'centrality is the importance of a certain research topic,' indicating that a platform's reputation is crucial in assessing its relevance and success in the market.

Furthermore, stakeholders should evaluate the range of funding opportunities available on equity crowdfunding platforms UK, ensuring that these platforms include technology startups that correspond with their particular financial strategies, especially in venture capital and private credit.

- Participating in community-focused investment opportunities, like those at fff.club, can improve collaborative wealth management by linking over 400 technology stakeholders for shared insights and strategies.

- This community aspect not only encourages collaboration but also creates possibilities for potential co-investing opportunities, enabling participants to pool resources and share risks.

- The expertise of founders like Akim Arhipov, who has two successful exits and experience as a wealth manager, and Tim Vaino, a lawyer and co-builder of Latitude59, adds credibility to the platform and its community-driven approach.

Fees are another essential element to consider, as they can significantly affect overall returns. Platforms vary in their fee structures, so understanding these costs upfront is vital for making informed decisions. Furthermore, the due diligence process carried out by equity crowdfunding platforms UK is crucial, as a comprehensive vetting of startups can provide backers with greater confidence in their selections.

As demonstrated by Honeycomb's achievement of securing $5.6 million from 5,635 backers in 2022, equity crowdfunding platforms UK with strong reputations can attract significant interest and funding. Furthermore, the ongoing developments in the crowdfunding landscape, such as Republic's initiative to establish secondary markets for startup backers, highlight the importance of selecting equity crowdfunding platforms UK that are responsive to market dynamics and stakeholder needs. Republic's proactive search for secondary market partners illustrates the necessity for platforms to adapt to current liquidity needs and stakeholder demands.

By concentrating on these crucial criteria—platform reputation, funding opportunities, fee structures, due diligence, and co-investing prospects—tech stakeholders can make strategic decisions that align with their financial objectives for 2024 and beyond, particularly in the context of equity crowdfunding platforms UK, especially considering the current uncertainty in the near-term supply and demand for secondary activity of Alternative Trading Systems (ATS).

The Role of Due Diligence in Successful Equity Crowdfunding for Tech Investors

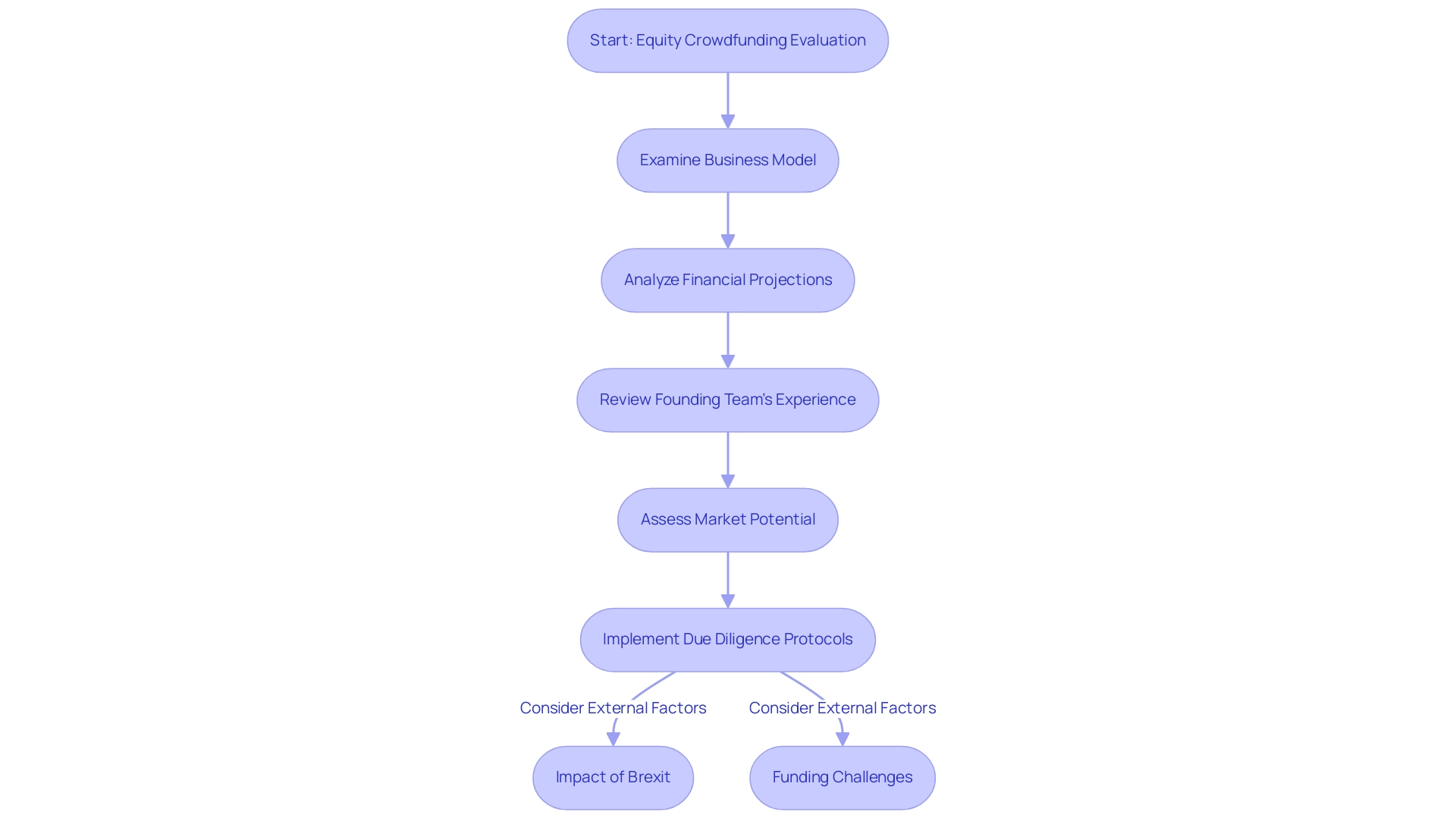

Due diligence stands as an essential pillar for technology financiers navigating the landscape of equity crowdfunding platforms UK, especially in the wake of the pandemic, which has led to economic disruptions and a notable surge in crowdfunding activity as businesses seek alternative funding sources. This process involves a meticulous examination of potential opportunities, encompassing a detailed analysis of the startup's business model, financial projections, and overall market potential. A key factor in this evaluation is the founding team's experience and track record, as robust leadership is frequently linked to a startup's probability of success.

Insights from seasoned financiers like Sten Tamkivi and Kristjan Vilosius underscore the significance of strategic due diligence in promoting robust financial practices. For instance, Tamkivi's investments in successful startups demonstrate how thorough analysis can lead to favorable outcomes. As highlighted by Brown, Linares-Zegarra, and Wilson, SMEs are more likely to face challenges with restricted access to funding after Brexit, emphasizing the necessity for stakeholders to implement thorough due diligence practices to take advantage of alternative funding sources.

Furthermore, examining the due diligence protocols of equity crowdfunding platforms UK can shed light on the thoroughness with which they vet startups, assisting individuals in making informed decisions. By engaging in comprehensive due diligence, technology backers not only mitigate risks but also enhance their prospects for favorable returns, particularly in an environment where approximately 9% of campaigns fall short of their funding targets. Real-world instances of successful technology funding often demonstrate that thorough due diligence is a common thread, significantly contributing to the success rates of startups.

Furthermore, findings from the case study named 'Future Research Directions in ECF' indicate that upcoming research could examine the long-term effects of Brexit on equity funding, further reinforcing the case for comprehensive due diligence while adopting the collaborative financing strategies shared by prominent technology backers. Kristjan Vilosius's approach to due diligence, particularly in managing his investment portfolio, exemplifies how structured methodologies can lead to better investment decisions.

Future Trends in Equity Crowdfunding for Tech Investors

The terrain of equity funding for technology backers is changing quickly, offering numerous opportunities along with considerable obstacles. One critical trend is the enhanced integration of technology within funding platforms, improving user experience and accessibility for both backers and startups. According to Wifi Talent, fundraising campaigns that include a video pitch tend to raise 105% more money than those without, underscoring the importance of engaging content as a tool for success.

However, the industry faces scrutiny and lawsuits against diversity programs, which may impede progress and create uncertainty for stakeholders. Furthermore, as regulatory frameworks mature in response to these challenges, we can expect stronger protections for stakeholders, fostering greater confidence in equity crowdfunding platforms UK ventures. This evolution is reflected in the strategic focus of fff.vc, which has shifted towards late-stage technology deals and diversified portfolios to navigate market uncertainties.

In its second year, fff.vc grew to 300 members, worked through 159 late-stage deals, and invested approximately 3 million euros, showcasing its commitment to empowering tech financiers by providing access to exclusive investment opportunities while fostering collaboration and knowledge sharing.

Additionally, the emergence of niche platforms, such as fff.vc, focusing on sectors like health tech and green tech is gaining traction. These specialized platforms not only enable investors to align their portfolios with personal interests and values but also tap into specific market segments that show promise. The reward-based crowdfunding market alone is projected to reach a total transaction value of US$1.05 billion globally by 2025, with the United States leading at US$475 million.

This highlights the feasibility of targeted funding and reinforces the significance of specialized platforms in the current landscape. Finally, the increasing focus on sustainability and social impact is influencing investment choices, as technology financiers are progressively pursuing opportunities that align with their ethical considerations. As these trends unfold, the equity crowdfunding platforms UK, supported by communities like fff.vc, are poised for significant growth and innovation, catering to the evolving demands of tech-savvy investors.

Furthermore, fff.vc is committed to providing educational resources and fostering community engagement, ensuring that its members are well-equipped to navigate this dynamic landscape.

Conclusion

Equity crowdfunding stands at the forefront of transforming how tech investors engage with innovative startups, democratizing access to investment opportunities that were once reserved for a select few. By enabling collective funding, this approach fosters a sense of community and collaboration, vital for the success of early-stage ventures. Key insights from industry leaders emphasize the importance of building strong networks and conducting thorough due diligence, which are crucial for navigating the complexities and risks associated with crowdfunding investments.

While the potential for substantial returns is evident, it is equally important for investors to recognize the inherent risks, including the high failure rates of startups and the challenges of liquidity. The data underscores the need for a strategic approach, with diversification and informed decision-making serving as critical tools for mitigating risk. As the landscape continues to evolve, tech investors must stay vigilant and adapt to emerging trends, such as the increasing integration of technology within crowdfunding platforms and the growing focus on sustainability and niche markets.

In summary, equity crowdfunding represents a promising avenue for tech investors, offering unique opportunities to support groundbreaking innovations while also demanding a proactive and informed investment strategy. By leveraging community insights and embracing rigorous due diligence, investors can position themselves to thrive in this dynamic environment, ultimately contributing to a vibrant ecosystem of entrepreneurial success.