Overview

The article discusses the top 10 crowdfunding platforms to consider in 2023, highlighting their unique features and target audiences. It emphasizes that platforms like Kickstarter and Indiegogo are pivotal in democratizing access to capital for diverse projects, while also noting the importance of understanding each platform's fee structures and success rates to maximize fundraising efforts.

Introduction

In recent years, crowdfunding has emerged as a transformative force in the landscape of capital raising, particularly within the technology sector. As innovation accelerates, the ability to harness the collective financial support of a diverse audience has become paramount for entrepreneurs and organizations alike.

The evolution of crowdfunding platforms in 2023 not only showcases advanced technological features designed to enhance user experience but also reflects a growing democratization of access to capital.

With a multitude of models available—from reward-based to equity crowdfunding—understanding the intricacies of this financial method is essential for investors and creators aiming to navigate its complexities.

As the market continues to adapt amidst economic fluctuations, exploring the current state of crowdfunding offers valuable insights into its potential and the strategies necessary for success.

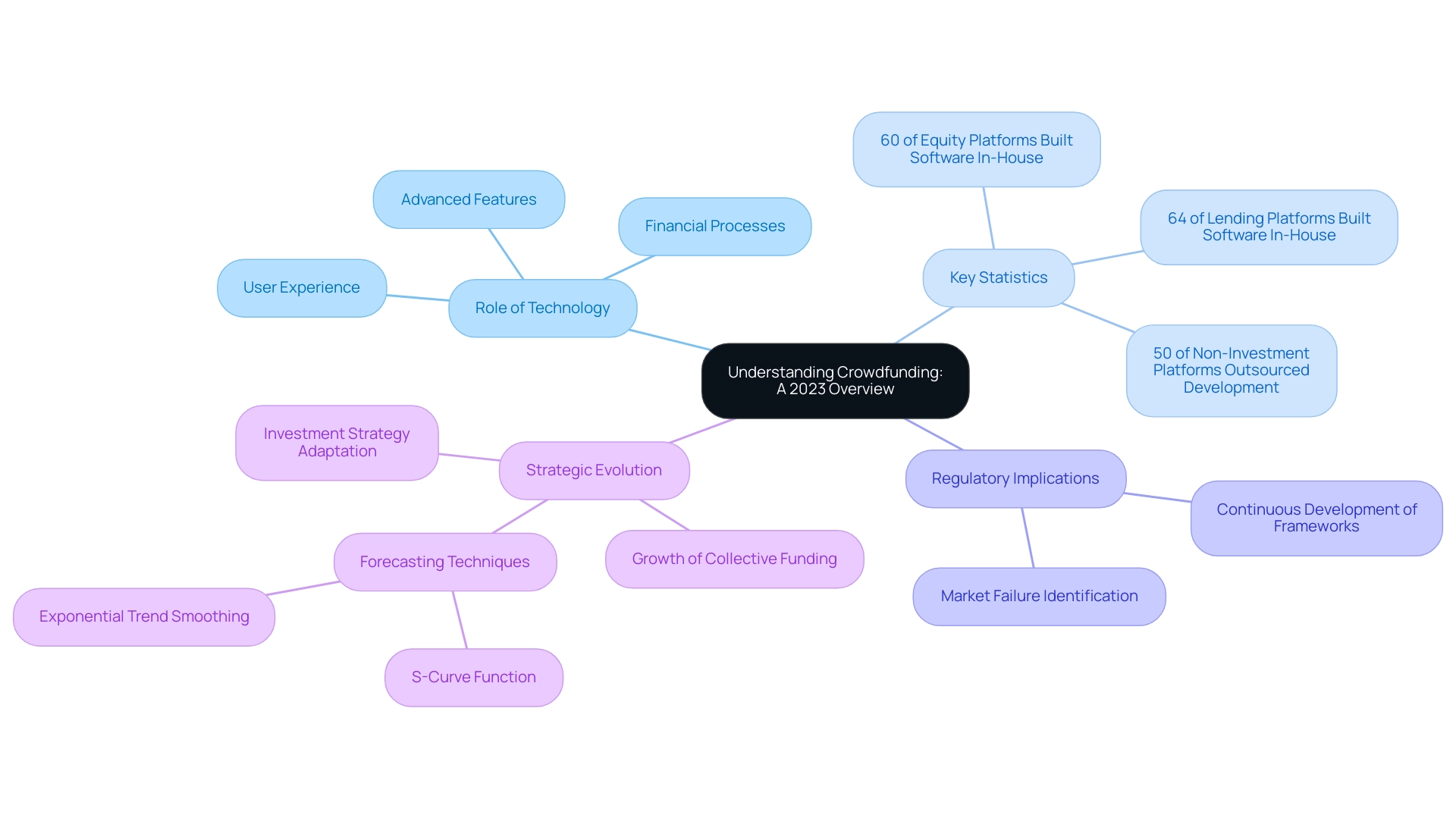

Understanding Crowdfunding: A 2023 Overview

Crowdfunding platforms have solidified their position as a pivotal avenue for capital raising, particularly within the tech sector, characterized by rapid innovation and entrepreneurial vigor. The significance of technology in crowdfunding cannot be exaggerated; numerous services are incorporating advanced features to improve user experience and simplify financial processes. In 2023, systems have significantly advanced, supporting a diverse range of endeavors from creative initiatives to high-tech startups.

This financial method empowers individuals and organizations to raise funds from a broad audience, primarily through crowdfunding platforms. Importantly, this trend has democratized access to capital, allowing diverse projects to obtain funding that might otherwise remain elusive through conventional financing avenues. Current statistics indicate that 60% of equity and 64% of lending services created their fundraising software internally, highlighting the technological emphasis in this area and implying a trend towards increased customization and control over service capabilities.

As Karsten Wenzlaff observes,

For governments in Europe considering the establishment or modification of tailored fundraising systems, the paper points out areas where these services identify market failure, emphasizing the continuous development of regulatory frameworks.

Additionally, diverse forecasting techniques applied within the sector, such as the S-curve function and exponential trend smoothing, help in understanding the non-linear growth of technology adoption in funding initiatives. This comprehension of the current fundraising landscape is crucial for investors and entrepreneurs aiming to effectively harness crowdfunding platforms, especially given the emerging trends indicating substantial growth and transformation in the sector.

Amidst a year of uncertainty in tech, characterized by market slowdowns and valuation dips, the strategic evolution of collective funding becomes even more relevant. For instance, fff. Vc has grown to 300 members, representing 28 countries, and has worked through 159 late-stage deals, investing approximately 3 million euros.

These statistics underscore the importance of adapting investment strategies to navigate the challenges of the current market.

Top 10 Crowdfunding Platforms to Consider in 2023

- Kickstarter: Widely recognized for its focus on creative projects, Kickstarter serves as a vital bridge between innovative entrepreneurs and enthusiastic backers. In December 2024, the number of active equity crowdfunding raises on crowdfunding platforms like Kickstarter reached an all-time high of 569, underscoring their pivotal role in the crowdfunding landscape. Notably, Kickstarter campaigns boast a success rate of 22.4%, according to Zippia, which signifies the site's effectiveness in translating ideas into funded realities. Recent successful campaigns, such as 'Donate for Desh' by the Indian Congress party and the Kickstarter campaign for the EBO X robot companion, exemplify the platform’s ability to attract financial support for diverse projects.

- Indiegogo: Offering a versatile range of funding options, Indiegogo allows creators to choose between fixed and flexible funding. This adaptability caters to a diverse array of projects, making it a popular choice for startups and established businesses alike. Indiegogo's unique approach has fostered a vibrant community of backers and innovators, enhancing its impact on the funding ecosystem.

- GoFundMe: Primarily geared towards personal causes, GoFundMe has emerged as a leading platform for charitable fundraising and personal emergencies. Its user-friendly interface and focus on community support have contributed to its popularity, allowing individuals to raise funds for various needs quickly and effectively.

- SeedInvest: Concentrating on equity crowdfunding, SeedInvest presents opportunities for investors to purchase shares in promising startups. This model is particularly appealing to tech investors looking to engage with emerging companies via crowdfunding platforms while benefiting from potential growth in the startup sector.

- Patreon: Designed to support creators through a subscription-based funding model, Patreon enables fans to contribute to their favorite artists, writers, and content creators on a recurring basis. This service fosters long-term relationships between creators and their supporters, providing a steady income stream for innovative projects.

- Fundable: As a hybrid platform, Fundable provides both rewards and equity funding, catering to a broad spectrum of entrepreneurs. This dual approach provides diverse funding avenues via crowdfunding platforms, allowing projects to attract both backers seeking rewards and investors interested in equity stakes.

- CircleUp: Targeting consumer brands, CircleUp connects investors with companies in need of growth capital while emphasizing data-driven insights. This analytical approach enhances investor confidence and supports informed decision-making, making CircleUp a key player in the consumer goods sector.

- Wefunder: Wefunder democratizes the investment landscape by inviting anyone to invest in startups, broadening access to early-stage investing. This inclusive model empowers a new generation of investors and fosters a diverse startup ecosystem.

- StartEngine: StartEngine focuses on equity raising, allowing investors to acquire shares in startups and small businesses. This system is particularly attractive to tech investors seeking early access to innovative ventures poised for growth.

- NextSeed: Focusing on small businesses, NextSeed enables investors to support local ventures while earning returns on their investments. This community-oriented approach not only aids small businesses in gaining necessary capital but also builds stronger local economies.

Weighing the Pros and Cons of Crowdfunding

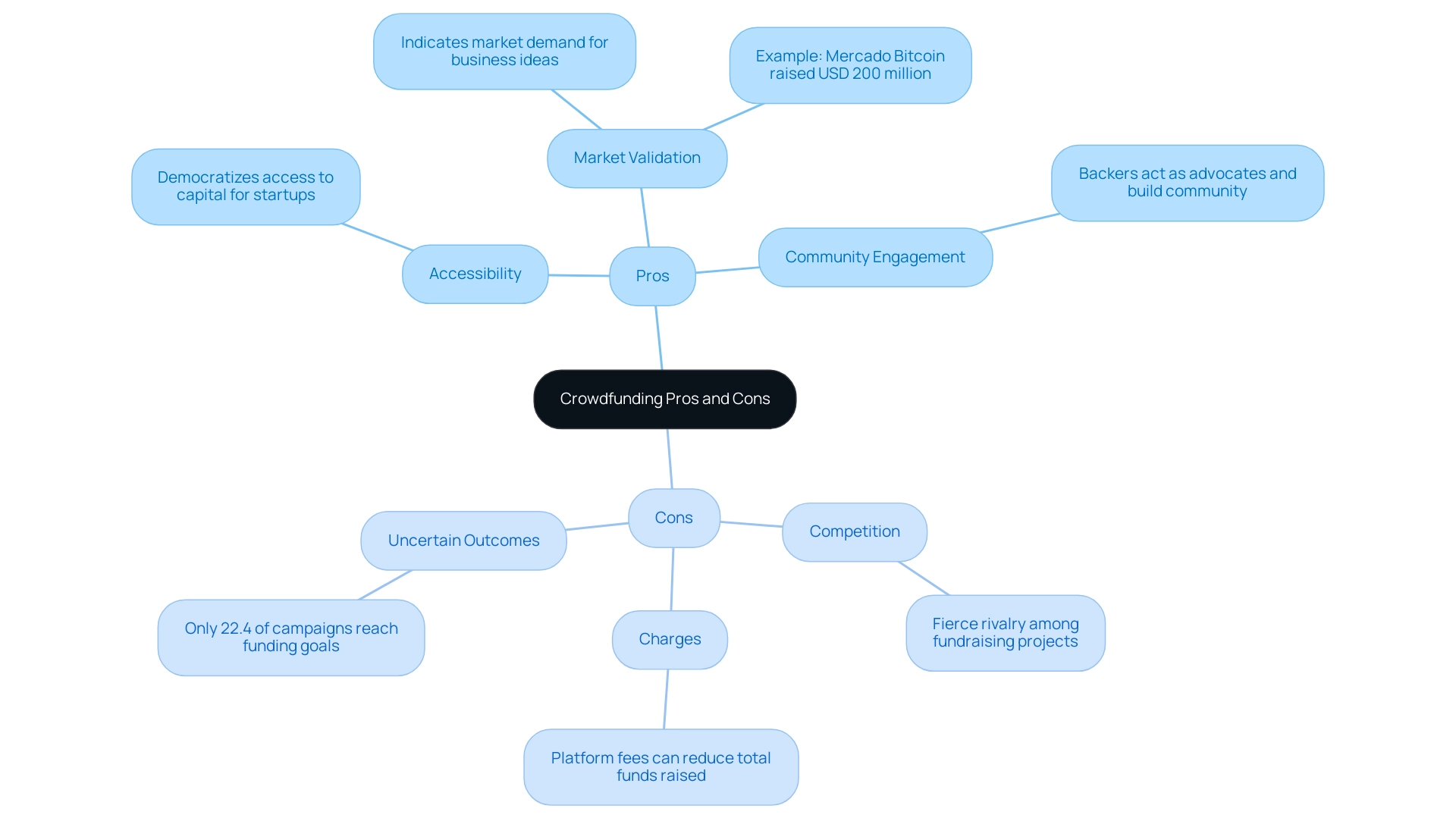

Pros and Cons of Crowdfunding

Pros:

-

Accessibility: Crowdfunding democratizes access to capital, enabling entrepreneurs who may find it difficult to secure traditional financing avenues to obtain necessary funds. This increased accessibility is particularly beneficial for startups and small businesses that often face hurdles in obtaining bank loans or venture capital.

-

Market Validation: Successfully funded campaigns serve as a strong indicator of market demand. They provide entrepreneurs with invaluable validation for their business ideas, allowing them to gauge interest and refine their offerings before fully launching a product or service.

A notable example is Mercado Bitcoin, which raised USD 200 million from the SoftBank Latin America Fund, reflecting the growing interest in cryptocurrency-related funding initiatives in Brazil and Latin America.

-

Community Engagement: Collective funding creates a robust sense of community and engagement. Backers not only provide monetary assistance but also act as advocates for the project, cultivating a devoted customer group that feels personally engaged in the initiative’s success.

Cons:

- Competition: The rise of fundraising websites has resulted in fierce rivalry, making it difficult for separate projects to achieve visibility and differentiate themselves among many campaigns. Business owners must dedicate substantial effort in marketing to draw in potential supporters.

- Charges: Most crowdfunding platforms impose charges that can greatly diminish the overall funds collected. These fees, which may include processing fees and platform charges, can vary widely and should be carefully considered when planning a campaign.

- Uncertain Outcomes: Crowdfunding does not guarantee financial success. In fact, statistics reveal that only 22.4% of all financial campaigns achieve their monetary targets, underscoring the inherent risks for entrepreneurs who may end up without the capital they sought if their initiatives fail to resonate with supporters. As mentioned by Zippia, this statistic emphasizes the difficulties encountered by entrepreneurs in the crowdfunding environment.

Considering these aspects, entrepreneurs must evaluate the advantages and disadvantages of crowdfunding thoughtfully, taking into account both the possibilities for financial support and the potential obstacles they may encounter.

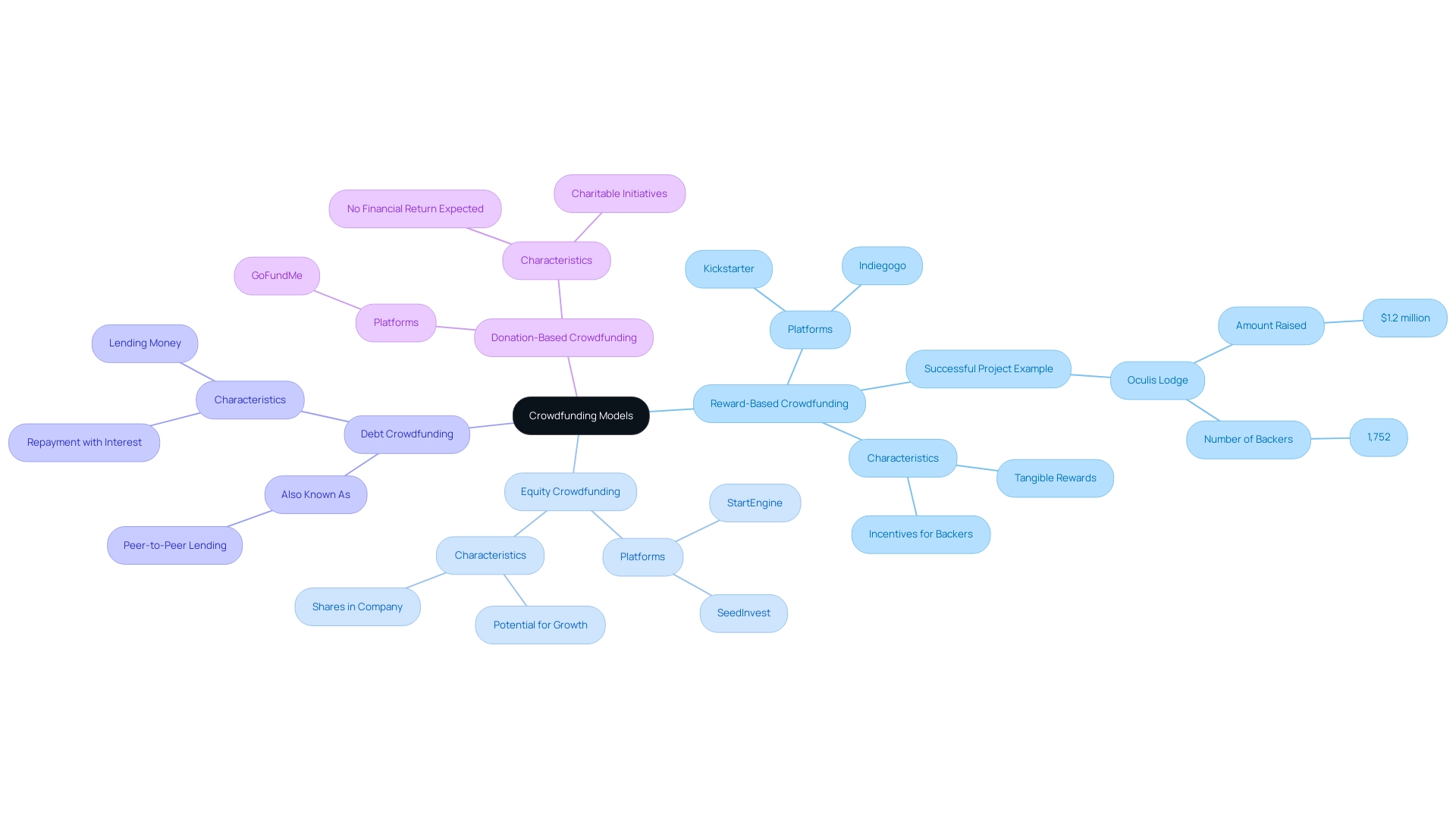

Exploring Different Types of Crowdfunding Models

- Reward-Based Crowdfunding: In this model, backers receive tangible rewards—such as products or services—in exchange for their financial contributions. This method is widely accepted on crowdfunding platforms such as Kickstarter and Indiegogo, where creators can provide various incentives to draw in funding. As highlighted by Shavarsh Zohrabyan, Head of Research and Market Analysis at the Crowdfunding Formula,

Overall, both Kickstarter and Indiegogo statistics for Q1 of 2023 were full of learnings, indicating the dynamic nature of crowdfunding platforms. Notably, Indiegogo's most successful project in Q1 of 2023, the 'Oculis Lodge', raised $1.2 million from 1,752 backers, showcasing the potential for substantial returns in reward-based crowdfunding. - Equity Crowdfunding: This model allows investors to acquire shares in a company, providing them with the opportunity to benefit from the company's future growth. Crowdfunding platforms such as SeedInvest and StartEngine have popularized this approach, reflecting a notable growth trajectory in equity raising throughout 2023. Recent reports indicate a shift in investor interest towards equity models as they seek more substantial returns.

- Debt Crowdfunding: Also referred to as peer-to-peer lending, this model enables individuals to lend money to businesses in exchange for repayment with interest. This framework has gained traction as a viable alternative for businesses seeking capital without relinquishing ownership.

- Donation-Based Crowdfunding: Primarily utilized for charitable initiatives, this model allows backers to contribute without expecting any financial return. Crowdfunding platforms, such as GoFundMe, exemplify this approach by serving as a conduit for philanthropic efforts. As the landscape evolves, understanding these distinct models is crucial for investors aiming to navigate the funding ecosystem effectively. Additionally, the success rates of Kickstarter projects reveal that those launched in March had a significantly higher success rate at 60.09%, compared to January's 33.35% and February's 47.89%. This data highlights the significance of timing in fundraising success. Overall, integrating premium and basic statistics, along with concentrating on venues, fundraisers, backers, and the national emphasis on France, can offer a more comprehensive overview of the funding ecosystem.

How to Choose the Right Crowdfunding Platform for Your Needs

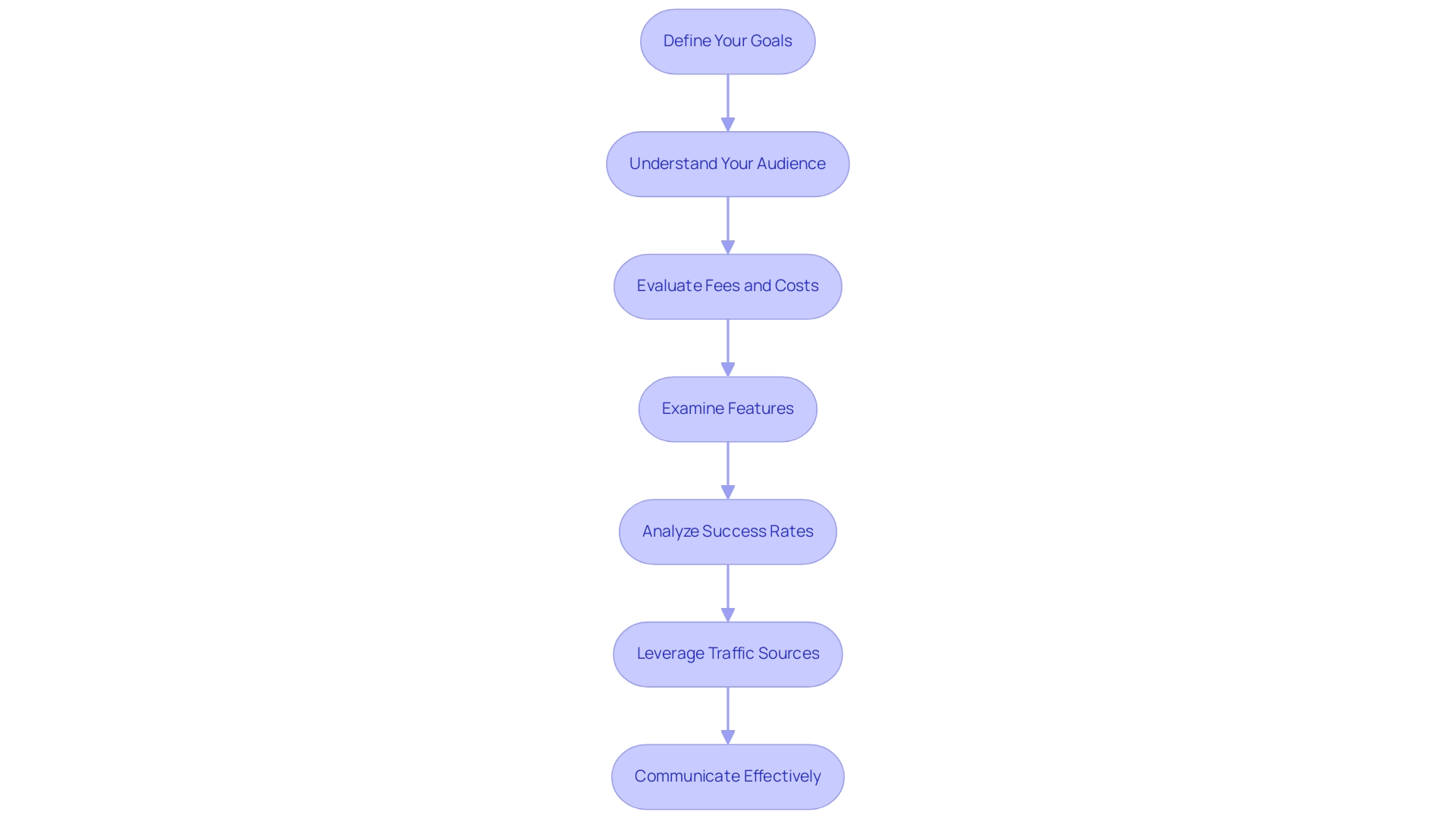

- Define Your Goals: Begin by articulating your objectives, which should encompass specific financial targets and project timelines. This clarity will serve as a roadmap for your campaign.

- Understand Your Audience: Conduct research to identify potential backers and choose a medium that aligns with their interests and demographics. Tailoring your approach to your audience can significantly influence your campaign's success.

- Evaluate Fees and Costs: Each fundraising service has its own fee structure, which can affect your net funding. For instance, Crowdcube is a notable UK-based service among crowdfunding platforms that charges a 7% fee on funds raised. Understanding these costs is essential for calculating the overall feasibility of your campaign.

- Examine Features: Investigate the specific attributes offered by each service, such as marketing tools, analytics, and customer support. These functionalities can enhance your campaign's visibility and effectiveness in reaching potential backers.

- Analyze the success rates of campaigns across various crowdfunding platforms. For instance, only 24.1% of Indiegogo campaigns have successfully raised more than $50,000. Such metrics offer valuable insights into where your endeavor might have the highest likelihood of flourishing. Furthermore, take into account that the average initiative on Kickstarter in Q1 of 2023 required 33 days to achieve its financial target, emphasizing the significance of establishing achievable timelines.

- Leverage Traffic Sources: Recognize that organic search traffic accounted for 36.11% of the total traffic to crowdfundr.com. Understanding how traffic sources can influence your campaign is crucial for maximizing visibility and attracting potential backers.

- Communicate Effectively: Campaigns that effectively communicate their funding goals tend to raise more funds, with visual representations increasing average funds raised by 35%. Utilizing videos and concise summaries can significantly enhance your fundraising efforts, with successful projects averaging 300 to 500 words in their descriptions.

Conclusion

Crowdfunding has established itself as a vital mechanism for raising capital, particularly in the technology sector, where rapid innovation thrives. The advancements in crowdfunding platforms throughout 2023 demonstrate an ongoing commitment to enhancing user experience and expanding access to funding for a diverse range of projects. As entrepreneurs and creators leverage these platforms, they not only tap into broader funding opportunities but also engage communities that can validate their ideas and support their initiatives.

However, navigating the complexities of crowdfunding requires a strategic approach. Understanding the various models—ranging from reward-based to equity crowdfunding—allows both investors and creators to make informed decisions that align with their goals. The benefits of crowdfunding, such as increased accessibility and community engagement, must be weighed against potential challenges, including competition and platform fees.

Ultimately, the continued evolution of crowdfunding reflects a significant shift in how capital is raised and distributed. As the landscape adapts to meet the needs of investors and entrepreneurs alike, embracing these platforms will be crucial for those looking to succeed in an increasingly competitive market. The insights gained from this exploration are invaluable for anyone aiming to navigate the crowdfunding ecosystem effectively and capitalize on its transformative potential.