Overview

The article outlines ten revenue model samples that businesses can implement today, including subscription, freemium, and advertising frameworks, each catering to different market needs and conditions. It supports this by providing examples and statistics, such as HelloFresh's success with subscriptions and TikTok's advertising revenues, illustrating how understanding and choosing the right revenue model can significantly impact a company's financial stability and growth.

Introduction

Navigating the intricate landscape of revenue models is essential for any business aiming for sustainable growth and success. As companies increasingly seek innovative ways to monetize their offerings, understanding the various frameworks available becomes crucial.

With a significant portion of the UK market comprising micro-businesses and small enterprises, the need for adaptable and effective revenue strategies is more pressing than ever.

This article delves into the fundamental concepts of revenue models, explores practical examples that can be implemented immediately, and provides insights into emerging trends that could shape the future of business income generation.

By examining the strengths and weaknesses of popular models, entrepreneurs can make informed decisions that align with their unique objectives and market demands.

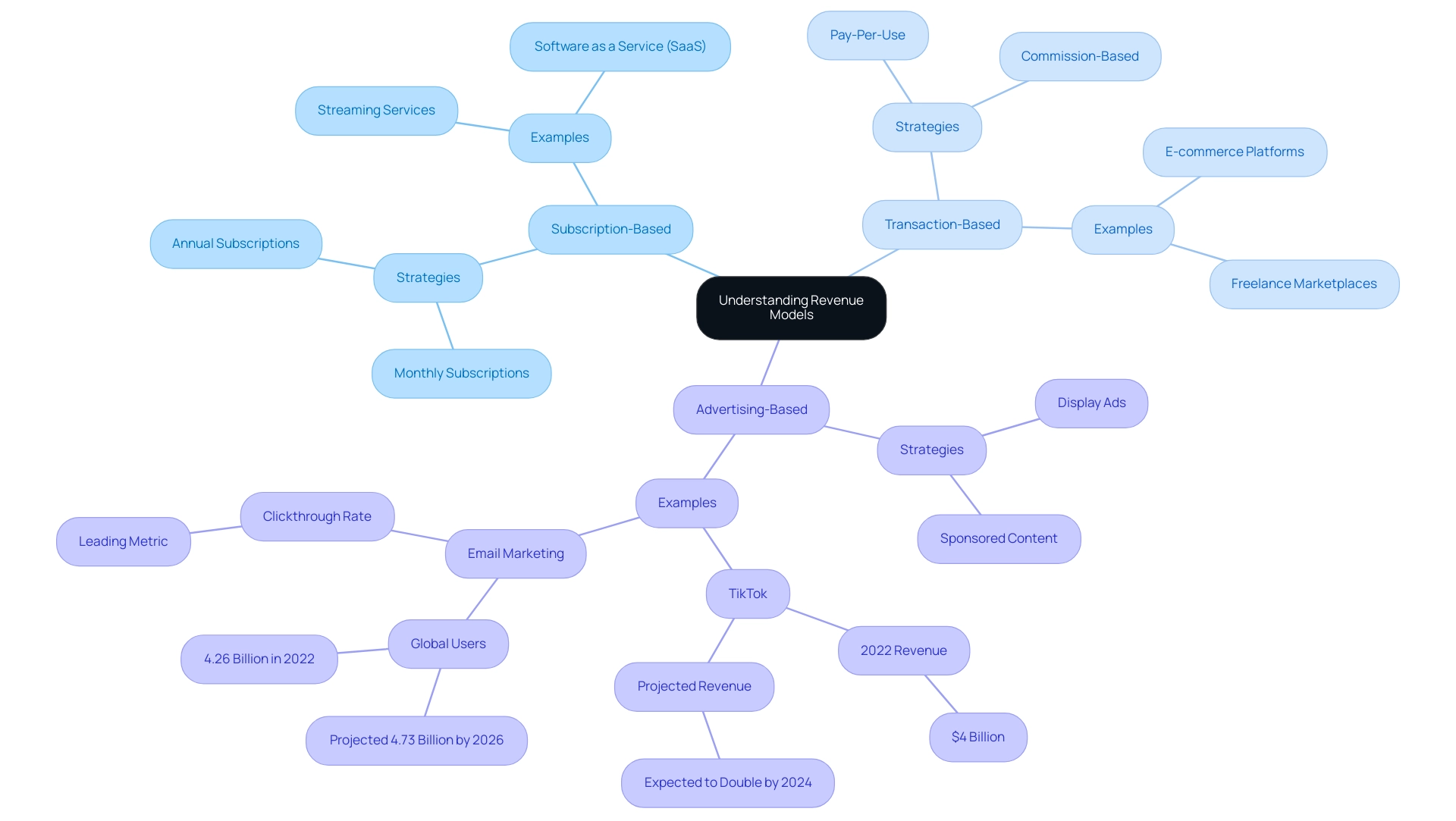

Understanding Revenue Models: A Foundation for Success

An income framework is an essential structure that serves as a revenue model sample, outlining how an organization generates funds through its operational activities. It encompasses the various strategies and tactics that form a revenue model sample for effectively monetizing products or services. Comprehending income structures is crucial, as they significantly impact organizational planning, funding needs, and overall growth strategies.

In 2024, it is especially significant that 99.2% of the UK commercial environment comprises micro-enterprises and small firms, highlighting the need for flexible income strategies. Typical income structures can serve as a revenue model sample that encompasses subscription-based, transaction-based, and advertising-based methods. Each framework addresses distinct business needs and market conditions, necessitating that entrepreneurs carefully assess which revenue model sample aligns most effectively with their objectives and target audience.

For instance, the video platform TikTok illustrated the profitable potential of advertising-based income strategies, generating $4 billion in advertising earnings in 2022, with projections suggesting that this figure may double by 2024. This trend reflects a broader shift towards digital advertising as a key income source for startups. Furthermore, the significance of email marketing as a financial model is emphasized by the statistic that the number of global email users reached 4.26 billion in 2022 and is expected to increase to 4.73 billion by 2026.

As emphasized in HubSpot's State of Marketing Report, the click through rate continues to be the leading metric marketers utilize to assess the effectiveness of their email marketing campaigns, highlighting the significance of efficient financial strategies. Furthermore, a recent case study revealed that as of late November 2024, 95% of enterprises reported they were trading, with 85% fully trading and 10% partially trading, illustrating the resilience of the commercial environment. Therefore, a deep understanding of income structures, such as a revenue model sample, not only assists in maneuvering through the intricacies of business activities but also prepares startups for enduring development in a competitive market.

Top 10 Revenue Model Examples You Can Implement Today

- Subscription Structure: This framework entails billing clients a regular fee for ongoing access to a product or service, making it especially beneficial in the software and media sectors. A notable example is HelloFresh, which boasts 7.1 million global active subscribers as of 2023, illustrating the effectiveness of this revenue model sample in generating steady revenue streams. The average subscription billing vendor is experiencing annual growth of 30%-50%, highlighting the broader market trends that reinforce the potential of subscription revenue model samples.

- Freemium Model: In this approach, companies offer basic services at no cost while requiring payment for premium features. This design is widely adopted by tech companies, allowing them to attract a large user base while monetizing through premium upgrades. The effectiveness of the freemium approach is underscored by various success stories, demonstrating significant conversion rates from free to paid users.

- Pay-Per-Use Approach: Customers are billed according to their actual usage of services, making this system ideal for utilities and cloud computing services. This flexibility can enhance customer satisfaction as users only pay for what they use, illustrating a revenue model sample.

- Advertising Framework: Revenue is generated through advertisements displayed on a platform, a structure prevalent in digital media. This approach can be highly lucrative for companies with large user bases, as evidenced by various revenue model samples from platforms that effectively monetize their audiences through targeted advertising.

- Affiliate Marketing Framework: This framework involves earning commissions by promoting other companies' products or services. It is an effective strategy for businesses looking to diversify revenue streams without the need for inventory.

- E-commerce Approach: Direct sales of products to consumers through online platforms characterize this approach, making it suitable for a variety of industries. E-commerce has seen explosive growth, particularly in recent years, as more consumers shift to online shopping.

- Licensing Approach: Companies charge for the right to use their intellectual property, which can be particularly effective in technology and creative industries. Licensing agreements can serve as a revenue model sample by providing a significant revenue stream while allowing the original creators to retain ownership.

- Crowdfunding Approach: This approach enables startups to gather capital from a wide array of individuals, frequently for product development. Platforms like Kickstarter have made it easier for entrepreneurs to connect with potential backers, showcasing innovative ideas.

- Consulting Approach: Offering expert guidance and services for a fee is central to this approach, making it an excellent choice for professionals in various fields. This framework can leverage existing expertise to generate additional income.

- Data Monetization Framework: With the increasing relevance of data analytics, this approach involves selling insights derived from data. Companies in tech-driven sectors can capitalize on their data assets, turning information into a valuable income source. The subscription management software market, projected to grow at a rate of 15% from 2019 to 2025, serves as a revenue model sample that exemplifies the expanding opportunities in this domain. As Isabelle Roussin, chief solution expert on quote-to-cash at SAP, notes, 'The trend we start to see is an ‘outcome-based’ approach, where customers will pay for a guaranteed outcome serving their needs – not for the usage, but for the guaranteed outcome of a usage.' This insight highlights the changing environment of income structures.

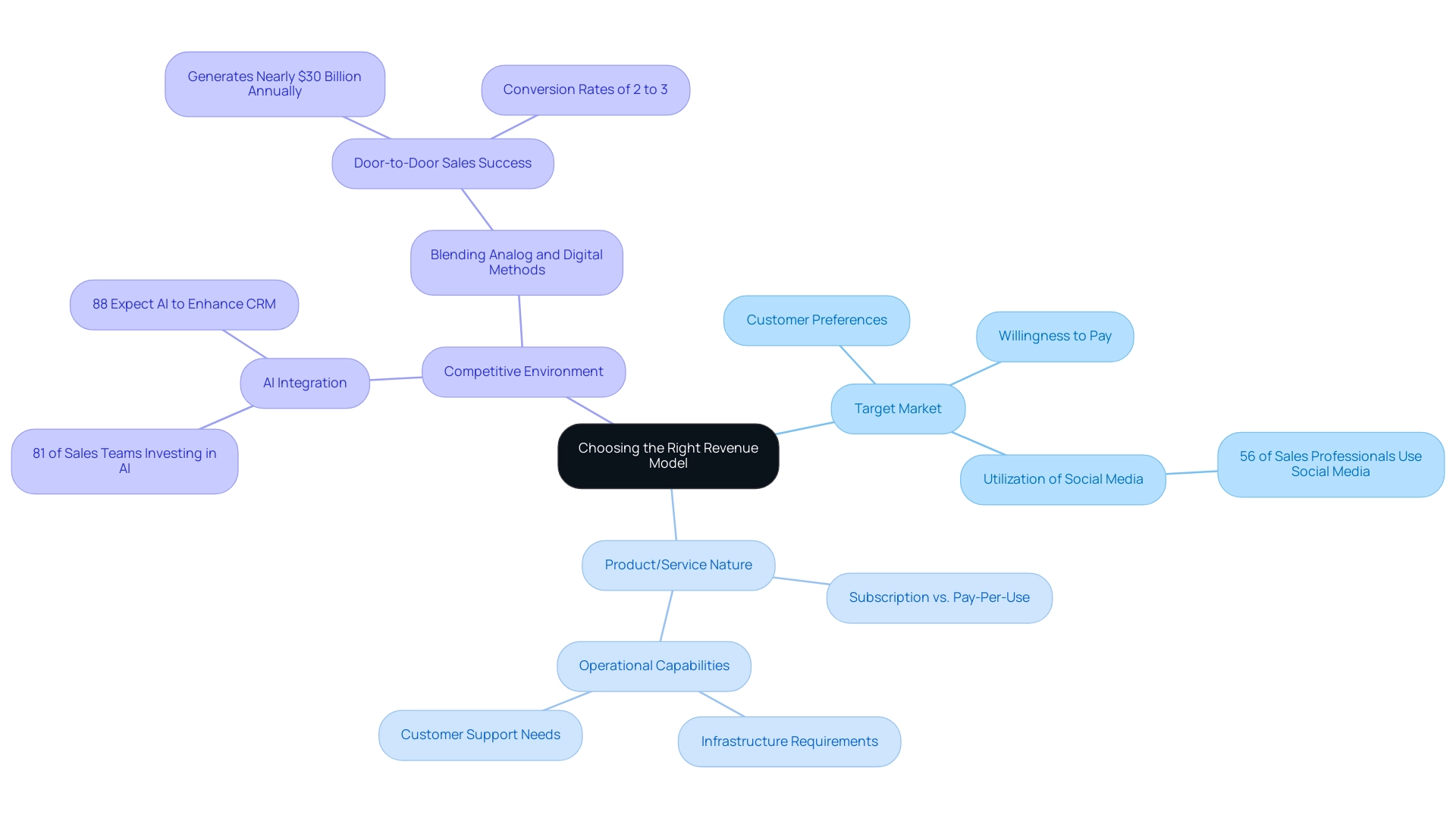

Choosing the Right Revenue Model for Your Business

When assessing the most appropriate income structure for your startup, it is crucial to analyze several important factors, including:

- Your target market

- The nature of your product or service

- The competitive environment

A thorough analysis of your customer base will uncover their preferences and willingness to pay, guiding your decision-making process. For instance, businesses concentrating on software may discover that a subscription approach aligns well with their offerings, whereas utility services might gain more from a pay-per-use system.

Moreover, comprehending your operational capabilities and available resources is essential, as certain income strategies require more extensive infrastructure and customer support than others. As Salesforce emphasizes,

81% of sales teams are investing in AI, with benefits including improved sales data quality and personalized customer interactions.

This integration of technology can further enhance your understanding of customer preferences and behaviors.

Significantly, 88% of sales leaders anticipate artificial intelligence will improve their CRM processes in the coming two years, emphasizing the increasing significance of AI in influencing income strategies. Ultimately, the selected financial strategy should not only align with your business objectives but also resonate with customer expectations, paving the way for a revenue model sample that supports sustainable growth. In 2024, companies will increasingly blend analog and digital approaches; for instance, a successful door-to-door sales strategy can yield nearly $30 billion annually with conversion rates of 2% to 3%.

This success highlights the significance of persistence, human connection, and the integration of data-driven insights in generating income strategies. Furthermore, with 56% of sales experts utilizing social media to discover new prospects, it is evident that contemporary sales strategies play a vital role in shaping financial approaches.

Pros and Cons of Popular Revenue Models

-

Subscription Model:

- Pros: The subscription model offers a predictable revenue stream, which can significantly enhance financial stability for startups. Moreover, it fosters customer loyalty, as subscribers often develop a habitual relationship with the service. Given the substantial growth of the subscription economy—witnessing a remarkable 435% increase from 2011 to 2021—businesses are increasingly shifting toward this revenue model to capitalize on consumers' preference for recurring access to products and services. Additionally, the trend towards an ‘outcome-based’ approach is emerging, where customers are willing to pay for guaranteed outcomes that serve their needs rather than just for usage.

- Cons: However, this model necessitates the ongoing delivery of value to retain subscribers. Churn Rate, which measures the percentage of subscribers who cancel their subscriptions within a given period, is a critical metric for businesses. If subscribers perceive a decline in quality or relevance, their likelihood of cancellation increases, adversely affecting churn rates. Companies must continually innovate and engage users to maintain satisfaction.

-

Freemium Model:

- Pros: The freemium model is effective in attracting a large user base rapidly. By offering basic services for free, companies can create significant initial interest and build a broad community around their product.

- Cons: The challenge lies in converting free users to paid subscribers. Many users may remain content with the free version, leading to low conversion rates and potentially unsustainable revenue. This design requires strategic planning to encourage upgrades.

-

Pay-Per-Use Model:

- Pros: This model provides flexibility for customers, allowing them to pay only for what they use. It aligns costs directly with consumption, making it an attractive option for users who prefer not to commit to fixed fees.

- Cons: However, revenue can be unpredictable, as it may fluctuate based on user engagement and demand. Businesses must carefully analyze usage patterns to forecast income effectively.

-

Advertising Model:

- Pros: The advertising model presents a low entry barrier for startups, alongside the potential for high revenue generation. By leveraging substantial web traffic, businesses can monetize their platforms effectively.

- Cons: Yet, to be successful, this model requires significant traffic to generate meaningful revenue. Without an adequate user base, the financial returns may not meet expectations, leading to reliance on external factors.

-

Affiliate Marketing Model:

- Pros: This model requires minimal upfront investment, allowing startups to promote third-party products and earn commissions on sales. It is a low-risk method to generate income without the burden of creating and maintaining inventory.

- Cons: Conversely, dependence on third-party products can limit a startup's control over revenue and brand reputation. Variability in product quality or changes in affiliate terms can directly impact profitability.

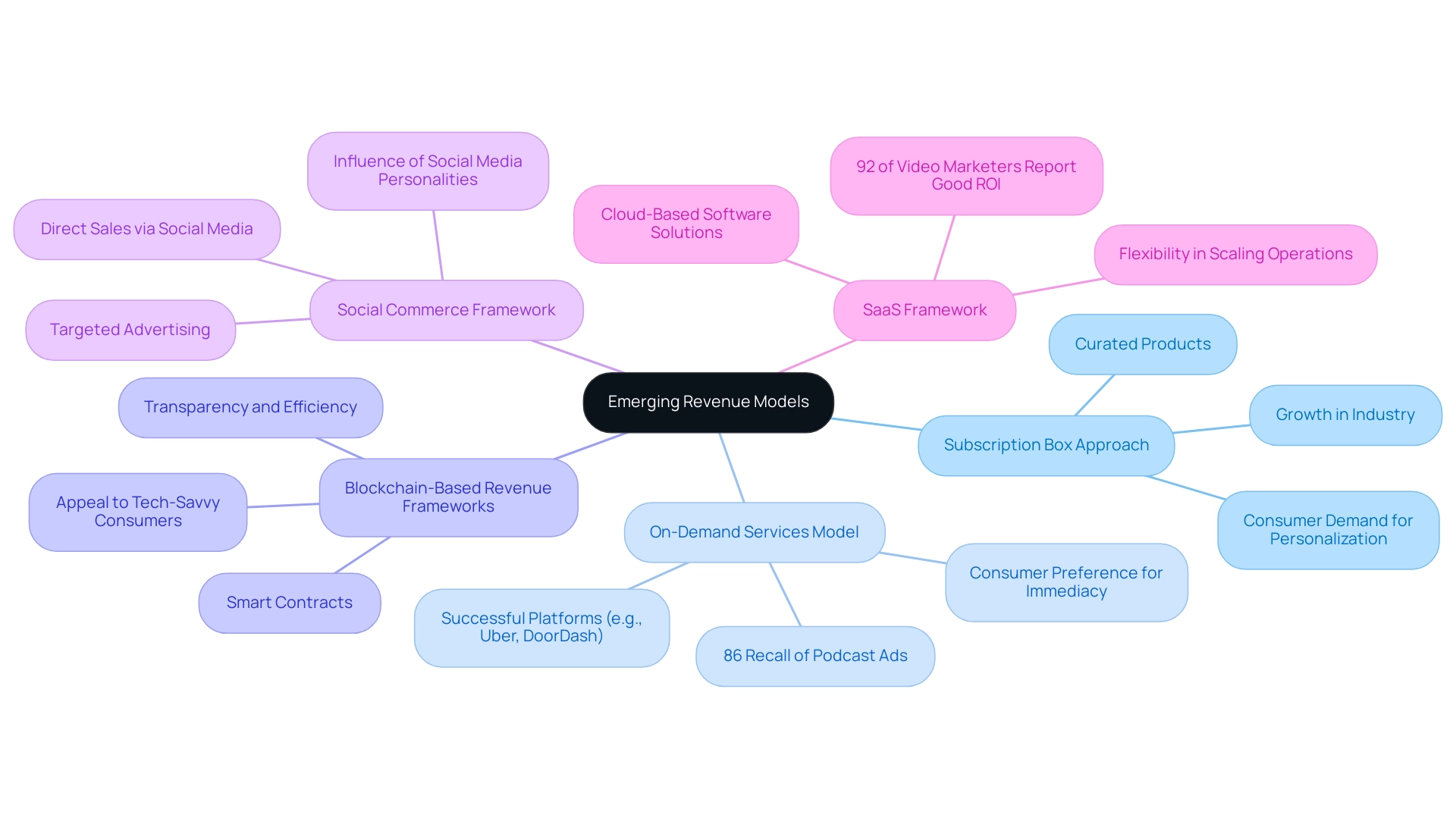

Emerging Revenue Models: Trends to Watch

As companies navigate the changing market landscape, several innovative revenue strategies are emerging and gaining widespread acceptance:

- Subscription Box Approach: This system provides curated products to consumers regularly, addressing the rising need for convenience and personalization. Notably, the subscription box service industry has seen remarkable growth, appealing to consumers who value curated experiences.

- On-Demand Services Model: This approach allows consumers to access services as needed, exemplified by successful platforms such as Uber and DoorDash. The adaptability of this framework aligns with the increasing consumer preference for immediacy and convenience in service delivery. Additionally, 86% of consumers recall podcast ads more than any other channel, highlighting the effectiveness of advertising in driving engagement within this model.

- Blockchain-Based Revenue Frameworks: By leveraging smart contracts, these frameworks enhance the transparency and efficiency of transactions. This trend reflects a broader movement towards decentralized finance and is particularly appealing to tech-savvy consumers and investors.

- Social Commerce Framework: This emerging framework facilitates direct sales through social media platforms, capitalizing on the influence of social media personalities and targeted advertising. As brands increasingly connect with consumers through social channels, the potential for income generation in this domain continues to expand.

- SaaS (Software as a Service) Framework: This framework offers software solutions through the cloud, allowing businesses to scale operations flexibly while managing costs effectively. With 92% of video marketers recognizing a strong ROI from video advertising, the SaaS approach has proven particularly effective in boosting customer engagement and retention.

The ongoing decline in global paid-for daily newspaper circulation—from 543 million in 2019 to 474 million in 2024—illustrates the shift from traditional income structures to a revenue model sample that emphasizes digital platforms. This case study illustrates the necessity for startups to adjust to the shifting environment.

The changing terrain of income strategies highlights the significance of flexibility for startups, especially as trends like GenAI integration into advertising speed up. Companies that harness these emerging models stand to create new revenue streams while meeting consumer expectations.

Conclusion

Understanding and selecting the right revenue model is vital for businesses striving for sustainable growth in today's competitive landscape. This article explored the fundamental concepts of revenue models, detailing various types such as:

- Subscription

- Freemium

- Pay-per-use

Each offering distinct advantages and challenges. The practical examples provided highlight how companies have successfully implemented these models, demonstrating their potential to generate consistent income and foster customer loyalty.

Furthermore, the discussion on emerging trends emphasizes the necessity for businesses to remain adaptable. Innovations like:

- Subscription box services

- Social commerce

are reshaping traditional approaches, reflecting shifting consumer preferences toward personalization and convenience. As the market evolves, leveraging data-driven insights and integrating technology will be crucial in fine-tuning revenue strategies.

Ultimately, a comprehensive understanding of revenue models allows entrepreneurs to make informed decisions that align with their business objectives and customer expectations. By carefully assessing the strengths and weaknesses of each model, businesses can position themselves for long-term success, ensuring they not only survive but thrive in an ever-changing economic environment.