Overview

The article focuses on identifying the top 10 crowdfunding platforms that are essential to know in 2025, highlighting their unique features and the evolving landscape of crowdfunding. It emphasizes the importance of understanding different crowdfunding types, community engagement, and emerging trends that will shape the fundraising environment, showcasing how platforms like Kickstarter, GoFundMe, and SeedInvest cater to diverse project needs and contribute to the democratization of funding opportunities.

Introduction

In an age where innovative ideas can spring from anywhere, crowdfunding has emerged as a transformative force in the financial landscape. This dynamic funding model harnesses the collective power of individuals, allowing entrepreneurs and creators to secure capital through online platforms while simultaneously engaging a community of supporters.

From tech startups to charitable causes, crowdfunding has democratized investment opportunities, enabling backers to fund projects that resonate with their values. As the industry evolves, understanding the diverse types of crowdfunding platforms, their unique features, and the emerging trends shaping the future becomes crucial for both creators and investors.

This article delves into the intricacies of crowdfunding, exploring its mechanics, the leading platforms to watch in the coming years, and the vital role that community plays in driving successful campaigns.

Understanding Crowdfunding: A Comprehensive Overview

Crowdfunding, especially via the top 10 crowdfunding platforms, represents a revolutionary method of raising capital by harnessing the collective efforts of numerous individuals. This model democratizes the investment process, enabling entrepreneurs and creators to access a diverse pool of backers. The importance of collective funding through the top 10 crowdfunding platforms lies not only in enabling the initiation of innovative projects but also in allowing supporters to back ideas aligned with their values, often in return for rewards, equity, or debt.

Notably, successful campaigns attract around 300 backers on average, emphasizing the community aspect of this funding model. Furthermore, research indicates that campaigns featuring a video pitch raise 105% more funds than those without, highlighting the critical role of storytelling in engaging potential investors.

As we delve deeper into crowdfunding mechanics, it's essential to recognize its profound impact on entrepreneurs, particularly in the tech sector, where new ideas are continuously emerging and reshaping the landscape. Recent trends show that from 2018 to 2024, Reg CF funding levels were at 69% of their 2021 peak, while Reg A+ ended 2024 at 46% of its 2021 peak, indicating a shift in funding dynamics that resonate with the strategic evolution observed within platforms like fff.vc, which has focused on diversifying portfolios amid market uncertainty.

During its operations, fff.vc has engaged in significant deals, investing approximately 3 million euros across various late-stage tech opportunities, including notable companies like Inbank and Bolt. However, the tech market has faced challenges, such as decreased valuations and increased risks in early-stage funding, prompting fff.vc to adapt its strategies by focusing on late-stage and secondary tech deals, typically ranging from 500k to 1 million euros per SPV.

Additionally, a case study titled '2024 Regulated Crowdfunding Summary' illustrates how the top 10 crowdfunding platforms are evolving as a critical component of private capital markets. Despite obstacles such as service unification and varying funding levels, the sector demonstrates resilience and creativity, with opportunities for expansion and influence in 2025, especially for non-traditional and underrepresented entrepreneurs.

Insights from Baltic investment leaders, such as Sten Tamkivi and Kristjan Vilosius, further emphasize the importance of community involvement in early-stage investments, highlighting how their experiences can guide tech investors through challenges while fostering a supportive investment ecosystem. Léa Bouhelier-Gautreau, an industry analyst, emphasizes the significance of comprehending how funding amounts differ among leading equity raising sites:

- 'How do funding amounts differ among top equity raising sites?'

- Uncover insights on median raises, system performance, and why Dealmaker is an outlier in today's startup funding landscape.

This expert insight emphasizes the need for technology financiers to stay informed about the evolving crowdfunding landscape.

Exploring the Different Types of Crowdfunding Platforms

The top 10 crowdfunding platforms can be categorized into several distinct types, each providing unique benefits and catering to various preferences of contributors.

-

Reward-Based Crowdfunding: In this model, participants receive non-financial rewards, such as products or services, in exchange for their contributions. Platforms like Kickstarter and Indiegogo are prominent in this space, attracting millions of backers.

Recent data indicates that campaigns reaching at least 30% of their funding goal within the first week are significantly more likely to achieve overall success. Jenny Chang, a senior writer specializing in crowdfunding, notes that this model has seen explosive growth, largely due to the quick adoption of disruptive technologies.

-

Equity Crowdfunding: This type allows investors to receive shares in a company, enabling them to participate in its growth and potential profits.

Notable platforms such as SeedInvest and Crowdcube have gained traction, especially as more businesses recognize the value of tapping into this funding source. The equity fundraising market is increasingly appealing to early-stage startups, supported by expert opinions highlighting the transformative impact of disruptive technologies in this sector.

-

Debt Crowdfunding: Also referred to as peer-to-peer lending, this model connects investors with individuals or businesses in need of loans, with the expectation of repayment plus interest.

LendingClub and Funding Circle exemplify this approach, which has become particularly popular given the growing demand for alternative financing options. The global fundraising market is anticipated to attain $1.20 billion in 2024, highlighting the importance of debt-based funding in today’s financial environment. Notably, around 10% of funding businesses use manual verification, while 51% use semi-automated and 39% use fully automated identity verification methods, reflecting the industry's commitment to security and compliance.

-

Donation-Based Crowdfunding: This model primarily serves charitable causes, where contributors make donations without any expectation of financial return.

GoFundMe stands out as a leader in this category, having raised over $10 billion through more than 150 million donations. The platform sees around 10,000 new campaigns launched daily, and on significant occasions, such as June 2, 2020, it experienced the highest donation day in its history, largely influenced by movements like Black Lives Matter.

This case study exemplifies the impact and reach of donation-based fundraising, illustrating its significance in the broader funding landscape.

By understanding these various funding types, investors can make informed decisions based on their goals and the evolving environment of the top 10 crowdfunding platforms in the fundraising industry.

The Top 10 Crowdfunding Platforms for 2025

As we look ahead to 2025, the landscape of fundraising continues to evolve, influenced by economic conditions and shifting donor behavior. Notably, the number of people asked to donate on the street has risen from 15% in 2021 to 19% in 2022, indicating a growing willingness to contribute. Here are the top 10 funding websites to observe:

- Kickstarter: A frontrunner in reward-based funding, Kickstarter remains the preferred site for creative projects, with a track record of successfully funded campaigns that inspire innovation.

- Indiegogo: Known for its flexible funding options, Indiegogo is particularly favored by tech startups, allowing them to test products and gauge market interest effectively.

- SeedInvest: This equity funding platform stands out for its rigorous vetting process, providing backers access to high-quality startups that meet stringent investment criteria.

- Crowdcube: Located in the UK, Crowdcube enables individuals to buy shares in startups, contributing to a vibrant entrepreneurial ecosystem while being supported by notable venture capital firms. In response to the economic climate, Crowdcube has adapted its strategies to better support entrepreneurs aiming to make a significant impact.

- GoFundMe: Dominating the donation-based fundraising space, GoFundMe is especially popular for personal, medical, and charitable causes, reflecting the growing need for community support. However, the National Council for Voluntary Organizations has raised concerns that there still isn’t enough local government funding to cover the cost of charities delivering public services.

- Lending Club: As a leader in debt financing, Lending Club connects borrowers with investors, facilitating personal and small business loans in a transparent manner.

- Fundable: Offering both rewards and equity crowdfunding options, Fundable caters to businesses seeking diverse funding methods to fuel their growth.

- Patreon: This subscription-based service enables creators to obtain continuous financial backing, nurturing long-term interaction with their audience and offering a sustainable income model.

- WeFunder: By enabling everyday backers to fund startups in exchange for equity, WeFunder democratizes investment opportunities, making it accessible to a broader audience.

- StartEngine: Concentrated on equity fundraising, StartEngine enables investors to purchase shares in promising startups, demonstrating a strong dedication to supporting entrepreneurial endeavors.

These services not only excel in user engagement metrics but also display successful campaigns that highlight the effectiveness of the top 10 crowdfunding platforms. With the expected economic difficulties, including the cost-of-living crisis, these systems are well-prepared to adjust and succeed, making them crucial participants in the fundraising sector for 2025.

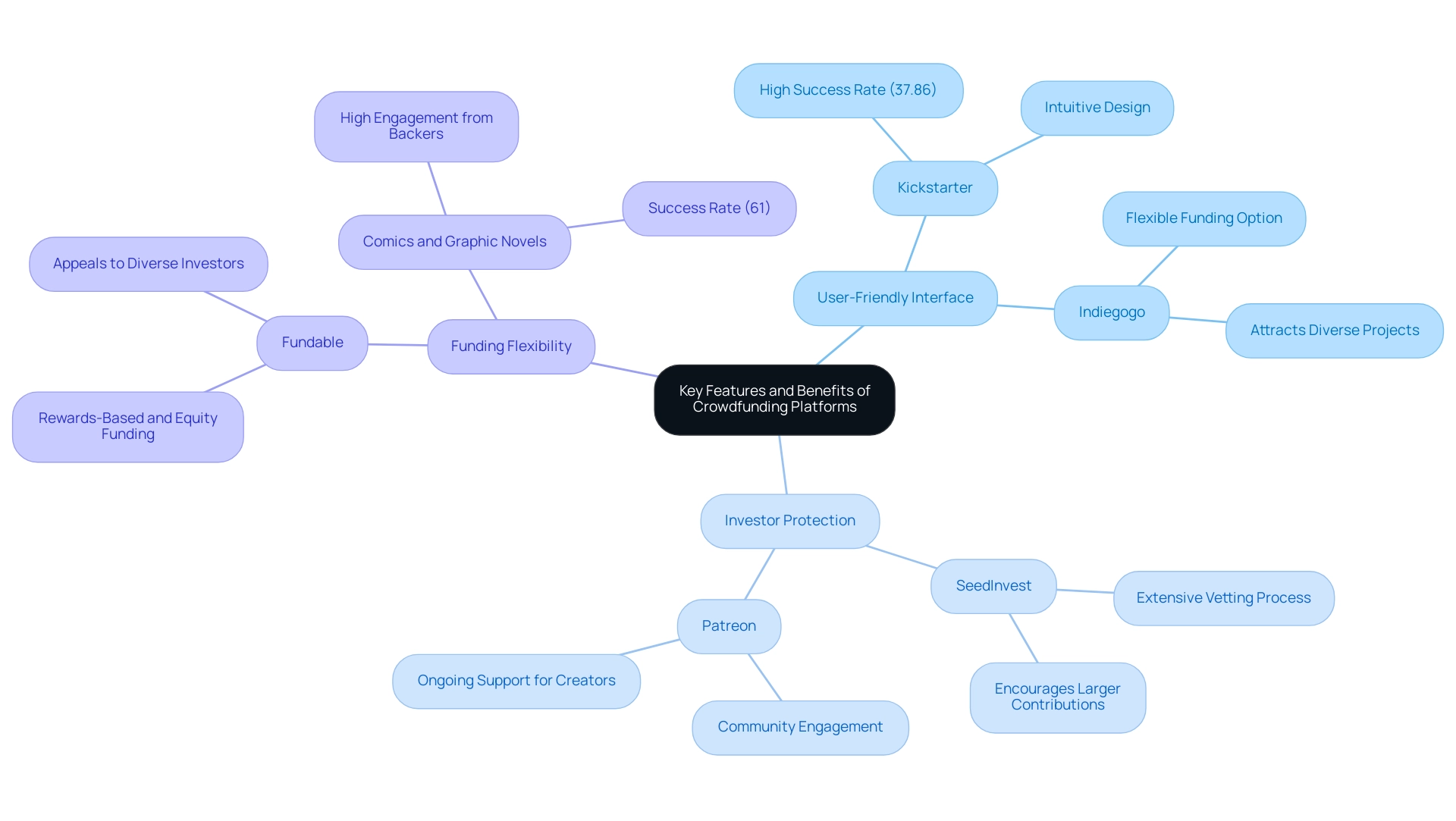

Key Features and Benefits of Leading Crowdfunding Platforms

When evaluating fundraising services, several key features and benefits stand out:

-

User-Friendly Interface: Services such as Kickstarter and Indiegogo are renowned for their intuitive designs, which streamline the campaign creation process. As Lauren McKinley notes, 'a user-friendly interface is essential for attracting backers who may be unfamiliar with the funding process,' highlighting its importance in engaging potential supporters.

Among the top 10 crowdfunding platforms, Indiegogo is a standout for its flexible funding option, allowing creators to retain funds even if their goals are not fully met. This feature significantly improves the feasibility of projects, making it a favorite among many creators.

-

Investor Protection: For those interested in equity funding, platforms like SeedInvest are noteworthy for their extensive vetting processes. This dedication to safeguarding stakeholders instills confidence and encourages larger contributions, essential for long-term success.

Patreon is recognized as one of the top 10 crowdfunding platforms that exemplifies the power of community by fostering ongoing relationships between creators and their supporters. This engagement not only enhances loyalty but also raises the chances of ongoing funding for future projects.

Fundable stands out as one of the top 10 crowdfunding platforms by offering both rewards-based and equity funding, which addresses a wider range of projects and investors, making it particularly appealing in today’s diverse investment environment.

Moreover, the success of the gaming category on Kickstarter, with over 47,068 funded projects and a success rate of 37.86%, demonstrates how these features can directly relate to campaign success. Furthermore, the comics and graphic novels category boasts a remarkable funding success rate of nearly 61%, illustrating the varying success rates across different categories and reinforcing the importance of funding flexibility and project viability. With these compelling features, Kickstarter remains among the top 10 crowdfunding platforms for those looking to enter the funding arena.

Navigating the Risks and Challenges of Crowdfunding

Crowdfunding presents a wealth of opportunities for investors, but it is essential to navigate its inherent risks carefully. Key considerations include:

- Project Viability: Success rates vary significantly among fundraising projects. Researching thoroughly before contributing is imperative, as many projects fail to meet their funding goals or deliver on promises. Significantly, collective funding and venture capital investments are heavily concentrated in London, where 51% of crowdfunded companies are based. This regional allocation can affect project feasibility, as local market dynamics play a crucial role in the success of funding initiatives.

- Lack of Regulation: The regulatory environment surrounding equity crowdfunding can be convoluted and differs from one region to another. This complexity necessitates a deep understanding of local laws to safeguard assets.

- Potential for Fraud: As with any investment avenue, the risk of scams exists. Conducting due diligence is crucial to avoid falling victim to fraudulent schemes, especially given the increased activity in the market.

- Market Saturation: The influx of projects can make it challenging for new ventures to attract attention. With numerous creators vying for investor interest, distinguishing oneself becomes increasingly difficult. The global collective funding market is projected to grow at a CAGR of 13.8% from 2024 to 2032, indicating an increasingly competitive landscape. In light of the projected growth of the global fundraising market, valued at USD 1.41 billion in 2023 and anticipated to reach USD 4.50 billion by 2032, understanding these risks is paramount for making informed investment decisions. Furthermore, it is important to note that all figures presented are estimates for the year 2024. As noted by Wifi Talent,

Crowdfunding campaigns that include a video pitch tend to raise 105% more money than those without, showcasing the importance of strategic presentation in overcoming these challenges.

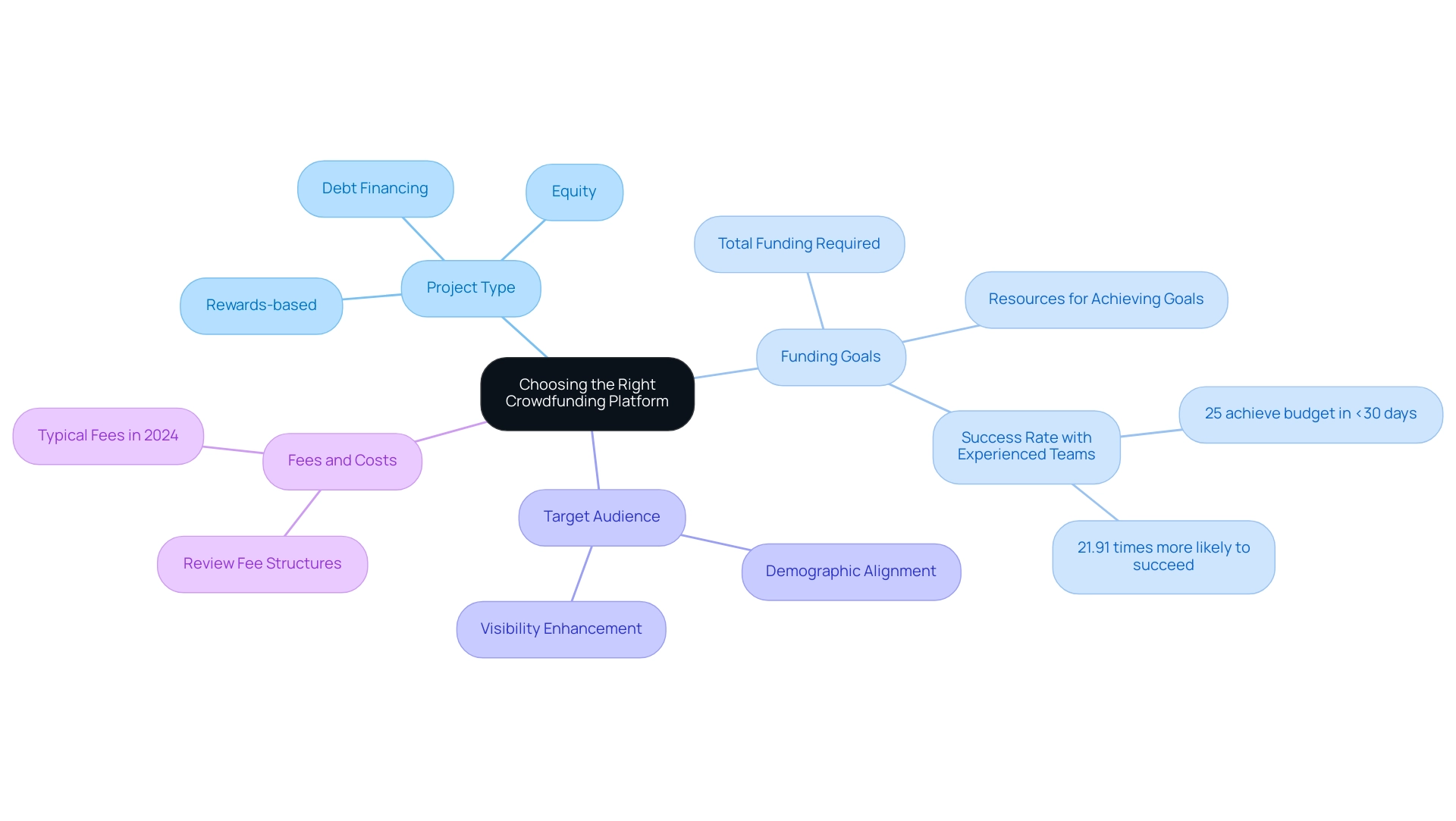

Choosing the Right Crowdfunding Platform for Your Needs

When choosing the appropriate funding site, it's essential to assess several key factors to maximize your chances of success:

- Project Type: First and foremost, identify whether your project aligns best with rewards-based, equity, or debt financing. Each type caters to different audiences and funding mechanisms, and understanding these distinctions will provide clarity in your selection process. For instance, equity crowdfunding systems (ECFPs) democratize access to finance for entrepreneurs, allowing them to connect directly with investors while facing lower financial costs compared to traditional sources.

- Funding Goals: Clearly define your funding requirements. This includes evaluating the total sum you intend to gather and identifying which resources are best suited to assist you in achieving those financial goals. Research indicates that 25% of projects led by experienced team members achieve their essential budget in under 30 days, underscoring the importance of strategic planning. In fact, having experienced project members makes you 21.91 times more likely to achieve your funding goals, highlighting the critical role of team expertise in choosing a suitable environment.

- Target Audience: It's crucial to recognize where your potential backers are likely to congregate. Select a service that specifically caters to that demographic, as this alignment can significantly enhance your project's visibility and backing potential.

- Fees and Costs: Conduct a thorough review of the fee structures of various services, as these costs can impact your overall funding. Grasping typical fees across fundraising sites in 2024 will assist you in making a knowledgeable choice, guaranteeing that you select an option that aligns financially with your project's objectives.

As Cinta Borrero-Domínguez et al. emphasize, strategic planning and analysis are vital components of fundraising success. By thoughtfully assessing these factors, you set your project up for greater success and guarantee that you choose an option that aligns with your distinct project requirements and funding goals.

Future Trends in Crowdfunding: What to Expect in the Coming Years

Looking ahead, the fundraising landscape is poised for significant evolution, characterized by several key trends:

-

Increased Regulation: The future will likely see the establishment of more comprehensive regulatory frameworks aimed at safeguarding participants and promoting transparency within the industry. This is essential as crowdfunding continues to attract institutional backers, who accounted for nearly 49% of the funding secured in the UK as of 2017, ensuring a greater emphasis on due diligence and quality deals.

-

Integration of Technology: The infusion of advanced technologies such as artificial intelligence and blockchain will be pivotal in enhancing security and user experience on crowdfunding platforms. This technological shift is anticipated to foster growth and efficiency, facilitating navigation of the funding process for both backers and entrepreneurs. As Brian Belley from Kingscrowd asserts,

At Kingscrowd, we remain committed to building the tools and services that democratize access to capital and empower both backers and entrepreneurs to thrive in this dynamic ecosystem.

-

Focus on Sustainability: Campaigns that prioritize environmental and social responsibility are anticipated to gain momentum. With leaders like Triin Hertmann promoting impactful sustainable funds through Grünfin, which concentrates on financial opportunities that produce both returns and positive social impact, and Sten Tamkivi highlighting community and innovation through his work with Plural, crowdfunding initiatives that align with these values are more likely to appeal to backers, reflecting the growing demand for responsible funding options.

-

Community-Driven Models: There is a noticeable trend towards platforms that facilitate community engagement and support, marking a shift towards collaborative funding. The contributions of Baltic capital leaders like Hartmann and Tamkivi highlight the significance of community in early-stage funding, nurturing a sense of belonging that allows backers to feel more connected to the projects they support, enhancing the overall funding experience. For instance, initiatives led by these leaders frequently involve community-driven funding rounds that enable local participants to contribute to impactful startups.

-

Success Metrics: Interestingly, campaigns that reach at least 30% of their funding target within the first week are considerably more likely to thrive. This insight is crucial for both investors and entrepreneurs looking to assess the viability of funding initiatives. Hartmann and Tamkivi's focus on community engagement and sustainability further supports this metric, as projects that resonate with their values tend to attract more initial funding, particularly on the top 10 crowdfunding platforms. As we approach 2024, it is crucial to monitor these trends closely, particularly as public markets demonstrated over 20% annual returns while private markets exhibited a more complex performance. Among the top 10 crowdfunding platforms, the top three Reg CF platforms—Wefunder, StartEngine, and Dealmaker Securities—have collectively raised an impressive $233.9 million, accounting for nearly 67% of all Reg CF capital raised. Additionally, Dealmaker Securities topped the combined Reg CF and Reg A+ investment volumes, securing a total of $172.1 million, highlighting the growing potential and changing dynamics of collective financing.

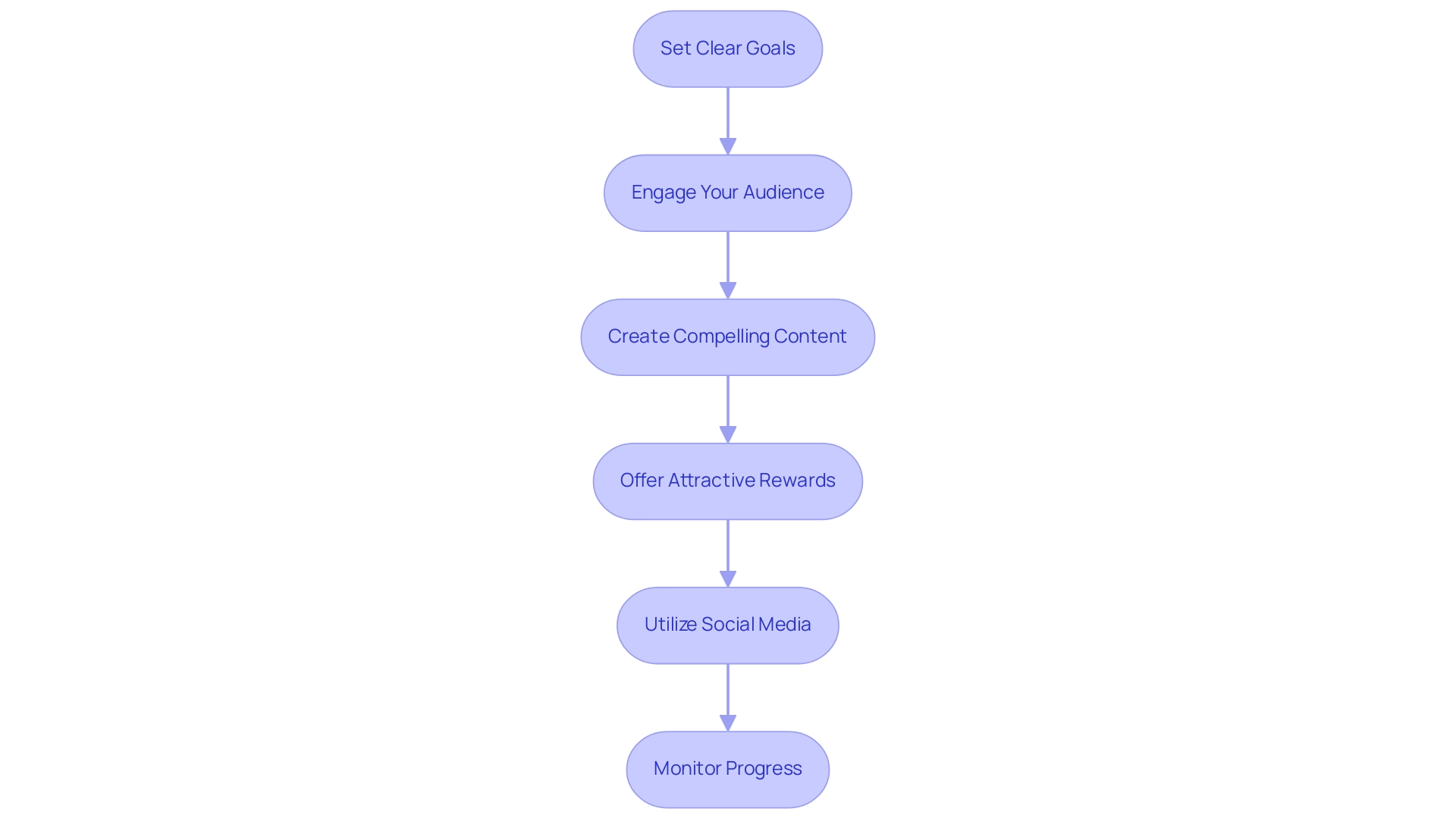

Tips for Running a Successful Crowdfunding Campaign

Launching a successful fundraising campaign requires strategic planning and execution. Here are key tips to enhance your chances of success:

- Set Clear Goals: Clearly define your funding target and outline how the funds will be utilized, providing transparency to potential backers.

- Engage Your Audience: Leverage social media channels and email marketing to cultivate a community around your project. As Grant Ejimone notes, those aged 24-35 are significantly more likely to participate in funding efforts, making this demographic crucial for outreach.

- Create Compelling Content: Invest in high-quality videos and images to elevate your campaign's visual appeal, as engaging content can capture attention and foster interest.

- Offer Attractive Rewards: In reward-based funding, ensure that your incentives are not only appealing but also relevant to your backers' interests, which can greatly enhance their willingness to support your project.

- Utilize Social Media: With social searches accounting for 9.77% of the traffic to funding platforms, maintaining an active social media presence is vital for reaching wider audiences and driving engagement.

- Monitor Progress: Keep track of your campaign's momentum; campaigns that achieve at least 30% of their funding goal within the first week tend to have higher overall success rates.

Additionally, the funding industry is experiencing significant growth and diversification, particularly with the rise of equity funding, which presents emerging opportunities for tech backers. By implementing these strategies, campaign creators can effectively engage their audience, build trust, and increase the likelihood of a successful funding outcome.

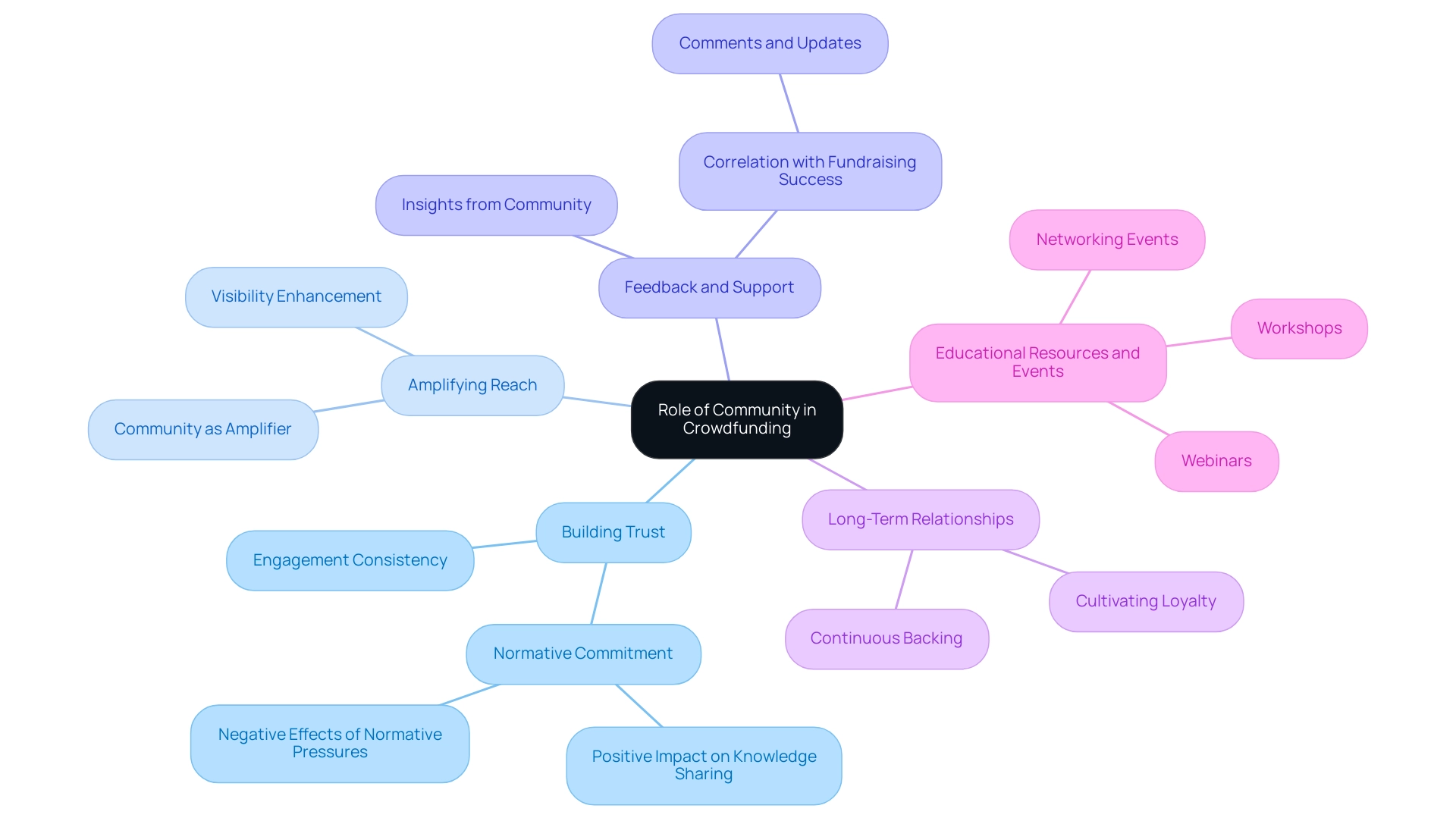

The Role of Community in Successful Crowdfunding

The role of community in crowdfunding cannot be overstated, as it significantly influences the success of campaigns. Here are several key aspects that illustrate this impact:

- Building Trust: Engaging consistently with your community fosters trust, a crucial element that encourages backers to support your project. Luo et al. have noted that normative commitment positively affects knowledge-sharing intentions in virtual communities, reinforcing how trust is foundational in these interactions. However, it's essential to recognize that group norms can also influence engagement levels, with normative pressures sometimes leading to negative effects on participation intentions.

- Amplifying Reach: A robust community, such as the one fostered at fff.club, can act as a powerful amplifier for your campaign, spreading the word and increasing visibility. Engaging over 400 tech backers for collaborative wealth management, members at fff.club indicate to funders the potential of projects, enhancing the likelihood of obtaining further funding through community endorsement.

- Feedback and Support: Community members are invaluable sources of feedback and support. They can provide insights that help refine your project and approach, as seen in the analysis of 116,956 Kickstarter projects, where community engagement features, such as comments and updates, were positively correlated with fundraising success. Insights from Baltic investment leaders like Sten Tamkivi and Kristjan Vilosius emphasize the significance of overcoming challenges and nurturing community in investment, providing valuable viewpoints for technology financiers. Tamkivi's experience in founding successful startups and Vilosius's structured approach to investing can guide new participants in crafting effective funding strategies.

- Long-Term Relationships: Successful campaigns frequently lead to enduring relationships with backers, cultivating a loyal supporter base for future initiatives. The trust and involvement developed during the campaign can lead to continuous backing, which is crucial for lasting achievement in the fundraising arena.

- Educational Resources and Events: fff.club provides a range of educational materials and events aimed at empowering technology stakeholders. These consist of workshops, webinars, and networking events that offer insights into market trends and investment strategies, further augmenting the community's worth.

Comprehending these dynamics, including the impact of group norms and the possible adverse effects of normative pressures, while actively promoting community involvement through sites like fff.club can greatly improve the chances for success in fundraising efforts.

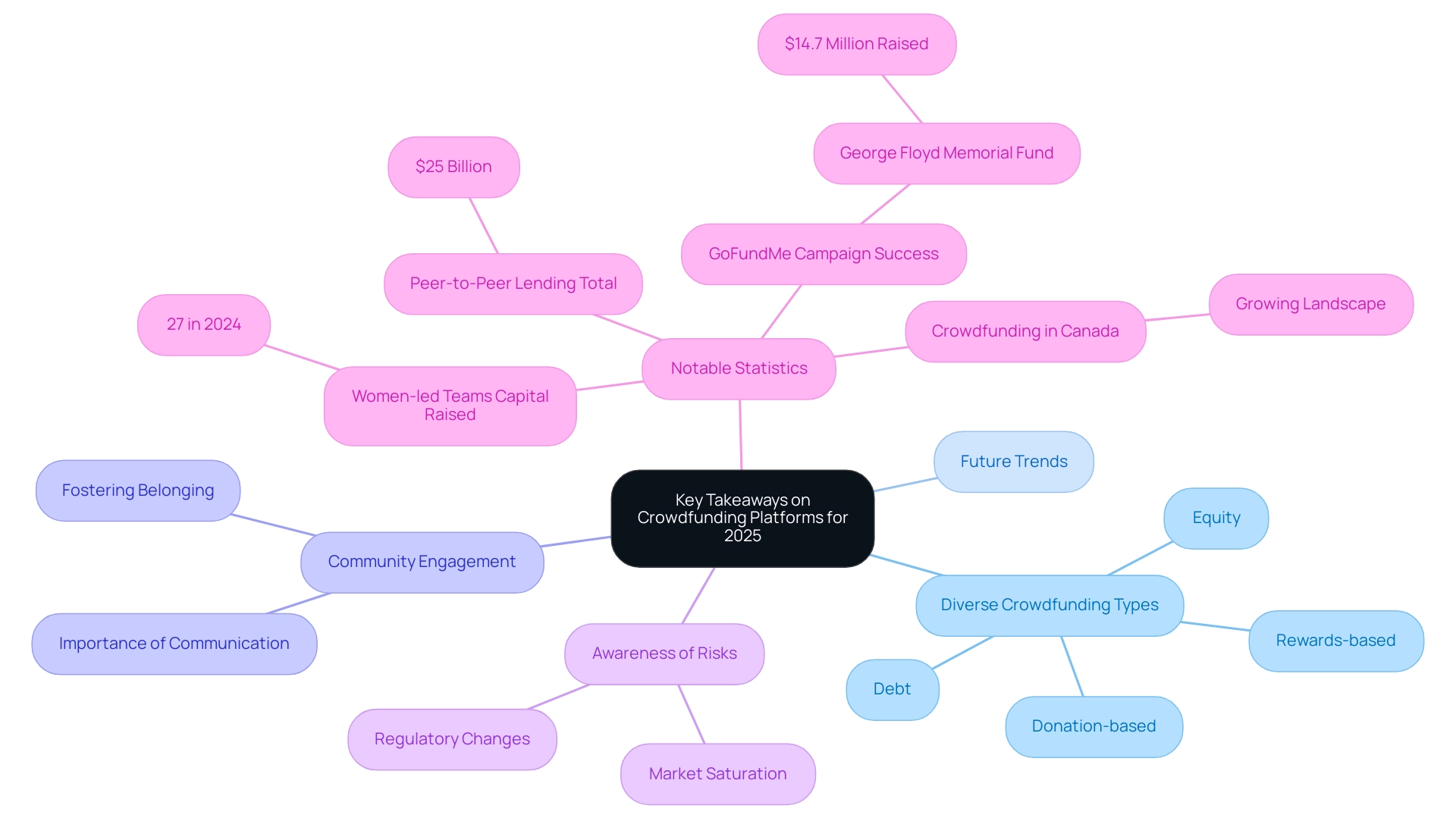

Key Takeaways on Crowdfunding Platforms for 2025

Understanding the complexities of crowdfunding systems is crucial for both backers and creators aiming to succeed in this dynamic environment. Here are key takeaways to consider about the top 10 crowdfunding platforms:

- Diverse Crowdfunding Types: Familiarize yourself with the various categories of crowdfunding—such as donation-based, rewards-based, equity, and debt crowdfunding—to select the platform that best aligns with your objectives.

- Future Trends: Keep an eye on the top 10 crowdfunding platforms for 2025, as understanding emerging trends can significantly enhance your strategic positioning.

- Community Engagement: Recognizing the critical role of community involvement is paramount. Successful campaigns often stem from effective communication and active engagement with supporters, fostering a sense of belonging and shared purpose.

At fff.club, over 400 tech financiers, including prominent figures like Martin Villig, Co-Founder of Bolt, and Mantas Mikučkas, Co-founder of Vinted, are participating in collaborative wealth management, emphasizing the transformative power of community-driven investment opportunities. Notably, women-led teams achieved a record 27% of total capital raised in 2024 fundraising, showcasing the importance of diverse perspectives and innovative ideas in community-driven campaigns. Additionally, fff.club provides educational resources aimed at empowering investors with the knowledge and tools necessary for successful fundraising endeavors.

- Awareness of Risks: It’s vital to be cognizant of the risks and challenges associated with such initiatives, including market saturation and regulatory changes. Being prepared will enable you to navigate these hurdles more effectively.

As Chris Treloar, CEO of a prominent investment platform, emphasizes, > Learn about their strategies, growth, and how they’re appealing to a broader audience. This insight highlights the necessity of adapting to the evolving funding ecosystem. Furthermore, the total sum gathered through peer-to-peer lending has reached $25 billion, highlighting the substantial effect of this model within the fundraising arena. Moreover, case studies, such as the documentation of crowdfunding service providers in Canadian provinces like Ontario and Quebec, reveal a growing landscape for the top 10 crowdfunding platforms, further enriching the discussion on the diversity of crowdfunding services.

Conclusion

Understanding the crowdfunding landscape is essential for both creators and investors aiming to harness its potential. The article highlights the diverse types of crowdfunding platforms, including:

- Reward-based

- Equity

- Debt

- Donation-based

Each catering to different project needs and investor preferences. Emphasizing the importance of community, it illustrates how successful campaigns often rely on a strong network of supporters who amplify reach, provide feedback, and foster trust.

As the crowdfunding industry continues to evolve, emerging trends such as:

- Increased regulation

- Technological integration

- A focus on sustainability

are set to shape its future. The anticipated growth in this sector presents new opportunities, particularly for underrepresented founders and community-driven initiatives. Investors and entrepreneurs alike are encouraged to stay informed and adapt to these changes to maximize their chances of success.

In conclusion, navigating the complexities of crowdfunding requires a strategic approach, including clear goal-setting, engaging content, and an understanding of the risks involved. By leveraging community support and staying attuned to industry trends, participants can effectively position themselves for success in the dynamic world of crowdfunding as it continues to develop into 2025 and beyond.