Overview

The article focuses on identifying the top 10 best crowdfunding platforms for startups in 2025, highlighting their unique features and benefits. It provides a detailed comparison of platforms like Kickstarter and Indiegogo, emphasizing their funding models, community engagement, and potential for market validation, which are crucial for startups seeking to finance their projects effectively.

Introduction

In 2023, the crowdfunding landscape presents a unique opportunity for startups to secure funding and validate their ideas in a competitive market. With a plethora of platforms available, entrepreneurs can choose from options like:

- Kickstarter

- Indiegogo

- GoFundMe

Each catering to specific project needs and funding models. However, navigating this space requires a keen understanding of the advantages and challenges associated with crowdfunding. From accessing diverse capital sources to engaging with a supportive community, the potential benefits are significant. Yet, startups must also be aware of the pitfalls, such as the time commitment and public scrutiny that come with launching a campaign.

This article delves into the following topics:

- The top crowdfunding platforms

- The pros and cons of using them

- Key features to consider

- Best practices for running a successful campaign

- Common mistakes to avoid

Providing a comprehensive guide for entrepreneurs looking to harness the power of crowdfunding.

Top Crowdfunding Platforms for Startups in 2025

- Kickstarter: Renowned for its focus on creative projects, Kickstarter is considered one of the best crowdfunding platforms for startups. By enabling entrepreneurs to present their ideas and secure resources through backer pledges, it fosters a community-driven approach to project financing. The platform's all-or-nothing financial model incentivizes project creators to establish realistic goals and engage meaningfully with their audience, ensuring that only fully-supported projects receive financial backing.

- Indiegogo, recognized as one of the best crowdfunding platforms, offers both fixed and flexible funding options, catering to a wide array of projects. Its unique marketplace allows new ventures to continue raising funds even after their initial campaigns conclude, providing them with ongoing financial support and visibility. This flexibility makes Indiegogo an appealing choice for diverse entrepreneurial ventures.

- GoFundMe is considered one of the best crowdfunding platforms, primarily recognized for personal causes, but it has increasingly attracted new businesses seeking to fund social initiatives. The platform's user-friendly interface empowers entrepreneurs to narrate their stories and connect with potential backers who resonate with their mission, thus expanding their financial opportunities.

- SeedInvest is considered one of the best crowdfunding platforms that focuses on equity-based fundraising, enabling new businesses to gather funds by providing equity shares to investors. Especially tailored for technology-focused ventures, SeedInvest draws accredited investors keen on obtaining ownership in innovative firms, thus improving potential funding results.

- Crowdcube is considered one of the best crowdfunding platforms in the UK, supporting equity financing by allowing new businesses to gather capital through share sales. Backed by major venture capital firms, it boasts a strong track record of successful campaigns, making it a trusted option for tech entrepreneurs seeking investment.

- Fundable, one of the best crowdfunding platforms, merges both rewards and equity financing, offering new ventures the flexibility to select the financial model that best aligns with their business goals. This flexibility is especially beneficial for technology ventures with diverse financial needs. Notably, Fundable imposes a success fee of 3.5% on all funds raised, ensuring that entrepreneurs are aware of the associated costs.

- StartEngine: As one of the best crowdfunding platforms in the U.S., StartEngine enables new businesses to raise capital from both accredited and non-accredited investors, significantly broadening their potential investor base. This inclusivity is crucial for tech companies aiming to attract diverse funding sources.

- Wefunder is considered one of the best crowdfunding platforms, focusing on community-driven investments to empower new ventures in raising funds from their supporters and advocates. This platform is particularly effective for businesses with a strong community presence, fostering a sense of ownership among investors.

- Focusing on equity-based funding, Republic is recognized as one of the best crowdfunding platforms, democratizing investment opportunities by enabling ordinary investors to contribute as little as $10 to support new ventures. This accessible model encourages widespread support for emerging ventures, promoting a culture of investment among a broader audience.

- Patreon: Although it does not conform to the conventional funding model, Patreon allows new businesses to create ongoing income through membership subscriptions. This model is especially beneficial for content creators and tech startups that provide ongoing services or products, allowing them to build a loyal customer base while ensuring steady income.

In the words of Rosanna Yau, "We’re still on the path to achieving these ambitious goals, but these milestones serve as strong signals that we’re headed in the right direction." This sentiment reflects the potential successes that can be attained through effective use of funding platforms.

A remarkable instance of collective funding success is Mercado Bitcoin, which raised USD 200 million from the SoftBank Latin America Fund in July 2021. This fundraising initiative not only took advantage of the rising interest in cryptocurrencies in Brazil and Latin America but also greatly boosted Mercado Bitcoin's market share, demonstrating the potential of collective funding in the cryptocurrency sector.

Understanding the Pros and Cons of Crowdfunding for Startups

Pros:

- Access to Capital: Crowdfunding opens the door for new ventures to tap into a wide array of potential investors, enabling them to raise funds without relying solely on traditional financing avenues. This democratization of capital access is especially beneficial in today's competitive landscape. Significantly, the top Launch Party on BackerKit attracted over 12,000 participants, showcasing the vast interest and potential capital available through funding.

- Market Validation: A successful crowdfunding campaign can serve as a powerful proof of concept, validating the company's idea and making it more appealing to additional investments. This aspect of market validation is crucial in a landscape where investor confidence can make or break a venture. As Olga Okhrimenko, Marketing and Communications at CrowdSpace, notes, "Crowdfunding not only provides funding but also validates the market demand for innovative ideas."

- Community Engagement: By actively involving backers, businesses can cultivate a dedicated community of supporters who are personally invested in their success. This not only fosters loyalty but can also lead to constructive feedback and enthusiastic advocacy for the brand.

- Marketing Exposure: Marketing exposure through the best crowdfunding platforms acts as a launchpad for startups, granting them substantial visibility. This enhanced exposure can help them reach a broader audience, ultimately contributing to brand recognition and growth.

Cons:

- Time-Consuming: Initiating a fundraising campaign demands considerable time and effort. Entrepreneurs must develop a compelling pitch, maintain backer communications, and manage the fulfillment of rewards—all of which can detract from other critical business activities.

- All-or-Nothing Funding: Many fundraising platforms function on an all-or-nothing model. If the funding goal is not achieved, the company walks away with no funds, which poses a significant risk and can lead to financial strain if not carefully planned.

- Equity Dilution: In the scenario of equity raising through the crowd, new ventures may be obligated to relinquish a share of their ownership. This dilution can complicate future fundraising efforts and affect control over the company.

- Public Examination: Initiating a funding drive exposes startups to public scrutiny. The potential for negative feedback can be daunting for entrepreneurs and may impact their brand image, particularly if the initiative fails to meet its goals.

Additionally, the regulatory landscape is critical to consider. A case study titled "Codes of Conduct in Europe" analyzes the rationale for using Codes of Conduct (Coc) in European funding initiatives, highlighting the importance of institutional design and monitoring. Grasping these frameworks can offer insights into best practices and assist in reducing risks related to fundraising efforts.

Key Features to Look for in a Crowdfunding Platform

-

When assessing the best crowdfunding platforms, it is crucial to evaluate the funding model they offer—whether it is all-or-nothing or flexible funding. This choice can significantly influence your strategy, as an all-or-nothing model requires meeting fundraising goals to receive any funds, whereas a flexible model allows you to keep whatever amount is raised. This distinction can influence investor confidence and overall project success.

- Fees and Costs: Understanding the fee structure is essential in maximizing your net funding. Key costs include platform fees, which typically range from 5% to 10%, payment processing fees, and any additional expenses that might arise. An awareness of these fees can help you make an informed decision about which of the best crowdfunding platforms aligns best with your financial goals.

- Audience Reach: The platform's audience demographic plays a vital role in your initiative's potential success. Utilizing one of the best crowdfunding platforms with a robust user base in your industry can significantly enhance your visibility and attract the right investors. For instance, platforms that specialize in technology startups may provide better engagement for tech-focused projects. Considering that private investors made up 72.4% of equity and 78.5% of lending investors in 2022, comprehending these demographics is essential for effectively targeting your efforts.

- Support and Resources: Look for platforms that offer a wealth of educational resources, marketing support, and community access. Interacting with a network of more than 400 tech investors at fff. Club can significantly assist you in maneuvering through the funding process efficiently, enhancing your likelihood of campaign success. This community provides valuable networking opportunities, mentorship, and access to exclusive investment insights that can further enhance your project’s appeal on the best crowdfunding platforms. This support is especially important given the increasing interest in collective funding as an investment option, as indicated by the significant presence of private investors in this space.

- Regulatory Compliance: Ensure that the funding platform adheres to relevant regulations, particularly for equity funding. Adherence to guidelines, such as those outlined by the European Crowdfunding Service Providers (ECSP), is vital for safeguarding both your startup and its investors. As industry players generally favor regulation, selecting one of the best crowdfunding platforms will enhance your credibility and protect your interests. Grasping the implications of these regulations can offer investors with greater assurance in their financial decisions.

In 2023, the collective financing landscape has changed considerably, with donations of $106 million gathered for natural disaster relief, as pointed out by Grant Ejimone. This emphasizes the potential of collective financing as a model that encourages community involvement and develops a dedicated customer base prior to product launch. The community-driven aspect of platforms like fff. Club highlights the effectiveness of collective funding in generating support and validating market interest. Furthermore, case studies indicate that crowdfunding serves as an alternative financial resource for startups, enabling them to bypass traditional financial institutions while enhancing market validation and customer loyalty. By leveraging the collective knowledge and resources of the fff. Club community, tech investors can significantly increase their chances of successful fundraising.

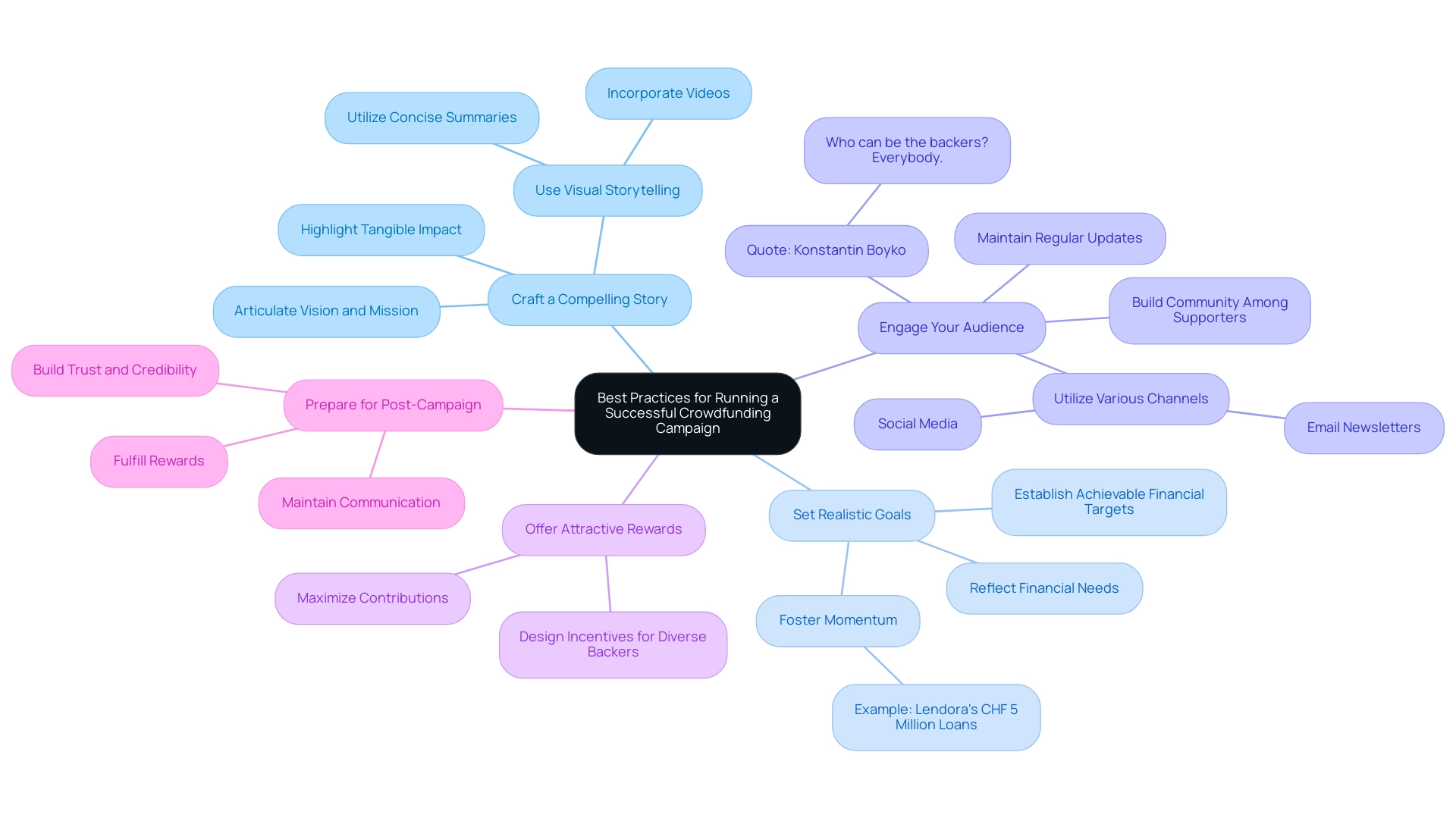

Best Practices for Running a Successful Crowdfunding Campaign

- Craft a Compelling Story: To attract potential backers, your initiative must convey a compelling narrative. This narrative should articulate your vision and mission while highlighting the tangible impact their support will have. Research indicates that campaigns that effectively communicate their financial goals, particularly through visual storytelling, can raise significantly more funds—up to 35% more when utilizing videos and concise summaries. In fact, a case study titled 'Impact of Communication on Fundraising Success' demonstrates that effective communication strategies can significantly boost fundraising outcomes.

- Set Realistic Goals: Establishing an achievable financial target is crucial. This goal should accurately reflect your financial needs while remaining attainable. Realistic goals foster momentum and encourage backers to contribute, as they feel more confident in supporting a project that demonstrates clear planning. For instance, Lendora has successfully financed CHF 5 million in loans, showcasing the effectiveness of well-defined funding objectives.

- Engage Your Audience: Proactively engage with your audience across various channels such as social media and email newsletters. This engagement should take place before, during, and after the initiative to keep backers informed and involved. Regular updates not only maintain interest but also strengthen the sense of community among supporters. As Konstantin Boyko, co-founder of CrowdSpace, states, 'Who can be the backers? Everybody.' This highlights the importance of reaching out to a diverse audience.

- Offer Attractive Rewards: In a rewards-based funding model, it is essential to design incentives that appeal to a diverse range of backers. Offering attractive rewards at different contribution levels can increase overall engagement and financial support. Ensuring that these rewards resonate with your target audience is key to maximizing contributions.

- Prepare for Post-Campaign: A well-structured plan for fulfilling rewards and maintaining communication with backers post-campaign is vital for building trust and credibility. This ongoing relationship can lead to future support for subsequent projects, reinforcing the importance of transparency and continued engagement with your backers.

Common Mistakes to Avoid in Crowdfunding

-

Neglecting Market Research: A fundamental mistake in crowdfunding efforts is the failure to conduct thorough market research. Comprehending the target audience is essential; without it, marketing strategies may become ineffective, resulting in poor performance. For instance, recent data highlights that initiatives lacking robust market research often struggle to resonate with potential backers, ultimately diminishing their fundraising potential. A notable success story is Beta Bionics, which went public at a $1 billion valuation after raising $234 million for its IPO, demonstrating the impact of effective market research and engagement.

-

Inadequate Preparation: Entering a crowdfunding effort without comprehensive planning can lead to significant setbacks. Rushing the process often results in missed opportunities and inadequate engagement with backers. Sean Angus, President and Co-Founder of The LaunchPad Agency, emphasizes the importance of preparation, stating,

You should also know what your budget is for advertising, along with a little leeway in case you have to make a last-minute adjustment.

This insight emphasizes that a well-organized strategy is crucial for maximizing success.

-

Overpromising: Setting unrealistic expectations can severely damage a startup's credibility. When campaigns overpromise and underdeliver, backers may feel disappointed and lose trust in the project. This discontent can lead to a tarnished reputation, making future fundraising efforts even more challenging. Therefore, establishing achievable goals is crucial for maintaining backer satisfaction and trust.

-

Ignoring Feedback: The failure to consider feedback from backers or potential investors can stifle growth and improvement opportunities. Effective communication fosters a sense of community and belonging among supporters. Case studies indicate that organizations often falter when they neglect to maintain consistent communication with donors after securing funding, leading to disenchantment and disengagement. For instance, many NGOs fail to communicate effectively with their backers, resulting in feelings of disconnection. By actively seeking and implementing feedback, new ventures can enhance their offerings and strengthen relationships with their backers.

-

Underestimating Fulfillment: Many new businesses underestimate the logistics involved in fulfilling rewards promised to backers. This oversight can result in delays and negative experiences for supporters, ultimately harming the campaign's reputation. As crowdfunding continues to evolve, startups must prioritize fulfillment strategies to ensure timely delivery and satisfaction, which are key to fostering long-term loyalty and support. Engaging potential backers with hope and excitement for the New Year could help gather support and enhance marketing strategies.

Conclusion

The crowdfunding landscape in 2023 offers startups a powerful avenue for securing funding and validating their ideas. By exploring various platforms such as Kickstarter, Indiegogo, and GoFundMe, entrepreneurs can tailor their campaigns to fit specific project needs, whether they seek donations, equity, or community support. Each platform presents unique advantages, from Kickstarter's all-or-nothing model to Indiegogo's flexible funding options, highlighting the importance of selecting the right fit for a startup's goals.

While the benefits of crowdfunding are compelling—access to a broad investor base, market validation, and enhanced community engagement—startups must navigate inherent challenges. Time commitment, public scrutiny, and the potential for equity dilution are critical factors that can impact a campaign's success. Understanding these pros and cons enables entrepreneurs to develop informed strategies that maximize their chances of reaching funding goals.

To run a successful crowdfunding campaign, best practices such as:

- Crafting a compelling narrative

- Setting realistic funding goals

- Engaging with backers consistently

are essential. Additionally, avoiding common pitfalls like neglecting market research and overpromising can safeguard a startup's reputation and foster lasting relationships with supporters.

In conclusion, embracing crowdfunding as a strategic funding model can significantly enhance a startup's trajectory. By leveraging the power of community and adhering to best practices, entrepreneurs can not only secure financial backing but also cultivate a loyal customer base that believes in their vision. As the crowdfunding landscape continues to evolve, those who approach it with careful planning and a clear understanding of their audience will be well-positioned for success.