Overview

The article compares various online crowdfunding platforms to help potential users identify which one best suits their needs. It highlights distinct crowdfunding models—reward-based, equity, debt, and donation-based—while analyzing the features, benefits, and risks of platforms like Kickstarter, Indiegogo, SeedInvest, GoFundMe, and LendingClub, emphasizing the importance of understanding each platform's unique offerings to make informed investment decisions.

Introduction

The rise of crowdfunding has transformed the way individuals and businesses access capital, creating a vibrant ecosystem driven by collective financial contributions. This innovative approach encompasses various models, each tailored to meet distinct investor needs—from reward-based systems that offer early product access to equity crowdfunding that allows investors to own a stake in emerging companies.

As the popularity of these platforms grows, understanding the nuances of each type, the risks involved, and the regulatory landscape becomes essential for anyone looking to navigate this dynamic investment space.

With insights into popular platforms and emerging trends, this article provides a comprehensive overview of crowdfunding, equipping potential investors with the knowledge needed to make informed decisions in an ever-evolving market.

Understanding Crowdfunding: Types and Mechanisms

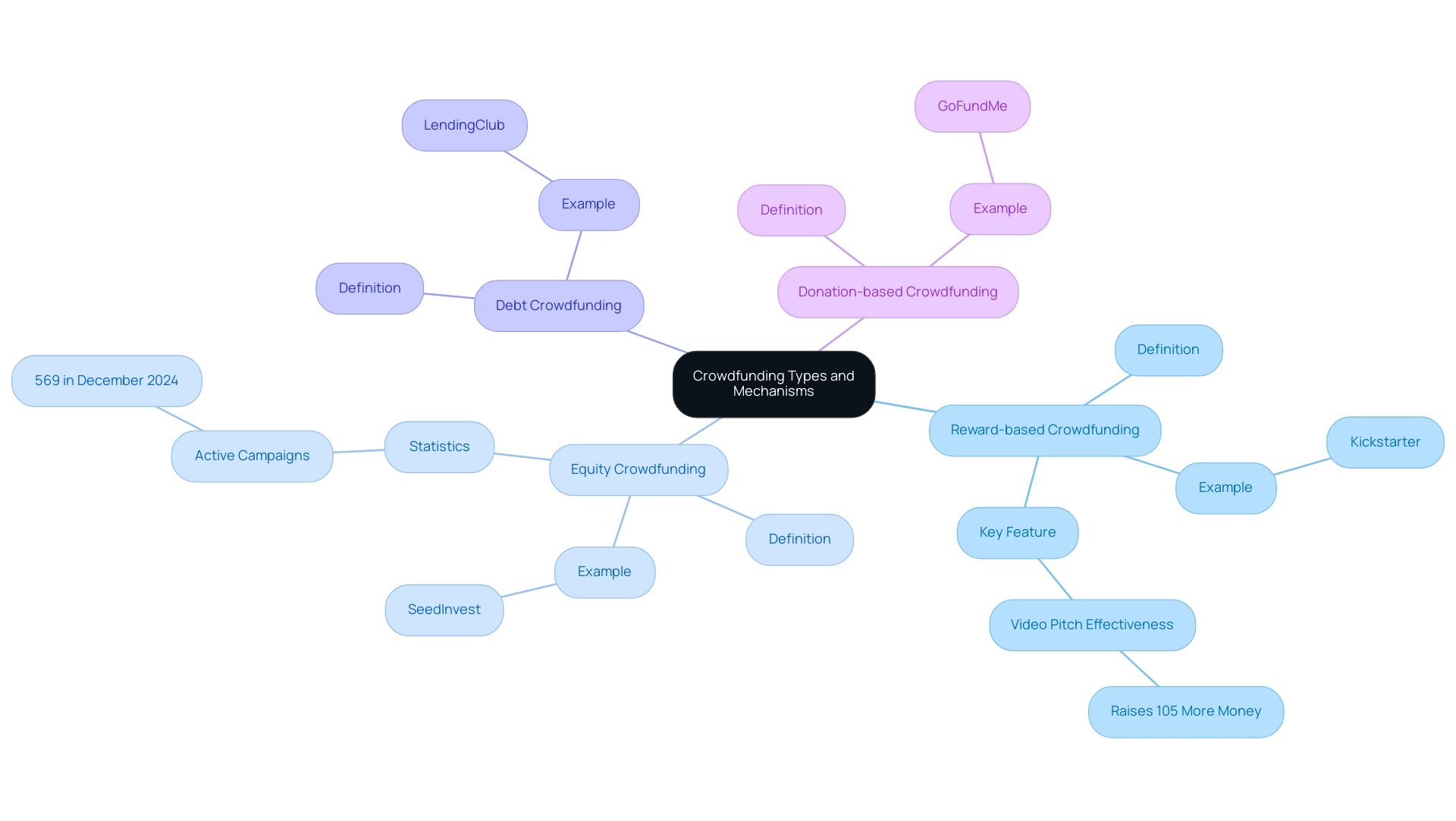

Crowdfunding represents a dynamic approach to capital raising, harnessing the collective contributions of individuals primarily through online platforms. It encompasses various models, each designed to meet different investor needs:

- Reward-based Crowdfunding: This model invites contributors to provide funds in exchange for non-financial incentives, such as early access to products. A leading example is Kickstarter, which has successfully facilitated numerous innovative projects. Significantly, fundraising campaigns that include a video pitch tend to raise 105% more money than those without, highlighting the effectiveness of this strategy.

- Equity Crowdfunding: In this scenario, individuals obtain equity stakes in companies, enabling them to participate in the potential growth of the business. With the number of active equity fundraising campaigns hitting a record of 569 in December 2024, services like SeedInvest illustrate this model, allowing investors to become part-owners of emerging enterprises. This growth highlights the rising significance of equity funding in the investment landscape.

- Debt Crowdfunding: Often referred to as peer-to-peer lending, this approach allows individuals to lend money to businesses or individuals, with the expectation of repayment plus interest. LendingClub is a prominent service in this domain, connecting borrowers and lenders effectively.

- Donation-based Crowdfunding: This model allows individuals to contribute funds to causes or projects without expecting any financial return. GoFundMe has become well-known as a venue for this type of fundraising, facilitating charitable projects and personal financial campaigns.

Grasping these unique forms of collective financing is crucial for assessing the variety of online services accessible today. Each model serves different investor preferences and objectives, making informed choices crucial in the evolving environment of collective financing. As emphasized in the '2024 Regulated Investment Summary,' investment raising is becoming a vital element of private capital markets, showcasing resilience and innovation despite obstacles such as consolidation and varying investment volumes.

Comparing Popular Crowdfunding Platforms: Features and Benefits

When assessing well-known funding sources, several key features and advantages are prominent:

- Kickstarter: recognized as one of the leading online crowdfunding platforms, is renowned for its focus on creative projects and operates on a reward-based crowdfunding model. This system utilizes an all-or-nothing funding approach, which not only motivates creators to meet their funding goals but also instills confidence in backers. However, it is important to note that Kickstarter is less suitable for equity investments. Significantly, the average success rate for fundraising campaigns on this site is roughly 22.4% to 23.7%, highlighting the competitive aspect of reaching funding objectives.

- Indiegogo: one of the prominent online crowdfunding platforms, offers both reward-based and equity funding opportunities similar to Kickstarter. It distinguishes itself with flexible funding options, enabling project creators to retain funds even if they do not reach their set goals. This capacity makes Indiegogo an ideal choice for entrepreneurs aiming to engage a wider audience. The system has experienced substantial growth in equity fundraising, which is presently advancing at a pace more than three times quicker than the lending segment.

- SeedInvest: is one of the online crowdfunding platforms that specialize in equity crowdfunding, allowing individuals to purchase shares in promising startups. The platform is acknowledged for its rigorous vetting process, which guarantees that only high-quality startups are showcased to prospective funders. Nevertheless, it typically requires a minimum investment, which might not align with every investor's financial capacity.

- GoFundMe: primarily a donation-based service, is widely utilized for personal causes and charitable projects. Its user-friendly interface and absence of service fees enhance accessibility for individuals seeking to raise funds for various purposes. However, users should be aware that financial returns to donors are not part of this model.

- LendingClub: as a leader in debt financing, links borrowers with private backers, providing the possibility for interest earnings. Investors must remain aware of the risks linked to lending, including the chance of borrower defaults.

In summary, each online crowdfunding platform serves unique needs, and understanding their distinct features is essential for investors aiming to choose the most appropriate funding solution for their objectives. As mentioned by Grant Ejimone, > Donations of $106 million were raised for natural disaster relief in 2023, < emphasizing the significant potential of fundraising initiatives.

Evaluating the Risks of Crowdfunding Investments

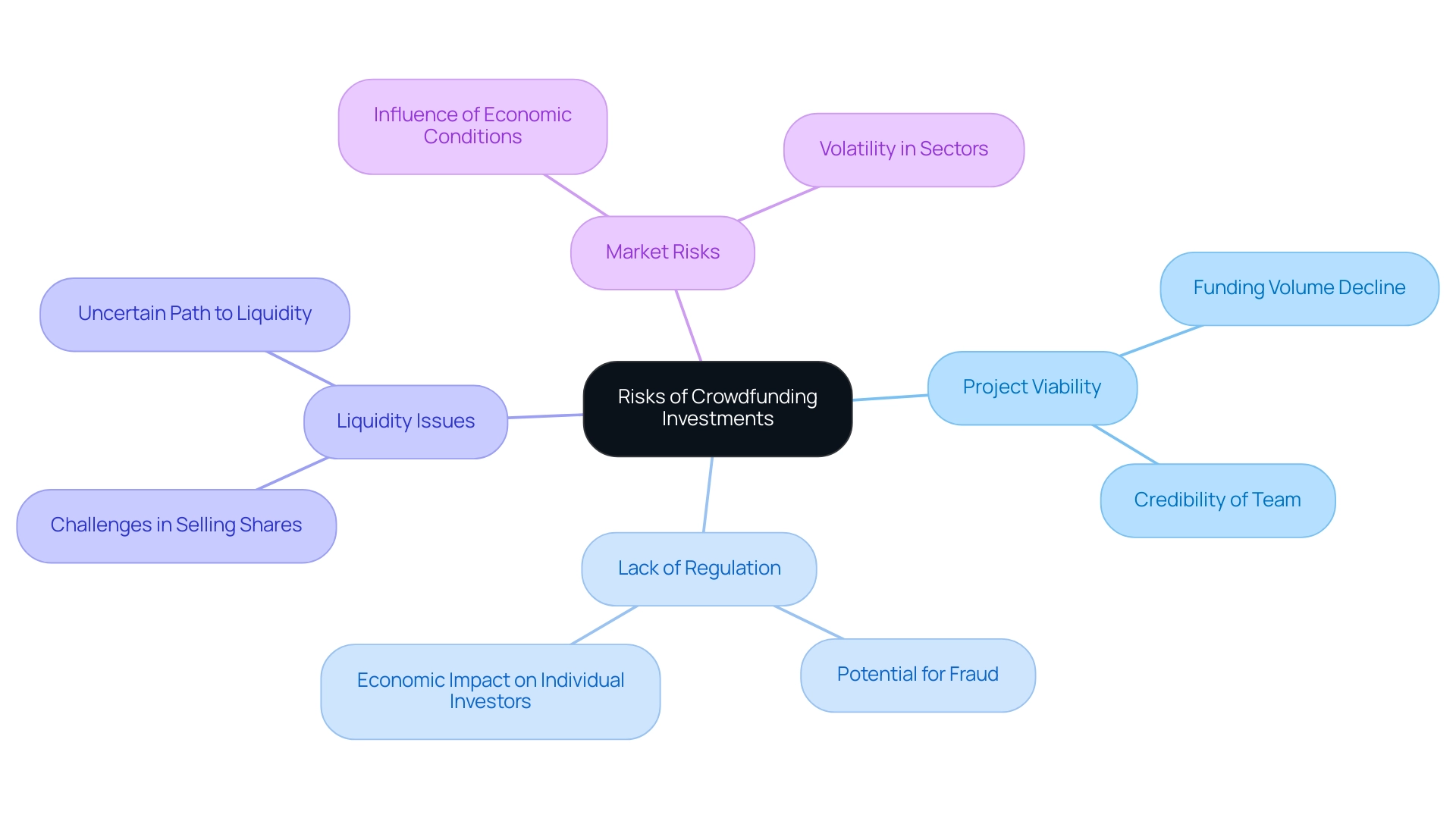

Investing in projects on online crowdfunding platforms presents numerous opportunities, but it is crucial to recognize the inherent risks involved. Some of the primary risks include:

-

Project Viability: A significant number of funding initiatives are in their nascent stages, leading to uncertainty in their success.

Investors must rigorously assess the feasibility of each project and the credibility of the team behind it. The overall funding volume in 2024 was noted to be 18% lower than in 2023, which may indicate heightened caution among financiers regarding project viability. However, it's notable that the number of active equity fundraising initiatives reached an all-time high of 569 in December 2024, indicating a contrasting trend that suggests some confidence in specific projects.

-

Lack of Regulation: Unlike conventional investments, collective funding operates within a less regulated framework, potentially exposing participants to fraudulent schemes or poorly managed projects.

Experts warn that, with the expense of living rising in the UK, online crowdfunding platforms that depend on private backers could be more negatively impacted than those reliant on institutional support.

This economic factor could result in decreased disposable income for prospective financiers, further affecting the feasibility of many funding initiatives. Therefore, comprehensive research is essential before committing any funds.

-

Liquidity Issues: Crowdfunding investments are often illiquid, which means that participants may face challenges in selling their shares or recovering funds in a timely manner.

This concern is particularly pronounced for equity investors, where the path to liquidity can be uncertain.

-

Market Risks: Economic conditions can significantly influence the success of funding projects, particularly in volatile sectors such as technology or consumer goods.

Investors should remain vigilant about market trends when assessing potential opportunities. Comprehending these risks enables investors to approach collective funding with caution and to diversify their portfolios accordingly, as the landscape continues to evolve.

For instance, after substantial declines in venture capital valuations from 2021 to 2023, a recent report indicated stabilization in 2024, with Seed deal valuations reaching a median of $13 million. This stabilization suggests a potential recovery in the venture capital market, which could positively influence investment initiatives, but caution is still warranted given the historical failure rates of various funding projects.

Regulatory Considerations in Crowdfunding

The regulatory landscape governing online crowdfunding platforms is notably diverse across different regions. In the United States, the Jumpstart Our Business Startups (JOBS) Act has cleared the path for equity funding, allowing companies to gather capital from a wider range of backers. However, online crowdfunding platforms impose specific restrictions to protect participants, including:

- Limitations on individual investments based on income and net worth

- Mandatory compliance with registration and reporting requirements

This framework aims to improve investor protection while promoting growth in online crowdfunding platforms. Conversely, many international jurisdictions offer a more permissive regulatory environment, which can either facilitate or restrict crowdfunding activities. For example, some nations have adopted less stringent regulations, thereby creating a wider array of funding opportunities for potential backers through online crowdfunding platforms.

Notably, online crowdfunding platforms such as Kickstarter have gained significance in markets like Germany, where they intersect with the banking industry by providing alternative funding routes for startups. Understanding these regulatory frameworks is crucial for investors aiming to engage in compliant offerings through online crowdfunding platforms and safeguard their investments. Recent data indicates that by December 2024, the number of active equity fundraising efforts reached an unprecedented high of 569, surpassing the previous record of 561 in March 2022.

Additionally, successful funding campaigns typically have an average of around 300 backers, further illustrating what constitutes a successful venture in this space. As such, it is prudent for individuals to seek advice from legal or financial experts to navigate these complexities effectively. Moreover, as mentioned by Fit Small Business, campaigns on online crowdfunding platforms that reach at least 30% of their funding target within the first week are statistically more likely to succeed, emphasizing the importance of early participant engagement.

The case study titled 'Impact on Businesses' further emphasizes that collective funding provides alternative financing sources for startups and small enterprises, bypassing traditional financial institutions and serving as a tool for market validation and community engagement, which enhances credibility and customer loyalty.

Future Trends in Crowdfunding

The financing landscape is set for significant change in the upcoming years, propelled by various key trends that appeal to technology backers looking to establish valuable connections and acquire insights.

-

Increased Regulation: As collective funding gains popularity, regulatory bodies are expected to enforce stricter guidelines aimed at enhancing investor protection.

These measures will promote greater transparency and accountability across online crowdfunding platforms, ultimately fostering trust within the investment community.

-

Technological Advancements: The integration of innovative technologies, particularly blockchain, is set to revolutionize crowdfunding transactions.

These advancements promise to enhance security and efficiency, creating new opportunities for both stakeholders and project creators. Brian Belley aptly states,

At Kingscrowd, we remain committed to building the tools and services that democratize access to capital and empower both supporters and entrepreneurs to thrive in this dynamic ecosystem,

underscoring the pivotal role of technology in this evolution.

-

Diverse Funding Models: The emergence of varied crowdfunding models, including real estate crowdfunding and community-based funding through online crowdfunding platforms, is expanding investment options for individuals.

These new models not only improve portfolio diversification but also address a wider range of interests.

-

Global Expansion: Crowdfunding is witnessing a surge in global popularity, with platforms venturing into new markets.

This expansion opens up a wider array of opportunities for stakeholders, enabling them to tap into different regional markets and innovative projects.

Significantly, online crowdfunding platforms provide businesses with alternative funding sources and market validation, assisting startups and small enterprises in avoiding conventional financial institutions while connecting with a community of supporters.

-

Current Market Context: The recent stabilization of VC valuations, as highlighted in the case study, indicates a recovery in the private market after previous declines, with Seed deal valuations at $13.0 million.

This trend is pertinent for financial backers as it indicates a changing environment that may affect funding dynamics.

By staying informed about these trends, especially with over 16,000 investors, founders, and industry leaders engaged in this space, tech investors can effectively modify their strategies.

This positioning allows them to capitalize on the evolving crowdfunding ecosystem, fostering collaborative wealth management and enhancing their investment insights.

Furthermore, at fff.club, fellows can actively participate in deal flow, conduct due diligence, and explore co-investing opportunities, while also benefiting from weekly tech and economic updates and engaging in community events.

Conclusion

The exploration of crowdfunding has revealed a multifaceted investment landscape characterized by diverse models tailored to meet various investor needs. From reward-based crowdfunding platforms like Kickstarter that foster creativity to equity crowdfunding options such as SeedInvest, which offer ownership stakes in startups, investors have a range of avenues to consider. Each model presents unique features, benefits, and challenges, making it crucial for potential backers to understand their options thoroughly.

While the opportunities in crowdfunding are significant, so too are the risks. Issues related to project viability, regulatory uncertainty, and liquidity must be carefully evaluated. Investors should approach this dynamic environment with caution, conducting comprehensive research to mitigate potential pitfalls. The regulatory framework surrounding crowdfunding is continually evolving, with emerging trends hinting at increased oversight and technological advancements that could reshape the landscape.

Looking ahead, the future of crowdfunding appears promising, driven by innovations and global expansion that will likely open new investment avenues. As this ecosystem becomes more sophisticated, informed investors can leverage these trends to optimize their strategies and enhance their portfolios. By remaining vigilant and adaptable, individuals can navigate the complexities of crowdfunding effectively, positioning themselves to benefit from this transformative approach to capital raising.