Overview

The article compares SAFE (Simple Agreement for Future Equity) and convertible notes, highlighting their distinct characteristics and implications for tech investors. It emphasizes that while SAFEs offer simplicity and speed for early-stage funding without accruing interest, convertible notes provide more security through interest accumulation and maturity dates, thus influencing investor choices based on risk tolerance and investment goals.

Introduction

In the dynamic landscape of startup financing, the choice between Simple Agreements for Future Equity (SAFEs) and convertible notes has become increasingly pivotal for investors and entrepreneurs alike. As startups seek swift capital infusion to fuel their growth, these two instruments offer contrasting advantages and challenges that can significantly influence investment outcomes.

- SAFEs, with their streamlined structure and absence of interest, appeal to those looking for quick and uncomplicated funding solutions.

- Convertible notes provide a layer of security through interest accrual and defined maturity dates.

As investment activity surges across the Baltics and Nordics, marked by notable funding rounds and a steady M&A landscape, understanding the nuances of these financing mechanisms is essential for navigating the evolving market dynamics. This article delves into the definitions, key terms, and strategic implications of SAFEs and convertible notes, equipping investors with the insights needed to make informed decisions in a rapidly changing economic environment.

Understanding SAFE and Convertible Notes: Definitions and Mechanics

A Simple Agreement for Future Equity (SAFE) serves as a streamlined financing tool, and when discussing financing mechanisms, it is important to consider the differences between SAFE versus convertible note, as both allow participants to convert their investment into equity during a future funding round. This mechanism usually permits the issuance of shares solely upon the happening of a specific event, like new financing, which increases its attractiveness to early-stage startups and individuals seeking straightforward terms. In contrast, debt instruments operate as loans that convert into equity at a later time, often determined by a set valuation cap or discount rate.

The interest accumulation and the existence of a maturity date add extra intricacy to these financial instruments, which can be beneficial for investors seeking a level of security in unstable markets. As the startup environment in the Baltics and Nordics keeps thriving, emphasized by notable recent funding like Plural's €4.6M in Molyon and Sitoo's €26M from Verdane, the attractiveness of simple agreements for future equity is highlighted in this prosperous investment atmosphere. These transactions not only demonstrate the increasing trust in the market but also show how such funding rounds can affect the selection between funding agreements and alternative financial instruments.

Furthermore, M&A activity stayed consistent in 2023, with 145 transactions in Q4 alone, reflecting market dynamics that could affect stakeholder decisions regarding Safes and convertible instruments. Understanding the safe versus convertible note options is crucial as the choice between these instruments can significantly impact investment strategy and potential returns, making it essential to grasp their distinct advantages and operational frameworks. As Alberto Onetti, chairman of Mind the Bridge, notes, 'Tunisia is often overlooked in discussions of Africa's burgeoning tech scene,' highlighting the importance of understanding the broader global context when assessing investment strategies.

Key Terms and Conditions of SAFE and Convertible Notes

A SAFE (Simple Agreement for Future Equity) typically includes key terms such as a valuation cap, which establishes a maximum price for conversion into equity, and a discount rate that provides investors with a percentage reduction on the share price at the time of conversion. Notably, these financial instruments do not accrue interest, which streamlines the investment structure and minimizes risks associated with default. This simplicity is advantageous for early-stage companies looking to raise capital quickly.

Furthermore, the yearly discount assessed at -47.03% provides a quantitative viewpoint on the possible advantages of simple agreements for future equity in relation to investment instruments. In contrast, these investment instruments feature more complex conditions, including interest rates that can vary from 2% to 8%, and a maturity date, which signifies the cutoff for converting the instrument into equity. While both safe versus convertible note structures incorporate valuation caps and discounts—similar to Safes—the inclusion of interest introduces an additional layer of complexity.

Technology financiers must thoroughly comprehend these terms to navigate the associated risks and rewards effectively. Moreover, recent discussions highlight the importance of being cautious with simple agreements for future equity, as over-reliance on these instruments can lead to challenges such as complex capitalization tables and potential mispricing of equity. The case study titled 'Risks of Over-Reliance on Safes' emphasizes that while Safes simplify fundraising for early-stage companies, there are significant risks associated with their excessive use.

As noted,

the journey to raising capital is not just about the money or reaching a particular valuation in your seed round—it's crucial to find partner(s) and shareholders who also share your vision and can provide the support you need to succeed.

This highlights the necessity for stakeholders to align their growth ambitions with sound financial planning, ensuring resilience in their capital-raising strategies.

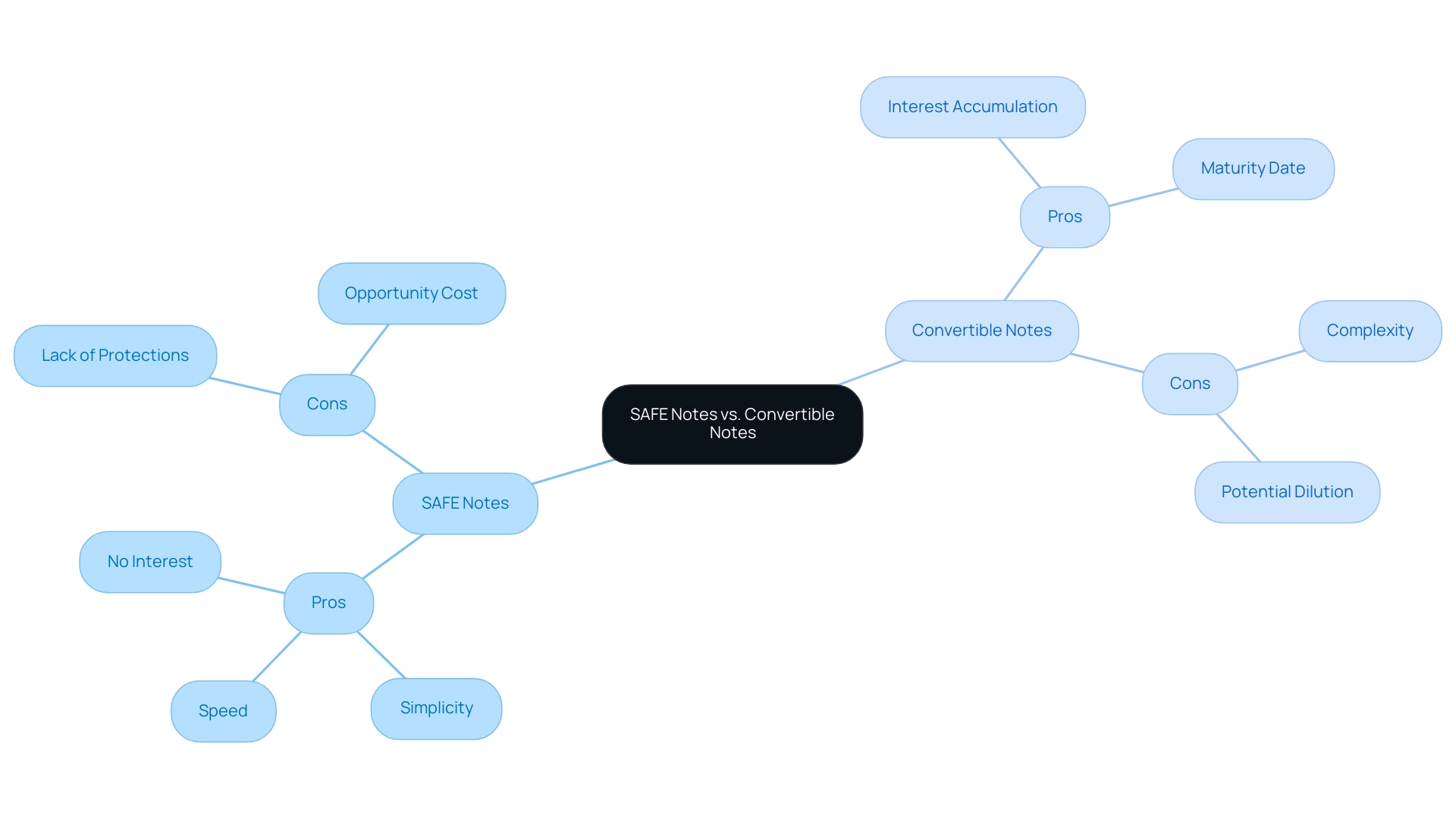

Pros and Cons of SAFE Notes vs. Convertible Notes

SAFE instruments are created for speed and simplicity, making them especially beneficial for early-stage investments where startups need rapid access to funds without the burdens of debt. These instruments do not accrue interest, which allows startups to limit their liabilities during critical growth phases. However, one of the disadvantages of these agreements is the possible lack of protections for backers that typical debt instruments usually provide.

For example, in the case of a liquidation, flexible instruments can offer options for repayment, improving security for stakeholders. Significantly, individuals who chose to avoid these financial instruments may have overlooked chances with firms that realized remarkable returns between 12X and 34X, emphasizing the substantial opportunity cost linked to disregarding them.

In comparison, the safe versus convertible note brings a degree of complexity but offers advantages like interest accumulation and a specified maturity date. Investors often view these features favorably, especially when seeking some assurance of returns prior to equity conversion. Still, this added complexity may pose challenges, including potential dilution for both startups and stakeholders.

As noted by Jas Bhogal, a corporate partner, 'Both safe versus convertible notes and CLNs function in comparable manners and are intended for securing early-stage funding for start-ups.' This highlights the significance of grasping the nuances of each choice, especially as market sentiment changes in 2024.

In this context, a well-crafted pitch deck that aligns with stakeholder interests and presents a cohesive narrative is crucial for securing funding in the current market climate. This is evidenced by the success of ventures like WNT Ventures, which supports deep tech founders through strategic investments and incubation programs.

Investor Perspectives: Choosing Between SAFE and Convertible Notes

When assessing funding alternatives, participants frequently encounter a crossroads between Simple Agreements for Future Equity and the safe versus convertible note, with their choice significantly shaped by risk tolerance and particular investment goals. For those inclined toward higher growth potential and willing to embrace a degree of risk, Safes present an attractive option due to their inherent simplicity and expedited execution. The absence of interest accumulation can be particularly appealing for individuals focusing on long-term equity gains, allowing them to fully capitalize on the startup’s growth trajectory without immediate financial overhead.

In contrast, cautious financiers often lean towards exchangeable instruments, appreciating the assurance that accompanies interest accumulation and the established schedule for conversion. This structure can offer a safety net in uncertain market conditions, providing more predictability in returns. However, it is essential to recognize that flexible debt instruments can result in increased interest payments and dilution risks in larger funding rounds, which may dissuade certain backers.

Moreover, Jas Bhogal, a Corporate Partner with extensive experience in startup financing, warns that an inaccurate cap table can erode stakeholder confidence and lead to costly disputes. This statistic underscores the critical nature of clarity and communication in these transactions, as any misrepresentation can significantly impact the decision-making process regarding funding instruments. Ultimately, the choice between simple agreements for future equity and safe versus convertible note options will be influenced by the financier's overarching strategy, their approach to portfolio diversification, and their appetite for risk.

Jason Mendelson, co-author of the influential book 'Venture Deals', emphasizes that understanding these dynamics is crucial for navigating the complexities of startup fundraising. As exemplified by WNT Ventures, which invests in deep tech founders, their approach demonstrates how financiers can effectively leverage both instruments to provide high conviction support and resources for building successful global businesses. This case study demonstrates how actual investor strategies are shaped by individual risk tolerance and market conditions, emphasizing the subtle distinctions between convertible instruments and alternative financing options.

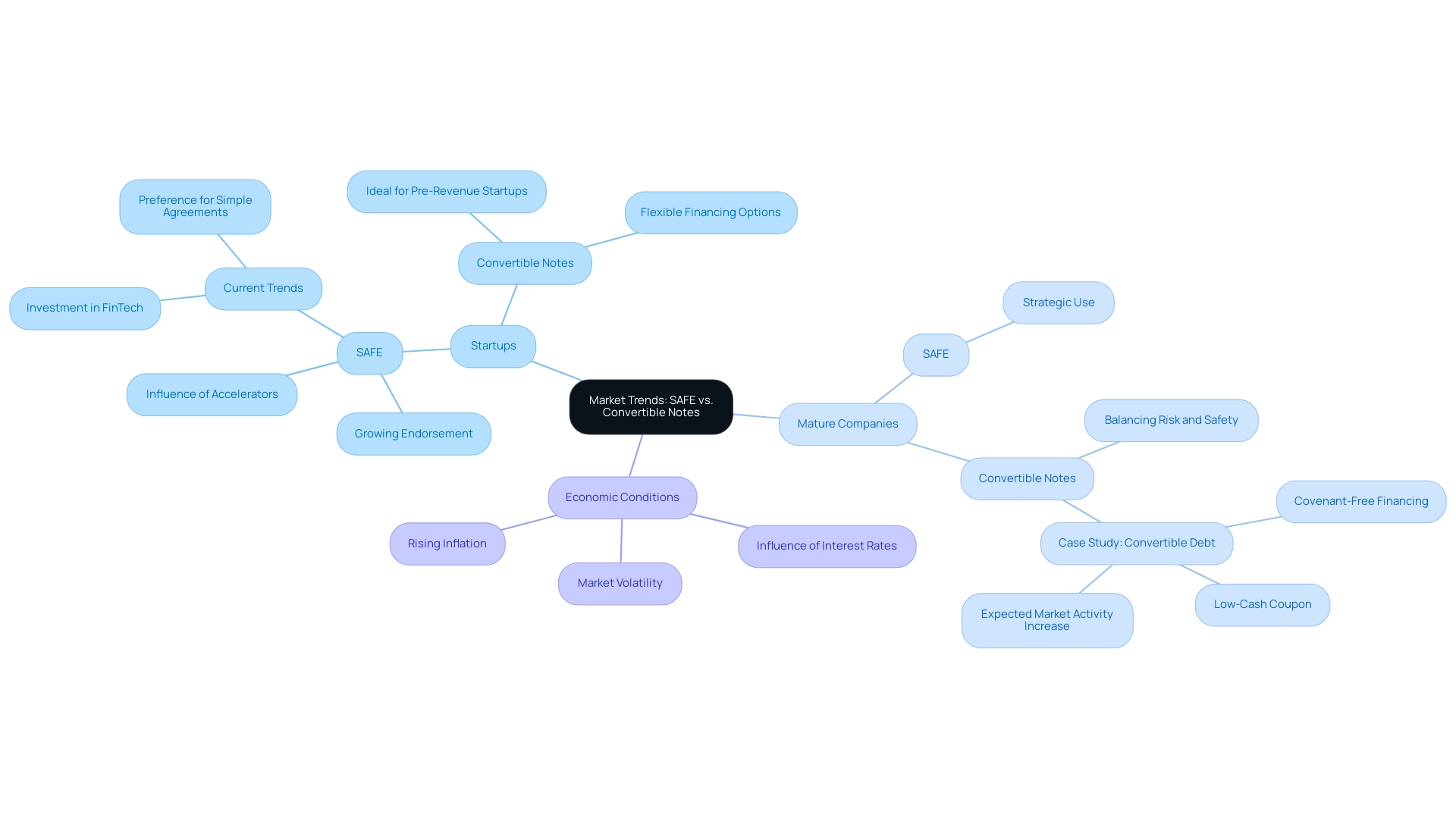

Market Trends: Sector Preferences for SAFE vs. Convertible Notes

In recent years, the tech sector has increasingly gravitated towards the safe versus convertible note, particularly among startups that prioritize swift and uncomplicated funding solutions. This shift is largely fueled by the proliferation of accelerators and incubators, which often advocate for simple agreements due to their straightforward structure. As Peter Walker, Head of Insights at Carta, aptly states, 'Hopefully these benchmarks help set the terms!'

This highlights the growing endorsement of Safes in early-stage financing, as benchmarks can guide startups in setting favorable terms. Significantly, recent venture capital activities, such as:

- Startup Wise Guys' investment in Nigerian FinTech Rise

- Plural's $4.6M funding for Milton's lithium-sulfur battery tech

highlight a broader trend of backers favoring straightforward funding mechanisms in the current economic climate. On the other hand, flexible debt instruments, including safe versus convertible note, remain a staple in the financing strategies of more mature tech companies.

These entities frequently aim to balance risk with the safety that debt characteristics offer, making the choice between a safe versus convertible note particularly desirable in an environment characterized by economic uncertainties or increased caution among backers. A recent case study titled 'Debt with Conversion Features as a Financing Alternative' indicates that in a high interest rate environment, this type of debt offers a low-cash coupon, covenant-free, and flexible financing option to manage capital costs. Highlighting this case study demonstrates how debt that can be exchanged serves as a strategic option for technology financiers maneuvering through changing market situations.

As demonstrated by increasing investments in drone technology and AI, the debt market is expected to experience a surge in activity over the next twelve months, as current issues confront upcoming maturities and new issues contemplate this option over traditional debt. This context underscores the necessity for technology financiers to remain agile, adapting their strategies to align with both market trends and the evolving preferences for financing methods among tech startups and established companies alike. Furthermore, the performance of the adjustable market is influenced by stock market conditions and interest rates, which adds another layer of complexity for investors to consider, particularly in light of current economic conditions that include rising inflation and market volatility.

Legal and Regulatory Considerations for SAFE and Convertible Notes

Both Simple Agreements for Future Equity and alternative financing instruments are increasingly under the microscope of legal and regulatory scrutiny, a situation that varies significantly across different jurisdictions. These financial instruments, being a more recent financing mechanism, have historically faced less regulatory oversight. However, as their usage rises, compliance with securities laws is becoming a focal point for regulators.

Corporate risk and compliance professionals prioritize remaining informed about the latest ESG-related advancements, with 77% concurring that it is significant or extremely significant, emphasizing the necessity for vigilance regarding the consequences of issuing simple agreements for future equity, particularly relating to disclosure obligations and stakeholder rights, as these elements can greatly influence investment results.

Conversely, exchangeable instruments are a well-established option, yet they require careful consideration of legal provisions, such as interest rates and maturity dates, which must comply with local regulations. With more than 90% of legal departments anticipating an increase in workloads over the next two years, understanding the legal implications of these investment choices is paramount. Non-compliance can lead to significant penalties, as illustrated by the case study on cybersecurity challenges, where data breaches can cost businesses an average of $4.45 million, leading to legal penalties and reputational damage.

This underscores the necessity for stakeholders to stay informed about the rapidly evolving legal landscape surrounding these financing instruments. Secureframe helps organizations strengthen security and speed up compliance, providing practical solutions for tech investors navigating the complexities of safe versus convertible note, thereby ensuring they remain compliant and well-positioned in their investment strategies.

Conclusion

The choice between Simple Agreements for Future Equity (SAFEs) and convertible notes is crucial for both investors and startups navigating the vibrant financing landscape, particularly in the Baltics and Nordics. SAFEs offer a streamlined approach, appealing to early-stage ventures seeking rapid capital without the burden of interest or complex terms. Their simplicity enables startups to focus on growth, although they present certain risks, such as potential misalignment in equity pricing and investor protections.

Conversely, convertible notes provide a layer of security through interest accrual and defined maturity dates, making them attractive for conservative investors. While they introduce additional complexity, their structure can offer greater predictability in uncertain market conditions. The ongoing evolution of investment strategies underscores the importance of understanding the nuances of each financing instrument, as well as the broader market dynamics influencing these choices.

As the tech sector continues to embrace SAFEs, driven by the support of accelerators and incubators, convertible notes remain a staple for more mature companies seeking to balance risk and security. The legal and regulatory landscape surrounding both instruments is also evolving, highlighting the necessity for investors to remain vigilant and informed. Ultimately, the decision between SAFEs and convertible notes should align with an investor's risk tolerance, strategic objectives, and the specific needs of the startups they aim to support. By grasping the distinct advantages and implications of each option, investors can make informed decisions that enhance their capital-raising strategies and contribute to the success of the ventures they back.