Overview

ASPI StockTwits can enhance your tech investment strategy by providing real-time updates, sentiment analysis, and community engagement, which are crucial for making informed investment decisions in a rapidly changing market. The article emphasizes that leveraging these features allows investors to navigate market noise effectively, access diverse insights, and refine their strategies, ultimately leading to improved financial outcomes.

Introduction

In the rapidly evolving world of technology investments, staying informed is more crucial than ever. ASPI StockTwits emerges as a powerful social media platform specifically designed for investors, facilitating real-time updates and community engagement that allow users to navigate the complexities of the market with confidence.

As investors seek to capitalize on fleeting opportunities and emerging trends, the ability to access immediate insights and market sentiment becomes indispensable.

This article delves into the key features of ASPI StockTwits, the importance of community engagement in shaping investment strategies, and practical tips for leveraging this platform to enhance decision-making and investment success.

With the right tools and connections, tech investors can refine their approach and uncover lucrative opportunities in an increasingly competitive landscape.

Understanding ASPI StockTwits: A Tool for Tech Investors

ASPI StockTwits is a dedicated social media platform that stands out for individuals interested in finance, emphasizing the immediacy of information sharing essential for navigating the evolving tech landscape. Users can effortlessly post updates, insights, and opinions regarding various stocks, particularly in the dynamic tech sector. By enabling investors to track specific stocks or sectors, ASPI StockTwits provides a continuous stream of sentiment and expert viewpoints, which is essential for tech investors aiming to diversify their portfolios amidst financial uncertainties.

According to a recent study examining the evolution of textual sentiment in the stock exchange over the past decade, the significance of real-time information has never been clearer. For instance, during the GameStop incident, short-sellers lost an estimated $8B, highlighting the financial implications of trading sentiment and the necessity for timely insights. As the financial landscape continues to evolve in 2024, platforms like StockTwits become indispensable, enabling traders to access real-time information that is crucial for making informed decisions.

Furthermore, platforms such as YouTube have arisen as important sources for financial education, enabling traders to learn about various strategies and market assessments. This strengthens the platform's worth in the fast-moving realm of technology investments and aligns with fff. Vc's dedication to promoting investment and offering access to exclusive opportunities.

In its journey, fff. Vc has grown to 300 members across 28 countries, completed 159 late-stage deals, and invested approximately 3m€ in notable companies. Community members can expect deals across various asset classes, including Tech, Private Equity, Real Estate, and Private Credit.

Join us at fff. Vc to access top opportunities, save time on building your own deal flow, and make informed decisions with the support of our network.

Key Features of ASPI StockTwits for Tech Investment

ASPI StockTwits offers a collection of vital features designed for technology enthusiasts seeking to traverse today's dynamic financial environment efficiently while using ASPI StockTwits to establish meaningful connections within the community.

- Real-Time Updates: With real-time notifications on stock movements and financial trends, individuals can make prompt decisions that capitalize on fleeting opportunities. Statistics demonstrate that timely information can significantly improve trading results, with studies suggesting that individuals who act on real-time data can increase their returns by as much as 10%.

- Sentiment Analysis: The platform utilizes user-generated content to provide sentiment scores, allowing stakeholders to evaluate the current market mood towards specific stocks. This analytical approach helps individuals quickly discern bullish or bearish trends on ASPI StockTwits.

As one technology financier noted, "Real-time sentiment analysis has changed the way I approach my trades; it gives me insights that traditional metrics often miss."

- Trending Stocks: Individuals can monitor trending stocks based on user engagement metrics, offering insights into emerging investment opportunities that may not yet be on the radar of mainstream participants.

- User Engagement and Community Building: The interactive nature of StockTwits nurtures a network where individuals share insights and strategies, amplifying learning and collaboration. For individuals interested in deal flow, due diligence, and co-investing opportunities across venture capital, private credit, and real estate, the recent M&A deal involving MultiChoice Group Ltd and Vivendi SE Groupe Canal + SA, valued at 2.7 billion U.S. dollars, illustrates how significant shifts can be tracked and analyzed in real-time.

Furthermore, the community provides weekly technology and economic updates, which keep stakeholders informed about trends and opportunities, along with participation in events that promote networking and education. By leveraging these features, tech stakeholders can refine their market understanding, enhance their decision-making processes, and connect with like-minded individuals, ultimately leading to more strategic actions and valuable insights.

The Role of Community Engagement in Investment Strategies

Community engagement on ASPI StockTwits fosters a collaborative atmosphere that allows technology enthusiasts to share insights, strategies, and experiences. Influential figures like Sten Tamkivi, former General Manager at Skype and a notable backer with over 100 contributions, and Kristjan Vilosius, founder of Katana MRP and a prominent angel backer, illustrate how building connections within the funding community can lead to innovative financial opportunities, particularly in early-stage and Climate Tech sectors. By actively participating in discussions, investors benefit from a diverse range of perspectives regarding market movements and stock performance, making it easier to navigate challenges.

This exchange of ideas can unveil financial opportunities that may have otherwise gone unnoticed. Furthermore, public input plays a vital role in confirming funding choices, thereby reducing the risks linked to individual decision-making. As Tim Stobierski, a marketing specialist and contributing writer, notes, 'As the statistics above demonstrate, corporate social responsibility is an important concept for businesses to consider.'

This emphasizes the wider effects of public participation, especially how corporate social responsibility can affect stakeholder behavior and promote local involvement in financial strategies. Cities such as Louisville and Pittsburgh exemplify successful application of engagement strategies, showcasing significant investments in user and public involvement. Such models can inspire tech investors to harness the power of collaborative investing.

Furthermore, the case study of local banks during economic downturns illustrates that these institutions, due to their conservative lending practices, were able to weather economic storms better than larger counterparts. During the 2008 financial crisis, local banks continued lending to neighborhood businesses, preventing economic collapse. Consequently, engaging in the ASPI StockTwits network not only enhances an individual's strategy but also boosts their confidence, reflecting a rising trend toward collective-driven investment success.

Furthermore, statistics show that community content marketing can significantly impact traffic and reach, engagement and retention, and ultimately conversion and revenue, further underscoring the value of collaborative investing.

Navigating Market Noise: Using ASPI StockTwits to Identify Opportunities

The overwhelming noise in the trading environment often clouds the judgment of technology financiers, making it challenging to extract actionable insights from the incessant stream of information. The platform aspi stocktwits provides a solution by offering real-time insights and discussions focused on specific stocks, enabling individuals to cut through the clutter. To effectively navigate this tumultuous landscape, consider the following strategies:

- Follow Key Influencers: Identify and engage with seasoned investors and analysts who consistently provide insightful analyses and predictions. Their expertise can significantly enhance your understanding of economic dynamics.

- Utilize Sentiment Scores: Leverage sentiment scores to assess the prevailing mood, which can be a critical indicator of potential stock movements. This quantitative measure helps investors anticipate market reactions more accurately. Given that it takes about 100 trades for the average trade to converge to expected results, employing sentiment scores can help streamline this process and enhance financial outcomes.

- Engage in Discussions: Actively participate in relevant conversations on the platform, and consider joining the group at fff.club. This community not only provides educational resources and weekly technology and economic updates but also acts as a center for technology stakeholders to clarify uncertainties and gain diverse perspectives, enriching your financial strategy. As Dave from Build Alpha notes, "Build Alpha aims to make this identification and testing easy and with no coding necessary," emphasizing the accessibility of tools such as aspi stocktwits.

- Set Alerts: Utilize the alert features of aspi stocktwits to stay updated on sudden shifts in stock sentiment or price fluctuations, ensuring you never miss a potential opportunity.

Additionally, algo traders face the challenge of complexity in the market, which can lead to overfit strategies that perform poorly under changing conditions. Referencing the case study on curve fitting risks highlights the necessity for robust strategies, such as out-of-sample testing and ensuring a large trade count, to mitigate these risks.

By implementing these strategies and engaging with resources at fff.club, including opportunities for deal flow, due diligence, and co-investing, tech investors can effectively filter out noise and concentrate on high-potential funding opportunities. The expertise of founders like Akim Arhipov and Tim Vaino, who have significant experience in the financial and tech sectors, further enhances the value of this group, ultimately improving their decision-making process in a competitive environment where constant innovation is key.

Integrating ASPI StockTwits into Your Tech Investment Strategy

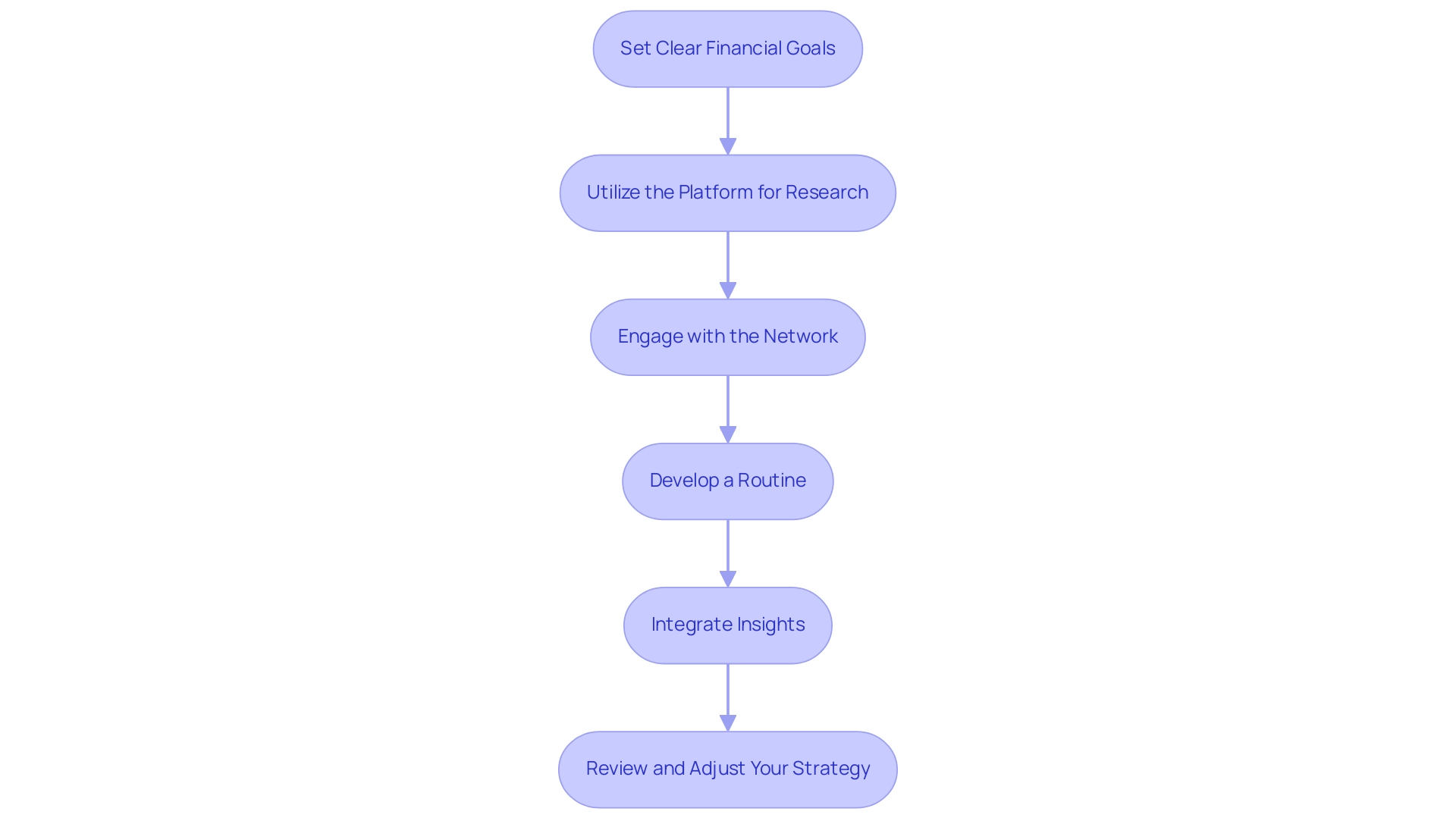

To effectively incorporate ASPI StockTwits into your technology financial strategy while utilizing the network and resources at fff.club, consider the following steps:

- Set Clear Financial Goals: Begin by clearly defining your financial objectives. Are you aiming for long-term growth, generating income, or engaging in short-term trading? Establishing specific goals will guide your decisions and help measure your success.

- Utilize the Platform for Research: Leverage ASPI StockTwits as a powerful tool for research. Concentrate on sentiment analysis and extract insights from group discussions to assess public sentiment regarding potential assets, which can affect stock performance. As consumer preferences shift, with 31.9% citing convenience and familiarity as top reasons for engagement, utilizing real-time information becomes crucial.

- Engage with the Network: Participate actively in the fff.club network to build valuable connections and gain financial insights. The strength of collaboration in private market funding is substantial; interacting with fellow members can offer you deal flow, due diligence assistance, and co-investing prospects across venture capital, private credit, and real estate. Additionally, fff.club offers various resources and events, such as webinars and networking sessions, that facilitate deeper engagement and learning.

- Develop a Routine: Establish a consistent routine for checking StockTwits. Frequent interaction with the public will keep you informed about the latest trends and feelings that could affect your finances. This is particularly important given the fast-paced nature of social media, where timely information is crucial. Notably, Facebook's shares per post have declined from 15 in 2023 to 13 in 2024, illustrating the changing dynamics of social media engagement.

- Integrate insights gained from ASPI StockTwits with traditional analysis methods like fundamental and technical analysis. This comprehensive method enables balanced financial choices, as it merges public sentiment with solid data. Tracking various metrics such as engagement rates and conversions, as highlighted in the case study on measuring social media performance, is essential for optimizing your strategy.

- Review and Adjust Your Strategy: Periodically assess the effectiveness of your financial strategy. Utilize insights from ASPI StockTwits and the fff.club community to make informed modifications to your approach, ensuring that you stay adaptable to market changes.

By following these steps, tech enthusiasts can cultivate a strong financial strategy that leverages the influence of community insights and real-time information, ultimately improving their decision-making process and financial success. Moreover, by engaging with fff.club, investors can access vetted investment opportunities in venture capital, private equity, real estate, and private credit, further enriching their investment strategies.

Conclusion

ASPI StockTwits has proven to be an essential tool for tech investors navigating the complexities of the modern market. By offering real-time updates, sentiment analysis, and a vibrant community for engagement, it empowers users to make informed decisions. The platform facilitates immediate access to market sentiment and expert insights, which are crucial for capitalizing on fleeting investment opportunities.

The importance of community engagement cannot be overstated. By sharing insights and strategies, investors can benefit from diverse perspectives that enhance their decision-making processes. This collaborative environment not only fosters learning but also mitigates risks associated with solitary investment choices. As demonstrated through various examples and case studies, actively participating in such communities can significantly improve investment outcomes and confidence.

In an environment rife with market noise, leveraging tools like ASPI StockTwits allows investors to cut through distractions and focus on high-potential opportunities. By integrating these insights into a well-defined investment strategy, tech investors can enhance their ability to adapt to market changes and refine their approaches. The combination of real-time information and community support positions investors to thrive in an ever-evolving landscape, ultimately leading to greater success in their investment endeavors.