Overview

This article serves as a heartfelt guide for startups seeking to attract angel co-investors, outlining strategic steps and best practices that truly resonate with their journey. We understand that developing a solid business plan can feel daunting, but it is essential in showcasing your startup's viability.

Crafting a compelling pitch is another crucial step, as it allows you to share your vision and passion with potential investors. Moreover, the importance of actively networking cannot be overstated; it not only enhances your appeal to investors but also fosters collaborative relationships within the investment community.

By sharing these insights, we hope to nurture a supportive environment where startups can thrive and connect with those who believe in their potential.

Introduction

In the ever-changing landscape of startup funding, we understand that entrepreneurs often face daunting challenges. Angel co-investing has emerged as a game-changing strategy that not only empowers these innovators but also helps to alleviate risks for investors. This collaborative approach invites multiple investors to come together, pooling their resources while combining financial support with invaluable expertise and networks that are crucial for fledgling companies.

Insights from seasoned tech investors reveal the transformative potential of this model, especially in regions bursting with entrepreneurial spirit. As startups navigate the complexities of securing capital, grasping the intricacies of angel co-investing becomes essential.

This article explores the motivations behind angel investments, the critical steps that startups can take to attract co-investors, and the best practices for nurturing lasting relationships. Ultimately, we aim to equip entrepreneurs with the knowledge they need to enhance their funding prospects and drive innovation in a competitive market.

Understanding Angel Co-Investing: A Primer for Startups

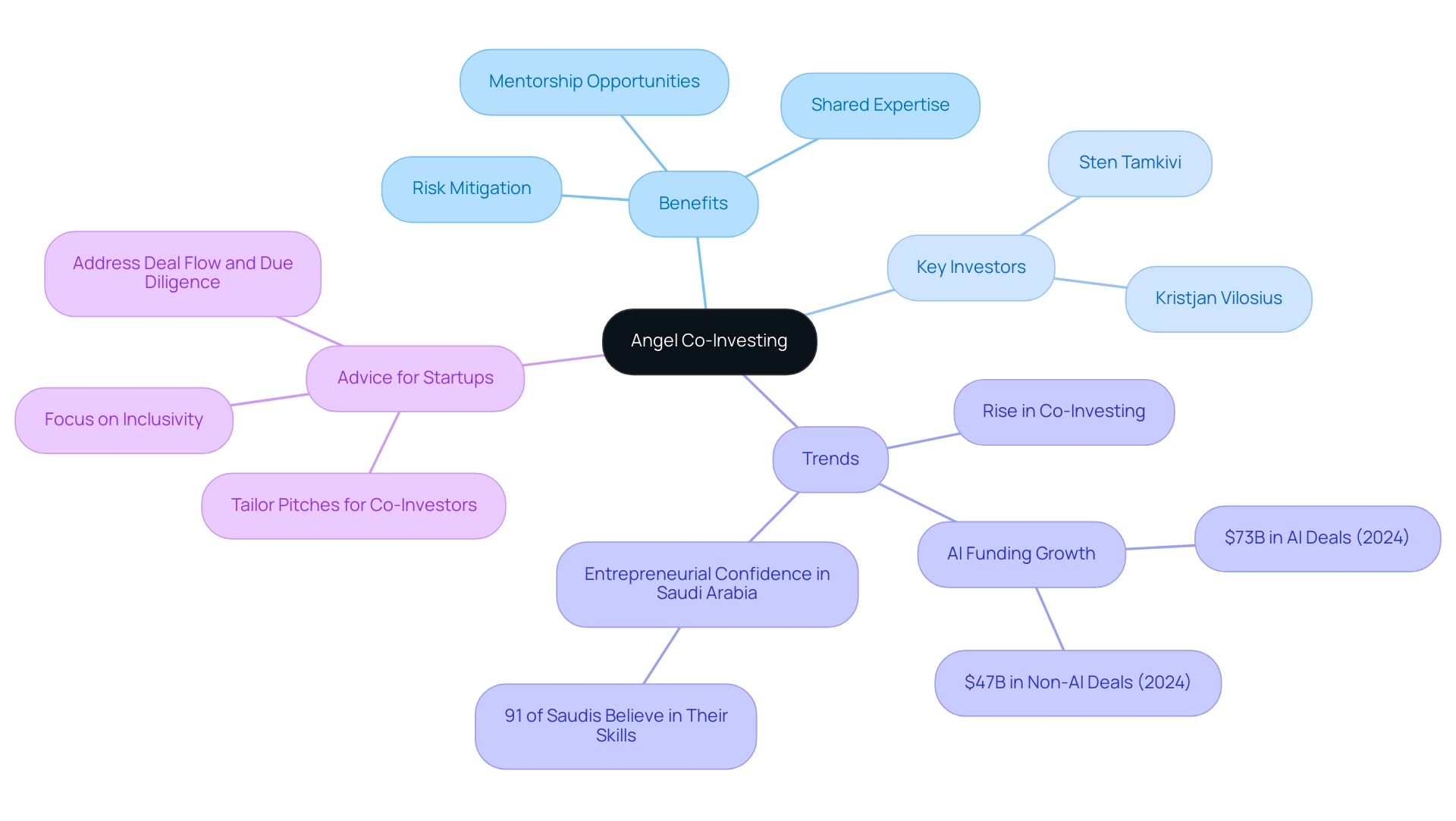

Angel co-investors engage in a strategic method where several backers combine their resources to fund a new business, usually alongside a lead participant. This collaborative model not only distributes financial risk but also introduces a wealth of diverse expertise and expansive networks, which can be invaluable for emerging companies. Insights from prominent Estonian tech investors such as Sten Tamkivi, former General Manager at Skype and co-founder of Plural, and Kristjan Vilosius, founder of Katana MRP, further illuminate the significance of this model in fostering innovation and resilience within the entrepreneurial ecosystem.

We understand that navigating the complexities of the tech landscape can be daunting. Their experiences underscore the importance of collaborative investment strategies, offering a beacon of hope for those looking to thrive in this environment.

For new ventures, grasping the intricacies of co-investing is vital, as it can greatly enhance their chances of obtaining necessary funding. Startups should be aware that angel co-investors often prefer to invest collectively to mitigate risks. This collective investment approach can result in larger funding rounds, as the combined financial contributions of various backers can create a more appealing proposition for new businesses.

Moreover, the mentorship opportunities that arise from such collaborations can provide new ventures with critical guidance and insights, enhancing their chances of success in a competitive landscape.

As we look ahead to 2025, the trend of co-investing continues to gain momentum, with a significant rise in participation from financiers seeking to capitalize on the growing entrepreneurial ecosystem. This is especially pertinent in areas such as Saudi Arabia, where 91% of working-age individuals show assurance in their capacity to initiate new businesses, suggesting a strong entrepreneurial spirit that venture capitalists can leverage. This increasing confidence indicates a promising environment for co-investing, as backers seek to support innovative ventures.

The financial landscape is also shifting, with $73 billion in mega deal dollars allocated to AI companies in 2024, compared to $47 billion for non-AI companies. This trend highlights the significance of angel co-investors in the tech sector, as they seek to align with companies that have high growth potential.

The advantages of co-investing extend beyond simple financial backing; they include shared expertise and resources that can drive new ventures toward accomplishing their objectives. As Patrick Collison, CEO and co-founder, states, 'Our mission is to grow the GDP of the internet,' highlighting the critical role that supporting innovative businesses plays in economic growth. By understanding this model, startups can tailor their pitches to attract co-investors, ultimately enhancing their funding opportunities and fostering a collaborative environment that drives innovation and growth.

Furthermore, the belief in inclusivity, as emphasized by fff.club, reinforces that financial opportunities should be accessible to all, aligning with the theme of collaboration in angel co-investors. Additionally, addressing deal flow and due diligence is crucial for individuals seeking to make informed choices in private markets, ensuring that they maximize their investment potential.

What Motivates Angel Investors to Co-Invest in Startups?

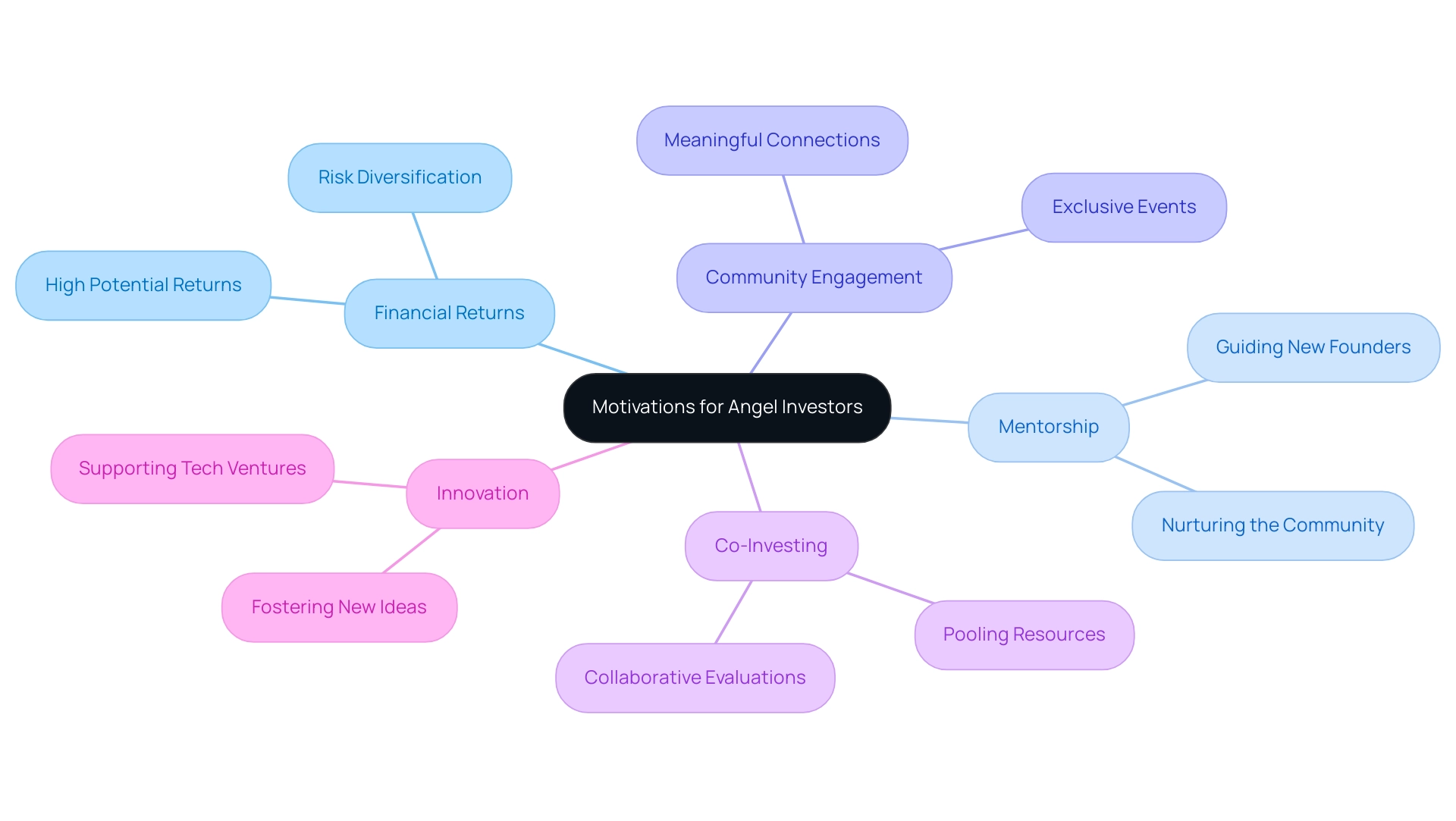

In 2025, angel backers are driven by a rich tapestry of motivations that extend far beyond simple financial returns. Many prioritize high potential returns, but they are equally passionate about the missions of the ventures they support. A significant number of these backers are former entrepreneurs who understand the hurdles of starting a business and are eager to nurture the community by guiding new founders.

This mentorship not only enriches the startup ecosystem but also cultivates a collaborative environment that resonates with the community-driven spirit of our organization, which proudly includes over 410 tech professionals.

Co-investing emerges as a vital motivation for angel co-investors, enabling them to pool resources and diversify their portfolios, thereby reducing the risks associated with individual investments. This approach is especially pertinent in the tech sector, where rapid changes present both remarkable opportunities and potential challenges. Through collaborative investment evaluations and collective due diligence, our members can harness their combined expertise as angel co-investors, enhancing decision-making processes and uncovering high-quality deal opportunities.

Our members frequently share heartfelt testimonials, such as Salv Bolt from Inbank, who remarked, "The collaborative evaluation process at fff.club has significantly improved my investment decisions."

Beyond financial returns, early-stage backers are drawn to the community aspects of investing, seeking meaningful connections and insights. They benefit from weekly tech and economic updates, as well as exclusive events that foster deeper engagement. Understanding these motivations is crucial for new ventures aiming to attract angel backers; crafting engaging narratives that resonate with these potential financiers can significantly improve the likelihood of securing funding.

For example, a recent study on the funding preferences of very small enterprises in France revealed that entrepreneurs often lean towards internal funding over external options. This highlights the necessity of demonstrating traction and customer engagement to potential backers. Investors typically hesitate to commit funds to startups that struggle to clearly convey how their product addresses a pressing problem, as underscored by the observation: "Investors avoid startups that cannot demonstrate traction or customer engagement."

In summary, the motivations of benefactors in 2025 encompass a desire for financial returns, a commitment to mentorship, and a passion for fostering innovation. Additionally, equity financing represents a significant portion of capital acquired by early-stage backers, particularly in the technology sector. By aligning their pitches with these motivations and engaging with the community at fff.club, new ventures can craft compelling cases for funding that resonate with affluent individuals eager to make a meaningful impact in the tech landscape.

Our structured process for screening high-quality deals ensures that every investment opportunity is thoroughly vetted, further enhancing the appeal of joining our supportive community.

Preparing Your Startup for Angel Co-Investment: Key Steps to Take

To effectively engage with angel co-investors, startups should follow these essential steps:

-

Develop a Solid Business Plan: A well-structured business plan is crucial. It should clearly outline your business model, conduct thorough market analysis, and present realistic financial projections. This foundational document acts as a roadmap for your venture and shows to backers that you possess a clear vision for growth.

-

Create a Compelling Pitch Deck: Your pitch deck must succinctly convey your venture's vision, value proposition, and potential return on investment. A compelling narrative, supported by data and visuals, can significantly enhance your chances of capturing investor interest. Significantly, pitch decks play a crucial role in obtaining investments, with statistics showing that companies with well-crafted decks are more likely to attract funding.

-

Build a Strong Team: We understand that investors often prioritize the team behind a new venture as much as the idea itself. Highlight the expertise and experience of your team members, showcasing their backgrounds and relevant accomplishments. A strong team can instill confidence in backers, as they are more likely to invest in capable individuals who can execute the business plan effectively. It's important to note that team-related challenges contribute to 18% of new business failures, emphasizing the need for a competent team.

-

Establish Clear Financial Needs: Clearly articulate how much funding you require and provide a detailed breakdown of how these funds will be utilized. This transparency not only fosters trust but also assists investors in grasping the financial roadmap of your venture.

-

Prepare for Due Diligence: Be ready to provide comprehensive information about your business operations, financials, and market strategy. This preparation is critical, as due diligence is a standard part of the investment process. Having organized and accessible documents can streamline this phase and demonstrate your professionalism.

In 2025, the landscape for startups remains competitive, with the UK housing over 5,377 startups, ranking third globally. However, challenges persist, as tech-related problems account for 6% of failures and legal hurdles for 2%. To navigate these challenges, new ventures can learn from case studies, such as those from Estonia, where support from angel co-investors has contributed to a success rate of approximately 25% for new businesses.

For instance, the Estonian Entrepreneur Database indicates that only 25.2% of businesses have been active for five years or more, highlighting the challenges in achieving long-term success. By concentrating on these preparation steps, new ventures can enhance their attractiveness to angel co-investors and improve their chances of securing investment. As Luisa Zhou, founder and expert in building successful businesses, states, "Building a solid foundation is key to scaling your startup and attracting the right investors."

Additionally, leveraging the collaborative environment of this platform, where members can co-invest, engage in deal flow, and learn from one another, can further enhance the overall investment experience. At the platform, tools such as the due diligence checklist and investment tracking software are available to support your efforts in securing funding. Join our platform today to access exclusive resources and connect with fellow participants, including experienced founders like Akim Arhipov and Tim Vaino, who offer valuable insights from their successful ventures.

How to Find and Attract Angel Co-Investors: Effective Strategies

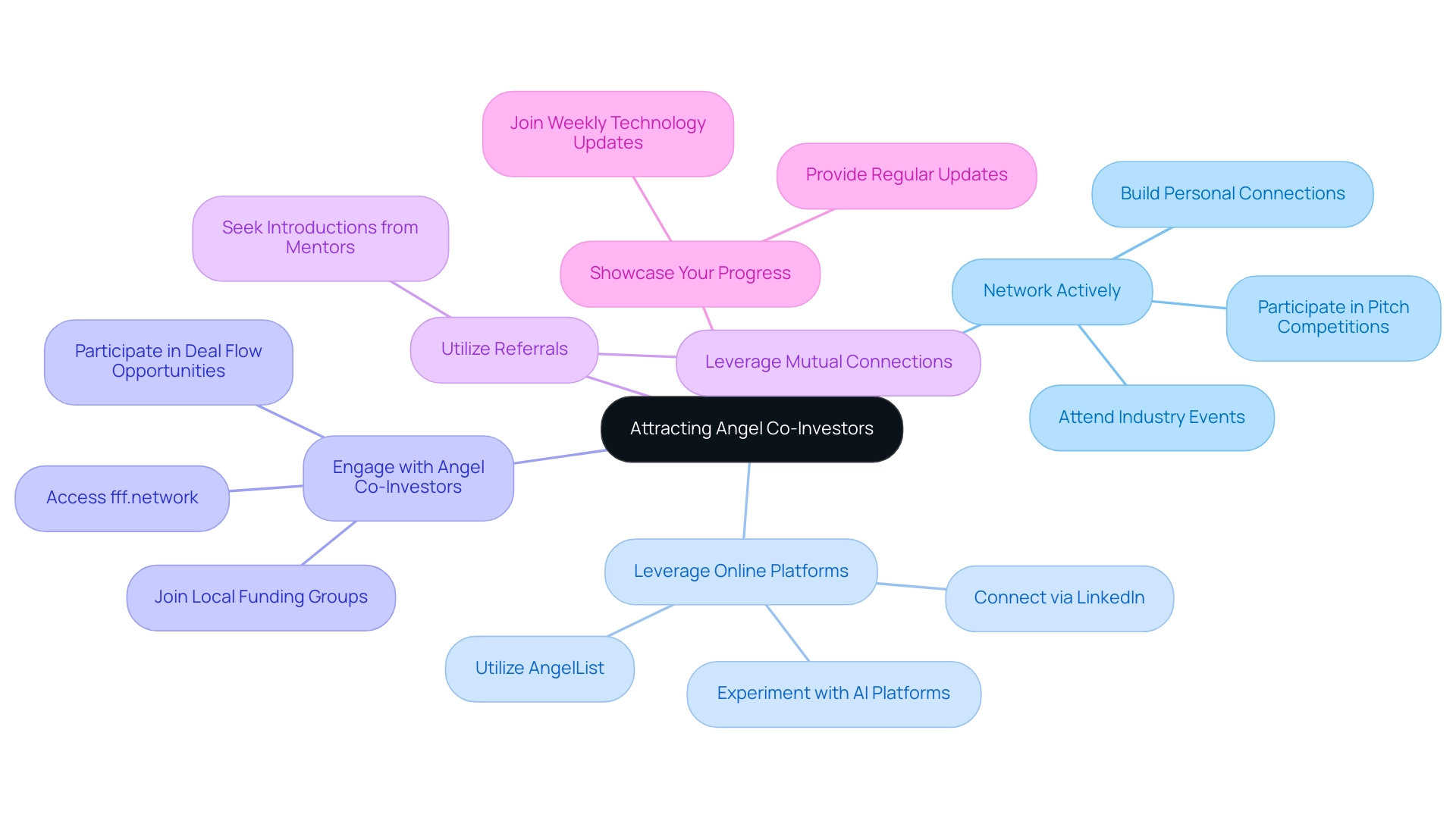

Engaging angel co-investors requires a proactive and strategic method, especially within our dynamic community. We understand that navigating this landscape can be challenging, but there are several effective strategies to consider:

- Network Actively: Engaging in industry events, pitch competitions, and startup meetups can significantly help in building relationships with potential backers. Many of our members have found that participating in these environments, particularly through the fff. Club network, not only increases visibility but also facilitates meaningful interactions that can lead to investment opportunities. While 61% of employees prefer remote meetings, nearly 100% believe face-to-face meetings are best for building lasting relationships, underscoring the importance of personal connections.

- Leverage Online Platforms: Utilizing platforms such as AngelList and LinkedIn can help identify and connect with early-stage financiers. These platforms have become essential tools for startups, enabling direct outreach and fostering relationships with backers who are actively seeking new opportunities. Notably, 44% of companies or planners are experimenting with popular AI platforms in 2024, indicating a shift towards technology-driven networking strategies that can enhance your outreach efforts.

- Engage with Angel Co-Investors: Joining local angel funding groups or networks, including those linked with fff.network, can provide access to a wider pool of potential co-financiers. Being part of these communities offers valuable insights and facilitates introductions to seasoned investors interested in your sector. Additionally, the fff. Club provides unique opportunities for deal flow and due diligence, enhancing your chances of successful funding.

- Utilize Referrals: Seeking introductions from mutual connections or mentors can significantly enhance your credibility and increase the likelihood of securing meetings with potential investors. Referrals often carry weight and can open doors that might otherwise remain closed.

- Showcase Your Progress: Keeping your network informed about your venture's milestones and achievements is vital. Regular updates not only sustain interest but also demonstrate your dedication and progress, making your venture more visible to potential backers. Moreover, joining the weekly technology and economic updates of the organization can keep you informed and involved with the latest trends, showcasing your proactive stance.

Networking Tips:

- Attend relevant events to meet prospective funders face-to-face, particularly those organized by the group, as personal interactions are essential for cultivating lasting relationships.

- Utilize social media strategically to share insights and updates about your venture, engaging with your audience and drawing attention from financiers. The convenience of online networking saves time (92%) and money (88%), making it an appealing choice for startups.

- Build relationships with mentors who can provide guidance and introduce you to their networks, enhancing your chances of finding the right co-investors.

By implementing these strategies, startups can effectively navigate the landscape of investor funding, increasing their chances of attracting the right angel co-investors to support their growth. Furthermore, recognizing that the probability of launching a business rises with age can assist in customizing methods to involve possible financial backers more efficiently, especially within the cooperative atmosphere of the platform.

Building Lasting Relationships with Angel Co-Investors: Best Practices

Building lasting relationships with angel co-investors hinges on consistent communication and mutual respect, especially in the supportive atmosphere cultivated by our community. Founded by Akim Arhipov, an experienced wealth manager with two successful exits, and Tim Vaino, a lawyer who co-created Latitude59, this platform is dedicated to empowering technology financiers through inclusive financial education. Here are essential best practices to help you nurture these connections:

- Communicate Regularly: Keeping your backers informed about your startup's progress, challenges, and milestones is crucial. Regular updates not only demonstrate transparency but also reinforce the value of their investment, aligning with the fff.club mission of inclusive financial education.

- Seek Feedback: We understand that fostering an environment of open dialogue is vital. Encouraging feedback from your stakeholders can lead to valuable insights that enhance your business strategy, reflecting the collaborative spirit of our community.

- Involve Them in Key Decisions: When appropriate, include your stakeholders in strategic discussions. This involvement nurtures a sense of partnership and can lead to more informed decision-making, empowering technology stakeholders through engagement.

- Show Appreciation: Acknowledging their support and contributions—whether through formal updates or informal check-ins—strengthens the relationship and builds a network of valuable connections. Recognizing their role in your journey is essential.

- Be Transparent: Honesty about challenges and setbacks is fundamental for building trust and credibility. Investors appreciate transparency, which can lead to more constructive discussions and solutions, further enhancing our community's collaborative efforts.

Relationship Management Tips:

- Regular Updates: Consistent communication keeps investors engaged and informed, fostering a sense of belonging in the fff.club community.

- Open Feedback Channels: Encourage dialogue to gain insights and foster collaboration, aligning with our commitment to empowering stakeholders.

- Involvement in Decisions: Including stakeholders in key discussions enhances their commitment and support, vital for successful funding outcomes.

In 2025, statistics indicate that effective communication frequency with stakeholders is paramount, with 30% of companies prioritizing exceptional customer experience. This emphasis aligns with the necessity for new ventures to prioritize relationships with financiers, as sustaining strong connections can lead to improved funding results. As Akim Arhipov states, "financial superpowers should be accessible to everyone," highlighting the importance of inclusivity in these relationships.

By adopting these best practices, new ventures can establish robust, enduring connections with angel co-investors and utilize the resources provided by fff.club, including exclusive insights on deal flow, due diligence, and co-investing opportunities. Furthermore, just as various social media platforms have distinct optimal posting frequencies, startups should customize their communication strategies with stakeholders based on their preferences, enhancing the relevance of the communication tips provided.

Overcoming Challenges in Securing Angel Co-Investment: Solutions for Startups

Startups often encounter significant hurdles when seeking angel co-investors, and insights from Baltic investment leaders like Sten Tamkivi and Kristjan Vilosius can illuminate pathways to success. We understand that these challenges can feel overwhelming, but implementing effective solutions can greatly enhance the chances of securing funding. Here are some common obstacles along with actionable strategies to overcome them:

- Lack of Network: A limited network can hinder access to potential backers. Engaging with startup incubators, such as those advocated by community-focused platforms like fff.club, can be a game-changer. As many have experienced, Sten Tamkivi attributes his early success to the relationships he established through such programs, which offered invaluable introductions to a wide range of financial backers and nurtured crucial growth connections.

- Unclear Value Proposition: Startups must articulate a compelling value proposition that highlights their unique offerings and market potential. A well-defined pitch, supported by the educational resources available through community initiatives, can significantly influence funding interest. Kristjan Vilosius emphasizes that a clear value proposition was crucial in securing funding for his venture, Katana MRP, and suggests that founders leverage community feedback to refine their pitches further.

- Investor Skepticism: Overcoming skepticism is crucial. Startups should proactively address stakeholder concerns by presenting data-driven insights and demonstrating traction through metrics such as user growth or revenue milestones. As Mihkel Torim, a key figure at LHV, highlighted, the club's dedication to providing members with essential insights and resources is crucial for making informed choices, assuring stakeholders of the venture's potential for success.

- Competition for Funding: The startup landscape is crowded, making differentiation essential. Founders should emphasize their unique strengths and market positioning to stand out. Highlighting innovative solutions or niche markets can capture the attention of financiers in a competitive environment. The insights shared by seasoned individuals within the community, including Tamkivi and Vilosius, can offer valuable perspectives on how to effectively navigate this competition.

- Limited Resources: Many new ventures operate with constrained resources, which can impede fundraising efforts. Leveraging online platforms and educational resources, as promoted by community networks, can enhance fundraising knowledge and skills. This proactive approach equips founders with the tools necessary to navigate the funding landscape effectively.

By addressing these challenges head-on and employing strategic solutions, new businesses can significantly improve their chances of attracting angel co-investors. Utilizing insights from accomplished financiers and establishing a strong community network ultimately facilitates successful funding rounds in a global startup ecosystem that includes over 150 million startups, with venture funding amounting to $66.5 billion in Q3 2024.

Managing Post-Investment Relationships with Angel Co-Investors: A Guide

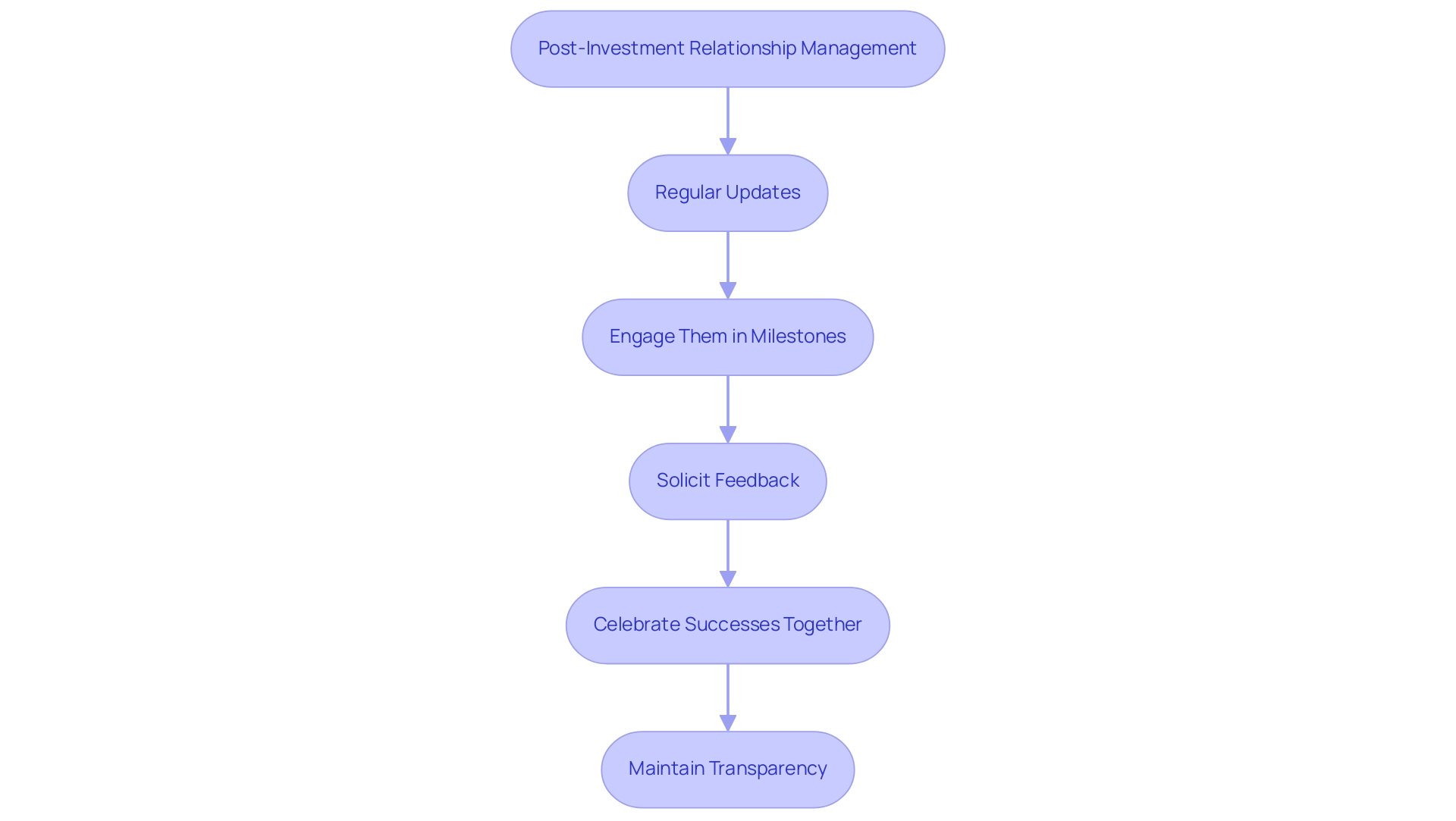

Successfully managing relationships with angel co-investors after securing funding is crucial for ensuring ongoing support and collaboration, particularly within the community-driven framework at fff.club, which boasts over 400 engaged members. We understand that nurturing these relationships can be challenging, but here are essential strategies to foster them:

-

Regular Updates: Consistently informing your stakeholders about your progress, challenges, and future plans is vital. This transparency not only keeps them engaged but also reinforces their confidence in your leadership. As many of our members have experienced, the significance of utilizing technology to enhance communication with stakeholders cannot be overstated, as emphasized by Martin Villig, Co-Founder of Bolt.

-

Engage Them in Milestones: Actively involving your stakeholders in significant milestones and decision-making processes fosters a sense of partnership and shared ownership of the venture's success. Statistics reveal that 73% of participants prefer to be involved in milestone celebrations, underscoring the value of shared successes within the collaborative environment that fff.club promotes.

-

Solicit Feedback: Encouraging your stakeholders to share their insights and advice based on their experiences enhances your decision-making and makes them feel appreciated and essential to the process. At fff.club, the diverse expertise of members provides a rich source of insights for startups.

-

Celebrate Successes Together: Acknowledging and celebrating achievements with your stakeholders strengthens the bond and enhances mutual satisfaction. Organizations that prioritize quality stakeholder relations are likely to see higher satisfaction rates, as indicated by customer satisfaction statistics showing a strong correlation between good relationships and overall satisfaction.

-

Maintain Transparency: Being candid about challenges and setbacks fosters trust and credibility, essential elements of a robust relationship with stakeholders. Significantly, 73% of consumers are inclined to change after several negative experiences, which reflects the possible repercussions of overlooking relationships with funders.

Post-Investment Relationship Tips:

- Ongoing communication is essential for keeping funders informed and involved within the supportive community at fff.club, which includes access to educational resources and participation in exclusive events.

- Engaging funders in crucial milestones enhances their sense of partnership and connection.

- Openness regarding difficulties builds trust and fortifies relationships.

In 2025, the significance of regular updates cannot be emphasized enough, as research shows that new ventures that maintain consistent communication with their funders experience a notable rise in engagement and support. Moreover, with two-thirds of marketers intending to boost their video marketing budget, new businesses might consider utilizing video updates as a tactic for attracting funding. By implementing these strategies, startups can effectively manage their post-investment relationships, ensuring that angel co-investors remain engaged and supportive throughout the journey.

Conclusion

Navigating the landscape of angel co-investing can feel daunting for startups seeking funding, but it also opens up a world of opportunity. Embracing this collaborative investment model not only helps alleviate financial risks but also connects entrepreneurs to a wealth of expertise and networks, significantly enhancing their chances of success. Understanding the motivations of angel investors—whether they seek financial returns or a chance to mentor—empowers startups to craft compelling narratives that truly resonate with potential co-investors.

Preparation is crucial in this journey. Startups should focus on developing solid business plans, creating engaging pitch decks, and building strong teams to attract angel co-investors effectively. Many of our members have found that actively networking and leveraging online platforms can lead to vital connections within the investment community. Building lasting relationships with investors relies on consistent communication, transparency, and involving them in key decisions, fostering a sense of partnership that is essential for long-term support.

As the startup ecosystem continues to flourish, especially in regions bursting with entrepreneurial spirit, the importance of angel co-investing becomes even more pronounced. By acknowledging common challenges and employing strategic solutions, startups can position themselves favorably in the eyes of investors. The journey to securing angel co-investment is filled with potential, and by understanding the dynamics at play, startups can enhance their funding prospects and drive innovation in an increasingly competitive market. Remember, you are not alone in this endeavor; the community is here to support you every step of the way.