Overview

Securing a 0 down RV loan requires understanding eligibility criteria, comparing lenders, and carefully navigating the application process to avoid common pitfalls. The article outlines essential steps such as checking credit scores, gathering documentation, and scrutinizing loan terms, emphasizing that informed decision-making can lead to favorable financing outcomes, especially in a growing RV market.

Introduction

In the realm of recreational vehicle ownership, financing options can often feel overwhelming, especially for those eager to embark on their RV adventures without a hefty down payment. As the popularity of RV living surges, understanding the intricacies of RV loans becomes increasingly vital for potential buyers.

This article delves into the essentials of zero down payment RV loans, exploring:

- Eligibility requirements

- The differences between secured and unsecured financing

- A step-by-step guide to navigating the application process

Additionally, it highlights:

- Common pitfalls to avoid

- The key terms to scrutinize in financing agreements

This empowers readers to make informed decisions in this exciting journey toward RV ownership.

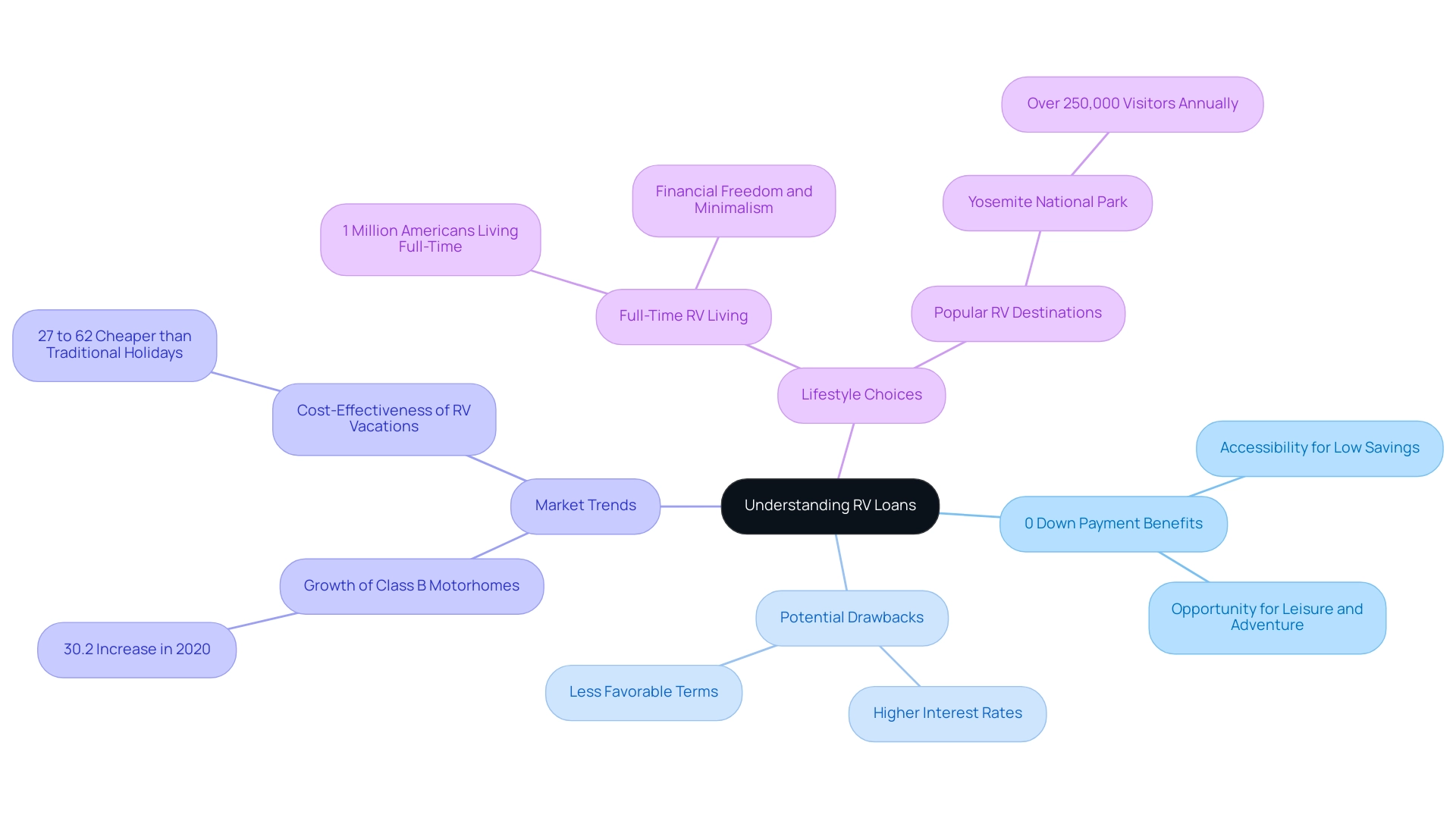

Understanding RV Loans: The Basics of Financing Without a Down Payment

RV loans provide a specialized funding option for individuals seeking to acquire recreational vehicles with a 0 down RV loan, alleviating the burden of a substantial down payment. This option is particularly advantageous for those without substantial savings who still aspire to invest in an RV for a variety of uses, including leisure and adventure. Lenders typically assess the RV's value alongside the borrower’s creditworthiness to determine eligibility for these financings.

As the RV sector is undergoing significant expansion, especially with Class B motorhomes, which experienced an impressive 30.2% rise in 2020, comprehending the subtleties of these funding alternatives becomes more crucial.

While the possibility of obtaining a 0 down RV loan is attractive, it is vital for borrowers to recognize the potential compromises. These credits frequently carry higher interest rates or less advantageous conditions compared to conventional funding that necessitates an upfront payment. Therefore, borrowers must carefully evaluate the terms and conditions related to these agreements to make informed choices.

The increasing popularity of full-time RV living, with around 1 million Americans choosing this lifestyle due to reduced living expenses and the freedom of mobility, further highlights the allure of RV funding. States like Florida, known for their lack of state income tax, have become hotspots for full-time RVers, reinforcing the financial benefits of this lifestyle choice. Additionally, RV vacations can be over 60% cheaper than traditional holidays, as highlighted by the CBRE Hotels Advisory Group, which found that RV vacations are on average 27% to 62% less expensive on a per day basis compared to other vacation options analyzed.

Popular destinations like Yosemite National Park attract over 250,000 visitors annually, showcasing the recreational opportunities available to RV owners. As we progress through 2024, remaining informed about RV financing choices, including average interest rates and recent trends, is vital for prospective buyers aiming to benefit from a 0 down RV loan.

Eligibility Requirements for 0 Down RV Loans: What You Need to Know

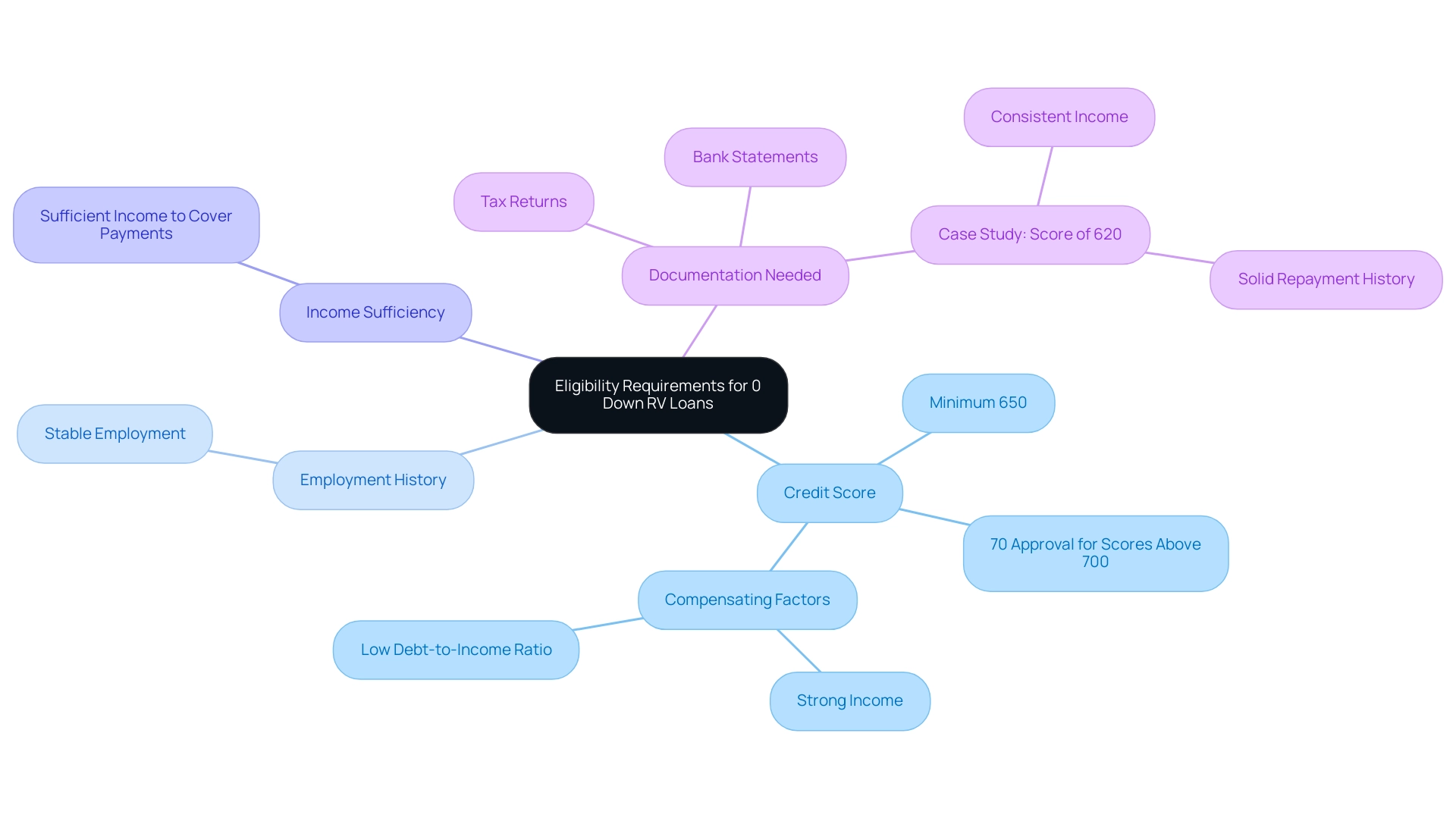

To qualify for a 0 down RV loan, borrowers typically need to meet several important eligibility criteria. Lenders generally require a credit score of at least 650; however, some may consider lower scores if compensating factors, such as a strong income or a low debt-to-income ratio, are present. According to recent statistics, approximately 70% of borrowers with credit scores above 700 are successfully approved for 0 down RV loans, highlighting the importance of maintaining a good credit profile.

A stable employment history is crucial, along with demonstrating sufficient income to comfortably cover monthly payments. Furthermore, lenders often request comprehensive documentation of monetary history, including bank statements and tax returns, to evaluate the borrower’s repayment capability. In a recent statement, a leading RV lender noted, 'We are willing to work with borrowers who show strong financial management, even if their credit scores are slightly below our typical threshold.'

Considering that credit scores play a pivotal role in approvals, prospective borrowers should proactively review their credit reports and take necessary steps to enhance their scores before applying. For example, a case study of a borrower who secured a 0 down RV loan despite a credit score of 620 illustrates that demonstrating consistent income and a solid repayment history can lead to favorable terms.

Exploring Different Types of RV Loans: Secured vs. Unsecured Financing

When examining RV financing choices, it's essential to comprehend the distinctions between secured and unsecured credit. Secured RV financing utilizes the vehicle itself as collateral, which means that in the event of default, the lender has the right to repossess the RV. This arrangement typically results in lower interest rates, as lenders face reduced risk.

In contrast, unsecured RV financing does not require collateral, making them a more precarious choice for lenders. Consequently, these financial agreements often come with higher interest rates to compensate for the increased risk. Notably, a credit score ranging from 660 to 700 is generally required to secure favorable terms for RV financing.

For example, LightStream offers RV financing ranging from $5,000 to $100,000 with same-day funding available, catering to borrowers with good to excellent credit. While they provide quick funding, it's important to note that their financial amounts may not suffice for high-end RV purchases, and they do not allow prequalification. Therefore, individuals must assess their financial landscape and preferences carefully.

While secured financing may provide more beneficial terms, they inherently carry the risk of losing the RV if payments are not upheld. Additionally, current legal reforms and changes in eviction policies can influence repossession rates, potentially impacting the RV financing landscape. According to the editorial team at Bankrate,

Our staff writers have a wide range of experience, education, and certifications to give you unbiased information you need to make important borrowing decisions.

Thus, borrowers are encouraged to weigh their options thoughtfully, considering both the potential benefits and the risks associated with each type of credit.

Step-by-Step Guide to Applying for a 0 Down RV Loan

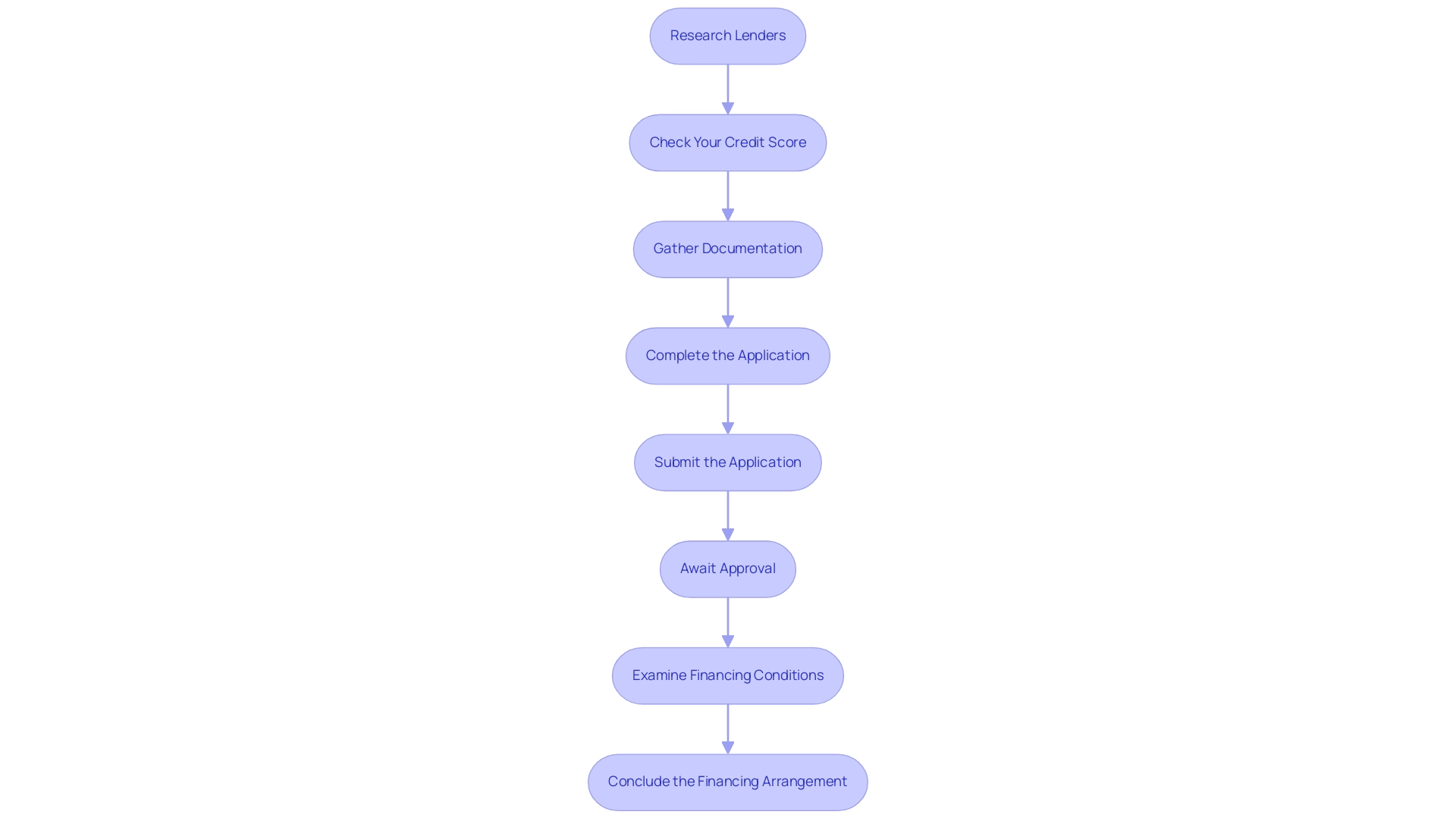

- Research Lenders: Begin by investigating lenders that specialize in 0 down RV loan financing. Compare interest rates, borrowing conditions, and customer feedback to identify the lender that best matches your monetary objectives.

- Check Your Credit Score: Before submitting an application, evaluate your credit score and history. Understanding your credit profile will not only clarify your eligibility but also prepare you for lender discussions.

- Gather Documentation: Assemble all necessary documents, which typically include proof of income, bank statements, and tax returns. Having these documents ready can significantly expedite the application process.

- Complete the Application: Accurately fill out the application, ensuring all information is complete. Be ready to discuss your financial situation and the rationale behind your request for a 0 down RV loan.

- Submit the Application: After thoroughly reviewing your application for any errors, submit it to your chosen lender. Retain copies of all documents submitted for your personal records.

- Await Approval: Post-submission, the lender will evaluate your application and may ask for additional information. Prompt responses to these requests can help speed up the approval process, which in 2024 averages around a few days to a week.

- Examine Financing Conditions: If your application is approved, take the time to meticulously review the financing details and stipulations. Ensure you fully understand your obligations before signing any agreements.

- Conclude the Financing Arrangement: Once you are at ease with the conditions, sign the agreement and finalize any outstanding documents to secure your funding. This crucial final step will set you on the path to enjoying your RV adventures, which, according to recent statistics, includes an average of 4,500 miles driven annually by Rivers and three trips per year for 90% of travel trailer owners. Additionally, as noted by the CBRE Hotels Advisory Group, RV vacations are by far the most economical, being 27% to 62% less expensive on a per day basis compared to other vacation options. This financial advantage, along with the increasing trend of approximately 1 million Americans residing full-time in RVs for reduced living expenses and mobility flexibility, highlights the importance of obtaining favorable financing alternatives like a 0 down RV loan.

Avoiding Common Pitfalls: Tips for Securing Your RV Loan Successfully

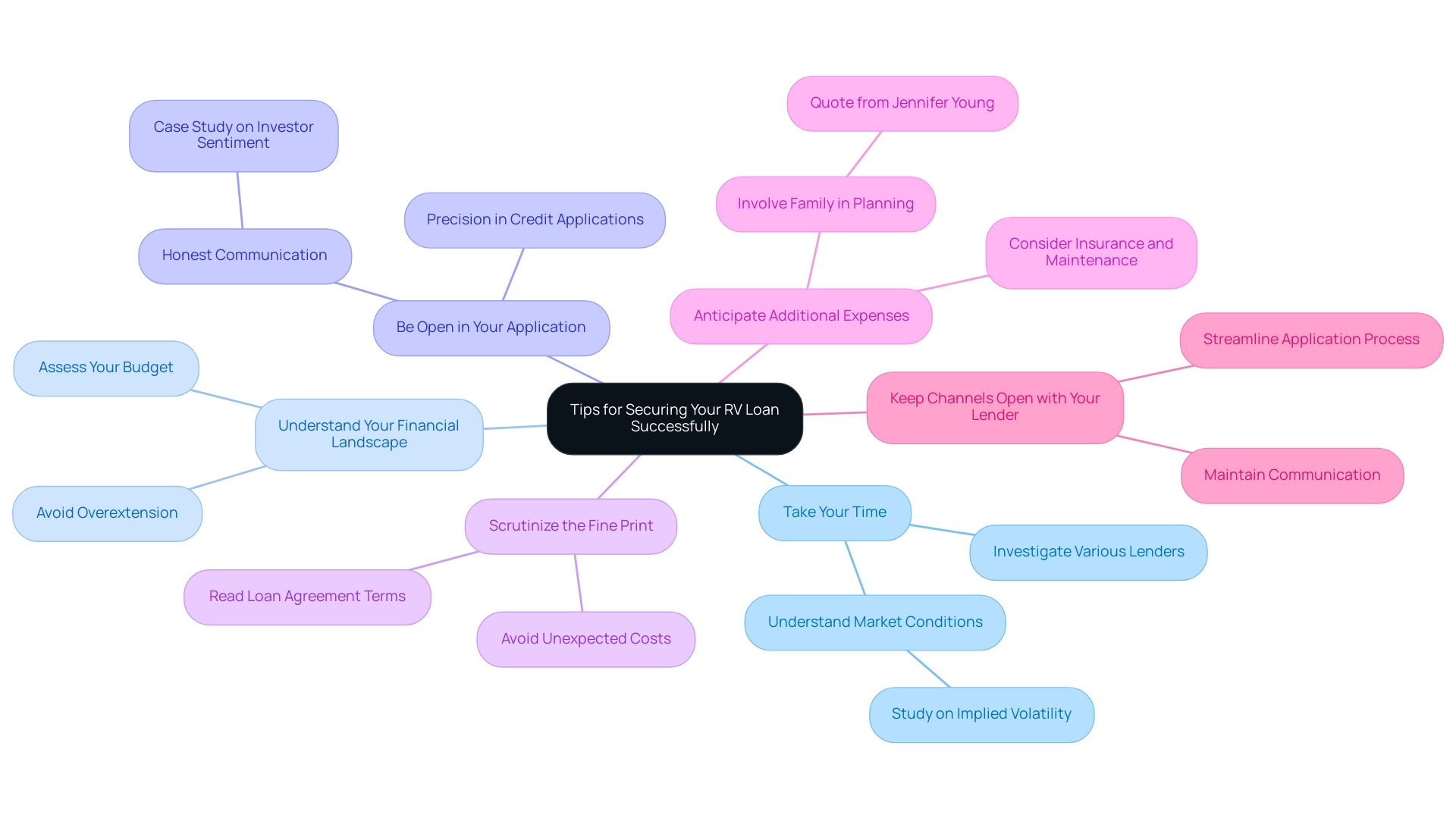

- Take Your Time: Rushing the financing process can lead to poor decisions and unfavorable terms. It's essential to investigate and evaluate various lenders, as this diligence can significantly impact the total expense of your 0 down rv loan. According to a study analyzing the volatility of implied volatility (VOV) across 6023 firms, understanding market conditions can greatly influence borrowing decisions.

- Understand Your Financial Landscape: Before diving into applications, assess your budget thoroughly. Having a clear understanding of your monetary situation helps prevent the overextension of your resources, a common pitfall that leads many to regret their borrowing decisions. As monetary specialists recommend, being open about your budget is essential.

- Be Open in Your Application: Precision is vital when completing credit applications. Misrepresentation of your monetary situation can result in denial or complications down the line, an issue that many applicants face in 2024. This aligns with findings from the case study on retail versus institutional investor sentiment, which highlights the importance of honest communication in monetary dealings.

- Scrutinize the Fine Print: Never underestimate the importance of the loan agreement. Carefully reading the terms related to interest rates, fees, and repayment schedules is essential to avoid unexpected costs in the future. Overlooking these details can lead to significant monetary pitfalls, similar to those seen in stock performance influenced by investor sentiment.

- Anticipate Additional Expenses: RV ownership entails more than just the purchase price; when considering a 0 down rv loan, expenses for insurance, maintenance, and registration should be factored into your overall budget. Comprehending these additional expenses is essential as they can greatly affect your economic viability. Jennifer Young notes that involving family in planning can help manage these costs effectively.

- Keep Channels Open with Your Lender: Maintaining communication with your lender throughout the application process can streamline your experience. Open dialogue allows for quick resolutions to any issues that may arise, ensuring your application remains on track. Financial specialists consistently recommend this practice as a key strategy for effective debt management.

Decoding Loan Terms: What to Look for in Your RV Financing Agreement

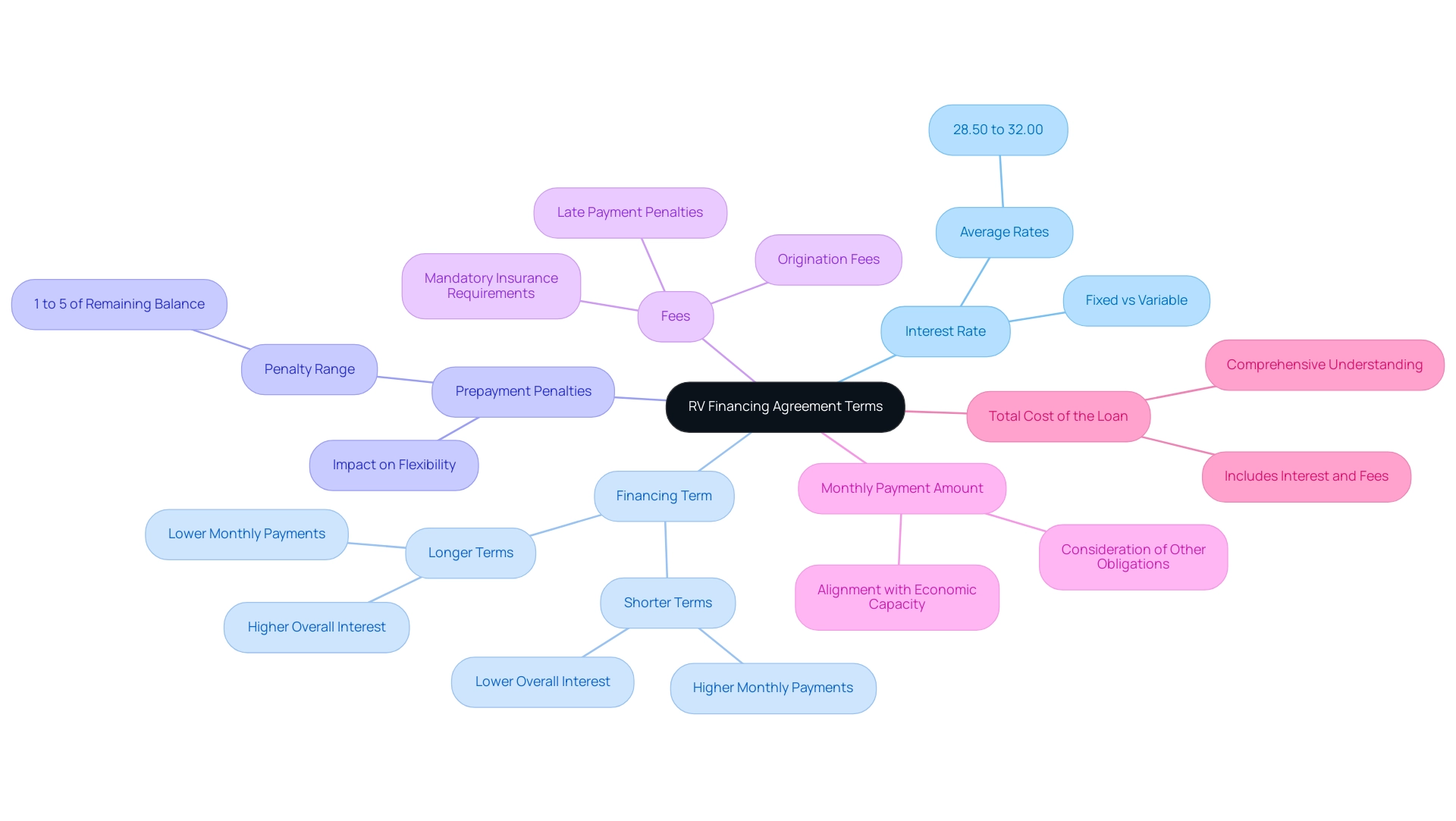

When evaluating your RV financing agreement, it's crucial to carefully scrutinize several key terms that can significantly impact your financial commitments:

- Interest Rate: Determine whether the rate is fixed or variable, as this decision influences your monthly payments. Given that average personal borrowing interest rates can range from 28.50% to 32.00%, understanding this aspect is vital for informed decision-making.

- Financing Term: The duration of the financing influences the total interest paid over time. Generally, shorter borrowing terms may result in higher monthly payments but lower overall interest expenses, making it essential to balance between affordability and cost.

- Prepayment Penalties: Investigate whether there are penalties associated with early repayment of the debt. These penalties can hinder your monetary flexibility, especially if your circumstances change. According to recent statistics, many RV loans include prepayment penalties that can range from 1% to 5% of the remaining loan balance, which could significantly affect your ability to pay off the loan early.

- Fees: Be vigilant about any additional charges, such as origination fees, late payment penalties, or mandatory insurance requirements. These costs can accumulate and impact your overall budget.

- Monthly Payment Amount: Ensure that the monthly payment aligns with your economic capacity, taking into account all other obligations. This alignment is crucial for maintaining economic health.

- Total Cost of the Loan: Evaluate the total cost of the loan over its duration, including interest and fees. This thorough comprehension is essential to grasping the full scope of your monetary commitment.

In light of recent trends in RV funding agreements, understanding these terms is more crucial than ever. With the average price of unleaded gasoline increasing by 1.3% to $3.16 per gallon in January and continuing to rise, cost considerations become even more critical for potential RV owners. This increase can influence overall travel expenses and, therefore, the economic viability of RV ownership.

As Prosper, a pioneer in personal loans, emphasizes, having a clear grasp of your financing options is essential for making sound investment decisions. Furthermore, education and training, as illustrated by the Cummins Apprentice Programs, can empower borrowers to navigate these financial landscapes more effectively, ensuring they make informed choices that align with their technological investments.

Conclusion

Understanding the intricacies of zero down payment RV loans is crucial for potential buyers eager to dive into the world of recreational vehicle ownership. This article has outlined the essential components of securing financing without a hefty initial investment, covering:

- Eligibility requirements

- The distinctions between secured and unsecured loans

- A detailed application process

Navigating these loans requires careful consideration of the associated risks, including potentially higher interest rates and less favorable terms. By being aware of these pitfalls and approaching the application process with diligence—such as:

- Checking credit scores

- Gathering necessary documentation

- Scrutinizing loan agreements

Borrowers can position themselves for success in their RV financing journey.

Ultimately, the allure of RV ownership, whether for travel or full-time living, is within reach for many, especially with the financial advantages highlighted throughout this article. Armed with knowledge about the various financing options and a keen awareness of what to look out for, prospective RV owners can confidently embark on their adventures, transforming their dreams of exploration into reality.