Overview

The article provides a comprehensive step-by-step guide on how to secure a zero down car lease, emphasizing the importance of understanding the financial implications and terms involved. It explains that while a zero down lease allows individuals to acquire a vehicle without an upfront payment, it often results in higher monthly payments and requires careful consideration of factors such as credit scores, mileage limits, and potential penalties, which are crucial for informed decision-making.

Introduction

Navigating the world of car leasing can be daunting, especially when considering options like zero down leases. This leasing arrangement allows individuals to drive away in a new vehicle without the burden of an upfront payment, making it an appealing choice for many. However, it is essential to understand the intricacies involved, including:

- Potential higher monthly payments

- Mileage restrictions

- Other financial implications that could affect the overall cost of leasing

As consumer preferences shift towards leasing over purchasing, particularly in light of rising vehicle prices and interest rates, a thorough examination of the benefits and drawbacks of zero down leases becomes crucial. This article delves into the key aspects of zero down car leases, providing insights into their financial implications, advantages, and essential steps for securing one.

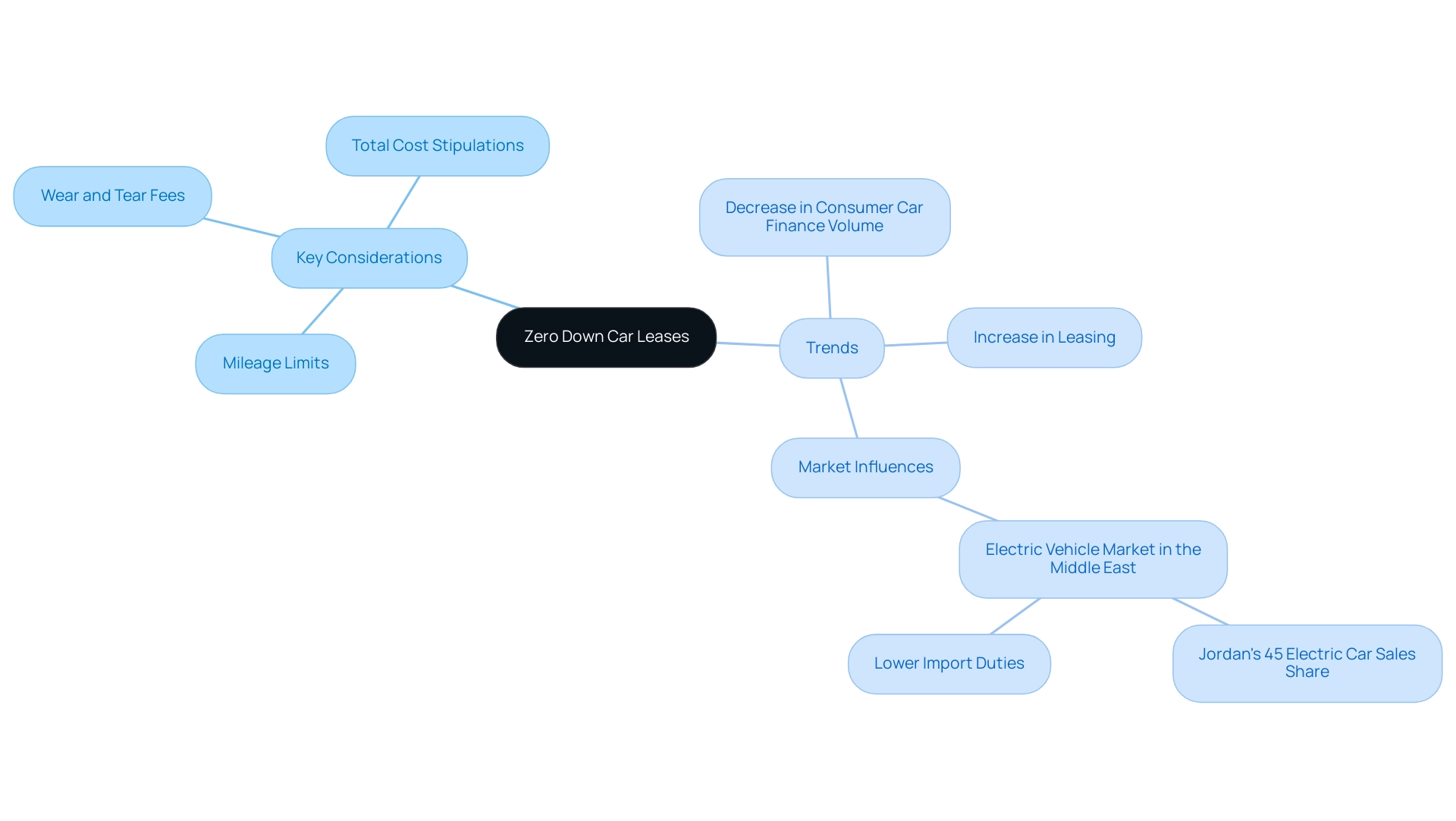

Understanding Zero Down Car Leases: What You Need to Know

A 0 down for car lease agreement allows individuals to obtain an automobile without any initial payment, making it an appealing option for those who wish to evade upfront expenses. This leasing option typically allows for 0 down for car lease by incorporating the down payment into the monthly payment structure, thereby lowering the barrier to entry for vehicle access. However, it is imperative to fully comprehend the terms and conditions associated with these agreements.

Key considerations include:

- Mileage limits

- Potential excess wear and tear fees

- Other stipulations that may impact the total cost over the lease duration

Recent trends indicate a shift in consumer preferences, with an anticipated increase in the percentage of new cars leased rather than purchased through financing. This trend is underscored by a reported decrease of 8% in new business volumes for consumer car finance in March 2023, according to the Finance & Leasing Association (FLA).

Additionally, the effective interest rate of outstanding household loans in the UK, currently at 6.97%, further emphasizes the financial landscape affecting rental options. Furthermore, as the market evolves, prospective tenants should thoroughly review all terms and conditions, ensuring they are well-informed and prepared for their rental commitments. Notably, the electric auto market in the Middle East, where Jordan leads with over 45% electric car sales share, demonstrates how lower import duties compared to internal combustion engine transports can influence leasing trends in emerging markets.

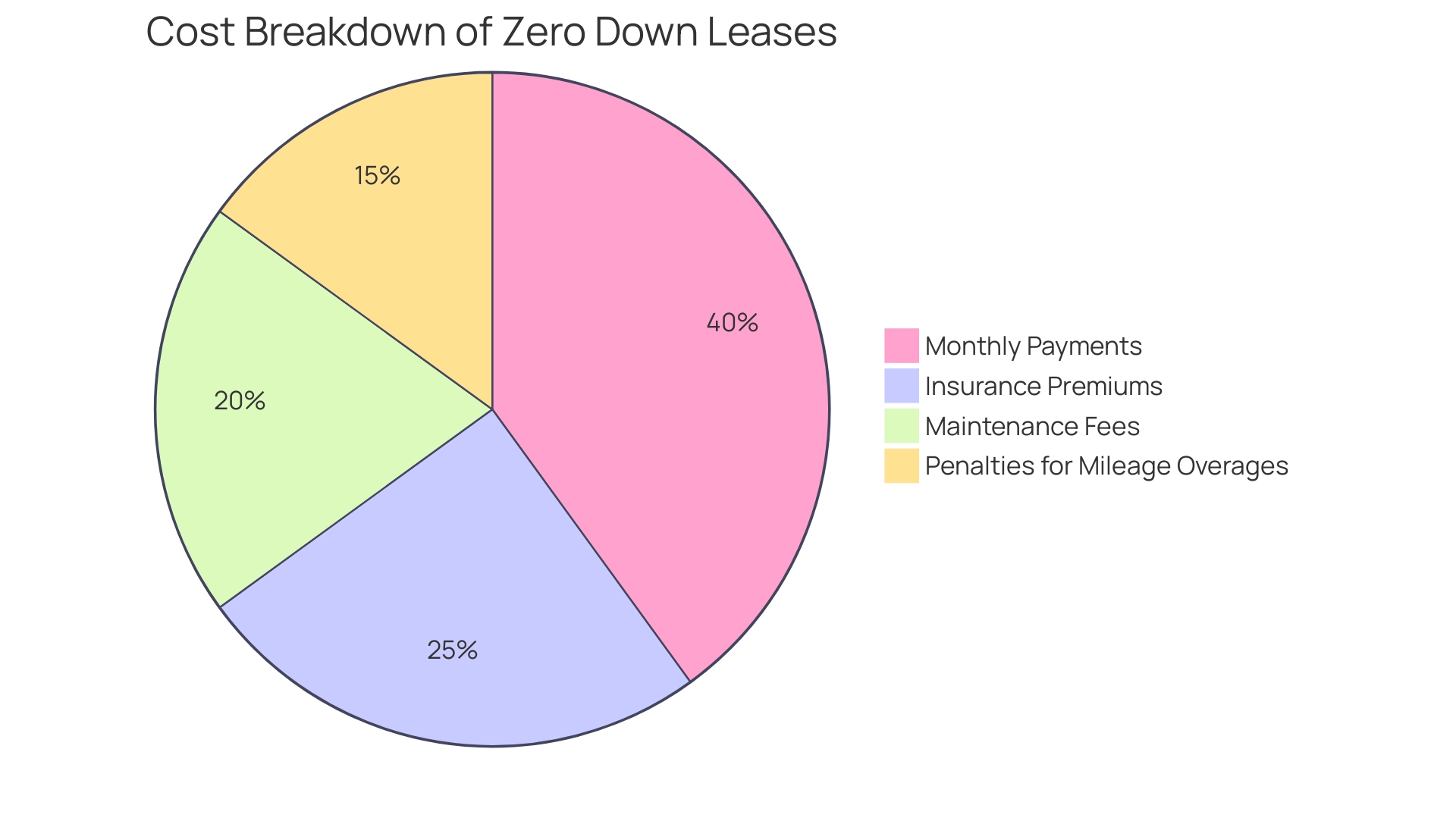

Financial Implications of Zero Down Leases: Costs and Considerations

Renting an automobile with no initial payment typically leads to increased monthly costs compared to standard agreements that necessitate an advance payment. This increase can be attributed to elevated interest rates often associated with 0 down for car lease agreements, which may escalate overall financial obligations. For instance, recent studies indicate that the average price difference between buying outright and financing a car stands at $8,354, with specific models like the GMC Sierra reflecting an even larger discrepancy of $11,370.

Consequently, it is imperative to thoroughly evaluate your budget to ascertain whether the higher monthly payments align with your financial strategy. It is also vital to comprehend all elements of the rental contract, including possible expenses such as excess mileage, which can greatly influence your total outlays. Furthermore, the supply chain disruptions have affected availability and pricing of automobiles, influencing the choice between renting and owning.

While possessing a vehicle provides stability during market instabilities, renting may entail higher expenses or difficulties due to shortages. Alongside the monthly rental payments, potential tenants should consider other possible expenses, such as:

- Insurance premiums

- Maintenance fees

- Penalties for surpassing mileage limits

As John Tallodi advises, improving your credit rating requires making regular monthly payments on time and keeping your credit utilization low.

Carrying out a thorough examination of the overall expense of leasing, especially with options such as 0 down for car lease throughout the term, can offer valuable insights into the full financial impact and facilitate informed decision-making.

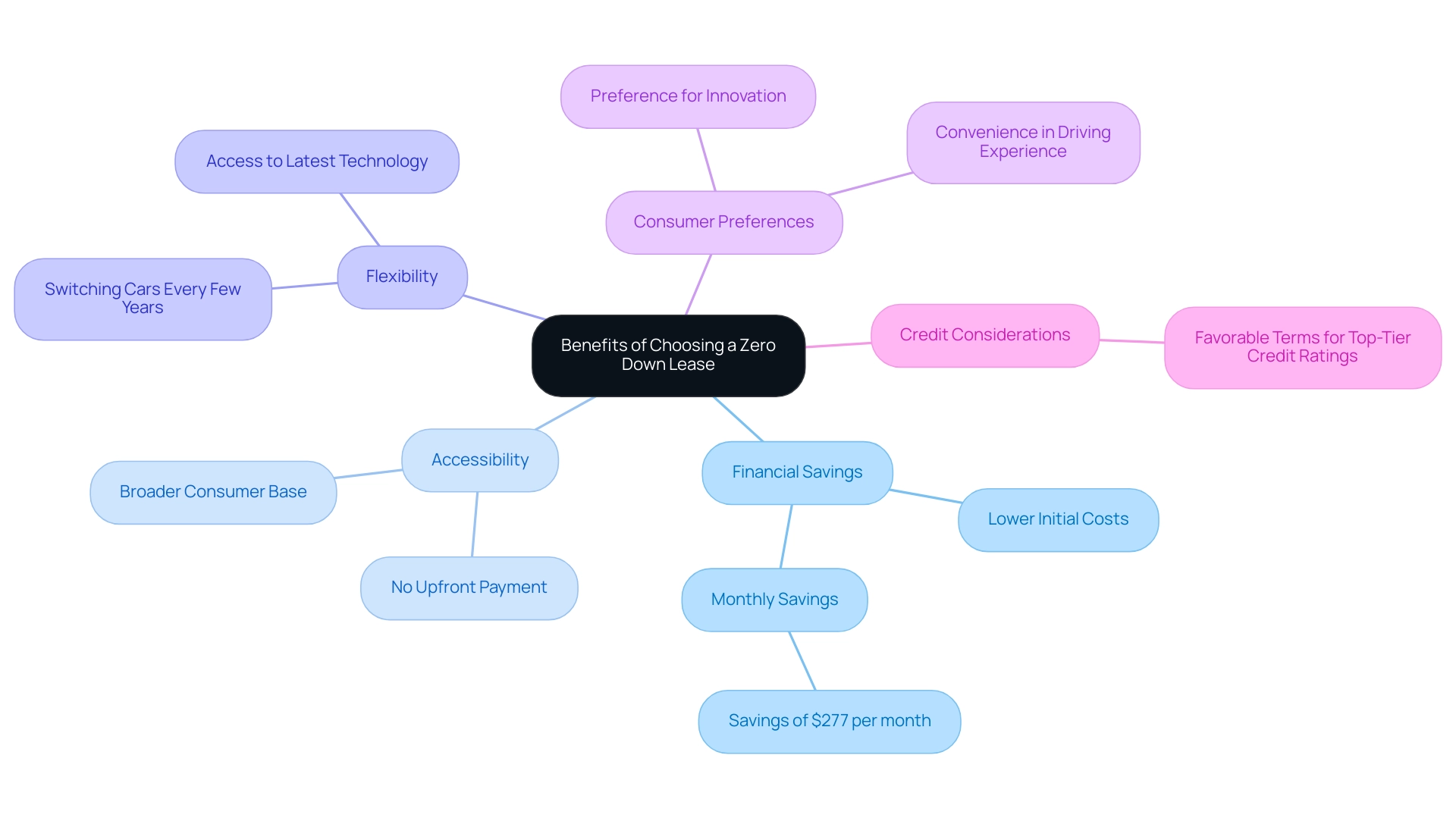

Benefits of Choosing a Zero Down Lease: Why It Might Be Right for You

One of the principal advantages of a 0 down for car lease agreement is the opportunity to drive a new vehicle without the financial burden of an upfront payment. This feature is especially attractive for consumers who prefer to direct their capital toward other investments or expenses, such as taking advantage of 0 down for car lease options. Furthermore, leases with 0 down for car lease frequently entail lower overall initial costs, broadening accessibility to a diverse range of consumers.

For instance, opting for a seven-year term to borrow $25,000 at 5.09% can save a new-car buyer around $277 per month compared to five-year financing at the same rate. This statistic emphasizes the financial advantages linked to renting. Moreover, the Ford Puma, a compact crossover SUV lauded for its nimble handling and fuel economy, serves as a prime illustration of an option that corresponds with the benefits of zero down financing.

This rental framework also offers the flexibility to switch cars every few years, aligning with the preferences of many contemporary drivers who prioritize access to the latest technology and features. According to recent consumer reports, this approach has proven beneficial for individuals who appreciate innovation and convenience in their driving experience. As noted by Jim Gorzelany, a senior contributor,

As always, be sure to run the numbers on any vehicle under consideration to see if renting or financing a given model for various available term lengths from multiple sources will warrant the best overall deal.

This insight emphasizes the importance of evaluating individual circumstances when considering financing options like 0 down for car lease. It is also important to note that rental terms are most favorable for individuals with top-tier credit ratings, which is a crucial financial consideration for tech investors.

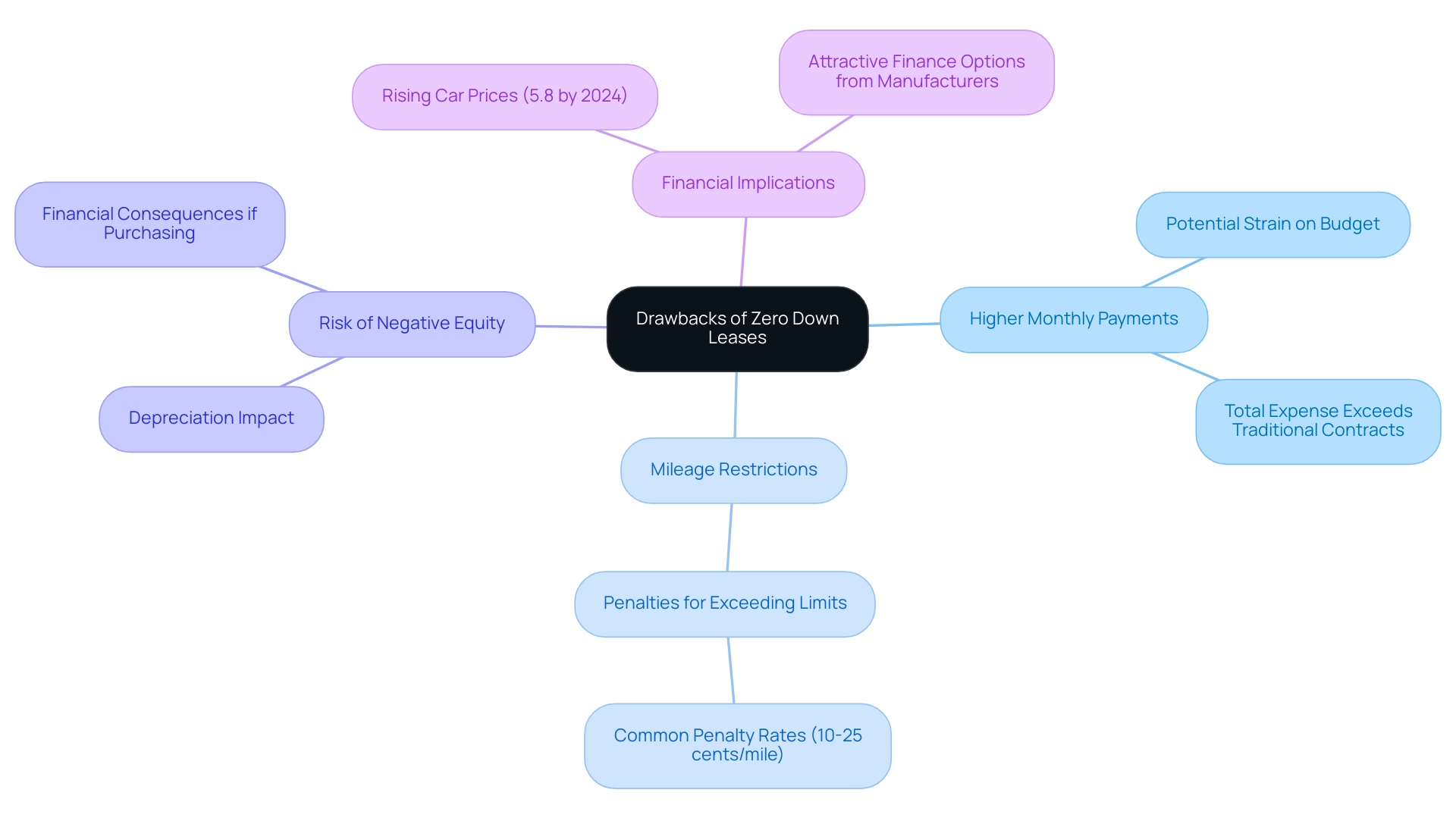

Drawbacks of Zero Down Leases: What to Watch Out For

While 0 down for car lease agreements provide instant financial relief by eliminating initial expenses, they also have significant disadvantages that necessitate careful evaluation. One significant concern is the potential for higher monthly payments, which can place a strain on your budget. According to industry forecasts, new automobile prices are expected to increase by 5.8% by the end of 2024, which may further affect rental rates and the overall expense of renting a vehicle.

Consequently, the total expense of a zero down arrangement can exceed that of a traditional contract due to elevated interest rates. Additionally, these leases often impose mileage restrictions, and exceeding these limits can lead to substantial penalties; it is common for penalties to range from 10 to 25 cents per mile over the agreed limit. Jim Gorzelany, a senior contributor, advises:

As always, be sure to run the numbers on any automobile under consideration to see if leasing or financing a given model for various available term lengths from multiple sources will warrant the best overall deal.

Furthermore, it's essential to consider the risk of negative equity, especially if the asset depreciates more rapidly than expected. This can significantly impact your financial situation if you opt to purchase the car at the end of the lease term. However, it's important to note that renting can be beneficial for those who do not want to own a vehicle long-term, allowing them to return the vehicle without the hassle of selling it.

The case study 'Is Leasing Right for You?' demonstrates that renting might be a good option for individuals who like to change cars every 2-3 years and prefer lower monthly payments with minimal maintenance costs. Moreover, manufacturers are currently offering attractive finance options to help mitigate the impacts of rising car prices, making leasing a more appealing choice for some consumers.

Therefore, while 0 down for car lease agreements can be appealing, it is crucial to understand their financial implications for making informed decisions.

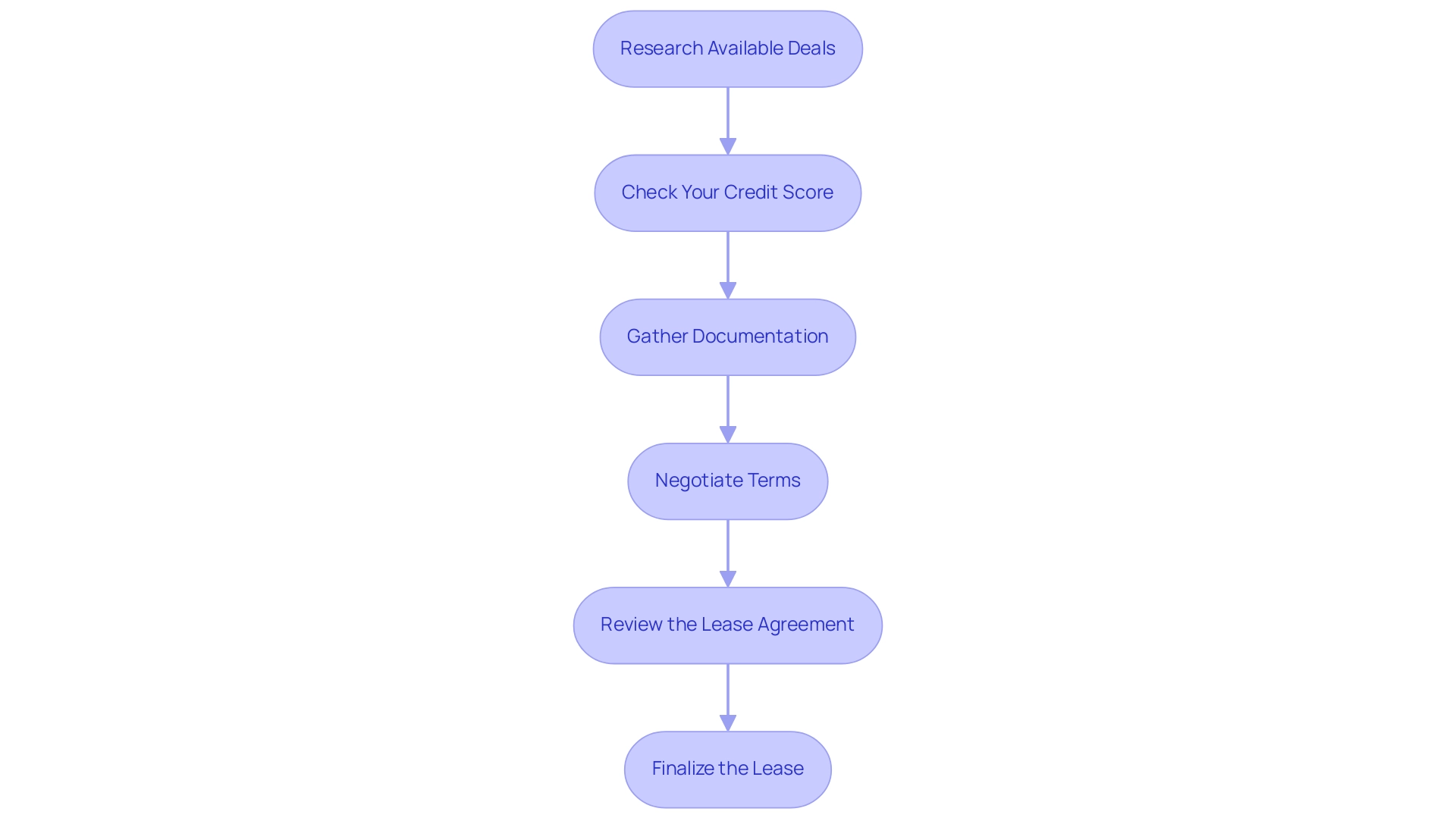

Step-by-Step Guide to Securing a Zero Down Car Lease

-

Research available deals by conducting thorough research on dealerships and online platforms that specialize in 0 down for car lease agreements. Compare various offers, terms, and conditions to identify the most favorable deal that aligns with your requirements. With approximately 2.88 million EVs on the roads in the US, the market for electric transportation is expanding, making it essential to find competitive leasing options.

Check Your Credit Score: A solid credit score is typically essential for qualifying for 0 down for car lease agreements. Obtain your credit report and rectify any inaccuracies prior to submitting your application, as this could significantly impact your financing options.

-

Gather Documentation: Assemble all necessary documentation, including proof of income, residency, and identification. Having these documents readily available will expedite the application process and enhance your credibility with lenders.

-

Negotiate Terms: After choosing your preferred vehicle, engage in negotiations with the dealership regarding the rental conditions. Clearly communicate your preference for a 0 down for car lease agreement and discuss important factors such as monthly payments, interest rates, and mileage limits. According to industry experts, effective negotiation can yield more favorable rental conditions. Additionally, consider the implications of the new Vehicle Excise Duty tax starting in April 2025, which will influence the overall expense of leasing electric vehicles.

Review the Lease Agreement: Prior to signing, meticulously review the lease agreement. Ensure that you fully comprehend all terms, including associated fees, penalties for early termination, and maintenance responsibilities. This comprehension is essential to prevent unforeseen expenses. For instance, a case study on prediction model development illustrates how data analysis can inform decisions on car leasing and pricing, providing insights into realistic cost expectations.

-

Finalize the Lease: Upon agreement of terms, sign the lease documentation and take possession of your new vehicle. Retain a copy of the agreement for your personal records and strictly adhere to the outlined terms to prevent any penalties or additional charges.

Conclusion

Navigating the complexities of zero down car leases reveals both opportunities and challenges for consumers. These leases provide an appealing option for those looking to avoid upfront costs, allowing access to a new vehicle without the burden of a down payment. However, it is crucial to recognize that this convenience often comes with higher monthly payments and potential financial pitfalls associated with mileage restrictions and excess fees.

Understanding the financial implications is essential. Higher monthly payments may strain budgets, especially in a market where vehicle prices are projected to rise. Moreover, careful consideration of the lease terms and potential costs can help avoid unexpected expenses that may arise during the lease term. For many, the decision to lease rather than buy hinges on individual financial strategies and lifestyle preferences, emphasizing the need for a thorough evaluation of all available options.

Ultimately, securing a zero down lease can be a practical choice for those who value flexibility and access to newer vehicles. By conducting diligent research, checking credit scores, and negotiating terms, prospective lessees can make informed decisions that align with their financial goals. As the automotive landscape continues to evolve, understanding the nuances of leasing will empower consumers to navigate their options effectively and select the best path for their needs.