Overview

A 0 down vehicle lease allows individuals to lease a car without an upfront payment, making it an appealing option due to lower monthly payments and the ability to drive a new vehicle without long-term commitment. The article supports this by detailing the benefits of cash flow management, eligibility requirements, and the step-by-step application process, emphasizing how this leasing model can be accessible and financially advantageous for a wider range of consumers.

Introduction

In the evolving landscape of automotive financing, zero down vehicle leasing emerges as a compelling option for those looking to drive a new car without the financial strain of an initial payment. This innovative model not only allows lessees to enjoy lower monthly payments but also provides the flexibility to drive a new vehicle every few years.

As the market adapts to the increasing popularity of electric vehicles and the growing demand for accessible leasing options, understanding the intricacies of zero down leasing becomes essential. From eligibility requirements to the diverse range of available models, this article delves into the benefits, application processes, and common misconceptions surrounding zero down vehicle leasing, equipping potential lessees with the knowledge needed to make informed decisions in a rapidly changing market.

Understanding Zero Down Vehicle Leasing

A 0 down vehicle lease offers a creative way to operate a new car without the burden of an upfront cost. This model enables lessees to enjoy the advantages of a new automobile with a 0 down vehicle lease, bypassing the upfront costs commonly associated with traditional purchasing. Significantly, lease payments are usually lower than those of auto loans, as they are determined based on the asset's depreciation during the lease term instead of its total price.

This makes a 0 down vehicle lease an appealing choice for many. As the vehicle rental industry continues to evolve, significant growth is anticipated, particularly with 14 million electric vehicles projected to be sold globally in 2023—a staggering 35% year-on-year increase. The most recent European Economic Forecast also indicates modest growth in equipment investment for 2024, suggesting further opportunities in the rental sector.

Experts like Charlie Jardine, CEO of EO Charging, assert that the EV market is on the brink of substantial growth, fueled by decreasing costs and robust government support. Additionally, the World Leasing Yearbook highlights that Estonia has maintained one of the highest annual rental volumes as a percentage of GDP worldwide for the past fifteen years, providing valuable insight into global rental trends. This context is essential for tech investors to consider as they evaluate the potential of 0 down vehicle lease options in a rapidly changing market landscape.

Furthermore, the FinTech Market's SaaS rental system exemplifies how technology can streamline operations for rental companies, enhancing efficiency and ensuring compliance while delivering superior customer experiences, which directly supports the zero down rental model. Understanding these dynamics will help you assess whether a 0 down vehicle lease aligns with your financial strategies and investment goals.

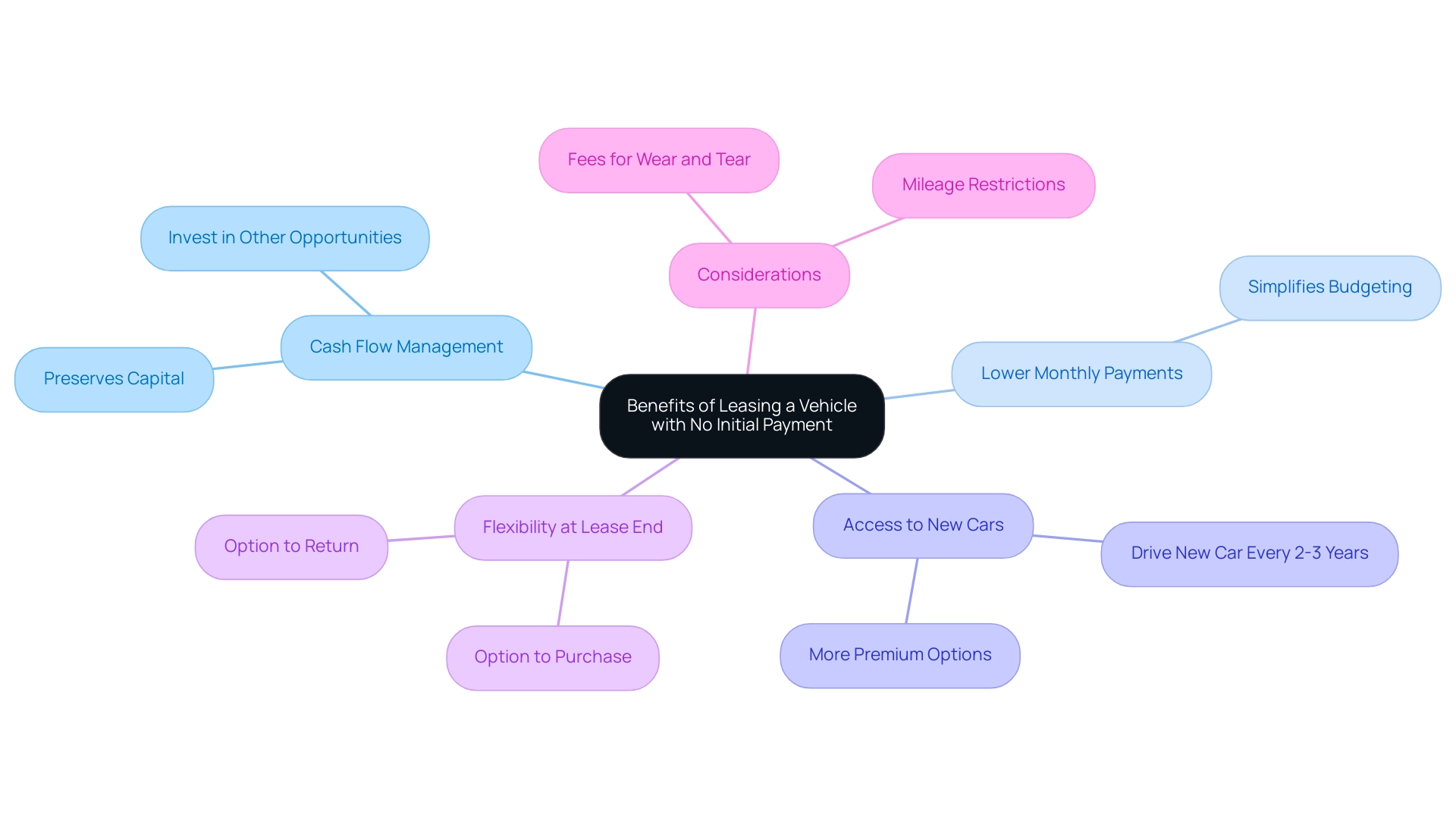

Benefits of Leasing a Vehicle with No Initial Payment

Renting an automobile with a 0 down vehicle lease offers considerable benefits, especially regarding cash flow management. This approach allows you to preserve your capital, enabling you to invest in other opportunities or cover essential expenses. Furthermore, it offers the privilege of operating a new or more premium car than one might usually afford with a conventional deposit.

Significantly, a 0 down vehicle lease often includes lower monthly payments, simplifying your budgeting process. Leasing also allows you to drive a new car every 2 to 3 years, providing a refreshing driving experience without the long-term commitment of ownership. At the conclusion of the lease term, you retain the flexibility to either purchase the car or return it, further enhancing your ownership options.

However, it is crucial to consider associated factors, such as mileage restrictions and potential fees for wear and tear, which can impact the overall rental experience. As Ben Luthi, a distinguished writer with contributions to notable publications such as Time and USA Today, indicates, assessing these factors is crucial for making informed financial choices in the area of vehicle rental. Furthermore, for individuals with limited finances, the drawbacks of purchasing—such as larger initial costs and increased monthly expenses—can make a 0 down vehicle lease a more practical option.

Eligibility Requirements for a 0 Down Lease

To qualify for a 0 down vehicle lease, a good to excellent credit score is typically required, with a benchmark often set at 700 or above. This threshold reflects the general consensus that a score above 800 is considered 'good' according to Experian, although lenders may have varying criteria. Additionally, during busy periods, you could wait for up to five working days for a credit check decision, so it's wise to plan accordingly.

Along with your credit score, lenders will assess your income to ensure that you can comfortably fulfill the monthly obligations. It's essential to be prepared to provide documentation such as pay stubs or tax returns as proof of income. Moreover, a stable employment history can significantly bolster your application, demonstrating reliability to potential lenders.

To enhance your likelihood of obtaining a rental agreement, consider providing a larger initial sum, using a guarantor, or selecting a more economical vehicle. Some dealerships may implement specific eligibility requirements based on their policies, making it prudent to consult directly with them for detailed information. As noted by credit expert Lewis Bromley,

You can also contact Cifas, the UK’s leading fraud prevention service, which can provide additional guidance on securing a lease under favorable terms.

Moreover, it's essential to recognize that obtaining a car loan may initially decrease your credit score because of a hard inquiry, but regular timely contributions can positively affect your score as time progresses, emphasizing the significance of upholding good credit for a 0 down vehicle lease.

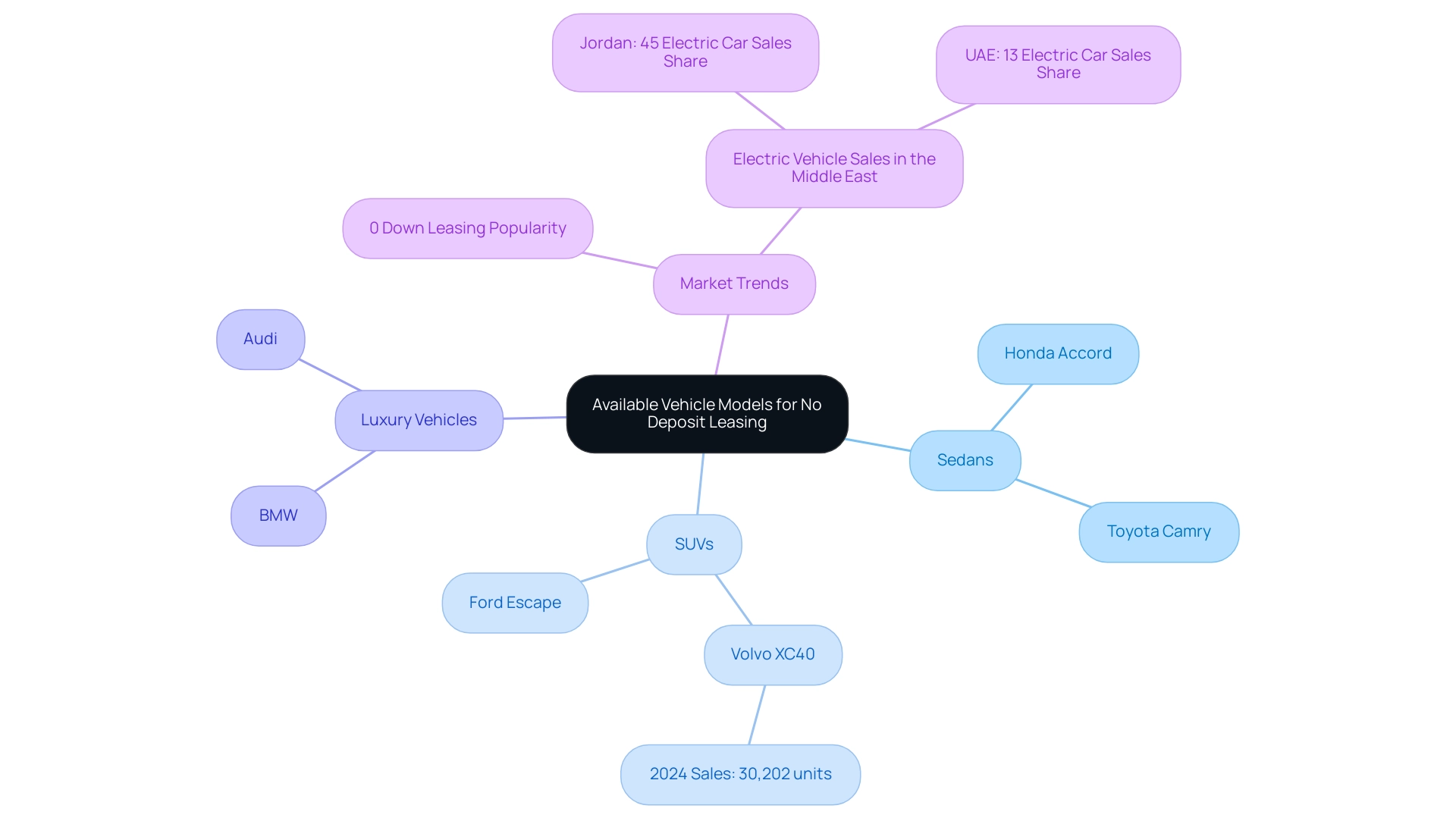

Available Vehicle Models for No Deposit Leasing

An increasing quantity of dealerships are adopting 0 down vehicle lease options as financing alternatives across different vehicle types, catering to various consumer requirements. In 2024, popular models such as the Honda Accord and Toyota Camry remain strong contenders in the sedan segment, while the Ford Escape is favored among SUVs. Notably, the Volvo XC40, which sold 30,202 units in 2024, is also a significant player in the market, making it a viable option for a 0 down vehicle lease.

Luxury brands such as BMW and Audi are offering 0 down vehicle lease options, contingent on dealership promotions and regional availability. This reflects the increasing trend in the automotive market towards more accessible rental options. As Thom Groot of The Electric Car Scheme emphasizes, lower EV prices are essential to encourage mass adoption, especially during current economic challenges.

Therefore, exploring a wide range of models can lead to significant savings for potential lessees. It is essential for them to:

- Shop around

- Inquire about specific availability of cars

- Stay informed about ongoing promotions that fit their budget and lifestyle

Furthermore, case studies from the Middle East, including Jordan's leading 45% electric car sales share due to favorable policies, demonstrate the potential for growth in electric vehicle rentals.

With the right approach, consumers can discover appealing rental opportunities through a 0 down vehicle lease, eliminating the burden of an initial down payment.

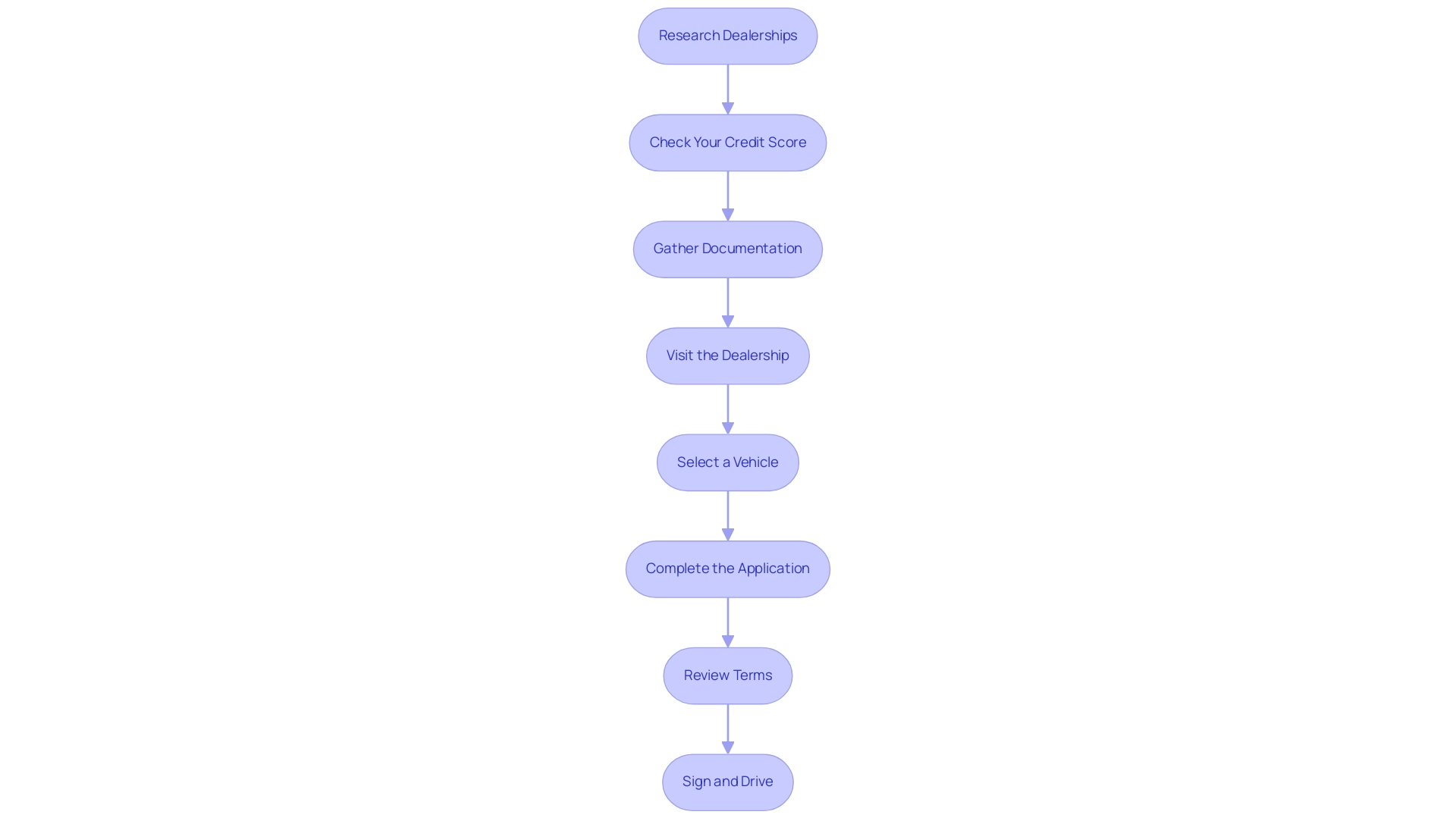

Step-by-Step Application Process for a 0 Down Lease

- Research Dealerships: Begin your journey by identifying dealerships that offer a 0 down vehicle lease. It's essential to look for customer reviews and feedback to gauge their reputation and service quality. As of January 2025, Leasehold Services Ltd has received a perfect rating of 5/5 stars from over 60 verified customers, showcasing their dedication to customer satisfaction.

- Check Your Credit Score: Your credit score plays a pivotal role in the rental process. Obtain your credit report to ensure you meet the eligibility requirements for a 0 down vehicle lease. A good score can significantly enhance your chances of approval.

- Gather Documentation: Prepare all necessary documents, including proof of income, identification, and proof of residence. This paperwork is crucial in demonstrating your financial stability and readiness for rental.

- Visit the Dealership: Once you're ready, visit the dealership and express your interest in a 0 down vehicle lease. Be prepared to discuss your financial situation openly with the sales representatives, as transparency can help in negotiating favorable terms. As Abdi Ali, a Senior Technical Accounting Consultant, emphasizes, "A strategic mindset and commitment to excellence can drive efficiency in the rental process."

- Select a Vehicle: Choose a vehicle from the dealership's inventory that aligns with your needs and budget. Make sure to consider factors such as fuel efficiency and maintenance costs, as these will affect your overall rental experience.

- Complete the Application: Fill out the leasing application thoroughly with your personal and financial information. This is a critical stage where attention to detail can make a difference in your approval process.

- Review Terms: After submission, carefully review the rental agreement terms, including monthly payments, mileage limits, and end-of-rental options. Understanding these details is essential to avoid potential surprises later on. Additionally, consider the end-of-contract tips: return the car in a safe and roadworthy condition, with all documentation, spare keys, and equipment, and ensure it is serviced according to the manufacturer's schedule.

- Sign and Drive: Upon approval, sign the rental agreement and enjoy the freedom of driving your new vehicle. Remember, the useful life of the underlying asset is typically around 25 years, a testament to the value of your new agreement. For small enterprises, utilizing software solutions like LeaseGuru powered by FinQuery can enhance rental accounting management, ensuring compliance and efficiency.

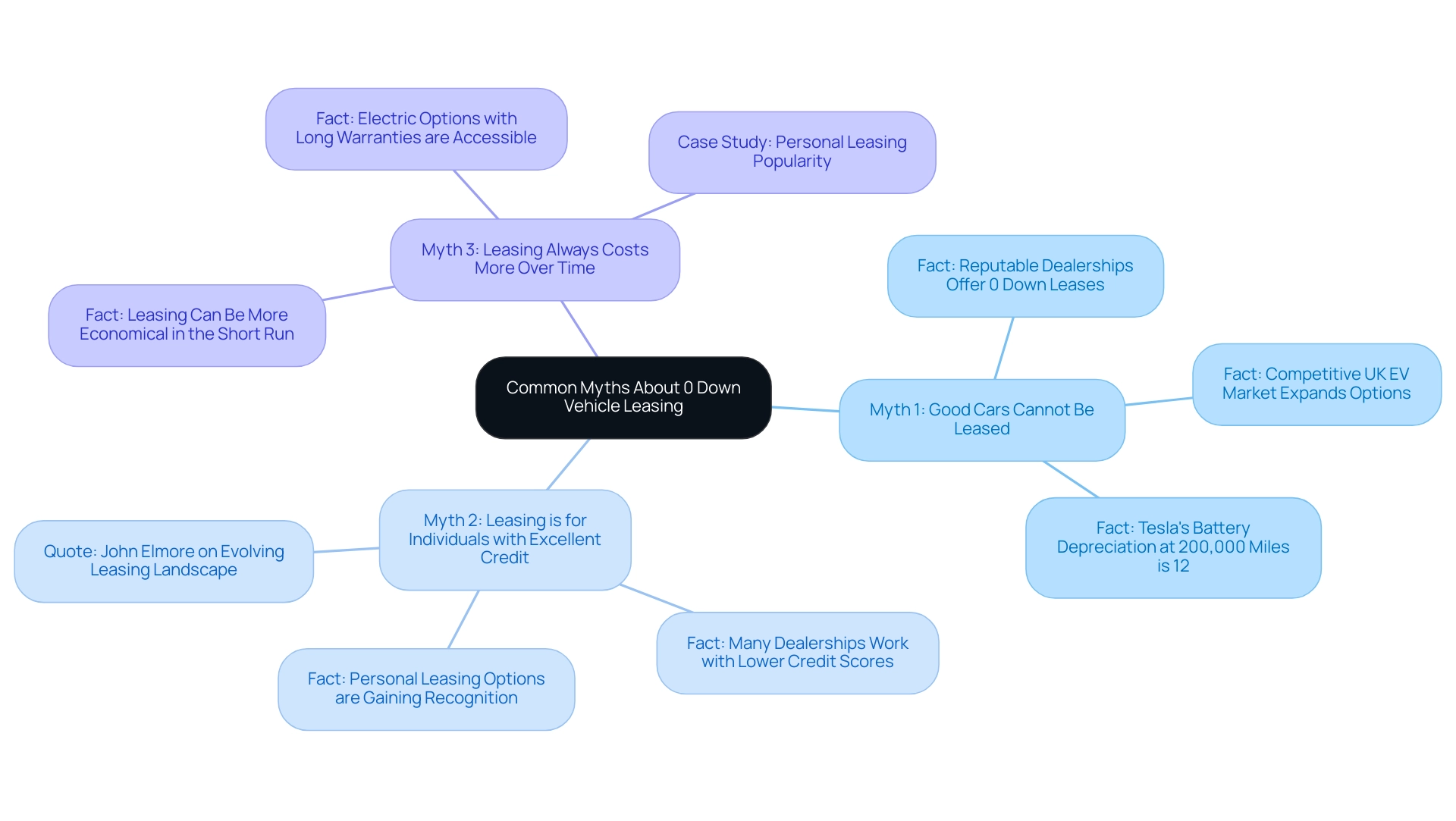

Common Myths and FAQs About 0 Down Vehicle Leasing

Myth 1: A good car cannot be obtained through a zero down agreement.

Fact: Contrary to this belief, numerous reputable dealerships offer a diverse selection of automobiles available for a 0 down vehicle lease. This trend is supported by the increasing competitiveness of the UK EV market, particularly with the emergence of East Asian brands, which further expands consumer options.

Additionally, Tesla's average battery depreciation at 200,000 miles is only 12%, showcasing the reliability of electric vehicles in the rental market.

Myth 2: Leasing is exclusively for individuals with excellent credit.

Fact: Although strong credit ratings may enhance rental opportunities, many dealerships are willing to work with consumers who have lower credit scores.

This inclusivity is vital as personal rental options like the 0 down vehicle lease and Personal Contract Hire (PCH) become more acknowledged among individual motorists, breaking the stereotype that such arrangements are reserved for businesses. John Elmore, Editor and Spokesperson for Electric Car Guide, emphasizes that “the evolving landscape of vehicle leasing now accommodates a broader range of consumers, making it accessible to many.”

Myth 3: Leasing always results in higher costs over time.

Fact: Leasing can actually be more economical in the short run due to lower monthly payments compared to buying a car outright.

This affordability is particularly attractive in a market where electric options, such as those from manufacturers with 10-year or 100,000-mile warranties on their batteries, are becoming more accessible. The case study on Personal Leasing Popularity demonstrates that personal leasing is gaining traction among individual motorists, further illustrating the financial advantages of leasing.

FAQs:

-

Can I purchase my leased vehicle at the end of the lease?

Yes, the majority of leases come with a purchase option, allowing you to buy the vehicle if you choose.

-

What are the consequences if I exceed the mileage limit?

Exceeding the mileage limit may result in additional charges, so it is essential to accurately estimate your anticipated mileage needs before signing the lease.

Conclusion

Zero down vehicle leasing presents an advantageous pathway for individuals seeking a new car without the financial burden of an upfront payment. This innovative leasing model not only enables lower monthly payments but also offers the freedom to drive a new vehicle every few years. As explored throughout the article, the significant growth of the electric vehicle market and the increasing accessibility of leasing options underscore the relevance of understanding zero down leasing dynamics.

Potential lessees can benefit from improved cash flow management, allowing them to invest their capital elsewhere while enjoying the luxury of driving a higher-end vehicle. With a variety of models available, including sedans and electric cars, consumers have ample choices to suit their preferences and budgets. It is essential to be aware of the eligibility requirements, such as credit scores and income verification, to enhance the chances of securing a lease.

Dispelling common myths surrounding zero down leasing reveals a more inclusive landscape, where individuals with varying credit profiles can find viable options. As the market continues to evolve, leveraging the insights shared in this article equips potential lessees with the necessary knowledge to make informed decisions. Embracing zero down vehicle leasing can lead to not only economic benefits but also an exciting driving experience, making it a compelling choice in today’s automotive financing landscape.