Overview

Securing 0 down RV financing involves several strategic steps, including checking your credit score, researching specialized lenders, and gathering necessary financial documentation. The article emphasizes that understanding these steps not only facilitates the financing process but also aligns with current market trends, making RV ownership more accessible despite potential economic fluctuations.

Introduction

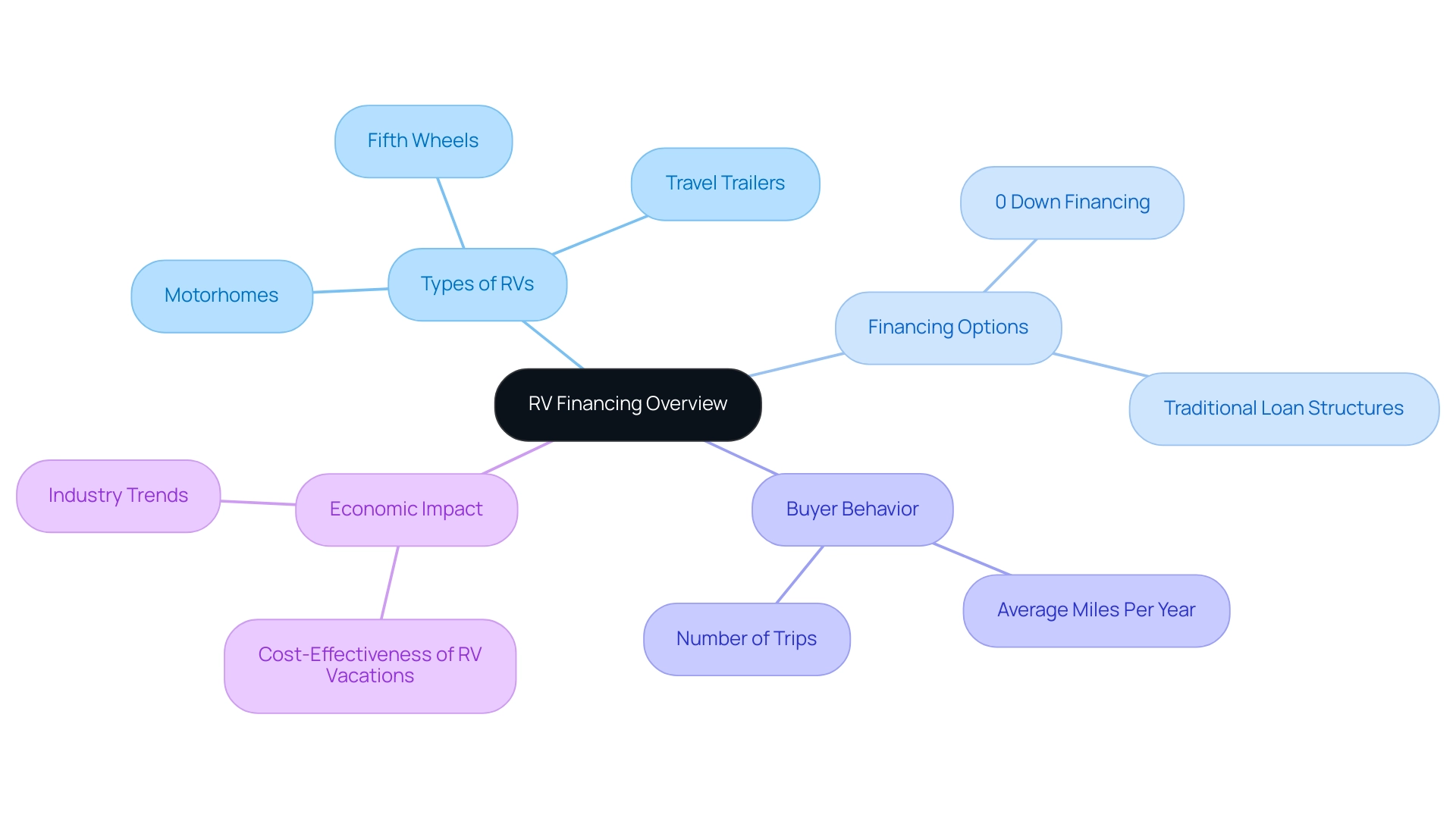

In the evolving landscape of recreational vehicle ownership, understanding RV financing is essential for prospective buyers looking to embark on their adventures. With options ranging from motorhomes to travel trailers, the financing process mirrors traditional home and auto loans, yet it comes with its own unique set of challenges and opportunities.

As interest rates fluctuate and the RV market adapts to economic shifts, potential owners must navigate a variety of financing avenues to make informed decisions. This article delves into the intricacies of RV financing, exploring:

- Why financing is a smart choice

- The diverse options available

- Practical steps to secure favorable terms

Whether it's the allure of family road trips or the freedom of full-time RV living, understanding the financial landscape can empower buyers to turn their RV dreams into reality.

Understanding RV Financing: An Overview

RV funding is a specialized process designed for acquiring recreational vehicles, encompassing a broad range of options such as motorhomes, travel trailers, and fifth wheels. In 2024, the landscape of RV funding is evolving, with interest rates and terms closely mirroring those found in traditional home and auto loans. Lenders typically evaluate creditworthiness, income, and the RV's market value when determining eligibility.

This understanding is crucial for potential buyers, as it allows them to navigate the funding landscape effectively. For instance, RV owners average around 4,500 miles per year and take multiple trips, with 90% of travel trailer owners embarking on three RV trips annually. This underscores the economic effect of RV vacations, which, as per the CBRE Hotels Advisory Group, are significantly the most cost-effective choice, costing on average 27% to 62% less per day than other vacation types analyzed.

This trend highlights the popularity of RVs and the 0 down RV financing options available to support such investments. However, as the RV industry experiences shifts, potentially indicating a broader economic slowdown, it is essential for buyers to stay informed about available financing structures and terms. Understanding these dynamics will empower them to make strategic decisions regarding their RV purchases.

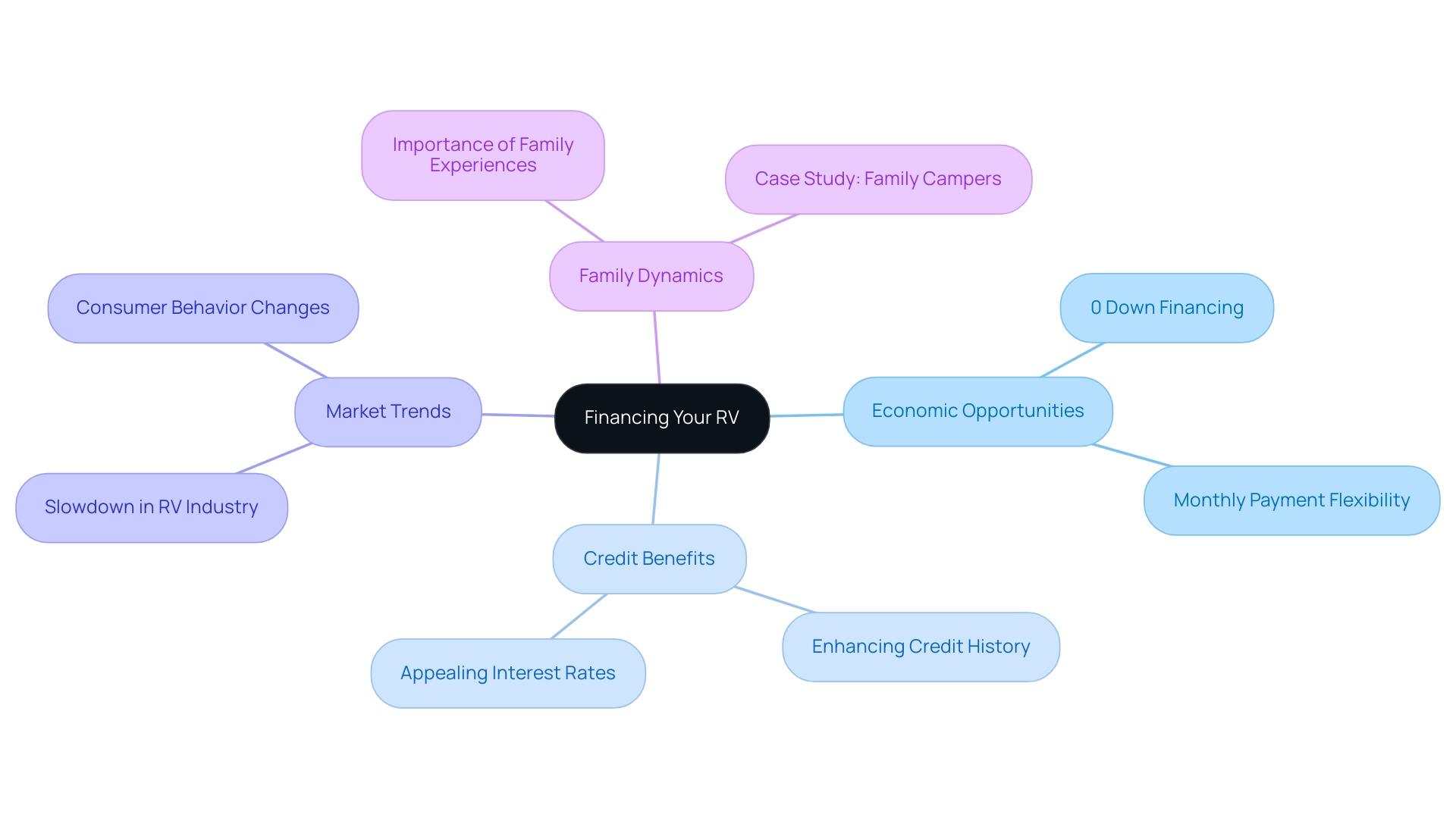

Why Financing Your RV is a Smart Choice

Funding an RV offers a strategic economic opportunity for buyers, especially in the current market situation. By utilizing 0 down rv financing, individuals can spread the cost of the RV over several years, which helps them manage their average monthly payments and makes ownership more attainable without a hefty upfront investment. This approach allows for greater monetary flexibility, enabling tech investors to allocate funds to other ventures or investments.

Notably, consistent and timely payments on RV loans can significantly enhance one’s credit history, providing long-term financial benefits. Current trends suggest that numerous funding alternatives, such as 0 down rv financing, feature appealing interest terms, especially for individuals with excellent credit, enhancing the allure of funding. As stated by RV Trader, around 74% of prospective buyers noted that reduced interest rates would encourage them to buy an RV earlier, emphasizing the need for options like 0 down rv financing.

However, it is essential to consider the recent slowdown in the RV industry, which raises concerns about market stability and may affect funding options. Furthermore, the case study of 'Family Campers' demonstrates how family dynamics are essential in RV ownership; funding can make these family-oriented experiences more attainable. Ultimately, funding not only makes RV ownership more feasible but also aligns with broader trends in consumer behavior, particularly as the RV market adapts to changing economic conditions.

Exploring Your RV Financing Options

Exploring RV funding methods reveals a variety of pathways for prospective buyers, including 0 down RV financing. Conventional bank loans continue to be a favored option, frequently offering attractive conditions and terms. However, credit unions stand out due to their typically lower interest charges and more personalized service, making them an increasingly appealing option for many.

In fact, recent insights from the financial sector suggest that credit unions can provide terms that are significantly more advantageous than those from traditional banks, especially for RV loans. In 2024, the average interest percentage for RV loans through credit unions is projected to be around 6.5%, compared to 7.5% for traditional banks. Additionally, specialized RV lenders cater exclusively to the recreational vehicle market by offering 0 down RV financing, providing tailored funding solutions that can better meet the unique needs of RV enthusiasts.

Although dealer loans are another option, it's crucial to recognize that they may involve higher charges, possibly affecting the total cost of ownership. Considering the differences in choices, purchasers should carefully evaluate prices, terms, and conditions among these funding pathways to determine the optimal solution that matches their financial goals. Additionally, as RV vacations have been recognized as the most affordable choice, averaging 27% to 62% cheaper per day compared to other travel alternatives, comprehending these funding methods becomes essential.

As the RV sector progresses, especially with Indiana topping sales at $6.8 billion, the recent decline in RV production and shipments might indicate wider economic consequences, impacting both funding availability and interest rates. This landscape necessitates careful consideration of funding options in light of the changing market dynamics.

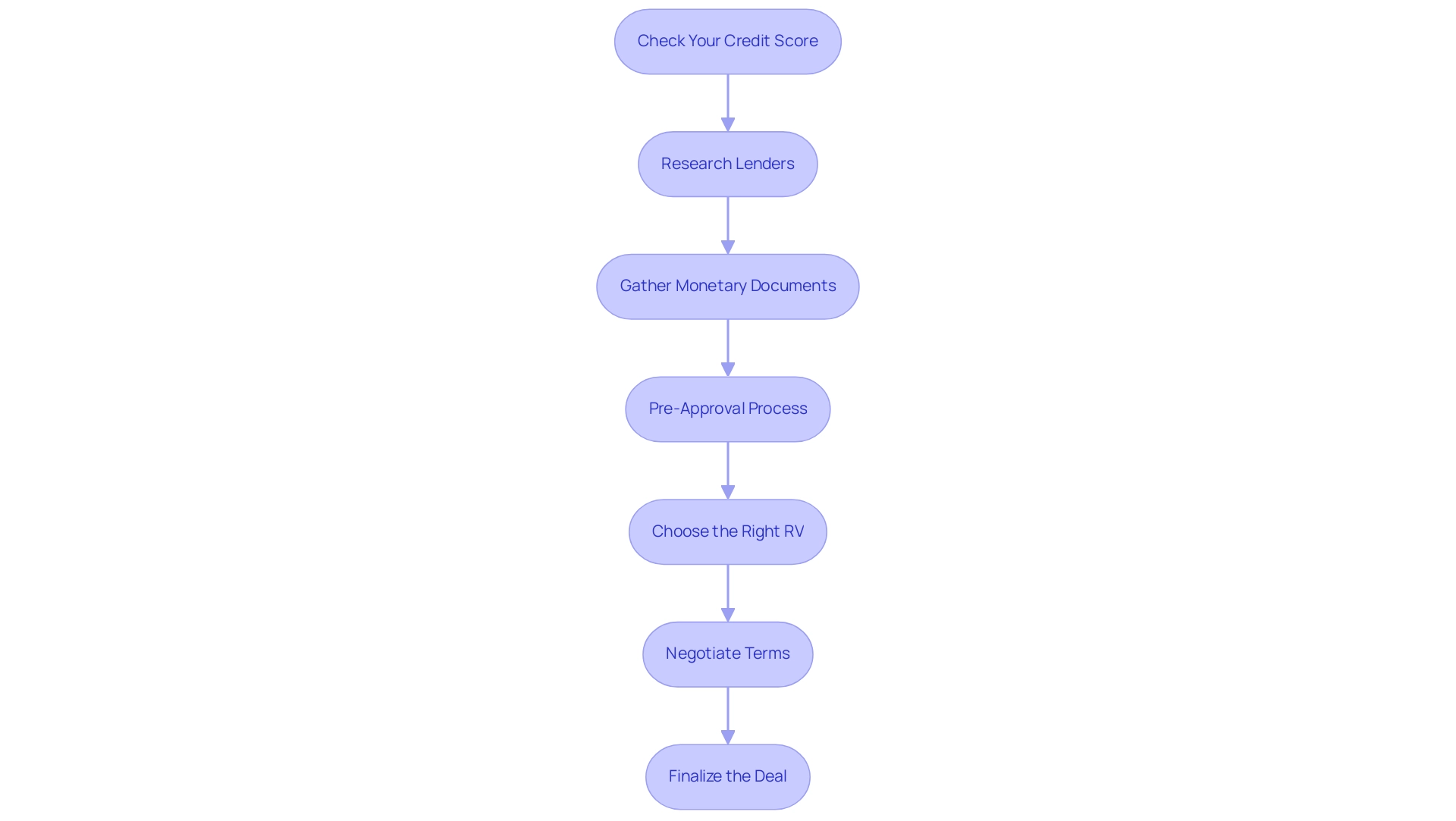

Step-by-Step Guide to Securing 0 Down RV Financing

Obtaining 0 down RV financing can turn your dreams of RV ownership into reality. To navigate this process effectively, follow these essential steps:

-

Check Your Credit Score: Begin by evaluating your credit report and score.

A strong credit score, usually above 700, greatly enhances your likelihood of qualifying for 0 down RV financing options. As financial advisors highlight, many individuals earning over $200,000 annually still find it beneficial to enhance their credit profiles before applying. Al observes that this proactive approach can result in improved funding options.

-

Research Lenders: Research lenders that specialize in 0 down RV financing options.

Examine their reputations, interest rates, and loan terms through customer reviews and comparison websites to ensure you find the best fit.

-

Gather Monetary Documents: Compile essential monetary documents such as proof of income, tax returns, and a comprehensive list of your assets.

This documentation is vital for lenders to evaluate your financial health accurately.

-

Pre-Approval Process: Seek pre-approval from multiple lenders to gain insights into your borrowing capacity and the terms available.

This step is crucial, especially with recent changes in RV funding pre-approval processes that have made obtaining capital more competitive.

-

Choose the Right RV: Select an RV that meets your budgetary constraints and aligns with lender requirements.

Bear in mind that some lenders impose restrictions regarding the age and type of RV, so choose wisely to avoid complications in the funding process.

-

Negotiate Terms: With pre-approval in hand, enter negotiations with your chosen lender.

Concentrate on obtaining advantageous funding conditions, including interest rates and repayment durations, to optimize your monetary commitment.

-

Finalize the Deal: After reaching an agreement, meticulously review the contract before signing.

Ensure that all terms match your discussions to prevent any last-minute surprises.

In light of the current RV market dynamics, where towable vehicles have seen an increase of 3.1% while motorhomes have decreased by 4.7% compared to September 2018, understanding these trends is vital.

By following these steps, potential buyers can adeptly navigate the intricacies of securing 0 down RV financing, particularly during a time when the RV industry is facing shifts in consumer demand and potential economic downturns.

This process not only provides access to ownership but also aligns with the growing trend of full-time RV living, which offers economic advantages and a simpler lifestyle. Around 1 million Americans are embracing this lifestyle, drawn by the freedom and lower living costs associated with it.

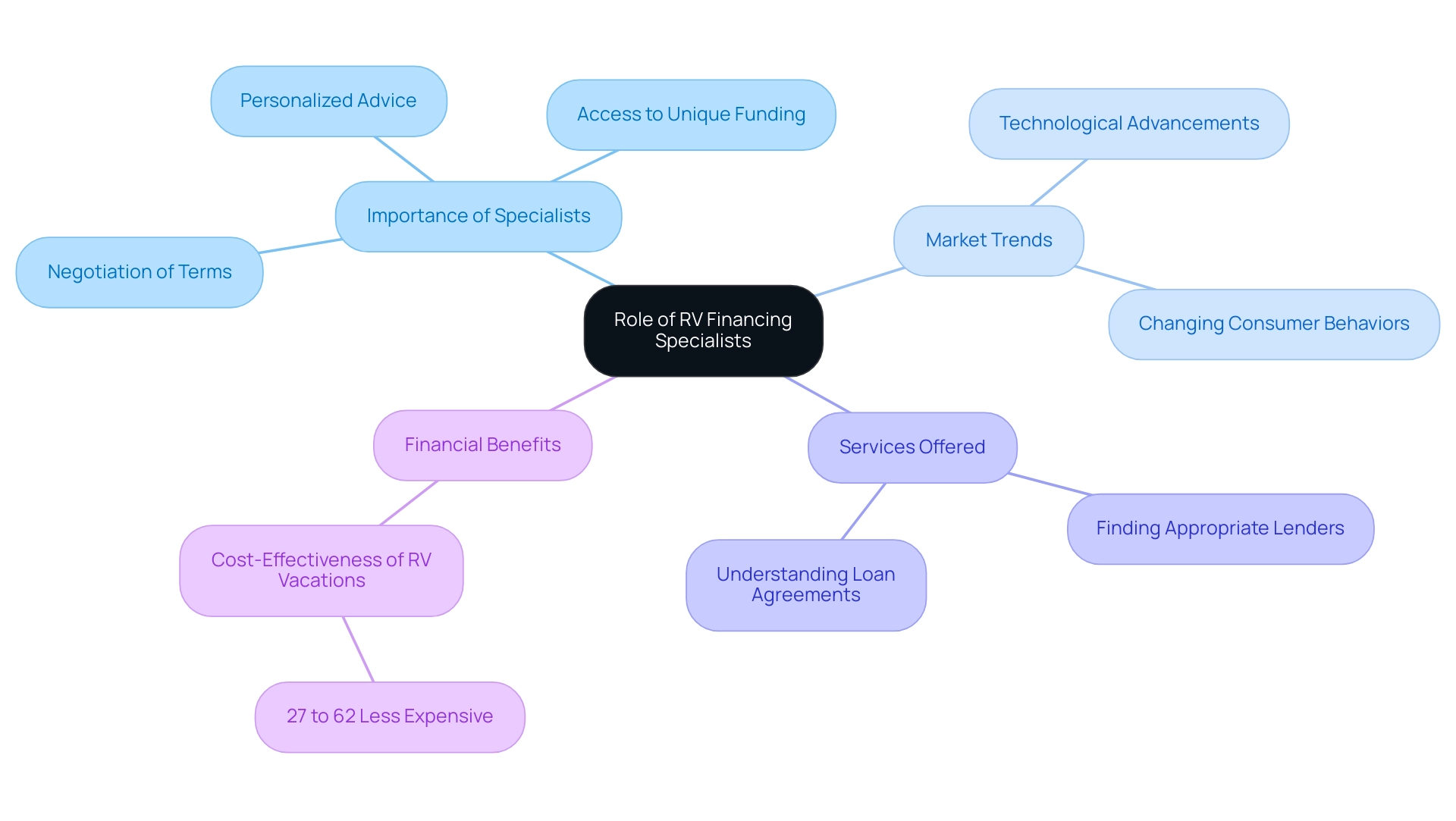

The Role of RV Financing Specialists in Your Journey

RV funding specialists are essential partners for buyers seeking optimal funding solutions, especially in a market where 0 down RV financing can be crucial given the 26.5% decrease in motorized RV shipments compared to 2023. These specialists possess extensive knowledge of the RV market and the intricacies of funding, enabling them to offer personalized advice tailored to individual financial circumstances. In 2024, their role is increasingly crucial as they adapt to evolving market trends shaped by technological advancements and changing consumer behaviors.

Experts help purchasers in finding appropriate lenders, negotiating advantageous terms, and understanding the intricacies of their loan agreements. Remarkably, they frequently have access to unique funding alternatives that are not broadly accessible, greatly improving the chances of obtaining favorable terms. Current statistics indicate that a growing percentage of buyers are employing specialists for RV purchases, reflecting the increasing reliance on expert advice in navigating this complex landscape.

According to the CBRE Hotels Advisory Group, RV vacations are the most economical travel option, costing on average 27% to 62% less per day compared to other vacation choices. This underscores the financial wisdom of working with RV financing experts, who empower buyers to navigate the complexities of 0 down RV financing confidently, ultimately leading to a smoother purchasing experience.

Conclusion

Understanding the intricacies of RV financing is essential for anyone looking to turn their dream of RV ownership into reality. By exploring various financing options, potential buyers can discover pathways that not only make ownership feasible but also align with their financial goals. The article highlights how financing an RV can provide significant benefits, including manageable monthly payments, improved credit history, and a variety of lending options tailored to specific needs.

As the RV market evolves, staying informed about interest rates, lender options, and current economic conditions is crucial. Traditional banks, credit unions, and specialized RV lenders each offer unique advantages, making it imperative for buyers to compare terms and rates to find the best fit. Additionally, understanding the step-by-step process for securing financing—especially options like zero down financing—can empower individuals to make informed decisions that suit their financial situations.

Ultimately, partnering with RV financing specialists can enhance the purchasing experience by providing expert guidance and access to exclusive financing options. This support is invaluable in navigating the complexities of the market, especially during times of economic fluctuation. By leveraging the insights and strategies discussed, prospective RV owners can confidently embark on their journeys, enjoying the freedom and adventure that RV living promises while making sound financial choices.