Overview

Creating and managing a company cap table involves understanding equity distribution among stakeholders, ensuring transparency, and maintaining accurate records of ownership percentages and share types. The article emphasizes that a well-structured cap table is crucial for informed decision-making and attracting investors, as it helps mitigate disputes and illustrates the potential dilution effects during funding rounds, ultimately supporting strategic planning and compliance efforts.

Introduction

In the dynamic world of startups, understanding the intricacies of capitalization tables, or cap tables, is paramount for ensuring clarity in equity ownership and fostering investor confidence. These essential documents not only outline the ownership stakes of founders, investors, and employees but also play a critical role in navigating funding rounds and potential dilution. As startups face mounting challenges in a post-pandemic economy, maintaining a clean and accurate cap table has never been more vital.

From leveraging technology to streamline management processes to adhering to best practices that prevent common pitfalls, this article delves into the foundational elements of cap table management that can significantly influence a startup's trajectory and success.

Understanding the Basics of Cap Tables

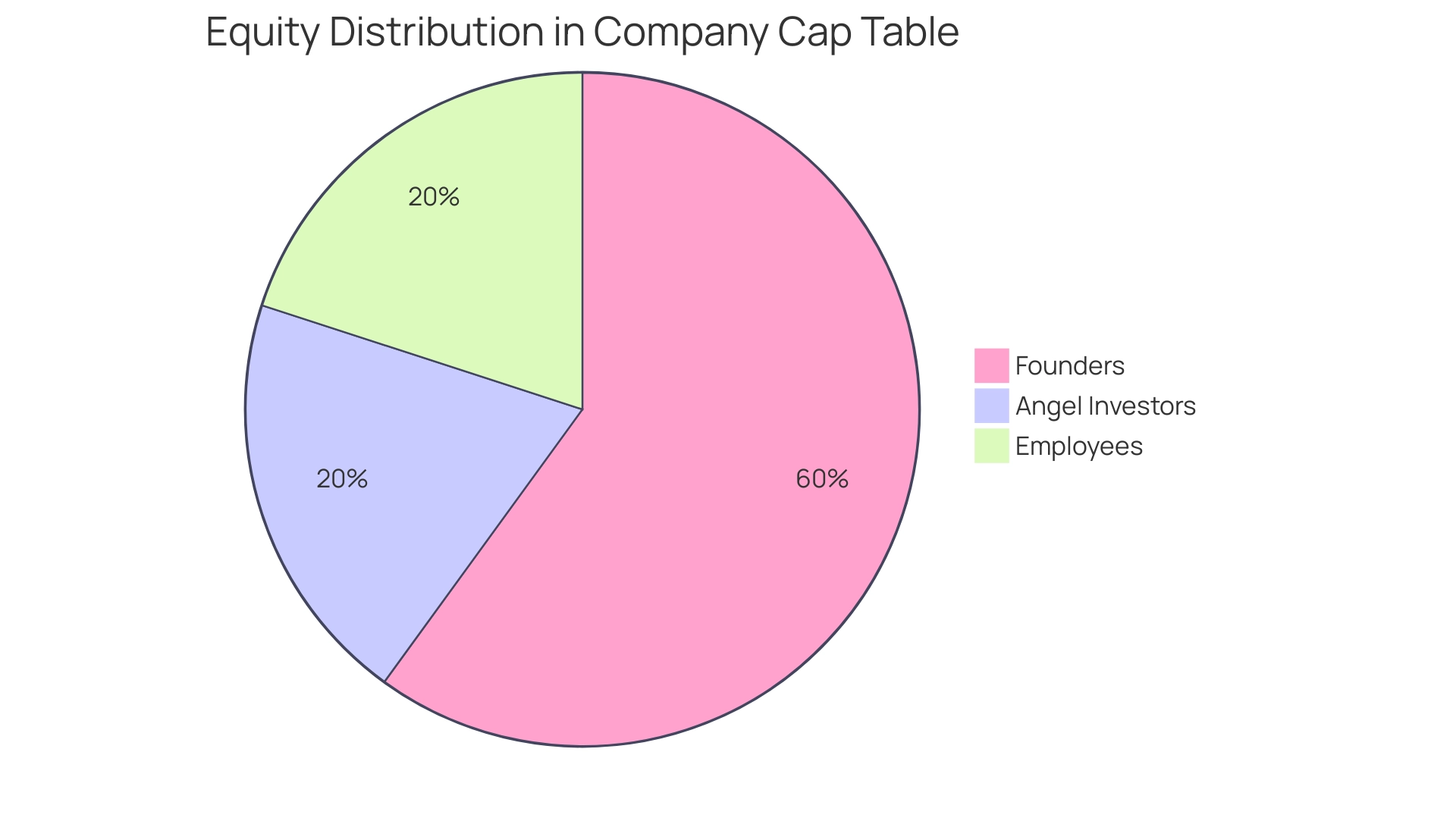

A company cap table, often referred to as a cap sheet, serves as a comprehensive ledger that details the equity stake of a startup. It involves various stakeholders, including founders, investors, and employees, detailing their respective equity percentages and the types of shares held. For instance, a typical cap structure may illustrate a scenario where:

- Founders own 60% of the company

- Angel investors hold 20%

- The remaining 20% is allocated to employees via stock options

Comprehending the basics of the company cap table is crucial for anyone engaged in the entrepreneurial ecosystem, as they offer vital insights into structure and potential dilution during funding rounds. Notably, at a typical venture-backed startup, employee equity pools generally account for 10-20% of total shares outstanding, as noted by The Muse, highlighting the importance of equity incentives in attracting and retaining talent. This foundational knowledge is vital for making informed decisions about future financing and ownership adjustments, particularly in a landscape where 57% of small businesses were reported to be 11% below pre-pandemic employment levels.

Moreover, the ongoing challenges in both the UK and US markets, such as rising costs and talent shortages, further underscore the significance of the company cap table in navigating these complexities. Therefore, understanding the intricacies of capitalization structures can significantly influence strategic planning and investor relations, particularly considering the COVID-19 pandemic's severe effects on small businesses, where many faced substantial revenue declines and ongoing economic challenges.

The Importance of a Clean Cap Table for Startups

A carefully preserved company cap table is essential for new ventures, acting as a foundation of transparency and clarity in equity distribution. As of April 2024, trends suggest that investors increasingly prefer startups with clean capital structures, seeing them as a sign of professionalism and readiness. Reem, a seasoned investor, emphasizes the importance of transparency by stating,

Who was first, who was second, when did they arrive, were they there from the beginning, how much money did they invest, how many shares they got, did they first invest in a SAFE and CLA and was this converted later.

This detailed record helps mitigate disputes regarding possession and streamlines the issuance of new shares or options. Key details that should be recorded in the company cap table include:

- Shareholder agreements

- Investment round information

- Regulatory compliance

These are essential for a comprehensive understanding of property frameworks. To maintain a clear company cap table, it is essential to execute regular updates after each funding round or equity transaction, ensuring that all stake alterations are precisely recorded.

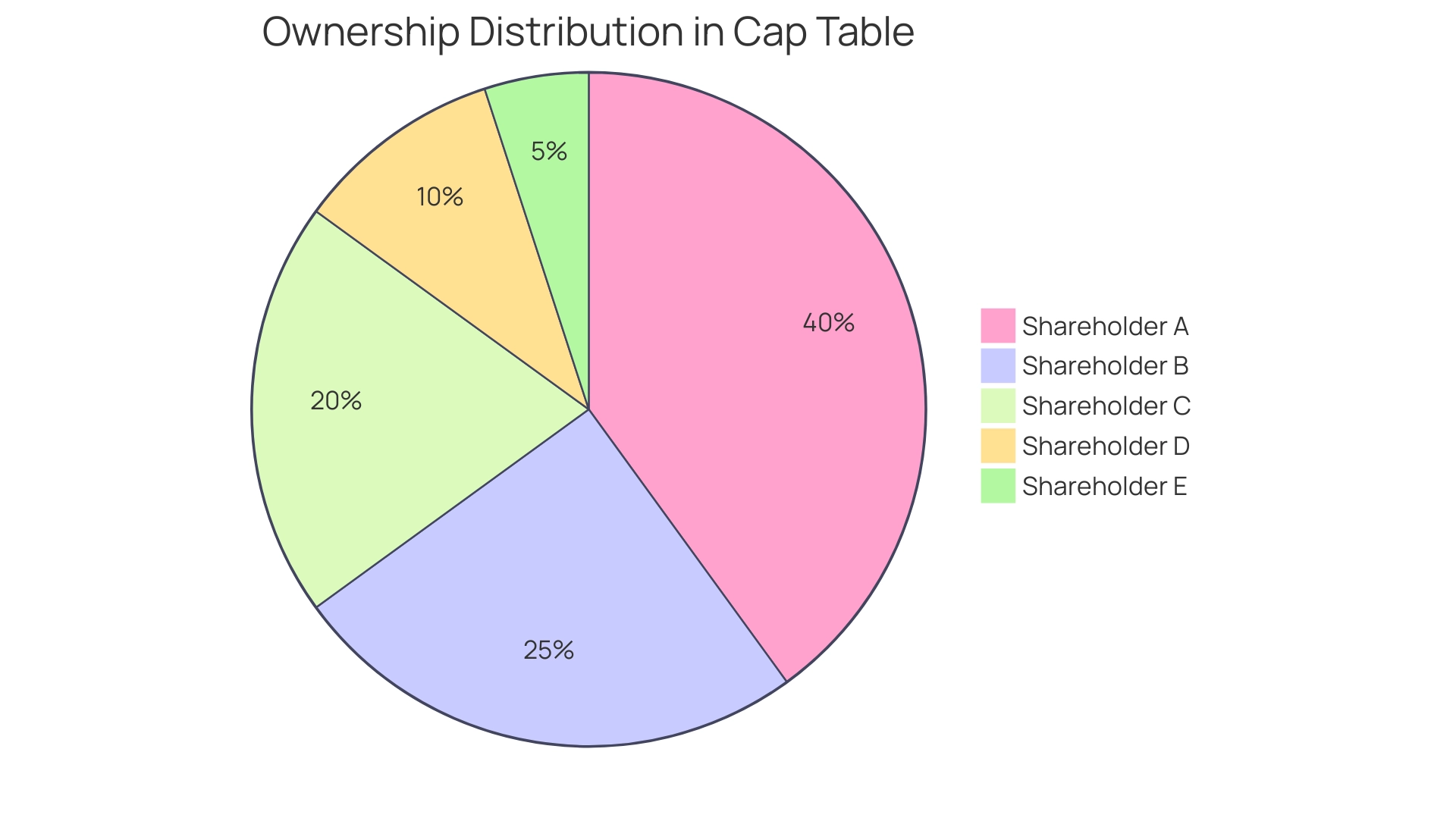

Such diligence not only enhances investor confidence but also supports strategic planning and forecasting. The process of creating and updating a company cap table involves collecting information about current shareholders, outstanding share options, and proposed funding rounds, as illustrated in the case study 'Creating and Updating a Cap Structure.' Additionally, founders are encouraged to incorporate visual elements like pie charts to illustrate ownership and voting rights, further promoting clarity in the capitalization structure.

By adhering to these practices, new ventures can effectively attract investors and demonstrate their commitment to transparency. Moreover, with Adam’s new position as Chief Legal Officer & Head of Corporate, the significance of legal oversight in maintaining capitalization records is emphasized, ensuring that all regulatory and compliance aspects are thoroughly addressed.

Key Components of an Effective Cap Table

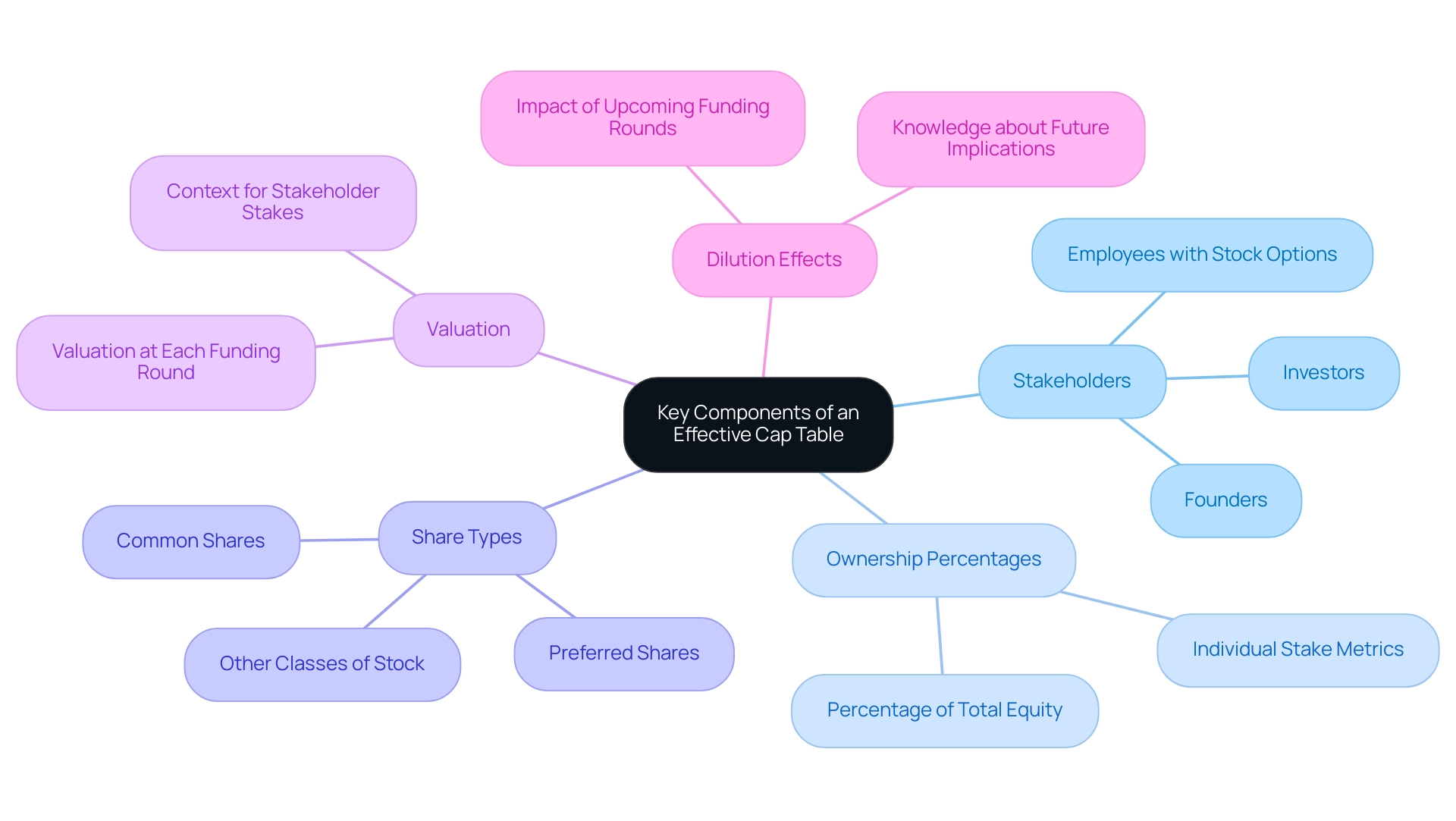

A well-structured company cap table is essential for any startup, as it encompasses several fundamental components that provide clarity and facilitate informed decision-making. The following elements are critical:

- Stakeholders: Enumerate all equity holders, including founders, investors, and employees with stock options, to ensure transparency.

- Ownership Percentages: Clearly delineate the percentage of total equity held by each stakeholder, as understanding these metrics is crucial for gauging individual stakes within the company.

- Share Types: Differentiate between common shares, preferred shares, and any other classes of stock, as this categorization impacts voting rights and dividend preferences.

- Valuation: Incorporate the company’s valuation at each funding round, providing necessary context for stakeholder stakes and investor confidence.

- Dilution Effects: Illustrate how upcoming funding rounds may dilute existing ownership percentages, thereby equipping stakeholders with knowledge about future implications.

The importance of maintaining an accurate company cap table cannot be overstated. Adam Kudryl, Chief Legal Officer & Head of Corporate, emphasizes this point, stating,

Your capitalization structure is only as strong as the data within it, so make sure it’s robust.

Inaccuracies can lead to substantial legal expenses; in fact, reconciling different versions of a cap document can incur costs exceeding £15,000.

This emphasizes the significance of establishing a comprehensive and precise company cap table structure from the outset.

Moreover, startups should avoid relying on basic spreadsheet solutions for their company cap table management. As the business scales, these Excel-based approaches can introduce complications. Instead, creating further connections to a primary dataset can better accommodate the company's unique trading structure and requirements related to the company cap table.

This method can simplify management by connecting various subjects like investors, shareholders, and vesting schedules, ultimately preventing potential pitfalls. A case study titled "Avoiding Complications in Cap Management" illustrates this approach; by linking various subjects, companies can streamline their cap management and avoid complications. By following these best practices, new ventures can guarantee that their capitalization structures remain effective instruments for investment and growth.

Best Practices for Managing Your Cap Table

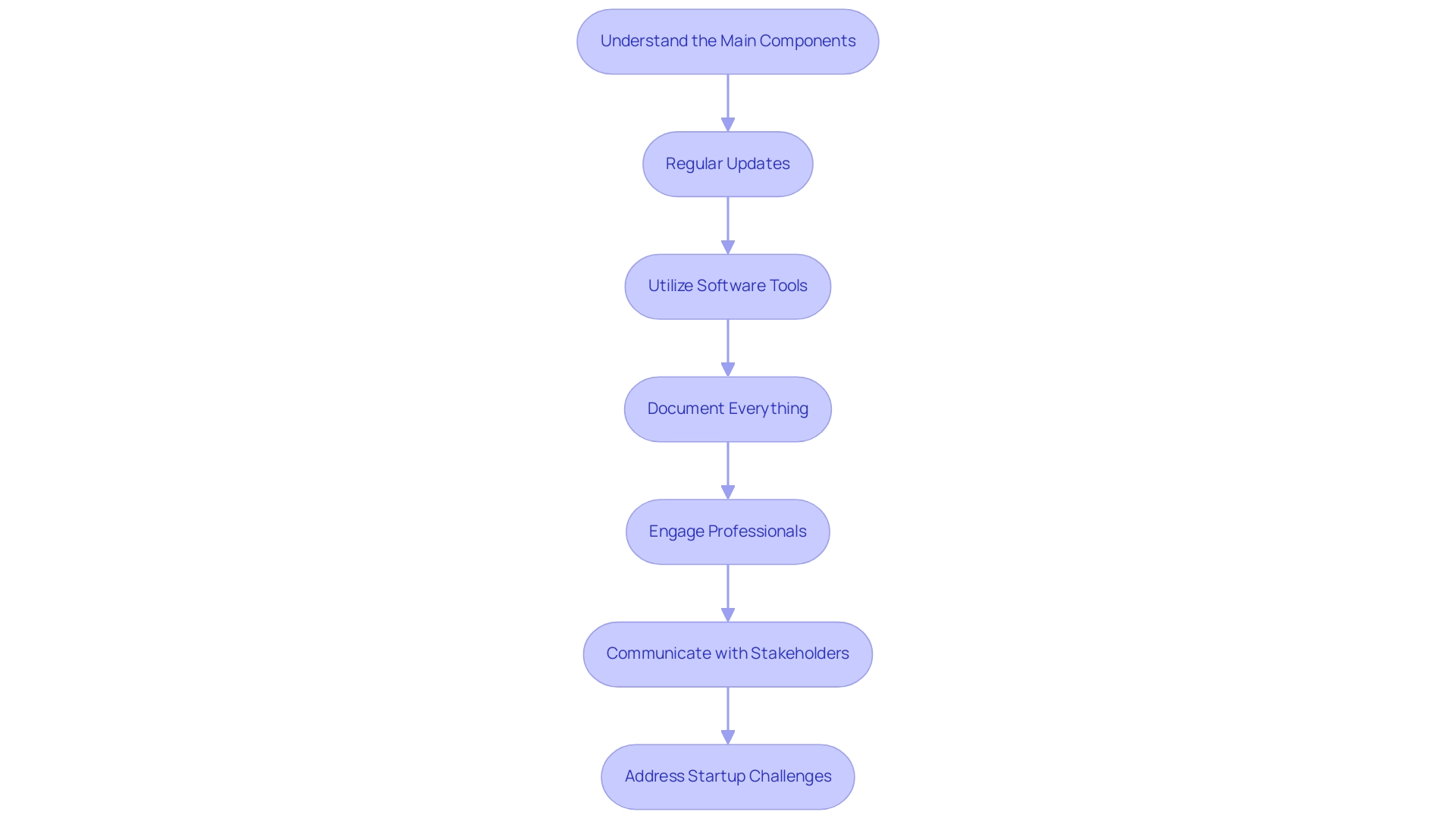

Efficient management of your company cap table is essential for preserving a correct comprehension of your venture's equity framework. Here are several best practices tailored for startups:

-

Understand the Main Components: A company cap table consists of essential components, including company information, shareholder breakdown, and equity structure. Grasping these elements is essential for understanding distribution of assets and possible changes in the future.

-

Regular Updates: Ensure that your company cap table is updated immediately following any equity transaction. This practice is vital for maintaining accuracy and providing stakeholders with a clear view of ownership distribution.

-

Utilize Software Tools: Leverage software tools for managing the company cap table to automate updates and minimize the risk of errors. These tools enhance accuracy, as highlighted by industry experts who note,

By putting a premium on accuracy and accessibility, it empowers founders to make equitable decisions for their companies.

-

Document Everything: Maintain thorough records of all equity transactions in the company cap table, which includes share issuances and transfers. Detailed documentation is essential for transparency and future reference.

-

Engage Professionals: It's wise to consult with legal and financial advisors to ensure that your company cap table aligns with regulatory requirements and best practices. Their expertise can help prevent costly mistakes.

-

Communicate with Stakeholders: Regularly share updates on your company cap table with stakeholders to foster transparency and build trust. Keeping everyone informed can mitigate misunderstandings and enhance collaborative decision-making.

-

Address Startup Challenges: Startups often face challenges such as feeling overwhelmed by tasks and changing market conditions. Prioritizing cap management can help alleviate these pressures.

By applying these best practices, new ventures can optimize their company cap table management, ultimately leading to more informed decision-making and a clearer financial outlook. For instance, the case study titled "Components of a Cap Table" illustrates how understanding the key components of the company cap table provides a comprehensive view of the company's financial structure, which is essential for stakeholders.

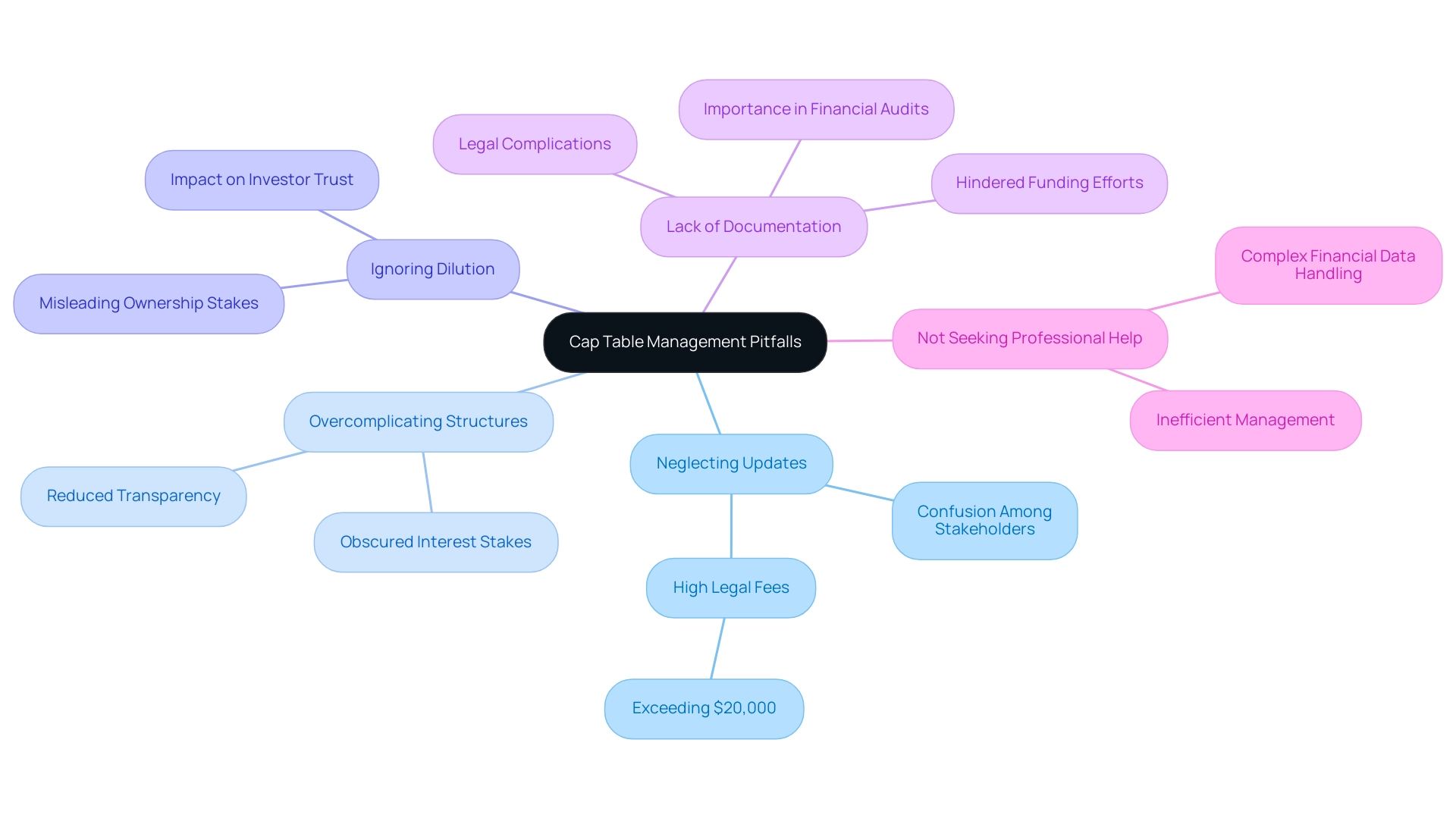

Avoiding Common Pitfalls in Cap Table Management

Effective cap management is crucial for startups, yet several common pitfalls can jeopardize this process:

- Neglecting Updates: Regular updates to the cap record following each transaction are essential. Failing to do so can result in confusion among stakeholders and lead to disputes that may require extensive legal resolution. In fact, legal fees for reconciling different versions of a cap record can exceed $20,000 in some cases, highlighting the financial risks of neglect.

- Overcomplicating Structures: While it may be tempting to create intricate equity structures, this complexity can obfuscate interest stakes for stakeholders. A straightforward company cap table enhances transparency, allowing all parties to easily grasp their equity positions.

- Ignoring Dilution: Startups must proactively account for dilution in future funding rounds. Miscalculating potential dilution can mislead stakeholders about their ownership stakes, ultimately affecting investor trust and future funding opportunities. Effective management of the company cap table not only predicts dilution risks but also demonstrates the founder's power in navigating these challenges.

- Lack of Documentation: Documenting every equity transaction is not just best practice; it is a legal necessity. Failure to maintain proper documentation can lead to significant legal complications down the line and hinder future funding efforts. Moreover, the company cap table plays a vital role in financial audits during funding rounds, making thorough documentation even more critical.

- Not Seeking Professional Help: Many startups mistakenly believe they can manage their capitalization records independently. However, engaging a professional service provider can enhance the efficiency of the company cap table management, ensuring accurate handling of complex financial data and legal implications.

As Mike Hinckley, founder of the Growth Equity Interview Guide, aptly states,

A robust cap structure fosters trust, supports strategic decision-making, and lays the groundwork for successful partnerships and future funding rounds.

With the complex calculations and legal implications involved, professional expertise becomes essential in reducing the risks linked to cap management. By identifying and tackling these challenges, new ventures can adopt proactive strategies to ensure effective cap management, ultimately preparing themselves for success in future funding efforts.

Leveraging Technology for Efficient Cap Table Management

Utilizing technology can profoundly improve the efficiency of cap table management for startups. Specialized software solutions like Carta and Equity Effect provide user-friendly interfaces that assist in monitoring equity interests, creating detailed reports, and automating updates. These platforms often feature advanced scenario modeling tools, enabling users to visualize the potential impacts of upcoming funding rounds on ownership distributions.

Furthermore, cloud-based applications promote real-time collaboration among stakeholders, ensuring that all parties have immediate access to the most current data. According to Flexera, 32% of a cloud budget goes to waste, highlighting the importance of adopting efficient technology solutions to avoid such pitfalls. For a pre-seed portfolio company raising €5–10m in Series A funding, effective cap management becomes crucial to navigating financial complexities.

Furthermore, with 46% of European companies storing all their data in the cloud, and 43% of that data classified as sensitive, the implications for data management in capitalization processes are significant. By adopting these technological solutions, new ventures not only streamline their capitalization management processes but also minimize the likelihood of errors, thereby enhancing overall financial transparency. As the landscape of startup financing evolves, the importance of integrating robust technology into cap table management becomes increasingly clear, positioning companies for success in a competitive market.

Conclusion

Maintaining an accurate and effective capitalization table is essential for startups navigating the complexities of equity ownership and investor relations. A cap table serves as a comprehensive record detailing the ownership stakes of founders, investors, and employees, thereby providing critical insights into the company's equity structure. Understanding the fundamentals of cap tables, including the importance of regular updates, stakeholder transparency, and proper documentation, is crucial for fostering investor confidence and avoiding common pitfalls that could jeopardize a startup's future.

Moreover, adopting best practices in cap table management, such as:

- Utilizing specialized software

- Engaging professional advisors

can significantly enhance operational efficiency. By leveraging technology, startups can streamline their processes, minimize errors, and ensure that all stakeholders have immediate access to current data. This proactive approach not only supports strategic decision-making but also positions startups favorably in the competitive landscape of funding rounds.

Ultimately, a well-maintained cap table is not just a financial document; it is a vital tool that can influence a startup's trajectory and success. As the post-pandemic economy continues to evolve, the clarity and professionalism reflected in a clean cap table can make a substantial difference in attracting investment and navigating future challenges. Startups that prioritize effective cap table management will be better equipped to build trust with investors and foster long-term growth in an increasingly complex market.