Overview

The article provides a detailed step-by-step guide for investors on how to calculate the Multiple on Invested Capital (MOIC), emphasizing its importance in evaluating investment performance. It explains that MOIC is calculated by dividing total distributions by total capital invested, and highlights its advantages, such as simplicity and direct comparison among investment opportunities, while also addressing its limitations, including the neglect of the time value of money.

Introduction

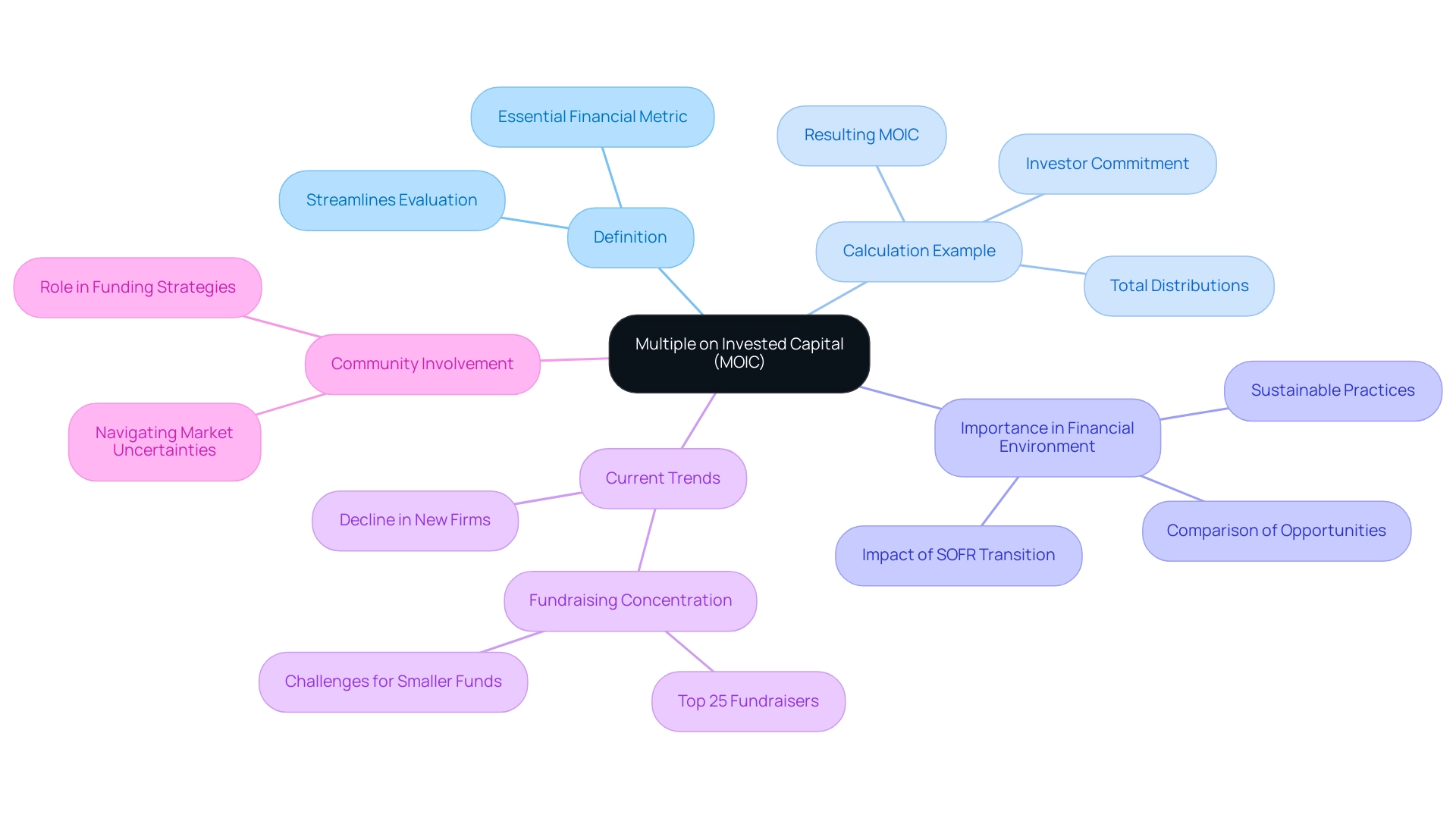

In the intricate world of finance, understanding the metrics that signify investment success is paramount. Among these, the Multiple on Invested Capital (MOIC) stands out as a vital tool for investors seeking to measure the value generated from their financial commitments.

As the investment landscape shifts, particularly with the rise of venture capital and the growing emphasis on sustainable practices, grasping the nuances of MOIC becomes increasingly essential.

This article delves into the definition, calculation, and comparative significance of MOIC, while also examining its advantages and pitfalls. Through real-world examples and expert insights, it offers a comprehensive understanding of how MOIC can guide investors in making informed decisions amid a rapidly changing market environment.

Understanding MOIC: Definition and Importance

Multiple on Invested Capital serves as an essential financial metric for assessing the overall value produced from a capital allocation against the funds utilized. It is calculated by dividing the total distributions received from the fund by the total capital invested. For example, if an investor commits $1 million and ultimately receives $3 million, the resulting multiple on invested capital would be 3.0.

This measure is essential as it streamlines the process of evaluating financial success, enabling investors to effortlessly compare various opportunities. As the financial environment changes, especially in venture capital, grasping multiple of invested capital becomes even more relevant. In 2024, the significance of this measure is underscored by the ongoing shift in financial benchmarks; as noted by industry experts, the transition from USD LIBOR to the Secured Overnight Financing Rate (SOFR) reflects a broader evolution in market dynamics.

Furthermore, with only 651 new firms launched in 2023, the lowest level since 2012, the environment for emerging funds is increasingly challenging. Current trends indicate substantial fundraising concentration, with the leading 25 fundraisers representing 41 percent of total commitments, highlighting the importance of strong metrics for guiding financial decisions effectively. Insights from Baltic financial leaders such as Donatas Keras and Kristjan Tamla further illustrate the role of community in fostering funding strategies, particularly in the context of early-stage and Climate Tech financing.

As we observe a rising demand for sustainable practices in private equity, the significance of the moic formula in analysis only intensifies, guiding investors towards more informed and responsible choices. Additionally, fff. Vc has worked through 159 late-stage deals and invested approximately 3 million euros, focusing on diversifying portfolios across various asset classes, including Tech, Private Equity, Real-Estate, and Private Credit.

This strategic evolution emphasizes the significance of community involvement in navigating the uncertainties of the current market.

Calculating MOIC: Step-by-Step Formula and Methodology

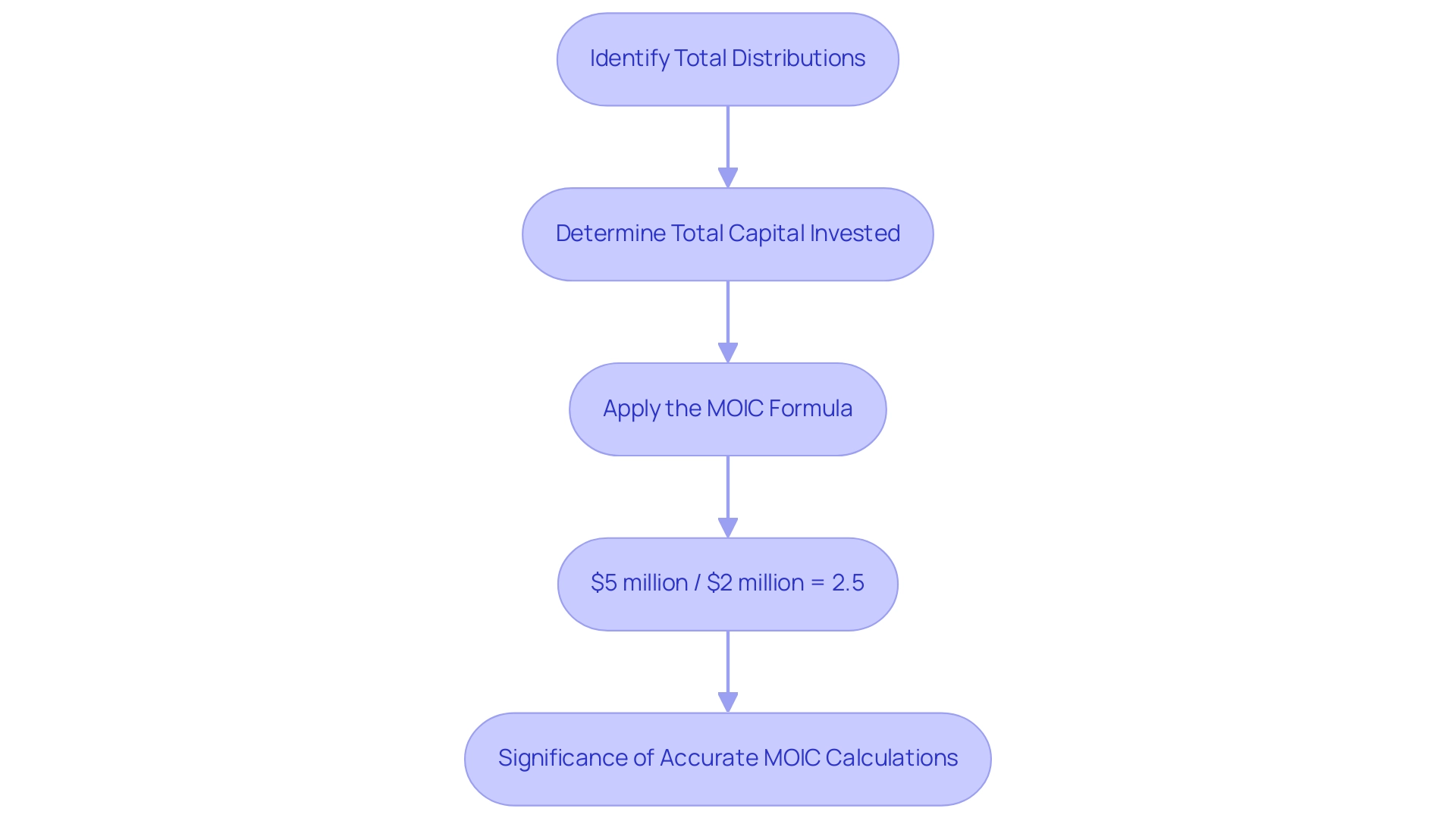

Calculating the Multiple on Invested Capital is an essential skill for any tech investor seeking to assess financial performance accurately. Here’s a structured approach to calculating the MOIC formula:

-

Identify Total Distributions: Start by determining the total amount of cash or stock received from your assets.

This encompasses all forms of returns, including dividends, interest, and sale proceeds.

-

Determine Total Capital Invested: Next, calculate the total capital you initially invested. Be sure to include any extra contributions made throughout the holding period.

-

Apply the MOIC Formula: The formula to compute MOIC is straightforward:

MOIC = Total Distributions / Total Capital Invested

For instance, consider a scenario where you received $5 million in distributions from an initial investment of $2 million. Applying the formula:

MOIC = $5 million / $2 million = 2.5

This result indicates that you have achieved a return of 2.5 times your original investment, showcasing the effectiveness of your investment strategy.

The significance of accurate MOIC calculations is underscored by the Gerber statistic's returns, which have consistently outperformed those derived from historical covariance and the Ledoit and Wolf shrinkage method across various investment scenarios.

This emphasizes how essential it is for investors to master return on capital calculations to accurately evaluate their performance.

Furthermore, understanding the governance benefits of private ownership versus the capital costs associated with public ownership can influence your multiple on invested capital calculations. For example, private ownership may result in greater governance advantages, which could improve the potential gains from your assets, thus impacting the outcome of the multiple on invested capital.

As emphasized by Trent Spears in The Journal of Financial Data Science:

The authors examine a scenario where multiple perspective estimates, including uncertainties, are provided for the same underlying subset of assets at a specific moment.

This quote demonstrates the intricacies involved in assessing returns and emphasizes the significance of a comprehensive grasp of multiple of invested capital calculations. By mastering the financial metric calculation, you position yourself to make informed choices regarding your finances.

MOIC vs. Other Metrics: Understanding the Differences

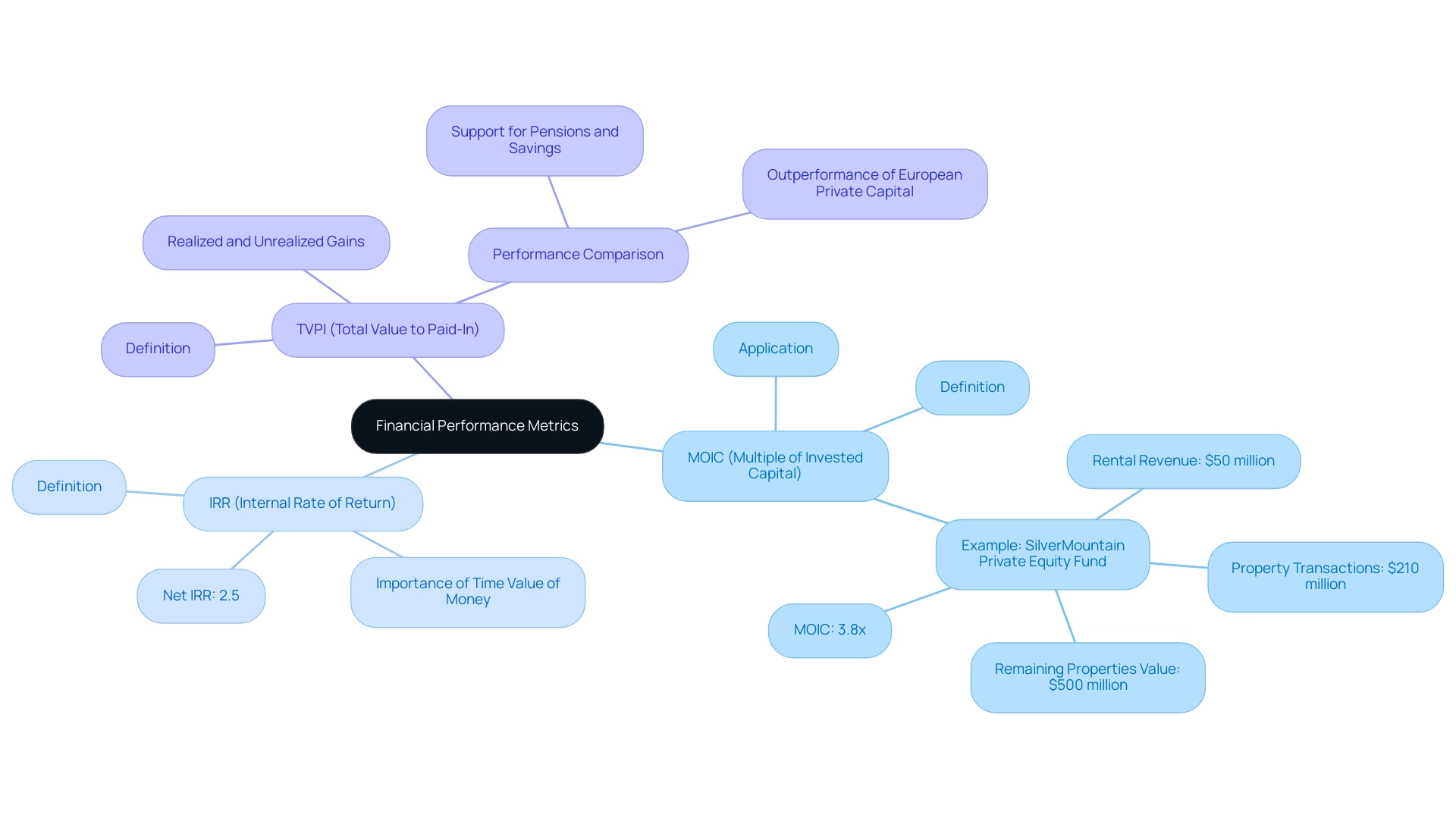

The multiple of invested capital is often assessed alongside other crucial financial indicators, each providing distinct perspectives on performance:

- IRR (Internal Rate of Return): While the multiple of invested capital measures the overall value produced from a capital allocation, IRR emphasizes the annualized rate of return. This distinction is crucial, as IRR incorporates the time value of money, making it particularly useful for assessing the timing of cash flows. Investors benefit from understanding how quickly their capital is generating returns, which can influence future financial decisions. Significantly, as of September 2023, the net internal rate of return for private equity is only 2.5 percent, highlighting the significance of these indicators in assessing performance.

- TVPI (Total Value to Paid-In): Similar to the moic formula, TVPI measures the total value obtained from a contribution, but it includes both realized and unrealized gains. Consequently, TVPI offers a more comprehensive view of a financial asset's performance trajectory over time. This metric is particularly valuable for investors seeking to evaluate the overall health and potential of their portfolio, especially in light of recent research indicating that European private capital has continued to outperform listed equity benchmarks, a trend that has supported pensions and savings as markets recover from the COVID-19 pandemic.

By grasping the distinctions between these metrics, investors can make informed decisions tailored to their specific financial objectives and the nuances of their analyses. As Brian Vickery, a partner in the Boston office, observes, 'Women and minorities continue to be underrepresented in senior positions and funding roles,' emphasizing the necessity for diversity in financial decision-making.

To demonstrate the application of the moic formula, consider the SilverMountain Private Equity Fund, which has a diverse portfolio of commercial real estate holdings. The fund gathered $50 million in rental revenue and $210 million from property transactions, with remaining properties appraised at $500 million after loan repayments, leading to an impressive multiple of invested capital of 3.8x. This indicates the fund produced $3.80 for each dollar put in, offering a clear illustration of how the moic formula can signify financial success.

As we approach 2024, comprehending the performance of private equity grows increasingly important in choosing the suitable measure for assessment.

Pros and Cons of Using MOIC in Investment Analysis

The use of MOIC (Multiple on Invested Capital) presents a balanced mix of advantages and disadvantages for investors:

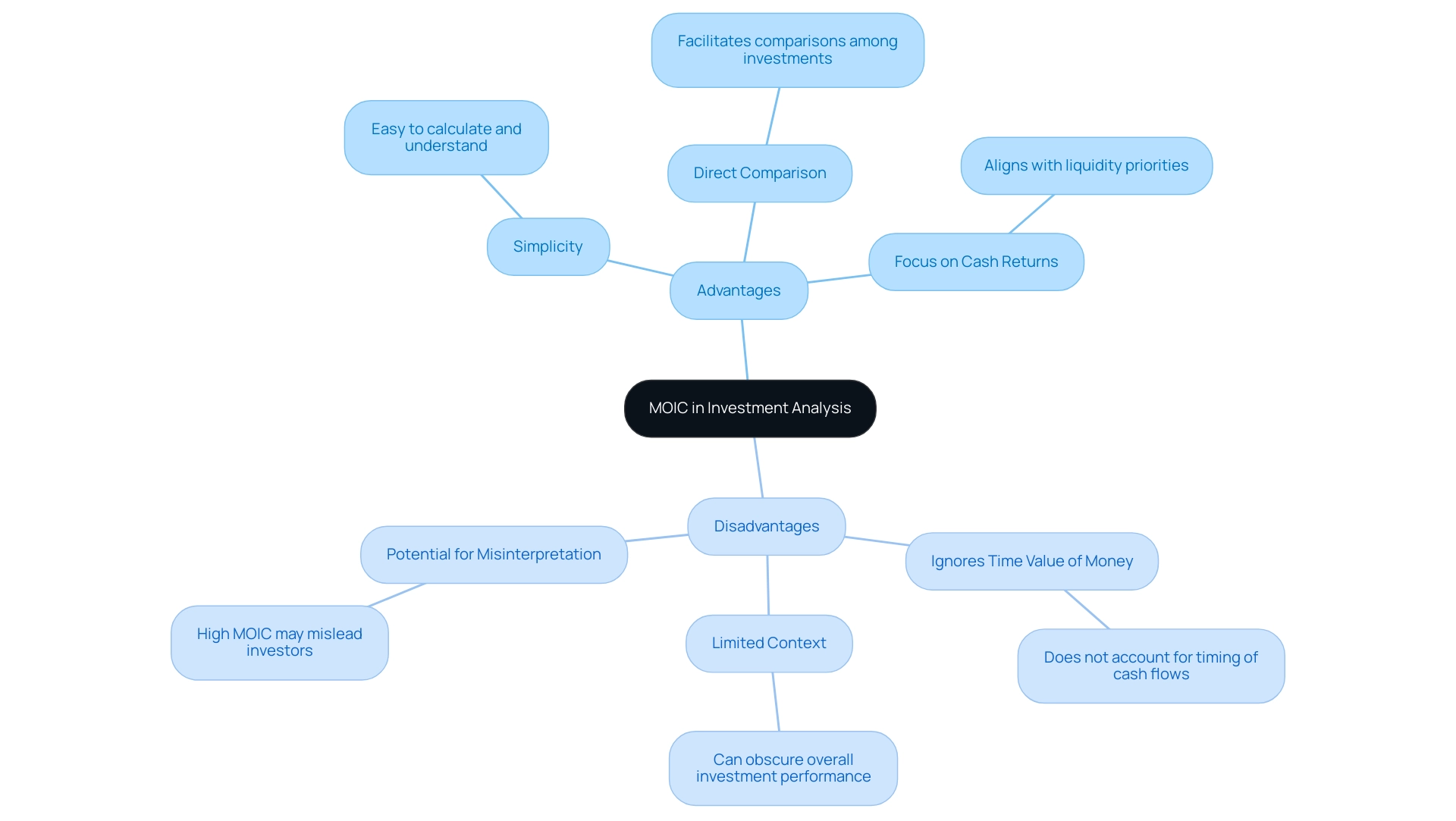

Advantages:

- Simplicity: MOIC is straightforward to calculate and comprehend, making it an accessible metric for investors across various experience levels.

- Direct Comparison: It facilitates easy comparisons among various financial opportunities, streamlining the decision-making process.

- Focus on Cash Returns: By emphasizing actual cash returns, the metric aligns well with the liquidity priorities of investors.

Disadvantages:

- Ignores Time Value of Money: Unlike the Internal Rate of Return (IRR), MOIC does not factor in the timing of cash flows, which can lead to misconceptions, especially in long-term investments.

- Limited Context: Solely depending on multiple of invested capital can obscure a comprehensive view of an investment's performance, particularly in scenarios where unrealized gains are substantial.

- Potential for Misinterpretation: A high multiple on invested capital might be misleadingly interpreted as an assurance of future returns, neglecting crucial factors that could influence performance.

Dr. Josh Lerner highlights that "Given this regulatory pressure and scrutiny from sophisticated investors, private market benchmarking has rarely been more pressing." This emphasizes the significance of grasping the nuances of metrics such as the MOIC formula. Most private equity firms aim for a multiple of capital of between 2.5x and 3.5x, which is assessed using the MOIC formula as a standard for evaluating funding opportunities.

Recent discussions highlight the necessity for a more comprehensive method to financial analysis, emphasizing the MOIC formula, as demonstrated by case studies illustrating both the strategic advantages and drawbacks of multiple on invested capital. For instance, the case study titled "Practical Applications in Financial Strategy" demonstrated how a $100,000 allocation yielded $400,000, achieving a 4x return; yet, this example also underscores the importance of contextualizing such metrics within broader financial strategies. By being aware of the pros and cons, investors can leverage the MOIC formula to analyze their invested capital more effectively.

Applying MOIC: Real-World Examples and Case Studies

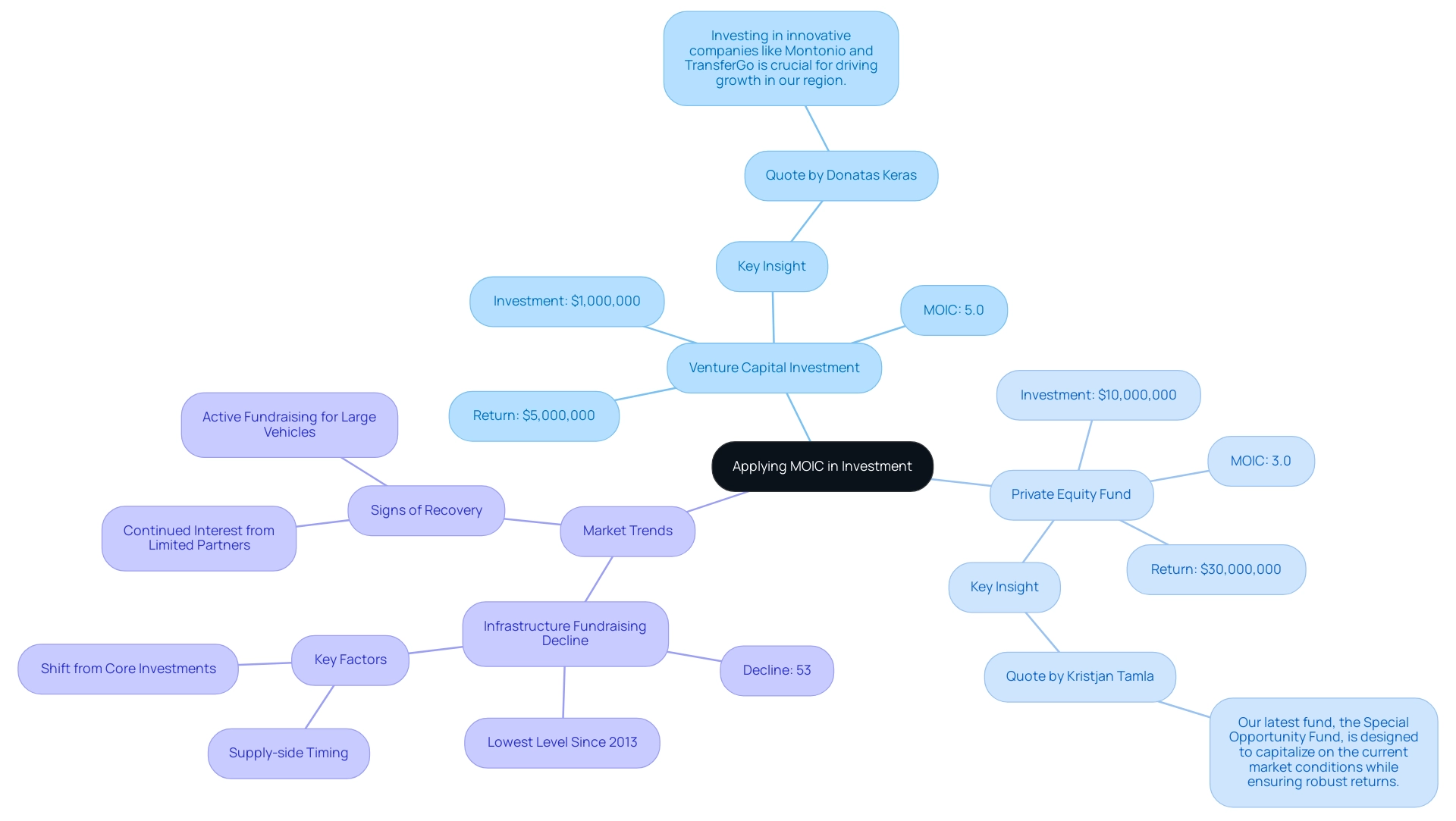

Real-world applications of the concept provide valuable insights into investment performance across different sectors, particularly within the Baltic investment landscape. Consider the following examples:

-

Venture Capital Investment: A venture capital firm allocates $1,000,000 to a promising tech startup. After five years, the startup is acquired for $5 million, yielding a MOIC calculation of:

MOIC = $5 million / $1 million = 5.0

This fivefold return exemplifies the potential for significant capital appreciation in the tech sector, a sentiment echoed by Donatas Keras, a founding partner of Practica Capital, who emphasizes the importance of identifying high-potential startups in the Baltics, stating, "Investing in innovative companies like Montonio and TransferGo is crucial for driving growth in our region."

-

Private Equity Fund: In another instance, a private equity fund invests $10 in a company. Over the course of seven years, the fund receives $30 in distributions.

The MOIC is calculated as follows:

MOIC = $30 million / $10 million = 3.0

This illustrates a threefold return, underscoring the fund's capacity to effectively evaluate its investment performance, a principle Kristjan Tamla, Managing Director of ofTEN, applies within the real estate sector. He notes, "Our latest fund, the Special Opportunity Fund, is designed to capitalize on the current market conditions while ensuring robust returns."

These instances emphasize the importance of the MOIC formula as an essential tool for evaluating financial results, especially considering recent market trends. For instance, infrastructure and natural resources fundraising has recently seen a dramatic decline of 53%, the lowest level since 2013. This decline, as highlighted in the case study on 'Infrastructure Fundraising Decline', underscores the significance of strong performance metrics for navigating these turbulent times.

The change in funding approaches emphasizes how areas such as venture capital and private equity need to adjust, underscoring the significance of the MOIC formula in evaluating performance amidst evolving circumstances. Brian Vickery, a partner in the Boston office, highlights that despite the current challenges, there are signs of recovery, with ongoing interest in large funding vehicles. Such insights from Baltic leaders underscore the value of the MOIC formula in guiding investment decisions, especially as industry leaders look to adapt and thrive in evolving market conditions.

Conclusion

Understanding the Multiple on Invested Capital (MOIC) is essential for investors navigating today's complex financial landscape. This article has highlighted the importance of MOIC as a straightforward metric that aids in evaluating the total value generated from investments against the capital deployed. By simplifying the assessment of investment success, MOIC allows for effective comparisons across diverse opportunities, which is particularly crucial in a market characterized by evolving dynamics and increased competition.

Moreover, the article has provided a detailed methodology for calculating MOIC, emphasizing the need for accuracy in this process. The distinctions between MOIC and other metrics such as Internal Rate of Return (IRR) and Total Value to Paid-In (TVPI) have been explored, illustrating how each metric offers unique insights that can guide investment decisions. Understanding these differences empowers investors to tailor their analyses to align with their specific objectives and investment timelines.

While MOIC presents clear advantages, such as its simplicity and focus on cash returns, it is important to remain aware of its limitations. The potential for misinterpretation and the lack of consideration for the time value of money necessitate a balanced approach to investment analysis. Real-world examples have demonstrated how MOIC can reflect investment success, yet they also underscore the importance of contextualizing this metric within broader strategies and market conditions.

As the investment landscape continues to evolve, embracing robust metrics like MOIC will be vital for making informed investment choices. By mastering MOIC calculations and understanding its role alongside other financial metrics, investors can better navigate the challenges ahead, ensuring their strategies are both effective and resilient in the face of change.