Overview

The article provides a comprehensive guide on calculating the Multiple on Invested Capital (MOIC), emphasizing its significance for investors in evaluating the effectiveness of their investments. It details the calculation process, compares MOIC with other metrics like IRR and TVPI, and discusses best practices for utilizing MOIC effectively, highlighting the importance of a multifaceted approach to investment analysis that considers market context and trends.

Introduction

In the intricate world of investment analysis, understanding the Multiple on Invested Capital (MOIC) is paramount for both seasoned investors and newcomers alike. This essential metric not only quantifies the performance of investments by comparing total returns to the initial capital outlay but also offers invaluable insights into the profitability of ventures, particularly in private equity and venture capital.

As investment landscapes evolve, recent developments in the Baltics and Nordics highlight the necessity for robust metrics like MOIC to navigate a complex financial environment.

However, while MOIC serves as a critical tool for evaluating investment success, it is crucial to recognize its limitations and the importance of integrating it with other metrics such as:

- IRR

- TVPI

By delving into the nuances of MOIC, investors can enhance their decision-making processes, adapt to market changes, and ultimately achieve greater financial success.

Understanding Multiple on Invested Capital (MOIC)

The Multiple on Invested Capital acts as an essential financial indicator for investors, measuring the effectiveness of their assets by comparing the total value obtained against the initial capital expenditure. Specifically, the moic calculation is performed by dividing the total distributions from a project by the total capital contributed to determine the multiple on invested capital. For instance, if an investor commits $1 million and ultimately receives $3 million, the moic calculation would show a result of 3.0.

This measure is especially significant in the areas of private equity and venture capital, as it provides a clear and concise approach for assessing profitability using moic calculation. Recent developments in the Baltics and Nordics, such as Metaplanet's contributions to Weather, which raised $7.7M, and Neurable, which secured $13M, underscore the dynamic funding environment. Considering reports from Invest Europe highlighting the necessity for strong measurements, such as moic calculation, to compare private equity with publicly traded stocks, comprehending this measure becomes increasingly vital.

Importantly, Invest Europe has emphasized the private equity sector's considerable role in employment and job generation in Europe, highlighting the wider economic effect of financial indicators such as the moic calculation. The present environment shows that 70% of general partners (GPS) are actively working with portfolio companies to address supply chain challenges created by suggested tariffs, which can directly affect investment return evaluations. This partnership highlights the significance of accurate measures, such as return on invested capital, in evaluating financial strategies during challenging periods.

As Brian Vickery, a partner in the Boston office, noted, 'The statistics indicate signs of modest advancement,' reflecting the gradual progress in performance metrics, including the moic calculation, which can guide investors in making informed decisions amidst changing market conditions. By understanding the importance of that metric and remaining aware of recent financial trends, especially in emerging areas such as Web3 and neurotechnology, investors can more effectively manage the intricacies of their portfolios and improve their decision-making processes.

Calculating MOIC: The Formula and Methodology

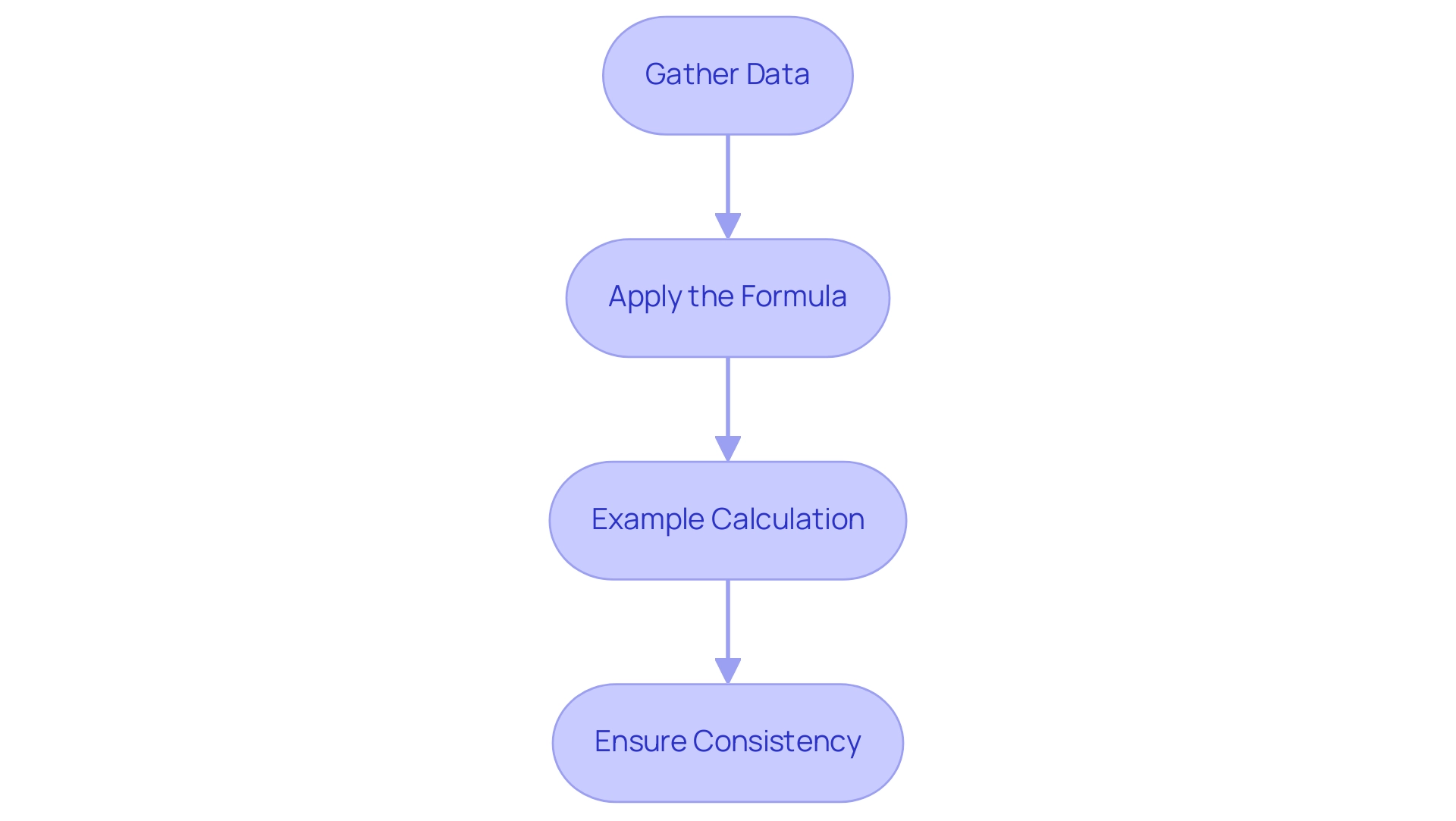

To accurately calculate the Multiple on Invested Capital, follow this structured approach:

-

Gather Data: Begin by collecting essential data, specifically the total capital invested in the project and the total distributions received. This foundational step is critical to ensure the accuracy of your calculations.

-

Apply the Formula: Utilize the following formula for your calculations:

[ \text{MOIC} = \frac{\text{Total Distributions}}{\text{Total Capital Invested}} ]

This formula serves as a straightforward method for assessing the performance of your investment against the capital put forth.

-

Example Calculation: For instance, if you invested $500,000 and later received $2,000,000 in distributions, your calculation would be:

[ \text{MOIC} = \frac{2,000,000}{500,000} = 4.0 ]

This result indicates that you received four times your initial investment, a clear sign of a robust return. To provide additional context, consider Investment B, which had a MOIC of 1.2x after Year 0 and increased to 3.2x after Year 5. These figures serve as a benchmark for assessing the performance of your financial assets over time.

When applying the MOIC calculation, it's vital to ensure consistency and accuracy in your inputs. A notable practice is to avoid re-entering the same input in different cells to prevent inconsistencies. As highlighted in a case study, referencing existing inputs minimizes errors and bolsters the reliability of financial models.

Caliber Collision emphasizes this approach with their tagline, 'Restoring the rhythm of your life,' by implementing systems and processes that improve accuracy and communication. This attention to detail can significantly enhance the integrity of your evaluations.

MOIC vs. Other Key Investment Metrics: A Comparative Analysis

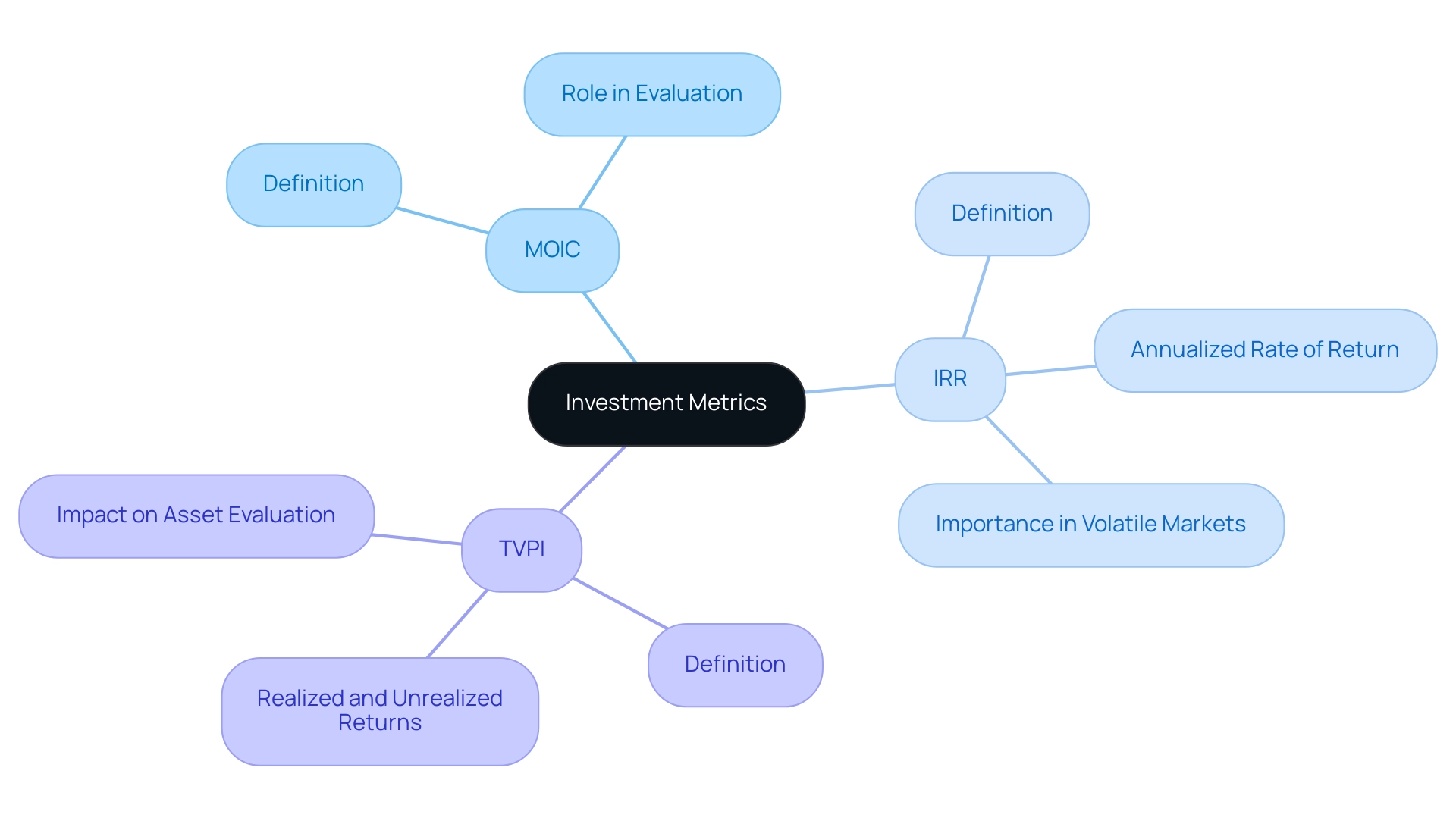

Multiple on Invested Capital is often examined alongside other essential financial indicators, namely IRR (Internal Rate of Return) and TVPI (Total Value to Paid-In). The difference between these measurements is essential for investors aiming to evaluate their results effectively.

- IRR (Internal Rate of Return): Unlike the moic calculation, which merely shows the multiple of returns produced, IRR signifies the annualized rate of return, considering the timing of cash flows. This measure, although more intricate, is crucial for assessing the effectiveness of a financial venture over time, as it indicates how swiftly capital is returned to stakeholders. Grasping IRR can offer deeper insights into asset effectiveness, particularly in volatile markets.

- TVPI (Total Value to Paid-In): TVPI resembles the moic calculation, but it expands the analysis by incorporating both realized and unrealized returns. This measure provides a thorough evaluation of an asset's results by considering the present worth of ongoing assets together with cash distributions. For investors, TVPI offers a wider viewpoint, especially in unstable situations where unrealized gains can have a substantial impact.

Given the present scenario, where LPs are still below their targets in private debt—illustrated by an increasing allocation gap of 1.4 percent—grasping these measurements becomes even more vital. This underweight stance may indicate a careful strategy toward private debt opportunities, highlighting the necessity for precise evaluation indicators like IRR and TVPI to inform decision-making.

As funding committees observe a growth in ethnic and racial minorities, reaching 30 percent, the variety of viewpoints may affect the understanding of these indicators. Varied perspectives can result in more refined conversations on financial outcomes, potentially influencing how indicators like TVPI are emphasized in assessments.

Additionally, the recent decrease in infrastructure and natural resources fundraising—falling by 53 percent to the lowest level since 2013—highlights the difficulties investors encounter. This case study emphasizes the significance of utilizing the moic calculation, IRR, and TVPI to maneuver through a changing financial environment, where comprehending the implications of these measures can assist investors in spotting chances amid challenges.

In summary, understanding the distinctions between the moic calculation, IRR, and TVPI allows investors to choose the most appropriate measure based on their personal strategy and goals, particularly considering recent market changes and fundraising patterns.

Limitations of MOIC: What Investors Should Know

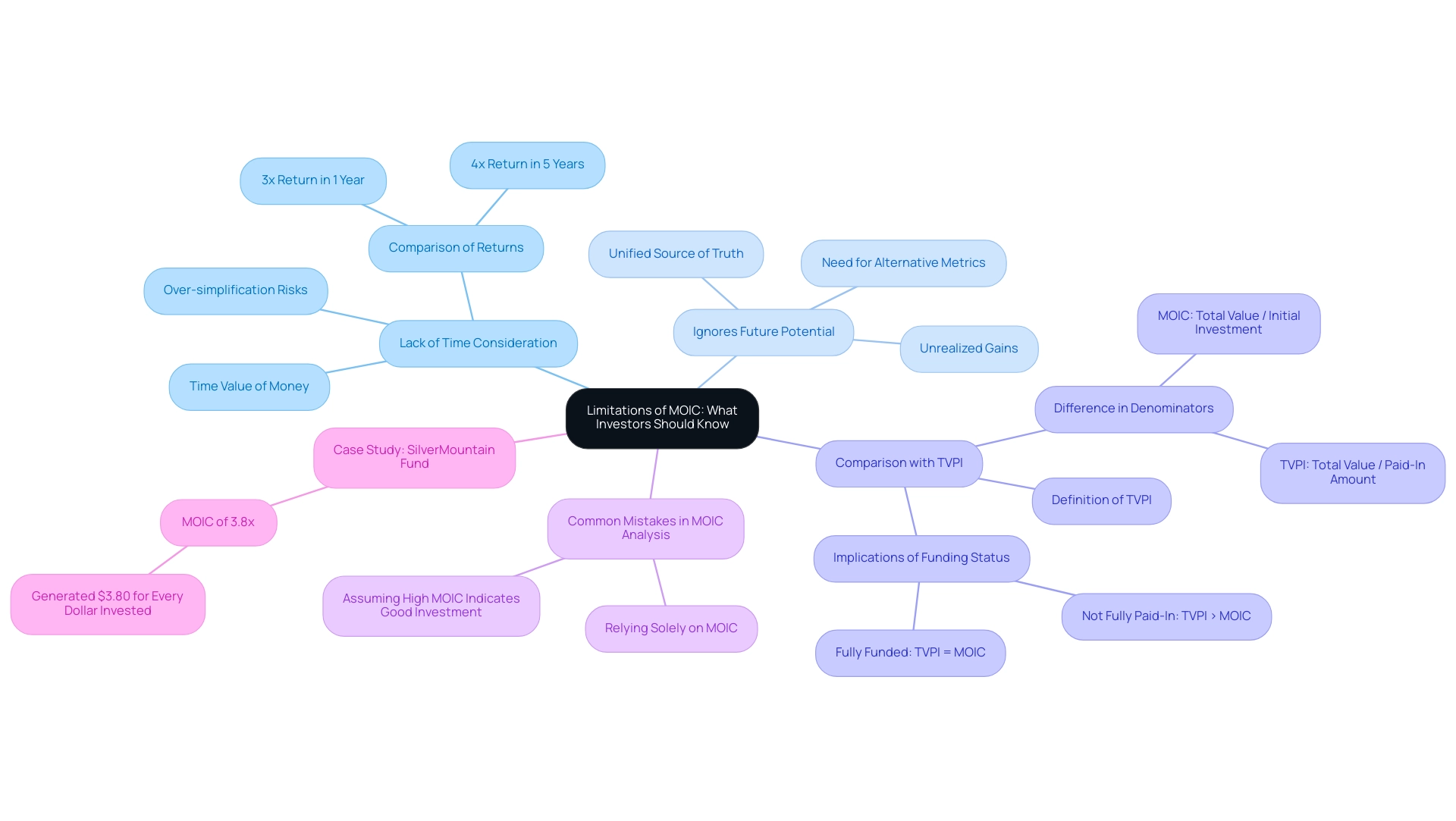

While the Multiple on Invested Capital is a useful metric for assessing performance, it is essential to acknowledge its limitations:

- Lack of Time Consideration: One significant drawback of this metric is its failure to account for the time value of money, a critical factor in evaluating returns. For instance, a funding opportunity that achieves a 3x return in one year may actually represent a less favorable outcome compared to an asset that yields 4x over five years, despite the latter appearing less impressive at first glance. Over-simplification can occur when solely relying on the moic calculation, as it may not account for complex funding scenarios. A thorough analysis must consider various factors such as prevailing market conditions, the underlying approach, and the associated risk profile. As Richard King, Founder & CEO of Finance Alliance, highlights, a nuanced understanding of financial indicators is crucial for informed decision-making in investing.

- Ignores Future Potential: Moreover, the metric does not capture unrealized gains or potential future returns, which can result in an incomplete assessment of the asset's true value. This restriction highlights the significance of employing alternative performance indicators alongside other measures to obtain a more comprehensive perspective on outcomes. Additionally, attaining a unified source of truth in portfolio analysis is crucial for alleviating pressure and enhancing fund management. For example, the moic calculation for the SilverMountain private equity fund shows a multiple of invested capital of 3.8x, indicating it generated $3.80 for every dollar invested. This statistic highlights the potential of the multiple of invested capital in the moic calculation while also emphasizing the need to consider other measures for a complete analysis.

As illustrated by the case study comparing the multiple of invested capital to Total Value to Paid-In (TVPI), where TVPI may exceed the multiple of invested capital when a fund is not fully paid-in, it is crucial to understand that TVPI divides total value by the paid-in amount, while the multiple of invested capital divides by the initial funding. This difference in denominators can significantly influence the interpretation of these measurements. Investors must adopt a broader approach to portfolio analytics.

By evaluating various measures, they can reduce the dangers linked to excessive dependence on such metrics and improve their overall financial strategy.

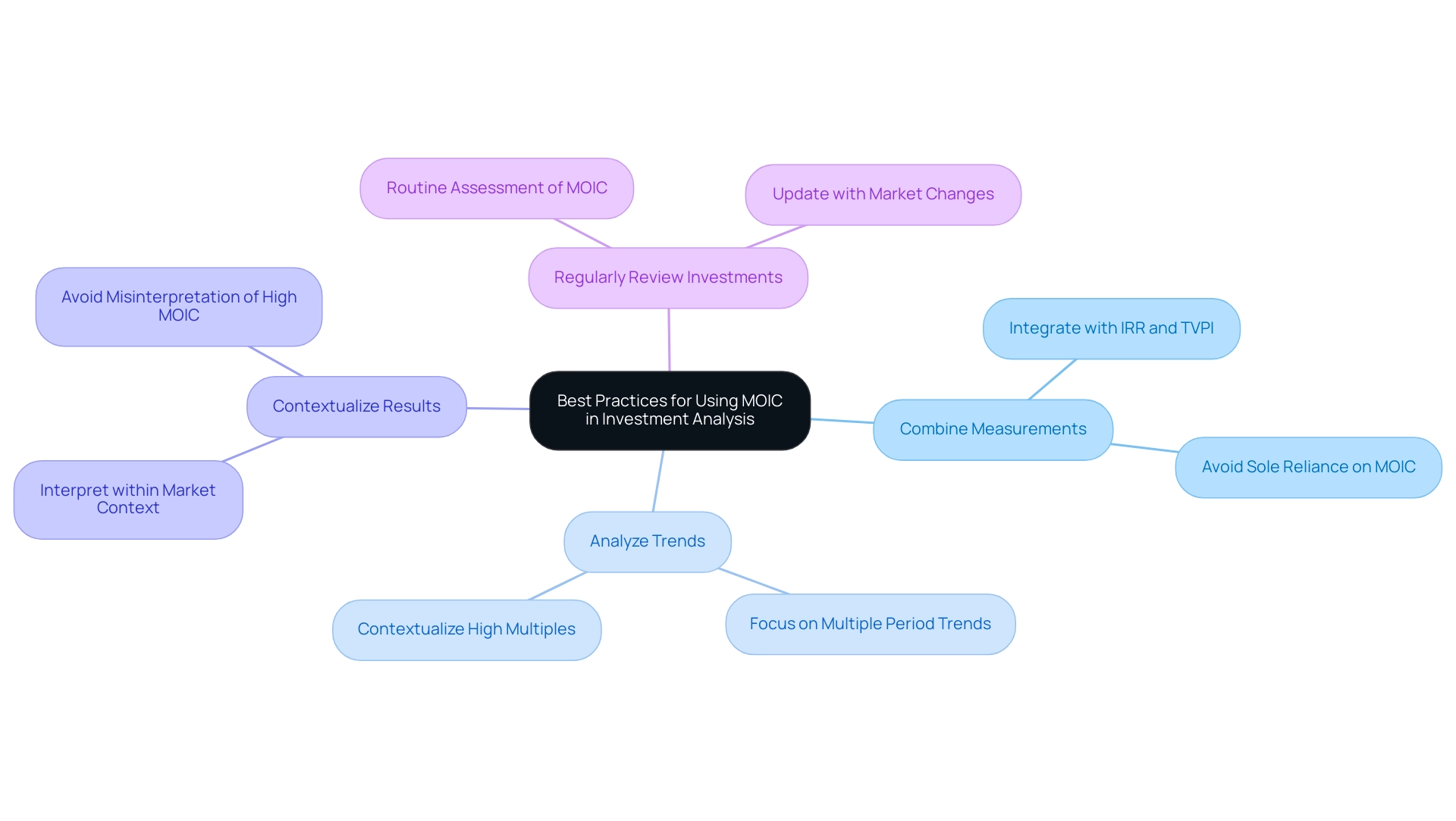

Best Practices for Using MOIC in Investment Analysis

To enhance the effectiveness of the metric in your financial analysis, consider implementing the following best practices:

-

Combine Measurements: Integrate the multiple of invested capital with other essential indicators such as Internal Rate of Return (IRR) and Total Value to Paid-In (TVPI). This multifaceted approach will provide a more comprehensive perspective on your investment performance. It's essential to avoid the common mistake of assuming that this particular metric is the only one that matters, as this can lead to misinformed decisions.

-

Analyze Trends: Concentrate on multiple period trends instead of depending on a single calculation. This longitudinal analysis will help you better understand the trajectory and potential of your investments. For instance, a multiple of 3.0x for a Year 5 exit exemplifies how a high multiple can be interpreted within the context of other metrics.

-

Contextualize Results: Always interpret performance results within the broader market context and current economic conditions. This consideration is essential to prevent misunderstandings that could result in incorrect financial decisions, such as misjudging a high multiple of invested capital as a certain profitable opportunity.

-

Regularly Review Investments: Establish a routine for assessing and updating your moic calculation as distributions are received or as market conditions change. This practice ensures that your analysis remains relevant and accurate.

The case study titled 'MOIC in Private Equity' illustrates how private equity and venture capital firms focus on achieving high returns rather than the time it takes to achieve those returns. By adhering to these best practices, investors can effectively utilize the moic calculation as a valuable component of their investment analysis strategy, fostering informed decision-making and enhanced performance evaluation.

Conclusion

Understanding the Multiple on Invested Capital (MOIC) is crucial for investors aiming to evaluate their investments effectively. This financial metric not only quantifies investment performance by comparing total returns to initial capital but also highlights its significance in the context of private equity and venture capital. As the investment landscape, particularly in the Baltics and Nordics, continues to evolve, the necessity of robust metrics like MOIC becomes increasingly apparent.

While MOIC serves as a valuable tool, it is essential to recognize its limitations. It does not account for the time value of money, can oversimplify complex scenarios, and may overlook unrealized gains. Therefore, integrating MOIC with other metrics such as IRR and TVPI is vital for a comprehensive analysis. This multifaceted approach allows investors to navigate the complexities of their portfolios and make informed decisions based on a holistic view of their investments.

By adopting best practices—such as analyzing trends, contextualizing results, and regularly reviewing investments—investors can maximize the effectiveness of MOIC in their investment analysis. Ultimately, a nuanced understanding of MOIC, coupled with other performance metrics, equips investors to adapt to market changes and seize opportunities for greater financial success. Embracing this comprehensive approach ensures that investment strategies are both robust and adaptable in an ever-changing financial environment.