Overview

In this article, we delve into the best UK property crowdfunding platforms, thoughtfully detailing their features, advantages, and the challenges they present. We understand that embarking on real estate investment can feel daunting, and our aim is to highlight how these platforms are working to democratize access to such opportunities. By reducing entry barriers for investors, they open doors to potential passive income streams. However, we recognize the importance of thorough due diligence—many of our members have shared their experiences navigating risks like illiquidity and market fluctuations. Together, we can foster a community that supports informed decision-making in this evolving landscape.

Introduction

In recent years, property crowdfunding has emerged as a transformative approach to real estate investment, breaking down traditional barriers and welcoming a broader audience into the fold. By pooling resources from multiple investors, this innovative financing method empowers individuals to participate in real estate projects without the burden of substantial capital.

As the market continues to grow, especially in regions like North America and Asia Pacific, many of our members have found themselves drawn to the potential for attractive returns and diversified portfolios.

However, we understand that alongside these opportunities, there are inherent risks and complexities that require careful navigation. This article delves into the mechanics of property crowdfunding, exploring the benefits it offers while also addressing the associated risks.

We aim to provide key considerations for selecting the right platform, creating a comprehensive guide for those looking to tap into this dynamic investment landscape with confidence and support.

What is Property Crowdfunding? An Overview

Property collective funding represents an innovative financing method that many consider among the best UK property crowdfunding platforms. It enables the collective pooling of capital from multiple investors, allowing individuals to engage in real estate ventures without the burden of substantial capital requirements. By contributing smaller amounts towards a shared goal, investors can take part in opportunities that were once out of reach. Typically, the best UK property crowdfunding platforms act as intermediaries, showcasing a diverse selection of financial opportunities, including residential developments, commercial real estate, and even mixed-use ventures.

Many investors find comfort in returns that are directly linked to the performance of the underlying assets, which may involve rental income and potential capital appreciation. This democratization of real estate participation has significantly broadened access, allowing individuals with limited financial resources to engage in the market. As we look towards 2025, the real estate collective funding environment is experiencing notable expansion, particularly in regions like North America, which thrives due to its stable economy and strong financial culture.

At the same time, the Asia Pacific region is witnessing a surge in activity, reflecting a growing interest in alternative funding options. Recent advancements in the sector, such as Brikkapp's introduction of a new marketplace and Arrived Homes' strategic acquisition of rental assets, illustrate the dynamic nature of real estate financing. These initiatives not only enhance market presence but also provide stakeholders with a broader array of choices, addressing the rising demand for accessible real estate opportunities.

As many of our members have experienced, the evolving market reveals that real estate collective funding is becoming a crucial aspect of the financial landscape. There is a significant rise in involvement from tech-savvy investors seeking innovative methods to diversify their portfolios. Additionally, the performance of conventional assets, like the S&P 500, which yielded over 17 percent in 2024, offers a valuable context for assessing the potential of real estate collective funding.

Current trends in property crowdfunding, particularly among the best UK property crowdfunding platforms, highlight a shift towards inclusivity and accessibility. This movement aligns with the broader goal of democratizing funding opportunities, as emphasized by fff. Club founder Akim Arhipov, who advocates for making financial superpowers accessible to all. Furthermore, community members at fff. Club can connect with tech leaders from companies like Bolt and Wise, enriching their financial experience through co-investing and shared learning.

Overall, the community-driven approach of platforms like fff. Club enhances the financial experience through co-investing and learning among members. This collaborative spirit is vital in driving meaningful results in the ever-evolving real estate funding market.

How Property Crowdfunding Works: Mechanics and Processes

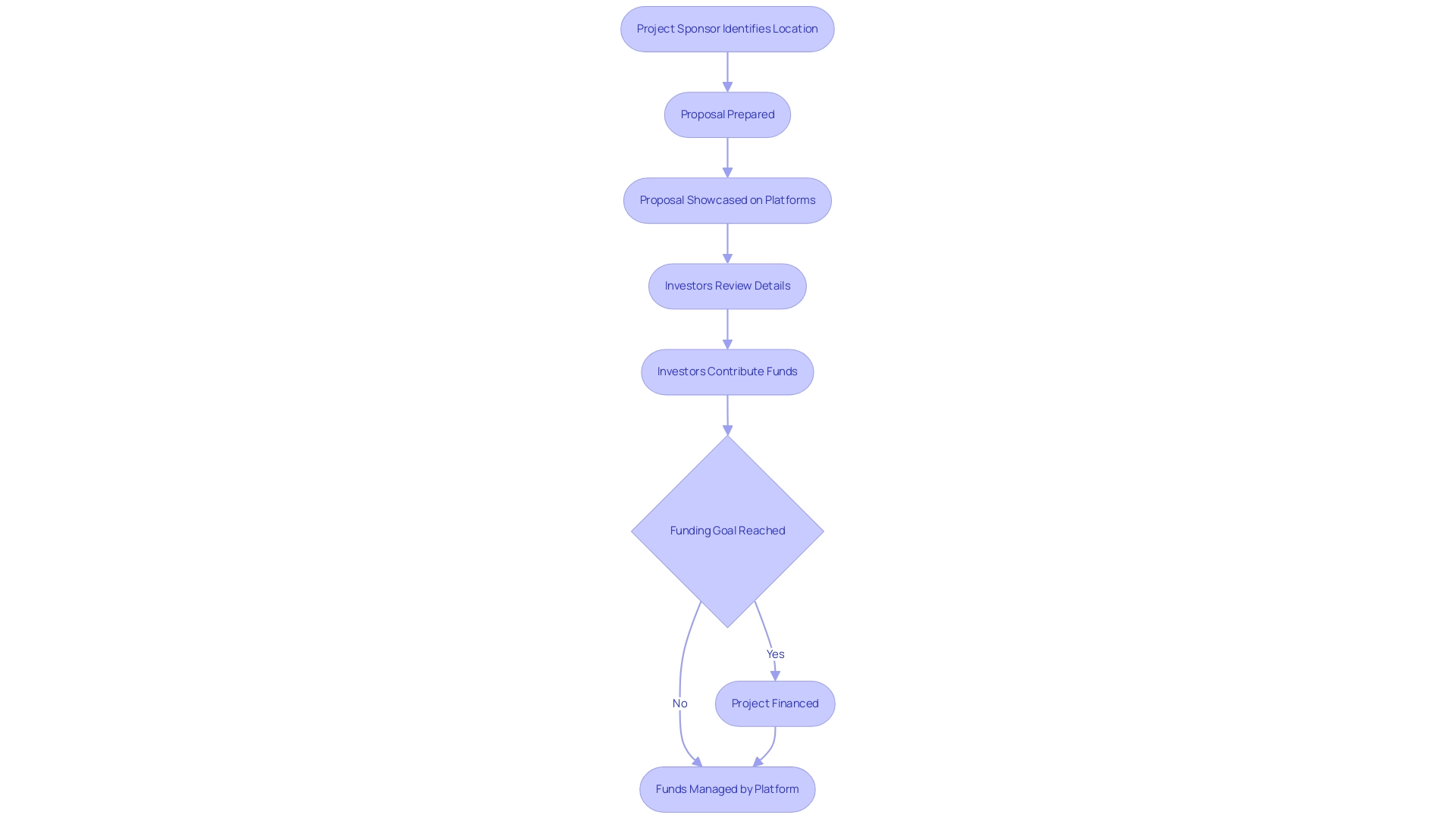

Real estate collective financing is made more accessible through the best UK property crowdfunding platforms, which serve as vital intermediaries between backers and property projects. We understand that navigating this landscape can be challenging, so the process typically begins with a project sponsor who identifies a promising location and prepares a detailed proposal for funding. This proposal is then showcased on the best UK property crowdfunding platforms, allowing prospective backers to examine crucial details such as projected returns, associated risks, and funding timelines.

Investors can choose the amount they wish to contribute, and once the collective funding goal is reached, the project is financed. The best UK property crowdfunding platforms take on the responsibility of managing the funds, which includes overseeing asset management and distributing profits to stakeholders. This streamlined approach not only enhances transparency but also simplifies the engagement process for individuals eager to participate in real estate ventures.

As many of our members have experienced, the average funding targets for property investment projects in the UK have seen a significant rise in 2025, reflecting the growing popularity of the best UK property crowdfunding platforms and indicating increasing investor confidence and interest in this investment avenue. The volume raised through reward-based fundraising worldwide has reached approximately 1.03 billion USD, underscoring the expanding market potential.

Recent analyses of the competitive landscape reveal key players in the real estate investment sector, including some of the best UK property crowdfunding platforms like AHP Servicing LLC, Crowdestate AS, and CrowdStreet Inc. These platforms, recognized for their excellence, are continuously evolving and adopting innovative strategies to capture market share and respond to recent business developments. We understand that for tech investors, grasping the strategies of these key players can provide valuable insights into potential funding opportunities and associated risks.

Successful examples from the best UK property crowdfunding platforms illustrate the mechanics at play. The rise of collective funding securities following the JOBS Act in 2012 has introduced a new financial strategy, albeit with uncertainties regarding performance during economic fluctuations. This situation emphasizes the importance of careful financial strategies and the necessity for thorough due diligence.

As Albert Einstein famously stated, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it." This quote serves as a reminder of the importance for stakeholders to comprehend the complexities of their assets, particularly in the fluid context of real estate collective funding.

Expert insights reveal that the mechanics of property crowdfunding, especially through the best UK property crowdfunding platforms, not only facilitate funding opportunities but also foster a collaborative atmosphere where participants can learn from one another. At Finance, Freedom, Fellows, we connect with over 400 technology financiers, empowering them through community-driven funding opportunities, educational resources, and exclusive insights from Baltic financial leaders like Donatas Keras and Kristjan Tamla. This community-driven aspect enriches the overall financial experience, enabling members to co-invest and share knowledge, ultimately driving meaningful outcomes in the dynamic real estate market.

The Benefits of Property Crowdfunding: Why Invest?

Investing in the best UK property crowdfunding platforms offers a multitude of advantages that cater to both novice and seasoned investors. We understand that entering the real estate market can feel daunting, but one of the most significant benefits is the reduction of entry barriers to real estate funding. With minimal contributions often beginning at just £100, a wider range of individuals can now explore the opportunities for capital growth, making this journey more accessible.

This inclusivity aligns beautifully with the ethos of the best UK property crowdfunding platforms, such as fff.club, which seeks to empower everyone through collaborative funding opportunities and high-grade deal screening. As many of our members have experienced, this approach fosters a sense of belonging and shared purpose.

Furthermore, property collective funding promotes diversification, allowing individuals to distribute their capital across various projects and property categories. This strategy not only mitigates risk but also enhances the potential for returns. For instance, the recent launch of N.V. REIT by Neighborhood Ventures in January 2023 exemplifies how these platforms are broadening access to funding opportunities for both qualified and non-accredited investors.

Additionally, the successful fundraising of USD 43 million by Crowd Street in October 2022 underscores the growth and increasing popularity of the best UK property crowdfunding platforms. We recognize that such milestones can inspire confidence and hope for potential investors.

At fff.club, we are committed to screening high-grade deals and performing due diligence, leveraging the expertise of over 300 members to evaluate investment opportunities. This thorough vetting process is crucial in building trust and confidence among stakeholders, particularly in a market that can be complex and challenging to navigate. One of our investors, John Doe, shared, "Investing through fff.club has transformed my approach to real estate. The collaborative evaluation process gives me confidence in my investments."

Moreover, real estate collective funding provides the opportunity for passive income through rental returns and capital growth. As highlighted by the residential segment's expected dominance in the real estate investment market in 2025, this avenue is increasingly viewed as a less risky entry point for investors. For example, in June 2022, Arrived Homes garnered attention by purchasing 59 single-family rental units for $23 million, showcasing the profitable potential of this approach.

As Albert Einstein famously stated, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it." This quote resonates with our mission to empower investors to grasp funding methods, such as real estate group financing, which are essential for financial achievement.

In summary, the advantages of real estate collective funding in 2025 are clear: lower entry costs, diversification, thorough project vetting through the best UK property crowdfunding platforms, and the opportunity for passive income make it an appealing choice for investors looking to grow their wealth in a dynamic market. Additionally, our detailed sourcing and evaluation process ensures that every opportunity is carefully considered, further enhancing the value we provide to our members. We are here to support you on this journey, ensuring you feel valued and informed every step of the way.

Understanding the Risks of Property Crowdfunding

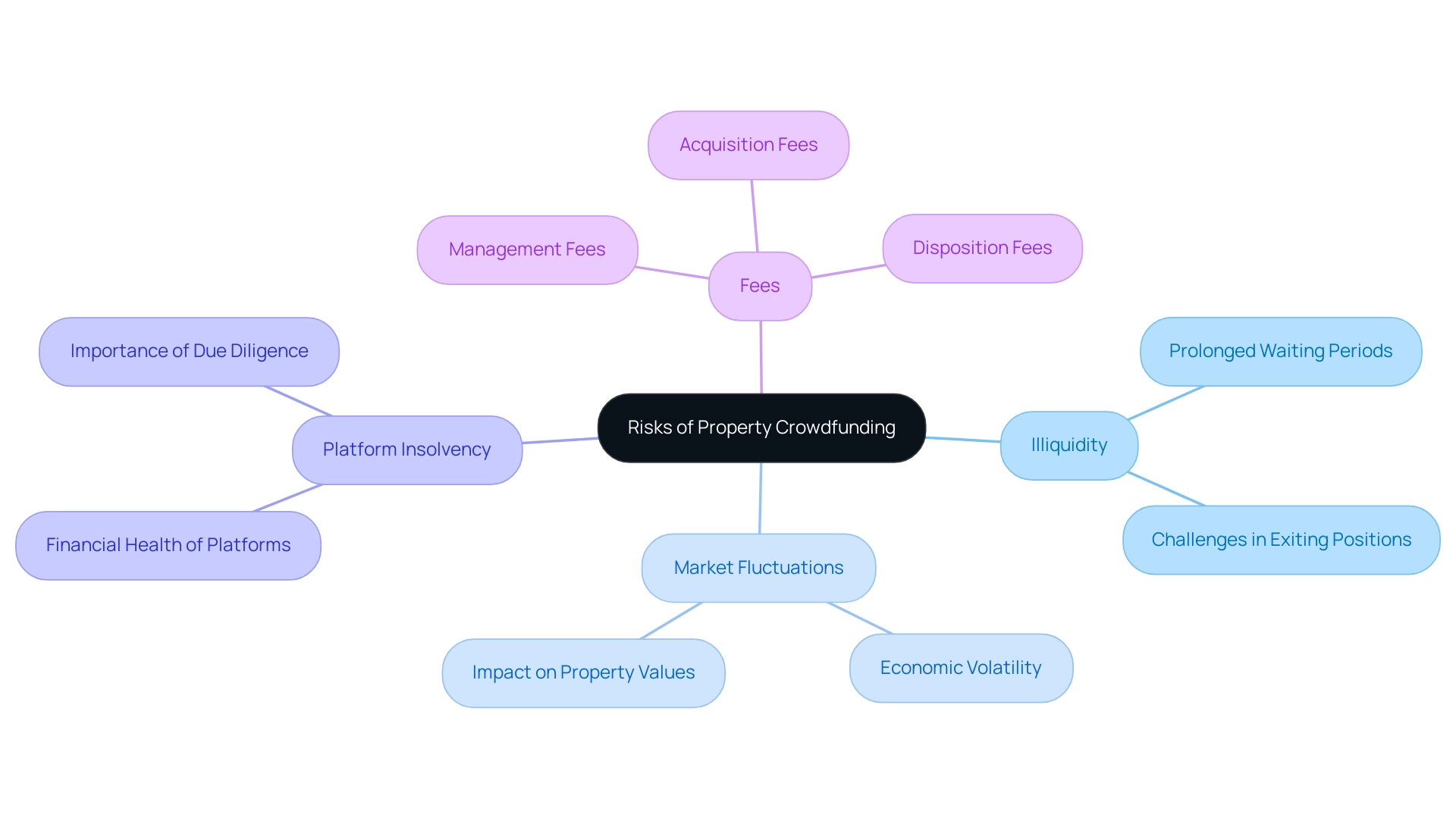

While real estate collective funding offers various benefits, we must recognize the inherent risks involved. A primary concern is the illiquidity of assets; unlike stocks, real estate properties can take considerable time to sell, making it challenging for individuals to exit their positions promptly. As many of our members have experienced, the illiquidity rates in real estate collective funding ventures in the UK remain a significant factor in 2025, with many investors facing prolonged waiting periods before realizing returns.

Market fluctuations and economic downturns can also adversely impact real estate performance. For instance, the real estate collective financing industry is projected to reach $349.26 billion by 2032, driven by increased accessibility and technological advancements. However, we understand that this growth comes with the caveat of navigating economic volatility, which can affect local property values and overall financial stability.

Another critical risk is the potential insolvency of funding platforms. As highlighted in discussions among industry leaders, including insights from experts, the financial health of these platforms is paramount. If a platform faces financial challenges, it could endanger funding, underscoring the importance of comprehensive research and due diligence. Charles Clinton, CEO of Equity Multiple, emphasizes this due diligence, asserting that individuals must be vigilant in evaluating the platforms they choose to engage with.

Moreover, individuals must also be mindful of the various fees linked to crowdfunding platforms, such as management, acquisition, and disposition charges, which can reduce overall returns. Comprehending these expenses is crucial for making informed financial choices.

Considering these risks, it is vital for stakeholders to perform thorough due diligence on each project and the best UK property crowdfunding platforms available. This includes evaluating the platform's financial stability, understanding the specific risks tied to individual investments, and staying informed about market trends. By doing so, individuals can better navigate the intricacies of real estate financing and enhance their likelihood of achieving favorable results.

Prominent individuals from the fff.club community, including Martin Villig and Taavi Roivas, illustrate the quality of participants who operate in this area, further emphasizing the significance of informed decision-making in the ever-evolving landscape of real estate funding.

Choosing the Right Property Crowdfunding Platform: Key Considerations

Selecting the best UK property crowdfunding platforms in 2025 can feel overwhelming, but it’s important to approach this task with care and consideration. First and foremost, we understand that examining a platform's track record and reputation is crucial. Platforms with a proven history of successful projects and positive backer feedback tend to offer a more dependable financial experience, which can ease some of your concerns.

For instance, many of our members have found platforms like CrowdSpace to be reliable, as they consistently deliver up-to-date information through regular monitoring and collaboration with platform representatives. This ensures that investors feel well-informed and supported throughout their journey.

Next, assessing the various forms of capital allocation available on the platform is essential. It’s important to ensure that these offerings align with your specific financial goals and risk tolerance. A diverse range of investment options can enhance portfolio resilience, particularly in a dynamic market, which many investors find reassuring.

We also encourage you to scrutinize the fees associated with the platform. High fees can significantly diminish overall returns, making it vital to understand the fee structure before committing your hard-earned funds. Transparency plays a critical role in this process; platforms must provide clear and comprehensive information regarding project details, associated risks, and expected returns. This transparency fosters trust and allows you to make informed decisions, which is something we all value.

Regulatory compliance is equally important. We urge you to verify that the platform is authorized by relevant financial authorities; this serves as a safeguard for your protection as an investor. Compliance not only enhances credibility but also ensures that the platform adheres to industry standards, giving you peace of mind.

In discussing the best UK property crowdfunding platforms, it’s worth highlighting notable examples that have effectively navigated the complexities of the market. For instance, Sunswap, which secured £17.3 million through public funding, illustrates how innovative projects can draw substantial financial support while tackling urgent ecological issues. These case studies emphasize the potential for funding platforms to enable significant contributions, which can be incredibly inspiring.

Additionally, on average, crowdfunding campaigns secure approximately $7,000 in funding. This provides a quantitative perspective on the potential of these platforms, reminding us of the possibilities that lie ahead.

Moreover, platforms like Finance, Freedom, Fellows highlight the importance of collaborative evaluation of financial opportunities and thorough due diligence. With a network of over 300 experts assessing high-grade deals, they ensure a smooth and convenient investment process, which can enhance the likelihood of successful outcomes. As many of our members have experienced, "300+ heads are better than one," allowing you to leverage collective expertise and make informed decisions based on comprehensive evaluations.

Ultimately, professional guidance underscores the significance of comprehensive research and due diligence when choosing a funding platform. As investment expert Darya Zarya notes, 'Real estate collective funding is one of the easiest ways to tap into the real estate market,' emphasizing the accessibility and potential of these platforms when chosen wisely. Moreover, with the life sciences field anticipated to gain from heightened governmental attention and financial support in 2025, it’s important to contemplate how these trends might impact real estate fundraising opportunities.

By considering these crucial elements, you can enhance your likelihood of success in the ever-evolving landscape of real estate funding, and remember, you’re not alone in this journey.

Legal Considerations in UK Property Crowdfunding

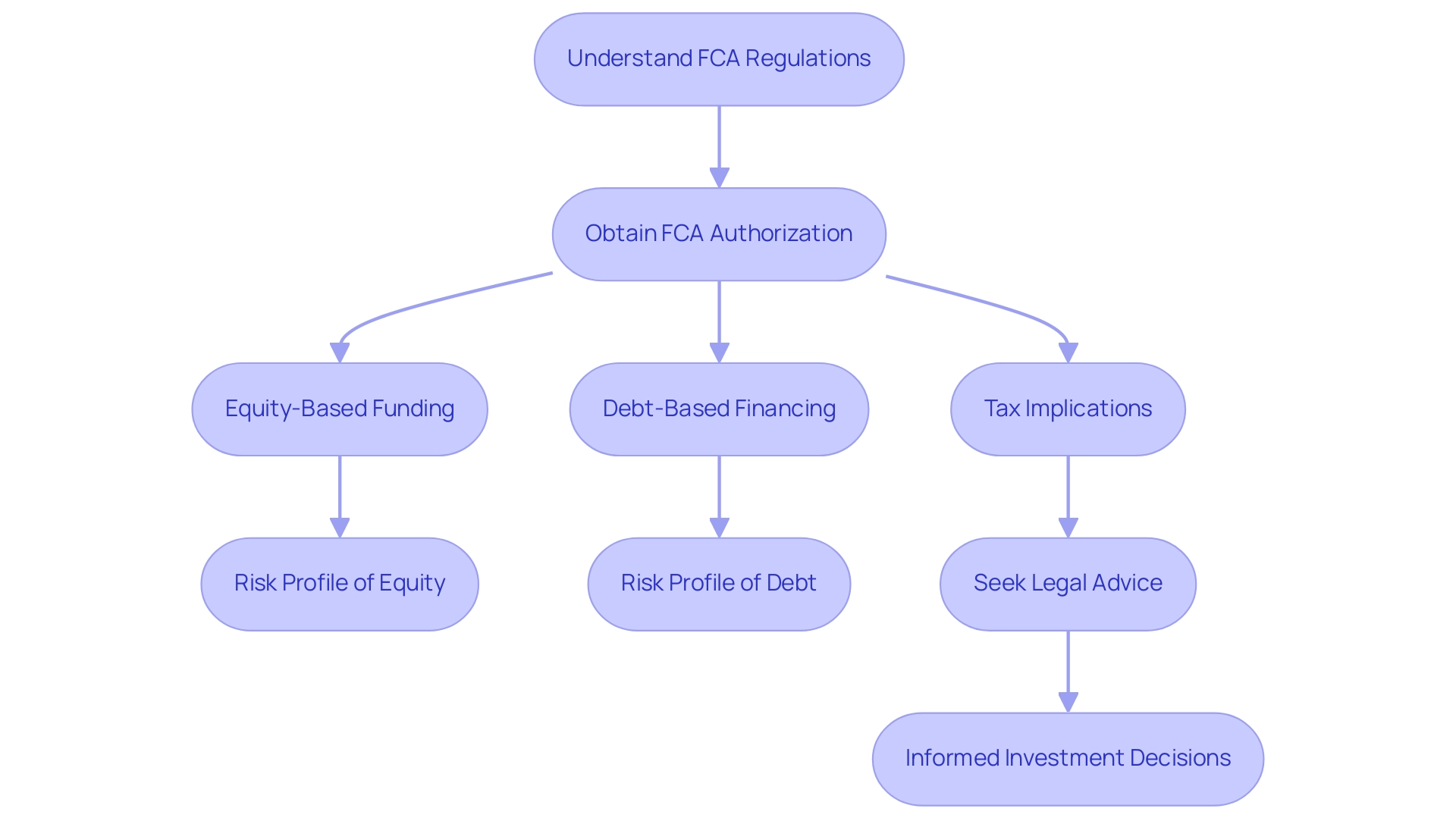

In the UK, property collective funding operates under the careful oversight of the Financial Conduct Authority (FCA), which establishes a comprehensive regulatory framework designed to safeguard stakeholders. To function legally, funding platforms must secure FCA authorization, adhering to rigorous standards concerning transparency, stakeholder communication, and risk disclosure. This regulatory environment is crucial for maintaining stakeholder confidence and ensuring that platforms provide clear information about the nature of assets, whether they are equity or debt, along with the inherent risks involved.

We understand that navigating the legal landscape surrounding real estate collective funding can be daunting. It’s important for investors to grasp the differences between various investment types and their associated risks. For instance, while equity-based funding allows individuals to acquire shares in a real estate venture, debt-based financing typically involves lending money to real estate developers in exchange for interest payments. Each option presents its own risk profile, which requires careful consideration.

Moreover, tax implications play a significant role in property crowdfunding ventures. Rental income and capital gains from these assets may be subject to taxation, making it vital for individuals to seek guidance from legal or financial advisors to effectively navigate these complexities. This proactive approach not only aids in compliance with legal requirements but also strengthens the overall investment strategy.

As the FCA continues to assess regulations related to equity raising and peer-to-peer lending, with a focus on investor protection and promotion standards, staying informed about these developments is essential. The changing regulatory landscape, coupled with the increasing demand for well-managed rental units, underscores the importance of ongoing learning and adaptation in the competitive UK real estate market. As Egan notes, "the BTR sector represents a robust solution for the supply-demand imbalance, especially as demand for well-managed rental homes grows across the UK."

Additionally, recent trends reveal that only 6% of funding rounds from 2011 to 2021 resulted in companies exiting the private market, highlighting the necessity for thorough due diligence and informed decision-making in this space.

In summary, understanding the FCA regulations and legal aspects related to property funding is vital for individuals aiming to successfully navigate this dynamic market. Engaging with legal specialists and staying updated on regulatory changes will empower stakeholders to make informed decisions and enhance their financial outcomes. The post-election stability in the UK is revitalizing VC activity, particularly in sectors like life sciences, which is driving demand for lab and office spaces. This further emphasizes the need for continuous learning through networking, education, and mentorship.

Pros and Cons of Property Crowdfunding: A Balanced Perspective

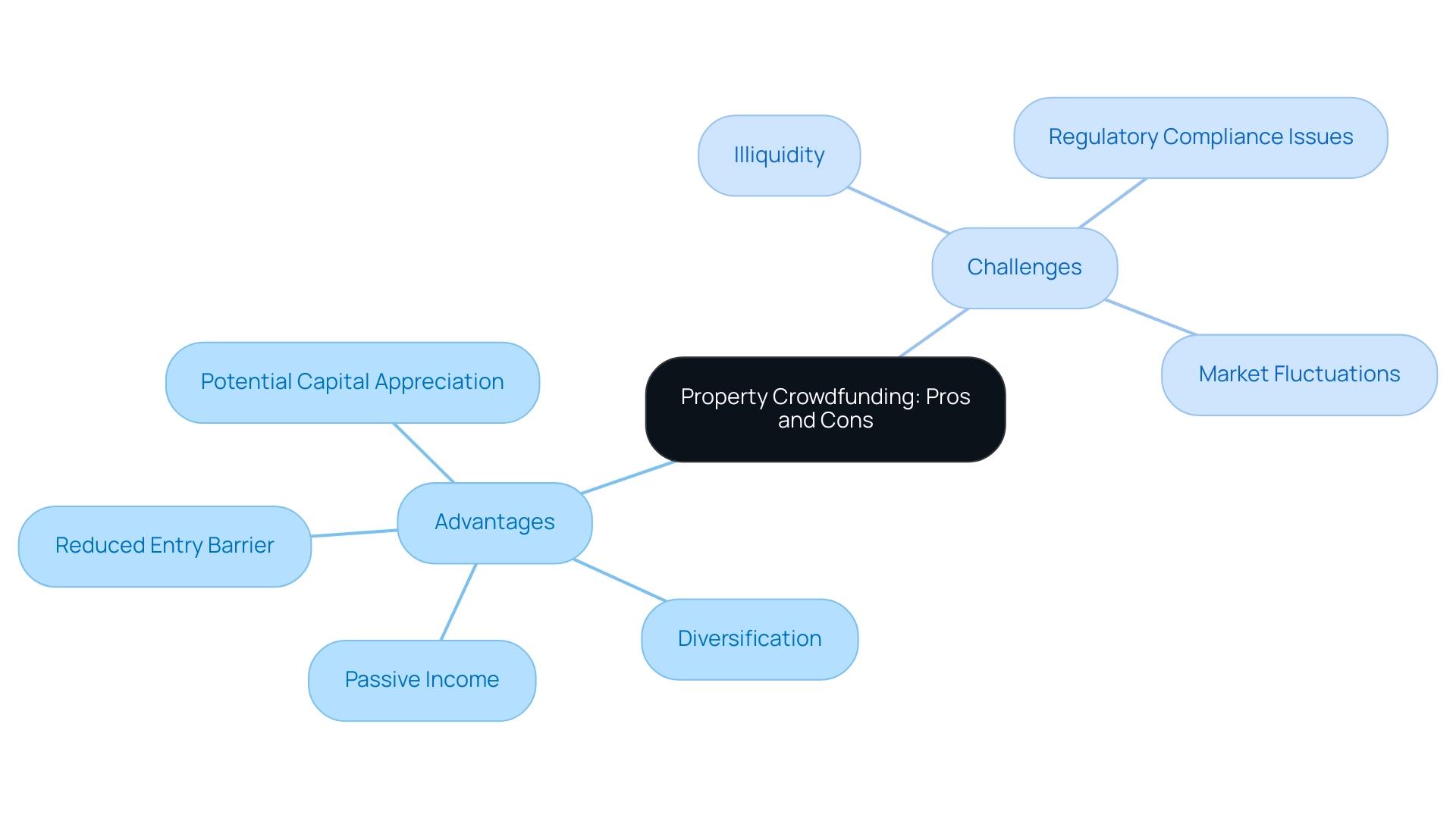

Property crowdfunding presents a compelling opportunity, particularly through the best UK property crowdfunding platforms, which come with both distinct advantages and notable challenges. We understand that one of the primary benefits of these platforms is their reduced entry barrier, allowing investors to participate with smaller capital amounts. This democratization of access to real estate opportunities is crucial for many looking to enter the market. Additionally, this model facilitates diversification, enabling individuals to spread their resources across various projects, thereby mitigating risk.

Moreover, the best UK property crowdfunding platforms can yield passive income through rental returns and potential capital appreciation, making them an attractive option for those seeking to enhance their income streams. As many of our members have experienced, this can be a rewarding avenue for investment.

However, it’s vital for investors to remain vigilant regarding the inherent risks associated with these platforms. Illiquidity is a significant concern, as funds may be tied up for extended periods, limiting access to capital when needed. Market fluctuations can also impact these platforms, potentially leading to losses in real estate values. We understand that these uncertainties can be daunting.

Furthermore, the stability of the best UK property crowdfunding platforms is essential. Platforms that fail to comply with regulatory standards may face legal consequences, jeopardizing financial contributions. As Tanel Orro, CEO at Reinvest24, notes, "The team at Reinvest24 has decades of combined professional experience in finance, real estate, and technology," highlighting the importance of expertise in navigating these platforms.

Looking ahead to 2025, market sentiment towards the best UK property crowdfunding platforms reflects a cautious optimism. Many acknowledge their potential while emphasizing the importance of thorough due diligence. Platforms like Finance, Freedom, and Fellows, recognized as leaders in this space, typically conduct due diligence on funding options before allowing participation. This process can significantly influence stakeholder confidence and decision-making. This collaborative approach to investment evaluation is echoed by industry leaders like Donatas Keras and Kristjan Tamla, who stress the value of leveraging collective expertise to identify high-grade deals.

Experts in the field, such as Abby Blumenfeld, Senior Relations Analyst at EquityMultiple, emphasize the necessity of understanding key financial terms and concepts, especially when considering these platforms. Educational resources designed for individuals at all levels, such as webinars and informative materials, equip individuals with the knowledge needed to navigate the complexities of real estate investing effectively.

A balanced perspective on the best UK property crowdfunding platforms reveals that while the advantages are compelling, the disadvantages warrant careful consideration. The case study titled "Educational Resources for Real Estate Participants" underscores the importance of access to educational materials and webinars, which are essential for individuals to enhance their knowledge and make informed financial decisions. As the landscape evolves, financial experts continue to assess the pros and cons, providing insights that can assist individuals in making informed choices.

Ultimately, the best UK property crowdfunding platforms can serve as a valuable component of a diversified investment portfolio. By approaching them with a strategic mindset and a commitment to ongoing education, investors can navigate this landscape with confidence and support.

Conclusion

Property crowdfunding represents a significant evolution in real estate investment, offering both opportunities and challenges. We understand that the prospect of pooling resources to invest in properties with lower capital requirements can feel empowering, as it democratizes access to the real estate market. The benefits are clear:

- reduced entry barriers

- diversification across various projects

- potential for passive income through rental yields and capital appreciation

are all attractive features for investors seeking to grow their wealth.

However, it is essential to navigate the inherent risks associated with property crowdfunding. Illiquidity, market fluctuations, and the financial stability of crowdfunding platforms can create uncertainty. We recognize that these challenges require diligent research and careful decision-making. It’s crucial for investors to be equipped with the knowledge to evaluate platforms and projects thoroughly, ensuring they understand the specific risks and costs involved.

Choosing the right crowdfunding platform is a vital step in this investment journey. Factors such as the platform's reputation, the types of investments offered, fee structures, and regulatory compliance must be thoroughly assessed. As many of our members have experienced, making informed choices and leveraging community-driven resources can enhance the chances of successful outcomes in this dynamic landscape.

In conclusion, property crowdfunding stands as a compelling investment avenue for those willing to engage thoughtfully and strategically. We understand that as the market continues to evolve, remaining informed and adaptable will empower investors to capitalize on the potential that property crowdfunding offers while mitigating its risks. Embracing a balanced perspective, with a commitment to ongoing education and due diligence, can lead to meaningful investment success in the world of real estate crowdfunding.