Overview

Crowdfunding platforms for real estate provide a democratized investment opportunity by allowing individuals to invest in fractional shares of properties, significantly lowering entry barriers and fostering portfolio diversification. The article highlights the growth potential of these platforms, projecting a robust market expansion driven by technological advancements and increasing investor interest, while also emphasizing the importance of assessing platform features, risks, and due diligence in making informed investment decisions.

Introduction

The rise of real estate crowdfunding marks a significant shift in the investment landscape, democratizing access to opportunities that were once the domain of wealthy individuals and institutions. By allowing investors to pool resources and participate in various real estate projects, this innovative model not only lowers entry barriers but also enhances portfolio diversification.

As the market continues to expand, with projections indicating a substantial increase in value over the coming years, understanding the mechanics and benefits of real estate crowdfunding becomes essential for potential investors.

This article delves into the intricacies of this investment avenue, exploring:

- Leading platforms

- Associated risks

- Emerging trends that are shaping the future of real estate investment.

Understanding Real Estate Crowdfunding: An Overview

Property collective funding has surfaced as a revolutionary method, allowing several backers to combine their assets through crowdfunding platforms for real estate to finance various property initiatives, encompassing both residential and commercial assets. This model is mainly supported through crowdfunding platforms for real estate, effectively democratizing access to property opportunities that were traditionally reserved for wealthy individuals or institutional stakeholders. By enabling participants to invest in fractional shares of properties, crowdfunding platforms for real estate significantly lower the barriers to entry while simultaneously fostering portfolio diversification.

Insights from prominent investors such as Donatas Keras, a founding partner of Practica Capital, and Kristjan Tamla, Managing Director of efTEN, highlight the increasing significance of this financial avenue in the Baltic region. For example:

- Keras has been crucial in Practica Capital's funding of Montonio, a FinTech startup transforming payment solutions in the Baltics.

- Tamla has effectively overseen the efTEN Special Opportunity Fund, which concentrates on acquiring undervalued property assets.

Their expertise emphasizes the strategic potential within early-stage funding and property management.

As per recent evaluation by Facts & Factors, the property investment market was valued at roughly USD 12.17 billion in 2023 and is expected to hit about USD 17.8 billion in 2024, eventually rising to nearly USD 349.26 billion by 2032. This reflects a robust compound annual growth rate (CAGR) of roughly 45.2% from 2024 to 2032. Comprehending the mechanics of this financial process is essential for prospective participants, as it establishes the foundation for informed decision-making in the subsequent sections of this article.

Furthermore, with crowdfunding platforms for real estate like Bricksave revealing intentions to broaden into Uruguay in 2025, the momentum of property collective funding keeps increasing, highlighting its potential as a feasible financial opportunity. Additionally, the 'Comprehensive Study of the Real Estate Crowdfunding Market' provides an in-depth analysis of market definitions, growth drivers, opportunities, and challenges, which further enriches our understanding of this evolving landscape.

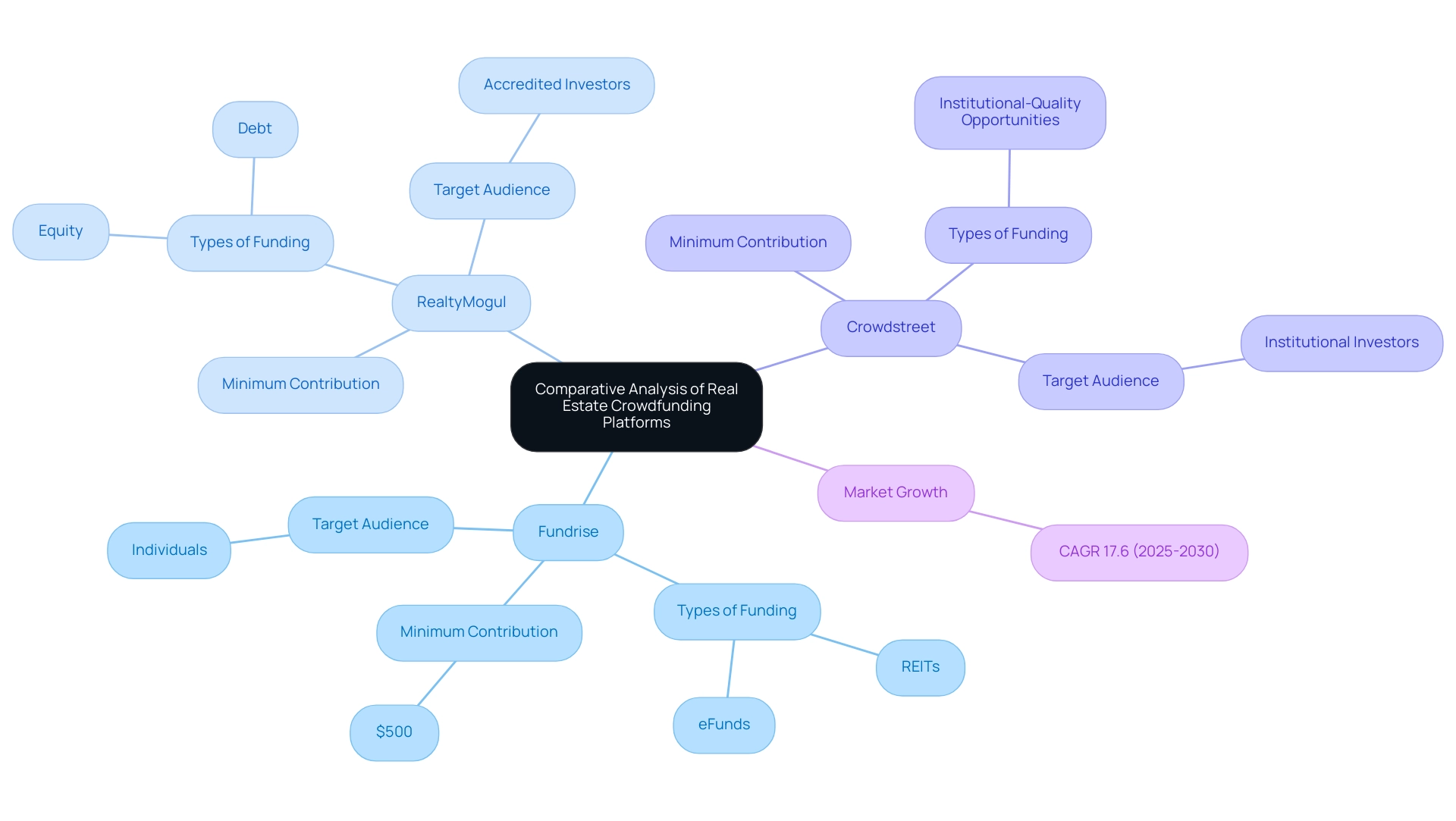

Comparative Analysis of Leading Real Estate Crowdfunding Platforms

The environment of crowdfunding platforms for real estate is characterized by various notable platforms, each offering distinct features designed for different types of backers.

- Fundrise distinguishes itself by allowing individuals to start with a minimum contribution of only $500, providing a varied array of options, including REITs and eFunds.

- In contrast, RealtyMogul primarily serves accredited individuals, offering opportunities for both equity and debt funding, with a particular emphasis on commercial properties.

Meanwhile, Crowdstreet sets itself apart by focusing on institutional-quality commercial property opportunities, providing participants access to larger-scale transactions that frequently offer greater potential returns.

According to market projections, crowdfunding platforms for real estate are anticipated to expand at a CAGR of 17.6% from 2025 to 2030, indicating significant growth potential for estate crowdfunding. It is essential for financiers to carefully assess each platform's fee structures, minimum contribution requirements, and the types of projects available, as these factors will significantly impact their funding strategy.

As Sofia Gancedo, COO of Bricksave, declares, 'The acquisition aligns with Bricksave's commitment to democratizing real estate participation through accessible, transparent, and profitable solutions.' Furthermore, the recent acquisition approach of Arrived Homes, which included buying 59 single-family rental properties valued at $23 million, underscores the increasing demand from retail participants and the potential for varied financial opportunities.

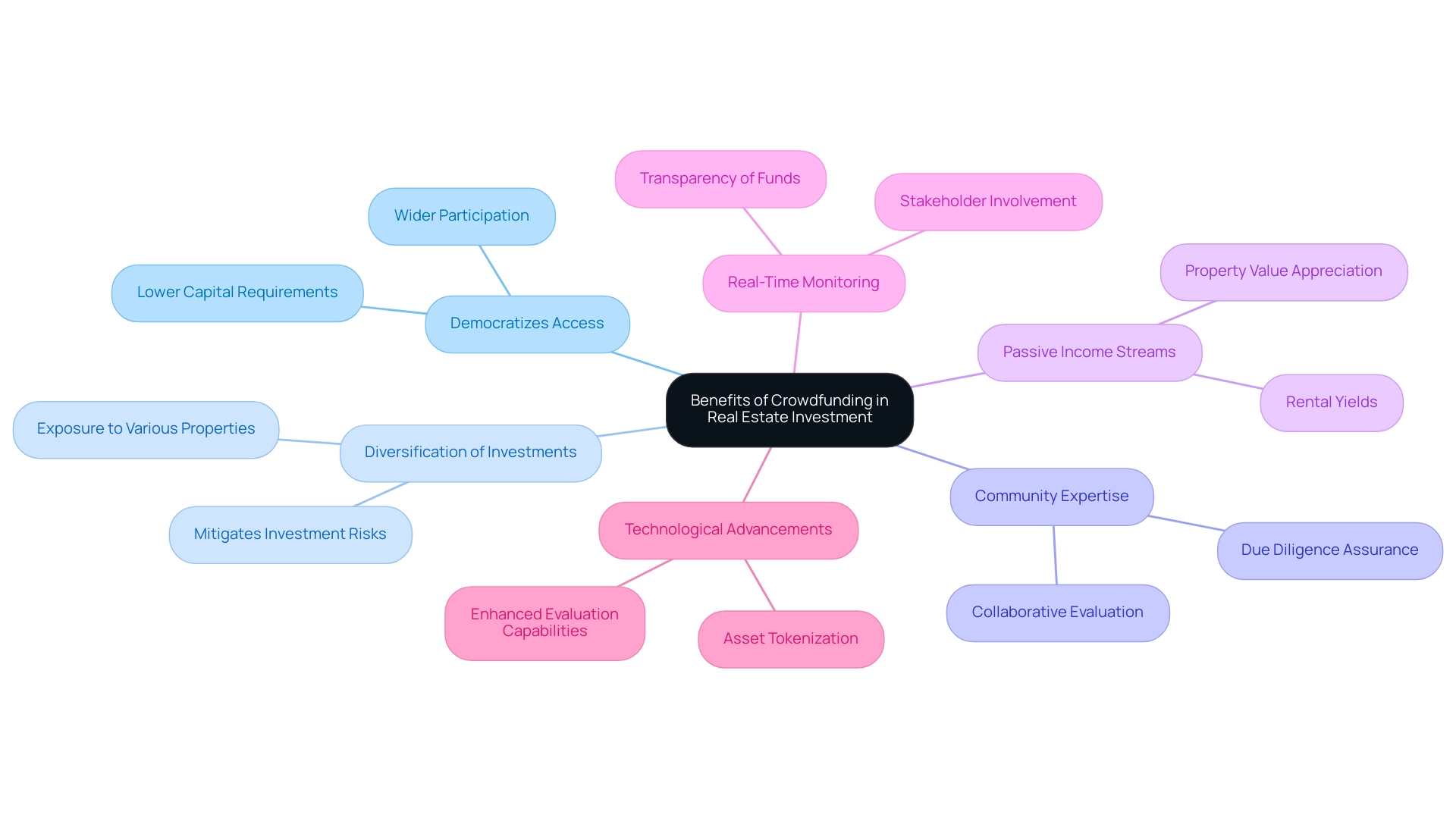

Benefits of Crowdfunding in Real Estate Investment

Crowdfunding platforms for real estate offer numerous advantages that greatly reduce capital obstacles, allowing a wider variety of participants to enter the market. This innovative funding model, exemplified by crowdfunding platforms for real estate, not only democratizes access to estate investments but also offers exposure to a diverse array of properties, thereby mitigating the risks associated with concentrating investments in a single asset. Platforms like fff. Club are at the forefront of this evolution, leveraging the expertise of over 300 members to collaboratively evaluate and screen high-grade deals, ensuring thorough due diligence that instills greater confidence among stakeholders. One investor remarked, 'Investing through fff. Club has transformed my approach to real estate; the collective knowledge and support make me feel secure in my decisions.'

In Italy, equity-based funding is rapidly increasing, despite rather rigid regulations, indicating a growing acceptance of this funding model. Technological advancements further enhance the capabilities of crowdfunding platforms for real estate to conduct comprehensive evaluations, empowering members through collective insights. According to insights from Fit Small Business, campaigns that secure at least 30% of their funding goals within the first week tend to achieve overall success, highlighting the importance of early traction in funding initiatives.

This statistic highlights the competitive nature of collective funding and the necessity for developers to focus on projects that align with crowdinvestor demand. Presently accessible offers encompass chances in residential properties and commercial estate developments via crowdfunding platforms for real estate, enabling individuals to diversify their portfolios. Additionally, individuals can enjoy passive income streams through rental yields and the potential for property value appreciation, making crowdfunding platforms for real estate a compelling avenue for wealth accumulation.

The clarity provided by online platforms allows real-time monitoring of funds, promoting a sense of involvement and control among stakeholders. Moreover, the existing trend towards asset tokenization illustrates how fractional ownership is transforming the landscape, enabling platforms like Digishares to assist in acquiring high-value assets with minimized capital expenditures. This development in the collective financing sector not only boosts participant involvement but also corresponds with the increasing recognition of such funding as a valid financial resource.

Apply now to explore these exciting financial opportunities.

Navigating Risks in Real Estate Crowdfunding

Crowdfunding platforms for real estate provide encouraging possibilities for participants in collective funding, but it is crucial to acknowledge the related risks. Key concerns include:

- Project delays

- Market fluctuations

- The possibility of total capital loss

Unlike conventional real estate opportunities, crowdfunding generally provides restricted liquidity, which can impede individuals from swiftly converting their shares when prompt access to funds is necessary.

Moreover, valuation risk can occur due to subjective judgments, leading to overvaluation or incorrect assumptions about costs and revenues. The quality of projects can vary greatly across crowdfunding platforms for real estate, emphasizing the importance for stakeholders to conduct thorough due diligence before committing resources. Insights from seasoned financiers like Donatas Keras, a founding partner of Practica Capital, emphasize the significance of comprehending the Baltic funding environment, especially in early-stage ventures.

Practica Capital has made notable investments in companies such as:

- Montonio

- Ovoko

- PvCase

- TransferGo

This showcases their commitment to fostering innovation in the region. Recently, they announced their fund III, which is poised to deploy another 80m€ into future success stories in the Baltics. Meanwhile, Kristjan Tamla, Managing Director of ofTEN, emphasizes the operational intricacies of property funds, which can inform stakeholders about the dynamics of crowdfunding platforms for real estate.

Considering inflation threats that can diminish purchasing power—leading to actual returns that may not meet expectations, like lending funds to a property developer at 8% per year while inflation is at 5%, producing an effective return of just 3%—it becomes essential for stakeholders to comprehend these threats thoroughly. As highlighted by Manuchehr Shahrokhi, 'Our findings thus posit that RECF is an evolutionary process while it is currently transformative and disruptive.' Such insights from leading Baltic asset managers are essential for creating a balanced approach that aligns with individual financial goals and mitigates potential pitfalls in the changing landscape of property financing.

Furthermore, the recent acquisition of Hashnote by Circle demonstrates the dynamic nature of the financial technology sector, which can affect the funding landscape and opportunities for stakeholders.

Future Trends in Real Estate Crowdfunding

The future of real estate collective funding is set for substantial expansion, propelled by technological innovations and a rising acceptance of alternative financing models. As investors seek portfolio diversification, crowdfunding platforms for real estate are expected to expand their offerings, embracing niche markets and international projects. Significantly, successful campaigns frequently draw an average of approximately 300 supporters, indicative of a strong interest in this funding avenue.

This trend reflects the strategic development noted at fff.vc, where the emphasis has moved towards risk diversification and funding across different asset classes, including property, amidst a backdrop of market uncertainty. Insights from James Pullen, a partner at White & Case, resonate here:

For all these ongoing challenges, however, there is a sense of cautious optimism building across real estate as interest rates peak, consensus forms on valuations, and visibility on future performance improves.

Such optimism indicates a supportive atmosphere for collective funding endeavors.

Furthermore, evolving regulatory frameworks signal a growing governmental recognition of collective funding's potential to democratize investment access, likely leading to more supportive policies. The integration of blockchain technology emerges as a transformative force, enhancing transaction transparency and security—crucial elements for attracting risk-averse investors. As debt-oriented fundraising gains traction, it provides a dependable pathway for those seeking stable returns through loans to property developers.

Additionally, collective funding serves as an alternative financial source for startups and small enterprises, circumventing traditional financial institutions, thereby enhancing market validation and community engagement, which ultimately fosters increased credibility and customer loyalty. Investors who remain knowledgeable about these emerging trends will find themselves well-positioned to take advantage of the changing landscape of property funding in 2024 and beyond, especially as the market segments by investor type (individual and institutional) and property type (residential and commercial), presenting diverse opportunities. In line with fff.vc's growth, which has seen membership rise to over 300 members and a total investment of around 3m€ across various deals, including notable names like Inbank and Bolt, community members can expect similar opportunities through crowdfunding platforms for real estate.

Conclusion

Real estate crowdfunding is reshaping the investment landscape by democratizing access to opportunities that were once limited to affluent individuals and institutions. This innovative model allows diverse investors to pool resources, significantly lowering barriers to entry while promoting portfolio diversification. With projections indicating substantial market growth, understanding the mechanics and advantages of real estate crowdfunding is increasingly crucial for potential investors.

Leading platforms offer varied features tailored to different investor profiles, ensuring that individuals can find suitable options based on their investment goals. The benefits of this model extend beyond mere accessibility; they include:

- The potential for passive income

- Diversification across asset types

- The ability to participate in projects that align with investor interests

However, it is essential to remain cognizant of the risks involved, such as project delays and market fluctuations, which necessitate thorough due diligence.

Looking ahead, the future of real estate crowdfunding appears promising, with technological advancements and evolving regulatory frameworks poised to enhance its appeal. Investors who stay informed about emerging trends will be well-positioned to leverage the opportunities presented by this dynamic investment avenue. As the market continues to evolve, real estate crowdfunding represents not only a viable path for wealth accumulation but also a transformative force in the broader financial ecosystem.