Overview

The article compares various crowdfunding platforms in the UK by examining their features, fees, and success rates, highlighting the importance of selecting the right platform for effective fundraising. It emphasizes that equity crowdfunding platforms like Crowdcube have higher success rates (approximately 70%) compared to reward-based platforms, and discusses how factors such as usability, regulatory compliance, and fee structures significantly influence campaign outcomes and user experience.

Introduction

Crowdfunding has rapidly transformed into a vital funding avenue in the UK, allowing entrepreneurs and organizations to tap into collective financial support from a diverse pool of contributors. This innovative financing model not only democratizes access to capital but also fosters community involvement in various projects, particularly within the technology sector.

As the landscape evolves, understanding the different types of crowdfunding platforms, their associated fees, and the success rates they offer becomes crucial for both campaigners and investors.

This article delves into the intricacies of crowdfunding in the UK, exploring its significance, the features of leading platforms, and the financial implications for those looking to navigate this dynamic funding environment.

Understanding Crowdfunding: An Overview of Its Importance in the UK

Crowdfunding has emerged as one of the best crowdfunding platforms UK, serving as a pivotal funding mechanism that empowers individuals and businesses to secure capital through collective contributions from numerous participants, predominantly through online channels. This financing model democratizes access to funding, allowing innovative projects—especially within the technology sector—to thrive without reliance on traditional backers or banking institutions. Notably, community share offers on Crowdfunder incur a platform fee of 3%, which is an important consideration for potential fundraisers.

In the context of fff.vc, the minimum amount for participation is set at £1,000, ensuring that investors can engage meaningfully. The importance of collective funding cannot be overstated, as it not only facilitates the financial support needed for startups through the best crowdfunding platforms UK but also promotes community engagement in funding initiatives. As Philip Volna, Product Marketing Manager, states, 'A UK loan-based platform is obliged to hold regulatory capital either equal to a percentage of loans funds or £50,000 — whatever is higher.'

This highlights the regulatory landscape that impacts crowdfunding operations. fff.vc sources its deals from a diverse range of innovative startups, providing opportunities for individuals to engage with high-potential projects.

The platform also manages deals post-closing, ensuring that stakeholders receive updates and support throughout the investment lifecycle. As the UK navigates the evolving landscape of technology and entrepreneurship, leveraging the best crowdfunding platforms UK is becoming increasingly vital for collective funding. It provides essential resources for startups while addressing the pressing need for core and multi-year funding necessary for the survival of charitable organizations, subsequently reducing bureaucratic processes that often hinder progress.

Furthermore, businesses seeking to navigate these regulatory complexities can utilize appointed representative services for legal consulting and compliance, facilitating smoother compliance processes. The terrain of collective funding in 2024 will likely reflect these trends, showcasing its critical importance for entrepreneurs and investors alike.

Exploring Different Types of Crowdfunding Platforms in the UK

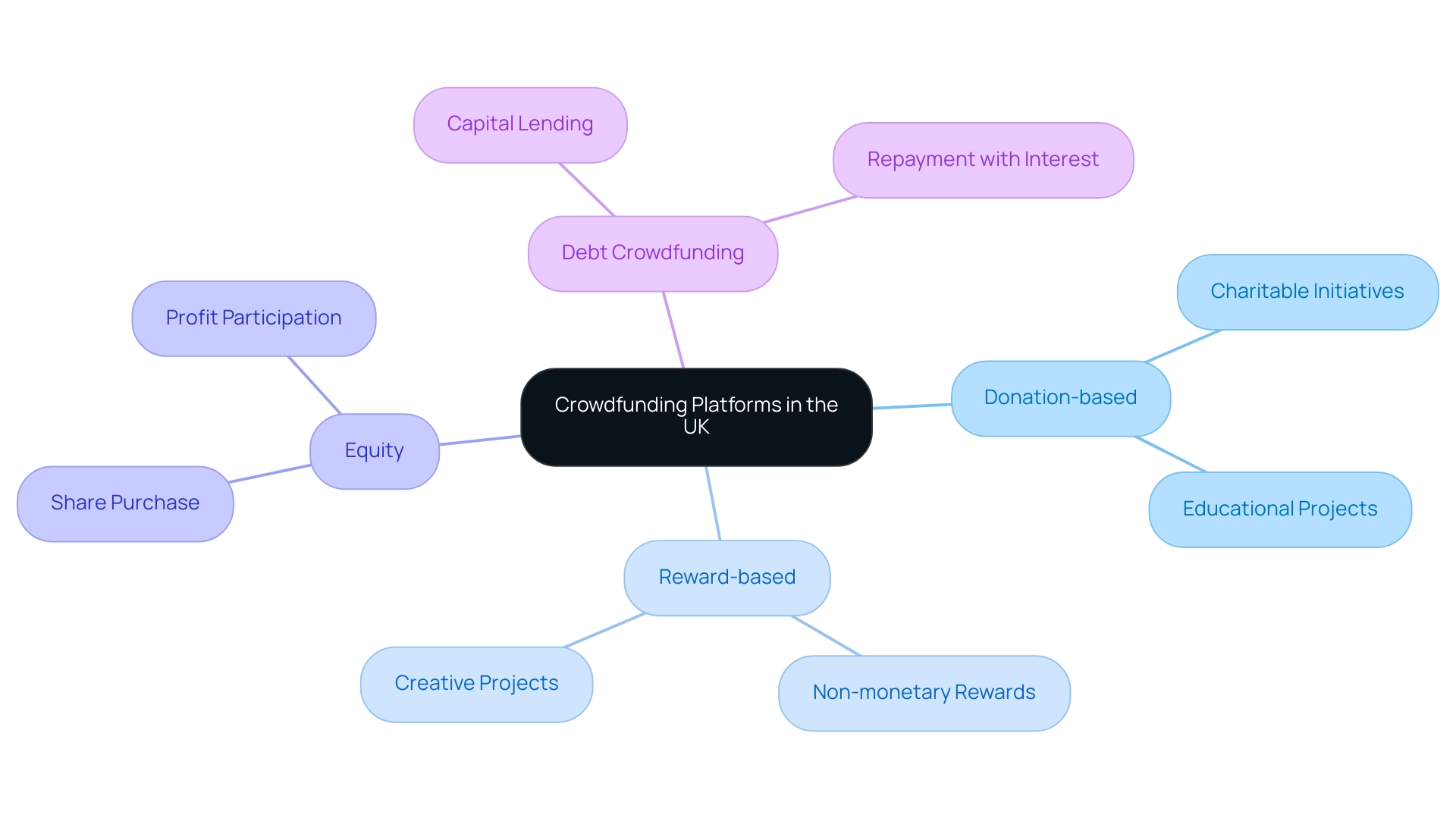

In the UK, the best crowdfunding platforms are classified into four primary categories: donation-based, reward-based, equity, and debt crowdfunding.

- Donation-based services enable individuals to support various causes without the anticipation of receiving anything in return, rendering them especially appropriate for charitable and educational initiatives.

- Reward-based systems incentivize backers with non-monetary rewards, such as products or services, in exchange for their contributions; this model is especially popular among creative projects.

- Equity financing allows investors to purchase shares in a company, thus enabling them to participate in its potential profits, while

- Debt financing involves lending capital to businesses with the expectation of repayment with interest.

Understanding the nuances of these types is essential for potential campaigners when selecting the best crowdfunding platforms UK to achieve their objectives. Notably, data reveals that between 2011 and 2021, only 6% of funding rounds resulted in companies that successfully exited the private market, emphasizing the importance of careful evaluation in this investment landscape.

As Philip Volna states, 'Discover the essentials of investment banking, including the steps involved in mergers and acquisitions,' emphasizing the critical nature of understanding financial structures in fundraising. Additionally, a short guide to fundraising clarifies that donation-based fundraising is a common method where contributors do not expect monetary rewards, often used for charity and educational projects. Moreover, analyzing the kinds of businesses that employed collective funding worldwide in 2015 can offer understanding of the changing environment and the varied uses of these systems.

Key Features of Leading Crowdfunding Platforms in the UK

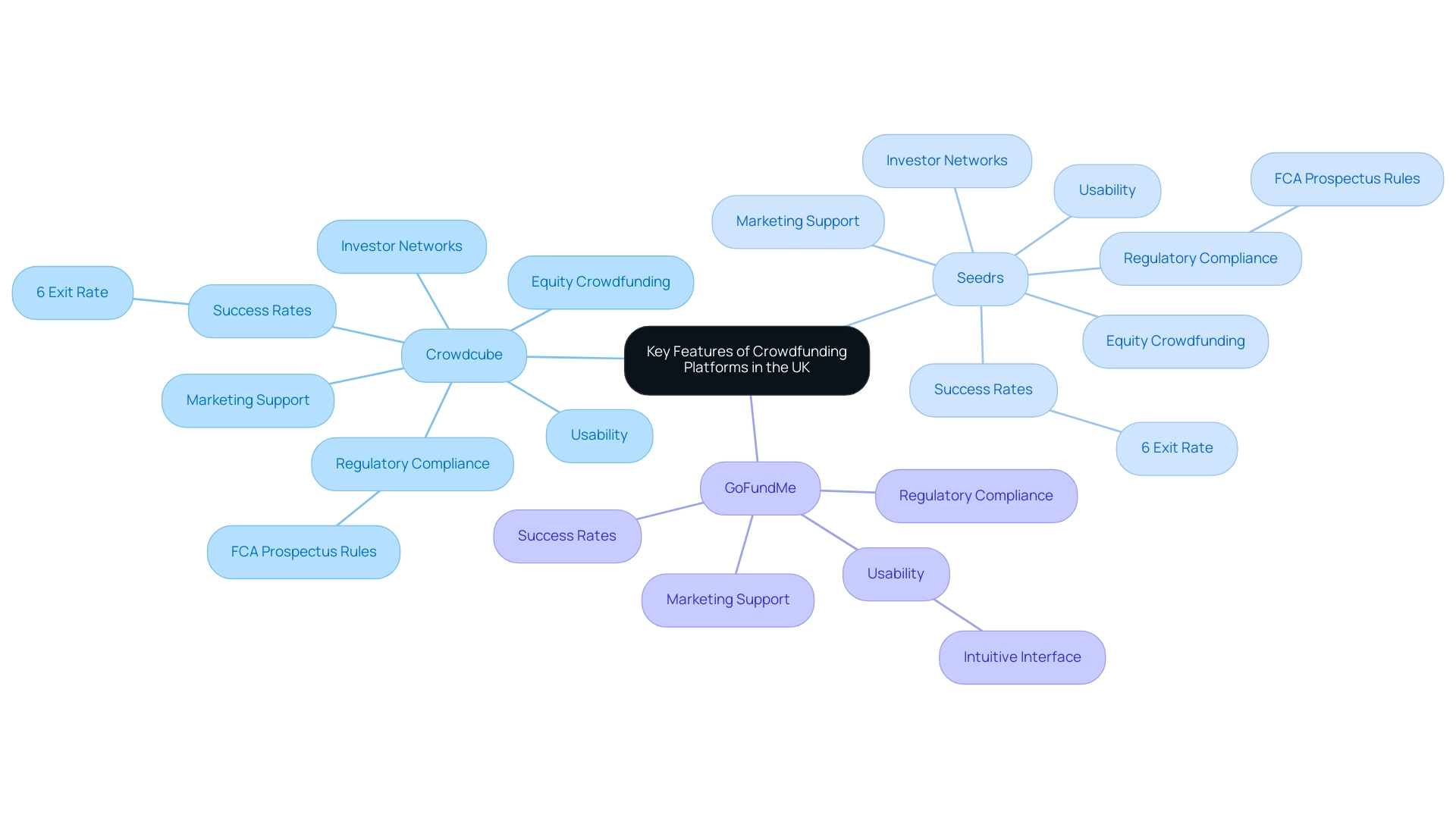

Notable fundraising websites in the UK, including the best crowdfunding platforms UK like Crowdcube, Seedrs, and GoFundMe, offer unique characteristics that greatly affect user experience and the effectiveness of fundraising initiatives. A critical aspect to evaluate is the system's usability; Crowdcube and Seedrs facilitate equity crowdfunding, characterized by their strong networks of potential investors and adherence to regulatory compliance, such as the Financial Conduct Authority’s (FCA) Prospectus Rules for deals exceeding €5 million, which ensures a higher level of investor protection and transparency. Philip Volna, a Product Marketing Manager, notes that a UK loan-based service is required to maintain regulatory capital of either a percentage of loan funds or at least £50,000, whichever is greater.

In contrast, GoFundMe is recognized for its intuitive interface, making it particularly appealing for donation-based initiatives. Moreover, both Crowdcube and Seedrs provide valuable marketing support, essential for enhancing campaign visibility and effectiveness. Assessing these features is essential for campaigners seeking to select from the best crowdfunding platforms UK that align with their project needs and objectives.

Additionally, a case study on the progression of crowdfunded companies reveals that these businesses often face challenges post-investment, with only 6% of crowdfunding rounds leading to exits through IPO or acquisition, compared to 11% for venture rounds. This underscores the challenges encountered by crowdfunded enterprises and stresses the significance of choosing the best crowdfunding platforms UK for success. Furthermore, user experience statistics indicate a direct correlation between features and campaign success, reinforcing the argument that a well-chosen system can significantly impact fundraising outcomes.

Understanding Fees: What to Expect from Crowdfunding Platforms

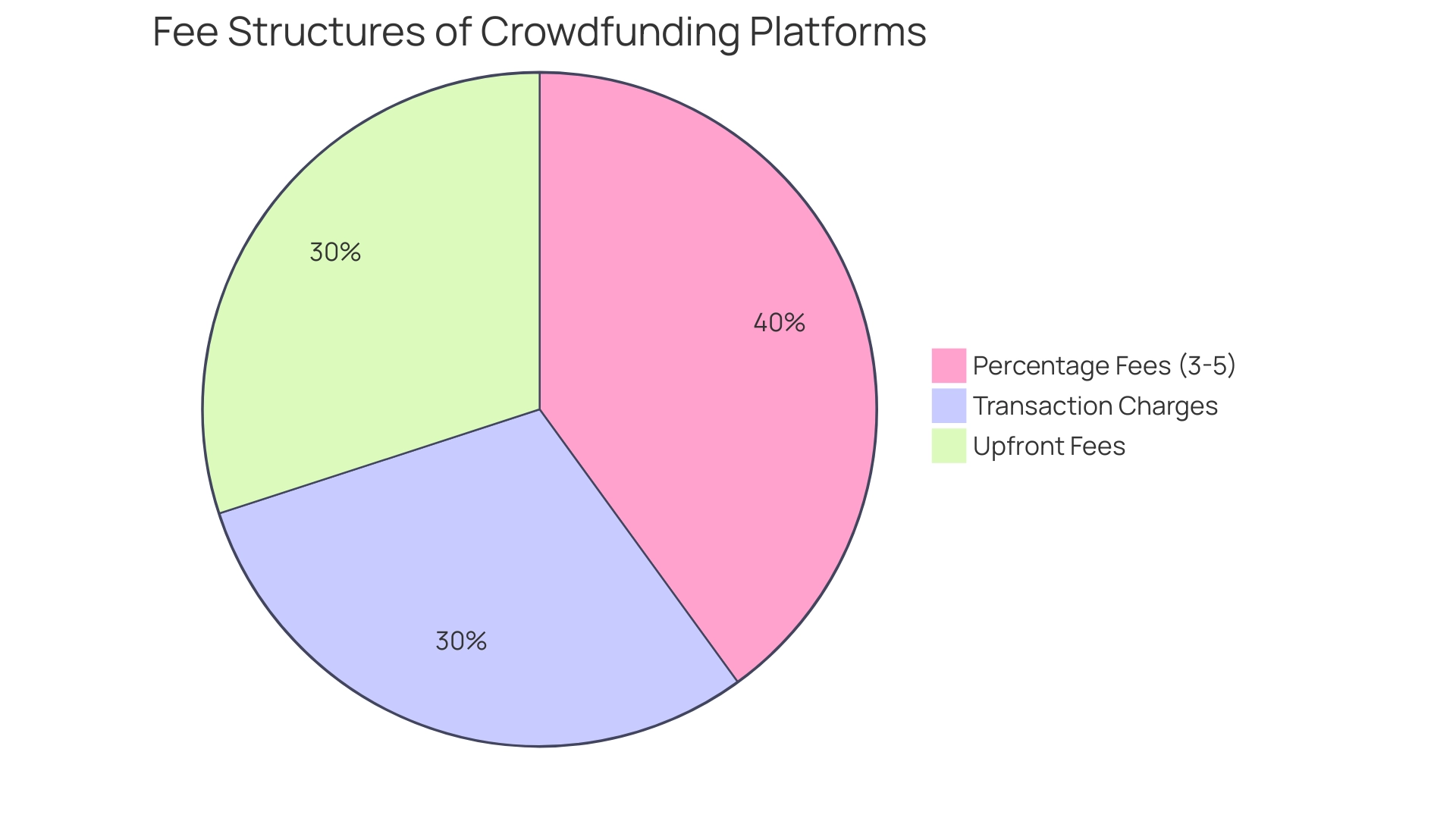

The charges related to the best crowdfunding platforms UK are an essential factor that can greatly affect the total expense of starting a campaign. Generally, these services impose a percentage fee on the total funds raised, which typically falls between 3% and 5%. Furthermore, there may be transaction charges that differ by service.

Remarkably, the best crowdfunding platforms UK, including services like Seedrs and Crowdcube, function on a success-based model, indicating they impose charges only if a campaign successfully achieves its funding target. In contrast, other services may require upfront fees regardless of the campaign's outcome, which can strain a campaign's financial resources. Recent studies suggest that fewer than half of fundraising campaigns reach their financial goals, leading some services to implement an all-or-nothing strategy to reduce risks for investors.

This dynamic necessitates a well-considered budgeting strategy for campaigners. As Aruna Madrekar, editor at Coolest Gadgets, observes, understanding market dynamics is essential for success in raising funds. For instance, Crowdcube is among the best crowdfunding platforms UK, charging a 7% fee on funds collected and effectively supporting growth for European enterprises.

Given that 57% of funding deals go to businesses that have stagnated, understanding the fee structures becomes essential for campaigners seeking to maximize their potential funding while minimizing costs. Furthermore, with social searches representing 9.77% of the overall traffic to these sites, assessing the fee structures and transaction fee statistics of various services can assist investors in making informed decisions that align with their financial goals.

Success Rates of Crowdfunding Platforms: Which Ones Deliver Results?

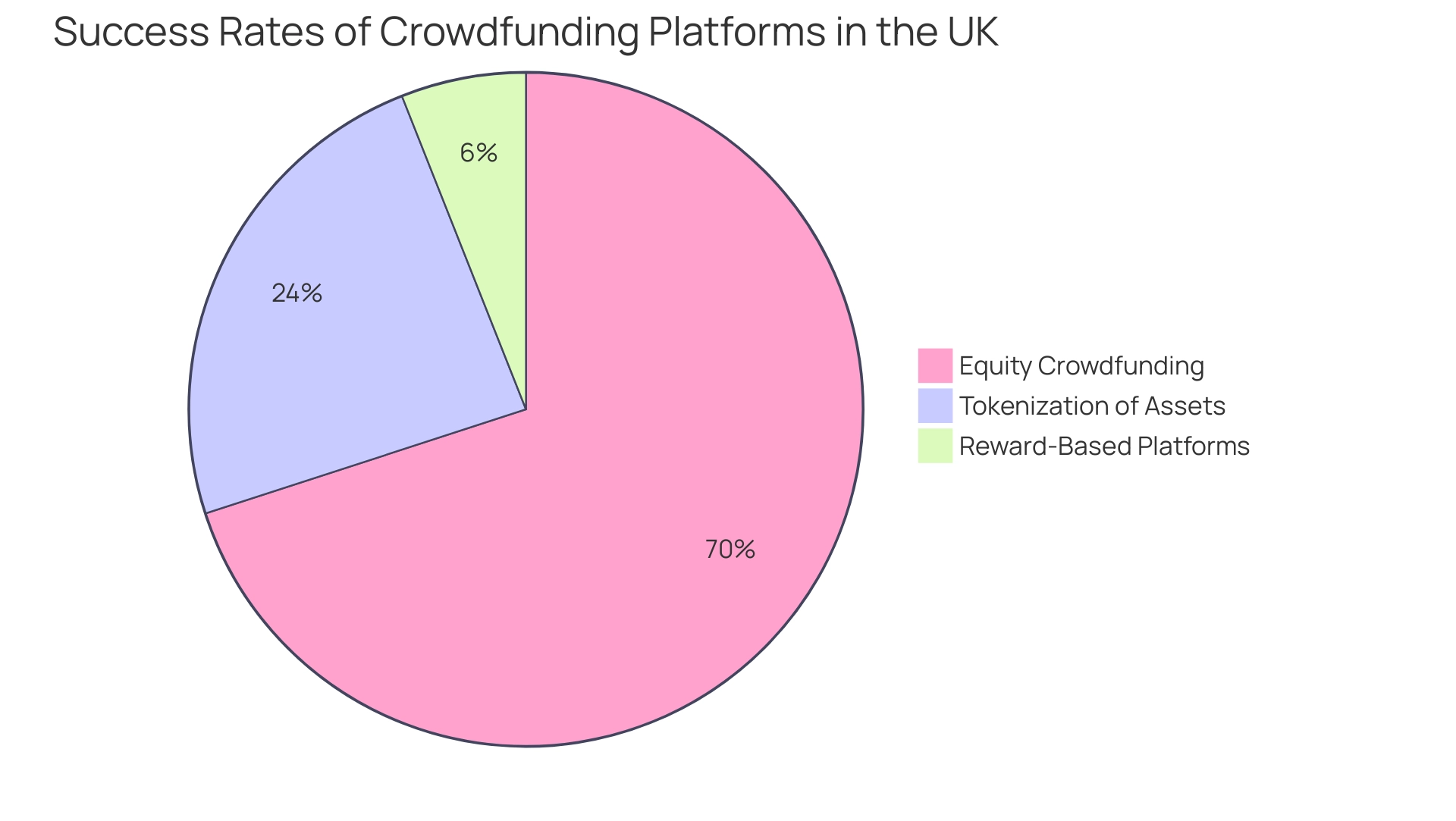

The success rates of funding sources in the UK show considerable variation, with some sources attaining distinctly higher rates than others. Equity crowdfunding sites, such as Crowdcube, report impressive success rates of approximately 70%. This statistic reflects a robust history of effectively connecting businesses with investors, thus enhancing capital acquisition opportunities.

Conversely, reward-based platforms generally experience lower success rates, primarily attributed to the intense competition inherent in this campaign model. Recent statistics indicate that only 6% of funding rounds from 2011 to 2021 led to companies exiting the private market, underscoring the high-risk nature of investing in early-stage businesses through equity financing. Furthermore, the tokenization of assets represents a promising development in the fundraising landscape, allowing investors to own fractional shares of high-value assets, thereby democratizing access to investment opportunities.

This method, illustrated by services such as Digishares, allows involvement in real estate ownership with smaller capital outlays. As emphasized by industry specialist Grant Ejimone, Donations of $106 million were collected for [[[[[[[[natural disaster relief](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics)](https://absrbd.com/post/crowdfunding-statistics) in 2023, demonstrating the wider potential of collective funding not only for investment but also for meaningful contributions. Evaluating these success rates and emerging trends is essential for prospective campaigners, enabling them to choose the best crowdfunding platforms UK that have proven effectiveness in achieving favorable outcomes for projects similar to theirs, while also considering the role of investment funds and investment banking in the crowdfunding ecosystem.

Conclusion

Crowdfunding has established itself as a cornerstone of financial support for entrepreneurs and charitable organizations in the UK. By democratizing access to capital, it allows innovative projects, particularly in the technology sector, to flourish without relying solely on traditional funding sources. Understanding the various types of crowdfunding platforms—donation-based, reward-based, equity, and debt—enables campaigners to select the most suitable options for their needs. Each platform offers unique features and fee structures, which are critical to consider for maximizing fundraising potential.

The fees associated with crowdfunding can significantly impact campaign viability, with many platforms charging a percentage of the total funds raised. Successful navigation of these financial implications is essential, especially given the statistic that less than half of crowdfunding campaigns achieve their funding goals. The success rates of these platforms vary widely, emphasizing the importance of selecting a platform with a proven track record. Platforms like Crowdcube demonstrate high success rates, while others face stiff competition, particularly in the reward-based sector.

In summary, as the crowdfunding landscape continues to evolve, it is imperative for both campaigners and investors to remain informed about the features, fees, and success rates of various platforms. This knowledge not only aids in making better financial decisions but also enhances the chances of project success in this dynamic funding environment. Embracing the opportunities provided by crowdfunding can lead to significant advancements for startups and community initiatives alike, making it a vital tool for the future of funding in the UK.