Overview

This article emphasizes the importance of understanding startup company equity for tech investors, recognizing the various ownership structures and the vital role of community support in overcoming investment challenges. We understand that navigating the complexities of equity can be daunting. Many of our members have shared their experiences of feeling overwhelmed by the intricacies of ownership types and fair allocation practices. However, knowledge in these areas can significantly influence not only the success of startups but also the financial outcomes for investors. By fostering a supportive community and sharing strategic guidance, we can work together to create a more equitable entrepreneurial environment. Your journey as an investor matters, and we are here to provide the insights and resources you need to thrive.

Introduction

In the ever-evolving world of startups, we understand that equity can feel like a daunting cornerstone of ownership and investment, profoundly shaping the future of emerging businesses. As the landscape of funding grows increasingly complex, many of our members have expressed the need to grasp the nuances of startup equity—from the types of shares issued to the dynamics of allocation. This understanding has never been more crucial, especially with recent trends indicating a surge in Web3 investments and a growing emphasis on community support among investors. The stakes are indeed higher than ever.

This article aims to delve into the fundamentals of startup equity, exploring various equity structures while highlighting the importance of strategic allocation and community collaboration. We hope to equip you with the insights needed to navigate this dynamic terrain effectively, fostering a sense of support and connection within our community.

The Fundamentals of Startup Company Equity

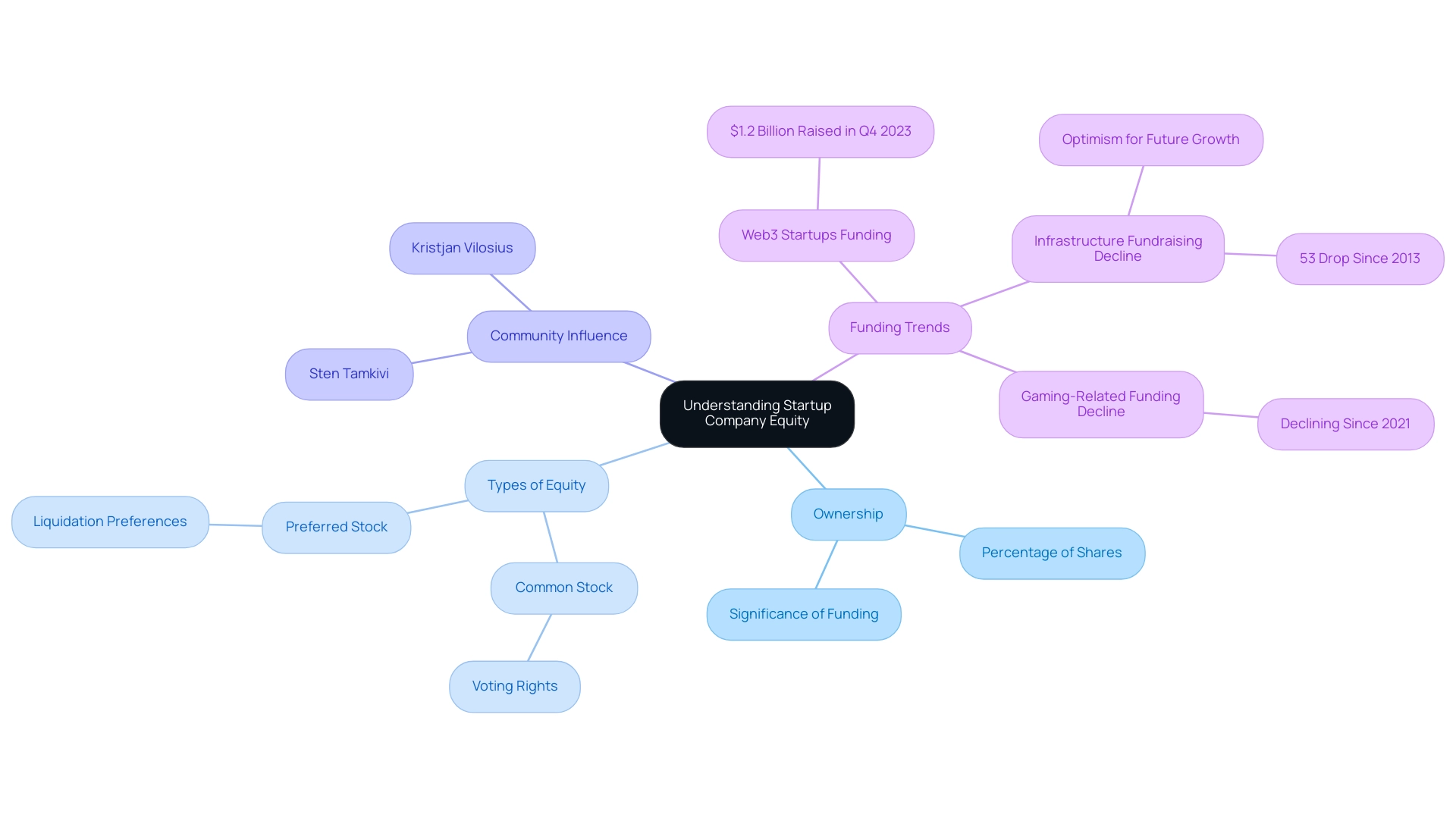

Ownership in a new venture typically manifests as a percentage of shares held by investors. In the evolving landscape of 2024, where Web3 companies alone raised $1.2 billion in Q4 2023, the significance of ownership in funding is truly paramount. Yet, we understand that 38.55% of individuals either strongly or somewhat disagree with the desire to start a business. This statistic reflects the challenging entrepreneurial atmosphere that can weigh heavily on new business funding.

Startups often exchange equity for funding, which provides stakeholders with a stake in the company's growth journey. Insights from Baltic funding leaders like Sten Tamkivi, who has made over 100 contributions and co-founded Plural, and Kristjan Vilosius, whose startup Katana MRP recently secured a 35m€ funding round, highlight the vital role of community in nurturing early-stage financing. Their experiences remind us how a supportive network can empower tech investors to successfully navigate their challenges.

Understanding the essentials of equity—particularly the distinctions between common and preferred stock, vesting schedules, and liquidation preferences—is crucial for making informed financial decisions. Common stockholders typically possess voting rights, allowing them to influence company decisions, while preferred stockholders enjoy preferential treatment during liquidation events. As Sourav Ghosh noted,

Barbara has been of excellent help to me in the early days of my start-up!

This underscores the importance of having informed advisors to help manage the complexities of new business ownership. Furthermore, the case study on 'Infrastructure Fundraising Decline' reveals broader trends in fundraising, illustrating that despite a 53% drop to the lowest level since 2013, there remains a sense of optimism for future growth in infrastructure. With ongoing shifts in startup financing and a notable decline in gaming-related investments since 2021, a solid grasp of startup company equity principles is essential for individuals looking to navigate these evolving trends and make informed choices.

Exploring Different Types of Startup Equity Structures

Startup company equity encompasses a variety of ownership structures, such as Common Stock, Preferred Stock, and Convertible Notes, each playing a unique role and appealing to different types of backers. Common Stock is often issued to founders and employees, granting them voting rights, yet placing them lower in the liquidation hierarchy. On the other hand, Preferred Stock provides significant advantages, including fixed dividends and priority during liquidation events, making it an appealing choice for those seeking stability and assurance in their returns.

Convertible Notes present a unique hybrid, functioning as debt that converts to ownership in subsequent financing rounds. This offers early-stage investors the chance to benefit from future ownership without facing immediate dilution, which many find reassuring.

As many of our members have observed, the landscape of startup financing is continually evolving. Notably, the portion of ownership allocated to South Asian founders rose to 23.7% in 2024, reflecting a diversification in our entrepreneurial ecosystem. However, conflicts related to resource allocation are not uncommon. Recent news highlights these conflicts, underscoring the necessity for clear documentation and mutual agreements among all stakeholders to mitigate disputes. As Sourav Ghosh beautifully expressed, "Barbara has been of excellent help to me in the early days of my start-up!" This sentiment emphasizes the importance of having informed advisors during the creation of ownership structures.

We understand that disparities in resource distribution persist. For instance, while women hold 38% of managerial positions, they only secure 28% of shares allocated to managers. This disparity illustrates the need to evaluate fairness structures, not just for financial implications but also for fostering equitable practices within startups. A case study on ownership distribution among managers and executives further emphasizes this point, revealing that men receive more ownership value on average than women, reflecting ongoing inequities in compensation.

Grasping the advantages and disadvantages of each ownership category, particularly startup company equity, is vital for individuals navigating negotiations and funding stages. By aligning ownership frameworks with their investment approaches, investors can enhance their returns while contributing to a more just entrepreneurial environment. Together, we can foster a community that values fairness and inclusivity in every step of the journey.

Equity Allocation: Balancing Interests Among Founders and Employees

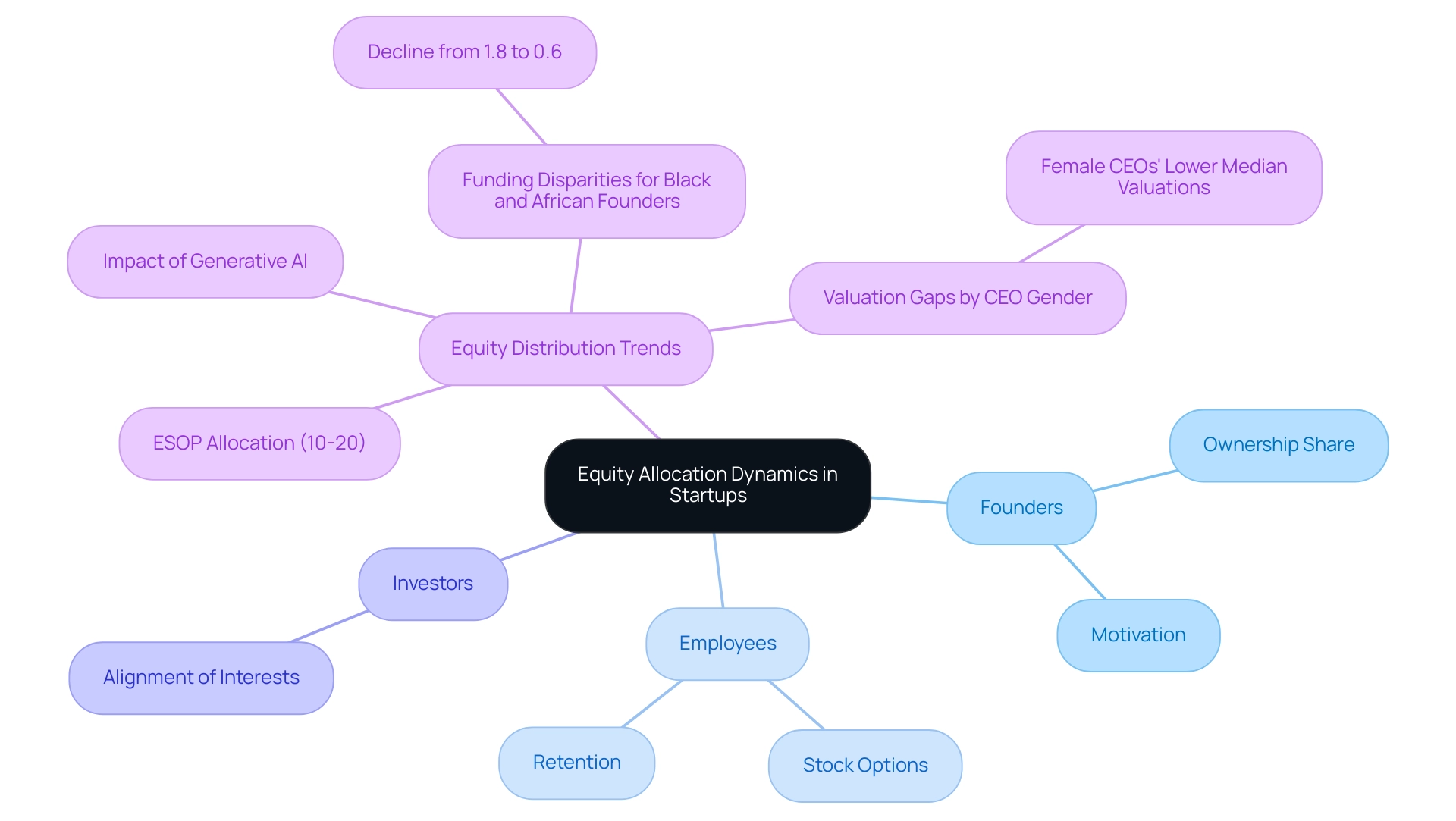

Equity allocation plays a vital role in the dynamics of new ventures, especially when it comes to startup company equity, significantly influencing founder motivation and employee retention. We recognize that founders often retain a substantial share of ownership, while early employees typically receive stock options as part of their compensation package. A commonly accepted guideline suggests that startups allocate between 10-20% of their equity for an employee stock option pool (ESOP).

This thoughtful allocation of startup equity not only attracts and retains top talent but also aligns the interests of founders, employees, and investors, fostering a shared commitment to the company's success. As many of our members have experienced, implementing a transparent resource allocation strategy can help mitigate potential disputes and cultivate a collaborative atmosphere, which is essential for driving growth. Recent reports indicate that employee stock option pools in tech companies are evolving, highlighting the importance of equitable distribution practices.

These trends are particularly important, especially in light of recent data showing that the portion of priced funding for Black and African founders has decreased from 1.8% to 0.6% since 2022. This underscores the necessity for just allocation practices to address systemic disparities. Moreover, as the landscape of generative AI evolves in 2023, new companies are exploring innovative ownership approaches to startup equity to effectively harness these advancements. This transformative potential of generative AI encourages emerging companies to reconsider their resource allocation strategies, helping them stay competitive and attract top talent.

Additionally, a case study titled 'Valuation Gaps by CEO Gender' reveals that companies with female CEOs have lower median valuations compared to those with male CEOs. This highlights the ongoing challenges that female-led businesses face in achieving equitable valuations. In this context, Tony Hsieh, the former CEO of Zappos, encapsulated this ethos beautifully by stating,

Chase the vision, not the money; the money will end up following you.

This sentiment reinforces that a well-structured strategy for startup company equity allocation can ultimately contribute to an emerging company's journey toward success.

Navigating Secondary Sales: Opportunities for Startup Investors

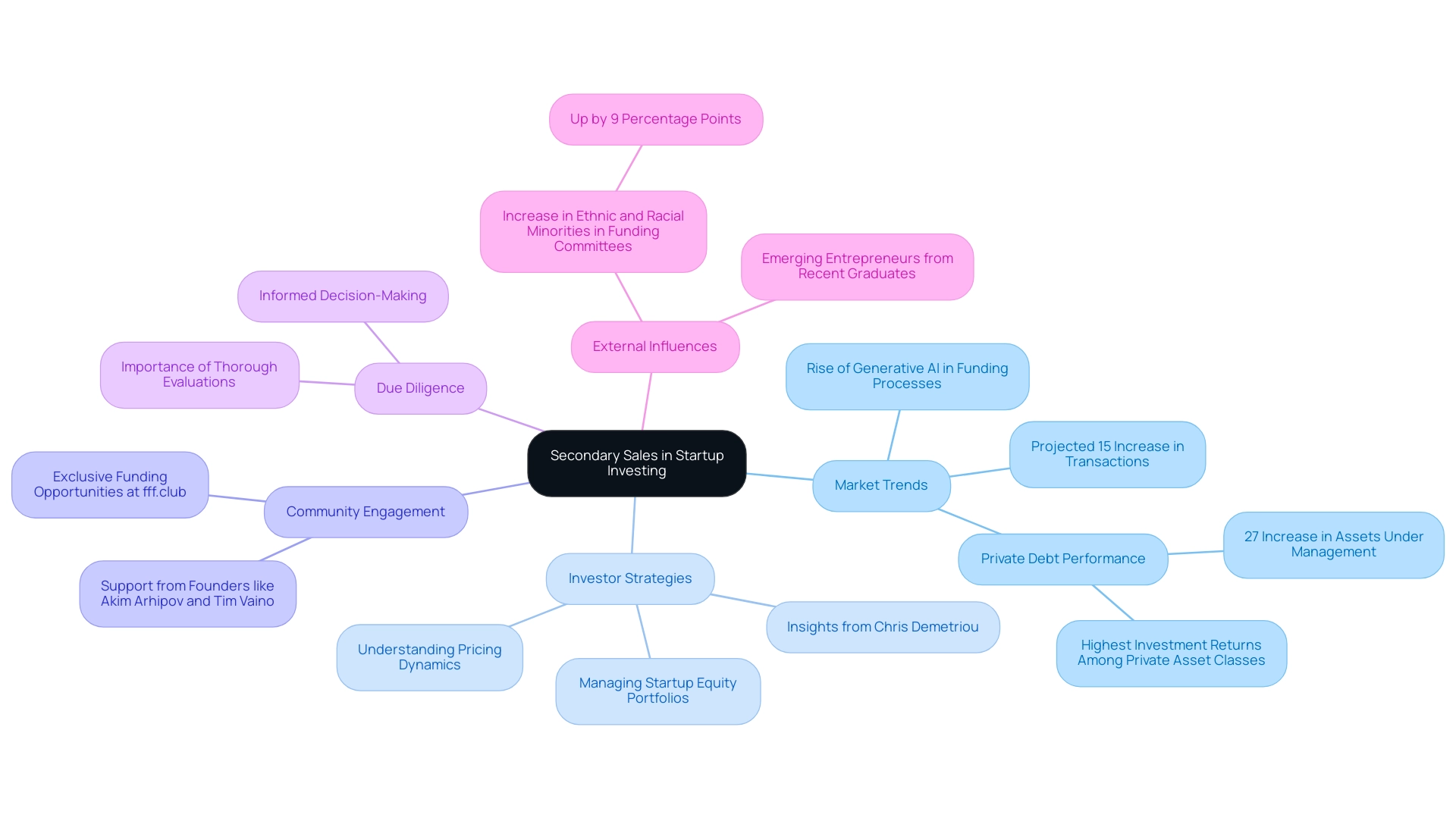

Secondary sales represent a critical mechanism in new venture financing, occurring when current shareholders—such as employees or early backers—decide to sell their shares to new stakeholders. This process not only offers liquidity in a typically illiquid market but also allows participants to achieve returns without the prolonged wait for an IPO or acquisition. As we look ahead to 2024, we understand that the landscape of secondary sales is expected to evolve, with a notable increase in the number of transactions projected to rise by 15% compared to the previous year. More platforms like fff.Club are emerging to facilitate these exchanges, effectively connecting sellers with buyers while prioritizing compliance and transparency throughout the transaction process.

We recognize that investors must remain vigilant regarding the pricing dynamics inherent in secondary sales, as shares may trade at either a premium or a discount, influenced by the startup's perceived value and prevailing market conditions. Chris Demetriou, Head of Business Advisory at Archimedia Accounts, shares a poignant insight:

It’s always a shame to see businesses fail early. But we take heart from the fact that over a third survive five years, which is no mean feat at all.

This perspective emphasizes the significance of grasping the subtleties of secondary sales, as they offer strategic opportunities for managing startup company equity portfolios and capitalizing on potential early exits.

Furthermore, the rise of generative AI in 2023 has encouraged private market participants to explore its potential in improving funding processes, including secondary sales. Notably, recent case studies on private debt performance illustrate how secondary sales can relate to broader trends in private markets. Private debt has experienced a 27% rise in assets under management, showcasing strong returns.

Additionally, the increase in ethnic and racial minorities in funding committees—up by 9 percentage points—reflects a growing diversity trend that could affect financial strategies, including those involving secondary sales. As these trends continue to develop, we believe that individuals equipped with knowledge about secondary markets will be better positioned to navigate the evolving landscape of early-stage equity. This is supported through community engagement and exclusive funding opportunities at fff.club. Moreover, understanding due diligence is crucial in secondary sales, as it ensures that participants make informed decisions based on thorough evaluations of the startup company equity involved.

The insights from founders like Akim Arhipov and Tim Vaino, who have extensive experience in the private market, can provide valuable perspectives on how to approach these opportunities effectively. Their stories resonate with many of our members, fostering a sense of shared experience and community support.

The Power of Community: Collaborating with Fellow Investors

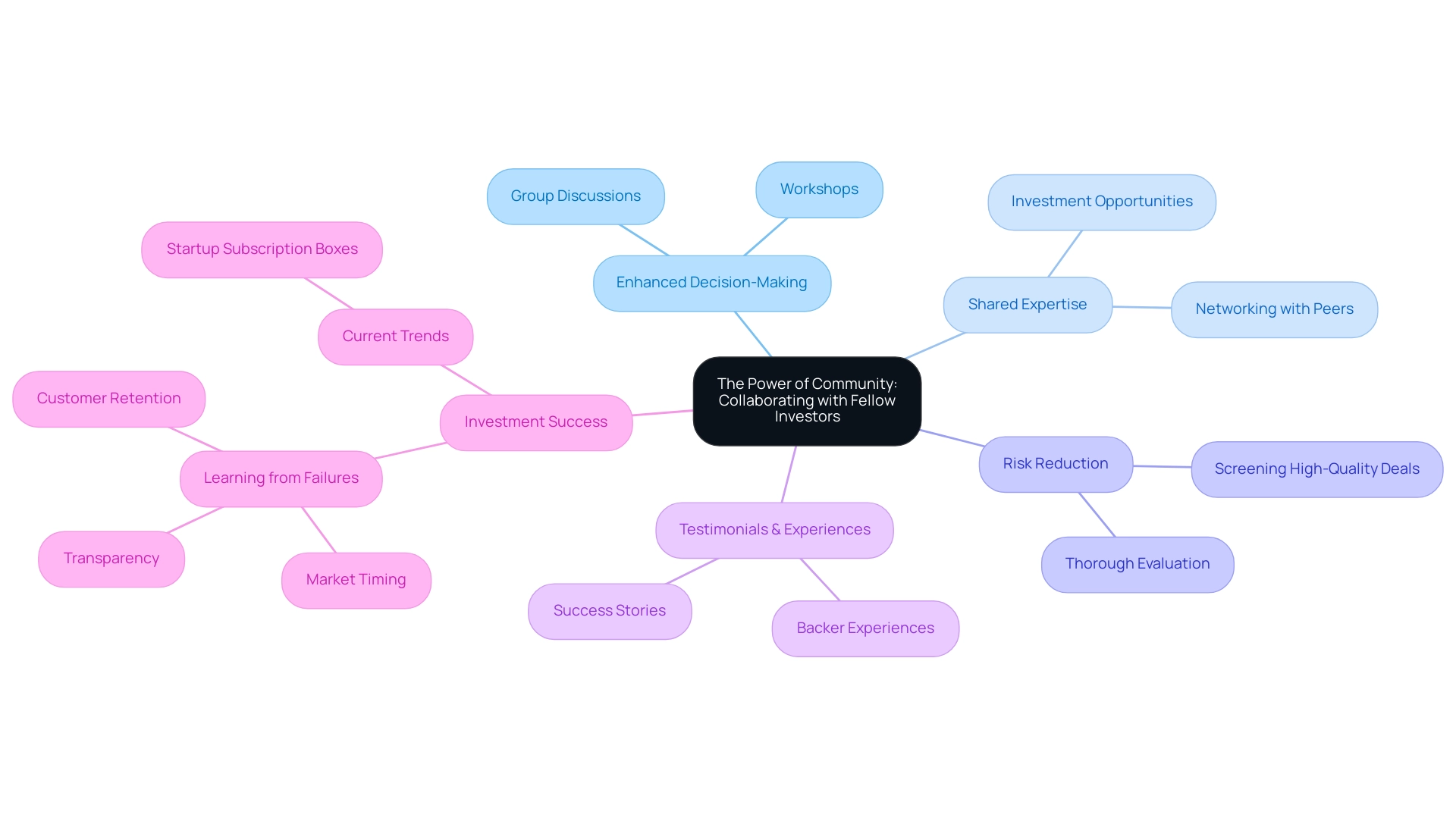

Cooperation among stakeholders is not just important; it is a vital element in enhancing decision-making processes and improving financial results. Platforms like fff. Club foster a vibrant environment where over 400 tech enthusiasts come together to exchange insights, discuss strategies, and collaborate on funding decisions.

We understand that navigating the complexities of investment can be daunting. By connecting with a community of like-minded individuals, members can tap into shared expertise, allowing for a more thorough evaluation of potential opportunities and an efficient reduction of risks often associated with early-stage funding. Testimonials from backers highlight their experiences with fff.club, illustrating how the platform streamlines the due diligence process and screens high-quality deals. Engaging in group discussions or workshops provides invaluable opportunities for individuals to refine their strategies, identify promising new businesses, and negotiate more favorable terms.

This collaborative approach not only nurtures a sense of community but also enhances the impact of tech investors, significantly boosting their chances of success in a competitive business landscape. In India, where there are currently 68 unicorns, the potential for investment success is immense, making collaboration even more essential. As Kinshuk Kale insightfully notes, 'Learn how to foster innovation, inspire collaboration, and boost creativity within your enterprise using practical strategies and technological solutions with Shorter Loop's end-to-end product management tools.'

This perspective underscores the importance of collaboration in navigating the complexities of investing in new ventures. Moreover, lessons learned from notable startup failures, as highlighted in the case study 'Lessons from Failed Startups,' emphasize the critical nature of market timing, transparency, and customer retention. By learning from past mistakes and collaborating with other stakeholders, individuals can make more informed decisions and ultimately achieve favorable outcomes.

We warmly encourage prospective stakeholders to join fff. Club and become part of this collaborative community, enhancing their investment journey together.

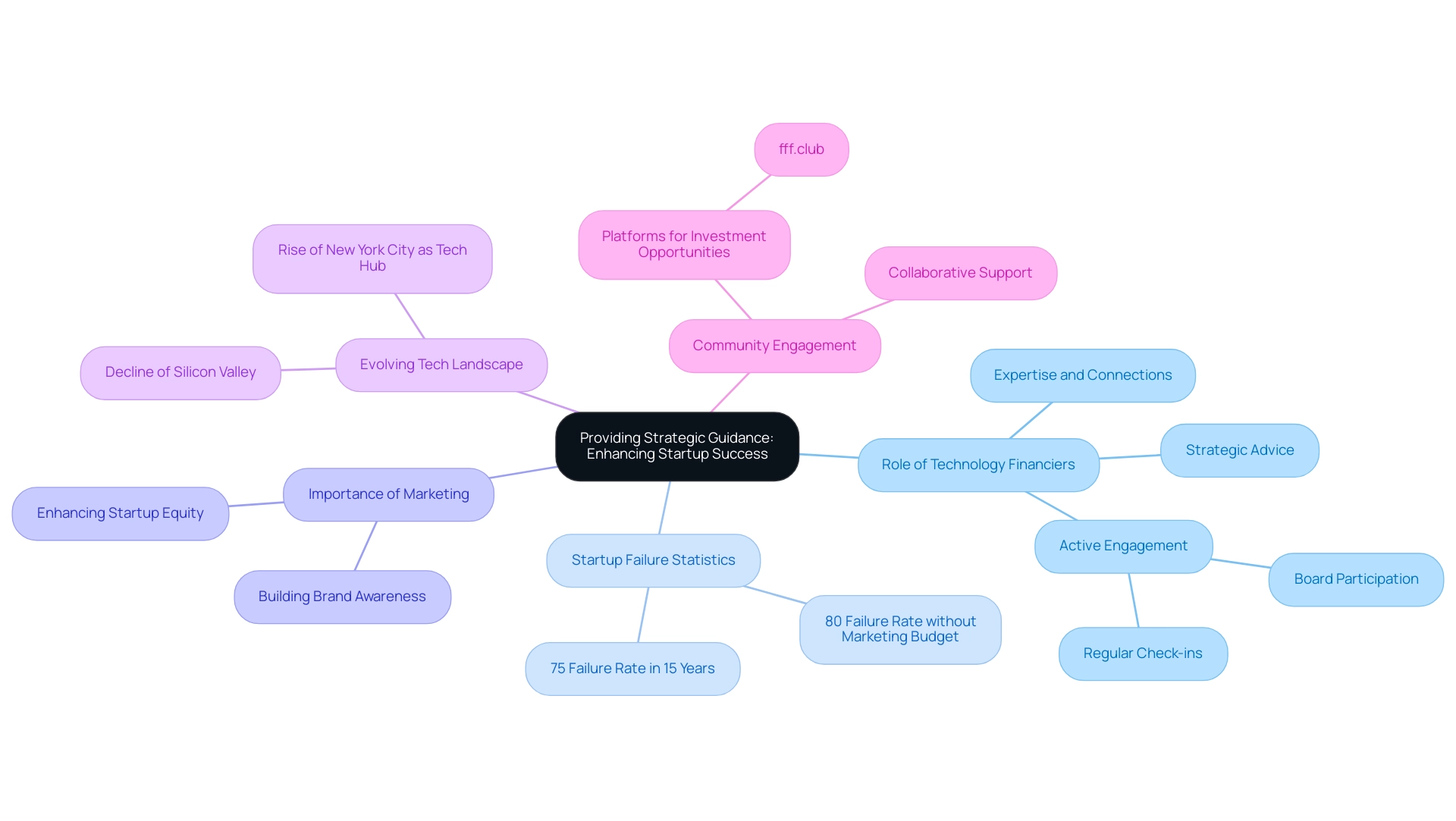

Providing Strategic Guidance: Enhancing Startup Success

Technology financiers play a crucial role that extends far beyond mere capital injection; they offer strategic advice that significantly enhances a new venture's chances of success. With approximately 75% of American new businesses failing within the first 15 years, the guidance and support concerning startup company equity provided by financiers become essential. As many of our members have experienced, financiers leverage their extensive industry expertise and connections to assist founders in navigating complex challenges, such as the considerable customer acquisition costs faced by FinTech companies, while also capitalizing on emerging opportunities.

Insights into market trends, operational efficiencies, and product development can truly be game-changers for a new venture's trajectory. Moreover, an individual's active engagement—whether through board participation or regular check-ins—ensures that new ventures adhere to best practices and industry standards. As highlighted by Sourav Ghosh, 'Barbara has been of excellent help to me in the early days of my start-up!' This sentiment reflects a broader trend where effective guidance from technology backers is increasingly recognized as a vital factor for business growth.

Recent reports indicate that 80% of startups lacking a marketing budget face failure, underscoring the necessity for strategic guidance in areas like marketing to build brand awareness and ultimately enhance startup company equity. Additionally, we understand that the ongoing transformation of the tech landscape, particularly with the anticipated decline of Silicon Valley and the rise of New York City as a new tech hub, emphasizes the need for proactive mentorship to navigate this evolving ecosystem.

Sten Tamkivi and Kristjan Vilosius exemplify how community engagement and collaborative support can enhance deal flow and due diligence, empowering technology financiers to navigate challenges effectively. Furthermore, through platforms like fff.club, tech financiers can access vetted investment opportunities that align with their strategic goals, ensuring they are well-positioned to make informed decisions. With these dynamics at play, the role of tech investors in providing strategic guidance is more critical than ever, enhancing both the success of startups and the growth of startup company equity in the investor's portfolio.

Conclusion

Navigating the complexities of startup equity can be daunting for many in the entrepreneurial landscape. This article has explored the fundamentals of equity, detailing the various structures such as Common Stock, Preferred Stock, and Convertible Notes, and their respective roles in attracting different types of investors. We understand that strategic equity allocation is crucial; it can align the interests of founders, employees, and investors, ultimately fostering a collaborative environment conducive to growth.

Moreover, the importance of community and collaboration among investors stands out as a vital factor in enhancing decision-making and investment outcomes. As many of our members have experienced, platforms like fff.club exemplify how collective knowledge and shared experiences can lead to better investment strategies and successful funding decisions. By engaging with a network of fellow investors, individuals can mitigate risks and capitalize on opportunities that arise in the dynamic startup ecosystem.

In conclusion, the journey through startup equity transcends mere ownership and funding; it’s about leveraging community support, strategic guidance, and equitable practices to create a thriving environment for innovation and growth. By equipping oneself with these insights and fostering connections within the investor community, stakeholders can navigate the evolving landscape of startups with confidence and purpose, ultimately contributing to a more equitable and prosperous entrepreneurial future.