Overview

This article aims to nurture an understanding of equity in startup companies, recognizing its vital role for founders and investors as they navigate control, profit distribution, and overall financial health. We understand that the complexities of equity can be daunting, and it is essential to address these concerns with care. By detailing the different types of equity—common stock, preferred stock, and stock options—we hope to provide clarity and support in your journey. Best practices for equity distribution are also emphasized, highlighting the importance of clear ownership agreements. As many of our members have experienced, the landscape of startup financing is evolving, influenced by trends like crowdfunding and adaptable ownership structures. We are here to guide you through these changes, fostering a community where you feel valued and informed.

Introduction

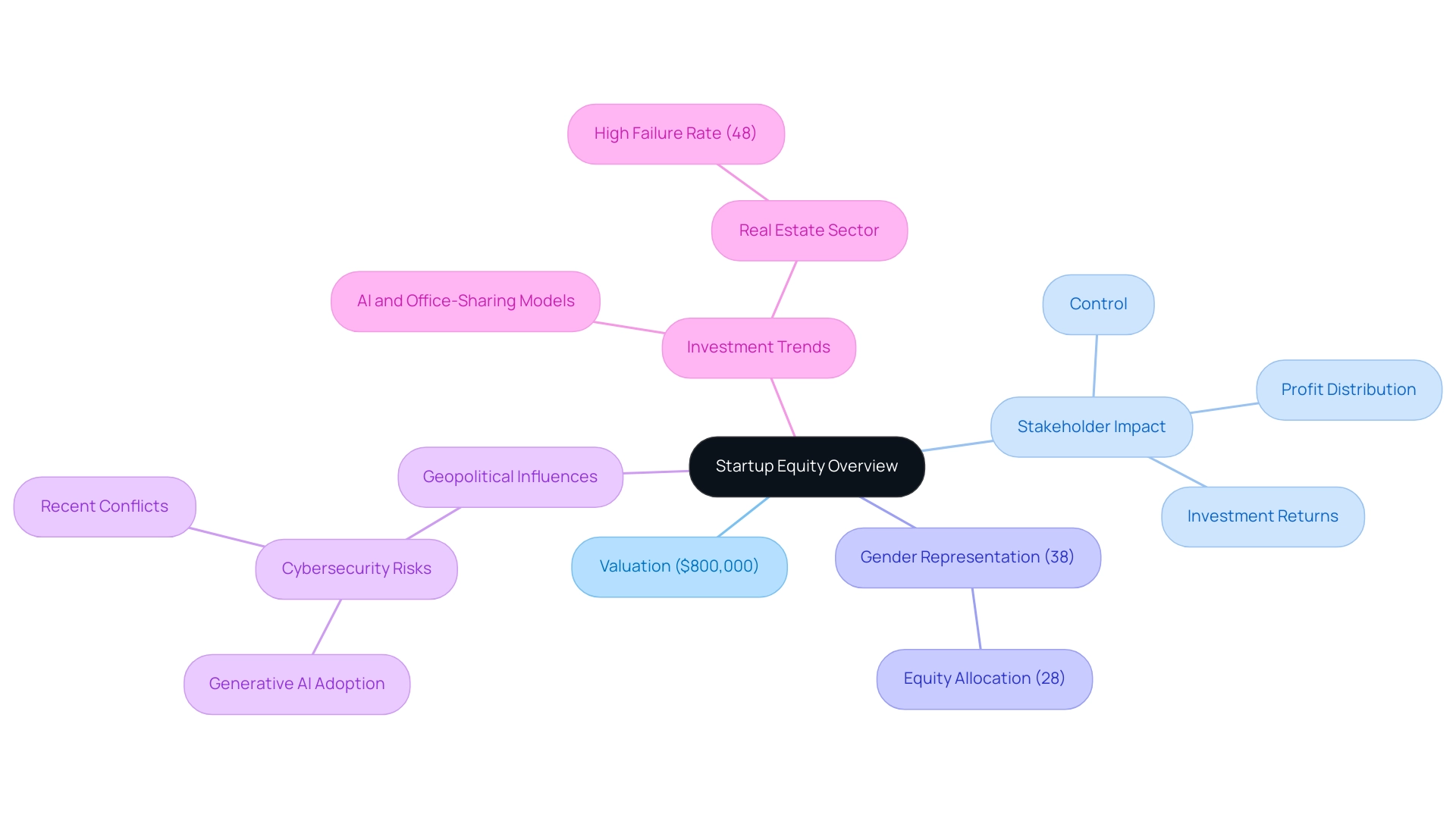

In the intricate world of startups, equity serves as the backbone of ownership and investment dynamics, shaping everything from control to profit-sharing. We understand that as startups navigate a landscape increasingly influenced by technological advancements and geopolitical uncertainties, grasping the nuances of equity is crucial for both founders and investors.

With an average valuation of $800,000 for startups, the stakes are undeniably high, and the implications of equity distribution can profoundly impact long-term success or failure. This article seeks to explore the essential aspects of startup equity, including:

- Its types

- Best practices for distribution

- Legal considerations

- The evolving role of equity compensation in attracting talent

By unpacking these critical elements, we aim to provide insights that empower stakeholders to engage with the complexities of equity in today’s fast-paced entrepreneurial environment, fostering a sense of community and support along the way.

Understanding Startup Equity: A Foundational Overview

Startup ownership signifies equity in a startup company, typically quantified as a percentage of its total shares. This concept of equity is vital, as it significantly influences control, profit distribution, and the overall financial health of a new venture. Currently, consistent reports indicate that startups are valued around $800,000, underscoring the importance of ownership in determining a company's worth.

For founders, understanding how their ownership share impacts both control and the assessment of their contributions is crucial for establishing equity in their startup. We understand that for investors, grasping how equity translates into voting power and potential returns on investment is essential, especially as fff.vc has pivoted to focus on late-stage and secondary tech deals. This shift fosters community investment in technology amid market uncertainty, which can be a source of concern for many.

Additionally, recent geopolitical conflicts, such as the Russia-Ukraine and Israel-Gaza wars, have heightened the need for strong fairness structures. Gili Raanan, founder and partner at Cyberstarts, highlights this by noting, 'The widespread adoption of generative AI technologies, coupled with these conflicts, has escalated the frequency and sophistication of cyber attacks.' This underscores the necessity for new ventures to navigate complex environments with well-organized ownership frameworks that promote equity in startup companies. Significantly, since 2022, the percentage of women in managerial and executive roles has modestly risen to 38%, receiving approximately 28% of all shares allocated to managers. This reflects wider trends in our entrepreneurial ecosystem, which we celebrate.

This increase is essential as it underscores the significance of equity in the financial structures of startup companies. Learning from past mistakes and the failures of others is crucial for success in new ventures; for example, 48% of real estate businesses fail within four years. Yet, those incorporating AI and office-sharing models are attracting significant investments, showcasing the potential rewards of considerate financial structures.

In the context of fff.vc, which has successfully grown to 300 members and invested approximately €3 million across various deals, understanding these dynamics equips stakeholders to engage in meaningful discussions about valuation, funding, and growth strategies in the evolving startup landscape. Community members can expect deals from Tech, Private Equity & VC funds, Real-Estate, and Private Credit sectors, reflecting a strategic diversification of investment opportunities that we are excited to share.

Types of Equity: Common Stock, Preferred Stock, and Options

- Common Stock: Common stock represents the most straightforward form of ownership, providing shareholders with a stake in the business. We understand that common stockholders typically enjoy voting rights, allowing them to influence corporate decisions. However, it’s important to acknowledge that they are often last in line to receive assets during liquidation, which can make their investment feel riskier compared to preferred stockholders. Statistically, resource distribution issues lead to legal disputes easily 60% of the time, underscoring the critical need for clear agreements among stakeholders to avoid such conflicts and protect everyone involved.

- Preferred Stock: In contrast, preferred stockholders possess a higher claim on both assets and earnings than their common counterparts. These investors generally receive dividends before common shareholders, ensuring a more stable return on their investment, which can be reassuring. Nonetheless, we recognize that preferred shares often come without voting rights, potentially limiting shareholder influence over corporate decisions. It is essential to recognize that not all preferred shares are created equal; different classes may carry varying rights and privileges, and terms may evolve through subsequent financing rounds. This variability can significantly impact investment dynamics and shareholder rights, as demonstrated in case studies regarding the variability of preferred shares. Moreover, anti-dilution provisions are vital as they safeguard investors' ownership percentages from dilution in future funding rounds, further highlighting the need for clarity in ownership agreements to support all stakeholders.

- Stock Options: Stock options grant individuals the right to acquire shares at a predetermined price within a specified timeframe, aligning their interests with the overall performance of the company. This ownership structure acts as a strong motivator, particularly in new businesses aiming to draw in and keep skilled individuals. As trends in stock option usage progress in 2024, numerous new businesses are increasingly acknowledging their worth as part of compensation packages. Financial specialists, including Tim Tuttle, stress that while stock options can inspire employees, comprehending the differences between common and preferred stock is crucial for both employees and investors to navigate the intricacies of startup ownership. Tuttle notes, "In that moment it’s very frustrating for founders, but the reason they’re there is because they weren’t able to convince investors to give them the money they needed to get there without introducing these aggressive terms to offset the risk," highlighting the challenges founders face in ownership distribution and the importance of understanding these dynamics together.

Equity Distribution: Best Practices for Founders and Advisors

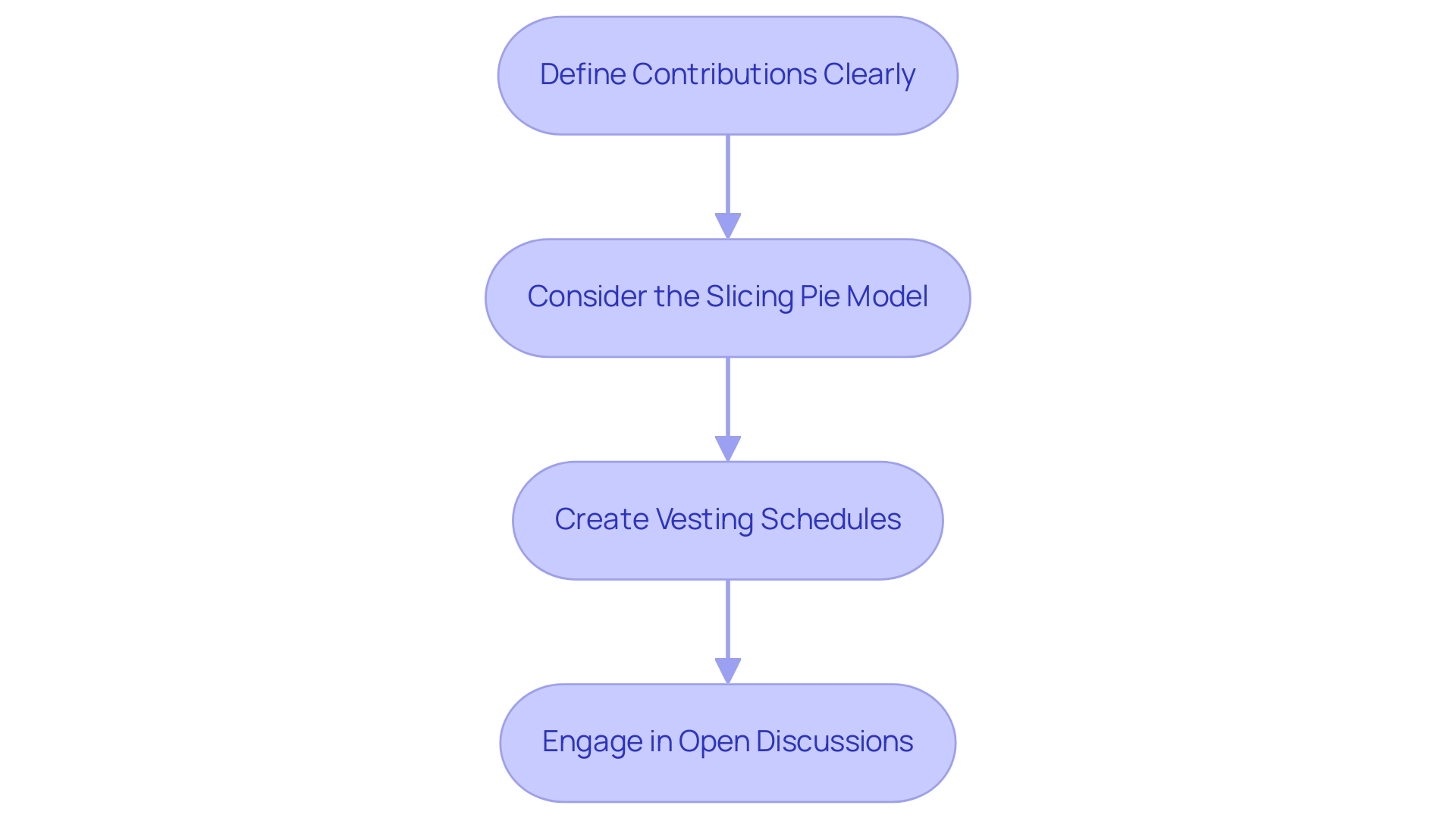

- Define Contributions Clearly: At the outset, we understand how important it is to establish explicit expectations regarding the contributions of each founder and advisor. This clarity not only helps to prevent misunderstandings but also sets a solid foundation for collaboration, fostering a sense of unity among team members.

- Consider the Slicing Pie Model: Embracing the Slicing Pie model can lead to a more equitable distribution of equity in startup company ownership. This dynamic ownership framework adjusts based on the actual contributions made by each participant, ensuring fairness as roles and responsibilities evolve over time. Many of our members have seen signs of modest advancement in resource distribution practices, which can be incredibly beneficial for startups.

- Create Vesting Schedules: Implementing vesting schedules is essential for safeguarding the startup’s interests, particularly in the event that a founder departs before their time. A typical arrangement features a four-year vesting period with a one-year cliff, allowing ownership to be gained gradually while maintaining its intended value. Additionally, Restricted Stock Units (RSUs) convert to common or preferred stock once vested, providing further options for ownership distribution that can ease concerns about fairness.

- Engage in Open Discussions: It is vital to maintain an ongoing dialogue regarding resource distribution agreements. Regularly revisiting these agreements allows for adjustments based on changes in contributions and responsibilities, promoting transparency and trust among all stakeholders involved. As Brian Vickery notes, the statistics indicate signs of modest advancement, highlighting the importance of adapting to evolving circumstances. We understand that these discussions can be challenging, but they are crucial for building a supportive and trusting environment.

Legal and Tax Considerations in Startup Equity

-

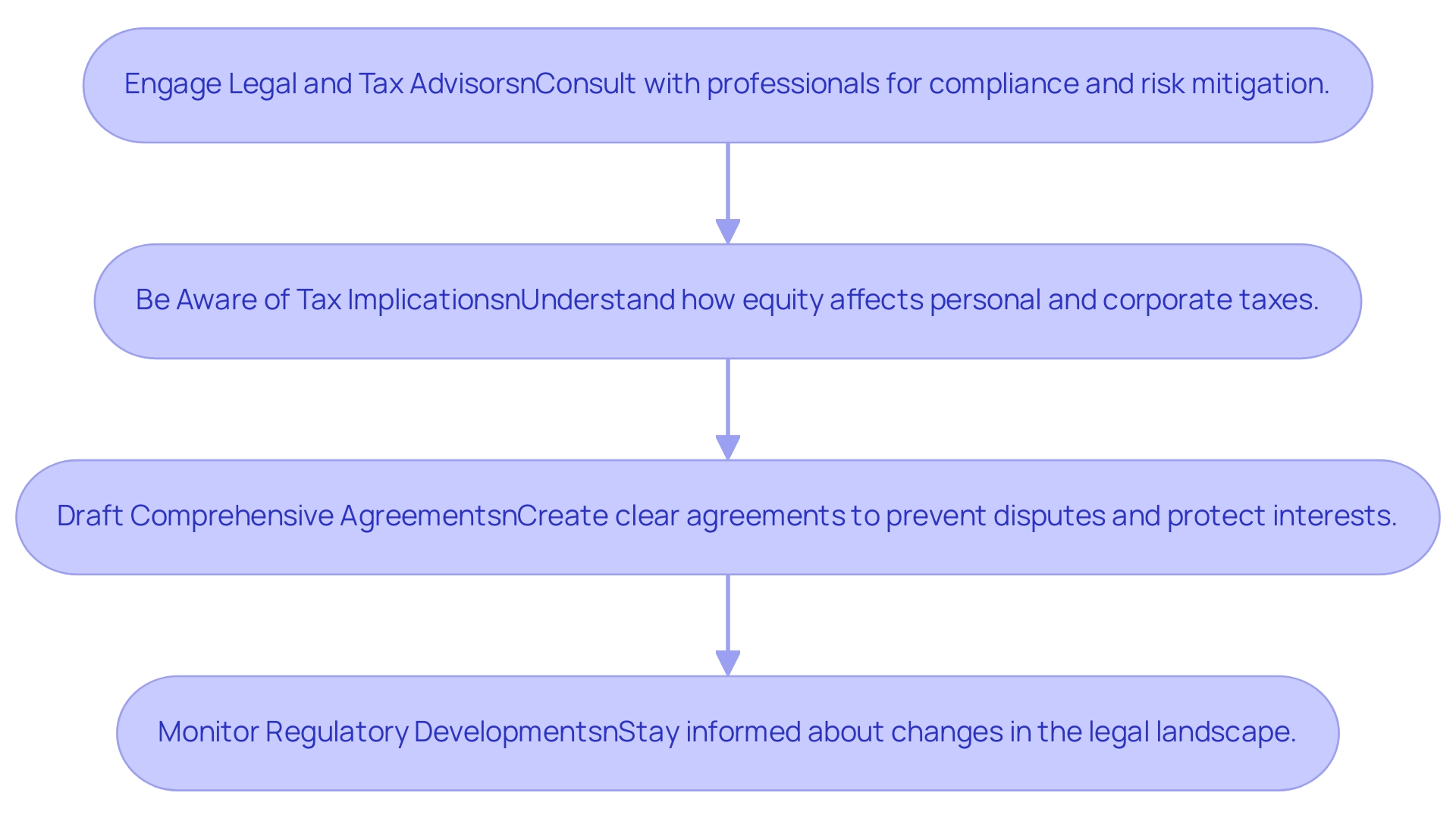

Engage Legal and Tax Advisors: We understand that navigating the intricate landscape of ownership agreements can be daunting for founders. That’s why it’s so important to prioritize consultations with legal and tax professionals. These experts can offer crucial insights into compliance with applicable laws and help mitigate potential risks associated with compensation.

Be Aware of Tax Implications: It’s essential to recognize that equity in startup company compensation can lead to various tax liabilities that may affect both personal and corporate finances. Founders need to be fully aware of how ownership grants influence their tax situations to make informed decisions. As Jonny Seaman, Investor Partnerships Manager, notes,

That’s why we’ve put together this guide on how to approach pre-revenue valuation and what solid numbers and facts you can use in your discussions with investors when you can’t point to revenue performance.

This highlights the importance of understanding tax implications in the broader context of valuation discussions. It’s worth noting that participants achieved an average of 1.22 out of 3 on EFL test questions, which emphasizes the need for enhanced understanding in compensation matters.Draft Comprehensive Agreements: Clear and precise agreements regarding ownership distribution and stakeholder rights are vital to prevent disputes. Well-drafted documents not only provide clarity but also protect the interests of all parties involved, making it easier to navigate future challenges.

-

Monitor Regulatory Developments: The legal landscape surrounding equity in startup company compensation is constantly evolving, and we understand how overwhelming this can be. Staying informed about regulatory changes is crucial for founders, enabling them to adapt their strategies effectively and leverage opportunities in a continuously changing business environment. With accelerators such as Y Combinator and TechStars leading VC deals in Q1 2024, their significant activity—37 and 32 deals respectively—highlights the implications of these regulations on the entrepreneurial ecosystem. This case study serves as a real-world example of why it’s so important for founders to remain vigilant regarding regulatory changes.

Attracting Talent: The Role of Equity Compensation

-

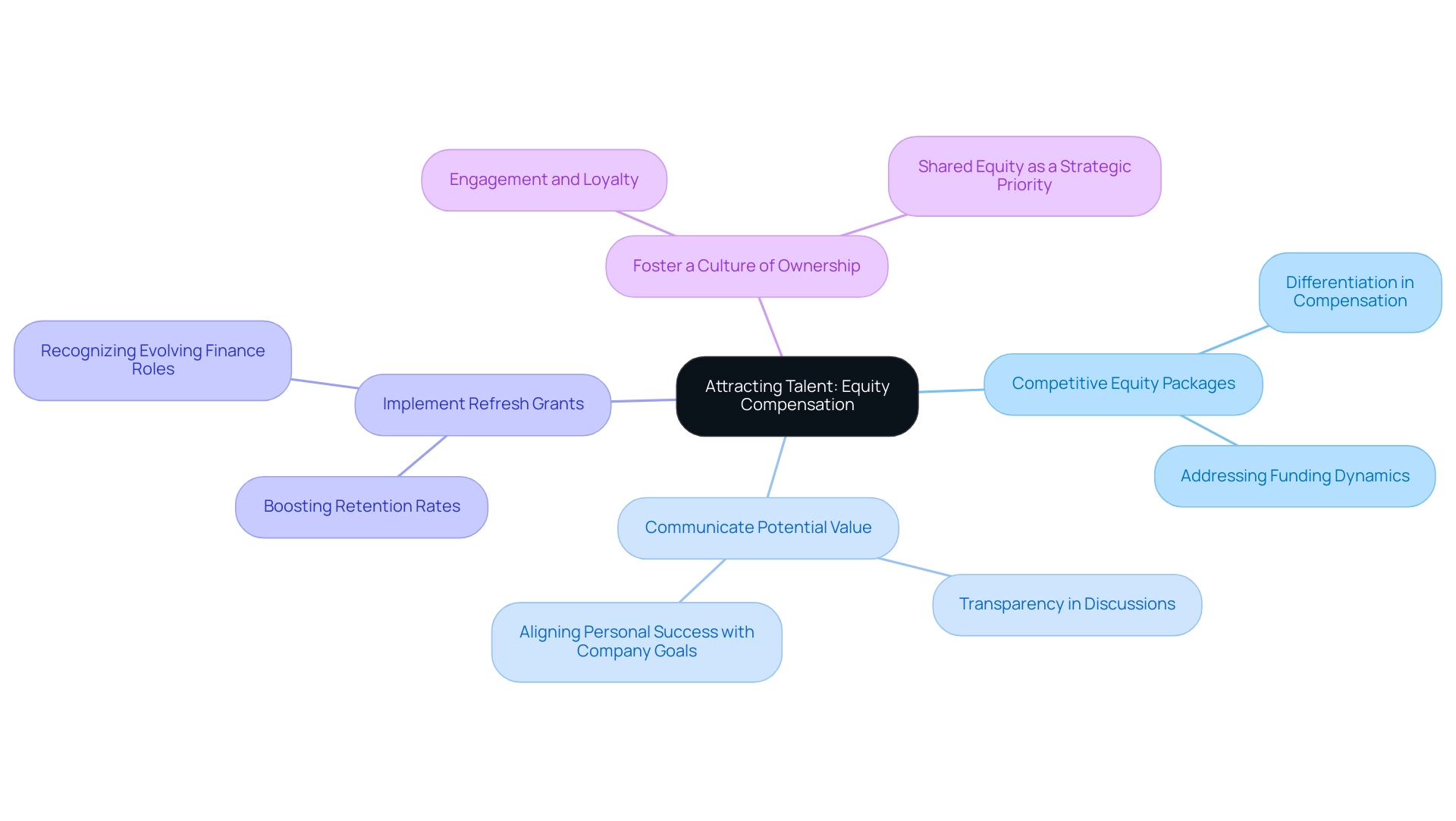

Provide Competitive Equity in Startup Company Packages: Attracting and retaining exceptional talent is a challenge many new companies face, and developing ownership compensation packages that stand out from industry norms can make a significant difference. In today's competitive landscape, where ventures led by entirely male teams secured 76.6% of funds raised in 2024, offering appealing equity in startup ownership stakes becomes a vital strategy for hiring. This statistic underscores the importance of differentiation for startups, especially in a market where traditional funding dynamics may favor specific demographics.

-

Communicate Potential Value: It is essential to communicate the potential worth of stock compensation to prospective hires. This involves illustrating how their ownership interest aligns with the organization's growth trajectory, thereby connecting their personal success with the company’s objectives. As Mayank Agarwal, Co-Founder & Head of Strategy at NeevHQ, insightfully points out,

But are you fully prepared to navigate the tax implications, vesting schedules, and strategic decisions around holding or selling your shares?

His perspective highlights the necessity for transparency in discussions about fairness, particularly as the responsibilities of finance professionals evolve, leading to increased compensation and demand for these roles.

-

Implement Refresh Grants: Introducing periodic equity refresh grants can be a compassionate strategy to maintain motivation and commitment as the organization grows. These grants serve as a reminder of the team’s equity in the startup and can significantly boost retention rates. Recent trends in CFO compensation dynamics indicate that as the roles of VPs of Finance and controllers gain recognition, startups that embrace refresh grants may find themselves in a stronger position to attract and retain key talent.

Foster a Culture of Ownership: Nurturing a culture where individuals view themselves as stakeholders is crucial for engagement and loyalty. By framing fairness not merely as a financial incentive but as shared equity in the startup and a collective journey towards success, startups can cultivate an environment that fosters commitment. This approach has shown to enhance staff retention through incentive programs, establishing it as a strategic priority in the competitive talent landscape of 2024. Startups that welcome this cultural shift may also witness improved performance as employees feel more invested in the company’s achievements.

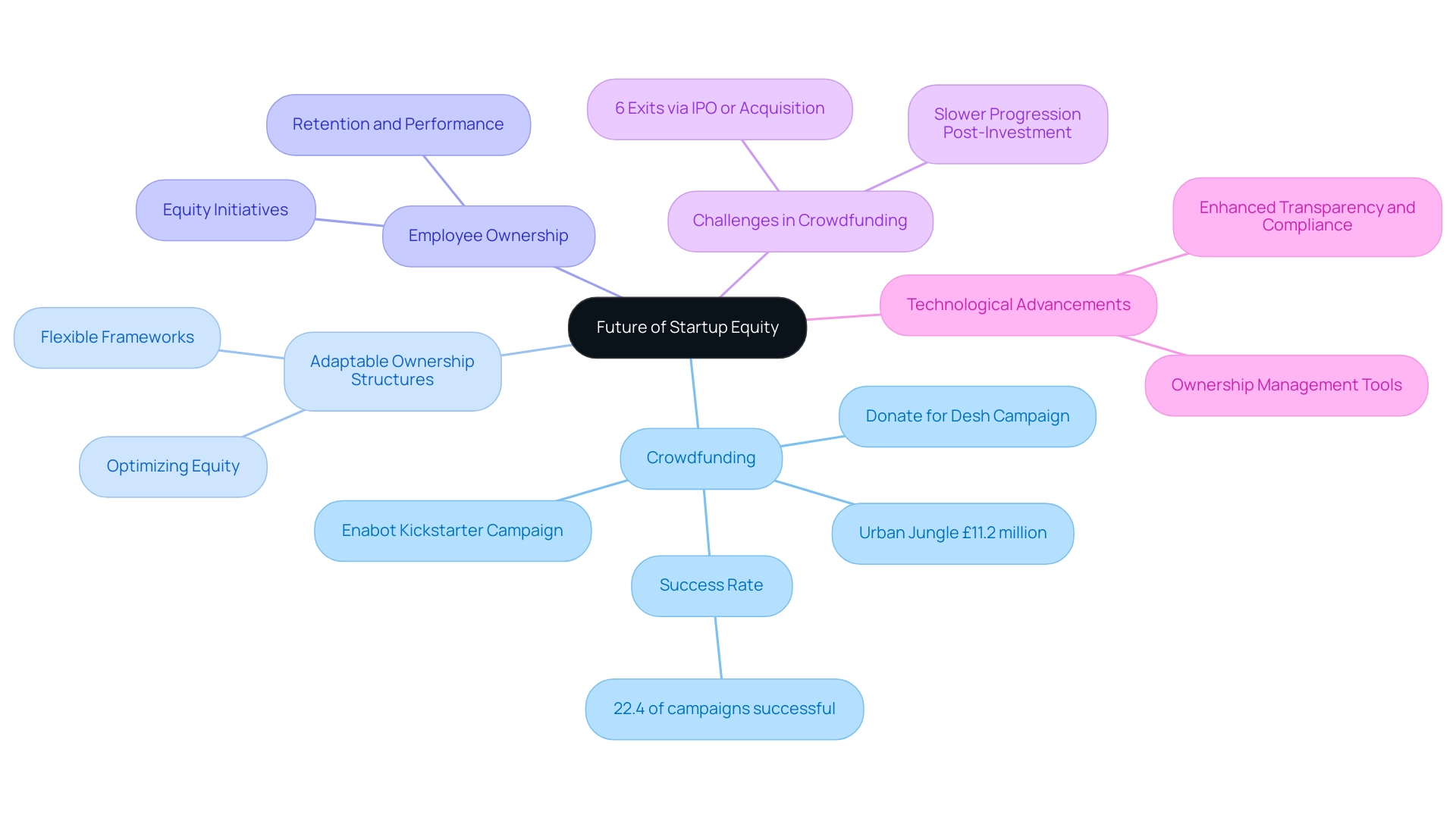

The Future of Startup Equity: Trends and Innovations

The terrain of new venture funding is undergoing a significant transformation, marked by a remarkable rise in the use of crowdfunding platforms. We understand that startups are increasingly turning to these platforms not only to raise capital but also to democratize investment opportunities, offering equity in startup company ownership stakes to a wider array of investors. Inspiring crowdfunding initiatives, such as the recent £11.2 million raised by Urban Jungle in April 2024, along with efforts like the 'Donate for Desh' campaign by the Indian Congress party and Enabot's Kickstarter campaign for a household robot, illustrate this trend. These examples show how ownership-based crowdfunding can serve as a viable alternative to traditional funding methods, which many of our members have found to be a game-changer.

Simultaneously, we recognize a significant shift toward adaptable ownership structures within startups. These flexible frameworks are thoughtfully designed to respond to organizational changes and various growth stages, enabling businesses to optimize their equity in startup company as they evolve. Expert analysis indicates that such adaptability is becoming increasingly vital for sustaining growth and meeting investor expectations, a sentiment echoed by many in our community.

Additionally, the focus on ownership models is gaining traction, fostering harmony between the interests of staff and the organization. This nurturing approach cultivates loyalty and dedication within teams, as organizations strive to create a more engaged workforce. The integration of employee ownership strategies, such as offering equity in startup company initiatives, is proving beneficial for both retention and performance, reinforcing the bonds of community among team members.

However, we understand that the journey of crowdfunded businesses often presents challenges. Research shows that crowdfunded companies tend to progress more slowly post-investment compared to their venture-backed counterparts, with only 6% of crowdfunding rounds leading to exits through IPO or acquisition. This statistic highlights the hurdles faced by crowdfunded companies in achieving substantial growth, a concern that resonates with many investors.

Moreover, technological advancements are playing a pivotal role in shaping the investment landscape. New tools and platforms for ownership management are streamlining the tracking and administration of equity in startup company ownership stakes, making it more efficient for new businesses to manage their ownership distribution. These innovations not only simplify processes but also enhance transparency and compliance, which are essential in today’s investment climate.

As the market continues to adapt to dynamic conditions influenced by factors such as the COVID-19 pandemic and geopolitical events, these developments in equity crowdfunding and management tools are likely to shape the future of startup financing. It's noteworthy that, according to statistics from Zippia, 22.4% of all crowdfunding campaigns are deemed successful, underscoring the potential of this funding model. Together, we can navigate these changes and support one another in this evolving landscape.

Conclusion

The exploration of startup equity highlights its vital role in shaping ownership structures, investment dynamics, and the overall success of emerging businesses. We understand that navigating this landscape can be challenging for founders and investors alike. By grasping the different types of equity—common stock, preferred stock, and stock options—stakeholders can better equip themselves to manage complex financial environments. Best practices in equity distribution, such as:

- Clearly defining contributions

- Implementing vesting schedules

can significantly reduce conflicts and foster collaboration among all involved.

Legal and tax considerations add another layer of complexity to equity management, making it crucial for founders to seek guidance from professionals who can help them navigate compliance and avoid potential pitfalls. Many of our members have found that the strategic use of equity compensation is essential in attracting and retaining talent, with competitive packages and a culture of ownership becoming increasingly important in today's competitive job market.

As the startup financing landscape continues to evolve, trends like equity crowdfunding and flexible equity structures are emerging. This shift indicates a move toward more democratized and adaptive investment strategies, which can be incredibly empowering. While challenges remain—especially for crowdfunded companies—advancements in technology are streamlining equity management processes, enhancing transparency and compliance.

In essence, a nuanced understanding of equity is indispensable for everyone in the startup ecosystem. By embracing these insights and best practices, founders and investors can position themselves for greater success in a rapidly changing entrepreneurial environment. We believe that together, by sharing experiences and resources, we can foster a supportive community that thrives on collaboration and shared knowledge.