Overview

In today's rapidly evolving technology sector, many investors face significant challenges in navigating the complexities of funding and risk management. We understand that this can often feel overwhelming. The article highlights seven key Special Purpose Vehicle (SPV) platforms that can provide much-needed support and guidance. Platforms like AngelList, Carta, and Sydecar play a crucial role in facilitating collaborative funding, allowing investors to access exclusive deals and streamline their investment processes.

By detailing the features and advantages of these SPVs, we aim to illustrate how they foster community engagement and ultimately enhance financial strategies. As many of our members have experienced, these platforms not only simplify the investment journey but also create a sense of belonging and support. This nurturing environment can empower investors to make informed decisions in a competitive landscape, alleviating some of the stress that often accompanies investment choices.

We invite you to explore these platforms and consider how they might align with your investment goals. Remember, you are not alone in this journey; the community is here to support you every step of the way.

Introduction

In the rapidly changing world of tech investment, many investors face the daunting challenge of maximizing opportunities while effectively managing risks. Special Purpose Vehicles (SPVs) have emerged as a compassionate strategy to address these concerns.

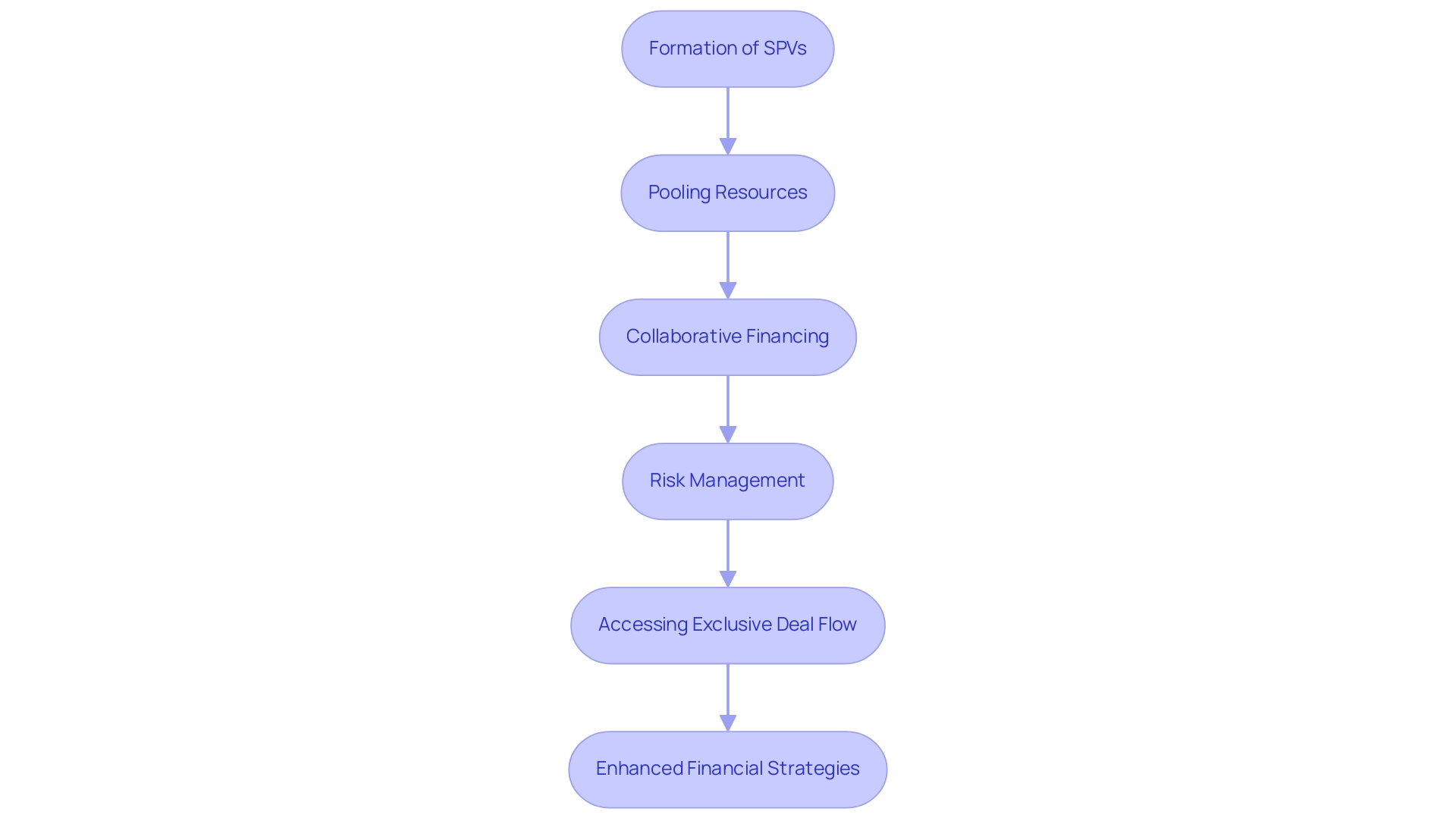

These specialized entities allow multiple investors to come together, pooling their resources and enabling access to exclusive deals. This approach not only diversifies portfolios but also alleviates the pressure of significant individual capital commitments.

As the tech sector continues to innovate at an astonishing pace, we understand that grasping the mechanics and benefits of SPVs is crucial for navigating this complex environment. From mitigating risks to fostering collaboration, the advantages of SPVs are reshaping the investment strategies of tech investors.

It is essential to explore their significance and the supportive platforms that facilitate these investments, ensuring that every investor feels valued and informed in this journey.

Understanding Special Purpose Vehicles (SPVs) in Tech Investment

Special Purpose Vehicles (SPVs) serve as spv platforms, which are specialized legal entities created for a specific aim, mainly employed in funding situations to pool resources from various contributors. We understand that navigating the technology industry can be daunting, and spv platforms emerge as a strategic instrument that allows backers to collaboratively finance startups or creative projects, efficiently distributing both risks and rewards among participants. This cooperative method is especially beneficial for technology financiers looking to broaden their portfolios without requiring significant personal capital contributions, aligning with the strategic funding emphasis for 2024 at fff.vc, which underscores portfolio management and risk diversification.

By isolating financial risk, SPVs empower investors to explore high-potential opportunities while maintaining a safeguard against potential losses. Many of our members have experienced the growing interest in SPVs firsthand, with deals exceeding $500 million in enterprise value witnessing a remarkable 37 percent increase in value and a 3 percent rise in deal count. This surge highlights the growing dependence on spv platforms as a viable strategy in the tech landscape.

As Doug Dannemiller, Senior Research Leader in Asset Management, notes, "The evolution of SPVs reflects a broader trend in asset management where collaboration and shared expertise are becoming essential for success." The advantages of employing SPVs go beyond simple risk management; they also foster improved collaboration among stakeholders. By pooling resources, members can engage in co-investing opportunities, share insights, and leverage collective expertise, ultimately enriching their financial strategies.

This aligns beautifully with the principles of communities like fff.club, where financiers are encouraged to learn from each other and work together on financial choices, connecting with industry leaders from firms like Bolt and Wise.

fff.club offers exclusive deal flow opportunities and educational resources that further enhance the advantages of SPVs. We are committed to ensuring that stakeholders are well-informed, and our essential FAQ guide for participants in fff.vc addresses key concerns regarding participation, fees, deal management, and community benefits.

As the technology funding landscape continues to evolve, the role of spv platforms is becoming increasingly important. They not only offer a mechanism for accessing exclusive deal flow opportunities but also promote a deeper understanding of wealth management among participants. By adopting SPVs, technology backers can navigate the intricacies of private market opportunities more effectively, positioning themselves for success in a competitive landscape.

Key Benefits of Utilizing SPVs for Tech Investors

Utilizing Special Purpose Vehicles (SPVs) offers several significant advantages for tech investors, particularly in the dynamic landscape of 2025, and we understand that navigating this terrain can be challenging.

- Risk Mitigation: SPVs enable investors to pool their resources, effectively distributing risk across a diverse range of projects. This collective approach not only minimizes individual exposure but also enhances the overall stability of financial portfolios. Indeed, statistics show that SPVs can lower risk exposure by as much as 50% for technology stakeholders, making them an essential resource for managing financial risks in the current market. Many of our members have shared how this strategy has provided them with peace of mind, knowing they are not alone in their investments.

- Access to Exclusive Deals: One of the standout benefits of SPVs is their ability to unlock access to unique financial opportunities that may be out of reach for individual participants. In 2025, a notable percentage of tech investors are leveraging SPV platforms to access exclusive deals, significantly enhancing their financial potential. As Mihkel Tourism, an industry leader, states, "The club's commitment to equipping members with the necessary insights and resources to make informed decisions is crucial in navigating these exclusive opportunities." This commitment is reflected by the experiences of members who have successfully participated through fff.club, showcasing the power of community-driven funding and the shared success that comes from collaboration.

- Simplified Management: SPVs streamline the investment process by managing the legal and administrative complexities associated with investments. This permits stakeholders to concentrate on strategic decision-making rather than getting bogged down by operational details, thereby improving efficiency and focus. We understand that the adaptability of SPV platforms is particularly relevant as insurance companies must also adjust to changing political and economic conditions to remain effective in risk management, and we are here to support you through these transitions.

- Tax Efficiency: The structure of SPVs can be optimized to enhance tax liabilities, making them a financially wise option for stakeholders. By strategically planning the tax consequences, technology stakeholders can maximize their returns while reducing their tax liabilities. Moreover, the dedication to inclusivity in financial education, as expressed by founders Akim Arhipov and Tim Vaino, demonstrates how SPVs enable co-investing and peer learning, thereby improving the overall funding experience. Many members have found that this not only boosts their financial outcomes but also fosters a sense of community and shared learning.

In summary, SPV platforms not only aid in risk management but also provide technology stakeholders with a pathway to exclusive opportunities, streamlined processes, and improved tax efficiency, making them a crucial instrument in the contemporary financial landscape. By quantifying non-financial contributions to operations and communities, stakeholders can also integrate these insights into their strategic decision-making processes, as highlighted by perspectives from prominent Estonian tech leaders like Sten Tamkivi and Kristjan Vilosius, who emphasize innovation, resilience, and collaborative funding strategies. Additionally, fff.club employs rigorous methodologies in deal screening and due diligence, ensuring that members are well-informed and supported in their financial journeys, reminding us all that we are stronger together.

Exploring Various Types of SPV Platforms for Investment

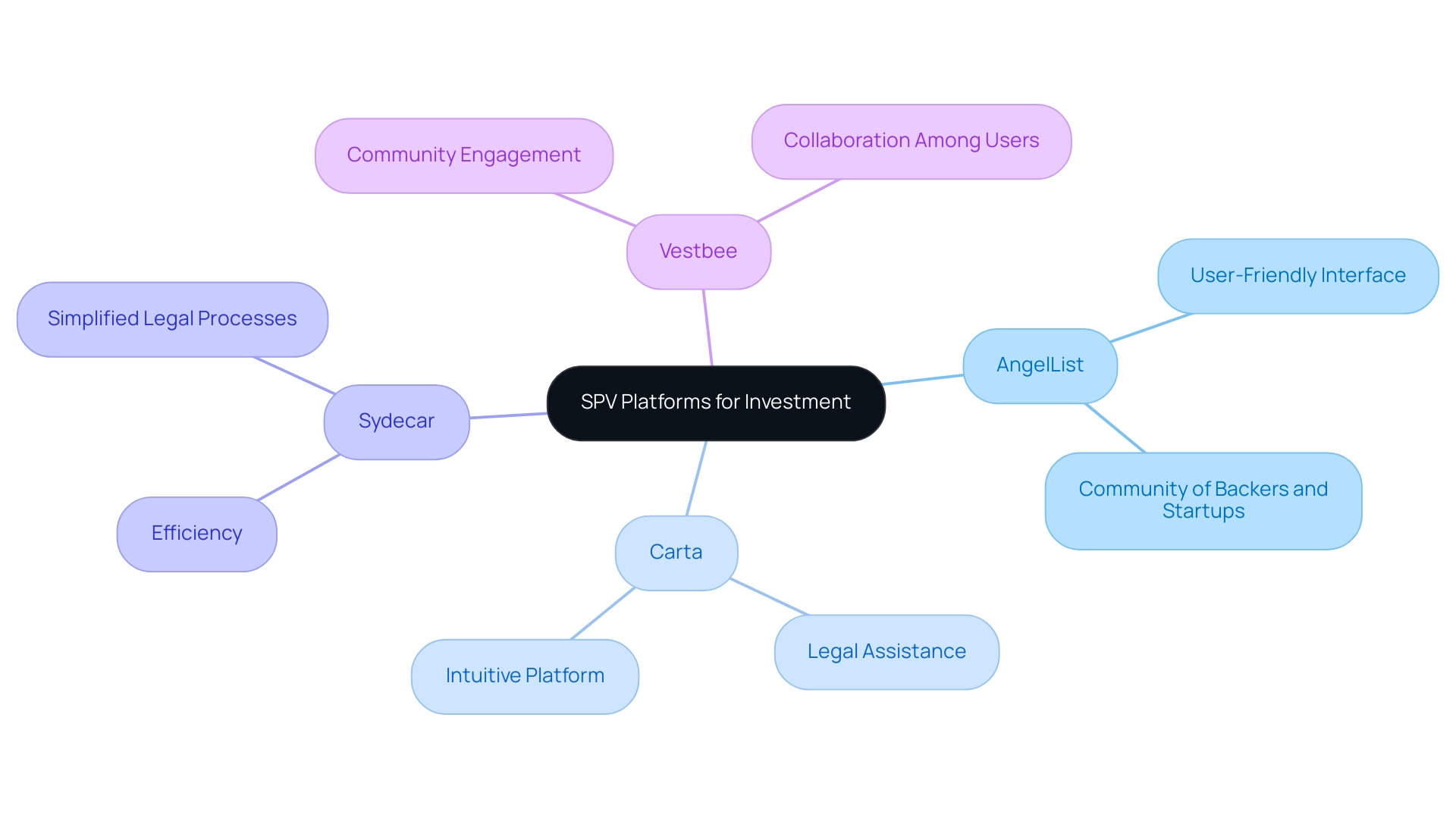

Technology backers often face challenges in navigating the complexities of funding, but fortunately, there are a variety of SPV platforms available, each thoughtfully designed to meet specific funding needs and streamline the pooling of resources. Let’s explore some of the most supportive options:

-

AngelList: Known for its user-friendly interface, AngelList makes it easier for individuals to create and manage Special Purpose Vehicles (SPVs). This platform empowers users to pool their resources effectively for startup funding, making it a cherished choice for many in the tech community. In 2025, AngelList continues to lead the market, largely due to its vibrant community of backers and startups that foster a sense of belonging.

-

Carta: With a strong focus on SPV management, Carta provides essential legal and compliance assistance, helping participants navigate the intricate world of SPV operations. Investors have shared positive experiences with Carta’s intuitive platform, which offers a wealth of resources that enhance their financial strategies. Insights from 2025 highlight successful technology allocations facilitated through Carta, showcasing its effectiveness in managing SPVs.

-

Sydecar: This platform is designed with efficiency in mind, allowing stakeholders to initiate and oversee SPVs while simplifying complex legal processes. Sydecar’s commitment to making the SPV process more accessible has resonated with technology backers seeking a smoother path to funding.

-

Vestbee: By connecting startups with funders, Vestbee embraces a community-oriented approach to SPV contributions. This platform not only facilitates funding but also encourages collaboration among users, enriching the investment experience.

As we look to 2025, the SPV landscape is evolving, with platforms like AngelList, Carta, Sydecar, and Vestbee leading the way. The stock trading and investing applications market is projected to grow to $134.32 billion by 2029, reflecting a compound annual growth rate (CAGR) of 20.4%. This growth underscores the increasing significance of SPV platforms in the technology funding ecosystem, as they provide vital resources for individuals to make informed decisions and seize emerging opportunities.

Akim Arhipov, founder of Finance, Freedom, Fellows, emphasizes the importance of inclusivity, ensuring that financial opportunities are within reach for everyone. This aligns beautifully with the community-driven ethos of these SPV platforms. Insights from Baltic financial leaders like Sten Tamkivi, who has adeptly navigated the technology landscape and invested in numerous startups, and Kristjan Vilosius, who balances entrepreneurial ventures with funding activities, further illustrate how community engagement and collaboration can enhance funding strategies. Their experiences serve as real-world examples that enrich our understanding of SPV platforms.

How to Set Up an SPV: A Step-by-Step Guide for Investors

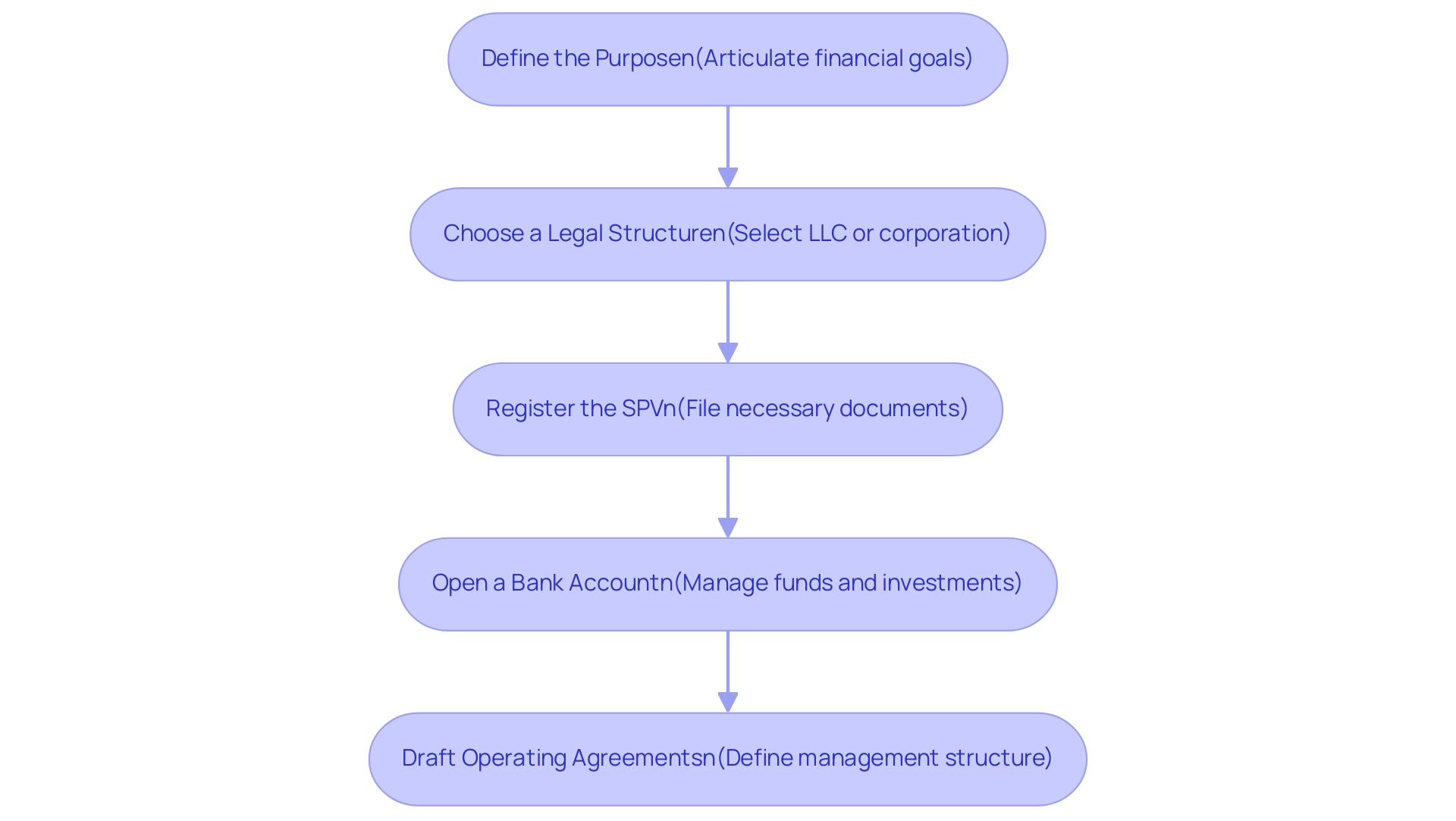

Creating SPV platforms can feel like a daunting task for tech investors seeking to streamline their funding processes while tapping into community insights. We understand that navigating this landscape can be challenging, so here’s a supportive guide to the essential steps involved:

- Define the Purpose: Start by clearly articulating the specific financial goals and objectives of your SPV. This clarity will serve as a guiding light for all your subsequent decisions and actions.

- Choose a Legal Structure: It’s important to select the most suitable legal entity for your SPV, whether it be a Limited Liability Company (LLC) or a corporation. The right choice can significantly impact your liability, taxation, and operational flexibility. Many of our members have found that taking the time to research this step pays off in the long run.

- Register the SPV: Completing the necessary registration by filing the required documents with the relevant regulatory authorities is crucial. This step ensures that your SPV operates within the legal frameworks that protect you and your investors.

- Open a Bank Account: Establishing a dedicated bank account for the SPV is essential. This account will help you manage funds, facilitate investments, and maintain clear financial records, making your operations smoother.

- Draft Operating Agreements: Developing comprehensive operating agreements that define the management structure, roles, and operational procedures of the SPV is vital. These agreements are key to ensuring smooth governance and decision-making processes, allowing everyone involved to feel secure and informed.

In the words of Akim Arhipov, founder of fff.club, "Financial superpowers should be accessible to everyone." This community-driven approach highlights the importance of cooperation among financial backers, including influential figures such as Martin Villig, co-founder of Bolt, and Taavi Rõivas, former Prime Minister of Estonia, who can offer invaluable insights and assistance.

Moreover, it’s essential for technology financiers to consider the effective maturity formula for netting sets with contracts exceeding one year, as this can significantly affect the financial structuring of SPV platforms. The recent case study on Output Floor Implementation sheds light on the regulatory landscape that may impact SPV operations, reminding us all to stay informed about changes in risk-weighted asset calculations. Lastly, the Pra's decision not to alter the definition of the 'corporates' exposure class serves as a poignant reminder of the regulatory factors technology stakeholders must navigate when establishing an SPV.

By following these steps and leveraging insights from the technology funding community at fff.club—including opportunities for deal flow, due diligence, co-investing, and access to educational resources and exclusive funding opportunities—participants can effectively set up SPV platforms that align with their financial strategies. This approach enables them to navigate the complexities of private market funding with greater ease and confidence, fostering a sense of community and shared success.

Managing Your SPV: Best Practices for Ongoing Success

To ensure ongoing success with your SPV, we understand the importance of implementing best practices that resonate with your needs and concerns:

-

Regular Reporting: We recognize that providing consistent updates on performance and financials is crucial for maintaining transparency with investors. In 2025, successful SPVs in tech investments have shown that frequent reporting not only fosters trust but also keeps stakeholders informed about the evolving landscape of their investments. This practice nurtures connections within the community at fff.club, allowing participants to share insights and strategies, ultimately enhancing deal flow opportunities.

-

Compliance Management: Staying abreast of legal and regulatory requirements is essential to avoid penalties and ensure smooth operations. We empathize with the challenges of compliance management, especially as the Financial Stability Board emphasizes the need for transparency in shadow banking activities. As Mihkel Tourism, an industry leader at LHV, states, "The club's commitment to equipping members with the necessary insights and resources to make informed decisions" underscores the importance of compliance in SPV platforms, particularly in the context of private market opportunities and facilitating deal flow.

-

Active Communication: We understand that establishing open lines of communication among stakeholders fosters trust and collaboration. Frequent discussions can help address concerns and align interests, which is especially advantageous in the dynamic tech funding environment. Engaging with fellow participants at fff.club can enhance these discussions, leading to better co-investing opportunities and improved deal flow.

-

Performance Review: Conducting regular evaluations of the SPV's performance enables prompt modifications to align with financial objectives. This practice is essential for adjusting to market shifts and ensuring that the SPV stays aligned with its goals, ultimately empowering technology financiers through informed decision-making and optimizing deal flow.

-

Governance and Transparency: We believe that proper governance structures are essential to mitigate risks associated with SPVs. By ensuring compliance and transparency, individuals can maximize the advantages of their investments while minimizing potential pitfalls. It is vital for companies to carefully evaluate the costs against the potential economic benefits to determine if SPV platforms are the appropriate structure for their needs, as highlighted in the case study titled "Disadvantage One: Complexity and Cost," which also discusses how governance impacts deal flow.

-

Case Studies on Compliance Management: Reviewing case studies that highlight successful compliance management in technology SPVs can provide valuable insights. For instance, companies that have navigated the complexities of SPV platforms often report enhanced stakeholder confidence and improved operational efficiency, showcasing the benefits of community engagement at fff.club and its positive impact on deal flow.

-

Best Practices Statistics: According to recent data, SPVs that adhere to best practices in governance and compliance management see a significant reduction in operational risks, with studies indicating a reduction of up to 30%. This emphasizes the significance of these strategies in attaining long-term success and underscores the educational resources accessible at fff.club for technology stakeholders, especially in improving deal flow with SPV platforms.

By incorporating these optimal approaches, we believe financial backers can enhance their SPV management strategies, ensuring they are well-prepared to navigate the intricacies of private market opportunities while establishing valuable relationships within the funding community.

Challenges and Considerations When Using SPVs

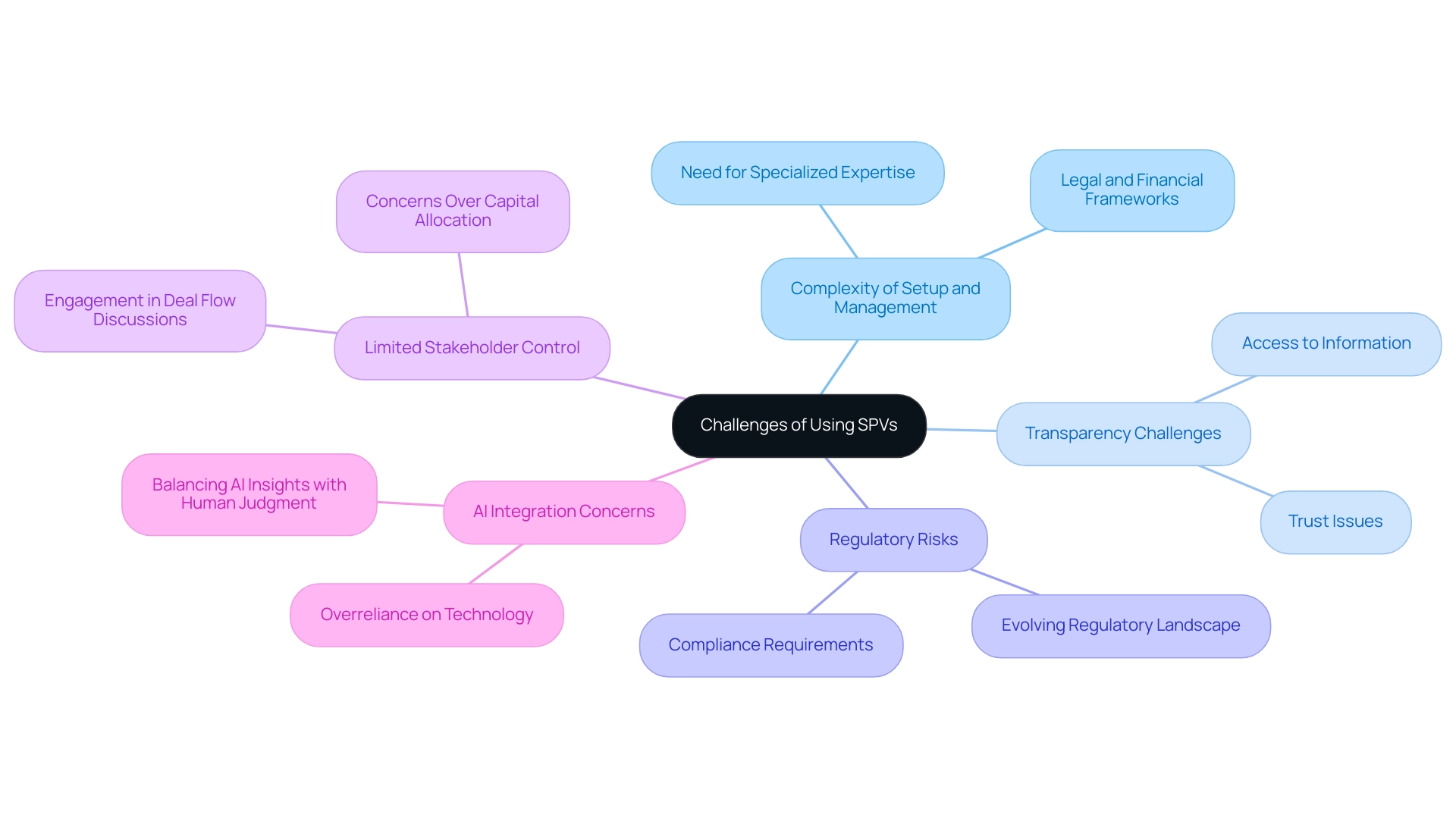

While Special Purpose Vehicles (SPVs) offer a range of benefits for technology investors, they also introduce several complexities that must be navigated carefully.

-

Complexity of Setup and Management: Establishing and managing an SPV can be intricate, necessitating a solid understanding of legal and financial frameworks. We understand that many investors often find themselves needing specialized expertise to ensure compliance and effective operation. This is where the community at fff. Club plays a crucial role, providing members with access to valuable insights and connections that can simplify the process.

-

Transparency Challenges: As many of our members have experienced, investors frequently encounter obstacles in accessing clear and comprehensive information regarding the SPV's operations and financial status. This lack of transparency can hinder informed decision-making and trust in the financial endeavor. At fff.club, members benefit from a network of over 410 professionals in technology who share insights and strategies, fostering a culture of transparency and collaboration.

-

Regulatory Risks: The regulatory landscape surrounding SPVs is continually evolving, and compliance can be a daunting task. We recognize that investors must stay vigilant regarding SPV platforms, as non-compliance can result in significant legal repercussions that impact both the SPV and its stakeholders. fff. Club highlights the significance of remaining updated on these changes, empowering technology stakeholders through educational resources and community involvement.

-

Limited Stakeholder Control: Unlike direct investments, SPVs may restrict participants' control over specific investment choices. This can lead to concerns about how their capital is being allocated and managed, particularly in high-stakes technology environments. By participating in the fff. Club community, individuals can engage in discussions about deal flow and co-investing opportunities, enhancing their control and understanding of their investments.

In 2025, a significant percentage of participants reported experiencing complexities in managing SPV platforms, highlighting the need for robust support systems. According to industry experts, the challenges of utilizing SPVs in technology funding are compounded by the rapid pace of innovation and the increasing regulatory scrutiny in the sector. As SPV platforms gain traction among property stakeholders and venture capitalists, particularly in the burgeoning AI market, understanding these challenges becomes crucial for successful financial strategies.

Furthermore, case studies reveal that while the integration of AI into financial analysis offers valuable data-driven insights, it also raises concerns about overreliance on technology, potentially undermining critical thinking skills essential for comprehensive decision-making. This balance is particularly vital for individuals utilizing SPVs, as they navigate the complexities of both technology and investment management. Notably, fff.club, with its commitment to inclusive financial education and community collaboration, emphasizes the importance of equipping members with the necessary insights and resources to make informed decisions, as highlighted by Mihkel Torim from LHV.

Additionally, fff. Club offers weekly updates on technology and economic matters to keep members informed about market trends. In a look-through scenario, asset performance is directly reflected on the fund level, while non-look-through shows a lower return ratio without operational expenses, further complicating SPV management.

Top 7 SPV Platforms Every Tech Investor Should Know

For tech investors navigating the dynamic landscape of private equity, particularly within the community-driven environment of Finance, Freedom, Fellows (fff.club), which boasts over 400 engaged members, we understand that finding the right SPV platforms can be a daunting task. Here are seven standout options for 2025 that can help you feel more connected and supported in your investment journey:

- AngelList: Renowned for its user-friendly interface, AngelList is a top choice for startup investments. It streamlines management on SPV platforms, enabling individuals to easily monitor their portfolios and engage with emerging companies. Many stakeholders have shared their success stories, praising its efficiency and accessibility, making it a valuable resource for those seeking to build connections within the technology community.

- Carta: This platform excels in providing comprehensive support for SPV platforms related to formation and administration. Carta's robust features encompass equity management and compliance tools, making it a favorite among experienced stakeholders who value meticulous oversight in their financial processes. As members have noted, its integration with community insights enhances the investment experience for technology stakeholders.

- Sydecar: Focused on simplifying the SPV platforms process, Sydecar offers a seamless experience for stakeholders. Its intuitive design and straightforward functionalities help demystify the complexities of SPV management, appealing to both novices and seasoned participants alike. Many have found it fosters a collaborative environment for knowledge sharing, which is so vital in our community.

- Vestbee: By linking backers with startups, Vestbee promotes a cooperative funding atmosphere. This platform not only facilitates investments but also encourages networking among tech professionals, enhancing the overall investment experience and aligning with the community-driven ethos of fff.club. As some members have expressed, the connections made here can be invaluable.

- Odin: This platform stands out by offering educational resources alongside its SPV platforms and management tools. This dual approach empowers participants with knowledge, enabling them to make informed decisions while managing their SPVs effectively. Many in the fff.club community have found this educational aspect crucial in their investment journeys.

- Assure: Known for its robust compliance and administrative support, Assure is a reliable choice for individuals seeking peace of mind. Its strong emphasis on regulatory compliance guarantees that SPV platforms are overseen in line with industry standards, which is essential in today’s examined financial environment, particularly for community-oriented stakeholders.

- SPV.co: This platform automates the creation and management of SPVs, significantly reducing the administrative burden on stakeholders. By streamlining processes, SPV.co enables participants to focus on identifying and capitalizing on lucrative opportunities in private equity, further enhancing the collaborative investment options available through fff.club.

Reflecting on the past year, the SPV landscape saw significant growth, with $4.7 billion raised in debt financing, marking a 14% share of VC funding. As Taavet Hinrikus, Co-Founder of Wise, noted, "We just have a lot more people who have the courage to start now," which resonates with the increasing entrepreneurial spirit we see in our community. As the European tech ecosystem matures, with more founders choosing entrepreneurship, these platforms become essential for tech investors looking to capitalize on emerging opportunities while engaging with a vibrant community at fff.club, which also offers regular events and updates to keep members informed and connected.

Conclusion

The exploration of Special Purpose Vehicles (SPVs) highlights their increasing importance in the world of tech investment. Many investors face the daunting challenge of navigating risks while seeking exclusive opportunities that often seem out of reach. SPVs provide a nurturing solution by pooling resources, allowing investors not only to mitigate risks but also to access these valuable opportunities. This collaborative approach cultivates a supportive investment environment, enhancing portfolio diversification and enabling investors to navigate the complexities of the tech landscape with greater ease.

As many of our members have experienced, platforms like AngelList, Carta, Sydecar, and Vestbee are leading this evolution. Each platform is designed to streamline SPV management and foster community engagement among investors. These platforms exemplify a shift towards a more inclusive and collaborative investment ecosystem, where knowledge sharing and co-investing can lead to improved outcomes for everyone involved.

However, we understand that while SPVs offer numerous advantages, they also present challenges that require careful consideration, such as regulatory complexities and transparency issues. By staying informed and leveraging resources available through communities like fff.club, investors can effectively address these challenges, ensuring their SPV investments are managed successfully.

In conclusion, SPVs represent a transformative tool for tech investors, blending risk management with the potential for significant returns. As the investment landscape continues to evolve, embracing SPVs can empower investors to seize emerging opportunities while nurturing a collaborative spirit within the tech community. The future of tech investment lies in harnessing the collective expertise and resources of like-minded individuals, making SPVs an essential strategy for navigating this dynamic environment.