Overview

This article addresses the important facts surrounding cash advances on credit cards, particularly focusing on their costs, impacts on credit scores, alternatives, and strategies for minimizing expenses. We understand that while cash advances can offer immediate access to funds, they often come with high fees and interest rates that can significantly affect your financial health and credit score. It’s crucial to approach this option with careful consideration and planning. Many of our members have faced similar challenges, and it’s vital to recognize the weight of these decisions. By sharing experiences and exploring alternatives, we aim to foster a supportive community that empowers you to make informed choices.

Introduction

In today's world, where financial flexibility is so important, cash advances on credit cards might appear to be a quick fix for those facing urgent financial needs. These swift withdrawals can feel like a safety net during tough times, but they often come with hidden costs that can quickly escalate. By understanding how cash advances work—including their fees, interest rates, and potential effects on credit scores—you can feel more empowered to make choices that are right for you.

As many of our members have experienced, navigating the financial landscape can be challenging, and exploring alternatives while finding ways to minimize costs is essential for anyone considering this option. This article aims to unpack the complexities of cash advances, offering insights and practical tips to help you manage this financial tool with confidence and care.

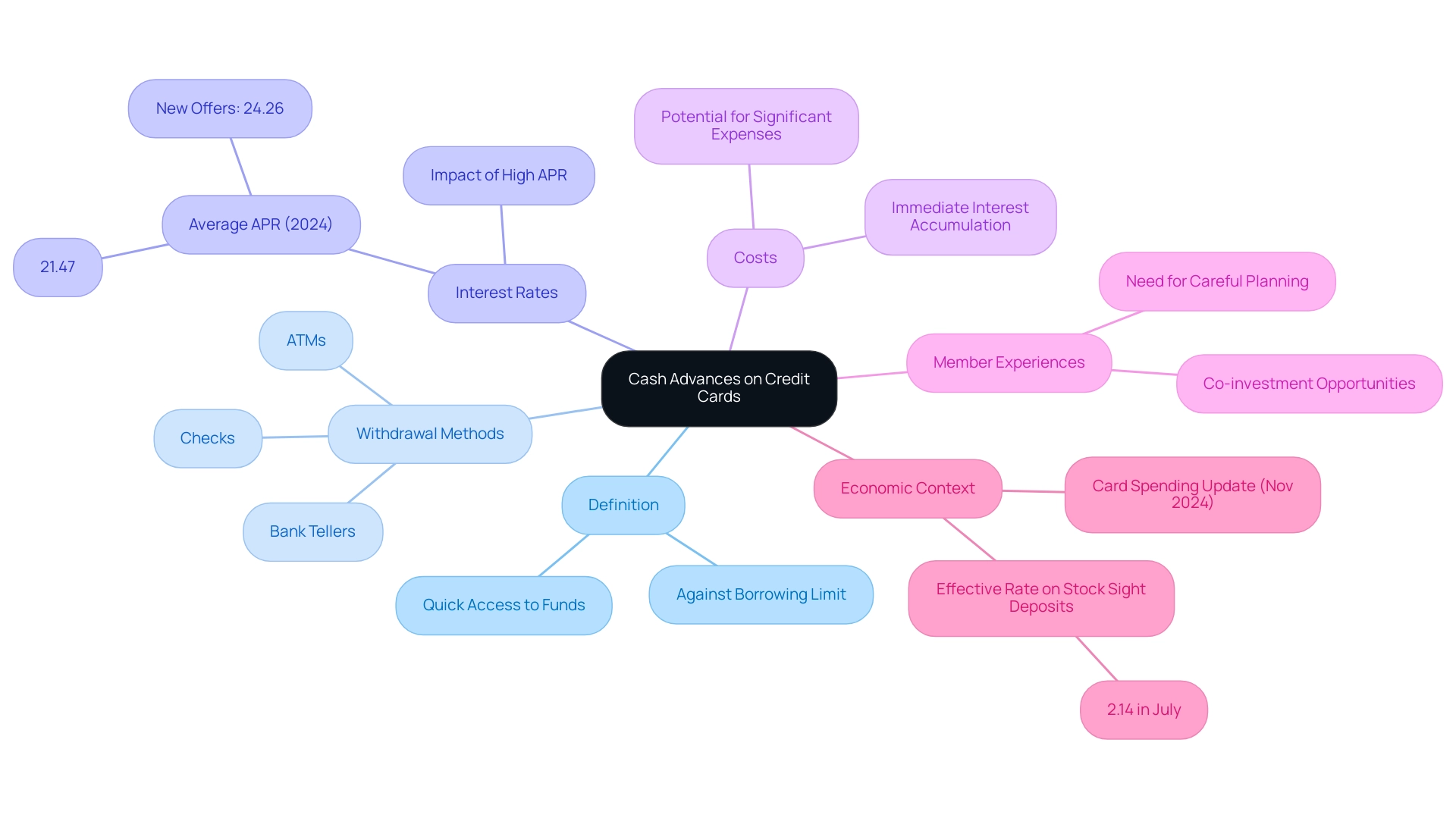

1. Name: What Are Cash Advances on Credit Cards?

A monetary withdrawal on a charge card provides a quick solution for holders in urgent situations, allowing them to extract funds against their borrowing limit. This can be done through various methods, such as ATMs, bank tellers, or checks issued by the card company. However, it’s important to note that unlike typical transactions, monetary withdrawals do not have a grace period; interest begins accumulating immediately. This can lead to significant expenses if not managed carefully, a concern many of our members have expressed.

The amount available for monetary withdrawals is often less than the overall limit, typically ranging from 20% to 60% of the total limit, depending on the card provider’s guidelines. For instance, in 2025, many card providers have set lending limits within this range, helping cardholders understand their borrowing potential. We understand that navigating these limits can be daunting, especially when unexpected expenses arise.

Recent data indicates that the average APR for loans remains notably high, with the interest rate for all charge cards reported at 21.47% in the fourth quarter of 2024. This statistic underscores the importance of understanding the financial implications of loans, particularly as new card offers feature even higher average APRs of 24.26%. As tech investors, being aware of how these elevated APRs can impact borrowing costs is crucial, especially for those managing substantial financial portfolios.

As Emily Herring, Publisher at Finder, points out, "The average transaction value on a payment card is £59," which showcases the common use of payment cards for daily expenses. Yet, when it comes to monetary loans, costs can escalate quickly, making it essential for cardholders to thoughtfully consider their options. Many of our members have shared their experiences with this, emphasizing the need for careful planning.

Additionally, members of fff. Club can co-invest and learn from each other, which can be incredibly beneficial when making informed decisions about financial boosts and credit management. Understanding withdrawal methods and the associated fees can empower cardholders to make informed choices during urgent financial moments.

Moreover, the effective rate on stock sight deposits, which rebounded to 2.14% in July, provides a broader economic context that tech investors may find relevant when assessing funding options. This insight can help members weigh their choices more effectively.

In summary, while cash loans offer immediate access to funds, it’s vital to weigh them against the risks and costs, particularly when considering options like 0 on cash advances on credit cards. The recent update on card spending for November 2024 further highlights trends in credit card usage, making it essential for tech investors to stay informed about these financial tools within the framework of their investment strategies. Remember, we’re here to support you in navigating these choices.

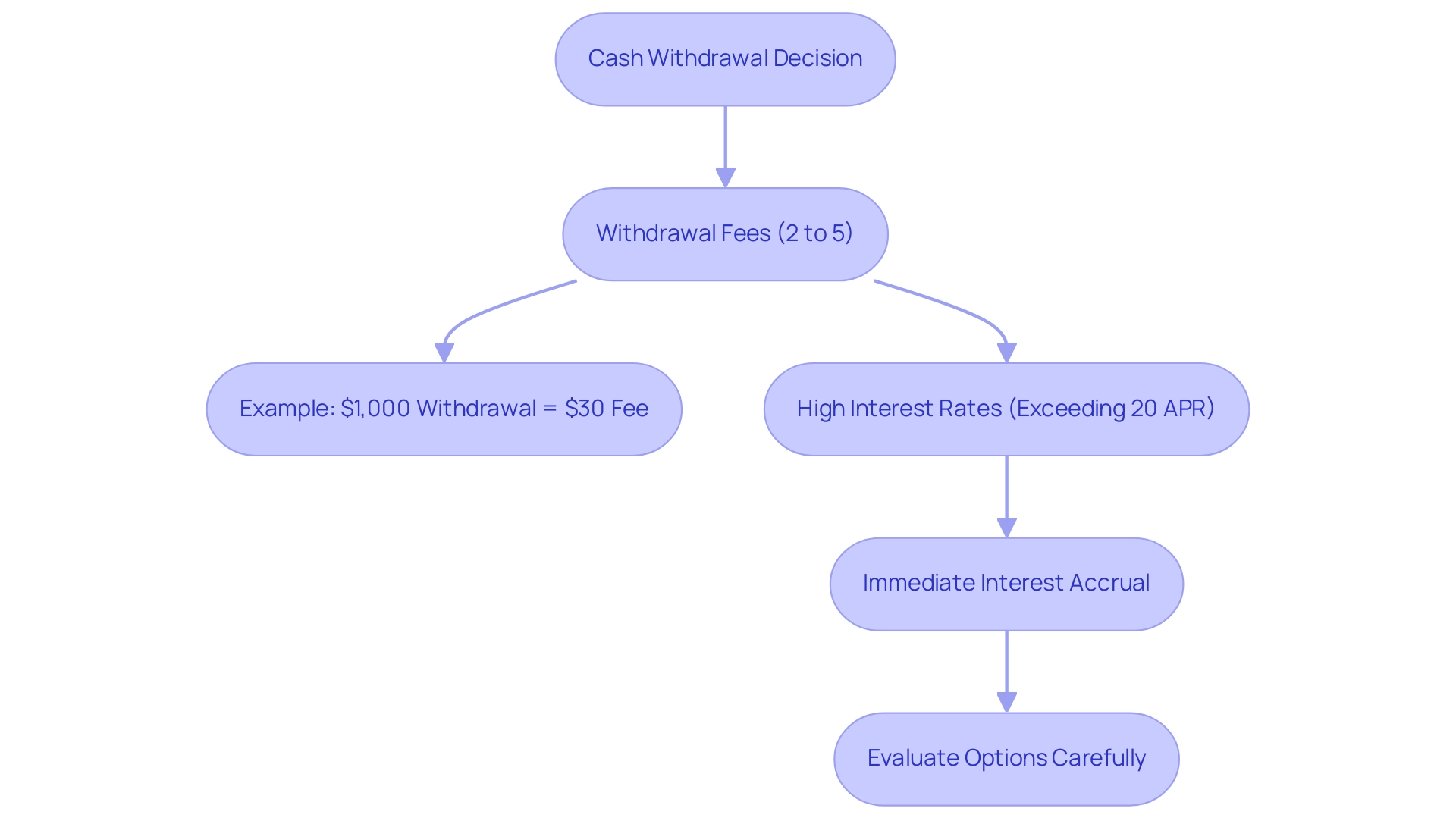

2. Understanding the Costs: Fees and Interest Rates

Cash withdrawals can quickly become a costly financial decision, especially when considering the fees and high-interest rates associated with cash advances on credit cards. We understand that credit card providers typically charge a withdrawal fee ranging from 2% to 5% of the amount taken out, or a fixed fee, whichever is higher. For example, if you withdraw $1,000, a 3% fee would add $30 to your total cost, which can be concerning.

Moreover, the interest rates on cash advances are often higher than those for regular purchases, frequently exceeding 20% APR, despite the fact that there is no grace period on cash advances. Currently, the fourth lowest loan APR is 17.99%, applicable to cards like the PenFed Power Rewards Visa Signature Card and the PenFed Promise Visa. Unlike standard transactions, monetary withdrawals begin accruing interest immediately after the withdrawal, which can feel overwhelming.

This combination of upfront fees and elevated interest rates positions cash advances as one of the most expensive ways to access funds. It’s crucial for investors to carefully evaluate their options before proceeding. In the realm of tech investing, communities like Finance, Freedom, Fellows (fff.club) play a vital role in helping members navigate these financial decisions. By fostering relationships and providing educational resources, such as webinars on financial literacy and investment strategies, fff.club empowers tech investors to make informed choices about loans and other financial strategies.

The founders, Akim Arhipov and Tim Vaino, are dedicated to democratizing financial knowledge, ensuring that every investor has access to the tools they need for success. As financial expert Margaret Seikel points out, 'Citi and Capital One categorize legal bets as monetary withdrawals but do not specify online gambling,' which highlights the complexities surrounding monetary withdrawal classifications.

Understanding these nuances is essential for technology investors, as financial decisions can significantly impact their overall investment strategies and wealth management. Engaging with the fff.club community provides the insights and resources necessary for effective decision-making, encouraging tech investors to join and benefit from shared knowledge and support.

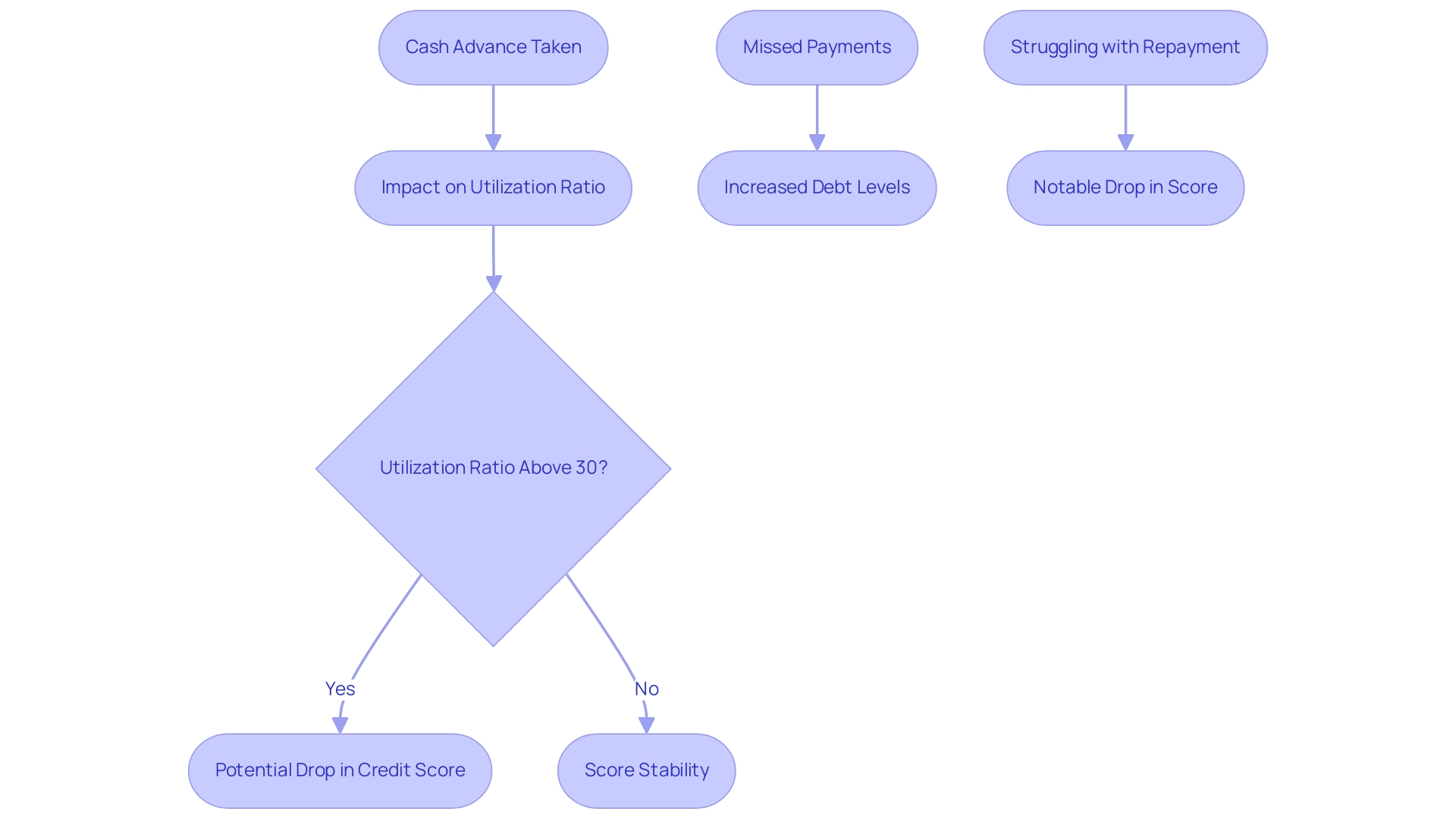

3. How Cash Advances Affect Your Credit Score

Using monetary loans can significantly influence your financial score in various ways. While taking a cash advance may not directly show up on your report, it can profoundly impact your utilization ratio, potentially leading to a concerning 0 on cash advances on credit cards. This ratio reflects how much of your available credit you are using compared to your total funds, and a high utilization ratio—typically above 30%—can signal to lenders that you might be overly reliant on borrowing, which can adversely affect your score.

We understand that financial management can be daunting. If monetary withdrawals result in missed payments or contribute to increasing debt levels, the repercussions can be even more severe. Recent research indicates that individuals who frequently rely on loans may experience a notable drop in their scores, particularly if they struggle with repayment. Financial analysts emphasize the importance of maintaining a healthy utilization ratio, as it plays a crucial role in scoring models.

For example, a case study examining the impact of cash advances on credit scores showed that borrowers who kept their utilization ratio below 30% generally enjoyed greater score stability compared to those who exceeded this threshold. In today’s economic climate, the 30-day delinquency rate for card balances was reported at 3.23% in Q3 2024, highlighting the ongoing challenges in managing debts that many tech investors face.

As Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, points out, leveraging technology and analytics can empower individuals to better understand their spending habits and make informed borrowing decisions. This insight is especially vital as we move into 2025, with the landscape of monetary loans evolving. Specialists caution that while cash advances on credit cards can offer quick access to funds, the long-term effects on credit scores and overall financial health should not be underestimated, particularly with the risk of reaching 0 on cash advances on credit cards.

Latoya Irby, a personal finance author, stresses the importance of wise money management, which is essential for tech investors striving to navigate their financial strategies effectively. Understanding these dynamics is crucial for tech investors who wish to skillfully traverse the complexities of financial management. We are here to support you in this journey, fostering a community where shared experiences can lead to greater financial well-being.

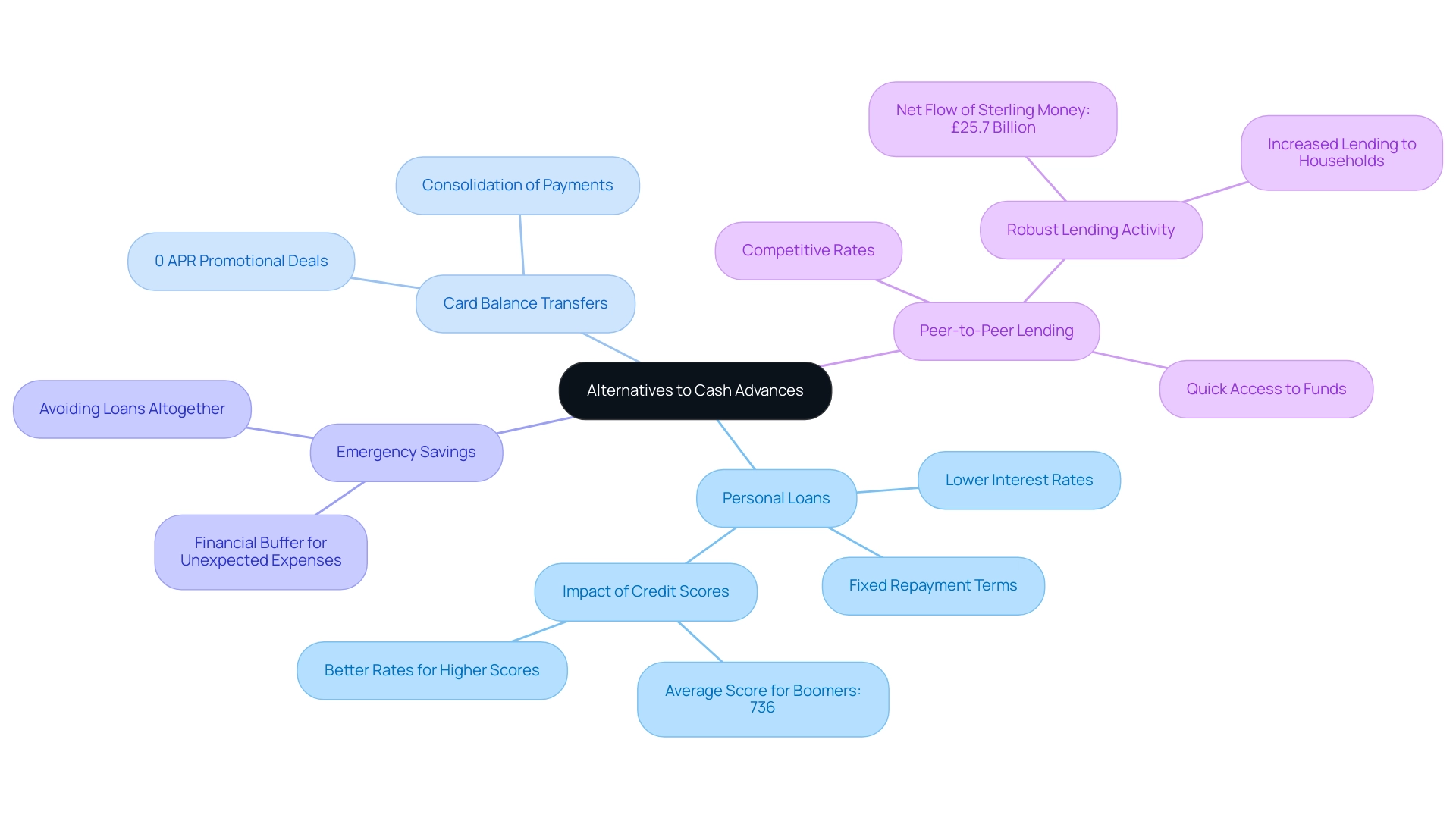

4. Alternatives to Cash Advances: Exploring Your Options

Before considering a cash advance, we understand that it’s essential to explore several viable alternatives that can not only save you money but also provide more favorable terms:

- Personal Loans: These loans often come with lower interest rates compared to cash advances, especially for those with better credit scores. With fixed repayment terms, personal loans can help you manage your finances more predictably. The average APR for personal loans varies significantly based on financial scores, with individuals boasting scores above 700 frequently securing rates below 10%. Notably, the average score for Boomers is 736, which can influence the rates they receive.

- Card Balance Transfers: Many credit cards offer promotional 0% APR deals for balance transfers, allowing you to access funds without incurring high fees. This option can be particularly beneficial if you have existing credit card debt, as it enables you to consolidate your payments and avoid interest during the promotional period.

- Emergency Savings: Tapping into an emergency fund can be a wise strategy to avoid the need for loans altogether. Financial advisors often recommend maintaining a savings buffer to handle unexpected expenses, which can alleviate the stress of urgent monetary needs.

- Peer-to-Peer Lending: This innovative approach connects borrowers directly with individual lenders, often resulting in competitive rates and quicker access to funds. The rise of peer-to-peer lending platforms in 2025 has made it easier for consumers to find flexible financing options tailored to their needs. Recent trends indicate robust lending activity, with the net flow of sterling money reaching £25.7 billion in January 2025, highlighting the increasing availability of funds.

By exploring these alternatives, you can sidestep the high costs associated with cash advances and benefit from more informed monetary decisions. As Erika Giovanetti insightfully notes, "Personal loans can have a positive or negative impact on your credit score, depending on how responsibly you manage your debt after you borrow one." This serves as a gentle reminder of the importance of choosing the right financial strategy, particularly in a climate of rising interest rates and inflation that affects us all.

5. Tips for Minimizing Costs When Using Cash Advances

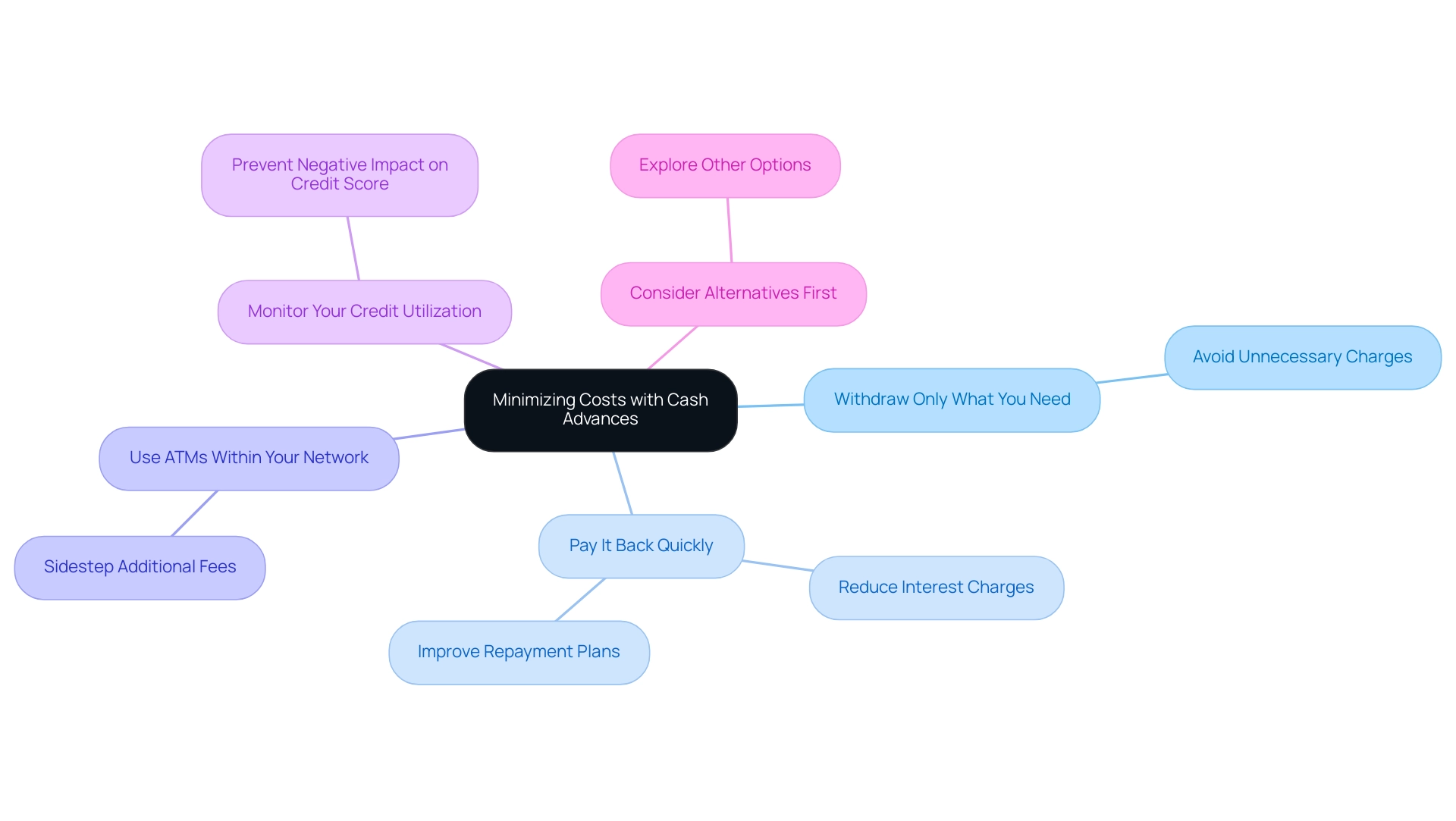

When faced with the need for a monetary withdrawal, it’s understandable to feel concerned about expenses. Applying these strategies can help alleviate some of that stress:

- Withdraw Only What You Need: By limiting your withdrawal to the exact amount required, you can avoid unnecessary charges that can quickly accumulate.

- Pay It Back Quickly: Making it a priority to repay cash advances promptly can significantly reduce interest charges, which can escalate rapidly if left unpaid. Many financial specialists emphasize the importance of improving repayment plans, especially since interest charges from loans and cards can build up considerably over time.

- Use ATMs Within Your Network: To sidestep additional fees, always choose ATMs that belong to your bank’s network, ensuring you keep more of your hard-earned money.

- Monitor Your Credit Utilization: Regularly checking your credit usage is crucial to prevent any negative impact on your credit score, as high utilization can affect your overall financial health.

- Consider Alternatives First: Before committing to a monetary option, take the time to explore other available choices, ensuring you make the most informed and beneficial decision for your economic situation.

As we look toward 2025, it’s essential to reflect on the average repayment time for cash advances on credit cards. Some options may even offer 0% on cash advances, which can significantly influence your overall financial strategy. By fostering emotional connections with your monetary choices and aligning them with your values, you can enhance your loyalty to your financial institution. In fact, nearly 60% of U.S. consumers remain loyal to a brand for life once they commit, and over half (55%) stay loyal because they genuinely love a product.

This loyalty can lead to better financial outcomes. Furthermore, the rise in contactless debit card transactions highlights a relevant trend that tech investors should be aware of, potentially linking it to the concept of 0% on cash advances on credit cards. As many of our members have experienced, understanding these dynamics can empower you to make choices that resonate with your financial goals and values.

Conclusion

Cash advances on credit cards can feel like a lifeline during urgent financial moments, yet they come with significant risks and costs that deserve careful thought. By understanding the ins and outs of cash advances—including the fees, high-interest rates, and the immediate accrual of interest—you can empower yourself to make informed financial choices. The average APR for cash advances often exceeds 20%, a stark reminder of why it's crucial to weigh this option against other financial strategies.

Many of our members have found that exploring alternatives such as personal loans, balance transfers, and emergency savings can offer more favorable terms and lower costs. Personal loans usually come with lower interest rates, while balance transfers can help consolidate debt without adding extra charges. Additionally, having an emergency savings fund can serve as a safety net, reducing the need to rely on costly credit options.

If you find yourself in a position where a cash advance is necessary, there are strategies you can implement to minimize costs. Withdrawing only what you absolutely need, paying it back quickly, and using in-network ATMs can make a difference. It's also essential to keep an eye on your credit utilization and explore alternatives before turning to cash advances, as these practices can help safeguard your financial health and credit scores.

In conclusion, while cash advances may appear to be a convenient solution for immediate financial needs, the long-term implications and costs can often overshadow the benefits. By staying proactive and informed, you can navigate the complexities of cash advances and make decisions that align with your financial goals. Prioritizing financial literacy and exploring viable alternatives will ultimately lead to better financial outcomes and a more secure future for you and our community.