Overview

The term "MOIC" stands for Multiple on Invested Capital, a financial metric used primarily in private equity to evaluate the total value generated from an investment relative to the capital invested. The article explains that MOIC is calculated by dividing the total value of an investment by the total capital invested, providing a straightforward measure of profitability that informs strategic decision-making, although it has limitations such as not accounting for the time value of money.

Introduction

In the realm of private equity, the Multiple on Invested Capital (MOIC) stands out as a pivotal metric for evaluating investment performance. By quantifying the total value generated relative to the capital invested, MOIC provides investors with a clear lens through which to assess profitability and inform strategic decisions. This article delves into the intricacies of MOIC, from its straightforward calculation to its significance in shaping investment strategies.

It also explores the comparative landscape of financial metrics, highlighting the distinctions between:

- MOIC

- Internal Rate of Return (IRR)

- Total Value to Paid-In (TVPI)

Furthermore, the limitations of MOIC are addressed, emphasizing the importance of a holistic approach to investment evaluation. Through this comprehensive examination, investors can gain valuable insights that enhance their decision-making processes in an ever-evolving financial environment.

Understanding Multiple on Invested Capital (MOIC)

Multiple on Invested Capital serves as a crucial financial metric primarily utilized in private equity to assess the total value generated from an investment in relation to the capital invested. The calculation of the multiple on invested capital is straightforward: it is derived by dividing the total value of an investment—which encompasses both distributions and any residual value—by the total capital invested. For example, if a contributor puts in $1 million and subsequently receives $3 million, the moic meaning would indicate a result of 3.0.

This measure is especially important as it provides a clear framework for evaluating profitability, enabling investors to effectively assess their capital allocation strategies. Richard King, the Founder and CEO of Finance Alliance, emphasizes the importance of robust financial metrics, noting that allocations characterized by reasonable acquisition valuations combined with strong EBITDA growth tend to yield superior performance. This is emphasized by CalPERS' recent commitment of $200,000,000 to General Catalyst Group XII - Ignition, L.P. in 2024, reflecting a strategic funding approach that aligns with these principles.

Furthermore, the historical background presented by the case study named 'The GFC Prompt for a Deeper Understanding of PE Portfolios' emphasizes the difficulties encountered during the Global Financial Crisis, demonstrating the significance of comprehending multiple of invested capital, or moic meaning, in managing risks and exposures in private equity. As such, comprehending the metric not only assists in assessing investment success but also guides strategic decision-making in the ever-evolving landscape of private equity.

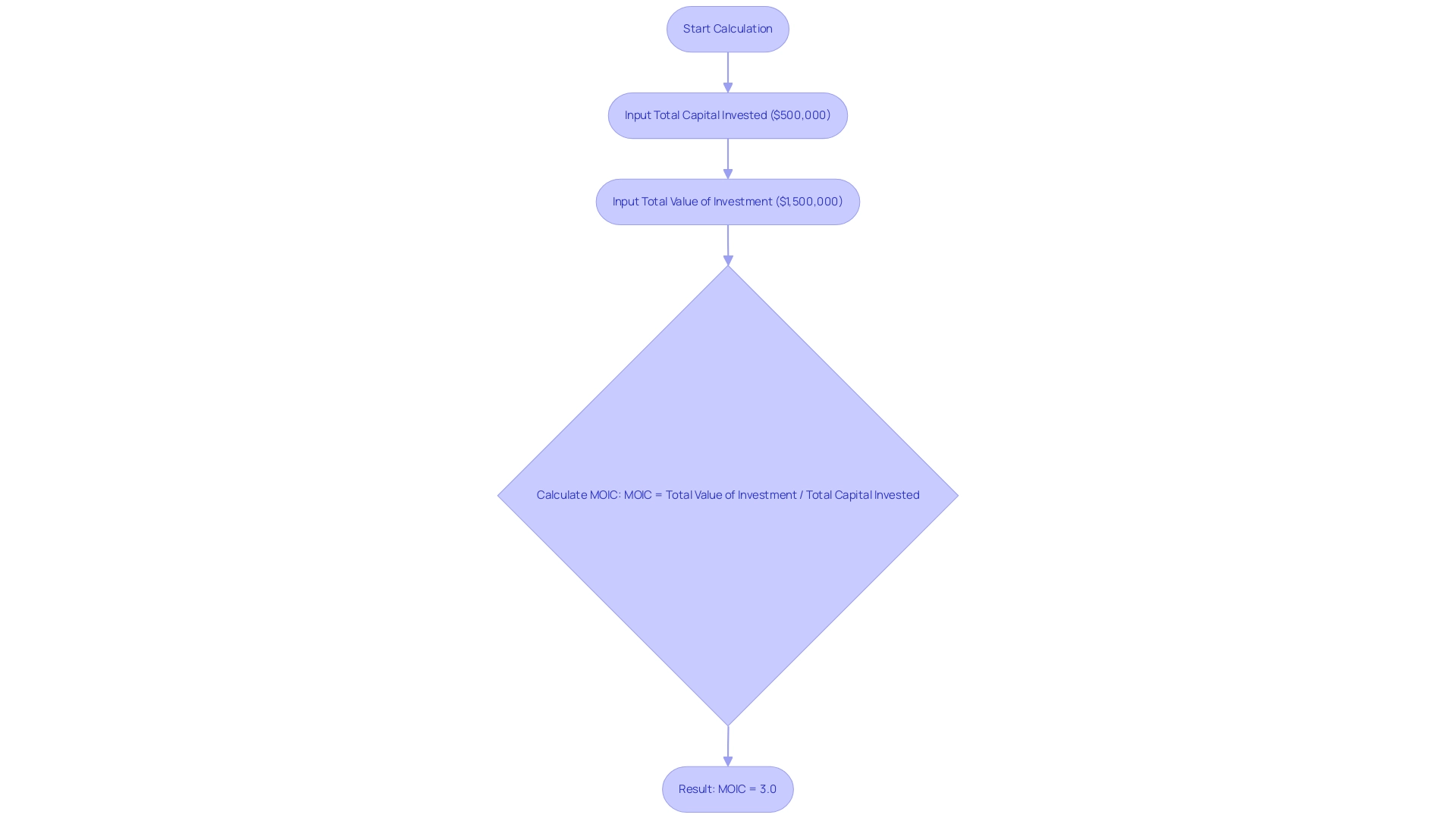

How to Calculate MOIC: Formulas and Examples

The calculation of the Multiple on Invested Capital (MOIC) is straightforward and can be articulated using the following formula:

MOIC = Total Value of Investment / Total Capital Invested.

For instance, consider an individual who commits $500,000 to a startup. If the total value of their shares later reaches $1.5 million, the MOIC can be computed as follows:

MOIC = $1,500,000 / $500,000 = 3.0.

This result signifies the MOIC meaning, indicating that the individual has generated three dollars in value for every dollar invested. However, it is crucial for investors to also account for the duration over which these returns are achieved, as this factor can significantly influence the overall assessment of a venture's success. As Stephen A. Schwarzman, CEO and co-founder at Blackstone, aptly stated, "The best allocations are the easiest ones to approve," highlighting the value of simplicity in financial decisions.

Furthermore, the case study of the Silver Mountain Private Equity Fund illustrates this concept effectively; the fund collected $50 million in rental income and $210 million from property sales, leading to a multiple of invested capital of 3.8x, which is referred to as MOIC meaning it generated $3.80 for every dollar invested. Recent materials, like the VC Regulatory Playbook from Carta, highlight the significance of comprehending different financial measures to make informed decisions regarding funding. This comprehensive method of evaluating assets assists investors in applying multiple of invested capital efficiently with other measures, enhancing their financial strategies.

Furthermore, for individuals seeking to enhance their comprehension of financial indicators, there are learning materials accessible, including an online course with 63 lessons and 13 hours of video.

The Importance of MOIC in Investment Strategies

Multiple on Invested Capital is a crucial measure for assessing financial performance, especially in the domain of private equity. The metric is calculated by dividing the total value of the asset by the capital invested, which enables investors to compare various assets effectively, assessing their potential returns and informing future strategies. A higher MOIC indicates that a venture has yielded substantial returns relative to the capital invested, highlighting the moic meaning and making it an appealing choice for future capital allocation.

Furthermore, at fff.club, we emphasize collaborative evaluation of ventures and thorough due diligence, leveraging the expertise of over 300 members to screen high-grade deals. This collective method not only improves the process of funding but also enables our members to make informed choices concerning their capital distribution. As emphasized by pleased stakeholders, including John Doe, who mentioned, "The joint efforts at fff.club have greatly enhanced my financial choices," insights obtained from data such as returns are vital for comprehending market dynamics.

In the realm of private equity, the case study named 'Performance Indicators in Private Equity' demonstrates how stakeholders assess the success of their assets using measures like Internal Rate of Return (IRR). Both the multiple of invested capital and IRR are essential for assessing the value created by the fund, and understanding the moic meaning is crucial when evaluating them in conjunction with each other and the associated fees. In 2024, the significance of this measure in investment strategies keeps expanding, as individuals increasingly depend on it not only to assess performance but also to steer their capital allocation choices efficiently.

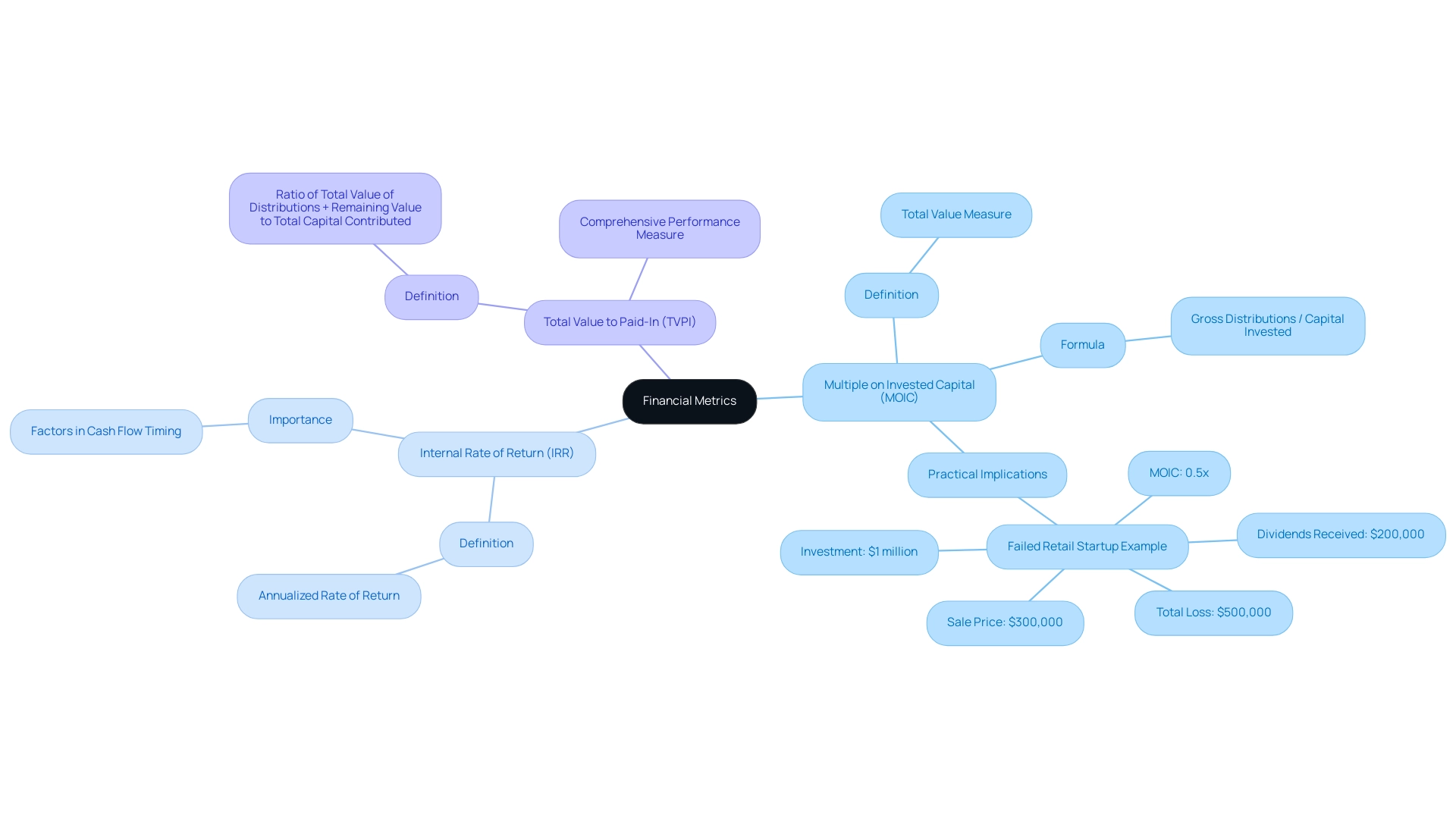

MOIC vs. Other Financial Metrics: Understanding the Differences

Grasping the differences between Multiple on Invested Capital, Internal Rate of Return (IRR), and Total Value to Paid-In (TVPI) is essential for individuals seeking to assess their financial metrics effectively. The metric serves as a straightforward measure of total value, calculated by dividing gross distributions by the capital invested. For example, a failed retail startup investment showed a multiple of invested capital of 0.5x, indicating a loss of value for stakeholders.

In this situation, a private equity firm that invested $1 million received only $200,000 in dividends and later sold the company for $300,000, leading to an overall loss of $500,000 for those who put in capital. This statistic illustrates the practical implications of multiple on-investment capital in real-world scenarios, enhancing the reader's understanding of its significance.

In contrast, IRR reflects the annualized rate of return, factoring in the timing of cash flows. This makes IRR particularly valuable for assessing the efficiency of capital over time. If an individual receives returns unevenly, IRR offers insight into how those returns affect overall performance.

TVPI, conversely, calculates the ratio of the total value of distributions plus the remaining value of a venture to the total capital contributed. This measure provides a thorough perspective on an asset's performance by factoring in both realized and unrealized gains.

While multiple of invested capital is helpful for grasping total returns, internal rate of return’s consideration of the time value of money makes it essential for individuals who emphasize cash flow timing in their strategies. Kyler Thomas succinctly explains the MOIC meaning by stating that the formula for MOIC is very simple: Divide the gross distributions of a fund or asset by the capital invested and you have the multiple on invested capital. This simplicity, however, does not encapsulate the nuanced understanding that IRR and TVPI provide.

Identifying these differences enables individuals to choose the suitable measure aligned with their financial goals, ultimately improving their decision-making processes. Furthermore, prospective backers should pursue unbiased tax and financial guidance prior to putting money into alternative assets to guarantee informed decision-making regarding these financial measures.

Limitations of MOIC: What Investors Should Know

While the Multiple on Invested Capital serves as a valuable metric, it possesses notable limitations that investors must recognize. Primarily, the metric fails to incorporate the time value of money, which can lead to misleading interpretations regarding an asset's performance over time. For example, a financial commitment may seem lucrative based solely on multiple of invested capital, yet overlook the decreasing value of returns when adjusted for time.

An important aspect to consider is that a multiple below 1x signifies a decline in worth for the asset, highlighting the possible dangers of depending exclusively on this measure. Furthermore, the possibility of inflation of performance metrics through unrealized gains can lead to an excessively positive representation of an asset's true value. Massimiliano Saccone, Founder & CEO of XTAL Strategies, emphasizes this risk, stating that in private fund investments, 'deposits and withdrawals' are neither possible nor in the control of clients.

This highlights the difficulties of evaluating performance solely through the metric, especially when accounting for the time value of money and unrealized gains. For example, the SilverMountain Private Equity Fund, which generated a MOIC of 3.8x, illustrates the moic meaning and how a high MOIC can be misleading without a comprehensive analysis of the underlying factors. Investors are advised to avoid relying solely on this metric; incorporating other performance indicators such as Internal Rate of Return (IRR) or Total Value to Paid In (TVPI) can yield a more nuanced understanding of investment efficacy.

Awareness of these limitations is essential for making informed decisions in a complex financial landscape.

Conclusion

Understanding Multiple on Invested Capital (MOIC) is essential for investors navigating the private equity landscape. This metric offers a clear, quantifiable means of assessing the total value generated by an investment in relation to the capital invested. By calculating MOIC, investors can gauge profitability and make informed capital allocation decisions, particularly when combined with other metrics like Internal Rate of Return (IRR) and Total Value to Paid-In (TVPI).

While MOIC is invaluable for evaluating investment performance, it is not without its limitations. The failure to account for the time value of money can lead to misleading interpretations of an investment's success. Therefore, integrating MOIC with a broader set of financial metrics ensures a more comprehensive analysis, allowing for better strategic decision-making.

In conclusion, a thorough understanding of MOIC and its comparative metrics empowers investors to navigate the complexities of private equity more effectively. By leveraging these insights, investors can enhance their evaluation processes and optimize their investment strategies for sustained success in an ever-evolving financial environment.