Overview

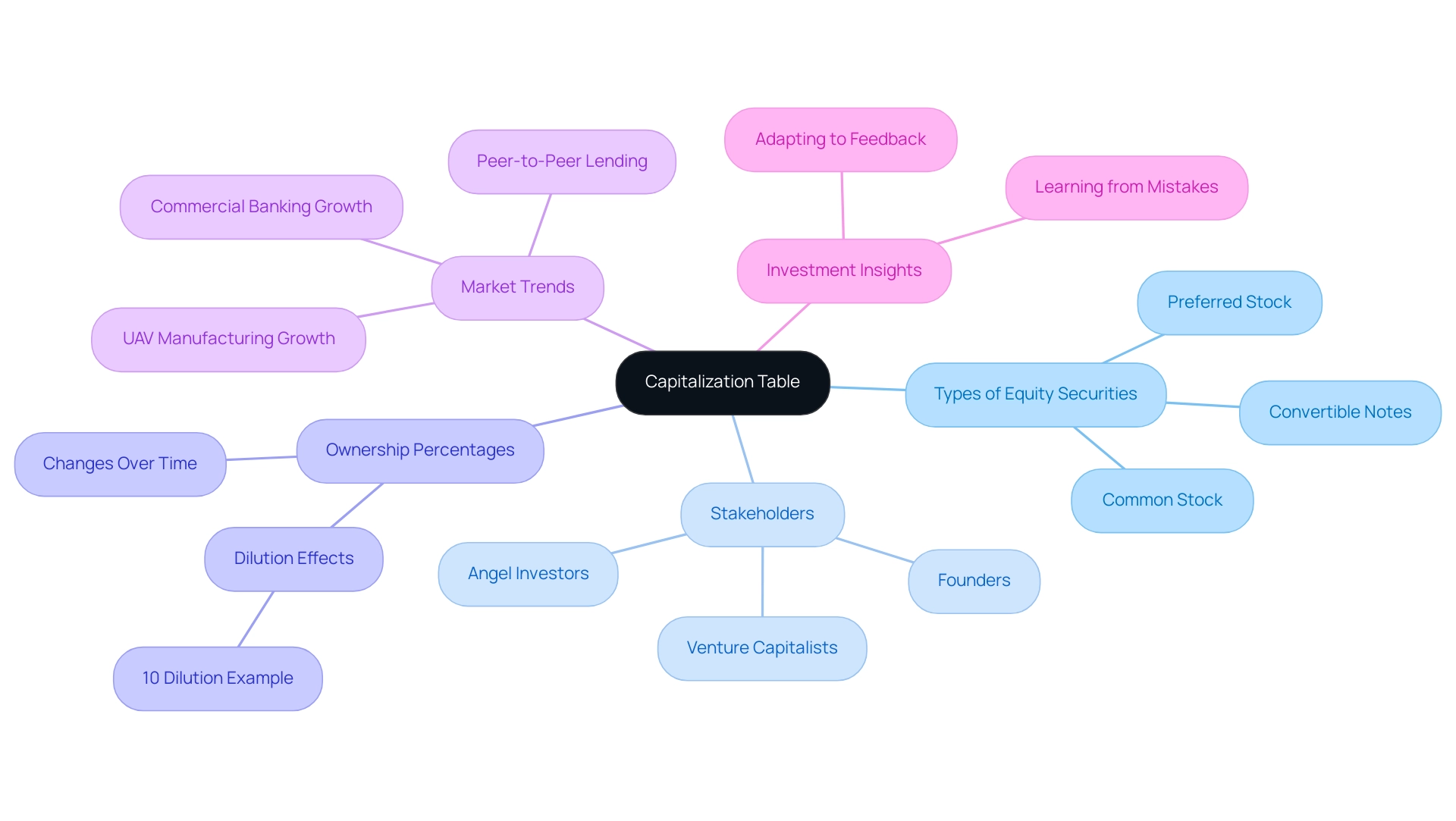

The cap table meaning refers to the representation of a company's ownership structure, detailing equity securities issued, their owners, and ownership percentages, which is crucial for tech investors to understand the dynamics of their investments. The article emphasizes that a well-managed cap table promotes transparency and informed decision-making, as it allows stakeholders to assess potential dilution and governance implications, ultimately influencing strategic investment choices in the evolving tech landscape.

Introduction

In the dynamic world of tech investments, understanding the intricacies of capitalization tables (cap tables) is not just beneficial—it's essential. These detailed documents provide a comprehensive overview of a company's equity ownership, revealing who holds what percentage of the business and how these stakes evolve over time.

As the landscape shifts towards late-stage and secondary tech deals, investors must navigate the complexities of ownership structures to make informed decisions. From assessing dilution risks to recognizing the impact of funding rounds, a well-structured cap table empowers tech investors to evaluate opportunities and mitigate potential pitfalls.

With the rapid evolution of sectors such as UAV manufacturing and commercial banking, grasping the nuances of cap tables can significantly influence strategic investment choices, making it a critical focus for those looking to thrive in the competitive tech arena.

Understanding the Basics of Capitalization Tables

A capitalization chart, or cap chart, represents the cap table meaning as a vital blueprint of a company's ownership stake, especially in the changing environment of technology investments. This detailed document encapsulates the types of equity securities issued, identifies their respective owners, and delineates the percentage of ownership held by each stakeholder, illustrating the cap table meaning. For technology backers, especially those involved with platforms like fff.vc, understanding the complexities of capitalization is crucial.

They provide a clear indication of the company's financial health and growth potential, especially as we see a shift towards late-stage and secondary tech deals amid market uncertainties. As noted, the cap table meaning provides a clear picture of who owns what percentage of the company and illustrates how ownership changes over time. A well-organized capitalization document, reflecting the cap table meaning, promotes clarity, enabling backers to make knowledgeable choices about their funding in startups and technology companies.

For example, an angel backer providing a specific amount of funds for 10% of your business will reduce everyone’s ownership share by 10%, emphasizing the cap's importance in understanding ownership dynamics. Moreover, as we approach 2024, the significance of capital structures is emphasized by the rapid evolution of the tech landscape, where grasping equity dynamics can greatly influence strategic investment decisions. With sectors such as UAV manufacturing and commercial banking anticipated for significant growth, understanding capital structures can assist investors in taking advantage of these opportunities.

Furthermore, fff.vc's accomplishments, which involve navigating 159 late-stage deals and expanding to 300 members across 28 nations, highlight the significance of having a clear understanding of capitalization structures for making informed investment decisions. The challenges encountered in early-stage investments further highlight the necessity for strategic insights that capitalization structures can offer, particularly in maneuvering through the competitive environment and obtaining access to premier deals.

The Significance of Cap Tables for Tech Investors

Cap charts are essential instruments for technology backers, offering crucial information about a startup's ownership framework and the cap table meaning in its funding path. They play a crucial role in assessing the potential dilution of shares, enabling stakeholders to gauge the implications of upcoming funding rounds. For example, when a cap overview shows that earlier backers collectively hold 30% of the business, it can signal a strong foundation of support, fostering greater funding confidence.

Furthermore, the allocation of equity among founders, employees, and stakeholders can significantly affect a company’s governance and decision-making processes. As Sarah, a seasoned angel backer, observes, keeping a precise capitalization record is crucial for refreshing ownership details and communicating portfolio worth. To simplify capitalization structures, technology backers can utilize Special Purpose Vehicles (SPVs), which help bundle shareholders and reduce the number of separate entities, thereby streamlining ownership configurations.

However, stakeholders must stay alert to common traps in capitalization management, including:

- Lack of transparency

- Inadequate governance practices

- Failure to plan for dilution

These issues can undermine trust and complicate investment decisions. The case study titled 'Fostering a Culture of Transparency' illustrates how building a culture of transparency is essential for gaining trust among stakeholders. Organizations that prioritize transparency are more likely to adopt practices that enhance data accuracy and stakeholder trust.

By understanding these dynamics, tech investors can make more informed, strategic choices that align with their investment objectives.

Key Components of a Cap Table: What Investors Need to Know

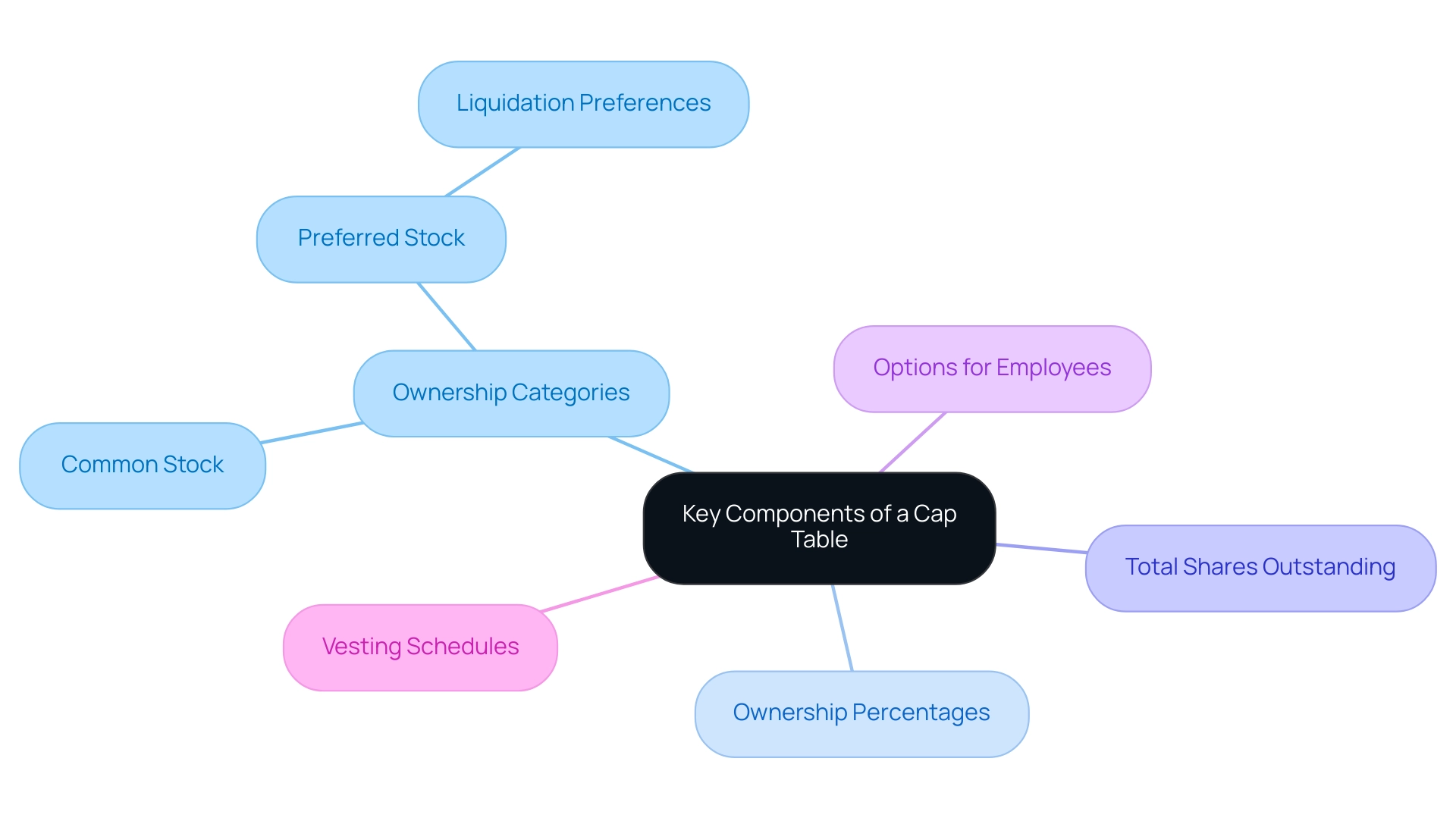

A well-organized capital structure is essential for understanding cap table meaning, and it includes several crucial elements:

- Ownership categories

- Ownership percentages

- The total number of shares outstanding

Typically, common stock serves as the fundamental ownership stake, while preferred stock offers additional rights, such as liquidation preferences, which can be crucial in exit scenarios. Additionally, options are often allocated to employees as part of their compensation packages, influencing ownership percentages as they are exercised over time.

Furthermore, a cap chart may detail vesting schedules, illustrating how equity is granted progressively, and outline the potential impacts of future financing rounds on existing ownership stakes. It is important to note that the cap table meaning underscores its significance, as cap tables are required to be presented annually by regulatory authorities and auditors to maintain transparency. Comprehending these elements is vital for technology stakeholders, as understanding the cap table meaning allows for a nuanced assessment of the risks and rewards inherent in their investments.

For instance, before granting shares to investors or employees, founders often engage in complex discussions about initial ownership contributions. A cap table meaning can assist in clarifying these discussions by visually detailing the company's ownership, ensuring that ownership distributions are comprehended and accepted from the beginning. As one expert noted,

It provides a clear picture of who owns what percentage of the company and how ownership changes over time.

This clarity is indispensable when navigating the complexities of startup equity dynamics, especially in light of the latest updates on equity types in startup funding.

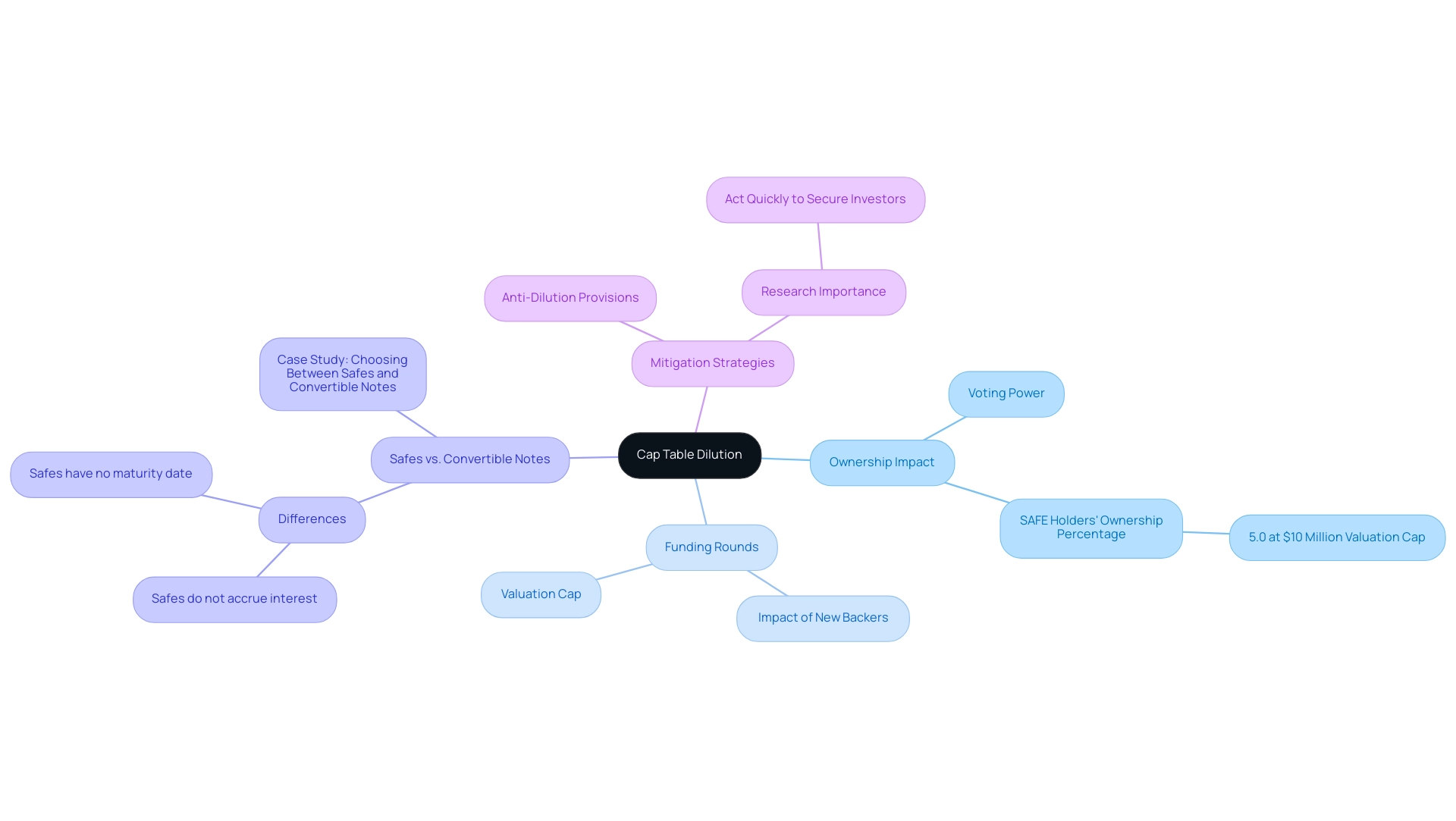

Navigating Cap Table Dilution: Impacts on Ownership and Investment

Cap table dilution is a critical concern for technology stakeholders, as understanding cap table meaning is essential when a company issues additional shares, potentially reducing the ownership percentage of existing shareholders. This phenomenon typically arises during funding rounds when new backers join the capital structure. For instance, a startup raising a Series A round at a valuation cap of $10 million could see SAFE holders attain an ownership percentage of 5.0%.

Such changes can significantly affect current stakeholders, diminishing their voting power and anticipated returns. As noted by Alex Civetta, an associate at Mintz,

The availability of the data can start to affect the data itself over the course of time, indicating that the evolving nature of ownership stakes requires diligent attention. Therefore, it is imperative for stakeholders to evaluate how future funding rounds may influence their equity positions, as this relates to the cap table meaning.

To mitigate risks associated with dilution, strategic negotiation of anti-dilution provisions can serve as a protective measure, ensuring that stakeholders maintain their interests even amidst changing capital dynamics. Furthermore, acting swiftly after performing comprehensive research is crucial for obtaining the appropriate backers and reducing friction during these processes. It is also important to understand the differences between Safes and convertible notes, as both allow for raising funds without determining a specific company value; however, Safes do not accrue interest and have no maturity date.

The case study titled 'Choosing Between Safes and Convertible Notes' illustrates how startups navigate dilution and the decision-making process involved, emphasizing that founders should not overthink their choice, as both can be effective depending on the situation.

Common Cap Table Mistakes and How to Avoid Them

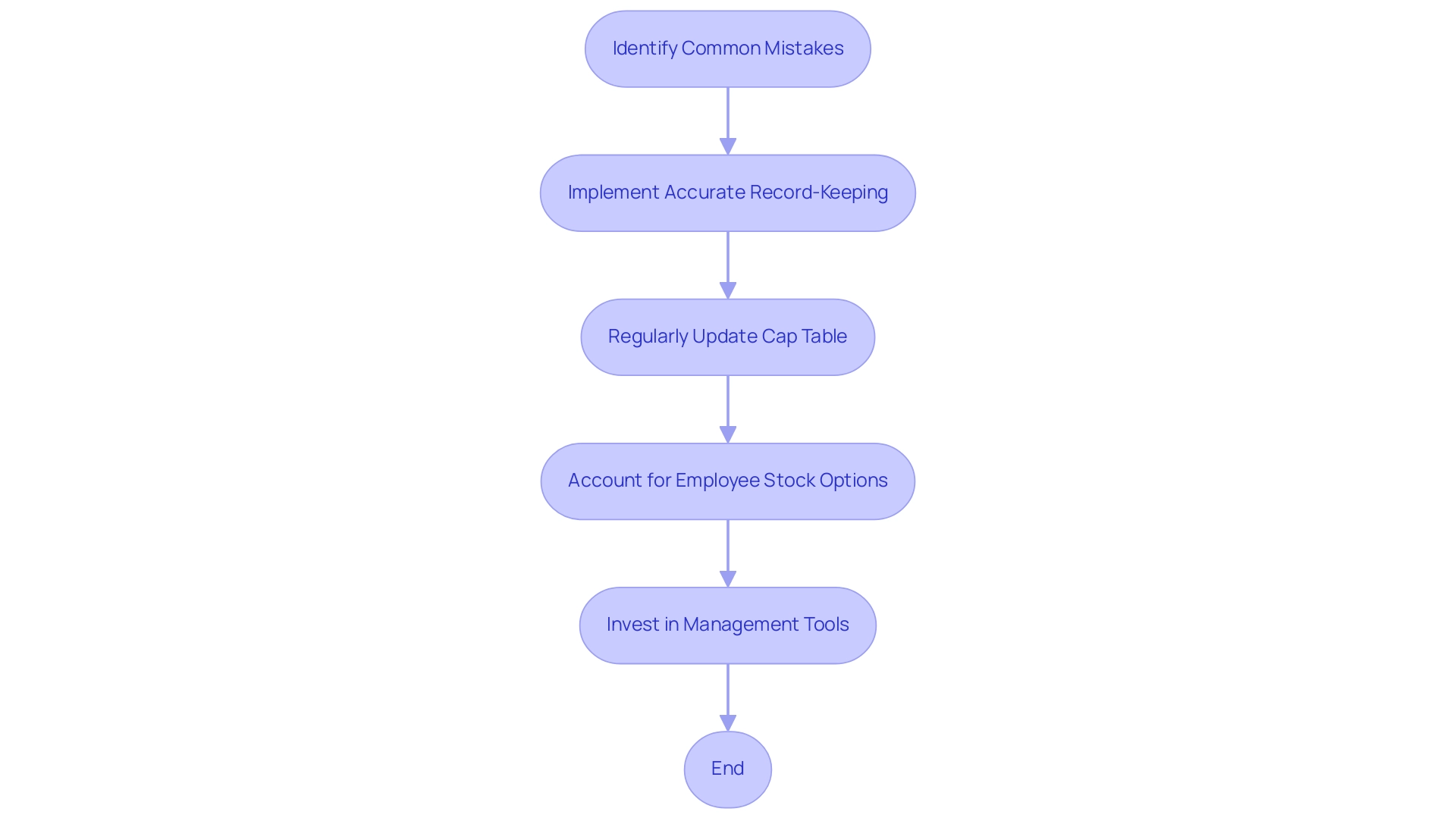

Common errors in cap management can have significant repercussions for startups and their investors. Inaccurate record-keeping and failure to update the cap table meaning after funding rounds are common issues that often lead to confusion regarding ownership stakes. Additionally, neglecting to account for employee stock options can distort the true equity distribution.

Such errors not only jeopardize confidence of stakeholders but can also spark potential disputes among shareholders. As one expert wisely cautions,

Don’t feel like you have to choose the easiest option (such as a free spreadsheet template) just to check the box.

An accurate and well-[organized cap table meaning](https://globalshares.com/insights/more-common-cap-table-mistakes) can reassure investors about your credibility, making it imperative for tech investors to prioritize regular updates to ensure that capitalization records accurately reflect the current ownership structure.

Investing in comprehensive waterfall analysis tools can further enhance transparency, as these tools help manage liquidity event distributions fairly by providing real-time updates and generating reports that elucidate the distribution of equity. A notable case study illustrates the dangers of overlooking these details: discrepancies between capitalization records and legal agreements can lead to costly legal disputes, particularly in scenarios involving former employees with inaccurate vesting schedules, which can result in significant financial and reputational damage. By being vigilant about these common pitfalls and employing robust management solutions, individuals can maintain a clear understanding of their investment positions and safeguard against future conflicts.

The Importance of Keeping Your Cap Table Updated

Keeping an updated record of the cap table meaning is imperative for several reasons. Foremost, it guarantees compliance with regulatory requirements, as inaccuracies can lead to significant legal repercussions. In the words of Nan Meka from AfterWork Ventures,

Founders and backers use cap table meaning as a scorekeeping of significant ownership events in their company’s history.

This highlights their role in navigating equity changes effectively. Moreover, a revised capitalization structure provides stakeholders with the current information essential for informed decision-making, enabling them to understand their stakes and the consequences of forthcoming funding rounds. Transparency and trust among stakeholders—including employees and investors—are also improved through accurate capitalization management.

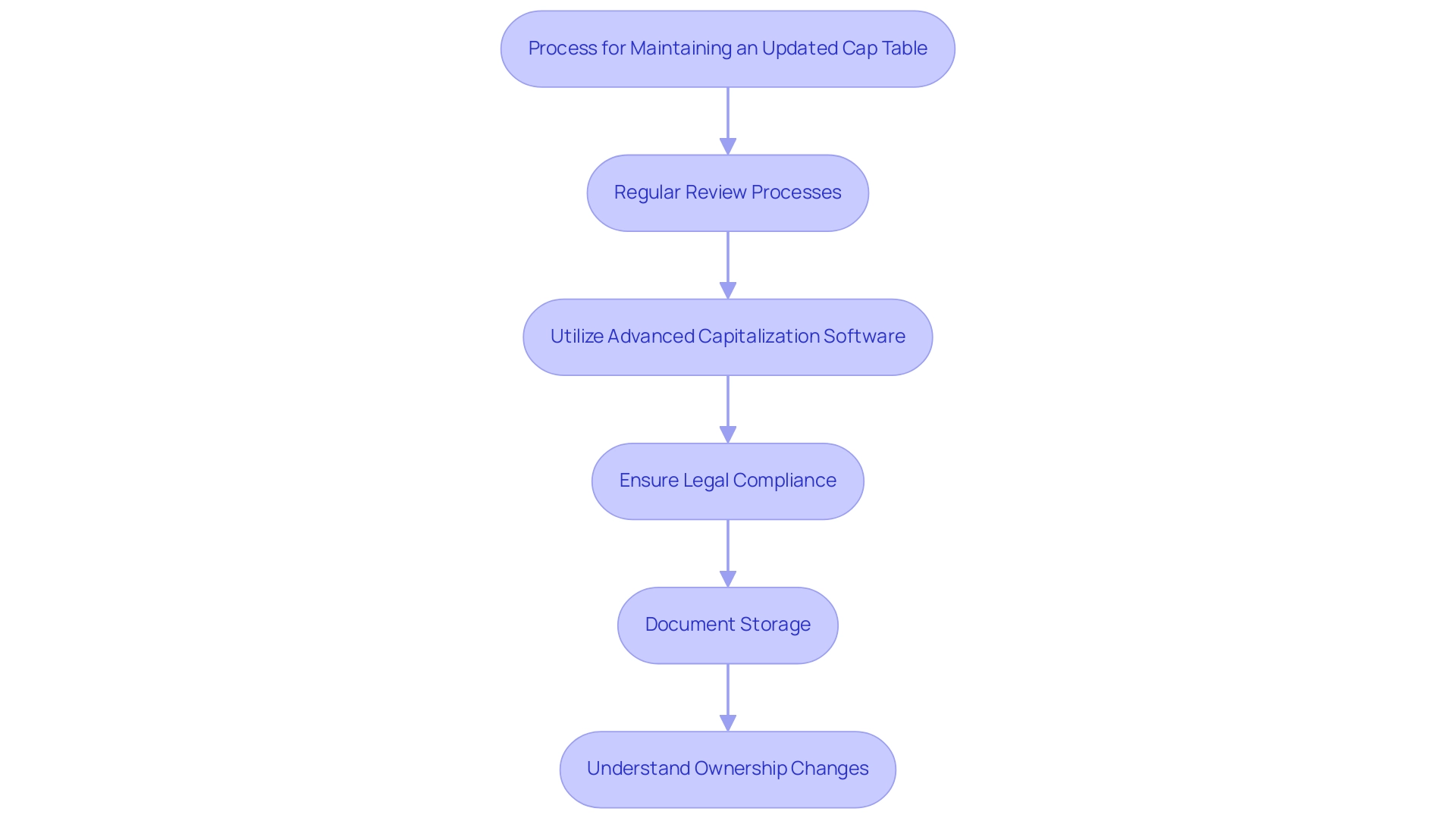

To ensure that their capitalization records accurately reflect the latest ownership changes, technology backers should implement regular review processes and utilize advanced capitalization software, such as Global Shares, which provides real-time updates, legal compliance, and document storage. Such tools automate updates, minimizing the risk of errors and ensuring adherence to compliance standards as we progress into 2024. Additionally, as highlighted in the case study titled 'Importance of Cap Tables,' regular updates are crucial for understanding the cap table meaning, detailing who owns what percentage and how ownership changes over time.

Leveraging Technology for Effective Cap Table Management

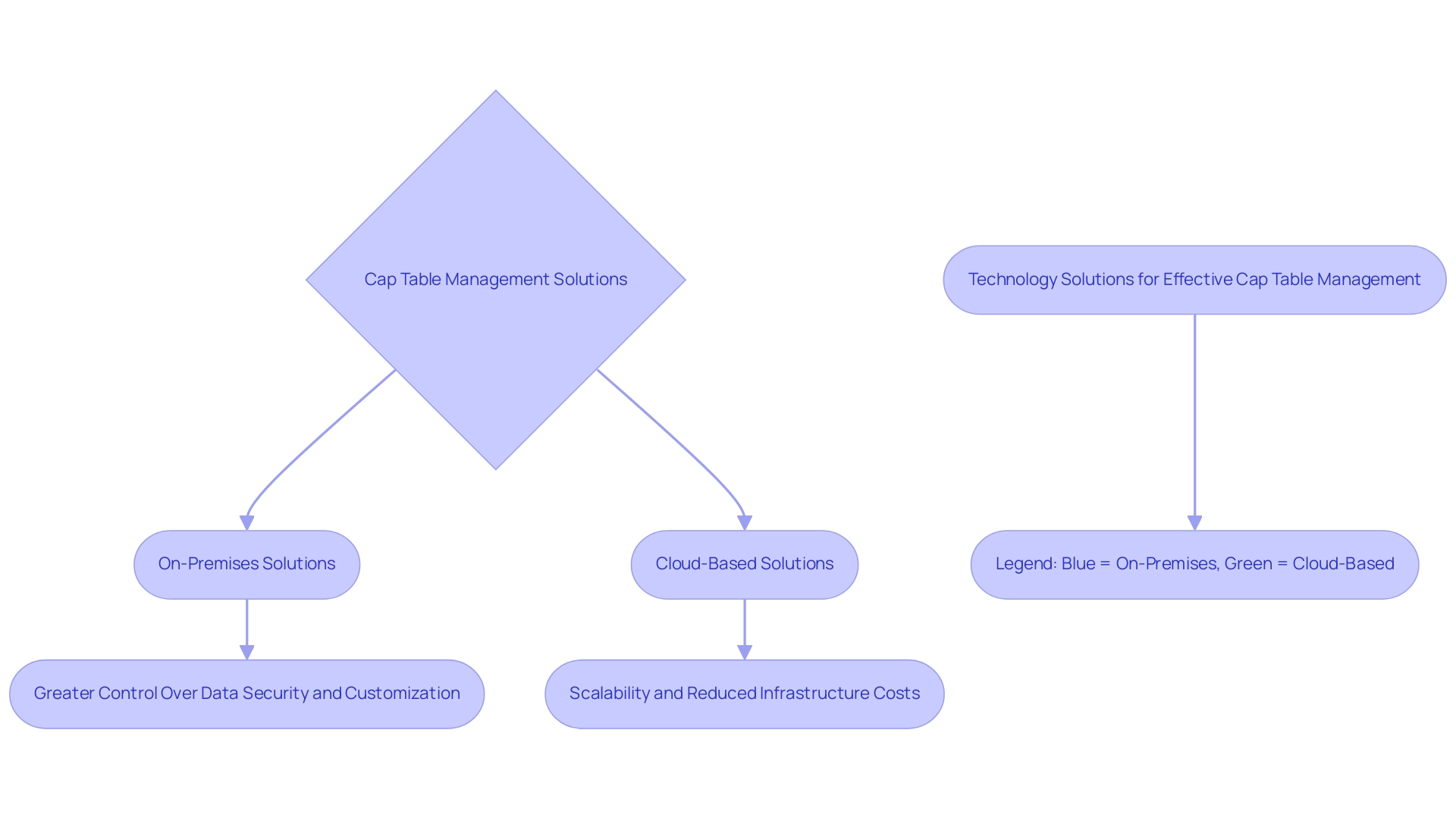

In the domain of cap management, technology acts as a crucial facilitator for startups aiming to understand cap table meaning while optimizing their ownership tracking and compliance procedures. A diverse array of software solutions exists, categorized into on-premises and cloud-based options.

- On-premises solutions offer startups greater control over data security and customization,

- while cloud-based platforms provide scalability and reduced infrastructure costs.

Significantly, platforms like Carta and EquityZen provide user-friendly interfaces that streamline cap management, enabling technology backers to effectively visualize ownership frameworks and produce detailed reports. The integration of automation and data visualization enhances accuracy, ensuring that cap records are consistently up-to-date and reflective of the current equity landscape. As a result, stakeholders can make well-informed decisions and engage in strategic planning with confidence.

Furthermore, the adoption rates of these technologies indicate a growing recognition of their value, as they not only optimize operational efficiency but also provide critical insights for future investments. As investors are presented with the long-term gains of sustainable agribusiness, it becomes evident that the financial advantages of using cap software can significantly reduce risks and improve overall investment strategies. Additionally, streamlining data collection tasks through automation and integration is vital for improving efficiency in understanding cap table meaning.

Conclusion

Understanding and effectively managing capitalization tables is paramount for tech investors navigating the complexities of equity ownership. Cap tables provide a clear framework highlighting ownership percentages, equity types, and the implications of funding rounds, enabling investors to assess dilution risks and make informed decisions. As the tech landscape continues to evolve, especially in late-stage and secondary deals, the insights derived from well-structured cap tables become increasingly crucial.

Investors must remain vigilant about common pitfalls in cap table management, such as inaccuracies and lack of transparency, which can undermine trust and lead to disputes. Regular updates and leveraging technology, such as advanced cap table software, ensure that ownership structures are accurately maintained, complying with regulatory requirements and enhancing stakeholder confidence.

Ultimately, a thorough understanding of cap tables empowers tech investors to navigate the competitive landscape with clarity and strategic foresight. By prioritizing effective cap table management, investors can position themselves to capitalize on emerging opportunities while mitigating potential risks, paving the way for successful investment outcomes in an ever-changing market.